Mar

17

Body Snatchers

March 17, 2024 | Leave a Comment

preparing us for something she saw:

Janet Yellen warns inflation decline might not be 'smooth'

lets now interfere with amazing growth and maybe in old mare's chances. you would think that Yale and husband taught her something about indirection - but I guess the blinders on her - she never said a thing that wasn't in the old mare's interest.

i find Invasion of the Body Snatchers relevant to the choices made in work and politics today.

Mar

14

An interesting study of change

March 14, 2024 | Leave a Comment

an interesting study of change in the last 100 years and the replacement of the old which the author loved and the new which he hates.

Small-Town America: Finding Community, Shaping the Future, by Robert Wuthnow.

but compare beautiful and loving depiction of small town life.

Old Home Town, by Rose Wilder Lane.

Mar

13

Contextualization, from Asindu Drileba

March 13, 2024 | Leave a Comment

I found this podcast episode very interesting.

Contextualization Within a Framework of Conditional Probabilities w/ Will Gogolak

As a risk officer with the Chicago Mercantile Exchange, Will Gogolak was setting margin requirements and saw a wide variety of traders’ accounts and what separated the winning traders from the losing ones, before leaving to pursue his own trading and obtaining a PHD in finance and share his knowledge of quantitative analysis and market experience with students at Carnegie Mellon University. Combining his market experience with knowledge of statistics helps William create his custom buy the dip strategy with futures and leveraged ETFs, and focusing on probabilities and determining market direction for informed trading decisions.

Peter Ringel agrees:

Love the hole series. Half of speclist was a guest.

Big Al offers:

Also very informative are these interviews with "Uncle Roy", on Top Traders Unplugged:

Zubin Al Genubi comments:

Speaking of cognitive bias, I realize that if I feel bearish, so does everyone else. You have to go against how you feel and against the consensus.

Sam Johnson asks:

Do you need to go against the cognitive bias of how everyone FEELS or how everyone is positioning?

Zubin Al Genubi responds:

Don't most traders and their systems trade and position for that past regime? As Roy said, trend followers are all piled in at the turns and all will reverse at the same time. With the widespread use of systems everyone is doing basically the same trade. You can't get a fill after the turn as we saw last fall. You have to pre-position…be in position ahead of the enemy forces.

Mar

12

Sandhills Boy

March 12, 2024 | Leave a Comment

Sandhills Boy is a bio of Elmer Kelton and the cattle business in west Texas from 1920 to 1950 and the life of Elmer and his father. It shows that Elmer's life covered every variety of hardship and striving and experiences with minipulation in prices. The audible recording narrated by george Guidal is highy recommended for all.

Mar

11

More Dimock

March 11, 2024 | Leave a Comment

From Wall Street and the Wilds, by A. W. Dimock, pages 142 and 145:

My own surplus money burned holes in my pocket and seldom has the proverb, "Easy come, easy go," received more apposite illustration. From promoting a church to buying a castle, from street railroads in Boston to Sea Islands in Carolina, my check book was always busy. Incidentally it was lavish when my sympathy was appealed to and for all such gifts I have nothing but scorn to-day, now that I know what real sympathy may mean and from behind the scenes have witnessed the hollow mockery of advertised philanthropy.

Thrice have I purchased or built costly edifices as residences for my family and myself and three times has fate stepped in and taken them for schools, wherefore I have come to look upon myself as an instrument of Providence designed for the promotion of education.

Mar

10

An interesting period to study, from Steve Ellison

March 10, 2024 | Leave a Comment

1999-2001 is an interesting period to study as there are many parallels to the present. Back then, the approach of the year 2000 caused a rush to buy new technology to fix all the old systems that used two digits to represent the year. The efforts were generally successful, and doomsday predictions failed to materialize, but the event pulled a lot of demand for technology from the future into the present. When that future arrived in 2001 and 2002, technology sales slumped because everybody already had shiny new systems–no need to buy more. A similar scenario occurred with the rush to enable remote work and communications in 2020, a bonanza for technology companies. What is different this time is that the technology bust resulting from the saturated market already occurred in 2022-23, but now there is a second wave.

K. K. Law notes:

Don't know if anybody ever mentioned about in the 2000 era many optical components manufacturers double-booked and triple-booked the actual TAM. I knew that first hand but too late. Then the CEO of a major component manufacturer called JDSU, now has become a much bigger company, due to multiple M&As, decided to resign in order to sell his company stocks.

Steve Ellison responds:

I vividly remember that JDSU reported blockbuster earnings in October 2000 that for a day or so reversed the Nasdaq rout that by then had been in progress for 7 months. Jim Cramer, who was still running his hedge fund and presumably still had an edge from calling his buddies at bulge bracket firms to find out what big orders they were working that day, pointed out that JDSU's sales were probably just piling up in inventory at downstream suppliers (that had all reported disappointing results); hence JDSU sales were about to go off a cliff. Since I still have the scars from owning JDSU, I developed a tracker of some important companies in Nvidia's ecosystem (chart below). If one of the other stocks turns down, maybe it will be an early warning.

K. K. Law comments:

The actual bookings of all the optical suppliers were over-inflated by many folds over the actual demands by the telecom system manufacturers and service providers . The market eventually realized that.

Steve Ellison adds:

Even in the absence of fraud, when there is a component shortage, buyers inflate their orders to try to gain priority, and executives at the supplier might misinterpret the orders as real demand. When the bottleneck is alleviated, and supply begins to actually flow, the buyers quickly cancel the excess orders in a phenomenon known as the "dreaded diamond", as I discussed in a Spec List thread in 2021.

Mar

7

Price Signals, Price Gouging, and Philanthropy

March 7, 2024 | Leave a Comment

Price Signals, Price Gouging, and Philanthropy, by Peter Calcagno

In the wake of the (COVID-19) pandemic news outlets and politicians alike are discouraging everyone from price-gouging and hoarding. The question is why? We are told that to raise the prices during a crisis such as a natural disaster or a pandemic is cruel and unethical. However, as any good principles of economics student can tell you, price gouging laws only create price ceilings and shortages of goods. No one is directly calling for the capping of prices on goods during these times of crisis, but price gouging laws are effectively the same. Producers are afraid of raising prices for fear they may be reported as price gouging, and in many states, the burden of proof is on the producer to demonstrate they did not engage in price gouging.

The issue at hand is an old one in economics that people keep failing to learn. Prices are signals that contain information and incentives and help to ration goods. F.A. Hayek demonstrated that we do not have to know why prices are rising to understand how to behave. As consumers, we economize on goods, and producers understand that there is a greater demand for the product and should offer more to the market. What price gouging laws cannot do is change the scarcity of resources as Michael Munger explained to us years ago after Hurricane Fran. Instead, we have to find new ways to allocate scarce resources like waiting in line for first come, first served, or worse discriminatory practices. Yes, this sometimes forces us to make hard choices as to whether we should forgo the beer for toilet paper (or maybe it’s the other way around).

Mar

6

Wall Street and the Wilds, by A. W. Dimock, from pages 79-89:

Having proclaimed that all speculative systems are fallacious and having denounced their advocates as false or foolish, I am about to exploit one myself, claiming for it a mathematical and logical basis and substantial infallibility in practice. At least it proved unfailing during the years I employed it, and the average daily profits ran into the thousands. That my share of the accumulations failed to remain with me was not the fault of the system, but my own. Through its proceeds great railroads were founded, educational institutions endowed, and family fortunes established. My partner, who looked on askance at first, soon adopted the theory that a method which, though dealing in chance, worked so independently of it, was business and not gambling.

But while the pendulum of the gold tide beat slowly, the rise and fall of the waves was like the swinging balance of a watch. The unit of transactions on the Gold Exchange was five thousand dollars in gold and the prices varied by one eighth of one per cent. On an active day in the market, even though gold might close at the price at which it opened, the fluctuations, counting by eighths, ran high in the hundreds and sometimes invaded the thousands. What was the use of customers with their occasional commissions by the day or the week, when commissions galore hung before my eyes in every change in the market, whether up or down? I made of myself a nerveless machine and for nearly all the three hundred minutes of each daily session stood beside the curved rail that enclosed the Gold Room pit buying five thousand gold at every eighth.

All day I stood there, buying and selling, buying and selling, with a stubby pencil in my right hand and in my left a note-book, on the one and other side of which I dashed down prices with hieroglyphs for names as I nodded to the right and the left my acceptance of bids and offers. One minute might pass without a transaction and in the next a score be crowded. Always my bid and offer were on the floor a quarter per cent apart. Thus if I had just bought five thousand at a premium of fifty and one-eighth per cent, I would bid fifty for five more, and offer to sell five at fifty and one quarter. Every purchase was balanced, sooner or later, by a sale of the same amount at an advance of an eighth per cent. Thus if I made one purchase and sale in each minute of a day's session my profit for that day would be $1,875. Often this profit was multiplied, for in times of much excitement the price would skip the fractions and jump one per cent at a leap, in which case instead of selling five thousand at each eighth advance, making forty thousand at an advance of nine-sixteenths, the whole forty thousand would be sold at an advance of one per cent, an extra profit of $175.

Always the market looked strongest just as it was nearest its culmination and already tottering to its fall. But though reason and experience told me this the burden I carried rested no less heavily on nerves that were sore and quivered at every comment, in the daily press or on the floor of the Exchange, on the phenomenal strength of the market. That which bore me up and carried me through was the constant throbbing of the machine I had created. Buying and selling, always buying and selling at each eighth decline and each eighth advance, helped me to forget the adverse flood that the whole world seemed to predict.

Mar

2

ATH, from Zubin Al Genubi

March 2, 2024 | Leave a Comment

While S&P 500’s Friday [23 Feb] gain was only 0.03%, it was enough to propel it to another all-time high (13th record close this year); in years when S&P 500 did hit an all-time high, it did so 29 times on average since inception of modern version of index in 1957.

-Liz Ann Sonders

Here's #14 this year as we close up [1 Mar].

Peter Ringel asks:

How & why should one exit any equity longs [given the market advance of the last 10 years]? Not a trivial question to me.

Zubin Al Genubi responds:

Trade your system expectation time. Develop systems that can capture a trend. (Good luck with that.) (Or at least allow re entries, break outs.) Use appropriate money management and the geometric returns over time and increase net wealth. Trading in a nutshell.

Peter Ringel continues:

what if buy & hold is the best system in your arsenal - not annualized systems, but realized systems and normalized for risk? (though normalized for risk & leverage might be a debate.)

Let's say I have an uber-bullish setup: enter on 5th trading day of year and hold 5 days (not a real one). I can annualize it to compare it to other systems, but really it is just one trade, just a little slice of the year. In this case and current drift - an exit on day 5 is not justified, holding forever is.

Zubin Al Genubi sums it up:

Hard to beat buy and hold, but the drawdowns are hard to handle. Define your risk tolerance and design system around money management. As long as the system is positive it doesn't really matter how good because all returns were in the past. If you mean by "annualize" compounded annual geometric returns, that is the right way to compare systems, but also include the money management in the comparison. That is critical part many leave out.

Jeffrey Hirsch writes:

Today’s post RE ATH:

Ex-2020 S&P 500 Flatter Election Year March

But after 4 months of solid gains the market is poised for a modest pullback of maybe 3-6%.

S&P 500 Support: 4800 old ATH.

Steve Ellison comments:

A decade or so ago, I studied the 4-year presidential cycle and concluded that the pattern in annual returns had been very pronounced from 1948 to 1980. After 1980, maybe as a result of the pattern becoming widely known, later results were much more mixed and fell below statistical significance.

That said, for the past two years beginning with bearish midterm election year 2022, the major market averages have closely followed the classic presidential cycle playbook. I assume that, like the uptrend in NVDA, it will continue to work until it doesn't.

Feb

29

A +1 for the inspiring story, from Kim Zussman

February 29, 2024 | Leave a Comment

Nvidia Hits $2 Trillion Valuation on Insatiable AI Chip Demand

The chips are so valuable that they are delivered to the networking company Cisco Systems by armored car, said Fletcher Previn, Cisco’s chief information officer, at The Wall Street Journal’s CIO Network Summit this month.

H. Humbert is skeptical:

This won't end well, but I have no idea about the timing. I have a mixed record on predicting the future, so my prediction is worth what you paid for it, but this is what's likely to happen: due to the chip shortage (the TSMC bottlenecks described aren't easily solved in the short term) and their high prices, NVIDIA's hold on the software stack will be punctured. Someone will say "Hey, we need a second source, it's not good to just have one supplier". Once that happens their monopoly will be over, and it will deflate. Are there any signs of this today? No, none.

Asindu Drileba writes:

Nvidia's edge will evaporate if there is a breakthrough in a new AI paradigm that is not as computationally intensive as deep learning. Herding exists in research just as it does in markets. As of today, researchers are herding on deep learning because it is what has shown a great track record so far. But it is clearly known that there are better (but unarticulated) ways to build systems that exhibit the properties of Artificial Intelligence that industry wants to use to solve problems. As long as these techniques are not yet developed. I still see a growing market for someone like Nvidia in the long term.

H. Humbert adds:

Nvidia will see a growing market for a long time to come, the point is they're not levitating due to durable hardware advantages but because nobody wants to abandon their CUDA toolkit. Not yet, but some day someone will diversify for any number of reasons. They will still remain king of the hill, but cracks will develop.

Humbert H. comments:

Von Neumann latency and huge power consumption are issues and will eventually be a big enough problem. It is a know problem. If not solving the problem organically, I am sure they are looking out to buy the solutions if there are viable solutions. Don't know when it happens but will happen.

Jensen Huang's speech in 2011 about failure and changing course quickly. Sounds like a trader mindset.

Some alternate techniques are being developed but most of the average Joes don't know that yet. Speaking from my observation of what are happening, not just sheer speculations. This conference ISSCC - International Solid-State Circuits Conference on solid state device held this week at SF definitely covered areas related to high speed solid state device advances, limitations and solutions. The published papers and abstracts should have the most updated information.

Yelena Sennett is skeptical, too:

As long as Nvidia are buying their own chips, their sales will keep growing, especially if they keep recording it as revenue before delivery, lol. Scott McNealy's famous 'What were you thinking?' rant to investors for bidding Sun Microsystems' stock price up to 10x sales during the DotCom bubble:

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don't need any transparency. You don't need any footnotes. What were you thinking?

It’s not different this time - trading around ~ 30 times sales! The only question is if the market is different this time and NVDA is just one stock that will not affect the general market when it goes down back to reality of $200 - $300.

Feb

28

Fractal scaling and the aesthetics of trees, from Asindu Drileba

February 28, 2024 | Leave a Comment

:max_bytes(150000):strip_icc()/9-8eda0dbebc5e4ad68c351d9fa552ced9.jpg)

Fractal scaling and the aesthetics of trees

Trees in works of art have stirred emotions in viewers for millennia. Leonardo da Vinci described geometric proportions in trees to provide both guidelines for painting and insights into tree form and function. Da Vinci’s Rule of trees further implies fractal branching with a particular scaling exponent.

H. Humbert writes:

I could never understand how fractals help with markets. Yes, the world is fractal, but fractals are essentially a way to describe the "roughness" of random patterns. But is this roughness permanent? No. Are the patterns predictable? No. Yet somehow some wiggles are described as bullish and bearish fractals. Sounds like snake oil to me.

Asindu Drileba responds:

You're right! Mandelbrot himself admits that his techniques cannot predict the direction a financial instrument will move. He however says that his techniques can predict "by how much" a financial instrument will move. He describes that "large movements are more likely to be followed by large movements" and "small movements are more likely to be followed by small movements." Here is a short video of Mandelbrot describing his model.

H. Humbert replies:

Never read his books. I know Victor hated him with passion, he was one of the three most guilty, the other two were Taleb and Buffett. Watched the video, a lot of words but nothing practical. Also since his mode of thinking is simple and algorithmic, and he is famous, if there ever was anything to be gained from it, by now algorithmic trading surely made all those possible gains disappear.

Laurence Glazier comments:

There is always an element of hand-waving in attempts to make things easier than they are, and it can be seductive. Nature, however, likes economy of means, and therefore if the same-ish pattern can be used at different scales, I would expect this to happen - but this assertion itself has an element of hand-waving.

H. Humbert adds:

To me the main element of hand-waving is that coastal topography and tree branch patterns created by very different mechanisms themselves have anything to do with predicting market moves where human psychology among many things is involved.

Zubin Al Genubi writes:

There are entire financial industries and degrees relating to prediction, measurement, and trading volatility. It is one of the most important aspects of trading and protecting yourself from ruin. A simple example of the importance of understanding volatility is its mean reversion. In time of stress and price drops this is a key.

Anatomy of a Meltdown: The Risk Neutral Density for the S&P 500 in the Fall of 2008, Justin Birru and Stephen Figlewski.

September 2008 was when the crisis hit in force….On 55% of the trading days in October and November 2008, the index moved more than 3% up or down (corresponding to annualized volatility in excess of 47%). Interestingly, while it is well-known that the market tends to move faster and further on the downside, in this extraordinary period sharp moves to the upside were just as common. On the two days with the largest price changes in October, the market rose more than 10%.

H. Humbert continues:

Once again something unpredictable happened that was difficult to take advantage of. It seems like crisis-related volatility would have to subside sooner or later when the crisis is over, is this a revelation? I recall the March 2020 day when the market hit the Covid lows. I literally said to myself "this has got to be the bottom". But did I do anything? No, because I really wasn't sure. Some forces ended the crisis, but they're only obvious in retrospect.

Feb

26

Predictions, and inspiration

February 26, 2024 | Leave a Comment

Sam Eisenstadt the founder of Value Line's methods (now conveniently canceled from mention in official history) liked to predict market moves on a monthly basis. His method now would predict a 200-pt move 6 months in future.

most similar to Eisenstadt regression methods are 2021, 2022, 2119, 2017, 2016, 2015, 2014, 2012, 2011, and 2008.

an inspiring story:

Nvidia Hits $2 Trillion Valuation on Insatiable AI Chip Demand

It took Nvidia NVDA 24 years as a public company for its valuation to reach the rarefied air of $1 trillion. Thanks to the chip maker’s role in powering the AI revolution, a second trillion took eight months.

Feb

25

A textbook example

February 25, 2024 | Leave a Comment

wednesday [21 Feb] was a textbook example of how deception and weakness can induce the vulnerable to do the wrong thing. the S&P hovered at a 12-day low at 4968 until close then prof came in and jumped market 60 pts in last 20 minutes. however they had wht weather gage in Germany all the way.

the symphony of all markets was very healthy for stocks and bonds on friday.

a sociologist with pregnant ideas that covers may aspects of monetary interactions:

Feb

24

Meals for a lifetime

February 24, 2024 | Leave a Comment

Auschwitz Survivor Reveals The Secret To Overcoming Any Obstacle In Life with Dr. Edith Eger.

As a Jew living in Eastern Europe under Nazi occupation, Edith was taken to Auschwitz concentration camp with her parents and sister, at the age of 16. She explains how she found her inner resources, how she came to view her guards as the real prisoners, turn hate into pity and, incredibly, she even describes her horrific experience as ‘an opportunity’. She has liberated herself from the prison of her past through forgiveness.

Sushil Rungta writes:

I am also very fortunate to have met Dr. Eger a few times. Every meeting was illuminating. She really inspires by her story and by her humility. Both her books, The Choice and The Gift are must reads. Coming to the United States when almost 50 years old and accomplishing all that she has is truly remarkable. Also worth noting that her son-in-law is Noble laureate in economics.

Gyve Bones offers:

Last night I watched this dramatized documentary of the life and death of Fr. Maximilian Kolbe, a Polish Catholic priest who, as a prisoner in Auschwitz, offered his life for the tenth man chosen by the commandant to die in the starvation bunker in retribution for an escape from that cell block. The man was married and had children. Fr. Kolbe stepped out of the assembled ranks, which normally would get a prisoner shot, and asked the commandant if he could take the man’s place. The offer was accepted. He turned the starvation bunker into a chapel, with him leading the nine other men in constant prayer and singing hymns. He was the last one remaining alive, and so the guards dispatched him by injecting carbolic acid into his veins, which makes the CO² bubbles in soda, and causes the heart pump to cavitate and fail.

Feb

23

Backlash against travel meme, from Zubin Al Genubi

February 23, 2024 | Leave a Comment

There is a backlash against travel meme occurring. I don't have numbers but I'm noticing travel is down. I don't feel like traveling. My traveling friends are staying home. I saw a magazine article on why travel is bad. Boeing is down.

The Case Against Travel

It turns us into the worst version of ourselves while convincing us that we’re at our best.

H. Humbert responds:

Boeing is down because of the well publicized mechanical problems and the exposure of their general carelessness. They're not affected a great deal by the minute-to-minute variations in travel demand due to long lead times and large backlog.

Pamela Van Giessen writes:

The Davos crowd has been pushing no travel because climate change. Except for their private jets to exclusive Swiss resorts.

Air fare to AZ is high for Feb-April and Scottsdale airbnbs are pricey so I’m not sure if travel is really down except to MT because no snow for skiing. A friend reports that Park City was busy for Sundance. Besides, don’t most people travel a bit later during spring break when the kiddos are out of school? And could it be they are booking their travel for when they can drive and avoid airport unpleasantness?

Word is that Coachella sales are slow but Stagecoach which takes place a week later sold out super fast. Seems like Coachella is flagging on the booked acts, not a lack of travel interest (given that Stagecoach is basically down the road). Charley Crockett tickets for the middle of nowhere Emigrant MT sold out in about 20 mins for June. Maybe it’s all local but I suspect a fair number of tickets were bought by out of towners.

H. Humbert observes:

I was in Napa Valley recently for somebody’s birthday and everything was sold out but the winery. Some people needed to find last minute hotel reservations, was almost impossible. The restaurant where you eat in a yurt had no empty yurts, in torrential rain. Not considered the best time of the year to visit it either because it does tend to get rainy.

Henry Gifford comments:

10 or 20 years ago Boeing moved their corporate headquarters to Chicago for the stated purpose that they wanted to be taken seriously by Wall Street. Headquarters >1,000 miles from the nearest factory? Insane. The place was run by engineers, which is smart for a company manufacturing complex things. Now I think they are run by accountants and lawyers - see how Detroit has been making out with that strategy.

The problems a few years ago with planes diving unexpectedly were caused by the MCAS system: Maneuvering Characteristics Augmentation System - an acronym giving little indication about what it is or does. The system took an input from one angle-of-attack sensor on the nose - a fin whose position changes with the angle of the wind passing over the nose of the plane - and if it saw the nose was too high (could lead to a stall: chaotic airflow over the wings causing a loss of lift), it automatically pointed the nose of the plane down. This broke the rule in aviation design that the failure of one mechanical device (the angle-of-attack sensor) should not lead to a crash. Bad sensor readings caused the sensor to push the nose down when the plane was actually flying fine - two planes nosed down into the ground, killing hundreds of people. A better design strategy is to require simultaneous failure of two mechanical devices to cause a crash. In other words, the computer should have been wired to two sensors. The crazy thing was that the computer was wired to two sensors; each plane had two, or optionally three. If the software received contradictory signals, a red light should have alerted the pilots and disconnected the "ANDS" (automatic-nose-down-system (my name), and if the plane was on the ground, it should not take off until the sensor(s) work. Basic engineering 101.

The company might do well with government contracts, automatic market share, etc. But it will be decades before the young and ambitious will be proud to work there.

Bo Keely relates:

A new Slabber just retired here from Continental Air. He insists that Continental for years has been tied to the CIA, and that he too was that. With a Masters in Electronics, he is also the person the President called to deflect missals gone astray. The technique is to send two jets after the launch to intercept the wrong destination. The most recent example was one shot from a submarine off Hawaii aimed for a Utah test target, that misguided toward LA. That would have been a horrendous traffic jam. The first jet, slower that the missile, intercepts its trajectory to radio the bearing to a second jet to close in to electronically knock the missile off-course. It landed outside San Bernardino to cause a forest fire that the military blamed on careless campers. Other scapegoats have been UFOs, but they've been US missiles.

Humbert H. is skeptical:

Distance from Hawaii to Utah is about 3000 miles. So slow moving cruise missiles can be ruled out. For either ICBM or IRBM, depending on the phases of the trajectory, the speeds can vary. These vehicles' speeds after the boost phases range from Mach 18 to 25. Mach 1 is 767 miles per hour. A typical passenger jet can reach no more than 600 miles per hour. There are many things about the fictional story of the ex pilot just simply don't add up.

Feb

22

Games again, from Big Al

February 22, 2024 | Leave a Comment

I grew up playing lots of board games, and later, computer games. I see videos of college students not being able to do basic math, and I think, "They needed to play Monopoly when they were kids!" Here is an interesting Numberphile with Marcus du Sautoy about the game Risk:

The Game of Risk - Numberphile

du Sautoy has a book on games:

Around the World in Eighty Games

From Tarot to Tic-Tac-Toe, Catan to Chutes and Ladders, a Mathematician Unlocks the Secrets of the World's

Greatest Games

He is an interesting guy and has done a lot of popular math work.

Humbert H. writes:

I grew up in a house where cards were played all the time. We played everything from pinochle and canasta to spades and bridge. I was a degenerate rummy player in my teens, half a cent a point. Later on graduated to low ball, which is a truly sick game, only for the degens. Always managed to hold my own in all kinds of poker. Cards improved my memory and on the spot mental arithmetic. Learned a few hundred prop bets using cards and had a good measure of success with them. We still play all the time, and when grandbaby is a few years older, he can join.

James Goldcamp adds:

While Risk was always fun, it's Avalon Hill's Diplomacy that for me is the pinnacle of board games. It combines negotiation and cooperation useful in business, the bluffing and dissembling of poker, along with an element of pure calculation a la chess. While the board presents somewhat of a tight closed system (ask anyone who has played as Turkey!) I believe it teaches the best balance of grand strategy, pure tactics, and anticipation (and manipulation) of the intent and designs of the other players. In the initial days of the pandemic my gaming friends of decades prior reconvened using one of the free online diplomacy sites.

Honorable mention for baseball enthusiasts goes to another Avalon Hill great - Superstar Baseball. An excellent way for a kid to gain an appreciation for early 20th century players through Mays and Aaron.

Big Al wonders:

Was there a message here?

Thank you for your interest in the monetary policy game, Chair the Fed. The game has been a useful and fun tool to learn more about monetary policy. However, the Fed has updated its approach to monetary policy, and the changes are not readily accommodated within the existing structure of the game. As of June 1, 2021, the game is no longer available.

Asindu Drileba writes:

I came across this game from Jane Street.

Figgie is a card game that was invented at Jane Street in 2013. It was designed to simulate open-outcry commodities trading. Most of the skill in Figgie is in negotiating trades that benefit both the buyer and seller. Like in poker, your objective in Figgie is to make money over a series of hands.

Several financiers I have studied like to play games of chance outside the market - Warren Buffet (Bridge), Charlie Munger (Poker), Edward Thorpe (Blackjack), Vic (Checkers — I still don't know what to make of the checkers like board on the Daily Speculations homepage).

Feb

21

Unforgettable and brilliant things

February 21, 2024 | Leave a Comment

two unforgettable and brilliant things i have been reading are Willa Cather's A Chance Meeting and Mark Twain's account of the Queen's jubilee. the latter is appropriate for S&P at 5500 and should accompany all of Dimson's work.

Big Al offers:

Something else that may be fun:

Diamond Jubilee: Sherlock Holmes, Mark Twain, and the Peril of the Empire

Feb

20

Many lessons, from Jeff Watson

February 20, 2024 | Leave a Comment

There are many lessons in this short talk by Richard Feynman.

Barnum’s classic, The Art of Money-Getting, is read aloud in this video. A great addition to any spec’s collection. Quite dated, but the spirit is undeniable.

Feb

19

Trailhead (or rabbit hole), from Big Al

February 19, 2024 | Leave a Comment

Wandered across it a bit randomly. Of course, one could argue that "experimental finance" is/should be what every trader is practicing.

Potentially useful links in this article:

Experiments in finance: A survey of historical trends

A key figure:

The Lab Man: How experimental economics emerged from the shadows

Jeremy Clift interviews Nobel Prize winner Vernon L. Smith

Also:

Herd Behavior in Financial Markets: An Experiment with Financial Market Professionals

Kim Zussman adds:

Late list member Ross Miller worked with Vernon Smith and Charles Plott during his undergrad at Caltech in the early 70s.

How to Stay Mentally Sharp Into Your 80s and Beyond

Vernon L. Smith, 97, is a very busy man.

The economist at Chapman University just finished writing a book about Adam Smith and works about eight hours a day, seven days a week in his home office in Colorado Springs, Colo. He enjoys chatting with friends on Facebook and attending concerts with his daughter.

“I still have a lot of stuff to do. I want to keep at it,” said Smith, who won the Nobel Prize in economics in 2002.

Feb

18

What Makes for ‘Good’ Mathematics?

February 18, 2024 | Leave a Comment

Terence Tao, who has been called the “Mozart of Mathematics,” wrote an essay in 2007 about the common ingredients in “good” mathematical research. In this episode, the Fields Medalist joins Steven Strogatz to revisit the topic.

Gyve Bones offers:

Einstein, Address to German League of Human Rights:

Although I am a typical loner in daily life, consciousness of belonging to the invisible community of those who strive for truth, beauty, and justice has preserved me from feeling isolated. The most beautiful and deepest experience a mancan have is the sense of the mysterious. It is the underlying principle of religion as well as all serious endeavor in art and science. He who never had this experience seems to me, if not dead, then at least blind. To sense that behind anything that can be experienced there is a something that our mind cannot grasp and whose beauty and sublimity reaches us only indirectly and as a feeble reflection, this is religiousness. In this sense I am religious. To me it suffices to wonder at these secrets and to attempt humbly to grasp with my mind a mere image of the lofty structure of all that there is.

Richard Feynman, from The Pleasure of Finding Things Out:

I have a friend who’s an artist and has sometimes taken a view which I don't agree with very well. He'll hold up a flower and say “look how beautiful it is,” and I’ll agree. Then he says “I as an artist can see how beautiful this is but you as a scientist take this all apart and it becomes a dull thing,” and I think that he's kind of nutty. First of all, the beauty that he sees is available to other people and to me too, I believe. Although I may not be quite as refined aesthetically as he is, I can appreciate the beauty of a flower. At the same time, I see much more about the flower than he sees. I could imagine the cells in there, the complicated actions inside, which also have a beauty. I mean it’s not just beauty at this dimension, at one centimeter; there's also beauty at smaller dimensions, the inner structure, also the processes. The fact that the colors in the flower evolved in order to attract insects to pollinate it is interesting; it means that insects can see the color. It adds a question: does this aesthetic sense also exist in the lower forms? Why is it aesthetic? All kinds of interesting questions which the science knowledge only adds to the excitement, the mystery and the awe of a flower. It only adds. I don’t understand how it subtracts.

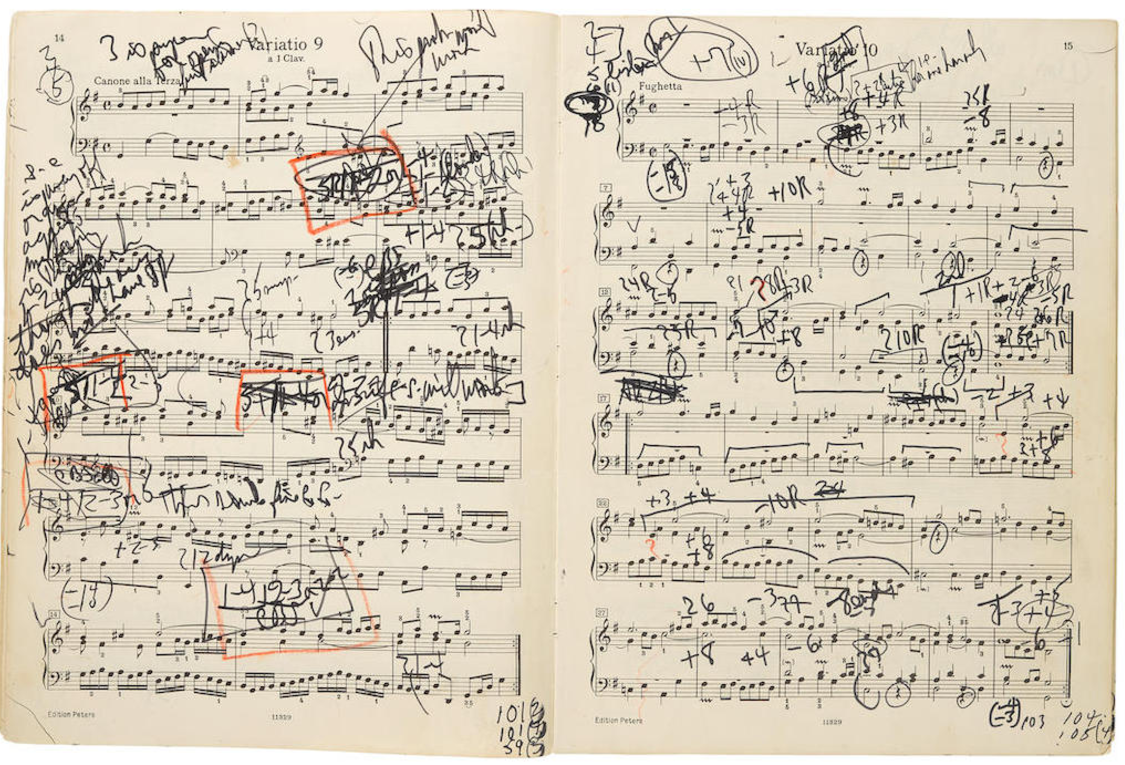

Pope Benedict XVI, On Beauty as a Way to God:

I remember a concert performance of the music of Johann Sebastian Bach—in Munich in Bavaria—conducted by Leonard Bernstein. At the conclusion of the final selection, one of the Cantate, I felt—not through reasoning, but in the depths of my heart—that what I had just heard had spoken truth to me, truth about the supreme composer, and it moved me to give thanks to God. Seated next to me was the Lutheran bishop of Munich. I spontaneously said to him: “Whoever has listened to this understands that faith is true”—and the beauty that irresistibly expresses the presence of God’s truth.

Feb

15

Intervention, and a fable

February 15, 2024 | Leave a Comment

how intervention spreads; gas stoves, toilets et al:

Interventionism: An Economic Analysis, by Ludwig von Mises and Bettina Bien Greaves

It is the purpose of this essay to analyze the problems of government interference in business from the economic standpoint. The political and social consequences of the policy of interventionism can only be understood and judged on the basis of an understanding of its economic implications and effects.

a very good precursor to Hume, Smith and Darwin:

The Fable of the Bees, by Bernard Mandeville

Mandeville's Fable of the Bees: A Reappraisal

Feb

12

Reminiscences of a Stock Operator, Annotated Edition, from Victor Niederhoffer

February 12, 2024 | Leave a Comment

i reviewed the Livermore book for Barron's and i believe if covers the bad quite well.

History Lessons for Investors

Reviewed by Victor Niederhoffer

Imagine that master novelist and chess aficionado Vladimir Nabokov wrote a fictional memoir about Capablanca—the 1920s world champion who never made a mistake on the board—and that Bobby Fisher then published an updated and annotated version, incorporating all of the important developments of modern chess strategy, along with a foreword by Anatoly Karpov.

A similar multilayered feast on investment is now available, with minor differences. Edwin Lefevre's Reminiscences of a Stock Operator is a novel told in the first person by a character inspired by legendary trader Jesse Livermore. This classic is now graced with extensive annotations by investment advisor Jon Markman and a foreword by hedge-fund manager Paul Tudor Jones.

The result is big and beautiful, cutting across two centuries of booms and busts and market and economic history, with a myriad of vintage historical photos and instructive historical charts throughout.

Peter Ringel responds:

Thank you, Vic. For many traders, Reminiscences was their first book about speculation.

Feb

11

Game theory

February 11, 2024 | Leave a Comment

the memory of old men staring disapprovingly out the winder at the University Club at the women on fifth avenue wearing miniskirts must be how the governors at the fed feel about the unprecedented decline in their boy's chances today [9 Feb].

what must they do to make sure they can remedy the situation. 30-year bonds now at a 60-day low at 119.75. the Governors must arrest the decline vigorously and soon.

i listen to Sherlock Holmes every nite and was surprised to come across this reference to Von Neumann and Morgenstern:

Sherlock Holmes and Game Theory

This essay reanalyzes the game theory interpretation by John von Neumann and Oskar Morgenstern of Arthur Conan Doyle’s “The Final Problem.”

Feb

7

Nvidia $200 Billion in 3 Days, from Cagdas Tuna

February 7, 2024 | Leave a Comment

It is not hard to see this is very late stages of speculative madness but I really would like to know how the risk management teams approve buying Nvidia stock here after adding $200 billion to market cap in 3 days?

Larry Williams offers:

Maybe my cycle forecast for NVDA would help:

Asindu Drileba writes:

I don't know why people are still buying Nvidia. But this is what I personally think of the stock. Nvidia has an 80% market share in the Graphics Card business. Their bread and butter used to be video gaming, 3d animation, video editing, later crypto mining, AI (computer vision), AI (Large Language Models), AI (Image generation) possible new advances may occur in Molecular Dynamics, Self driving cars etc. The CEO had an interesting interview where he talked about possible areas Nvidia may venture into.

But here is one strange thing about high performance computing (Nvidia's Niche): We would think that the better (higher performing) their products are, the less people would buy because people would do more with less right? It's actually the opposite.

— In gaming for example, when graphics cards improved people moved to less polygon looking characters and wanted more details like finer hair & plants. From there they even went to more computationally intensive algorithms like ray tracing that mimic real world scattering of light. Requiring even more compute in subsequent algorithmic advances.

— In Bitcoin, many people using Nvidia GPUs made it more difficult to earn money from crypto mining. Which requires people to have even more Nvidia GPUs just to continue earning the same income.

— In AI, when ever a new breakthrough was made, researchers often trained models with larger datasets, using more & more GPUs. Chat GPT for example was trained on 1 Trillion corpus of text.

So if they do maintain this 80% market share and these underlying industries continue to grow (and make new break throughs). It makes sense that Nvidia will be very valuable in the near or distant future. Buying now (at all time highs) is definitely dangerous but, even if the bubble pops, the underlying industries it facilitates will still be present. And if more breakthroughs in these industries are made, it makes sense that Nvidia still has some value left in it.

Cagdas Tuna responds:

Good fundamental points and there I have 2 counter outlook:

-Gaming industry; I almost everyday play an online game called Destiny 2, and their developer Bungie has reduced workforce around 10%. I know many other gaming companies are reducing/reduced workforce which doesn't give too much optimism in that area.

-Bitcoin mining; there is halving in a few weeks and this will require more powerful computers but it will also increase the cost which in the end will end up new miners losing money in most cases. Only way to maintain gains in mining is Bitcoin price to double or triple in a year.

Even on the best possible scenario it will not add 200 billion dollars worth growth in many many years.

Steve Ellison comments:

Words of wisdom from Rocky's Ghost, posted in the Spec List on April 4, 2017. And yes, I am long NVDA. I believe this is the study Rocky referred to.

Soros and I share very little. However, I have come to agree with him that the right position is to be long "bubble" (however defined). I used to subscribe to Anatoly's view and to be bearish during bubbled but I discovered that from a risk-adjusted-return perspective, it's better to be right "today" than right "tomorrow." Along this point, I read a study that shows a substantial percentage of stock returns occur during the last surge in a "bull market". If you miss this surge, it's very difficult to keep up with the indices in the short term. And in the long term, we're all dead.

Asindu Drileba replies:

Gaming Revenue was about $142B just in 2022. If cloud gaming, something Nvidia is planning todo is successful, I expect this to jump by several multipliers. I expect Cloud gaming to be a bigger business than say AWS. Gaming is really big, I believe you have heard about gaming being bigger than movies & music combined.

The Crypto market cap is $1.6T, a lot of these Crypto currencies use graphics cards to mine their currencies. So I don't think $200B is too much. For Nvidia which is well positioned in these industries, i.e., owning 80% of that market.

Humbert H. adds:

One fundamental point about predicting the future of NVIDIA. It's a complete accident (lucky for NVIDIA) that the hardware optimized matrix multiplication used for 3D graphics pipelines was also useful for AI.

K. K. Law riffs on The Great One:

Confirmation bias. And this is where the AI computation puck is at of course.

Cagdas Tuna realizes:

Now I see why everyone chasing this momentum with FOMO as all assumptions based on Nvidia will get all of the cake in the market!

Feb

6

AI can solve complex geometry problems

February 6, 2024 | Leave a Comment

Google DeepMind’s new AI system can solve complex geometry problems. Its performance matches the smartest high school mathematicians and is much stronger than the previous state-of-the-art system.

DeepMind says it tested AlphaGeometry on 30 geometry problems at the same level of difficulty found at the International Mathematical Olympiad, a competition for top high school mathematics students. It completed 25 within the time limit. The previous state-of-the-art system, developed by the Chinese mathematician Wen-Tsün Wu in 1978, completed only 10.

A collection of Olympiad geometry problems.

H. Humbert comments:

But it can't solve talent retention.

Google DeepMind scientists in talks to leave and form AI startup

Humbert H. writes:

If anyone were to ask, perhaps the real hidden value of the system could be for example in the application in discovery of new materials. Of course, the biggest question and the current AI can't solve immediately is how to syntheses the new materials in real experiment timely and to verify and validate the properties. If it could break new grounds in materials, one of the fantastic 7 is also on it too.

H. Humbert responds:

Depends on whether materials synthesis can be described via some set of rules. I don't know enough about it to see it one way or the other. I expect new drug discovery by pharma companies which is now being transitioned to digital molecule exploration from lab based experimentation to eventually use AI, at the every least for new protein synthesis which has both chemical and spatial folding problems and is a less general problem than "materials". DeepMind seems different from large language models that have been in the news lately in that it operates on much less data and is generally used to find better solutions to problems that are similar to games and have a more contained set of "rules" as opposed to mimicking human intelligence by mapping how humans answer questions after analyzing huge data sets.

Feb

5

Trading smörgåsbord

February 5, 2024 | Leave a Comment

Kim Zussman offers:

Meet the Investors Trying Quantitative Trading at Home

Pietros Maneos trades stocks like many of Wall Street’s most sophisticated operations: running dozens of computer-driven strategies in parallel to chase market-beating returns. But he isn’t some tech-savvy math type. He is a published poet who doesn’t know how to code. Maneos, 44 years old, uses online-trading platform Composer.trade to build, test and bet on quantitative trading algorithms that buy and sell stocks and exchange-traded funds out of his home office in Boca Raton, Fla. One algorithm, for example, holds a triple-leveraged exchange-traded fund tracking the Nasdaq-100 index if the S&P 500 index has recently trended higher—and Treasury bills otherwise. He is currently running 72 such schemes he constructed with the application’s graphical interface, but can also type requests in plain English that Composer’s AI will translate into code. “It’s like having my own personal black box,” he said. “You could argue that I’m a hedge fund with 72 strategies.”

Big Al is puzzled by this bit from the above:

Many users praise its simplicity. But several warned about the tax implications of wash sales and the absence of some common Wall Street risk-management tools, such as one that would automatically exit a strategy when a specified loss is reached.

Huh?

Zubin Al Genubi wonders about market microstructure:

On CME is not clear. Is there somewhere how price changes is explained? Seems the asks should go to 0 before price clicks up but they don't. There is a lot of juggling in the queue as well, spoofing, stuffing. I'm reading Flash Crash, by Liam Vaughan.

Jeff Watson responds:

Here is an excellent perspective on spoofing.

Big Al adds:

This book gets recommended a lot but I haven't read it. Pubbed in 2002.

Trading and Exchanges: Market Microstructure for Practitioners, by Larry Harris.

Asindu Drileba recommends:

I am currently enjoying this biography of Jessie Livermore by Patrick Boyle. It's so well narrated, I hope some of you enjoy it.

Henry Gifford observes:

Patrick Boyle says he used to work for Vic.

Feb

4

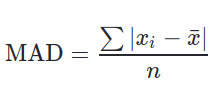

Convergence under CLT, from Zubin Al Genubi

February 4, 2024 | Leave a Comment

Under the central limit theorem, the distribution of sample means approximates a normal distribution as the sample size gets larger, regardless of the population's distribution. For a Gaussian distribution a sample size of 30 is fine. For Student T distribution with 3 degrees of freedom, which many of us use, with fatter tails, convergence under CLT requires a sample of at least 130! This would leave only some very broad trade criteria for a robust confidence level.

William Huggins responds:

that sample size is only required is you want to make confidence intervals based on the normal distribution (which requires convergence) but you can make confidence interval from almost any sample size and certainly with any distribution. the difference is that smaller sample T's produce large standard errors (due to fatter tails).

Theodosis Athanasiadis comments:

i believe one should approach testing and risk management differently. for back-testing you care more about the mean of the distribution so you should use either a bootstrap (as William mentioned) or even shrink the outliers using some robust statistic. for risk management/stops you should definitely use fatter tails.

Feb

3

Russ Roberts likes Milei’s economics

February 3, 2024 | Leave a Comment

Russ Roberts@EconTalker

Ninety seconds of economics. Shockingly clear and shockingly subtle.

Stefan Jovanovich comments:

This is the usual slight of hand by "free traders". Instead of discussing tariffs as a question of taxation, they always present it as a matter of personal liberty good vs. bad. Yet somehow that discussion never moves over to employment taxes; having the government take a quarter of everything even the lowest paid worker earns is not to be examinged as a matter of personal liberty.

The truth about tariffs as taxes is what Americans knew in the 19th century. If you want the revenue, the rate has to be low enough - 20% on average - that there is less pain in paying it than in smuggling or cheating. You cannot have quotas (funny how, in matters of employment taxes, we have them; no one is allowed to work for less than the minimum wage). Unlike employment taxes, tariffs take their money first from the wealthy; that was the Southern "way of life" complaint about them before and after the Civil War.

Feb

2

A certain chair; price controls

February 2, 2024 | Leave a Comment

The most bull thing of the month is that a certain chair would not be reappointed if there were a change in admins. Thus, the certain chair like anybody else will be extra vigilant to save his job by creating an ebullient picture in next 10 months.

How Price Control Leads to…Socialism, by Ludwig von Mises:

The government believes that the price of a definite commodity, e.g., milk, is too high. It wants to make it possible for the poor to give their children more milk. Thus it resorts to a price ceiling and fixes the price of milk at a lower rate than that prevailing on the free market. The result is that the marginal producers of milk, those producing at the highest cost, now incur losses. As no individual farmer or businessman can go on producing at a loss, these marginal producers stop producing and selling milk on the market. They will use their cows and their skill for other more profitable purposes. They will, for example, produce butter, cheese, or meat. There will be less milk available for the consumers, not more.

Full treatise: The Middle of the Road Leads to Socialism

Jan

31

The benefits of small business

January 31, 2024 | Leave a Comment

in book 1 of Les Miserables there is a resonant section as to how Jean Valjean, now Mssr. Madeleine, has invented a new way of making "English jet and the black glass trinkets", and his factories have uplifted all in the Town. it is the story I have seen with hundreds of small companies that have invented a new product or manufacturing technique and have created jobs and prosperity for their workers and town. It is strangely omitted from all the summaries of the book and could have been applied to Musk, Bezos and the Fad 5 in our current generation. every kid should read the chapter and reflect on what good business does.

I take my hat off to Norman Tyler of Tyco, and Harvey Sellers of Hi-Flier Kites, and Arthur Bernard of Bernard Welding, and Baron Coleman or Hospital Affiliates - the first 3 companies (out of eventually 100's) that I sold in my merger bus and I shall revere their memory.

"Unlike this judge, Elon Musk has actually contributed to the American People in the form of thousands of good paying jobs, innovative products and less expensive access to space." out of Les Miserables. Including significant ROI for those that supported Tesla.

Toward the close of 1815, a man, a stranger, had settled in the town, and had the idea of substituting in this trade gum lac for rosin, and in bracelets particularly, scraps of bent plate for welded plate. This slight change was a revolution: it prodigiously reduced the cost of the material, which, in the first place, allowed the wages to be raised, a benefit for the town; secondly, improved the manufacture, an advantage for the consumer; and, thirdly, allowed the goods to be sold cheap, while tripling them the profit, an advantage for the manufacturer.

- from book 5 chapter 1 of Les Miserables (a la Musk).

Jan

28

Revelations of The Prisoners Dilemma, from Asindu Drileba

January 28, 2024 | Leave a Comment

This is my favourite channel an YouTube. And I liked this particular episode so much it may be my favourite so far:

What The Prisoner's Dilemma Reveals About Life, The Universe, and Everything

The prisoners dilemma is a choice participants need to make that are as follows:

1. If both participants cooperate, they both get $10 each.

2. If only one of the participants cooperate, the defector gets $1, and the one trying to cooperate (be honest) gets $0.

3. If both participants defect (both are dishonest to each other), they both get $1, which is way less than the $10 they would each get by both cooperating.

These are the only four possible states or outcomes of the game. The objective is simple, if the game is repeated for several rounds, under different environments (varying ratio of cooperators & defectors). What strategy should one choose to make the most money? Several agents choose independent strategies and play against each other with whatever strategy they have chosen. All with the aim of making the most money. It turns out that the best strategy for this game amongst different agents is one they call "Tit for Tat". It can be summarised as, "Be Nice, Try to forgive, But don't be a doormat/push over."

Stefan Jovanovich writes:

Pinched from a Stanford course catalog from 1998/9: Axelrod's Tournament:

In 1980, Robert Axelrod, professor of political science at the University of Michigan, held a tournament of various strategies for the prisoner's dilemma. He invited a number of well-known game theorists to submit strategies to be run by computers. In the tournament, programs played games against each other and themselves repeatedly. Each strategy specified whether to cooperate or defect based on the previous moves of both the strategy and its opponent.

Big Al adds:

The Evolution of Cooperation, by Robert Axelrod

We assume that, in a world ruled by natural selection, selfishness pays. So why cooperate? In The Evolution of Cooperation, political scientist Robert Axelrod seeks to answer this question. In 1980, he organized the famed Computer Prisoners Dilemma Tournament, which sought to find the optimal strategy for survival in a particular game. Over and over, the simplest strategy, a cooperative program called Tit for Tat, shut out the competition. In other words, cooperation, not unfettered competition, turns out to be our best chance for survival.

Kim Zussman gets biological:

Cooperation and Darwin:

Humbert H. comments:

The original prisoner’s dilemma was about literal prisoners who didn’t get to play even twice with the same “partners”. There are a lot of situations in the real world that map to the prisoner’s dilemma, but a lot fewer that map to playing the same game with the same partners who are rational and capable of learning.

Big Al appends:

Yale Game Theory Course (24 videos), with Dr. Benjamin Polak.

Peter Grieve goes deep:

I am convinced that the principal functions of a healthy society are (1) to get to the good payoff of the Prisoner's Dilemma, and (2) to find an acceptable solution for the Trolley Problem.

Jan

27

Bitcoin forecast, from Larry Williams

January 27, 2024 | Leave a Comment

Asindu Drileba writes:

A lot of Bitcoiners are expecting a crazy bull run incoming. Their conjecture is that after the halvening, a shock of supply in BTC will cause the price to sky rocket. Previous bull runs have followed this halvening event. It is very refreshing to see a completely different original opinion.

Sam Johnson asks:

You certainly don't need to reveal the source or methodology of the red line data from your timely bitcoin forecast if you don't wish. But when choosing cycles to forecast markets, is there consistency in the order in which you approach finding good cyclical indicators? Do you begin by "chart matching" or finding a leading indicator that visually/numerically correlates well and front-runs certain markets, or do you start with a hypothesis, testing, and then using or discarding such forecasting cycles?

Larry answers:

The forecast here is really simple: it’s just the longer-term cycle forecast for GBTC. I arrive at it by doing a complete cycle search the meld together the 3 with the highest fit.

Andy Aiken asks:

How do you account for the fact that GBTC was a closed-end fund trading at a discount for the past several years, but the discount closed prior to it recharacterizing as an ETF on Jan. 11? This is a one-time event specific to GBTC, not subject to a cycle. What is the significance for bitcoin?

Larry answers (again):

I just use the back-adjusted data as provided.

Andy Aiken adds:

Speaking of mining rewards, the next halving (in which future mining rewards are cut in half, resulting in less reward from mining as well as less inventory to be sold by miners interested only in cash flow), is in about 100 days. This has been historically a (bullish) tailwind.

But with GBTC being converted to a spot ETF, several bankrupt entities are selling their inventory. FTX is now finished selling about $1B in GBTC since Jan. 11, but 3AC has yet to start selling, and that firm had more on its books than FTX. While I am more bullish than your projection, it's interestingly contrarian and would screw with traders' heads as markets like to do.

Jan

27

An inspiring passage

January 27, 2024 | Leave a Comment

An inspiring passage from In the Kingdom of Ice: The Grand and Terrible Polar Voyage of the USS Jeannette: "The polar regions were far safer than the Dark Continent. For decades our explorers, one after the other, have let themselves be slaughtered in the interiors of the most dangerous continents, especially Africa, perhaps by fanatical inhabitants, perhaps by the deadly climate, while such dangers and sacrifice occur with Arctic expeditions, at the most, only as rare exceptions.

The Hampton Sides story of De Long and Bennett inspires one to reach for the 5000 level in the S&P and further.

Jan

26

Variance swap, from Zubin Al Genubi

January 26, 2024 | Leave a Comment

Daily sd's 1 (1,1,1,1,1,0,0) mean variation .71 PL 2

Daily sd's 2 (0,0,0,0,0,0,5) mean variation .71 PL -18

Correct forecast, but went bust anyway, due to lumping of volatility.

Asindu Drileba asks:

What would be the best strategy to capture the return of this distribution? How would the position size be computed? Say you have $10.

Zubin Al Genubi replies:

OTM option? Don't know which direction so maybe a strangle? Its an example of a fat tail event surprising someone expecting a certain variance. Like the LTCM guys. $.20? 2%? As a hedge. Depends if its hedge or a trade.

William Huggins comments:

what you're picking up on is that variance alone doesn't describe non-normal distributions very well - you need additional tools like skewness (possibly kurtosis) to pick up on those differences. despite having a better description though, there is the presumption that the data generating process is stable across the sample period, and going forward. I've generally found (despite my poor timing record) that money is to be made when the distribution is changing, not stable (the computers rule those waves imo) so detecting breaks may be more valuable than fixed descriptions.

Peter Ringel writes:

I can confirm this from the math-undereducated trading side. Stability is boring, and boredom can lead to undisciplined trades. Shocks and short-term exaggerations are great.

Art Cooper points out:

Stability is boring, and boredom can lead to undisciplined trades. It's Minsky's Theory when this becomes widespread.

Zubin Al Genubi responds:

Thank you Dr Huggins. That is indeed the point that variance, regression, sd, means, should be used with power law distributions with extreme caution or not at all.

Hernan Avella questions:

Why is all that mumbo necessary when all you need is good entries and good stops? The house never closes and there are so many opportunities ahead. f you need that big of a stop, or it gets triggered so frequent that ruins the profits, your system sucks! It’s not a stop-loss problem.

H. Humbert comments:

I think he is saying the system did suck because it relied on improper statistical analysis, using gaussian distributions for prediction when it should have used a more sophisticated statistical analysis that doesn't make such assumption. If you know of good entries reliably without using statistics, more power to you! And maybe he needs volatility swaps in addition to variance swaps and then his system will be A-OK because that could be a simple way to hedge the fat tails. Since I don't trade, I'm just trying to interpret what's flying by.

Humbert H. writes:

Var swap vs. vol swap would be the purest expression. You could also buy a call on realized variance, by buying an uncapped variance swap and selling a capped variance swap (for historical reasons, the cap is struck at 2.5x the variance swap strike, the cap level acting as your effective call strike).

For 100k vega notional and uncapped strike at 22, and capped strike at 20, and realized vol over the period of 80:

100,000/(2*strike) = var notional = 2,272.72 var units uncapped, 2500 var units capped

Pnl uncapped 13.4mm

Pnl capped -4.1mm

Net 9.3mm for ~0.2m cost, not bad (approx (22-20) * vega not).

Some payouts were on the order of 2000:1 during March 2020. Pre 2020 you had some active sellers:

‘Amateurish’ Trades Blew Up AIMCo’s Volatility Program, Experts Say

H. Humbert responds:

Interesting. And an interesting article. You'd think that after LTCM people would realize that 100 year floods are just named that for convenience. That's why I never buy stocks in insurance companies. He whose name shouldn't be mentioned (not the fractalist but the Middle Eastern guy) always advocated buying black swan options, but I think the Chair didn't think he made money on this.

Kim Zussman links:

Jan

26

With direct applications to markets

January 26, 2024 | Leave a Comment

two excellent books with direct applications to markets:

Regression: Linear Models in Statistics, by Bingham and Fry.

Event History Analysis: Statistical theory and Application in the Social Sciences, by Blossfeld, Hamerle, and Mayer.

both highlly recommended

Zubin Al Genubi adds:

Previously recommended by Vic:

Event History and Survival Analysis: Regression for Longitudinal Event Data

I've used survival statistics for studying survival time between crashes, x-day highs/lows, ATH, bear markets. Poisson distributions are the distribution for time occurrences as well.

Big Al offers:

Free online book using R language:

Statistical Modeling: Regression, Survival Analysis, and Time Series Analysis, by Lawrence Leemis, William & Mary.

Jan

25

David Deutsch on Bayesianism, from Asindu Drileba

January 25, 2024 | Leave a Comment

People have said that the reason fundamental physics has slowed down is that we have picked all the lower-hanging fruit, but that's not true. There is more lower-hanging fruit than ever before, it's just that picking it is stigmatized.

- David Deutsch

The full podcast is here.

This reminds me of what Brian Arthur insinuated in his book, The Nature of Technology. Brian Arthur describes technology as a combination of other technologies. An example is smart phone being a combination of battery technology, wireless communication technology, a microprocessor technology etc. A common statement I hear often is that we will not see much more technological progress because all the lower hanging fruit (or important things to be invented) are gone. Brian Arthur in his book asserts that if technology is a combination of other technologies, then the invention of new technology should increase the possible space of new technologies that can be invented. For example an AI breakthrough (the invention of the Transformers Model that underlies ChatGPT) will make it easier to invent new products, discover new phenomena which will also make it easier to produce even newer technology. Could this insight be a a good conjecture for always being long technology companies, since we expected technology to grow almost boundlessly if this is true?

Peter Saint-Andre comments:

Although it's seemingly true that technology always grows, that doesn't necessarily mean that technology companies are always a good investment. Various technology industries (crypto, Internet, semiconductors, chemicals, automobiles, radio, railroads, etc.) have experienced cycles of over-investment and hype. I worked in Internet tech companies from 1996 through 2022, and plenty of the companies I worked at either went bust (returning nothing to the investors or employee stockholders) or never approached their former highs (can you say Cisco?). It's not clear to me that, on balance, technology companies provide above average returns. But my perspective is qualitative, not quantitative.

Zubin Al Genubi responds:

That is the Lucretius Fallacy. Thinking the prior highest or best is the top. There will always be something new, bigger, better. That is why NQ is good over time. The old fades out and the new rises ever higher.

Asindu Drileba replies:

It is true that most tech companies actually fail without ever yielding a profit. How ever if your are diversified i.e have a very broad portfolio of investments. You don't have to be successful very many times. You can do very well with a 90% failure rate. Fred Wilson (of Union Square Ventures) claims that half of all VCs beat "The Stock Market" (I am assuming he means the S&P 500).

Big Al writes:

Important, too, to notice the improvements in ordinary things we might otherwise take for granted. A lot of this progress happens in basic materials. A quick search produces:

9 Material Discoveries that Could Transform Manufacturing

During Covid, our dishwasher broke. It was at least 35 years old and possibly older (amazing the use we got from it!). Because seemingly everybody was remodeling while they were stuck at home, it took us 3 months to get a new Bosch (during which time I washed a *lot* of dishes). But I was amazed at what an improvement the new Bosch machine was: it's so much more efficient, with energy and water, and effective, as well as quiet and very smart. That experience woke me up a bit to how much things get improved, and without any central planning authority being responsible for it.

Hernan Avella warns:

Yet, the new Bosch won't last 1/2 of the old one.

Jan

24

For the Darwin fans, from Peter Saint-Andre

January 24, 2024 | Leave a Comment

I just posted the Voyage of the Beagle at my website for public domain books (optimized for reading on phone or tablet).

I'd previously also posted Darwin's Autobiography.

Jan

22

The Poisson Process and Poisson Distribution, from Asindu Drileba

January 22, 2024 | Leave a Comment

This is the best explanation I have seen so far concerning the Poisson Process & Poisson Distribution. It has clearly defined math variables (something explanations involving maths seldom do) & very clear practical examples. I wish more people describing math concepts wrote like this.

A Poisson process is a model for a series of discrete events where the average time between events is known, but the exact timing of events is random. The arrival of an event is independent of the event before (waiting time between events is memoryless).

Zubin Al Genubi comments:

Seems useful to study occurrences of crash or bear market.

Big Al offers:

3Blue1Brown does some great math videos, eg:

Binomial distributions | Probabilities of probabilities, part 1

H. Humbert is skeptical:

It's hard to know without a lot of study whether this is useful for any real-world applications. This distribution has been used in network traffic modeling since the advent of networks because networks have packets and packets have rates that COULD be pretty stable over the period of interest. It worked pretty well for legacy telephone networks, but not so much as computer networks become more and more complex. People still like it because it's a relatively simple formula where if you know the lambda you know everything, and it has no memory of the past so you don't need to store the past, but it doesn't really work well. It doesn't even work that well for predicting meteor showers because the rate itself is subject to change, so can it really work well as a predictive tool for the markets?

Andrew Moe writes:

Poisson has shown to be useful in predicting soccer and hockey scores. In the markets, one test might be to model uncorrelated markets against each other in a double Poisson, like the soccer quants do. Offense and defense, up markets and down.

Jan

21

Wall Street And The Wilds

January 21, 2024 | 1 Comment

great book: Wall Street And The Wilds (Internet Archive version), by Anthony Weston Dimock. 1915. invented a very good gold system. competed with the Commodore in steam ship lines and railroads. touched every area of gilded age business. was great naturalist and photographer.

Also: Dick In the Everglades

Jan

20

Useful bears

January 20, 2024 | Leave a Comment

El-Erian Says Markets Have Overpriced Speed, Depth of Fed Cuts

• I wouldn’t be surprised if cuts only start in summer: El-Erian

• Markets are underestimating stubborn service-sector inflation

Jan

19

Numberphile interview with Jim Simons, from Big Al

January 19, 2024 | Leave a Comment

Interesting in many ways:

James Simons (full length interview) - Numberphile

He worked a lot on differential geometry which would seem to be the area of Ralph Vince's manifolds.

Zubin Al Genubi writes:

Differential geometry would be good for Ralph Vince's optimal f portfolio calculation finding the peak "hump" in the multidimensional surface. Can anyone recommend a good entry level book?

Big Al offers:

Possible: The Leverage Space Trading Model: Reconciling Portfolio Management Strategies and Economic Theory by Ralph Vince.

Also a list of Ralph's publications.

Zubin Al Genubi comments:

An interesting aspect of Vince's optimal f calc for a portfolio is that it solved by iteration. The idea of iteration is interesting in finding optimal values in functions. Also, graphing is an important tool to find maxima, and inflection points in curved functions.

Big Al adds:

Newton's method in optimization

Jan

17

The sin-eater

January 17, 2024 | Leave a Comment

the joy of set pieces in O'Brian and Conan Doyle. the Hoodoo.

'I have a curious case in the sick-bay,' he said to James, as they sat digesting figgy-dowdy with the help of a glass of port. 'He is dying of inanition; or will, unless I can stir his torpor.'

'What is his name?'

'Cheslin: he has a hare lip.'

'I know him. A waister—starboard watch—no good to man or beast.'

'Ah? Yet he has been of singular service to men and women, in his time.'

'In what way?'

'He was a sin-eater.'

'Christ.'

'You have spilt your port.'

'Will you tell me about him?' asked James, mopping at the stream of wine.

'Why, it was much the same as with us. When a man died Cheslin would be sent for; there would be a piece of bread on the dead man's breast; he would eat it, taking the sins upon himself. Then they would push a silver piece into his hand and thrust him out of the house, spitting on him and throwing stones as he ran away.'

'I thought it was only a tale, nowadays,' said James.

[More on sin-eaters.]

Jan

17

Statistical Consequences of Fat Tails, from Zubin Al Genubi

January 17, 2024 | Leave a Comment

Statistical Consequences of Fat Tails

Taleb discusses how fat tails can affect probabilities. Is a 10 sigma event an outlier or is it part of a different power law distribution. How slowly does the Central limit theorem conform say Student T distribution to normal (need n>120) for proper confidence levels. Learned about Pareto and other power law distributions. Book suffered from poor editing, missing color references, and Taleb's abrasive pedantics. Recommended nonetheless.

Asindu Drileba writes: