Jan

4

12 Things That Happy People Do, from Jeff Watson

January 4, 2012 | Leave a Comment

Here's a good article listing 12 things that happy people do differently than everybody else. I don't agree with everything on the list and I would add a few anecdotal things points. I wonder if the we could compile a complete list of things happy people do differently. I'll bet there's more than 12 things, probably closer to 100.

Here's a good article listing 12 things that happy people do differently than everybody else. I don't agree with everything on the list and I would add a few anecdotal things points. I wonder if the we could compile a complete list of things happy people do differently. I'll bet there's more than 12 things, probably closer to 100.

Russ Sears writes:

Perhaps top on my list of New Years resolutions this year is to learn to enjoy effort both intellectually and physically. I believe this will perfect several of the items on the list… including 1. Take care of your body (and mind). Practice "Flow" 2. Savor Life's Joys (by practicing "Living") 3. Setting goals 4. Develop coping skills.

All these are achieved mainly by loving the challenges of effort. But perhaps more importantly, this will help you maximize the resources you are given.

This is the key to feeling good about yourself and overcoming the fears that turn into opportunities.

I would add to the list: "Learn to guard and value money for the freedom and potential opportunities it can bring to your and your families life".

Jan

2

Here's a great article called "guitar tricks for a middle aged dog" describing a 38 year old's successful attempt to learn how to play the guitar. Many lessons in this article can be carried over to trading and other areas of life.

Dec

15

Top 5 Regrets in Life, from Jeff Watson

December 15, 2011 | 2 Comments

Have you seen this article about the top 5 regrets of the dying? It is a must read.

Have you seen this article about the top 5 regrets of the dying? It is a must read.

Gary Rogan writes:

I really liked all of them, except based on everything that I know I disagree with the statement that "happiness is a choice". Irrational fears are not a choice, depression is not a choice, and neither is happiness.

Gibbons Burke writes:

Well, happiness is dependent on one's attitude, and in many cases, you can choose, control or direct your attitude.

My theory is unhappiness and depression happen when reality does not live up to one's expectations of what life is "supposed" to be like. I think the key to happiness is letting go of those expectations. That action at least is within an individuals purview and control. There is an old Zen maxim: If you are not happy in the here and now, you never will be.

Russ Sears adds:

I think most irrational fears and depression stem from the unintended consequences of one's choices or often, the lack of decisions, such as little or no exercise. However, I believe many of these choices are made when we are children, and we do not fully understand the consequences. Many of these bad choices may be taught often though example by adults or sometimes it is just one's unproductive coping methods that are simply not countered with productive coping methods by the adults in their lives. I think some people are more prone to fall into these ruts, but most of these ruts are dug none the less.

Jim Sogi writes:

The regrets are perhaps easily said on the deathbed but implementing these choices in life is very difficult. Many can not afford the luxury of such choices. When there is no financial security hard work is a necessity. Such regrets are not much different than daydreams such as, oh I wish I could live in Hawaii and surf everyday. The fact of the matter is that the grass always seems greener on the other side. Speak to the lifestyle guys in their old age. Will they say I wish I worked harder and had a career and made more meaning of life than being a ski bum or surf bum?

Gary Rogan responds:

What you say is true about the effects of exercise. But that's just one of many factors that are biochemical in nature. Pre-natal environment, genetics, and related chemical balances and imbalances are highly important in the subjective perception of the level of happiness. There are proteins in your brain that effect how the levels of happiness-inducing hormones and neurotransmitters are regulated and there is nothing you can do about it without a major medical intervention. Certainly some choices that people make affect their eventual subjective perceptions through the resultant stresses and satisfying achievements in their lives, so the choice part of it can clearly be argued. My main point was that by the time the person is an adult, their disposition is as good as inherited. They can vary the levels of subjective perception of happiness around that level through their actions, but they are still stuck with the range, mostly through no fault or choice of their own.

Since a few literally quotations on the subject have been posted, let me end with the quote from William Blake that was used before the chapter on the biological basis of personality I recently read:

Every Night & every Morn

Some to Misery are Born.

Every Morn & every Night

Some are Born to sweet Delight.

Ken Drees writes in:

I believe that you must put effort towards a goal and that exercise in itself begets a reward that bends toward happiness. It's the journey, not the end result. You must cultivate to grow. A perfectly plowed field left untended grows weeds–the pull is down if nothing is done.

Russ Sears adds:

It has been my experience with helping others put exercise into their lives that few teens and young adults have reached such a narrow range that they cannot achieve happiness in their lives. This would include people that have been abused and people that have a natural dispensation to anxiety. Their "range" increases often well beyond what we are currently capable of achieving with "major medical intervention". As we age however our capacity to exercise decreases. While the effects of exercise can still be remarkable; they too are limited by the accelerated decay due to unhappiness within an older body's capacity. Allowing time for our bodies is an art. Art that can bring the delights of youth back to the old and a understanding of the content happiness of a disciplined life to the young.

It has been my experience with helping others put exercise into their lives that few teens and young adults have reached such a narrow range that they cannot achieve happiness in their lives. This would include people that have been abused and people that have a natural dispensation to anxiety. Their "range" increases often well beyond what we are currently capable of achieving with "major medical intervention". As we age however our capacity to exercise decreases. While the effects of exercise can still be remarkable; they too are limited by the accelerated decay due to unhappiness within an older body's capacity. Allowing time for our bodies is an art. Art that can bring the delights of youth back to the old and a understanding of the content happiness of a disciplined life to the young.

Peter Saint-Andre replies:

Horsefeathers.

Yes, hard work is often a necessity. But hard work does not prevent one from pursuing other priorities in parallel (writing, music, athletics, investing, whatever you're interested in). Very few people in America have absolutely no leisure time — in fact they have a lot more leisure time than our forebears, but they waste it on television and Facebook and other worthless activities.

Between working 100 hours a week (which few do) and being a ski bum (which few also do) there lies the vast majority of people. Too many of them have ample opportunity to bring forth some of the songs inside them, but instead they fritter their time away and thus end up leading lives of quiet desperation.

It does not need to be so.

Dan Grossman adds:

Jim Sogi has a good point. The deathbed regret that one didn't spend more time with one's family is frequently an unrealistic cliche, similar to fired high level executives expressing the same sentimental goal.

The fact is that being good at family life is a talent not everyone has. And family life can be difficult, messy and not easy to make progress with. Which is perhaps one of the reasons more women these days prefer to have jobs rather than deal all day with family.

Being honest or at least more realistic on their deathbeds, some people should perhaps be saying "I wish I had spent more time building my company."

Rocky Humbert comments:

I feel compelled to note that this discussion about deathbed regrets has been largely ego-centric (from the viewpoint of the bed's occupant) — rather than the perspective of those surrounding the deathbed. I've walked through many a cemetery, (including the storied Kensico Cemetery) and note the preponderance of epitaphs that read: "Loving Husband,"; "Devoted Father," ; "Devoted Mother," and the absence of any tombstones that read: "King of Banking" or "Money Talks: But Not From the Grave."

I feel compelled to note that this discussion about deathbed regrets has been largely ego-centric (from the viewpoint of the bed's occupant) — rather than the perspective of those surrounding the deathbed. I've walked through many a cemetery, (including the storied Kensico Cemetery) and note the preponderance of epitaphs that read: "Loving Husband,"; "Devoted Father," ; "Devoted Mother," and the absence of any tombstones that read: "King of Banking" or "Money Talks: But Not From the Grave."

Notably, Ayn Rand's tombstone in Kensico is devoid of any comments — bearing just her year of birth and death. (She is, however, buried next to her husband.)

In discussing this with my daughter (who recently acquired her driver's license/learning permit), I shared with her the ONLY memory of my high school driver's ed class. (The lesson was taught in the style of an epitaph.):

"Here lies the body of Otis Day.

He died defending his right of way.

He was right; dead right; as he drove along.

But now he's just as dead, as if he'd been wrong."

Kim Zussman writes:

Is an approach of future regret-minimization equivalent to risk-aversion?

Workaholic dads have something to show for their life efforts that Mr. Moms don't, and vice-versa.

If so, perhaps the only free epithet is to diversify devotions — at the expense of reduced expectation of making a big mark on the world or your family.

Dec

11

The Wavejet, from Jeff Watson

December 11, 2011 | Leave a Comment

There's a big change coming in surfing during the spring of 2012. The Wavejet propulsion system is coming to your local surf break. This system is a pretty slick propulsion unit that can either be retrofitted into boards, or integrated into new boards. It uses state of the art electronics, has remarkable engineering, and is quite durable. The Wavejet purportedly will give 8-10 knots of speed paddling in calm waters for 40 minutes. The hardest part of surfing is the paddling, and the paddling can take it's toll. Eliminate the tough paddle, and one could have a more pleasurable time surfing, spending more time trying to catch waves, perfecting their riding skills while not too tired out. The downside of the system is that surfers will lose some of the exercise benefits a vigorous go out brings, surfers will get out of shape, surfers might try to surf in conditions that are above their skill level, and finally, this will allow non-surfing kooks to attempt (clog up) to surf breaks that are way beyond their non-existent skill levels. The Wavejet could be a development like the boogie board, which introduced wave riding to the masses. This could be good or bad depending on your perspective. Frankly, I think it will be a good thing as it will introduce the joys and stoke of riding a wave to the masses. The rest of my surfing buddies don't agree with me, but that's beside the point. Here's the Wavejet in action .

There's a big change coming in surfing during the spring of 2012. The Wavejet propulsion system is coming to your local surf break. This system is a pretty slick propulsion unit that can either be retrofitted into boards, or integrated into new boards. It uses state of the art electronics, has remarkable engineering, and is quite durable. The Wavejet purportedly will give 8-10 knots of speed paddling in calm waters for 40 minutes. The hardest part of surfing is the paddling, and the paddling can take it's toll. Eliminate the tough paddle, and one could have a more pleasurable time surfing, spending more time trying to catch waves, perfecting their riding skills while not too tired out. The downside of the system is that surfers will lose some of the exercise benefits a vigorous go out brings, surfers will get out of shape, surfers might try to surf in conditions that are above their skill level, and finally, this will allow non-surfing kooks to attempt (clog up) to surf breaks that are way beyond their non-existent skill levels. The Wavejet could be a development like the boogie board, which introduced wave riding to the masses. This could be good or bad depending on your perspective. Frankly, I think it will be a good thing as it will introduce the joys and stoke of riding a wave to the masses. The rest of my surfing buddies don't agree with me, but that's beside the point. Here's the Wavejet in action .

Dec

11

Flight Transcripts, from Jeff Watson

December 11, 2011 | Leave a Comment

Here's the long awaited black box transcript of what happened during the crash of Air France Flight 447. So many kinds of errors, combined with irrational thinking, false data, no data, and misconceptions caused this plane to splash. The parallels of the last few minutes of this flight are very similar to the thoughts and actions of that moment when a trader is digging his own grave. This transcript is worthy of much detailed analysis and discussion. I'm sure that the analysis of the transcript can better help speculators upgrade their worse case scenario plan.

Here's the long awaited black box transcript of what happened during the crash of Air France Flight 447. So many kinds of errors, combined with irrational thinking, false data, no data, and misconceptions caused this plane to splash. The parallels of the last few minutes of this flight are very similar to the thoughts and actions of that moment when a trader is digging his own grave. This transcript is worthy of much detailed analysis and discussion. I'm sure that the analysis of the transcript can better help speculators upgrade their worse case scenario plan.

Chris Tucker, air traffic controller at JFK, responds:

I have recently discussed this incident with a USAirways check captain. There are several problems– the first appears to be poor or insufficient training– partial panel operations are a part of the core instrument flight training curriculum– this is basic stuff. Figuring out which instrument or instruments that are unreliable is not that difficult. The other instruments combined can give a clear picture of the aircrafts situation. See a nice lesson plan in partial panel operations here.

I have recently discussed this incident with a USAirways check captain. There are several problems– the first appears to be poor or insufficient training– partial panel operations are a part of the core instrument flight training curriculum– this is basic stuff. Figuring out which instrument or instruments that are unreliable is not that difficult. The other instruments combined can give a clear picture of the aircrafts situation. See a nice lesson plan in partial panel operations here.

The second and most glaring problem to me is the disconnect between the two control sticks. Airbus uses a side mounted joy stick instead of a forward mounted control column with yoke. In most aircraft, the other pilot is always aware of the position of the control column because as the other pilot makes adjustments– his own column moves in synch– he can see it. So if the pilot in the left seat is pulling back on the yoke, the right seat pilot is aware of it and if this is the absolute wrong thing to do (as was the case here) he can bring his expertise to bear and help fix the problem. But that is not the case with the Airbus, and in this situation the pilot not flying was completely unaware that the pilot flying was holding the stick back.

The way this system is designed, in my opinion, is insane. The pilot not flying has little idea what the flying pilot is doing unless the flying pilot informs him– which should be mandatory in a situation like this.

It occurs to me that the even though all of the information necessary to fly the aircraft safely was right in front of them, that these two pilots became scared, very scared and stopped thinking properly. This is a big problem and it can only be addressed through training. Any pilot can tell you that when the aircraft stalls the immediate response is always to lower the nose and add power. Always. This is a part of training that should be done so thoroughly that it is imprinted on the student permanently.

So why did Bonin persist in holding back the stick? I find it difficult to believe that a pilot in a heavy, long haul international aircraft is so unfamiliar with his planes systems as to not understand the difference between operating in "normal law" - where the onboard computers will not allow the aircraft to stall– and "alternate law" where the computers will allow this. This is critical knowledge and I doubt their training regimen permits them to forget it– even if operation in "alternate law" has never occurred in the past. But something prevented them from believing that the aircraft was stalled– regardless of the blaring and continuous stall warnings.

I cannot say why this pilot behaved as he did, but I can say something that I say to all my trainees on the radar. "The best possible thing to do with the time available to you is to think". From this one premise you can elicit behaviors that will promote it. I like to wait until the trainee is very, very busy and say "stop talking– just stop for a few seconds and look at the situation and think about it. You have plenty of time to do what you need to do." It is my understanding that when you are talking you are not thinking– so we try to reduce the number of clearances, try to combine instructions, keep the chatter on the frequency down. Stopping and trying to think about the situation, even in the midst of chaos, is the best thing you can do to fix it. Why this didn't happen on that flight deck is beyond me.

Dec

8

Folly of Prediction, from Jeff Watson

December 8, 2011 | Leave a Comment

Levitt and Dubner (of Freakonomics fame) have a new podcast up titled the "Folly of Prediction." Very flawed, but definitely an hour of entertainment value for the specs.

Nov

13

World’s Smallest Car, from Jeff Watson

November 13, 2011 | 4 Comments

Here are the specs for the world's smallest electric car, recently developed by researchers at the University of Twente in the Netherlands.

Size: 1 molecule long Range 6 billionths of a meter Operating temp: -266C Seating: 0

Frankly, you have to see this to believe it.

Nov

9

McRib vs. 7/11 Barbeque Sandwich Showdown, from Jeff Watson

November 9, 2011 | 1 Comment

Here in Florida, and in many other areas of the country, McDonalds sandwich, the McRib is back on the menu for a limited engagement. I wrote earlier on Daily Speculations in 2009 about how much I enjoyed this tasty morsel of mystery pork. Since the McRib is back, I felt the need to stop by and get one or twenty.

Here in Florida, and in many other areas of the country, McDonalds sandwich, the McRib is back on the menu for a limited engagement. I wrote earlier on Daily Speculations in 2009 about how much I enjoyed this tasty morsel of mystery pork. Since the McRib is back, I felt the need to stop by and get one or twenty.

A little back story here. On my way to McDonalds, I needed to fill up my car and went over to 7/11 where the gas is the cheapest in town. While going inside and getting a coke, I noticed that 7/11 has their own version of a BBQ sandwich in their deli section (who knew that 7/11 had a deli section). Their BBQ sandwich is wrapped in plastic, has a sell by date, and needs to be microwaved. My first thought…."This would be perfect for a McRib, 7/11 "Barbeque Rib Sandwich" showdown. They're really cheap and I paid $2.19 and walked out with a 7/11 "Barbeque Rib Sandwich." I went straight over to MickeyD's and bought a McRib and some fries.Took both sandwiches home and put the 7/11 version in the microwave as instructed. When it was warm, I took the McRib and 7/11 sandwich out of their packaging and put them side by side to compare.

The McRib was still warm and had a nice looking bun with a 1/4 inch of mystery meat poking out the side of the bun with some of the tangy sauce dripping down the side. The 7/11 version had an anemic looking bun, stale and soggy, and one could not tell what was inside. I opened the McRib and saw the mystery meat, BBQ sauce, onions, and pickles, and it looked pretty good. Opening the 7/11 version, I noticed that there was some nasty type of ketchup like sauce that was misapplied and all on one side of the meat leaving the other side completely without sauce. The 7/11 version had no onions or pickles. There was, on that side without sauce, some half congealed grease stuck to the bun which really looked yummy. The meat itself, looked kind of gray and reminded me of what cadaver meat looks like, and I thought that it would look good in a Wes Craven movie. I decided to try the 7/11 BBQ sandwich first. I took a bite of the stale 7/11 bun and was immediately repulsed by the meat which tasted kind of like ALPO(and I know what ALPO tastes like due to a prop bet I made in my youth.)

The meat/bun/sauce,congealed grease combination from 7/11 sandwich was so horrible that I could only take two bites, and was not only reminded of ALPO, but had the disturbing thought that this is what cadaver meat probably tastes like.It gave new meaning to the definition…rancid.. I washed my mouth out with a Coke and bit into the McRib. The tang of the BBQ sauce, the onion and pickle made their mystery meat very palatable. The McRib bun was fresh, and I ended up eating the whole thing. I found the McRib to be pretty good and the onion/pickle garnish topped it off. There was no comparison, the McRib beat out the 7/11 Cadaver…I mean "BBQ Rib sandwich," by a million miles. This was the most lopsided food showdown in the history of the world. Granted, one will find a better BBQ sandwich at just about every real BBQ place on the planet, but in a pinch, the McRib manages to satisfy one's BBQ Jones.

Oct

31

Close to Developing Artificial Life, from Jeff Watson

October 31, 2011 | Leave a Comment

Scientists have come closer to creating artificial life and it's only a matter of time before they do.

What are the moral/market implications here?

Oct

28

Feds to End Ag Reports, from Jeff Watson

October 28, 2011 | 3 Comments

The USDA, in a cost cutting move, is cutting some agricultural reports, 14 of them to be exact. None of the reports are major commodities, but they include honey and sheep. Personally, I applaud this move and hope that the USDA gets completely out of the reporting business and leaves matters entirely to the private sector.

Critics complain that there will be less information to go around with the ending of the reports. I humbly suggest that the end result will be more accurate data available because the private sector has an incentive to make the data as accurate as possible.

Feds tighten belt by cutting agriculture reports

Oct

28

Race Car Drivers are Athletes, Jeff Watson

October 28, 2011 | 1 Comment

Hats off to Mr. Lack.

Vince Fulco comments:

I have always thought race car drivers professionalism and grit have been terribly under appreciated. Growing up I was partial to the European racing scene (formal courses and rally events). To think one has to stay constantly focused at great speed while riding in an extremely noisy environment (no insulation) and sometimes arm's length from the engine and transmission belting out tremendous amounts of heat (wearing nomex fire retardant suits/underwear) while constantly strategizing makes trading seem downright easy in comparison.

I remember a story about Porsche's Derek Bell (as I recall) who was in the final laps of the 24 Hours of Lemans when his transmission started to fail losing grip with its gears. On his last visit to the pits, someone got the crazy idea to pour a can of Coke into the transmission tunnel giving it just enough stickiness to make it through the race. Not sure if their version of urban legend but amusing nonetheless.

Oct

25

Eliminate Ballyhoo, by Jeff Watson

October 25, 2011 | 1 Comment

In the quest for the truth and the elimination of ballyhoo, one must get through all the BS to find the kernel of truth. Here is a very important glossary of mathematical mistakes that are commonly seen in the popular culture and often repeated as the absolute truth.

http://members.cox.net/mathmistakes/glossary1.htm

It would be an interesting exercise to see what we can add to the list, either in the popular culture arena, or market lore.

Ralph Vince comments:

How about (cultural ballyhoo) "After all, we're a very litigious society!" (this is usually accompanied by the reminder of some anonymous woman scalded by coffee at McDonalds being awarded an amount so ghastly that poor McDonalds will have to make up that amount against the rest of us somehow!)

I would posit we are not litigious enough. One need only sit in any municipal court or state appellate court for a couple of hours and see the litany of individuals being hauled before the altars of justice by the financial institutions or the paint manufacturers whose lead was ubiquitous, or any other host of entity vs the individual going on. Truly, I almost NEVER see an individual as plaintiff in one of these unless they are going after another individual. The vast majority of what goes on in the courts WE PAY FOR are actions brought by those who do not pay for these courts, against our neighbors.

Yet, our class action rights are eroded under our noses repeatedly and recently. The only ones in favor of so-called "Tort Reform," are the insurance companies. The medical professionals who think they will financially benefit by this are delusional. The delusion is further propagated to the hoi polloi under the even falser notion that the medical community will share these newfon legislated riches amongst us.

Rocky Humbert writes:

After reading this, it's unclear to me whether Ralph is in favor of, or opposed to, tort reform.And, arguably, he's guilty of a bit of cultural ballyhoo here. He writes, "The only ones in favor of so-called "Tort Reform," are the insurance companies."At a macro level, it's not obvious why insurance companies should necessarily support tort reform (or even care about it.) Insurance companies raise premiums to offset the costs of litigation. Their profits (the combined ratio) are the "spread" between premiums earned and the settlements paid.

If the costs of litigation decline, so will premiums — and if there were serious tort reform, it might actually damage insurance companies, since their products would no longer be required!!If there were no tort litigation, insurance companies might go out of business en masse!!! The visible and direct costs of litigation (to which Ralph alludes) are minuscule compared to the invisible costs. The invisible costs include the innovation and investment which are forgone because of the FEAR of litigation; the incalculable dead weight loss; the practice of defensive medicine which wastes resources (and which applies to other industries as well).

"Loser pays litigation costs" combined with allowing third parties to finance and benefit from winning litigation — would be a fine first step towards balancing the scales between plaintiffs and defendants. But to suggest that insurance companies actually want tort reform ignores their raisson d'etre.

Stefan Jovanovich comments:

Ralph omits the largest part of the litigiousness of our society, which I pray will be largely eliminated some day - the criminal justice system. Since misdemeanors rarely go to trial, they will be absent from the municipal court dockets; and state appellate courts are usually not the best venue for criminal appeals (the Feds are usually better) so Ralph may not have had a chance to see how much of the "justice" system is about law and order.

A visit to any Superior Court or Federal District Court would probably change his view; at present, the largest single obstacle to an individual seeking civil damages is that their right to a speedy trial is non-existent.As one defendant put it, "The United States of America versus Alphonse Capone! What kind of odds are those?"

Ralph Vince responds:

Rocky,

I'm not an attorney — and I AM a little over-impassioned about the subject, so don't be surprised by my phreneticism here on this subject, ok? I am utterly opposed to this (altogether speciously misnomered) "Tort Reform," idea!

Where you say ". If the costs of litigation decline, so will premiums," I could NOT disagree more. When the Bankruptcy Act of 2005 was passed (presumably, among other things, so that the costs financial institutions were having to suffer as a consequence of personal bankruptcies not be passed along to the rest of the peons like me) did we see credit card interest rates reduce as as result? Did we see banking fees come down? No, the margin gained by such legislation accrued to the banks.

Profits ONLY flow upwards. Those paying down here do not participate in profits. If we did, those $150 running shoes made in Jingalia would only cost us about ten bucks.

The notion of a frivolous lawsuit is something cast in sand, and something the courts can deal with already via sanctions, etc. Just try to get an attorney to take a patently frivolous lawsuit to court — or see what happens if a non-attorney attempts one pro-se. They will be clobbered by the courts.

In fact, I say to the average Joe F. Blow out there, just try to take his NON-frivolous lawsuit to court. Go see how easy that is. Go see what the typical attorney will require of you up front. He is already, effectively blocked from the system, Bleak-Housed out from the very courts his tax dollars pay for. And again, if you take from people their venue for settling disputes in a civil manner, they are then likely to settle them in an uncivil manner. What is wrong with allowing people the venue of settling their disputes?

Our courts are NOT clogged incidentally. These are not a natural resource of finite size. If we need more courts — set em up. More insane judges. No problem. Homer Simpson is a little sick of sitting at that control panel at the nuclear facility, he can sit on on the bench for us.

Finally, when I speak of profits only flowing upwards, I don't mean it with respect to tort reform alone. The notion is integral to the specious arguments we are subject to every day to try to stifle our abilities of thinking critically for ourselves (I am not referring to you personally here, you seem to do so quite well except when it comes to your interactions with women). We hear repeatedly how free trade brings the cost of goods down (taking away US jobs) or how if we don;t have illegals picking our produce that tomato will cost 5 bucks.

Nonsense. Perhaps there is a scenario, but I cannot think of one wherein Joe F. Blow benefits because the cost to producers is reduced legislatively. To do so but taking Joe's right to settle his disputes — against individuals AND entities — away from him, is the real crime.

Stefan Jovanovich responds:

Neither Ralph nor I is an attorney, but I am guilty of having been one in California for nearly 4 decades. I stopped being one when the State Bar of California decided that it has absolute jurisdiction over any commercial transaction of my companies simply because I was an officer of the court. What that meant in practical terms was that any business partner or even customer could claim I owed them a fiduciary duty as a lawyer even if our dealings were purely commercial. As W.S. Gilbert put it, "here's a pretty mess". Eddy's Mom and I decided that resignation was the better form of valor. It took us nearly 2 years from the Supreme Court's clerks to decide we really meant it; the last letter we have from them is one suggesting that we might want to reconsider because we would be losing all the member benefits - i.e. access to State Bar of California credit cards and life insurance.

The greatest obstacle to "the average Joe F. Blow" is the current system of pleading; it is archaic to a degree that would astonish Lincoln or any other railroad lawyer of the 19th century. David Dudley Field would not be amused, especially since his reforms were adopted in Britain with much greater success than they have been in the United States.

http://en.wikipedia.org/wiki/David_Dudley_Field_II

http://en.wikisource.org/wiki/The_Mikado/Here 's_a_how-de-do

Ralph Vince writes:

Stefan, we evidently live in different universes. I routinely get called to jury duty in Cuyahoga County, Ohio, losing a week every two years. This is a court for monkeys.I have been through that system on the wrong side. Ex-parte rulings, convicted judges, FBI swarming, lower court transcripts LOST going to the appellate courts, corrupt clerk of courts, corrupt sherrif's dept., (all have plead guilty), routine over-charging of defendatns hoping for the routine, gullible jury, etc.

I will tell you what I tell the prosecutor in voie dire. "There's no way in hell you will get me to convict my fellow man of anything. Bring in the DNA evidence, the video, of this child-molesting cop killer. I wont convict anyone here in monkey court."Then….the resultant litany of threats levied upon me. I do my week and I go home. At least where I am here, in this universe, there is NOTHING WHATSOEVER about "Justice."

Oct

11

Apollo and Dionysus, by Jeff Watson

October 11, 2011 | 17 Comments

In 1969, two contrasting events occurred almost simultaneously, the Woodstock Music Festival, and the Apollo 11 flight and landing on the moon. Ayn Rand gave a magnificent lecture titled Apollo and Dionysus comparing the two events and discussing the news coverage, the politics of both. Although this is an audio lecture that is quite long, it is well worth listening to the entire 69 minutes. Ms. Rand compares the majestic intellectual triumph of Apollo 11 with the "Mindless Mud-wallowing" of the Woodstock festival, the rational Apollo 11 vs the irrational Woodstock festival. She discussed the irrational mean spirited media analysis of Apollo 11 vs their irrational elevation to the heroic of the hippies at Woodstock. Her brilliant lecture gives one pause, and puts in perspective the protests going on in Downtown Manhattan and elsewhere.

In 1969, two contrasting events occurred almost simultaneously, the Woodstock Music Festival, and the Apollo 11 flight and landing on the moon. Ayn Rand gave a magnificent lecture titled Apollo and Dionysus comparing the two events and discussing the news coverage, the politics of both. Although this is an audio lecture that is quite long, it is well worth listening to the entire 69 minutes. Ms. Rand compares the majestic intellectual triumph of Apollo 11 with the "Mindless Mud-wallowing" of the Woodstock festival, the rational Apollo 11 vs the irrational Woodstock festival. She discussed the irrational mean spirited media analysis of Apollo 11 vs their irrational elevation to the heroic of the hippies at Woodstock. Her brilliant lecture gives one pause, and puts in perspective the protests going on in Downtown Manhattan and elsewhere.

Oct

2

Rush Hall of Fame Snub, from Jeff Watson

October 2, 2011 | Leave a Comment

Another snub from the Rock and Roll Hall of Fame for my favorite freedom loving Canadian rock band, Rush. The Beastie Boys, Guns n' Roses, and disco singer, Donna Summer are nominated this time around, but not Rush.

Another snub from the Rock and Roll Hall of Fame for my favorite freedom loving Canadian rock band, Rush. The Beastie Boys, Guns n' Roses, and disco singer, Donna Summer are nominated this time around, but not Rush.

Ike and Tina Turner, The Rascals, Abba, Gene Pitney, and Madonna are already members which suggests that the Hall of Fame's standards are not too high. Only the Hall of Famers the Beatles, Stones and Aerosmith have had more consecutive gold or platinum albums, with Rush nipping at their heels, turning in a whopping 24 consecutive big selling albums. However, one might suspect that politics might be involved, as Neil Peart is an Objectivist.

Here's one of their signature songs, "Tom Sawyer".

A modern-day warrior

Mean mean stride,

Today's Tom Sawyer

Mean mean pride.

Though his mind is not for rent,

Don't put him down as arrogant.

His reserve, a quiet defense,

Riding out the day's events.

The river

And what you say about his company

Is what you say about society.

Catch the mist, catch the myth

Catch the mystery, catch the drift.

Sep

28

Baltic Dry Index, from Jeff Watson

September 28, 2011 | Leave a Comment

Has anyone noticed the Baltic Dry Index as of late? Although well off its highs, it's come up well off its bottom on Feb 4 of 1043 and is at 1928 today. Has anyone done any statistical work on the BDI or found any correlations that might be interesting?

Lars Van Dort writes:

I didn't, but I once referred to an article on dailyspec of someone who did (this was after the Baltic Dry Index caught the attention by falling 34 days in a row).

The link to the article mentioned there is now broken, but I got it back using the Internet Archive. Perhaps you will find it useful. Of course, it never replaces doing one's own work.

Baltic Dry Index as a Reliable Forward Indicator? Nonsense.

05/18/2009 by Research Reloaded

In finance, be cautious of anyone who uses historical correlation to back up their argument. In shipping, just flat out run from them. Shipping's notorious Baltic Dry Index, which is an index of spot rates for shipping dry bulk commodities such as coal and iron ore around the world, achieved death defying heights and then, well, death-causing lows, in the course of 2008, falling 90% from its peak, and attracted a lot of attention in the process both on the way up and down. The BDI meme is still alive, especially given a recent rally, and we have quite a few people claiming it as a quality indicator, or even the best indicator (sheesh) for the direction of stock markets or the world economy. Unfortunately, a lot of smart people misunderstand what the BDI represents.

Full article linked above.

Sep

28

The HFT Boys Have Won…For Now, from Jeff Watson

September 28, 2011 | 1 Comment

If HFTs [High Frequency Traders] are making the big bucks in those markets, then we should be jumping on the bandwagon and taking advantage of that non-level playing field. Anything for an edge, and we all quest for the elusive edge, the overlay, and the HFT boys have won this round….for now. I admire those who can use technology to beat the market with better data, better systems, better and faster execution etc. This is just a culmination of the quest for a distinct edge first publicly demonstrated by N.M.Rothschild when he used courier pigeons to relay news faster than the competition.

Sep

28

For Corn Traders, from Jeff Watson

September 28, 2011 | 4 Comments

Here's a little tool to give you real time results on how the corn crop is coming in. Very useful.

Sep

17

Depression and Trading, from Jeff Watson

September 17, 2011 | 1 Comment

There is an interesting article on depression in Scientific American. If this article is true, and depressed people are better at certain types of thinking (ruminating), could this could be harnessed to better one's trading? Personal experience says yes, but I'm curious about everyone else.

Sep

12

The Next Bull Market, from Jeff Watson

September 12, 2011 | Leave a Comment

I suspect that this video is a preview of something that will be the next great bull market, a bull market that will dwarf the dot com market, a bull market that will be representative of a society changing technology right out of a science fiction novel. This new technology will redefine, reinvigorate, and recreate the industrial revolution.

I suspect that this video is a preview of something that will be the next great bull market, a bull market that will dwarf the dot com market, a bull market that will be representative of a society changing technology right out of a science fiction novel. This new technology will redefine, reinvigorate, and recreate the industrial revolution.

Ralph Vince writes:

This technology has been around a long time for prototying componentry. There is a particular file format (comprised of a tringualr mesh of 3 d vertices) which many CAD formats readily convert to OR can be converted into.

I think where the rubber meets the road on this is the ability, ultimately, to do away with the machining of parts, particularly out-of-service parts. Try getting parts to very old cars for instance. With a CAD drawing of such a part, the physical part — or, the physical components to the assembly of the part, could readily be recreated. I did a ton of work with this kind of stuff — what the video doesn't go into is that the drawing itself can have engineering rules embedded within it. It;s more fantastic really than the video shows!

Dylan Distasio writes:

I agree that this one will eventually be a game changer. Although what I'm about to link to is more of a hobbyist unit, it is still impressive in its abilities, especially for the price. I've seen demos of these firsthand, and they're pretty cool for a home user:

Shapeways is also doing some pretty cool stuff with this in the commercial space, and offers a lot of different materials.

Sep

9

Separating the Wheat from the Chaff in Technical Analysis, from Steve Ellison

September 9, 2011 | 2 Comments

The scientific method has two parts. There is theory, which requires knowledge and intuition to posit a cause and effect, and there is testing, collecting data to determine whether the observations refute the theory. If I understand your point correctly, empiricism is necessary but not sufficient. There should be a theory that is not entirely based on the observed data. As an imaginary example, “The S&P 500 is likely to decline on Friday afternoon because day traders are biased to the long side and want to be out of the market before the weekend” is better than “The S&P 500 was down on 19 of the past 30 Friday afternoons”.

Ralph Vince responds:

Steve, yes, but the premise, the cause, needs to be proven. “The S&P 500 is likely to decline on Friday afternoon because day traders are biased to the long side and want to be out of the market before the weekend” needs to be proven as causal, not merely posited as a possible cause.

Frankie Chui writes:

Yes, I always end up asking myself “why does it not work anymore after it has worked for so long?” when the moment I trade it the system stops working. It has also happened to me quite often where I backtest a strategy, everything seems ok, trade it for 2-3weeks and that’s the end of that system. Therefore, I am now experimenting with optimizing parameters in systems more frequently, perhaps once every two weeks on a rolling basis. Optimize two weeks of data, trade it for a week, optimize the past 2 weeks again, trade it for another week. Of course the 2 week/1 week time frame may not be the best (I just randomly chose it), but has anyone ever done anything with this kind if approach? I’m curious to see if this will work for day trading. I am new in mechanical trading, but I’m very curious to know if optimizing data fast enough will allow a trading system to work better and longer (for day trading).

Jeff Watson writes:

Frankie, you’re running up against Bacon’s ever changing cycles, which tend to render systems obsolete.

Phil McDonnell adds:

There is an insidious danger when you use optimization. The optimizer will fit the system to the data too well. It will never perform as well out of sample as in sample. It becomes especially important to use tests of statistical significance when you do optimizations.

The optimizer can actually create a multiple comparison problem in some cases. For example if you tested, looking for seasonality and wanted to find which month was the best to buy it would create a multiple comparison bias and any test for significance would have to have a much higher threshold than if you just tested September.

One way to judge a system and evaluate whether it will continue to work is to plot out the equity curve. If your testing assumes an equal sized investment each time then the system can be plotted on an ordinary arithmetic scale. If you compound it should be plotted on a log scale. Either way the most desirable system would be a system that looks like a smooth line going monotonically up to the right as time passes. If it starts to roll over then it may be a system about to fail.

Paolo Pezzutti writes:

The system should be quite robust. It should work pretty well with a sufficiently wide range of values of parameters. There should also be few parameters avoiding curve fitting.

Sep

9

Supernova, from Jeff Watson

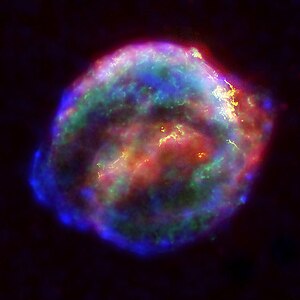

September 9, 2011 | Leave a Comment

For all those Stargazers out there, there's a magnificent supernova in the "Pinwheel Galaxy" M101 (Ursa Major), and it's only 23 million light years away.

For all those Stargazers out there, there's a magnificent supernova in the "Pinwheel Galaxy" M101 (Ursa Major), and it's only 23 million light years away.

.

.

.

.

It's expected to peak out at a 10 magnitude and should be easily visible from a 4' telescope.

Sep

4

More Taxes More Problems, from Jeff Watson

September 4, 2011 | 11 Comments

More taxes aren't really a solution for anything. Should China should be punished because of our inability to compete? A good philosophical question to ponder….Is it a bad thing for a neighbor like China or India to get rich, or will it only benefit us down the road? From a personal note, I think that the world is better off with as many rich countries as possible…..more customers for us to sell things to and more choices for us as customers to buy.

Sep

4

Waffle House Index for Disasters, from Jeff Watson

September 4, 2011 | 2 Comments

As a resident of the South, I particularly love that old Southern institution, the Waffle House. While every business might close during a hurricane, Waffle House has a great plan for keeping their restaurants open, and they manage to do a great job keeping their doors open, even with windows boarded up. The FEMA director can tell how bad a disaster is by looking at how much of the menu at a Waffle House is available. He's created a sort of Waffle House natural disaster index index.

As a resident of the South, I particularly love that old Southern institution, the Waffle House. While every business might close during a hurricane, Waffle House has a great plan for keeping their restaurants open, and they manage to do a great job keeping their doors open, even with windows boarded up. The FEMA director can tell how bad a disaster is by looking at how much of the menu at a Waffle House is available. He's created a sort of Waffle House natural disaster index index.

The test of the index is:

If a Waffle House store is open and offering a full menu, the index is green. If it is open but serving from a limited menu, it’s yellow. When the location has been forced to close, the index is red. Because Waffle House is well-prepared for disasters… it’s rare for the index to hit red. Incidentally, the the different state legislatures are legislating Waffle Houses out of business. My local Waffle House manager told me that business is way down at the locations nationwide because of the laws banning smoking inside the stores. Smoking bans do have unintended consequences, just ask any bar owner. Since many Waffle House customers are smokers, they are making other plans to eat.

Aug

24

Article of the Day, from Jeff Watson

August 24, 2011 | 4 Comments

I read a very entertaining article in Scientific American yesterday: "Can Math Beat Financial Markets ".

I read a very entertaining article in Scientific American yesterday: "Can Math Beat Financial Markets ".

Stefan Jovanovich writes:

Check out the author's home page.

Gary Rogan writes:

Looking at the page brings up the age-old question: can the same techniques that are used in natural science to study the universe that doesn't change from being studied and where the fundamental rules don't change at all be applied to a system where nothing prevents most rules (other than that old "human nature") from being changed at any time? He cut his teeth on never-changing, but how will it play with ever-changing? Somehow fractal coastlines are just not the same as fractal security price charts. Fat tails and non-gaussian distributions are great, but then what? We can evidently estimate the risk of something happening he says. But can we???

Ralph Vince adds:

Yes, when he speaks of their raison d'etre "To quantify risk" I think, "Huh? How? VAR? Just HOW DO they 'Quantify Risk.'

If alluding to using it ("algorithmic trading," in the context of some sort of proce prediction a la quant, I assume he means modelling prices using models based on SDEs. Again, "Huh? How? Does this guy know what he is talking about?")

Quant-dom, traces it's roots to pricing of various securities — warrants, options, spread on futures/forwards, backwardations, and the pricing of the plethora of derivative creatures who climbed out of the ooze of ercent decades. This is NOT predicting markets, or "Quantifying Risk," (the latter, clearly, has utterly failed using their conventional models).

The entire article smacks to me of something dumbed down to the point of being useless and silly

Aug

23

Perhaps Those People Lining Up to Sell Gold Know Something, from Gary Rogan

August 23, 2011 | 5 Comments

People are lining up in Wesport, CT to sell gold coins, according to a report on Seeking Alpha .

Has anyone ever reliably made profits from bubbles? If so, their existence can be prospectively determined, if not there is no clear answer. It's true that there may be people who know a bubble with 100% certainty, but they don't know where they are in the cycle so they are too worried about shorting them. This is pretty morally equivalent to having no idea about the existence of a bubble, although not quite. I'd say if someone can reliably predict that within a "reasonable" time the bubble will deflate below the current level, and are willing to bet on that, they "know" the bubble exists.

Jeff Watson writes:

Look at the 1980s Hunt Brothers silver debacle. Despite the big move in silver, I never knew anyone that made a boatload of money off of that huge move. I heard lots of tales of people getting rich off the silver market, pyramiding $5,000 into millions, but those people were always friends of friends twice removed, and nobody in my clearing firm, none of my buddies ever nailed silver. I suspect those people who got rich off of the silver market are as elusive or mythical as the Yeti. I also suspect that if you were long that silver market with a $5,000 account that you would have stood a better than even chance going bust.

Rocky Humbert comments:

The Hunt Brothers episode was a corner in an overleveraged market. I'd argue that the gold story today is totally different. Importantly, it's not a leverage-fed, euphoric or happy bull market. It's a funereal bull market. Because if gold is right, and it keeps going and going and going (?5,000? ?10,000 ?20,000 +++) all of one's paper assets will be worth what they are printed on, and the Chair will find out exactly what 2008/09 would have looked like without massive central bank liquidity infusions. (And being short stocks won't help either, since there won't be anyone left to pay you back.)

Hey Gary — for someone who thought total financial collapse was the "ONLY" outcome, how can you NOT be massively long gold??? That's not a bubble! Or is it? As I've been writing for two years now, gold's ascent is a confluence of negative real interest rates; undisciplined central bank behavior; a growing loss of confidence in government policies and financial systems; loss of Swiss bank secrecy; an accumulation of economic wealth by individuals in parts of the world without stable property rights and rule of law; etc. The CME can raise margin requirements all they want; but there needs to be a change in the underlying fundamentals (and/or perception of the fundamentals) to end this period. What will that change look like? Shouldn't that be the question on the table ….

Gary asks, "Can anyone reliably make profits from a bubble?" Hmmmm. Warren Buffett keeps a sealed envelope in his desk drawer with the name of his successor. In contrast, I keep a sealed envelope in my desk drawer with the EXACT high price in gold. Neither of us allow any peeking (or peaking.)

Note to Anatoly: You recently wrote that you think gold won't go all the way back down. If you believe that this is a genuine bubble, then you'll have been wrong on the way up. And on the way down. See Jeremy Gratham's extensive work on bubbles — and his observation that they retrace >100% of the parabolic extension.

Stefan Jovanovich says:

The U.S. Treasury had enough gold to be able to promise to redeem the customer balances of every member bank of the Federal Reserve in the United States in 1930; had that step been taken, the U.S. would not have suffered the extraordinary collapse in demand that created the death spiral of world trade

Tyler McClellan asks:

Stefan,

Just for fun, how would you have lowered real interest rates in the US, without dramatically widening the gold points, or say just abandon them all together.

Stefan Jovanovich replies:

Why would I want to administer interest rates at all? The problem with the Federal Reserve system is that its underlying premise is that the government should do so. Nothing can prevent speculation from having a component of folly and ruin — like all of life. The idea that the government — which is itself an interest group of the employees and beneficiaries of government borrowing and spending — can somehow avoid the same folly and ruin in its speculations seems to me to be the funniest of all the lunar illusions. Remove the notion that somehow banking is a special kind of business that requires absolute government guarantee (which, as we have seen, the government cannot afford any more than anyone else) and a great deal of the folly and ruin disappears because the truth — that everyone in commerce works without a net — is transparent. As someone once said, the illusion of safety is the most dangerous of all ideas.

Aug

21

Sage Advice From a 105 Year Old Banker, from Jeff Watson

August 21, 2011 | 1 Comment

Here's a great article about the current record holder for the title of oldest banker in the US. It is a very fascinating story, with a few small snacks for a lifetime. The whole moral of any type of story like this is that it pays to listen to what old timers have to say, and it also pays to examine their lives and to model the parts that make them successful, not just in business but in life. As a young kid thrown into the pits, I sought out and asked for advice from the grizzled old guys who started trading as early as the late 1920s - early 1930s (there were still a few of them around). I also learned to ignore the advice of real old clerks, etc. (There was a reason they were old clerks). It was and is my contention that if someone is a speculator for 40+ years, no matter what, he's a success if he's still in the game. They had seen it all and done it all, and I will say that taking some of advice is the difference between a 2 year speculation career and a 40 year career. Rich or poor, or in between, a 40 year veteran is going to have a superb defensive game, and a strong defense is more important to longevity than a great offense (in my opinion).

Here's a great article about the current record holder for the title of oldest banker in the US. It is a very fascinating story, with a few small snacks for a lifetime. The whole moral of any type of story like this is that it pays to listen to what old timers have to say, and it also pays to examine their lives and to model the parts that make them successful, not just in business but in life. As a young kid thrown into the pits, I sought out and asked for advice from the grizzled old guys who started trading as early as the late 1920s - early 1930s (there were still a few of them around). I also learned to ignore the advice of real old clerks, etc. (There was a reason they were old clerks). It was and is my contention that if someone is a speculator for 40+ years, no matter what, he's a success if he's still in the game. They had seen it all and done it all, and I will say that taking some of advice is the difference between a 2 year speculation career and a 40 year career. Rich or poor, or in between, a 40 year veteran is going to have a superb defensive game, and a strong defense is more important to longevity than a great offense (in my opinion).

Aug

15

The Oracle Opens His Mouth Again, from Jeff Watson

August 15, 2011 | 10 Comments

Here's a laughable op-ed piece from the Oracle of Omaha with the title, "Stop Coddling the Super Rich." In the essay, he tries to perpetrate and extend, to quote the Chair, "The idea that has the world in its grip." Buffett wishes to immediately raise tax rates on those making more than a million a year. He says that super rich wouldn't mind if they "were told that they had to pay more taxes…particularly when so many of their fellow citizens are suffering."

The hidden motive in this op-ed is that he wishes to create conditions that will bring more customers to his business. Like General Electric lobbying the government to ban 100 watt incandescent light bulbs in order to sell the new ones with the higher margins, the Oracle is lobbying everyone in order to benefit his book. And his folksy, aw-shucks demeanor, his phoney populist theme, is winning over a lot of people. The Oracle is constantly quoted and cited by the statists as an example of someone who is rich and feels that we could be doing more for the government .

Aug

8

A Shot Across the Bow, from Jeff Watson

August 8, 2011 | Leave a Comment

As the Chair so properly puts it, the S&P downgrade is a shot across the bow. In their own words (see S&P: "US Credit Rating Lowered" ).

Jul

29

The Science of Sprinting, from John Floyd

July 29, 2011 | 1 Comment

This is an interesting study on what makes a winning sprinter. I wonder if there are applications and lessons to trading? For example in the use of leverage and sizing as applies to the amount of force used? The volatility of markets in relation to leg speed? The size of the fund and alacrity that may be required in various markets do to sizing and visibility and physical characteristics of a sprinter?

This is an interesting study on what makes a winning sprinter. I wonder if there are applications and lessons to trading? For example in the use of leverage and sizing as applies to the amount of force used? The volatility of markets in relation to leg speed? The size of the fund and alacrity that may be required in various markets do to sizing and visibility and physical characteristics of a sprinter?

Jeff Watson writes:

This reminds me of a thread on DailySpec last year about the golf swing problem that nobody could really give a correct answer to. The observers of the runner were correct in their methodology in measuring the underlying influences of a quick sprint. Separating and isolating all forces (seeing what forces are really influencing and in play) and solving them independently is the first lesson that they teach you in any physics 201 class.

Jul

25

Looming Vs Receding, from Ken Drees

July 25, 2011 | 2 Comments

When I read this article I instantly thought about price and if it was going against me (looming) in a trade or if it was going in a profitable direction (receding). Time passage does seem different under the two conditions and thus my mindset and behavior must be different.

When I read this article I instantly thought about price and if it was going against me (looming) in a trade or if it was going in a profitable direction (receding). Time passage does seem different under the two conditions and thus my mindset and behavior must be different.

In fact, some investigators have suggested that the amount of energy spent during thinking and experiencing defines the subjective experience of duration. In other words, the more energy it takes to process a stimulus the longer it appears as a subjective experience of time. Something moving toward you has more relevance than the same stimulus moving away from you: You may need to prepare somehow; time seems to move more slowly.

Jeff Watson writes:

One of the best things in surfing is when the wave is breaking hollow and you can get inside and surf completely covered up by the wave in all directions except in front of you. This is called, among other things, "Getting Tubed," and although it's a very short experience, it's one of the most exhilarating things in surfing.

Surfing legend, philosopher, and master, Gerry Lopez , one of the best tube riders of all time, once observed that "Time expands inside the tube." He's right, as the typical time spent riding inside the tube is a couple of seconds, but to the rider it feels much, much longer. Here's a short video that captures 1/100th of what it's like inside the tube of decent waves.

There are other, holistic benefits to one's health gained by regularly riding tubes, but the benefits cannot well be described on paper as they are of a more metaphysical nature.

Jul

21

The First Great Global Warming Debate, from Jeff Watson

July 21, 2011 | 1 Comment

This is an excellent, but flawed article in Smithsonian.com discussing the first great Global Warming debate, which was between Thomas Jefferson and Noah Webster.

Jul

19

“As It Was” by Gardnar Mulloy, from Victor Niederhoffer

July 19, 2011 | 6 Comments

When a man has lived without illness to 99 years old and is still going strong, having won 122 national tournaments along the way, served as a lawyer for 70 years, visited hundreds of countries, played with every tennis player of the past 100 years from Bill Tilden to Jon McEnroe, won the Wimbledon doubles at 47, started a major animal rescue operation, witnessed murders, had a career in politics, played with all the famous Hollywood actors of 50 years, played with kings, Presidents and Duchesses, there is much to learn from him. I was pleased therefore to pick up Gardnar's autobiography written at the age of 95 and self published but available at the Newport Casino, where he was a thorn in the side of the powers that be there for 70 years. Writing at the age of 95, when many of his enemies have passed away, one benefits from his not holding back as so many auto's do these days for fear or libel or hurt feelings.

When a man has lived without illness to 99 years old and is still going strong, having won 122 national tournaments along the way, served as a lawyer for 70 years, visited hundreds of countries, played with every tennis player of the past 100 years from Bill Tilden to Jon McEnroe, won the Wimbledon doubles at 47, started a major animal rescue operation, witnessed murders, had a career in politics, played with all the famous Hollywood actors of 50 years, played with kings, Presidents and Duchesses, there is much to learn from him. I was pleased therefore to pick up Gardnar's autobiography written at the age of 95 and self published but available at the Newport Casino, where he was a thorn in the side of the powers that be there for 70 years. Writing at the age of 95, when many of his enemies have passed away, one benefits from his not holding back as so many auto's do these days for fear or libel or hurt feelings.

The first thing one learns from him is an anecdotal secret of a healthy life. He is a vegetarian, doesn't drink or smoke, has no air conditioning, gets to sleep early, and floats around the court at a single steady. His recipe for life is to enjoy the great pleasures of life — eating, exercise, sex, sleep, and bathing. (He recommends bathing with an olive oil cleaner rather than soap.)

Of course, as in all things, it's a combination of genes and environment that got him so far. He has two sisters in their 90s, his mother died at 95, he and his father were National father and son champions 3 times. He was a star football player, diver, and boxer at the University of Miami. He practiced on a home spun clay court with his father and was winning tournaments at the age of 13. He was married for 50 happy years to his college sweetheart, a beauty queen and swim champion.

Of course, as in all things, it's a combination of genes and environment that got him so far. He has two sisters in their 90s, his mother died at 95, he and his father were National father and son champions 3 times. He was a star football player, diver, and boxer at the University of Miami. He practiced on a home spun clay court with his father and was winning tournaments at the age of 13. He was married for 50 happy years to his college sweetheart, a beauty queen and swim champion.

Having played against or seen many of the players that he mentions in action, I was particularly interested in the stories about such low lifes as Bobby Riggs, Frank Shields, Herb Flam, Art Larsen, Ted Schroeder, and John Mac, who he praises as possibly the greatest tennis player but criticizes as a self centered poor sport who tried to kick him off a court at a Wimbledon prep because he was Mac. He has a beautiful, heartbreaking story about Gloria Butler whose father started the Monte Carlo club, but has given away all her possessions because her "master" has told her she should live as a hermit and give all her money away to guess who.

It is also quite educational to hear his take on the things that have changed during the past 80 years of tennis. He points out that just as important as the new materials in the rackets these days for faster and better play is the pressure of the balls. Because of the high pressure, and the change from a rubber center, topspin must be hit to keep the ball in, and this almost mandates the much lamented by all players of the era, extreme western grip. He believes that with modern equipment the old players would have fared quite well against the current crop.

Many other murders and near death incidents occur. For example, he describes how he got his friend Mike McLoughlin out of jail in Cuba as all the other casino owners were being executed. And he describes the suicide of Gladis Helman, the strange death by drowning of Frank Froeling's mother, and the attempted murder of FDR that he witnessed.

His love for his father shines thru and he describes with heart breaking detail how this 45th degree Mason lost his lumber business in the Hurricane of 1926, and was thwarted in all his entrepreneurial ventures thereafter because of the common problems of the depression. Apparently Mulloy inherited his father's inability to make money, as he seems to live very modestly in a two bedroom house, and he never seems to have 25 bucks extra to his name. I like the fact that of all the tournaments he's won he is proudest and happiest with the 3 father son tournaments he won with his dad.

His love for his father shines thru and he describes with heart breaking detail how this 45th degree Mason lost his lumber business in the Hurricane of 1926, and was thwarted in all his entrepreneurial ventures thereafter because of the common problems of the depression. Apparently Mulloy inherited his father's inability to make money, as he seems to live very modestly in a two bedroom house, and he never seems to have 25 bucks extra to his name. I like the fact that of all the tournaments he's won he is proudest and happiest with the 3 father son tournaments he won with his dad.

Amazingly, although he has singles wins over almost every great player of the last 75 years including the two Pancho's, Bill Talbert, Vinnie Richards, Riggs, Welby van Horne, Frank Parker, Godfrey von Cramm, Rosewall, Borotra, Cochet, he is not remembered much as a singles player, but is mainly renowned for his many grand slam doubles and Davis Cup victories. There's a nice youtube video of him playing with Trabert in doubles and he plays a nice fluid, but not overly forceful game, with a medium sized serve, a mediocre overhead, and good backhand volleys as highlights.

He was constantly fighting with the powers that be of the official associations. And with good reason. He describes how James van Allen refused to give food to the tennis players that lost in the Newport tournament, how he was defaulted by the Californian official Jones for complaining about favoritism to the Wasps, and how the officials were only interested in siphoning off all the money in the game for themselves rather than let a player make an honest living from the game.

His example of rich man Avery Brundage who disqualified Jim Thorpe for playing semi pro baseball is typical of what he faced as the tennis association made it impossible for a self respecting player to play the game unless he were independently wealthy or a special favorite of the "sponsors".

In a chapter entitled the pompous dictatorship of the USTA, he describes his experiences with the officials– mainly Holcumbe Ward, Julian Myrich, Robert Jones, and James van Allen. They were constantly on his back whenever there was money to be made by them at his expense. His experience reminded me so much of what I experienced in squash when I decided to turn pro because I couldn't afford to be a gentleman amateur any more. These experiences are sisters and cousins to what we experience so much today where those with access to power, money, and information gracefully slide from the political arena into the banking arena, consulting, private sector, or institutional arena as opportunity and advantage arises.

Gar is a man of respect and as he nears his 100th birthday, still winning the 90 and over's regularly in doubles, one should pause to hope that one could live as happy and productive a life as he doing the thing he loved the most and was so good at.

Jeff Watson writes:

That was the best biography that you have ever reviewed. Mulloy reminds me of my grandfather in so many ways. It would be interesting to list the similarities between productive old centenarians like them, because they all seem to share a common thread. I don't know exactly what the thread is, but it probably includes luck in the genetic lottery, and guys like these seem to have something extra, a joie de vie or something like that. Not like the miserable old 95 year old people that I run into here in Florida on an everyday basis. Mulloy also reminds me of a Mr. Woodykind, who I knew as a kid. Woodykind was an avid tennis player who retired to Pompano Beach and played tennis at the clay municipal courts back in the 60's when I lived there as a kid. He was in his 80's, very healthy, and was a champion who supplemented his retirement by wagers on his matches. He was a great guy who was also very sharp with many stories to tell about the old days. He gave me some advice that I still live by today.

Jul

18

The Science of Winning, from Jeff Watson

July 18, 2011 | 5 Comments

This is a great article in Newsweek, of all places, on the science behind winning.

Jun

30

The Appeal of Cynicism, from Russ Sears

June 30, 2011 | Leave a Comment

There are several reasons that cynics are on the rise in my opinion.

There are several reasons that cynics are on the rise in my opinion.

1. People assume the cynic is the expert. The cynic has an aura of authority.

2. Cynicism is masked as realism.

3. People assume the cynic is a healthy skeptic. On first encounter these two are hard to distinguish.

4. The cynic guards against disappointment.

5. The cynic creates an “us” against “them” world. "We won't be fooled again" by "them".

6. It is easier to find a problem than create a solution or even understand how complex creativity works.

7. It is easy to ignore the positive. Hard to ignore the negative.

8. People assume their bias is only one sided: When they like something too much. People recognize their biases when there is favoritism but justify their biases when there is disdain or prejudice. The cynic reinforces that their biases are the only morally defensible ones.

9. The cynic has many times when he is proven wrong, but it is often hard to pinpoint the opportunity cost to that cynicism (for ex. the profit he missed by staying out). However, when he is proven right, it is very easy to see how much he has saved.

9. The cynic has many times when he is proven wrong, but it is often hard to pinpoint the opportunity cost to that cynicism (for ex. the profit he missed by staying out). However, when he is proven right, it is very easy to see how much he has saved.

10. The belief that Type II errors or believing falsely in a person are much more damaging than Type I errors or not giving a good person a chance. Despite the time it takes for a person to prove she is proficient and the moment it takes to lose trust-worthiness.

11. The cynic is elevated as “your own man” by the media and politically. Thus becoming the “go to person” when they want something said or done. This creates all sort of side agreements and quid quo pro understandings. Every TV program needs the phone numbers of a few favorite cynics.

12. Ironically, the person most likely to publicly be called down for their cynical tendencies is the person that is cynical towards the celebrated cynic.

Con-artists understand deeply the appeal of cynicism and use it against their prey.

The cynic is the ultimate champion for the status quo. The cynic can define people by their weaknesses not their strengths. Since everybody has weaknesses, they can dictate who is important by defining who is not important. Old man’s disease is giving in to the appeal of cynicism.

Rocky Humbert writes:

"A cynic is a man who, when he smells flowers, looks around for a coffin."

"A cynic is a man who, when he smells flowers, looks around for a coffin."

H. L. Mencken

In the spirit of not being a cynic, I note today's news story reporting that volunteers in Japan are being asked to grow sunflowers to produce seeds … so even more sunflowers can be grown in areas contaminated by radioactivity from the Fukushima disaster. The proponents say sunflowers can efficiently absorb radioactivity from the soil in a process known as phytoremediation. Here's the news story.

The skeptic (as opposed to cynic) in me thought that this sounds like an example of "green" people confusing Flower Power with nuclear physics. But a little bit of research reveals a bit of "sunny" science for the weekend. There is REAL science here! Sunflowers (and certain other plants) CAN decontaminate radioactive soil faster and cheaper than many other approaches. Chernobyl was a large-scale proof of concept. Here are 2 of academic papers on the subject:"Screening of plant species for comparative uptake abilities of radioactive Co, Rb, Sr and Cs from Soil,"Gouthu et al ; Journal of Radioanalytical & Nuclear Chemistry" and "Uranium Absorption Ability of Sunflower, Veiver and Puple Guinea Grass," Roongtanakiat et al (2010)

SO THE MORAL OF THE STORY IS: "A cynic is a man who, when he smells flowers, looks around for radioactive contamination."

Pitt T. Maner III comments:

The phytoremediation and bioremediation fields have bloomed to aid companies tasked with difficult cleanups. Even earthworms can be useful with certain contaminants (PCBs).

Larger trees also can be used to influence the flow of impacted groundwater so that contaminants do not move offsite—effectively they act as small pumps (think of all the Florida maleleucas used to drain wetlands, now designated as "noxious weeds"). Trees can help with the treatment process through the uptake and concentration of contaminants or the breakdown of contaminants in the bacteriologically-rich portions of the root system .

The economics can be interesting and one can only imagine what they are in the Japanese case and how they affect current land values. Those with an understanding of the actual risks involved and the ability to cost effectively clean properties have in certain instances done well:

"Acquisition, adaptive re-use, and disposal of a brownfield site requires advanced and specialized appraisal analysis techniques. For example, the highest and best use of the brownfield site may be affected by the contamination, both pre- and post-remediation. Additionally, the value should take into account residual stigma and potential for third-party liability. Normal appraisal techniques frequently fail, and appraisers must rely on more advanced techniques, such as contingent valuation, case studies, or statistical analyses.[11] Nonetheless, a University of Delaware study has suggested a 17.5:1 return on dollars invested on brownfield redevelopment.[12]"

Kevin Depew writes: