Oct

12

The ideal PPI

October 12, 2024 | Leave a Comment

what was the ideal ppi for the BLS to report yesterday? under the circumstances the 0.30 rise in S&P was fairly good. but the gentlemen didn't like it at the close again. yet an all time hi with a weak close. can't be too wrong.

Oct

11

The similarities

October 11, 2024 | Leave a Comment

Catastrophe 1914. the similarities between the start of w.w.1. and the current situation before the first attempted assassination are very great.

From the acclaimed military historian, a new history of the outbreak of World War I: the dramatic stretch from the breakdown of diplomacy to the battles - the Marne, Ypres, Tannenberg - that marked the frenzied first year before the war bogged down in the trenches.

In Catastrophe 1914, Max Hastings gives us a conflict different from the familiar one of barbed wire, mud, and futility. He traces the path to war, making clear why Germany and Austria-Hungary were primarily to blame, and describes the gripping first clashes in the West, where the French army marched into action in uniforms of red and blue with flags flying and bands playing. In August, four days after the French suffered 27,000 men dead in a single day, the British fought an extraordinary holding action against oncoming Germans, one of the last of its kind in history. In October, at terrible cost the British held the allied line against massive German assaults in the first battle of Ypres. Hastings also recreates the lesser-known battles on the Eastern Front, brutal struggles in Serbia, East Prussia, and Galicia, where the Germans, Austrians, Russians, and Serbs inflicted three million casualties upon one another by Christmas.

Oct

2

Dissonance and disbelief

October 2, 2024 | Leave a Comment

Cognitive dissonance 2: "i think the former president did a 'hades of a job'", but prob of winning fell from 60% to 45% from 1 day before to 1 day after.

one is reading again don quixote where his household throws away his books on chivalry because they believe it contribute to his supposed madness. along comes this article and headline from charles schwab "how to identify head and shoulders patterns."

my goodness - at this stage in our education 70 years after magee on technical analysis and 120 years after it was first recommended in The Magazine of Wall Street. even sancho would throw up his hands in disbelief.

Sep

29

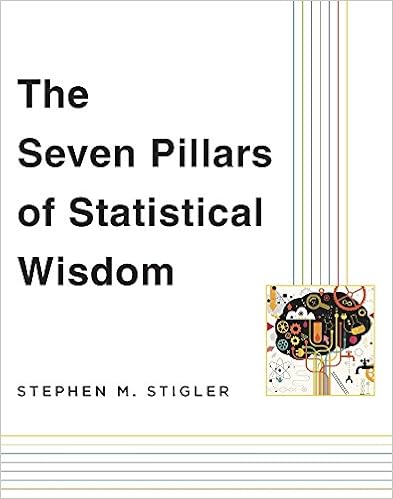

Review redux: The Seven Pillars of Statistical Wisdom, from Vic

September 29, 2024 | Leave a Comment

The Seven Pillars of Statistical Wisdom, by Steve Stigler, provides an illuminating and entertaining foundation for statistical activity. The seven pillars are Aggregation, Information, Likelihood, Intercomparison, Regression, [Experiment] Design, and Residuals. Every page of the book contains something fascinating and instructive.

It is at once an adventure story, a history lesson, a textbook on the foundations of statistics, and a tour de force with ingenious extensions of the works of the great in each field in Stigler's own inimitable hand — a persona that reminds one of Stigler's heroes, Galton himself.

The level of the book is such that the layman and the expert will both gain from it. I found every page insightful and it uplifts one to be part of a field with so many ingenious founders, and to know that there are such pillars that hold the edifice up.

I recommend the book highly. It is a masterpiece classic that will live forever.

Sep

26

An informal analysis, and books

September 26, 2024 | Leave a Comment

performing an informal content analysis of fox news 50 articles, the news about vp is overwhelmingly negative. however, she still leads in the odds by at least 5 percentage pts. under circumstances the other side's insistence they won debate is blind. this refusal to accept reality should lead to all sorts of negative results.

meanwhile, in books:

The Walking Drum is an erudite louis lamour adventure about 12th century business.

the book The Merchant in Medieval Europe is one of the most scholarly and complete I have ever read. A summary on the back cover is very apt. the book made me realize that most of my commercial inspirations were merely following the paths set by our predecessors.

some chapters: the merchant in the 13th century, trading companies, commercial correspondence, bookkeeping and commercial correspondence, arithmetic insurance, banking, interest rates, fairs, money supply, information, careers, exchange, brokers.

Power and Profit, an alternate title, is beautiflly illustrated with 200 prints and maps. "an academic classic that can be read purely for pleasure."

a well lived life: Peter Spufford

More:

Money and Its Use in Medieval Europe, by Peter Spufford.

Sep

23

Methods of trade

September 23, 2024 | Leave a Comment

three highly recommended books:

Power and Profit: The Merchant in Medieval Europe

all show how commerce, fairs and bazaars, and bourses in the 1100-1400 era showed the way for all modern methods of trade.

Sep

18

Hikes, cuts, and differentials

September 18, 2024 | Leave a Comment

now 8 percentage differential in favor of vice pres. the more things emerge as favoritism in debate, the greater the differential.

it took 12 days for a 20-day high and months for an all-time high which comes auspiciously for Hayek's road.

average number of consecutive decreases in fed rates after a turning point to a decline is 14.

In light of the progress on inflation and the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/2 percentage point to 4-3/4 to 5 percent.

Forbes Advisor: Federal Funds Rate History 1990 to 2024

Plenty of other data factor into Fed monetary policy decisions, including gross domestic product (GDP), consumer spending and industrial production, not to mention major events like a financial crisis, a global pandemic or a massive terrorist attack.

To that end, we’ve structured this compendium of fed funds historical data with narratives about the different factors that informed the Fed’s decisions. The central bank may be staffed by officious economists, analysts and business experts, but it’s also highly responsive to the changing political winds.

the swings in S&P futurs in last half hour from up 30 to down 15 and now +20 reminds me of how a loser in a squash game flails around with a big swing and no caution hitting all three walls on each shot. one fine player whose forefather lost the american revolution in the battle of Long Island hit one with all his power at my head when he was behind in a situation like this. i imediately called for the ref to default him, to no avail.

what was the match beween federer and djoko where federer was up match point and served to djok backhand and djok gave up and shot a hail Mary from his back hand and he won the match?

Djokovic's INSANE Comeback Against Federer! | 2011 US Open Semifinal

Sep

16

Cognitive dissonance

September 16, 2024 | Leave a Comment

odds in favor of vp reaches maximum with a 6% lead over former Pres. and former Pres claims he won the debate handily. as Soros liked to say: the more he talked about his honesty, the more closely i counted my silver.

perfect example of cognitive dissonance in our time.

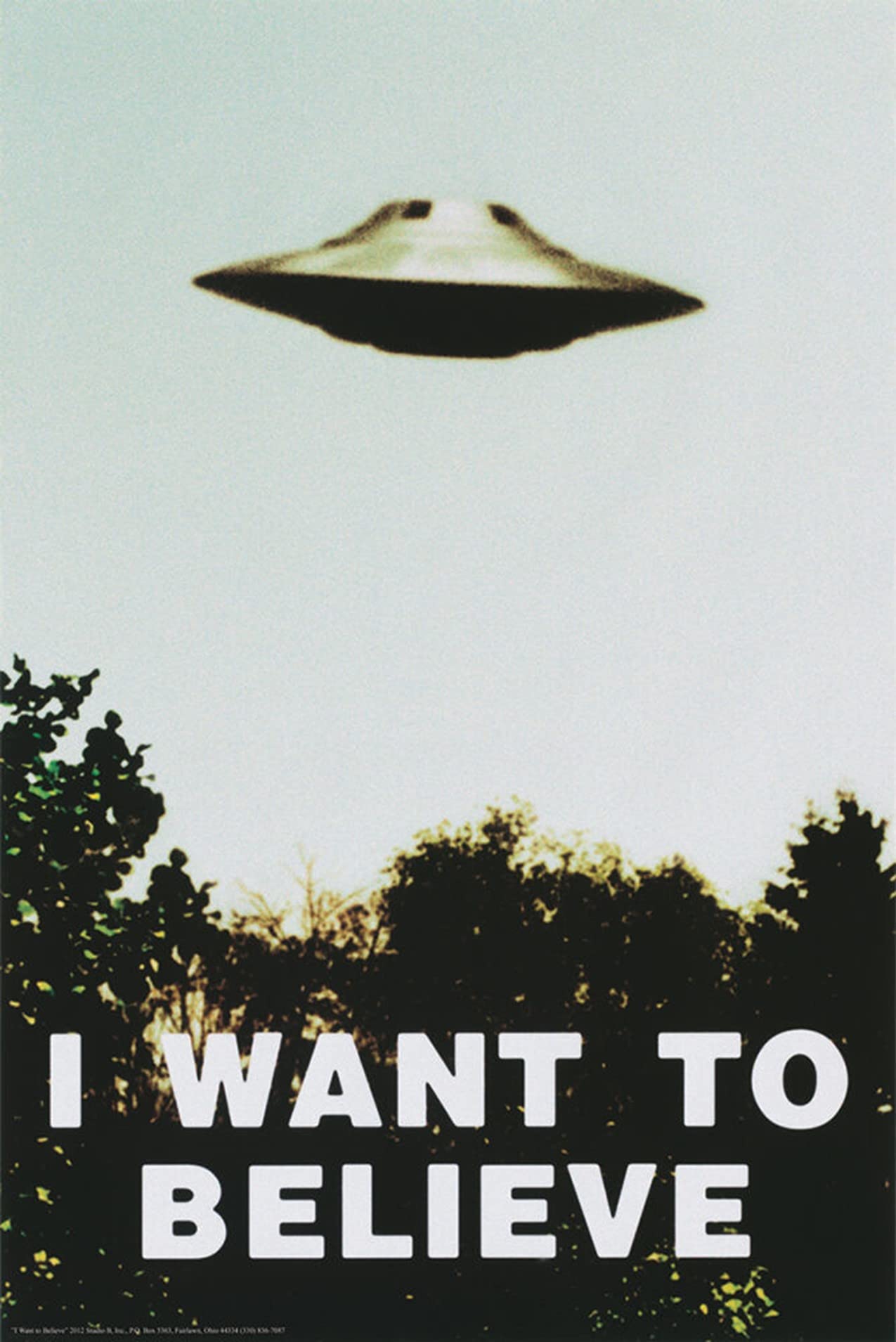

She attracted a group of followers who left jobs, schools, and spouses and who gave away money and possessions to prepare to depart on a flying saucer that, according to Mrs. Keech, would arrive to rescue the true believers. Given the believers’ serious commitment, Festinger wondered how they would react when the prophecy failed. He and his colleagues, posing as believers, infiltrated Mrs. Keech’s group and kept notes on the proceedings surreptitiously.

The believers shunned publicity while they awaited the flying saucer and the flood. But when the prophecy was disconfirmed, almost immediately the previously most-committed group members made calls to newspapers, sought out interviews, and started actively proselytizing.

Festinger was unsurprised by the sudden proselytizing after the prophecy’s disconfirmation; he saw the cult members as enlisting social support for their belief to lessen the pain of its disconfirmation. Their behaviour confirmed predictions from his cognitive dissonance theory, whose premise was that people need to maintain consistency between thoughts, feelings, and behaviours.

a question out of the blue????? "would you have a Republican in your cabinet?" one would like to have the moderators predicting stock prices?

Sep

15

Streaks of down days, from Big Al

September 15, 2024 | Leave a Comment

Vic tweeted that "after 5 down days in a row for S&P, it's very bullish. 5 days later only 2 of ten down with high positive expectation especially with bonds up and last one down."

That provoked a quick counting project. The main issue with this analysis is that everything is overlapping, but nonetheless I think it's an interesting result.

The data is SPY adjusted closes from inception thru 6 Sept. I identified all the down days and the streaks of down days, including 1-day "streaks", up to the longest which were 8-day streaks. So each down day fell into a bin, 1 up to 8. Each down day was put in a bin, whether it was the last day in a streak or not. (This eliminates the look-ahead bias of just considering only the final day of streaks.)

Then I calculated the 5-, 10- and 20-day % moves for every day in the data and compared the results for all the down days with the % moves for all days.

The table shows the results, with the best outcomes - streaks of 3, 4, and 5 days - highlighted.

Sep

14

Politics, rackets, markets

September 14, 2024 | Leave a Comment

the more he claims he won, the greater the odds against him. reminds me so much of the refereeing against me in the 1970's. of the 5 national singles i won, my opponent in finals didn't reach double digits. that was the only way for me to overcome bias.

Ed. - Racket Guy from Brooklyn, Sports Illustrated, March 03, 1975:

To the victor—Victor Niederhoffer, that is—belongs another silver pitcher. Last week in New York, at 31, he won the U.S. National Singles Squash Racquets championship for the fifth time. His opponents did little but gasp, sweat and run. But Niederhoffer seemed to play effortlessly. His shots were not always brilliant, but he patiently waited out long rallies, and his frustrated opponents consistently found themselves in situations where most of their moves were of high risk. And then they were forced to make mistakes which ruined them.

reminds me of what my father always said when people told him how good he looked as he was suffering from chemo: "thank you, i'll be the healthiest corpse in the graveyard."

the symmetry of it all. last week 5 down days in a row - from 5659 to to 5515. this week 5 days up in a row from 5421 to 5630.

Sep

13

Politics, money

September 13, 2024 | Leave a Comment

the forces of regulatory capture won the debate handily and that is good for the stock market. more emoluments to business. more centralized control, or as Waltz says, "neighborliness".

As money mutates into a new form that demands all kinds of markets, new ways of making financial transactions, and new kinds of business.

From: The History of Money, by Jack Weatherford.

From primitive man's cowrie shells to the electronic cash card, from the markets of Timbuktu to the New York Stock Exchange, The History of Money explores how money and the myriad forms of exchange have affected humanity, and how they will continue to shape all aspects of our lives–economic, political, and personal.

Sep

12

From the archives, still fresh: The Math Behind the Music, reviewed by Vic

September 12, 2024 | Leave a Comment

Book Review by Victor Niederhoffer: The Math Behind the Music (25 Sept, 2006)

The Math Behind the Music (Cambridge University Press, 2006) by Leon Harkleroad, will be of interest to musicians, mathematicians and marketicians. In a form that is accessible to every layman, the author describes the elementary mathematical principles behind sounds, instruments, compositions and visual aspects of scores in just 135 pages with a nice section of references and an included CD that covers examples of music that used math. No background is required as even such simple lower-school concepts as the factorial are developed by counting.

The first chapter is about the connections, history, common abstract patterns, and the composers and compositions that used math. The second chapter is about the physical basis of harmony, pitch and timbre that make up music. Considerable attention is paid to the frequency relations of various harmonies, and it's a good refresher for those who don't remember off the top that a fourth comes from any note by raising its frequency by 4/3, a fifth by raising its frequency by 1/2 and an octave by doubling. Sine curves are introduced to encapsulate the frequency patterns of various notes produced at different pitches by different instruments. Overtones are explained simply as the ratios of higher frequencies that a note produces that don't block out the original frequencies and the relation between harmonies and overtones is shown.

The third chapter discusses instrument tuning systems consistent with all the overtones and frequency relations between the notes of a scale.

The fourth chapter is the most interesting in that it shows how themes and melodies can be varied with simple rules such as opposition, inversion, and transposition. The relation between these simple rules and group theory are examined, and various ways of notating and combining the rules are covered.

The fifth chapter is about bell music, which is merely a variation of permutation and combination theory.

The sixth chapter is about randomization in music, with many of the same methods used to construct music as we use for simple simulations in markets.

The seventh chapter is about an attempt by one student to find the common basis, the patterns of harmony that make up the most popular songs. The eighth chapter is about how scores of music can be developed from visual cues, with rules to go from visual to music.

The ninth and final chapter is about failed efforts to combine music and math, with particular reference to George Birkhoff's efforts to develop a complete theory of aesthetics by developing a scale of beauty based on the simplicity-to-complexity ratio of a composition.

I found myself thinking many times of the relations between music and markets as I read the book. The combinations of opposites and inversions (where the intervals above a note and played the same intervals below, and transpositions (where the same theme is repeated a given number of intervals up) happens every day in the markets. The notation that musicians have developed to grapple with these techniques, including the summary of horizontal and vertical movements in visual sightings that the composer Villa-Lobos used to construct symphonies that depict buildings in a city, seems like a very fruitful field to augment technical analysis of markets.

The book is full of anecdotes and charts and methods that will be right on the top of the page for market practitioners, and will spark many a fruitful extension by those who wish to take the pencil to paper, and systematize what they have been doing in markets or charting with the work of some great composers and mathematicians in this related field.

Laurence Glazier offers:

This sounds a fine book. Abstract shapes indeed can be used for thematic material, in my chess days I considered using the outline of pawn structures like black's in the Dragon Variation. My mentor uses the letters in his friends' names. Music is developed by changing patterns in various - ever-changing! - ways, whether transposition, inversion, speed-changing, and I would add to the list in the book the use of rotation, a technique Chris Sansom and I used in the Fractal Music software. All this (except presumably rotation) applies in trading. The issue is whether it is predictive for traders, and that is akin to trying to predict what a Bach would do, the patterns are especially evident once they have happened.

Asindu Drileba adds:

The work of Dmitri Tymoczko might also be interesting for those that want to understand the relationship between randomness and music.

Sep

5

A call for an emphasis on predictive distributions, from Victor Niederhoffer and the Spec Trio

September 5, 2024 | 1 Comment

From Ask the Specs, by Victor Niederhoffer, Laurel Kenner, and Dr. Brett Steenbarger (December, 2003):

May I issue a call for an emphasis on predictive distributions rather than descriptive studies? By predictive, I mean, a study that:

• enumerates all observations of what has happened after a defined market event over a specific period of time;

• weighs whether the results indicate a random phenomenon or a tradable anomaly;

• measures the uncertainty associated with the latter conclusion; and

• predicts the probability that an x-percent move will follow the event being studied.

Based on my experience, the biggest mistake a trader can make is to concentrate on “advanced” methods such as Hurst exponents, regression coefficients, Fourier series, chaos, wavelets, fractals, et al. Unfortunately, all of those sophisticated techniques will get you nothing but a barrel of retrospective nothingness.

The key is to find a measure that can be calculated often and independently and then use it to predict. For example, what happens in the next one, five and 10 days after stocks reach a 20-day low? The philosophic memory and longings and expectations of the market are of great interest, but I have found queries as to whether they trend or reverse in accord with Prechter or Fibonacci or Elliott a distraction to the pursuit of profitable trading.

You could put the 100 smartest academics in the world in a room and let them try to predict the market for 100 years, and unless they were steered on a path to make fruitful predictions with readily ascertainable estimates of uncertainty, constantly adjusting for ever-changing cycles, they would achieve below-random results. The numerous professors I have hosted and supported in my office have not disabused me of this assessment.

Sep

2

Counting: Seasonality

September 2, 2024 | 1 Comment

A lesson from the archives: Seasonality and changing cycles, by Victor Niederhoffer and Laurel Kenner, (04/26/2004)

A good part of the anomaly literature is devoted to studies of seasonality. A basic problem with these studies is that merely picking a season to study involves making guesses as to when and where the seasonality is. For example, is it in January or December, on Monday or Friday, in the United States or the Ukraine? (Yes, our Google search turned up a study of anomalies in the Ukraine.) Thus, the very choice of a subject might involve random luck.

Another aspect of seasonality studies that must be considered is whether the effects noted are sufficient to cover transaction costs. A retrospective study showing that you can make 2 cents more on Friday trades than Monday trades in your typical $50 stock would not be sufficient in practice to leave anyone but the broker and the market-maker richer.

Thus, it's essential to temper the conclusions of such studies with out-of-sample testing — in other words, with real trading.

[ … ]

Comment by Philip J. McDonnell, a former student of the Chairman at UC Berkeley: Dr. Niederhoffer points out that there is no a priori reason to believe that any one day of the week is stronger than any other. Thus when Y— collected the data (thank you!), presumably the reason was to find out if any days of the week behaved differently. Only after peeking at the data was it possible to say that Monday was the best and Tuesday the worst.

There are 10 such pairwise comparisons:

Mon with other 4 days 4

Tues with 3 last days 3

Wed with Thu & Fri 2

Thu with Fri 1

Total 10

In other words it is also possible that Tuesday could have been the best day and Monday the worst or any other pairwise comparison by chance alone. So when the one best and the one worst day shown by the data are compared and shown to have say a 5% significance we need to remember that we implicitly ruled out the other nine cases which weren't the best or worst. So we need to take our 5% number and multiply by 10 to get the correct significance of 50%. 50% is exactly consistent with randomness.

The problem is multiple comparisons are often subtle and remain unrecognized. Multiple comparisons are insidious because they dramatically reduce the power of the statistical tests we employ.

[ … ]

[More reading: Multiple comparisons problem]

William Huggins offers:

Bonferonni method suggests raising the confidence level proportional to the number of tested hypotheses. To get 95% confidence despite ten tests, he suggests 99.5 as a threshold. It's a huge problem when testing which variables to include in a regression model.

Asindu Drileba writes:

The right way to do this type of thing is to form a specific hypothesis based on a single comparison and then to test it on the data. It is even possible to use data from a prior period to formulate our hypothesis. We then test our hypothesis on the subsequent period which excludes the period where we formed our hypothesis.

This is an approach used in machine learning. Datasets are always split into "training" and "test" datasets. "Training" datasets are exclusively used to build the components of the model. "Test" datasets are not used to build the model at all. They are excluded when building the model. The model built using the "training" dataset is then asked to make predictions on the "test" dataset. The accuracy on predictions made on the "test" datasets is then used to determine how accurate the model is (so it can be tuned for improvement or thrown away).

I found this particular statement from the full post so insightful because I didn't think of applying this approach to building models using other statistical methods (I thought it was something limited to machine learning).

Aug

30

The warrior’s path, and a favorite song

August 30, 2024 | Leave a Comment

many market lessons The Warrior's Path: Wisdom from Contemporary Martial Arts Masters. concentrate on one move or trade. be humble, et al. start at 5 yrs old. stick to one martial arts. what else?

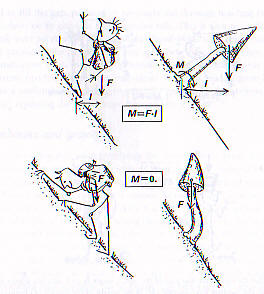

Karate: The Art of Empty Hand Fighting: The Groundbreaking Work on Karate, by Hidetaka Nishiyama (Author), Richard C. Brown:

The remarkable strength manifested by many individual karate techniques, both offensive and defensive, is not the mysterious, esoteric thing many observers, as well as certain proponents of the art itself, would have you believe. On the contrary, it is the inevitable result of the effective application of certain well-known scientific principles to the movements of the body. Likewise, knowledge of psychological principles, along with constant practice, enable the karate man to find openings and execute the proper techniques at the proper times, no matter how minute the movements of his opponent. At an advanced level, it is even possible for a karate expert to sense the movements of his opponent before they take place.

grandfather Martin's favorite song from the 1930's:

Most Gentlemen Don't Like Love

Aug

28

Phenotypic plasticity and reaction norms

August 28, 2024 | Leave a Comment

often the markets move to a constellation where the expected move is different despite the similarity of the independent variables. Bacon called it ever changing cycles. the silviculturists call it a reaction norm:

A ‘reaction norm’ describes the sensitivity of an organism, or of a set of organisms of the same genotype (e.g., the members of a clone), to some specific environmental variable. It quantifies phenotypic change (or lack of change) in a selected aspect of the phenotype as a function of variation in the environmental factor of interest.

A book of interest on this and other topics:

Geographic Variation in Forest Trees: Genetic Basis and Application of Knowledge in Silviculture

Geographic Variation in Forest Trees is the first book to examine this subject from a world-wide perspective. The author discusses population genetic theory and genetic systems of native North American tree species as they interact with environments in the major climatic regions in the world. He then demonstrates how this knowledge is used to guide seed zoning and seed transfer in silviculture, basing much of his discussion on models developed in Scandinavia and North America. In the final chapter, the author addresses the issue of genetic conservation — a subject of great concern in the face of accelerated forest destruction, industrial pollution, and climatic change. This comprehensive, well-researched book makes a significant contribution to the knowledge of one of our most important renewable natural resources.

More background: Phenotypic plasticity

Aug

26

Speaking of regression

August 26, 2024 | Leave a Comment

A Primer on Correlation and Regression, by Victor Niederhoffer

(07-Nov-2006)

Applying Regression and Correlation: A Guide for Students and Researchers, by Jeremy Miles of the RAND Corporation and Mark Shevlin of the University of Ulster, illustrates the proper and pitfall-laden path that leads to the many beautiful and illuminating things that correlation and regression can accomplish. The book is written for psychology students without any training in calculus, and it contains simple examples and extensive commentary on the regression output from standard statistical programs such as SPSS. However, the applications for psychology are almost identical to those that would be used in markets, with such variables as industries substituted for classes and companies for individuals.

And what a wonderful array of applications and extensions this book contains. I found myself augmenting my knowledge or learning something new on almost every page, and I have read many dozens of books on this subject. There are great sections on how to code your data so that you can do categorical regression, categorical covariance, structural equation analysis. There is a very good section on how to go through all the steps of logistic regression with simple examples and calculations to show how the maximum likelihood solution is computed. There is a very fine discussion of the reasons that you should never use stepwise regression and why hierarchical regression is much better. There is a complete chapter on all the computational methods of measuring the individual contributions to the prediction and the influence of each independent variable and each observation in the regression.

One of the main themes of the book that hold everything together is that everything that can be done with the usual analysis of variance techniques can be done with regression, but that regression does so much more. While I had read this before, I had never seen such a clear exposition of how to code the data so that you can actually accomplish the transformation and always come up with the more complete and useful regression solutions to such problems.

Aug

13

Diffusion of Innovations

August 13, 2024 | Leave a Comment

diffusion of information has been applied to everything (soon AI ) but not to change in relations of markets. a good book.

Diffusion of Innovations, 5th Edition Paperback – Illustrated, August 16, 2003, by Everett M. Rogers

In this renowned book, Everett M. Rogers, professor and chair of the Department of Communication & Journalism at the University of New Mexico, explains how new ideas spread via communication channels over time. Such innovations are initially perceived as uncertain and even risky. To overcome this uncertainty, most people seek out others like themselves who have already adopted the new idea. Thus the diffusion process consists of a few individuals who first adopt an innovation, then spread the word among their circle of acquaintances—a process which typically takes months or years. But there are exceptions: use of the Internet in the 1990s, for example, may have spread more rapidly than any other innovation in the history of humankind. Furthermore, the Internet is changing the very nature of diffusion by decreasing the importance of physical distance between people. The fifth edition addresses the spread of the Internet, and how it has transformed the way human beings communicate and adopt new ideas.

Aug

11

From the archives: Vic reviews Trees: Their Natural History, by Peter Thomas

August 11, 2024 | Leave a Comment

22-Aug-2006

Almost every page of the book Trees: Their Natural History teaches one new things about the workings and adaptations of trees, and I find these lessons of great value in improving my understanding of the markets.

The chapter on the shape of trees starts with the idea that one of the objectives of a tree is to raise its leaves above a competitor's, so that it can get the greatest possible share of light. It makes its shape based on a compromise between this and its other needs; its ability to pollinate and disperse its seeds, how much trunk it needs to support itself against wind, snow, and moisture, the conditions of the soil, the threat of fire and insect pests. All of the compromises vary with age.

One thing learned is that trees found at a high latitude and altitude are cone shaped with short downward sloping branches, and that the broad crowns of most hardwoods are associated with moist sites, deep shade, or harsh tree line conditions. In Britain there is a moist environment so most of the trees take on spherical shape.

Pines further south develop a flat topped umbrella shape which helps resist drying winds and maximizes convective heat loss by allowing free passage through the canopy.

The tree is an expert in shifting its center of gravity so as to minimize stress on any part of its structure. The principle it uses is to minimize lever arms. This means making the weight that any branch carries away from a fulcrum as small as possible, reducing the possibility of breakage. This principle keeps the horizontal length of a branch as small as possible, always subject to the compromise that the further a branch is extended outwards, often the more light it can get.

What the tree does is to bend its branches upright, so that the lever arms are not pulling the tree sideway. This applies not only to branches, but to the leaning of trees towards the sun. A beautiful set of diagrams illustrate the similarity of the adaptations that the tree makes to maintain a center of gravity to the adaptations a human makes to maintain their center of gravity. Trees use their terminal buds to build modules that change their shape, while humans use the brain to decide to change our center of gravity, for example when we bend forward whilst we are climbing up a hill.

Sample market hypotheses generated by this way of thinking are: The horizontal moves of markets would seem to be the reversals that they take from a given center of gravity. The more that they reverse to one side from a central point, perhaps a round number, the more likely that structures and activity will grow on the other side to minimize the stress. Eventually, conditions of light (competition) cause the market or a stock to move.

Alternatively, the greater the rate of ascent or descent, the more likely a market or stock is to show movement in a opposite direction to bring its center of gravity to a more stable level.

J.T. Holley responds:

Something that I have dealt with recently is the feeding of dying trees to resuscitate or bring them back to life. 'Spiking' trees with silly fertilizer spikes works well with the smaller trees, but you need bigger guns when you have the limbs leaning downward towards the ground. In parks and high traffic areas this is a huge hazard, the tree will seem to shed the limb to relieve the stress that Vic has mentioned above.

The only thing I learned regarding saving a tree is to take an auger, pipe, or some large metal rod and drive it into the ground. Rotate this until you have a two to three foot deep hole and pull it out. Fill this two thirds full of 10-10-10 and cover the rest with dirt and put your grass back over. These holes must be done around the 'drip zone' coming off the base of the trunk just inside the 'splash zone' from the outermost limbs.

I too believe, and should test, that the markets use these round numbers or spots to relieve their stress. These spots of light and competition allow it to be able to gain strength in times of weakness (sell off) to gain the nutrients to move higher and become stronger than before! Its like testing and finding Trend followers spots where they utilize "reversing stops" with their "fixed system". The Drip Zone is where the fertilizer is planted to pick 'em off and gain the edge.

Aug

7

To Aubrey on Leaving for College, from Laurel Kenner

August 7, 2024 | Leave a Comment

Essentials

See what you look at. Listen to what you hear. Feel what you feel.

Finding a way to use heart, hand, and mind together leads to joy.

Treat yourself as you would a dear friend.

Don’t lie. Lying tangles up your heart and mind. Lies require more lies, sapping energy.

Much of what is considered normal is wrong or worse.

Turn away from cynicism, intoxication, and callousness.

Read Xenophon’s account of Cyrus to learn about leadership. Read Seneca and Publius to learn how to retain your composure and virtue through Fortune’s ups and downs.

Be trustworthy.

Keep a good reputation.

Don’t talk trash about others behind their backs. That sort of talk has a way of flying like a bird back to the target and can turn people into enemies. Talking trash also makes your companions wonder what you say about them when they’re not around.

Genial curiosity can sometimes defuse bad situations.

Bad behavior is often about them, not you.

Deportment

Good manners reveal strength.

Respecting others as human beings is the essence of good manners. You don’t have to overthink it; good manners are often about little things, such as:

Get to appointments early.

Open doors for people with crutches and watch out for their feet.

Open doors for women and mothers with baby carriages.

If a woman joins you at a table where no seat is empty, give her yours. Pull the seat out for her and help her settle in.

Do not swear. It makes you seem churlish.

Don’t comment on the appearance of others. The exceptions: Tell your wife she looks lovely and tell a friend if his fly is open.

Do not make fun of what another person eats, drinks, or thinks.

Invest in comfortable, well-made clothes. Cheap clothes waste money because they don’t last, and they make people wonder if you will be as careless with them as you are with your own appearance.

Women

As you know, one of your most important roles is to protect women.

Women are vulnerable to falling in love too quickly, because they instinctively want a family. That's true of all women.

Sexually liberated women do not exist. Recognize that women who think they can act like men are prey in a harmful culture. You must protect them.

At Home

Wash sheets and pillowcases weekly.

Light and fresh air are healthy. Keep the windows in your room open if possible.

Follow the one-touch rule: Put things in their places. Put dirty clothes in the hamper. Put dishes in the dishwasher. Throw out papers you don’t need.

An orderly house helps keep life happy and productive.

Gratitude

Gratitude creates happiness. Write down five things you’re grateful for in a notebook every day.

Adulthood

What does it mean to become an adult? In a word: responsibility. Paying rent. Creating and protecting your family. Planning ahead. Making a career. Fulfilling your obligations. Making money. Contributing to freedom, community, earth.

On a higher level, adulthood is the ability to consider two opposing concepts. Adults can deal with ambiguity and subtlety.

Many wise sayings have converses that are equally wise and true. For example, perseverance and endurance are virtues; but the adage “survival is mobility” saved many Jews from the Nazi death camps.

In our modern world, “survival is adaptability” may be more apt. You must become adaptable without losing your soul.

Farewell

With all my love, I send you out into the world, an eagle destined to soar among mountain peaks. Be strong. Don’t forget to call.

-Mom

Vic adds:

beautiful advice - reach out to learn new things and be good to friends. don't be too trusting.

Sushil Rungta writes:

Wonderful lessons. While I loved all, the lessons on respecting others resonate with me the most. How often we behave callously towards others! Sometimes, unintentionally. Here, practicing mindfulness really helps.

Aug

4

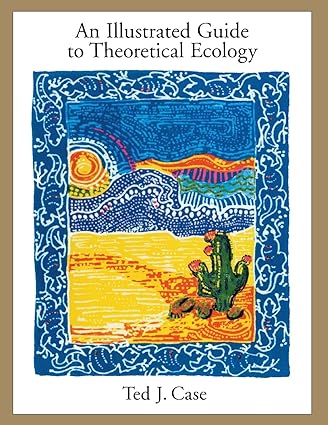

Book Review from Victor Niederhoffer: 'An Illustrated Guide to Theoretical Ecology'

(02 October, 2006)

Every now and then one comes across a book that completely clarifies what every educated person should know about a subject that is essential to understand as we go about the humdrum business of life and trading. Such a book is An Illustrated Guide to Theoretical Ecology, by Ted J. Case. I cannot recommend this book too highly, as it provides a foundation for thinking about competition, mutualism, growth, resource depletion, diffusion, population density, predation, life cycles and space. The book introduces the basic principles behind each of these subjects with simple algebraic equations and illustrative charts that describe various plausible relations. It then follows through with analytic solutions to develop a deep understanding.

Aug

2

Incentives

August 2, 2024 | Leave a Comment

the CEA test has a positive predictivity of 80% for colon cancer. most studies show it doesn't have a cost effectiveness. How accurate is a CEA blood test?

Doctors don't use the CEA test to make a first-time diagnosis of cancer. This test isn't an accurate way to screen for it because many other diseases can cause the levels of this protein to rise. And some people with cancer don't have high CEA levels.

but but but… the studies don't take account of the incentives and the next steps taken / it has positive predictivity of 80%. who wouldn't take the next step after a positive (CEA above 3.5)? I am not an MD. none of my kids and good friends who are MD's recommend it.

Jul

31

A comparison

July 31, 2024 | Leave a Comment

Deep Enough, a beautiful heroic book about the same subject as a hateful book, Angle of Repose. one won the Pulitzer Prize, the other is hardly known but highly recommended by me.

Jul

19

The golden ratio

July 19, 2024 | Leave a Comment

golden ratio of 1.65 appears in thousands of settings over thousands of years.

The Golden Ratio: The Divine Beauty of Mathematics, by Gary B. Meisner (Author) and Rafael Araujo (Artist)

The Golden Ratio examines the presence of this divine number in art and architecture throughout history, as well as its ubiquity among plants, animals, and even the cosmos. This gorgeous book—with layflat dimensions that closely approximate the golden ratio—features clear, enlightening, and entertaining commentary alongside stunning full-color illustrations by Venezuelan artist and architect Rafael Araujo.

A trader writes:

I have used the golden ratio trying to predict where the technical people find Fibonacci support and resistance levels in both cash and futures and applying them to grain spreads and basis capture. This was in conjunction with other tools being used and tested. I completely abandoned the method after finding other, more successful ways that work better than random.

William Huggins offers an historical lagniappe:

Leonardo of Pisa may be best known for his "sequence" but in his lifetime, it was his work as a tutor to the rich business class of late-Medieval Italy that paid the bills. His mathematical treatise Liber Abaci (1202), which was only "recently" translated into English, is broken into chapters including basic operations but he quickly jumps into the calculation of profits from business voyages and even introduces the notion of the time value of money.

Jul

14

Randomness, with a bit of song

July 14, 2024 | Leave a Comment

I would love to ask Dr. David Hand to answer the question of randomness of the negative correlation between Yankees winning and S&P performance. i believe the negative correlation is a real expression of the nature of the commercial background and spirit of the Yankees. all commercials e.g. are dei.

i thought it mite be an easy example of a random coincidence that would be grist for Dr. Hand's mill. i admire his work enormously. sent one of his, Statistics: A Very Short Introduction, to Berkeley son. The book has no numbers or maths in it and my Aubrey just received yet another 5 on his grads even though he never took a stats class.

[And now for the song…] completely fictional made up by Sondheim. example of how great composers with evil in hearts and do great things like Debussy and Wagner:

Someone in a Tree - Stereo - Pacific Overtures - Original Broadway Cast

Jul

10

Correlations, miracles, and rare events

July 10, 2024 | Leave a Comment

the negative corr between the Yankees winning and the S&P during last 25 days is about -0.80. can you come up with an explanation?

Yankees record in last 25 games

The Improbability Principle: Why Coincidences, Miracles, and Rare Events Happen Every Day

In The Improbability Principle, the renowned statistician David J. Hand argues that extraordinarily rare events are anything but. In fact, they're commonplace. Not only that, we should all expect to experience a miracle roughly once every month. But Hand is no believer in superstitions, prophecies, or the paranormal. His definition of "miracle" is thoroughly rational. No mystical or supernatural explanation is necessary to understand why someone is lucky enough to win the lottery twice, or is destined to be hit by lightning three times and still survive. All we need, Hand argues, is a firm grounding in a powerful set of laws: the laws of inevitability, of truly large numbers, of selection, of the probability lever, and of near enough. Together, these constitute Hand's groundbreaking Improbability Principle.

Jul

9

Amazing Weston Lifetime Collection of a Gentleman

July 9, 2024 | Leave a Comment

Amazing Weston Lifetime Collection of a Gentleman

Sale begins to close:

Wednesday, July 10th 2024 at 8:05 pm est

Jul

2

What markets teach

July 2, 2024 | Leave a Comment

a book recommended as the best book on economics ever is Reinventing the Bazaar, by John McMillan. you learn about flower markets, camel markets, pharma markets, bazaar markets in Morocco. and what it takes for them to work. i found the book fascinating albeit takes middle road.

Dasgupta, very erudite and sharp economist, recommends the McMillan book as essential for every current and would be economist. it tried to be eclectic as to free markets and need for government control. it's good to keep the enemy close as Godfather says.

Economics: A Very Short Introduction, by Partha Dasgupta.

Wes McCain is one of the most successful and erudite economists I have met in my 65 years career in Wall street. He recommends the Godfather as the most important and useful book for traders. I just watch the three Godfather Movies and they are excellent and highly recommended.

one of lessons that I wish my colleagues followed: "Fredo, don't ever take sides against the family again." so important in business and military, and markets especially.

every one says the opening line "i believe in america" is one of greatest opening lines ever. imagine the contumely that would be directed at it today.

Jun

30

Grandeur, and a very, very good wife

June 30, 2024 | Leave a Comment

There is grandeur in this view of life, with its several powers, having been originally breathed into a few forms or into one; and that, whilst this planet has gone cycling on according to the fixed law of gravity, from so simple a beginning endless forms most beautiful and most wonderful have been, and are being, evolved.

- Charles Darwin, The Origin of Species

there is grandeur in the inexorable rise in the S&P, documented by Dimson and Lorie.

i am forced to move and my paintings don't have much auction value so i would gladly reveal my methods for 50 million + and throw in a very valuable wife to the bargain.

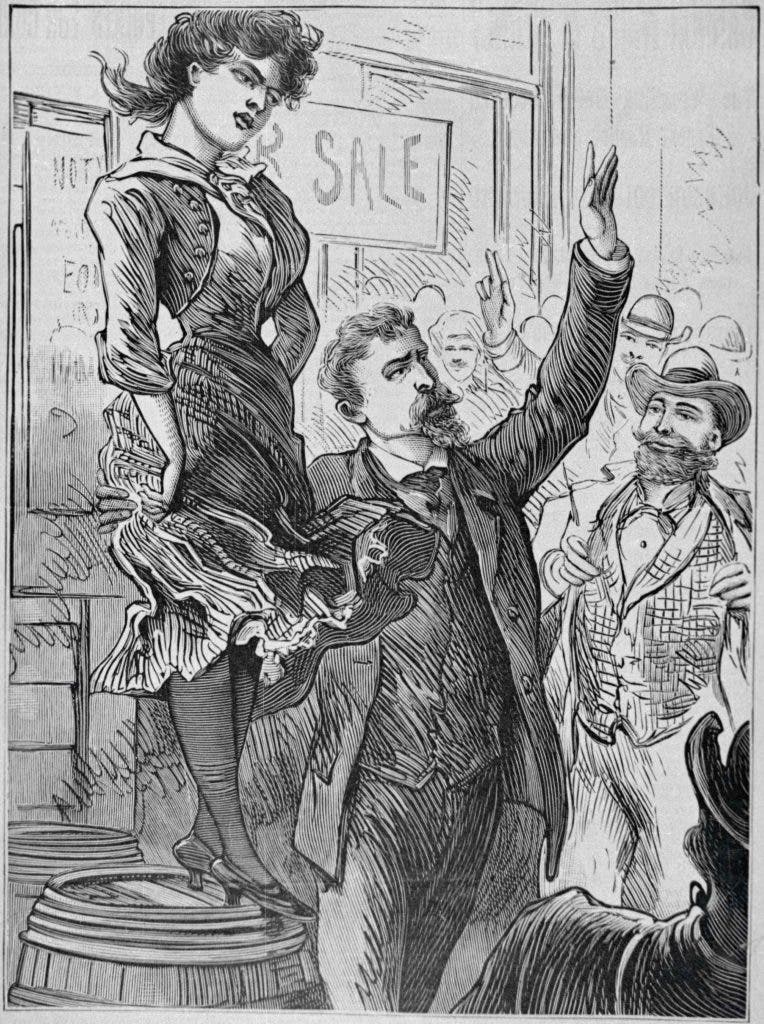

English Men Once Sold Their Wives Instead of Getting Divorced

Between the 17th and 19th centuries, wife-selling was a weird custom with a practical purpose.

she's a very good one. Tom Wiswell said his one regret in life was that he didn't marry a girl like Susan and since then many visitors have said same. The problem is that she is necessary to take care of me so I believe she could sell me for more than I could get for her. I told her at dinner that I was looking at ways of making money by selling some of our trees. She looked at me and said immediately that she wasn't going to send me the picture of her I asked for.

Jun

20

Odds, books, and Wilde in America

June 20, 2024 | Leave a Comment

with odds differential of 20 percentage points a max, how can we expect a change in the numbers announced? i would predict an increase in ppi and cpi.

a sensational phantasmagorical book building up from birth-death processes to the evolutionary theory of markets:

Adaptive Markets: Financial Evolution at the Speed of Thought, by Andrew Lo

Drawing on psychology, evolutionary biology, neuroscience, artificial intelligence, and other fields, Adaptive Markets shows that the theory of market efficiency isn't wrong but merely incomplete. When markets are unstable, investors react instinctively, creating inefficiencies for others to exploit. Lo's new paradigm explains how financial evolution shapes behavior and markets at the speed of thought - a fact revealed by swings between stability and crisis, profit and loss, and innovation and regulation.

given the latitude and longitude of a market, at a time, what do rotational symmetries enable you to predict?

The Force of Symmetry, by Vincent Icke

The Force of Symmetry gives an elementary introduction to the spectacular interplay among the three great themes of contemporary physics: quantum behavior, relativity, and symmetry. In clear, nontechnical language, it explores many fascinating aspects of modern physics, discussing the nature and interaction of force and matter. All these themes are drawn together toward the end of the book to describe the most successful physics theory in history, the "standard model" of subatomic particles. The book is suitable for undergraduate students in physics and mathematics.

D'Oyly Carte arranged for Oscar Wilde to tour U.S. to build up audience for Patience.

Oscar Wilde In America, The Definitive Resource Of Oscar Wilde's Visits To America

These pages document for the first time a detailed, comprehensive, and accurate record of all the dates, venues, and subjects of Oscar Wilde’s 1882 lecture tour of North America. Wilde conducted some 141 lectures over 11 months of 1882 and each has its own page beginning with the first lecture in New York City.

Jun

18

Back to school

June 18, 2024 | Leave a Comment

Aubrey one day before Berkeley. My kids all asked if I would be moving as Beethoven did when Karl left for school.

i cried when he didn't get into Harvard. he tried so hard and did so much. how could someone with 1600, a benevolent business in Eswatini, and 20 straight 5's on AP not get in? i guess his squash was not world caliber, and dei.

he only ran a 4.5 mile. his compatriots said if he knocked 30 seconds off he 'd have a chance. the best i ran was a 7.5 minute mile.

Jun

16

Brighton Beach knishes

June 16, 2024 | Leave a Comment

I grew up in Brighton Beach Brooklyn. By far the greatest Knishes of all time. The long gone Mrs Stahls.

Mrs. Stahl’s delicious Brighton Beach knishes

Yonah Schimmel gets credit for inventing the humble knish in 1910 at his still-thriving knishery on East Houston Street.

But knish fiends all over New York still lament the loss of Mrs. Stahl’s Knishes, a dingy place tucked under the elevated train at Brighton Beach Avenue.

The shop served up hand-made cushions of potato, kasha, and cabbage inside flaky baked dough. They were truly legendary.

A recipe: Old Fashioned Potato Knishes

Jun

12

Capgras delusion

June 12, 2024 | Leave a Comment

when a sizable part of speculators refuses to acknowledge the work of dimson et al and lorie and fisher et al in showing the 1000 fold increase in stocks over the last 100 years, we may attribute it to capgras delusion of imposters within.

Capgras delusion or Capgras syndrome is a psychiatric disorder in which a person holds a delusion that a friend, spouse, parent, another close family member, or pet has been replaced by an identical impostor. It is named after Joseph Capgras (1873–1950), the French psychiatrist who first described the disorder.

odds differential is now max of 17 percentage pts against regulatory capture. need a reduction.

Jun

12

Opposites

June 12, 2024 | Leave a Comment

Gilbert and Sullivan by Hesketh Pearson: sullivan was an inveterate gambler and inventor. personality was opposite to gilbert who was most litigious playwright in history.

From page 195:

Sullivan was at Monte Carlo when this letter arrived. He had recently been staying with the Prince and Princess of Wales at Sandringham, had then accompanied the Prince to the Continent, and was now enjoying princely festivities on the Riviera. His regular visits to the tables were reported in the papers, and he was extremely annoyed when certain English journals commented on his heavy gambling. What with dining among lords and counting his losses, he was in no mood to discuss grand opera with Gilbert. But he wrote again, recapitulating his main objections to Gilbertian comic opera: he was tired of it; his work was too good for it; he did not want to spend the rest of his life in clothing the same old types with music, e.g. "the middle-aged woman with fading charms"; he disliked the inhuman and impossible plots; in fact, the whole business had become distasteful to him.

Hesketh Pearson:

Hesketh Pearson published his first full-length biography, Doctor Darwin, when he was 43. By the time of his death thirty-four years later he had written another eighteen biographies, three travel books (all with Hugh Kingsmill), three books of reminiscences (one written with Malcolm Muggeridge), four collections of brief lives, a collection of short stories and essays, and a book on the craft of biographical writing, as well as numerous articles and talks. In England he was the most popular and successful biographer of his time.

From: Harry Ransom Center at the University of Texas

Jun

10

Stock/Bond ratio, from Hernan Avella

June 10, 2024 | Leave a Comment

I use a slightly modified version, I think is apt to use a rolling vol adjustment. Using VFINX (stocks) Long, VUSTX (long bonds) short. The stock bond ratio is higher than it was in 2000. the chart will show whatever you want; however, if you make the assumption that stocks and bonds have similar RISK ADJUSTED returns, mean reversion should be expected….at some point, but I don't think there's an actionable point here other than stay diversified. Here's a visual:

Stefan Jovanovich writes:

In the 40 years between the return of the dollar to the Constitutional standard (i.e. all paper issued by the Treasury had to be redeemable in coin) and the creation of a central bank that guaranteed that call money would always be available, the returns on the stock and bond markets had similar risk adjusted returns. For investors it was a choice whether to buy the common stocks of railroads with their wonderful but variable dividends or the secured bonds of the same companies.

A reversion to the mean could be a return to a period when cash, bonds and stocks all competed with one another in a connected equilibrium. That world saw creations of extraordinary fortunes; but against the one successful oil trust one had to measure the losses of all the enterprises that were unable to compete with Rockefeller's price-cutting for kerosene. What if AI means that sourcing for semiconductors only needs a few large relentlessly successful companies?

Vic asks:

how about no roll, no averaging on the bonds stock ratio?

Jun

7

More classic research

June 7, 2024 | Leave a Comment

Market Making and Reversal on the Stock Exchange

Victor Niederhoffer, University of Chicago, and M. F. M. Osborne, Washington, D. C.

Source: Journal of the American Statistical Association, Vol. 61, No. 316, (Dec., 1966), pp. 897-916

The accurate record of stock market ticker prices displays striking properties of dependence. We find for example that after a decline of 1/8 of a point between transactions, an advance on the next transaction is three times as likely as a decline. Further examinations disclose that after two price changes in the same direction, the odds in favor of a continuation in that direction are almost twice as great as after two changes in opposite directions.

Jun

5

M. F. M. Osborne

June 5, 2024 | Leave a Comment

M. F. M. Osborne. works on farm for free. uses his strength to go on anthropological dig. purposely spends 1 month in jail. graduate degree at Lick Obs. in Berkeley. becomes student of Oppenheimer who was smartest man at School. takes job at US Naval Research in sound division. writes scenes from life of the greatest contributor to random walk behavior.

while carrying his bio around, I fell down 7 stairs on my head onto concrete and all pages mixed up.

Brownian Motion in the Stock Market, M. F. M. Osborne.

It is the purpose of this paper to show that the logarithms of common stock prices can be regarded as an ensemble of decisions in a statistical steady state and that this ensemble of logarithms of prices, each varying with the time, has a close analogy with the ensemble of coordinates of a large number of molecules. We wish to show that the methods of statistical mechanics, normally applied to the latter problem , may also be applied to the former.

May

31

Kings of the Court

May 31, 2024 | Leave a Comment

Kings of the Court: The Story of Lawn Tennis by E. C. Potter, Jr. - the good old days in 1879, the third Wimbledon victory, Hartley got to the finals on Saturday. he had not arranged for anyone to replace him in pulpit. he rushed off the court, took a one-hour trip to Yorkshire, arrived at W. just in time to change his flannels, averted default and won W. those were the days of the identical twin Renshaws and Dohertys. many still rank the Dos in top 5 of all time from 1903. Pim in between the two sets of twins could pull of a let cord whenever he wanted. But he only won W twice because he only cared about perfecting his stoke.

May

24

Slow to adapt, from Big Al

May 24, 2024 | Leave a Comment

It's been 44 years since the introduction of the 3-point line in the NBA. To me, it's a curious case of slow adaptation. Of course, you have new generations of players growing up shooting the 3, but surely players in the early 80s were capable of learning and practicing. The low number of 3s seems like a failure of analysis, failure to understand the impact on points-per-possession, which wasn't much of a moneyball concept yet.

Also, early on it was pretty much just guards who shot the 3 well, with the big exception of Larry Bird. But now, lots of players 6-10 or taller shoot 3s with considerable accuracy. To me, this is more an issue of assumptions, that big men couldn't shoot from long. And then some big men put in more practice and showed they could do it, opening up the possibilities.

Interesting how there are thresholds people believe can't be crossed…until somebody crosses them…and then lots of people are running sub-4-minute miles.

The 3-Point Revolution, by Stephen Shea:

A gimmick? A publicity stunt? That’s what many thought of the 3-point line when the NBA adopted it for the 1979-80 season. Back in 1979, Washington Bullets coach Dick Motta commented, “The three-point field goal will definitely make things interesting.” He meant interesting in the sense that a game that would have been over might now be sent to overtime by a desperation heave. Neither Coach Motta nor anyone else foresaw an NBA game played like it is today.

Five years after its inception, NBA teams were only averaging 2.4 three-point attempts (3PA) per game. This past season, James Harden alone averaged ten. Teams averaged 29.

[ More data on 3-point shooting. ]

Larry Williams comments:

Good point!! …like the 4 minute mile…and we can only beat the averages by a few points…

Vic wonders:

what adjustments have markets been slow to adapt to in last 5 years?

Big Al adds:

An interesting sidebar from 2017:

The Basketball Team That Never Takes a Bad Shot

The NBA’s most efficient offenses seek out layups and threes. A high school in Minnesota takes the idea to the extreme.

By Ben Cohen

PINE CITY, Minn.—Jake Rademacher made a mid-range jumper in a recent high-school basketball game. But as soon as the ball left his hands, even before it banked in, Rademacher knew it was a bad shot. And his team doesn’t take bad shots.

Pine City High School seeks out only the most valuable shots in basketball: from underneath the rim or beyond the 3-point line. They play as if they’re allergic to all the space in between.

May

23

The Whole Story

May 23, 2024 | Leave a Comment

The Whole Story by John Mackey - a story of how an entrepreneur learned about the bourgeois virtues and thanks to his father and his supportive partners, wives, and in spite of the venture capitalists, went from rags to riches.

Whole Foods Market's cofounder and CEO for forty-four years, John Mackey offers an intimate and provocative account of the rise of this iconic company and the personal and spiritual journey that inspired its remarkable impact.

The Whole Story invites listeners on the adventure of building Whole Foods Market: the colorful cast of idealists and foodies who formed the company's DNA, the many breakthroughs and missteps, the camaraderie and the conflict, and the narrowly avoided disasters. Mackey takes us inside some of the most consequential decisions he had to make and honestly shares his regrets looking back.

May

21

Last Train to Paradise

May 21, 2024 | Leave a Comment

an excellent bio of the gilded age and a man who loved adventure and created the Florida East railroad and overcame numerous engineering and weather challenges. highly recommended.

The paths of the great American robber barons were paved with riches, and though ordinary citizens paid for them, they also profited. Les Standiford, author of the John Deal thrillers, tells how the man who turned Florida's swamps into the playgrounds of the rich performed the almost superhuman feat of building a railroad from the mainland to Key West at the turn of the century. An extraordinary man and partner of John D. Rockefeller in the Standard Oil Company, Flagler had the vision to build railroads to link this backward territory with the rest of America. Last Train to Paradise shows how he masterminded the nearly impossible engineering feat of spanning more than 100 miles of ocean and islands to reach the southernmost tip of the Eastern seaboard.

May

9

Teller of tales

May 9, 2024 | Leave a Comment

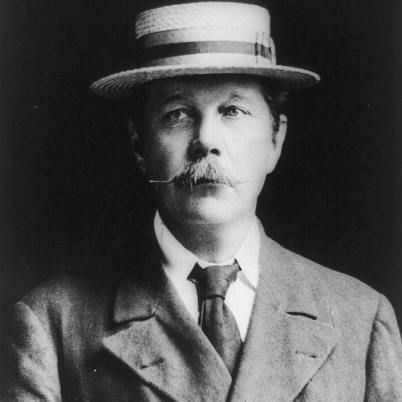

an excellent bio of a multitalented writer, thinker, and sportsman. a very chivalrous man. the story of Doyle going to a performance of Patience is resonant.

Teller of Tales: The Life of Arthur Conan Doyle

This compelling biography examines the extraordinary life and strange contrasts of Sir Arthur Conan Doyle, the struggling provincial doctor who became the most popular storyteller of his age when he created Sherlock Holmes. From his youthful exploits aboard a whaling ship to his often stormy friendships with such figures as Harry Houdini and George Bernard Shaw, Conan Doyle lived a life as gripping as any of his adventures. Exhaustively researched and elegantly written, Teller of Tales sets aside many myths and misconceptions to present a vivid portrait of the man behind the legend of Baker Street, with a particular emphasis on the Psychic Crusade that dominated his final years, the work that Conan Doyle himself felt to be "the most important thing in the world".

Apr

29

Follow-up to bourgeois virtues

April 29, 2024 | Leave a Comment

Jimmy Buffett and the Bourgeois Virtues

Jimmy Buffett was known for his “tropical rock,” whose music and lyrics borrowed liberally from rock, country, calypso, and island life. He sang with Frank Sinatra and Alan Jackson, and covered Old Hank. But he was also a lifelong entrepreneur – and erstwhile journalist – much like the great French economist Frédéric Bastiat. AIER is the home of the Bastiat Society, “a global network of individuals committed to advancing free trade, individual freedom, and limited government.” AIER is also the home of the Sound Money Project, something Jimmy knew about: “Now I got quarters in my loafers, tryin’ to fight inflation/When it only used to take a cent.”

Jimmy’s unflagging entrepreneurship embodies the “bourgeois virtues,” about which my AIER colleague and friend Art Carden has written with his mentor Deirdre McCloskey. Art is a Senior Fellow at AIER and Dr. McCloskey is a contributor. I don’t know if either is a fan of Jimmy Buffett.

Apr

28

A good antidote

April 28, 2024 | Leave a Comment

Carnegie Hero Fund Commission

Jameson Lobb, New York, NY

Jameson Lobb helped save a man from drowning, New York, New York, October 4, 2021. As a middle-aged man floated motionless in the East River between two piers at a popular waterfront overlook, a bystander on the pier nearest the man called for help. Alerted on the opposite pier was Lobb, 24, banking analyst, who was exercising with his friend. Lobb climbed over a railing and, fully clothed, jumped into the cold river and swam toward the submerging man’s location. Lobb submerged, grasped him, and resurfaced as the friend swam to them and positioned the man, who appeared to be unconscious, face up on the friend’s chest. Lobb held the man’s legs, and they swam, towing the man at least 100 feet back to the wooden, barnacle-covered fender of the far pier, where they had entered the water. While the friend held the man to the fender about 8 feet below the pier’s deck, Lobb climbed onto a beam, and they used a rope and life ring lowered by others to secure the man as he became responsive. With help from Lobb and the friend, bystanders then lifted the man onto the pier. Arriving first-responders tended to the man, who was taken to a hospital. Lobb, who suffered cuts on his arms, climbed back onto the pier and went to a hospital for precautionary treatment.

Apr

21

Very bullish

April 21, 2024 | Leave a Comment

very bullish when S&P is down 7 days in a row - only occurred 5 times since 1996, expectation in 2 days is +39 big. 6 20-day minimums in a row, happened 7 times since 1996, expectation in 4 days 100% up, mean gain 45 big.

Hernan Avella agrees:

I imagine the 2 or 3 fellow specs that still trade a significant size in this list are already loaded up with enough spu, because one expects fireworks next week.

From the department of non predictive studies: Choose your favorite trend indicator, or better yet, create an ensemble of trend indicators. Choose a measure of persistence of extreme readings (intensity and duration). Look back in history what happens after your signal gets triggered, look at different time frames.

I get 12 signals since 1980: 1985, 1987, 1991, 1994, 2001, 2007, 2008, 2009, 2011 and 2022.

Good luck next week.

Larry Williams comments:

We have only seen 6 down days in a row here in S&P 500 and not that in the Dow.

Big Al suggests:

Regarding the Dow vs S&P divergence, a relevant comparison below. INTC is the only shared component.

Apr

21

Good book, good food, good company

April 21, 2024 | Leave a Comment

great book that i'm reading as I am taking Aubrey around to visit colleges that accepted him:

The Bourgeois Virtues: Ethics for an Age of Commerce, by Deirdre Nansen McCloskey.

For a century and a half, the artists and intellectuals of Europe have scorned the bourgeoisie. And for a millennium and a half, the philosophers and theologians of Europe have scorned the marketplace. The bourgeois life, capitalism, Mencken’s “booboisie” and David Brooks’s “bobos”—all have been, and still are, framed as being responsible for everything from financial to moral poverty, world wars, and spiritual desuetude. Countering these centuries of assumptions and unexamined thinking is Deirdre McCloskey’s The Bourgeois Virtues, a magnum opus that offers a radical view: capitalism is good for us.

McCloskey’s sweeping, charming, and even humorous survey of ethical thought and economic realities—from Plato to Barbara Ehrenreich—overturns every assumption we have about being bourgeois. Can you be virtuous and bourgeois? Do markets improve ethics? Has capitalism made us better as well as richer? Yes, yes, and yes, argues McCloskey, who takes on centuries of capitalism’s critics with her erudition and sheer scope of knowledge. Applying a new tradition of “virtue ethics” to our lives in modern economies, she affirms American capitalism without ignoring its faults and celebrates the bourgeois lives we actually live, without supposing that they must be lives without ethical foundations.

visit to Sam's in Berkeley coming after 60 years:

Sam's Grill and Seafood Restaurant

Serving Mesquite-grilled Fresh Fish and Classic

San Francisco Dishes from the Gold Rush to today!

To Our Friends and Patrons,

We are happy to present to you an Old-Fashioned Eating House with Old Fashioned Waiter Service and Private Booths together with a professionally equipped kitchen for better and faster service. We want to continue to serve you as we have done over the past 75 years and keep our reputation as one of the GOOD EATING PLACES of “Old San Francisco.” We are proud of it and hope you will be, too.

Thank You! (taken from Sam’s menu from 1946)

An update: nothing has changed much at Sam's in 160 and 60 years - the petrale is still the best sole (better than Dover), the bread is the same excellent sourdough, and on a wed. evening it was packed (the lavatories were messy).

Apr

10

Gould, Fisk, and Black Friday

April 10, 2024 | Leave a Comment

From Wall Street and the Wilds, by A. W. Dimock, pages 178-180:

Gold business improved and my balance was growing when the Fisk and Gould gang entered the gold market. Fortunately I had not the capital to enter the lists with them and besides I was afraid. Their methods lacked sense and represented brute force only and the corner they were running was foredoomed to destruction, but their immediate power was uncanny. For they not only had money, but they controlled a bank which would have certified their checks in payment for all the gold on earth and they so controlled the courts that they could have filled their pockets with blank injunctions and mandamuses or even the profane form of the latter suggested by Fisk himself.

The price of gold had been run up to a point where it was impossible to hold it and ruin was in sight. Fisk's best suggestion to force mercantile and other shorts to cover was to advertise names and amounts in the morning journals with the warning that the price would be at once put to two hundred unless all the shorts covered. There was sense enough in the gang to suppress that manifesto of folly, for Gould had a scheme of sheer diabolism brooding in his more subtle mind.

[ … ]

That the corner was broken was clear to me and that a crash was coming seemed certain, so I sold and I sold and I sold.

[ … ]

Though I had made many a fine turn as the market reeled back and forth that day and my books at its close showed cash assets that would put financial trouble behind me for all time, yet a deadly fear held me in its grip. For my chief sales had been to the Gould broker, Speyers, and the Gould purpose to repudiate these purchases was now apparent. The intent to repudiate all purchases and enforce all sales, was confirmed by the course of the swindlers on the following day. The robbery had been deliberate and the FiskGould brokers who had been deputed to sell received instructions to make no sales to Speyers but to sell to others without regard to what Speyers was bidding.

From The Wizard of Wall Street and His Wealth, by Trumbull White:

Fisk, in his dark back office across the street, with his coat off, swaggered up and down, ‘a big cane in his hand,’ and called himself the Napoleon of Wall street. He really believed that he directed the movement, and while the street outside imagined that he and Gould were one family, and that his purchases were made for the clique, Gould was silently flinging away his gold at any price he could get for it.

Whether Fisk really expected to carry out his contract, and force the bears to settle or not, is doubtful, but the evidence seems to show that he was in earnest and felt sure of success. His orders were unlimited. ‘Put it up to 150,’ was one which he sent to the gold-room. Gold rose to 150. At length the bid was made—‘160 for any part of five millions,’—‘162 for five millions.’ No answer was made and the offer was repeated—‘162 for any part of five millions.’ A voice replied, ‘Sold one million at 62,’ The bubble suddenly burst, and within fifteen minutes, amid an excitement without parallel even in the wildest excitements of the war, the clique workers were literally swept away and left struggling by themselves, bidding still 160 for gold in millions which no one would any longer take their word for, while the premium sank rapidly to 135. A moment later the telegraph brought the government order from Washington to sell, and the result was no longer possible to dispute. Mr. Fisk had gone too127 far, while Mr. Gould had secretly weakened the ground under his feet.

[ … ]

Every person involved in the affair seemed to have lost money, and dozens of brokers were swept from the street. But Mr. Jay Gould and Mr. James Fisk, Jr., continued to reign over Erie, and no one can say that their power or their credit was sensibly diminished by a shock which, for the time, prostrated all the interests of the country.

For an overview: Black Friday (1869)

some items about Jay Gould. he was expert surveyor, writer, accountant, lawyer, metal tinkerer, and unblemished family man. passed away with 100 million dollar estate in 1892. had a grandson who was US squash champ, whose trophy i have.

Apr

9

Ideas for markets from Bill James

April 9, 2024 | Leave a Comment

some consilient ideas for markets from The Mind of Bill James, by Scott Gray:

(1) the strikeout rate is directly indicative of the longevity of a career. (2) the best managers are easy going. (3) minor-league performance is predictive of major league performance. (4) circular results: when something happens to offense, it also will happen to defense.

(5) having a runner on first base is bad - it's negative. (6) stealing is a negative. teams leading in steals do worse. (7) batting order doesn't matter. (8) a team playing in a hitter's park will have stronger pitchers.

similarity of scores are predictive: (9) the ratio between a team's wins and losses will be the same as the square of runs scored / runs allowed. (10) devise theories to explain how things are connected to one another.

Mar

30

From The Mind of Bill JamesThe Mind of Bill James by Scott Gray, which I've been reading:

All things in baseball tend to return to their previous form. A team whose record improves one year will tend to decline the following year, and vice versa. In 1980, for example, only five of the twenty-six teams moved in the same direction in which they moved in 1979. It also applies to individual players. Bill found a way to express not merely the statistical principle of regression to the mean, but also what he called the 70/50 rule. Seventy percent of teams that decline in one year will improve the next; 70 percent of teams that improve will decline; and in all cases the amount of rise or fall is about 50 percent, so that a team twenty games over .500 one year would be ten games over .500 the next. (The percentages are much different for very big or very small improvements and declines.) “These were not things that I had expected to find,” Bill wrote. “Weaned on the notion of ‘momentum’ since childhood, I had expected a team which won eighty-three games one year and eighty-seven the next to continue to improve, to move on to ninety; instead, they consistently relapsed. Half-expecting to find that the rich grow richer and the poor grow poorer, I found instead that the rich and the poor converged on a common target at an alarming rate of speed.

It also applies to individual players. Bill found a way to express not merely the statistical principle of regression to the mean, but also what he called the 70/50 rule. Seventy percent of teams that decline in one year will improve the next; 70 percent of teams that improve will decline; and in all cases the amount of rise or fall is about 50.

Steve Ellison writes:

From my experience, I think the S&P 500 is less mean reverting in 1- to 2-week timeframes now than it was in the mid-2010s. On the other hand, the presidential election cycle pattern has been spot on since the beginning of bearish midterm election year 2022.

Eric Lindell comments:

These data pertain to relative performance — eg, a team's record relative to other teams. For absolute gauges — like how much I weigh on a diet, there's no such reversion to mean.

Kim Zussman responds:

Funny stuff! For asset managers everything is relative. For their customers (without yachts), it is absolutely absolute.

Where Are the Customers' Yachts?: or A Good Hard Look at Wall Street

Humbert H. agrees:

And that’s why people should not entrust their assets to asset managers, unless these people suffer from some sort of emotional instability and can’t handle losses without some stranger pretending to care.

Mar

26

Timeless advice

March 26, 2024 | Leave a Comment

timeless advice from Frank Crampton, one of the most successfull self-made men of the early 20th century:

I should take jobs that would teach me something, and never one I thought I wouldn't like. Most important was not to stay on a job too long, three months was about right but never longer than four…

Deep Enough: A Working Stiff in the Western Mine Camps

Mar

21

Deep Enough

March 21, 2024 | 1 Comment

Deep Enough: A Working Stiff in the Western Mine Camps is a book and biography of a great man, highly instructive - the expression refers to when a miner had sunk his drilling to a non-economical point and by extension mean "let it go" or "i dont care."

great book about riches to rags and riches again, telling all about the western mining business in early 1900's with many instructive parts about history, life, and business. highly recommend especially for those seeking true Horatio Alger stories.

[Frank Crampton was also co-inventor of a "trigonometric calculating instrument", shown on this page (scroll down) from the National Museum of American History at the Smithsonian.]

Peter Buol was a good man that grubstaked many a successful hard-rock miner - made a killing in Borax with Crampton.

Mar

17

Body Snatchers

March 17, 2024 | Leave a Comment

preparing us for something she saw:

Janet Yellen warns inflation decline might not be 'smooth'

lets now interfere with amazing growth and maybe in old mare's chances. you would think that Yale and husband taught her something about indirection - but I guess the blinders on her - she never said a thing that wasn't in the old mare's interest.

i find Invasion of the Body Snatchers relevant to the choices made in work and politics today.

Mar

12

Sandhills Boy

March 12, 2024 | Leave a Comment

Sandhills Boy is a bio of Elmer Kelton and the cattle business in west Texas from 1920 to 1950 and the life of Elmer and his father. It shows that Elmer's life covered every variety of hardship and striving and experiences with minipulation in prices. The audible recording narrated by george Guidal is highy recommended for all.

Mar

11

More Dimock

March 11, 2024 | Leave a Comment

From Wall Street and the Wilds, by A. W. Dimock, pages 142 and 145: