Jan

6

It’s The Switches, from Martin Lindkvist

January 6, 2011 |

by Martin Lindquist with the assistance of Vic

by Martin Lindquist with the assistance of Vic

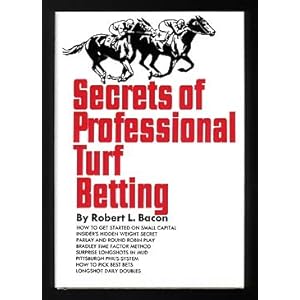

This is a chapter from Bacon with some changes to better describe the switches the trader may find him/her self in:

"Some amateur traders carry inconsistency to such a degree that they demand consistency from the market, while at the same time being utterly inconsistent in their methods of trading. It's not the markets that beat these traders - it's the switches!

Trading is simple. Everything about the game is logical and common sense and elementary. You don't need a whole staff of Phd's. All the figuring and the mathematics and the mechanics of trading can be understood by a child in junior-high school. But the game is decked out in an endless number of minor contradictions and open switches and deadfall traps, in order to lure the average trader into doing everything wrong.

If the average trader kept out of all these switches and traps, then the powers-that-be would have to make the markets far more complicated in order to insure the fact that the majority of traders continue to lose and thus continue to furnish money to keep up the market.

The amateurs who trade so carelessly and who fall into all the wrong switches, do not stop to consider the percentages of their rightful losses. When an amateur goes to the market and loses nine days or months in a row and loses all his capital, he has lost many times what the percentage calls for. He has no right to lose so much. It's almost as if he did it on purpose!

Look at the percentages. For example, suppose the stock market goes up an average of 5% per year. If so, a blind play on January 1st, or February 6th, or any mechanically designated day and holding for a year, will give 5% per year, over a period of time.

The amateur trader makes every possible wrong move and gets caught in every wrong switch. Thus the careless trader loses from 33% to 100% of total trading capital over a period of time, instead of earning from 5% and more per year on the money put in the market.

The amateur goes long only to have the stock turn south. He goes short and the stock stands still. He goes short a straddle only to have the stock start swinging violently and then sink down. Then when he switches back to short the stock runs up ten percent.

This situation gives a rough idea of why some system promoters claim - and rightly - that for the average trader, ANY system is better than no system at all! At least the system, no matter how bad it is, keeps him out of the switches.

But, of course, we are not studying here to play any senseless systems or methods. We want to play the smartest angles and plans of the "insiders" and the professionals. And it should be clear to straight thinking readers that what the professionals win is the difference between the amateurs actual losses of from 33% to 100% of betting capital and what the markets move up over time, minus commissions.

The professionals, including the hedge fund managers who make good from putting a stake available to other peoples trading, can win no more than this margin. The market gives its 5% first (for example) and then the balance of what the amateurs lose is cut up among the professionals. Once a student of trading learns to view the whole picture of trading operations as a picture of percentages, all these facts of life become clear.

As noted, it's the switches and not the markets that beat the amateur trader. A whole volume of books could not record all the possible switches that the amateurs can get themselves into. But here are a few that the professionals take good care to avoid:

First there is the switch of position: The professional trades long, only, because there is the least unfavourable percentage against a long position due to long term positive market drift. He never goes short; that keeps him out of the amateur's position switches.

Besides sticking to long positions only, the professional always makes trades of even amounts. He isn't like the amateur who lets greed or fear change the size of his trades. The beginner plunges on a trend that suddenly turns, then puts on a light trade on a contrarian situation that does turn around. He keeps switching amounts and positions so that he never has a worthwhile trade on when the market goes his way. He is always one day behind the direction of a stock and several days behind the rythm of the market.

The professional trader gauges his capital so that he has a planned series of trades of even amounts. If he is a big winner at the end of one month and feels that the next month will be good, he plans for a series of slightly larger trades for the entire next month. If he is not too pleased about the outlook for the next month, he plans on using a smaller scale of even trades for the whole month.

The amateur never does anything right when it comes to the handling of trading capital. He trades heavily when he has just gotten his bonus or the fund he's managing gets new inflow, which if it is in spring is the poorest time of the year for the amateur's corny method of picking the trending favourites. Then in the summer he trades heavily again on the type of contrarian setups that he should have traded in the spring, but summer is usually more serially correlated, so he loses.

In late summer the trader feels the pinch in the bankroll department. He trades lightly. By early fall he has used up most of his trading capital, so he can only make one trade. It is a stab on pyramiding a three week move that loses when the Fed chief blocks the move and the market crashes in the end of the third week when the first two weeks were up. Then when winter comes he has no money with which to trade, even if a terrific setup for a trade presents itself.

One of the worst (and most common) switches of all is to change methods of trade selection without giving the first method a fair chance to win. That is one of the switches that the professionals avoid by doing a statistical workout of their methods before actual trading, so that they know just what to expect. Amateurs switch from one method, one news story, one hunch, one angle, one stock, or one type of market to another, without reason.

The first wrong switch breeds a fear of wrong switches, which automatically puts the trader into an endless chain of unfortunate decisions. For example, the amateur starts trading bearishly based on some reports of terrorists threaths or the negative outlook for the dollar. But he changes to long positions based on the good earnings reports, just before the market tumbles in a fine losing streak. He is afraid, at first, of getting caught in another switch, so he dares not jump right back to shorts based on that Roach is coming out with a gloomy view. He sticks to the fact that consumer sentiment continues to rise. But the markets continue to go down while all his news stories are bullish. Finally he can't stand it any more, so he goes back to short because the President is losing trust among the voters or because some species somewhere caught a virus. Yes, he goes back, just in time to run into the long overdue streak of up days.

But there is now use kidding: The professionals keep out of switches by waiting for the sound trades with a positive expectancy. They don't take bad trades at any end of the trading week. They don't take bad trades - period!

Everybody knows that there is no better sport or entertainment than taking family or list members to the market for a day's fun. Everybody eats and drinks from the meals for a lifetime and laughs and hollers. Everybody in the party makes crazy statements as basis for trades, such as "It's like 87 again", "May is down a lot just like in 2000, better sell it all" or "It's inverted, the market always goes down when it's inverted", or "Everybody's long, is there a psychological disjoint", and then shrieks "I was right all along" as the market breaks down the last 15 day stretch. That's some fun! But it's fun only. It's NOT professional play.

The Professionals always remember that it's not the markets that beats the trader– it's the switches.

Comments

Archives

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles