Jul

23

The Colony, by Pitt T. Maner III

July 23, 2010 | Leave a Comment

Hard to believe that it has been almost 30 years since "The Road Warrior" movie (Mad Max 2), a classic of the dystopian genre and coinciding with DJIA 800 ranges. The show The Colony, starting next Tuesday the 27th, on the Discovery Channel has a bit of that Mad Max/Andromeda Strain post-apocalyptic feel.

I just hope the poor geology professor with no practical skills makes a good showing and can at least find some water–coming from Arizona State. She probably knows a bit of geohydrology. Did not see Season One, but this looks entertaining:

What would you do in the wake of a global catastrophe? Even if you survived it, could you survive the aftermath?

Season Two of THE COLONY introduces viewers to a new group of volunteers with differing backgrounds, skills and personalities, to bear witness to how these colonists will survive and rebuild in a world without electricity, running water, government or outside communication. Over the course of 10 episodes, the colonists - who include a construction foreman, teacher, carpenter and auto mechanic - must work to utilize and strengthen their exploration, technology and survival skills in ways they've never had to before.

Ralph Vince comments:

This, culturally, is AMAZING to me. A few weeks back I had an extended discussion with a group of very bright guys all in their early 20s — a candid discussion about their perceptions. A few very revealing things:

1. They are all very upbeat, economically, on a personal level. They feel they are smart and educated and will do fine even though they expect things to dissolve, they believe their formal education is their life preserver.

2. They all hate the boomers and consider them the "entitlements" generation — they regard the ones who were mostly their parents, the ones they refer to as "The greatest generation" as deserving of entitlements, but the boomers NOT entitled. Very interesting — I couldn't get to the logic of this other than we, the boomers, "screwed everything up, did nothing as a generation, and have a grotesque (to them) sense of entitlement to us".

3. They all, universally, expect things to decay, eventually, one way or another, into this MadMax anarchist future. When I would press them on this one, with things such as "Well you were saturated with these types of images growing up of the future, can't you foresee a less dark one, a more optimistic one?" They all universally agreed that "There is no other way the future can work out." Fascinating. Absolutely fascinating. With housing now more affordable than it ever was to any of the boomers — with borrowing at interest rate levels never before seen (and long rates banging around 4% !!!) and a protracted, decade-long-already contraction, the thought of a major up move over the next 15-20 years was something they could not possibly conceive of.

Vince Fulco writes:

Would note the release of the movie "Book of Eli" on DVD recently follows this post apocalyptic meme. Also has a fairly strong underlying theme of Pogo's "we've seen the enemy and he is us."

Pitt T. Maner III responds:

When will the post-Boomers give up on the end of "The Road " ideas and swing towards the "On the Road " themes again? Cyclicity.

James Lackey comments:

One posits (as Mr. Vic did with movies and baseball) stock returns or better said premiums ratios are higher during futuristic movie and tv times.. see 60's twilight zone and late 90's everything was deep space futuristic.. then post crash it was all cop shows and today perhaps its true on the mad max which came in when the rust belt was dying post 70's Opec deals.

One does not say that its different this time. In my day Generation X was deemed stupid, spoiled and lazy.. It was a cultural and economic shift and we didn't know what to do, but the second we figured it out everyone I know ""just did it" hence the Nike slogan "just do it".

It's good to see the young beat up the old on the net, but quite respectful in person. I have a great deal of respect for my Son's buddies and all the BMX kids we train. Their only problem is over specialization and the quote above shows that in their belief their credentials will be their savior.

I do not agree they despise the boomers… I'd rather think we like to think or say that as Gen X ers for a revenge trade.. No Gen X er believed for a minute SSI [Social Security] would work out so for the Gen YZ kids to even think about it at all is a big joke..Ive never heard about it once…matter of fact if any Old BMX racers bring up the 3 sins of talking about Work Marriage or Politics at the track the kids ride off… the older adult pros age 18-24 say it flat out and crack me up "I can't handle this drama, I am gonna go talk to the girls" These kids today are "awesome".

Ken Drees comments:

TV has recently been and still now is based on these themes "biggest loser" "bachelor" "dancing with the stars" "angry biker building show" "rock star real life" "idol" "top model" "fashion designer contest show" '"hell's kitchen" "next iron chef" "tattoo shop people" "dangerous fishing boat" "man in the wild" etc—a lot of contests, makeup, high energy, tears, people being eliminated, emotive overkill, action with real life injuries. All of this started with "survivor"–which is pretty much over–except they have a Spanish version of it on the Latin channel that I just flipped over yesterday so that trend must be in the last hurrah phase.

But these themes are lottery like–taking a chance to make it to the top–be the one who can outlast the competition and the make it all the way. So maybe that consciousness seeps into markets–can we survive another day, the odds are against us but I feel the magic. A big cross section of age groups are relating to these shows—I personally got hooked on Hell's Kitchen–something about the angry language that I try to keep under control and watching that blond haired man just let his anger spew at those inept cooks. Then you get into the finalists and start rooting for a favorite —like horse racing.

Survival in a post 401k smashed world, surviving unemployment, etc.

Kim Zussman comments:

1. They are all very upbeat, economically, on a personal level. They feel they are smart and educated and will do fine even though they expect things to dissolve, they believe their formal education is their life preserver.

2. They all hate the boomers and consider them the "entitlements" generation — they regard the ones who were mostly their parents, the ones they refer to as "The greatest generation" as deserving of entitlements, but the boomers NOT entitles. Very interesting — I couldn;t get to the logic of this other than we, the boomers, "screwed everything up, did nothing as a generation, and have a grotesque (to them) sense of entitlement to us.

Ralph please send our apologies for screwing things up for them. Ask them not to see "Avenue q", because exactly as Mr.s Rogers and Henson told them - and it is statistically remarkable - they really are all gifted, special, and specially equipped to make this a better world.

Sorry too about our house that you've been eyeing; its 20% upside down because of those college loans, and the one for your first car. At least there won't be any estate tax on it. And remember to hang that Ivy diploma proudly in the latrine - you never know when it might come in handy.

If you decide to get more education - forget about cloud quantum computing gene sequences. Go get your CPA, with emphasis on forensic accounting, and take some classes on retrieval of deleted emails, cash-tracing, and banking in the Bahamas. Also get certified to sell the plastics of the future - insurance.

Big shame about that 401 account. We were, as always, worried about you when they went below 700 and we sold everything. The good news is we got back in at 1200, so please work hard so your earnings propel it to the 12,000 you deserve.

About that screw-up: We were taught something like 2008-2009 was more unlikely than an asteroid collision. However now that the problem has been corrected, you have nothing to fear. Please tell your boss to deduct the maximum for your retirement account, auto-deposited in one of the index ETF's on the first of each month. Add to it on the taxable side too. More is better - buy as much as you can while you're young. Find a good ETF that will go up. If it don't go up, don't buy it.

Sorry about our health. We've been doing cardio for decades, so we're not going to MI like Opa or stroke like Oma. And we floss every day, so there won't be any need for chemo. But we did think to get long-term care insurance, and though you're mad hope you will pick nice nurses for us, and bring a case of Ensure now and then.

Alan Brice Corwin writes:

I've also recently had discussions with a large group of twenty-somethings, but I came away with a different impression. This may be a sampling or a context problem. They may have been less candid towards my generation because they were looking for money for their projects

The main difference in my encounter is that most of these people had boomers for parents. While most of our parents were in their early twenties when we (boomers) were born, their parents were often in their thirties and forties when they were born. There were a few with younger parents, but not very many. (We refer to our parents as the greatest generation because they beat the Nazis and the depression, but who are they referring to and why?)

In fact, I noticed a lot of sympathy for their boomer parents. Several of them noted that their parents had worked hard all of their lives and had expected to retire soon, but are now looking at having to work into their seventies or eighties. There was a general feeling that they would not allow this to happen to them. They would take care of their retirement needs while they were still young.

The main resentment that I encountered was that I was able to get my education for free. They don't think social security will be there for them, but they were young enough so that wasn't really a concern. The idea that someone could go to college for ten years and have money in the bank at the end of it was simply mind-boggling to them. People with full scholarships all the way through told me they had forty grand in debt after school.

I also detected less regard for their formal education among the group I talked to The pretty much all had college degrees, but they regarded their life preserver as their skills at seeing what was needed and building something to meet that need. Several told me that their college education was only good for getting a crappy job for a big corporation, and they had no interest in that.

One point of similarity I noticed is the sense of impending decay. One young man told me that he thought we would see a thousand bridges fail in the US in the next ten years, and that no one would step forward to maintain them. He said he saw no inkling of the common sense of purpose that must have existed when the roads were built. He further pointed out that the infrastructure needs were far greater today because there are now so many more people, but China and Dubai seem to be the only places where they are actively working to build a modern infrastructure. He said we have a 1900 model railroad system and a 1950 highway system (I didn't point out that the interstate highways weren't built until the late fifties and early sixties).

There was a sense that they would never have the life their grandparents had. This same young man said that his grandfather went to work for a company right out of college, worked for them for thirty five years without a layoff, and had been retired and playing golf on a generous pension for thirty years. His grandfather had bought his house for less than ten thousand dollars, and three years ago he could have sold the lot the house was on for nearly a million dollars (not any more).

Another thing I noticed was that almost everyone they idolized in business was a boomer. As you might expect with a group that was more iPhone app developers than anything else, Steve Jobs was far and away the person most admired. Eric Schmidt of Google was another favorite, but ranking way behind Jobs.

Marlowe Cassetti writes:

Wouldn't it be great if they were to make a new reality program based upon the Turtle Traders experiment. All the intrigues of students from diverse backgrounds competing. Ah, the high drama. I bet some of us Specs might be so inclined to view a few episodes. Am I right?

Lars van Dort comments:

Actually the BBC had a program called 'Million Dollar Traders' last year:

"Eight ordinary people are given a million dollars, a fortnight of intensive training and two months to run their own hedge fund. Can they make a killing?

The experiment reveals the inner workings of a City trading floor. The money is supplied by hedge fund manager Lex van Dam: he wants to see if ordinary people can beat the professionals, and he expects a return on his investment too. Yet no-one foresees the financial crisis that lies ahead.

The traders were selected in spring 2008, before the US credit crisis gathered pace. The successful candidates were chosen, trained and dispatched to their specially created trading room in the heart of the Square Mile. Among them are an environmentalist, a soldier, a boxing promoter, an entrepreneur, a retired IT consultant, a vet, a student and a shopkeeper.

The eight novice city traders struggle to ride the storm as stock markets around the world go haywire. Some of them take big risks, and others lose their nerve in spectacular fashion."

Episode 1:

http://vids.myspace.com/index.cfm?fuseaction=vids.individual&videoid=56317671

Episode 2:

http://vids.myspace.com/index.cfm?fuseaction=vids.individual&videoid=56321444

Episode 3:

http://vids.myspace.com/index.cfm?fuseaction=vids.individual&videoid=56337345

I quite enjoyed it.

Jul

15

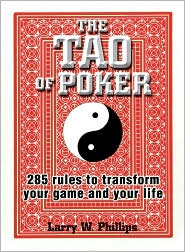

Stocks and No Limit Poker, from Jim Lackey

July 15, 2010 | 2 Comments

Stocks are much like no limit these days… you have one or two 10 minute bars to decide to go all in risk all or fold.

Stocks are much like no limit these days… you have one or two 10 minute bars to decide to go all in risk all or fold.

Vince Fulco writes:

Phenomenal observation. It's a function of fake liquidity. You've got to pick your spots wider and expect the reactions to be more severe in both directions. I read somewhere the other day the theory that folks are pricing in too much tail risk. Is this what happens when an economy is built on sand?

Jeff Watson writes:

Interesting comparison of stocks with no limit poker. While the risk of ruin approaches 100% in NL poker, I wonder what the risk of ruin would be in the stock market, especially with short term trading. I suspect that it would be higher than one would expect, with the vig, mistakes, and just being wrong factored in.

Jim Lackey writes:

No…anyone is capable of "not taking risk" and to see people brag about not losing is hilarious. No profits either, at least none to brag about vs. some indexing. To make real money you have to take real risk. Period. End of story.

Rocky Humbert comments:

How return is related to risk is a subject worthy of extended discussion, and I don't have the time to launch that thread right now.

However, I want to note that Fama has backed away from his early work that pioneered the model that the two must go hand-in-hand.

I for one do not accept the proposition that one must take large risks to have large returns and this distinction is a key difference between gamblng and investing.

This is a fascinating subject… I hope others will contribute. I have a plane to catch.

Jeff Sasmor comments:

"To make real money you have to take real risk period end of story." Yes!

Isn't the ultimate metric whether or not you make money? If you are good at scalping the E-mini SP on a 5 min chart and make money doing that then IMO it trumps the issues of risk and vig. Personally and IMO, and I know that most here will disagree (except maybe Jim) scalping has the lowest risk albeit with more vig (vig is pretty cheap these days at $4/round trip for the Emini SP and since one Emini SP ~= 500 SPY it's much less vig than the ETF). I don't even factor commissions into my thinking anymore.

But longer time frames are more comfortable for most people - and yes the vig is proportionally less but one downside among many is that you're much more susceptible to your own emotions about getting out of a losing trade (or a winning one) - and that's an additional term in the vig equation.

With computers (Skynet) running the show these days you can get your "head handed to you" no matter what time frame you're using. They seem to love chaos and high volatility, sort of like the Shadows in the old TV show Babylon 5; or for real sci-fi nuts - the eddorians from the Lensman space opera series. Or for others: think of computerized Sith.

Jun

28

To Remind Oneself Of All the Blessings, by Vince Fulco

June 28, 2010 | 1 Comment

Spend some time with an oncologist.

Wrapping up a flyfishing trip to Canada with a radiologist (Dad), an oncologist and a cardio-thoracic surgeon, had a couple of snippets to add to the ongoing list thread re: medical issues. Dad fresh from the annual AMA meeting– " medical community is in need of 25M specialists today growing to 250M by 2015. It will obviously not be met."

From the oncologist, "small private practices will cease to exist in the next few years due to the ongoing grind from unrealistic medicare, medicaid and insurance co. reimbursements. In all likelihood, within a decade most Docs will be hospital employees unable to cope with the budgetary pressures from all sides. Mayo clinic in AZ dropped medicaid recently and that was a big, big deal given the organization's philosophies."

And in the tech will save the day dept, from the surgeon, " Now having great success replacing heart valves using minimally invasive catheter and stent procedures to fix the valve in place." Imagine the entire valve apparatus (one of many) replaced in one fell swoop. Separately, estimates his patient population could be cut by 30 percent or more through better diet, cholesterol management, smoking cessation and regular exercise. Is very enthused and excited for the promise stem cells seem to hold.

On a final note, all commenters were deeply suspicious of and in the revulsion stage when it came to equities as an asset class. I estimate they were 2 to 10 years from retirement but no one thought it was an option given investment returns unless forced to do so for physical reasons.

Jun

7

Madoff in the News

June 7, 2010 | 3 Comments

An evil man in the news. "No one really believes they turned daddy in without a heads up that they were alreading coming for him, right?"

An evil man in the news. "No one really believes they turned daddy in without a heads up that they were alreading coming for him, right?"

Vince Fulco comments:

Since this story broke, I have been shocked to find out how many 'average joes' in my childhood community of upstate NY have been devastated by this mad man. Cases in point are a reasonably successful but otherwise unremarkable family doctor who was forced to return back to work full-time at 70 and separately a mid level real estate exec who's dealing with severe clinical depression after his couple of million $ in life savings; generated through scrimping and saving, were completely wiped out. The tentacles of evil reached so far that it does seem to give credence to the 6 degrees of separation theory. It could have been avoidable if following some of the earliest and simplest of universal truths:

1. Don't put all your eggs in one basket

2. If it is too good to be true, it probably is and

3. Trust but verify (often) among numerous others.

Anatoly Veltman comments:

A few aspects don't get enough attention:

1. Majority of those who lost participated of own lure/belief that they were in on special advantage/inside

2. That's one explanation of why many clients don't want to acknowledge that they were; another is that some took out more than put in.

3. Beyond profitable withdrawals, tens of billions more will never be accounted for– kept by investigating insiders.

4. The "reverse Robin Hood" of taking from many to give to few is thriving well past-Madoff: within the entire latest bubble and almost all government actions of present

Jun

7

Question About BP, from Steve Ellison

June 7, 2010 | 2 Comments

An analyst on CNBC yesterday was saying BP is cheap, and the dividend is secure. His interviewers (are they supposed to have an agenda of their own? Or is this just asking the tough questions?) kept hammering on their idea that it will be politically unacceptable for BP to pay dividends to its shareholders, a line of questioning that drew uncomprehending stares from the analyst.

An analyst on CNBC yesterday was saying BP is cheap, and the dividend is secure. His interviewers (are they supposed to have an agenda of their own? Or is this just asking the tough questions?) kept hammering on their idea that it will be politically unacceptable for BP to pay dividends to its shareholders, a line of questioning that drew uncomprehending stares from the analyst.

George Parkanyi comments:

Yeah that makes sense… take a whopping out-sized risk on BP with its huge potential future liabilities, in a world economy and market possibly on the brink, where P&G can lose 35% of its value in 10 minutes, for a dividend. Where do I sign up?

Rocky Humbert comments:

Here are some questions that one might consider before investing in BP. (No such analysis is required for a skilled trader who claims to be able to systematically buy low and sell high without regard to "fundamentals.")

Here are some questions that one might consider before investing in BP. (No such analysis is required for a skilled trader who claims to be able to systematically buy low and sell high without regard to "fundamentals.")

1. Remediation costs and liability are related to a spill size both by physics, practice and statute. The Exxon Valdez had a defined amount of crude. How much crude will spill from the Deepwater Horizon?

2. What is the law regarding punitive damage penalties if gross negligence can be proven? Is it like a RICO case (4x)? Is it capped by statute? Or can it be unlimited (like an old Joe Jamail lawsuit)?

3. What is the law regarding punitive penalties if there is criminal liability? What is the worst case penalty? If the Goverment files an criminal indictment, what effect(s) will have on their business?

4. What effect will the overhang of litigation have on the cost of BP's financing of their regular business? If there is a risk of a $50+ Billion punitive penalty, what will the credit rating agencies do? And if BP's cost of financing increases by 100-300 basis points, what effect does that have on their exploration budget?

5. If they capped the well today, can one assess the risks of #2, #3, and #4 with certainty?

6. What is the risk/cost of a boycott of their service stations? Did Exxon experience a boycott? And if so, what impact did it have on their downstream operations?

7. What is the tail (in years) of the litigation? Will they be required to post a performance bond? And if so, what assets will they sell to meet the performance bond? More generally, is there a risk that they will have to sell assets to meet other liabilities? Or, can they almost certainty meet the expenses out of current cash flow?

8. How is BP's stock faring versus other companies with exposure (Anadarko, Cameron, etc.)? Will these companies present a unified defense? Or will they be pointing fingers at each other — further concentrating the litigation risk?

9. How has BP's stock performed versus other major oil companies? For example, if BP is down 35%, but Chevron,Exxon,Conoco are also down 15%, which of these companies represents the best relative value, given the facts and probabilities?

10. If I am leaving for a five-year vacation, would I be comfortable purchasing BP at the current price, and not looking at it until I return? Is there any price where I would buy a non-trivial amount of BP and not look at it for five years?

Vince Fulco writes:

While I am no apologist for BP's seemingly high risk and perhaps incompetent procedures in the Gulf, I am also wondering about the proportionality of the public reaction (to the stock that is, not the beach pollution) vs. the total cost of the disaster. The company's mkt cap is down $70B since the explosion and is currently $115B for a company with $230B-ish in historical assets ($90B estimated in the US) and relatively low non-current debt levels. Moreover the company has a stand alone re-insurance company with $3.5B in assets. They may also have some additional cover which I am disregarding for now. As Ken has stated, halting the dividend brings $7-10B more to pay claims which I assume will have a somewhat long tail, say 3-5 years. And just because Chuck Schumer believes the payout should be halted, doesn't mean he knows anything about corporate finance strategies or management's responsibilities to its owners. More evidence of the worrying 'they came for…' behavior.

While I am no apologist for BP's seemingly high risk and perhaps incompetent procedures in the Gulf, I am also wondering about the proportionality of the public reaction (to the stock that is, not the beach pollution) vs. the total cost of the disaster. The company's mkt cap is down $70B since the explosion and is currently $115B for a company with $230B-ish in historical assets ($90B estimated in the US) and relatively low non-current debt levels. Moreover the company has a stand alone re-insurance company with $3.5B in assets. They may also have some additional cover which I am disregarding for now. As Ken has stated, halting the dividend brings $7-10B more to pay claims which I assume will have a somewhat long tail, say 3-5 years. And just because Chuck Schumer believes the payout should be halted, doesn't mean he knows anything about corporate finance strategies or management's responsibilities to its owners. More evidence of the worrying 'they came for…' behavior.

Given the rarity of the event, arguably the next comparable disaster naturally might be the Exxon Valdez (other smaller events could be chosen too). The best numbers I could find were a cost of roughly $5-7B stretched out over 20+ years. For argument sake, let's say the cost to BP is 10x as much or $50B; that would be roughly 1.6-1.8x mean operating income of the last 4 years.

I am not considering BPT in the conversation because it is a different animal and Rocky has addressed it well. Lastly, since our current admin seems to be in the business of picking winners and losers, are they ready to and can they kill a formerly $1/4T asset company 40% held by pensioners and retirement funds of our closest ally? It is also notable that LA's governor is already publicly complaining about the effect on jobs if a drilling ban is instituted for any length of time. Double edged sword indeed.

Disclaimer: This is absolutely not a recommendation for anyone but I am long right at these levels and would appreciate reasoned arguments against.

Rocky Humbert adds:

One more thought on BP as I work through their financials: The company generated free cash flow of about $7 Billion last year and paid $10.5 Billion dividends.

One more thought on BP as I work through their financials: The company generated free cash flow of about $7 Billion last year and paid $10.5 Billion dividends.

Their next dividend will be announced on about July 27th with an ex-date of 8/4/10. Looking at the pricing of at-the-money options, it appears that the market has priced in a cut of their dividend by 50% (from .84/share to about .44/share).

Any spec-lister who has a variant perception on their dividend policy (either holding it at its current level, or reducing it more than 50%), can execute an direction-neutral options "conversion" to express this view.

In my humble opinion, a 50% cut in the dividend seems entirely reasonable to satisfy all of the different constituencies. And, in assessing the future behavior of the stock, one needs to consider that Mr. Market has already discounted this news.

Before you invest in BPT, I suggest you get an objective estimate of the reserve tail in the Prudoe Bay field. I studied this several years ago and there is a NAV based on the dwindling reserves and foward curve in the crude market at various discount rates.

The field should start tailing off in 2011 or 2012 and the stock will be worthless certainly by 2020 so you need to value not only the current and future crude price but also the decline rate. I'd also suggest that you look at their financing and change of control provisions as well as cross default issues. Lastly, I owned BPT when it was at a substantial discount to its NAV at a large discount rate (versus crude futures), but could not short it when it went to a large premium because the shares could not be borrowed.

Jun

6

Time Horizons, Cycles, Digging, from Chris Tucker

June 6, 2010 | Leave a Comment

Recently I have been discussing lengthening my time horizons with my mentor and was tickled to find this post by GM Davies while perusing other blogs by people who post to Daily Spec. I am definitely one who is seduced by instant gratification and it is difficult for me to sit on a position for any length of time unless my indicators are emphatic about it. One evening after pondering over the theory of ever changing cycles and this post from Mr. Sogi, I found myself looking at all sorts of time intervals in charts to find the structures/setups that I prefer to trade. Lo and behold I have found that many times when a setup I like to trade is not evident in my usual time frames, if I dig a bit and look at odd frames such as one or four minute bar charts instead of two or three, or, say, 34 tick charts instead of 50, 25 or 10, then indications that were invisible in the "normal" or default charts tend to jump out at me. The same thing happens when I look at larger time frames.

One of the beautiful things about the charting tools I use is that they are flexible in this regard and allow me to be creative. Tracking down the cycle that is currently in play is a lot of work but has proven profitable. Kudos to Mr. Sogi and GM Davies for getting me thinking. Kudos to Chair for providing outlet for this incredibly diverse effusion of ideas, and for many other things not least of which is being a tremendous inspiration.

Jun

3

Patrick O’Brian Reccomendations, from Vince Fulco

June 3, 2010 | Leave a Comment

If one were to begin the series of Patrick O' Brian books, should they be read in the order in which they were written? I'm finding good prices for some of the later books and looking to get through 1 or 2 while I am out of the country for a few weeks without internet access and distractions.

If one were to begin the series of Patrick O' Brian books, should they be read in the order in which they were written? I'm finding good prices for some of the later books and looking to get through 1 or 2 while I am out of the country for a few weeks without internet access and distractions.

Gibbons Burke comments:

Yes, the series should be read in order, though some recommend that some readers may find that the second book of the series is a better introduction to the canon because there are more scenes on land.

I found it tremendously helpful reading the novels the first time through to have a dictionary and a pocket atlas readily available. Dean King's "A Sea of Words" is a most helpful companion to the series, as are his book of maps detailing the voyages in the novels, "Harbors & High Seas".

Google maps would be an even better resource these days. An iPad with the novels loaded into the Kindle app (they're not yet available in iBookstore), or audiobooks in the iPod app, combined with the Maps app, and the built-in dictionary would be a great way to circumnavigate the canon. Capt. Aubrey, who was ever interested in the latest go-fast sailing tech, might even approve, though it is likely O'Brian would express contempt.

Chris Tucker writes:

When Victor first introduced me to the books I mentioned that I had a bone to pick with him about them and that is that I was staying up until all hours of the night reading and I wasn't getting enough sleep. He wisely recommended that I try books on CD and listen to them while driving or whenever I had time to do so and so I forgave him for depriving me of sleep. I took advantage of the local library to get ahold of the recordings because they are a bit pricey.

If using a library, I find that tapes are actually better than CDs because if there is bad patch on a tape you may miss a few words or perhaps still here them but with derogated quality, but with a CD you may miss an entire track or two. Also important to note if listening to this series on CD or tape, Chair highly recommends, and I emphatically second, that you listen to the series as read by Patrick Tull, who manages to add to the already incredible drama that O'Brian evokes. Books read by Tull are available at RecordedBooks.com here.

May

26

Thought of the Day, from Vince Fulco

May 26, 2010 | Leave a Comment

The persistent strength all day long yesterday in GS with the classic 'eod' repeat rumor swirling of the SEC settlement firming up bids takes the cake! How to join the inner sanctum?!

May

19

I found this fascinating: A Visual Guide to Cognitive Biases.

May

18

A Theoretical Query, from Victor Niederhoffer

May 18, 2010 | 2 Comments

One may inquire in answer to Rocky's quiz to what pockets do the big v shaped moves big down and big up in a half hour accrue. One would not think that it would accrue to those who are leveraged more than 2 to 1 or 3 to 1, as not only must they meet initial margin but must meet maintenance margin before they are liquidated at the lows would not the ability to borrow from a big lender at low rates help the top feeders and flexions in such a regime? Just a theoretical query.

One may inquire in answer to Rocky's quiz to what pockets do the big v shaped moves big down and big up in a half hour accrue. One would not think that it would accrue to those who are leveraged more than 2 to 1 or 3 to 1, as not only must they meet initial margin but must meet maintenance margin before they are liquidated at the lows would not the ability to borrow from a big lender at low rates help the top feeders and flexions in such a regime? Just a theoretical query.

George Parkanyi asks:

Why not? You could target multiple stocks, some of which are just decoys to mask the main attack, work it from multiple accounts, have your "one cent" bids at the ready, and then bring the hammer down with a concentrated attack at exactly the place where most traders would place stop-losses. Enough kindling to spark a sudden flash fire. You slam the market down to the low bids placed that have been placed according to some pre-calculated algorithms that make it look random (which you've probably modeled already on a Cray). You cover with a huge profit. Others step in, it's all over, and you slink away. You would need to have detailed knowledge of how off-exchange platforms work (e.g. no stock-specific circuit-breakers). Some smart traders and top-notch trading platform programmers, with the appropriate financial backing, could pull this off. Come to think of it, it could have been a heist.

The main flaw I see with this though is that someone this smart would also have anticipated the attention that the anomalous trades would attract. In the end, some were actually busted. Could the manoeuvre then have been a decoy/catalyst for something else? Perhaps a huge, leveraged currency position, or one in some other correlated market like oil? If I were an sleuthing man, I would look there. Because of globalization and the interconnectedness of global markets, a foreign power could even set up something like this. Who might want to unload a pile of US Treasury paper, oh for example?

This would make a good movie.

Vince Fulco writes:

Last Thursday was eye-opening on so many fronts…

1) Technology has superceded our humanity– The exchanges and regulators proved themselves completely unprepared and uncoordinated for a growing cascade of one sided activity. What is so infuriating is that there has been a public warning by infrastructure experts and traders about the growing potential for systematic dislocations for a few years and as usual specs have been told, "all is well". Moreover there is evidence of a wholesale and I would say engineered withdrawal of bid side activity. Planes don't just fall out of the sky en masse.

2) Assume at all times that your systems will fail with questionable potential to regain access. I believe IB did the best that it could but I never saw the software behave in this manner after years of observing mkt stress pts. My DOM halted for 1-2 minutes twice with re-newed (displays of) activity 10 pts down each time and then a complete shutdown when SPUs were in the mid 60s-80s. The software came back up after a quick re-login however. Would be interested in behavior of others systems.

3) What we knew on de jure basis; that the exchanges will always do what is best for them, became de facto. Formal decisions as to what to cancel and what level to cancel (60%) were arbitrary, not subject to any outside scrutiny and not challenge-able. I was particularly bemused by the CME's almost immediate claim that their systems worked properly & there would be no trade cancellations even though the activity in cash instruments underlying them still needed to be examined more carefully and in limited circumstances were ultimately canceled. The House wins always in the end.

4) Amazed at the resiliency of human nature– while I am not surprised to see to this week's pop subsequent to ECB/EU/IMF activities, until trading activity fragmentation can be addressed more comprehensively, why are folks so confident that it won't happen again? And soon?

5) Trading is war– Any complacency can have fatal effects. One must always cast a wide net as there were suggestions and pre-cursors in other mkts, as much as 30-60 minutes prior, that would have kept one's exposure down if not non-existent. Always more to keep tabs on, more to learn and more to think about. And that's when fighting the last war.

Rocky Humbert responds:

As students of mathematical logic know, it is impossible to DISPROVE a conspiracy theory — because the absence of evidence is not a proof of anything. Hence I submit that the primary usefulness of speculative post-mortems should be introspection and self-improvement … (i.e. And what does this plunge foretell about the future? And what can be learned from the experience?)

On the first question, I recall a post by the Chair (some years ago), where he noted that when there's a horrible adverse price move in an open position — and the price then recovers, he anecdotally observes that one should exit — as the recovery was a golf "mulligan." We'll shortly find out whether the rally of the past few days is a mulligan.

Also on the first question, I was surprised to observe that yesterday's retail investor sentiment showed only a modest increase in bearish sentiment. Prior to the plunge the bull/bear/neutral ratios were 39/28/32 and yesterday (after the plunge and recovery) the bull/bear ratio was 36/36/26. So retail was evidently not spooked too badly … (I use this statistic as a qualitative contrary indicator.)

For me, the experience of last Thursday reinforces the value of always having dry powder to exploit panic (even if the prices are revisited), as the risk/reward of fading a market that declines 10% in ten days is vastly differently from the risk/reward of fading a market that declines 10% in ten minutes.

I would be most interested in hearing from others what lessons they learned…

Sushil Kedia comments:

If it is hugely profitable to build such a conspiracy, then with all the technology and all the geeks why do such events happen only so rarely?

Has the frequency of such conspiracy explained moves been rising?

The learning that I obtain from such an event, drawing on the Chair's older post of such being the golf mulligan and a recent one wherein he said that such moves clear out the short term longs and the spike back clears out the short term shorts too. So, the markets when turning from day to day battle shift gears for month to month and quarter to quarter battle move sizes, actually then such moves are like a "benign devil". The same way angina pains do trouble but are nature's blessing calling for a more thorough heart check up and recuperative measures to be brought in, moves as these reduce the number of people who would have suffered much deeper damage over a longer course of time in the particular markets.

Can't agree more with anything than Rocky's thought on having some dry power, always.This specific situation of electronic markets (that appear to be so high-tech and hence an illusion of having progressed) disintegrating for moments brings to mind the signature line of Mr. Bollinger: When you progress far enough, you arrive at the beginning!Man must work, to even have a hope to be paid. Any modifications to any degrees in the tools of work will not lead any man (computers too!) to a point where without work and just by stealing anyone can hope to be paid, consistently. Change the system to whatever, men will work even though sometimes thieves will be able to steal. Men may still not get paid upon work and it may not mean that it was someone's steal, since spills happen and will happen.

Victor Niederhoffer comments:

Well said. As Zachar points out and this was originally brought to my attention by someone deeply in my debt, who actually beat me the last time we played tennis, it's a millstein. If the shoe fits, wear it.

May

10

Insurance Week, from Kim Zussman

May 10, 2010 | Leave a Comment

VIX closed at 40.9 Friday- doubling in 4 days to a 1-year high - after closing at a 1-year low less than a month ago on Apr 12.

Also interesting that despite relative calm Friday compared to the day before, Friday's VIX close was higher than Thursday's high (Yahoo data):

Date Open High Low Close

5/7/2010 32.8 42.2 31.7 41.0

5/6/2010 25.9 40.7 24.4 32.8

5/5/2010 26.0 27.2 23.8 24.9

5/4/2010 22.5 25.7 22.5 23.8

5/3/2010 22.4 22.4 19.6 20.2

Vince Fulco writes:

I've been thinking for some time, which solidified watching Thursday's action, that there could be parallels to mkt instability and earthquake prediction. Something along the Arias Intensity measure could be created with index members acting as observation stations. I'm doubtful the existing vol indices do the job:

The Arias Intensity (IA) is a measure of the strength of a ground motion.[1] It determines the intensity of shaking by measuring the acceleration of transient seismic waves. It has been found to be a fairly reliable parameter to describe earthquake shaking necessary to trigger landslides.[2] It was proposed by Chilean engineer Arturo Arias in 1970…

Barking up the wrong tree or some theoretical underpinnings?

Thanks…

May

7

Since according to the regulators nothing adverse happened from a systems perspective [on May 6, 2010], are we to bake into our models the potential for a 50+ point swoon at any time and in vastly more compressed windows than ever seen before? The risk/return scenarios turn completely lopsided.

Riz Din asks:

I'm not familiar with the details of trading systems that may have been behind the move, but if they are just as happy buying as selling, can we then assume that there is an equal chance of a similarly mammoth sized swing to the upside?

William Weaver writes:

I doubt we could ever see the same type of vol to the upside simply because we're dealing with much more than computers, we're dealing with humans. Prospect Theory states that an investor who realizes a gain and a loss of equal magnitude will value the loss as much as twice that of the equivalent gain. This can be graphed by plotting the one day changes in the SPX on the x-axis (gains function) and the inverted one day changes of the VIX on the y-axis (value function). After calculating a least squares regression on both the positive days and the negative days (individually; two regressions) it is apparent that the slope of the losses is steeper than that of the gains.

We would need the entire world to be stuck short to see that kind of vol. But it would be fun to trade– of course I say that with a caveat; yesterday was a hell of a lot of fun to trade… after the fact. During it was survival even if you were raking it in!

Apr

28

Put a Beggar, from Victor Niederhoffer

April 28, 2010 | 1 Comment

Vis a vis the recent downgrade of Spain, the proverb of the day is "put a former unfreeman on a horse, and he will gallop."

Vince Fulco writes:

Reminds me of a story I heard recently whereby lawyers are working with clients to obtain rock bottom reappraisals in exchange for 75% of the first year's property tax savings.

Apr

18

The Bookie, from Jeff Watson

April 18, 2010 | Leave a Comment

Spending a little time in the "Sports Brokerage" industry in my youth, I learned to appreciate the services the bookie provides. He acts like a clearing firm, inserting himself between the trades. He acts like a market maker, pushing the line this way and that in order to keep the order flow even and balanced, yet at a level where it will see maximum trading. He assumes market risk between trades, and has to hold one side before he gets an order on the other side, or has to lay it off. He ensures that you will get paid and assumes the risk that he won't get paid on every bet. A bookie will sometimes provide credit, much like a brokerage firm will. For the amount of vig you pay a bookie, the whole transaction is risk reducing and value adding to you. His reputation depends on an image of fairness and not welshing and it is much safer getting large action down with a bookie than with an acquaintance. With an established bookie, you know you'll get paid on Tuesday or pay on Tuesday depending on the time of year and schedule you establish for the P&C.

Spending a little time in the "Sports Brokerage" industry in my youth, I learned to appreciate the services the bookie provides. He acts like a clearing firm, inserting himself between the trades. He acts like a market maker, pushing the line this way and that in order to keep the order flow even and balanced, yet at a level where it will see maximum trading. He assumes market risk between trades, and has to hold one side before he gets an order on the other side, or has to lay it off. He ensures that you will get paid and assumes the risk that he won't get paid on every bet. A bookie will sometimes provide credit, much like a brokerage firm will. For the amount of vig you pay a bookie, the whole transaction is risk reducing and value adding to you. His reputation depends on an image of fairness and not welshing and it is much safer getting large action down with a bookie than with an acquaintance. With an established bookie, you know you'll get paid on Tuesday or pay on Tuesday depending on the time of year and schedule you establish for the P&C.

Vince Fulco writes:

Said bookie could neither take up a forced collection in the neighborhood to then re-establish his operations nor make intentionally lame or kill a horse he was taking action on without repercussions. Perhaps we're just seeing the pendulum begin its swing hard in the opposite direction.

Apr

13

Speaking of Fishing, from James Lackey

April 13, 2010 | Leave a Comment

Would one of you big fish please buy, sell, or short the markets please? The movement, the ranges are too small. The joke around here is day trader's can't even find a way to lose money much less make. No way can the bookies and mistress allow this to continue. Or maybe they can… I hear in 1994 the markets were too slow to trade. That was before my time, so I have never seen this before. Kinda like 2008. Never saw that before either. Ha.

Would one of you big fish please buy, sell, or short the markets please? The movement, the ranges are too small. The joke around here is day trader's can't even find a way to lose money much less make. No way can the bookies and mistress allow this to continue. Or maybe they can… I hear in 1994 the markets were too slow to trade. That was before my time, so I have never seen this before. Kinda like 2008. Never saw that before either. Ha.

Vince Fulco adds:

Thought it was a hoot earlier in the week when Interactive Brokers lowered FUTS commissions unilaterally for us small, aspirational specs. When was the last time brokers obliquely sent the message 'please trade'? Just a matter of time till we get a relative vol shock; the ecosystem as laid out in EdSpec requires it.

Apr

8

P&C Insurance Companies, from Bill Rafter

April 8, 2010 | Leave a Comment

Suddenly my "buy" list has a large number of companies which have never graced the list before. They are property and casualty insurers. Although they have sufficient capitalization, their volumes are too small for me to get involved. Does anyone know why they would be in favor?

Dan Grossman writes:

Volumes too small for you to get involved… You must be quite a heavy hitter, trading millions of shares.

Volumes too small for you to get involved… You must be quite a heavy hitter, trading millions of shares.

I don't know what you mean by in favor, but because the insurance companies held mostly bonds, including mortgage bonds no one knew the value of, they were beaten down to very low levels, below book value, PE multiples of four or five. Now bond valuations are normalizing, and I guess the insurance stocks are returning to reasonable levels.

Scott Brooks writes:

I deal a bit in the insurance world and I have to say that this baffles me. Insurance brokerage firms that I deal with are hurting big time. Premiums are down as small businesses (which insurance brokerage firms have as clients) continue to layoff, not hire, and generally decrease payroll.

Maybe their revenues are down, but their margins are looking better, but I find that hard to believe since every P&C guy I know is busting his butt to bring on as many new clients as possible and bidding as low as possible to "buy" the business. The problem is that their competitors are doing the same to them.

Vince Fulco comments:

A few I follow remain at a healthy discount to book value (WTM, CNA) and I've been wondering when the rising tide would lift these ships– since other industries are being given the benefit of the doubt that conditions are normalizing — and when would some of them get credit for adequate portfolio management and improving pricing and underwriting activity. Loosely speaking, a properly running P&C company can trade from .9-1.3x book and when the punch bowl really overflows, multiples of 1.5-1.8x are possible. Still plenty of room vs. normalized valuations. Why it has taken the crowd until now to really start bidding them up, I remain puzzled particularly vs. underlying corporate performance. It would seem the investors wanted to wait the half life of the bond portfolios to ensure no more problems as most run short duration portfolios.

Secondarily, there had been concerns within the industry about six months back that the Obama administration would go after the Bermuda-domiciled ones doing biz in the US for a bigger tax bite. That seems to have fallen by the wayside for now. Talking my book as I've owned WTM off and on for the last seven years.

Ken Drees adds:

The big question is since these insurance companies were screwed by their debt holdings, took writeoffs and have muddled through — some with Tarp but most P&C did not get Tarp — where do these companies park their cash now? They used to make money in the derivative leverage through the bond kingdom — outside of normal operational gains through underwriting. What is the risk of their holdings now? I don't see many stock buy backs from these guys and I don't see dividend rates that have gone up — both factors here would show that companies would rather pay out earnings or reinvest in themselves. Will they be able to ring the registers as normal through the bond markets?

Kim Zussman replies:

At a recent lecture by a business law attorney, the take-away message was "everyone needs business practices liability insurance." He went through a litany of litigations; violations of overtime laws, rest-breaks, bonuses not being factored into overtime calculations, performance reviews, extensive paper-trailing, s_xual harassment (including a married doctor who had relations with a woman six times before hiring her, then continuing to pursue her on the job).

In an environment of increasing regulation/litigation, empowerment of little old ladies in lieu of rich guys, and increasing taxes, the deductible expense of increasing insurance coverage could make sense — even though lining pockets of bureaucrats and their legal co-conspirators.

Phil McDonnell asks:

Vince, I have a question. For CNA the ratio of receivables to revenue is about 100%, for wtm it is about 75% (by eye). That would correspond to 12 and 9 months worth of receivables they are owed by their customers. Are their customers really the slowest payers in the world or am I missing something?

Dr. McDonnell is the author of Optimal Portfolio Modeling, Wiley, 2008

Vince Fulco responds:

Not sure where you are looking but the largest receivables on the balance sheet from the last few years relates to business they've reinsured with others. WTM management is generally more risk averse than their peers and is inclined to cede segments of their business to better define their upside/downside. These arrangements have truing up terms, conditions and times which make the receivables ratio more lumpy than an ordinary industrial concern. The mix of biz between them and CNA is probably another factor.

If you are speaking specifically to 'insurance and reinsurance premiums receivable', they've been 21-22ish% of revenues for the last few years. I have no specific answer for that but it doesn't seem out of line if we think of the balance sheet as a point in time.

Apr

4

The Bull Move, from Victor Niederhoffer

April 4, 2010 | Leave a Comment

The bull move by many measures is the greatest in history. Birinyi looks for big 10% turning points in markets and found that by some measures this one is the greatest in history going up 1/5 of a % a day versus 1/6 % a day in the 10 others of comparable rise to this. And we're right in the midst of another such surge with exactly 20 days of consecutive 4% or more moves, an event that's only occured 6 times in last 15 years, with previous dates 5/28/1997, 4/06/1998, 11/24/1998, 4/12/2000, 5/15/2001, and 1/27/2004.

The bull move by many measures is the greatest in history. Birinyi looks for big 10% turning points in markets and found that by some measures this one is the greatest in history going up 1/5 of a % a day versus 1/6 % a day in the 10 others of comparable rise to this. And we're right in the midst of another such surge with exactly 20 days of consecutive 4% or more moves, an event that's only occured 6 times in last 15 years, with previous dates 5/28/1997, 4/06/1998, 11/24/1998, 4/12/2000, 5/15/2001, and 1/27/2004.

One notes also that we haven't had a a month minimum since Feb 8th, 2010. Since Feb 8, 2010, the median S&P 500 stocks is up 13%, and the top 10 are each up more than 40%. An opposite scenario is working itself out in the world of fixed income. How can we make sense of what is happening?

To what should we turn in conjunction with the bearish feedbak that counting gives. I have been considering the fields of economics, martial arts or romance. What fields would you suggest?

Vince Fulco comments:

The thought of a pendulum with too much transitory force being applied to one side comes to mind.

Russ Sears writes:

In my opinion to understand the crisis and the resulting recovery, you must understand that most of the crash stemmed from "model risks". People had bought these wonderfully complex AAA structured products that suddenly you had to be able to model the expected losses. In the past this was considered only a remote possibility with no need to model. Once it became clear that much of this "structure" was mush, it was equally clear that these things really could not be modeled well. A slight change of the breeze from the butterfly caused wild swings in the heavens.

Models with even a slight downward trend in the housing markets quickly turned into a death spiral in housing. AAA suddenly were worth pennies. And those that bought them were those least able to absorb the losses or downgrades, further cascading the price due to illiquidity.

One must wonder if this recent reversal similarly has the "all clear" signal being given, and people are coming out of their bunkers to see some rays of sun. In other words which came first for the pendulum, the crash or the recovery?

Ken Drees writes:

Some recent puffy white contrary clouds that have passed my eyes:

advertising aimed at gold straddles

advertising oil calls and bull spreads

themes of money market money needing to go to stock market to earn advertising mailers about apple type clone micro caps–a ground floor opportunity advertising for homeowners to lock in natural gas now–don't wait for summer since rates NG rates can't go lower best 12 months in recent stock market history and the recovery isn't even rolling yet at full steam.

Bond bears are simply frothy–they can't wait to feed! The fed is in a box and its locked and its under water.

Lots of interesting hooks in the water in many markets. I am not surprised since trends have been running themselves quite far without pause, and thats the action that creates the hooks–the unarguable facts of self reinforcing trend. Voila!

Kim Zussman suggests we look at the big picture:

The attached plots log [base 10] (SP500 close) every March from 1871-2010, using data from Prof. Shiller's website.

In the context of history, the recent decline and bounce don't really stand out. However stock returns of the recent decade are noticeably different than the prior two, and rather resemble the pre-WWII period.

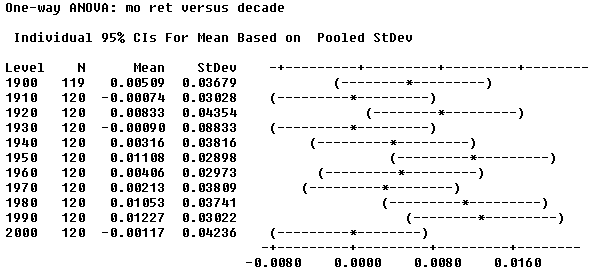

Next, Kim Zussman looks through a magnifying glass:

Using Shiller's SP500 monthly data, here is comparison of mean monthly returns by decade 1900-2000

Note that the 2000 decade was one of only 3 (1910, 1930) with negative mean monthly returns. The two prior decades, 1980's and 1990's, both had the largest mean monthly return since the 1950's, and the 50's, 80's, and 90's - the top 3 - all occurred in the last half of the century.

I also plotted log(sp500) within each decade. Drift is noticeable in some of the decades, and noticeably absent in others.

Mar

31

Commodity Tail-Wind, from Jeff Rollert

March 31, 2010 | Leave a Comment

My work indicates that most of the drop in commodity inputs, including PET and other plastics, has run its course on improving company margins. Now revenue gains have to increase greater than cost inputs, and I am finding little discussion on this. I would appreciate thoughts from readers of the site.

My work indicates that most of the drop in commodity inputs, including PET and other plastics, has run its course on improving company margins. Now revenue gains have to increase greater than cost inputs, and I am finding little discussion on this. I would appreciate thoughts from readers of the site.

Vince Fulco comments:

A few of my fundamentally driven long-short buddies concur. As I recall during the 1989-1993 and 2001-2003 periods, the pauses in the move to Dow 36K came from the periodic realization that while margin recovery was the easy/quick part (slash and burn everything in sight), it was the top line growth that remained halting & lumpy and required the real heavy lifting.

Mar

8

Lessons From Amazon’s Success, from Vince Fulco

March 8, 2010 | Leave a Comment

Here is a great post on the assertTrue() blog on lessons from Amazon's success.

Dec

26

Lady Gaga: 10 Things We Can Learn, from Victor Niederhoffer

December 26, 2009 | Leave a Comment

The great ascent of Lady Gaga from an also-ran performer in the Lower East Side techno-rock clubs a few years ago to number one selling recording artist in five countries, four million albums sold, and 20 million singles, rivals nothing so much as the ascent of Killmanjaro in 5½ hours or Apple's 4000% rise from 5 to 210 and the fourth largest market cap company in four years. Here are some of the things we can learn from her about how to be successful in the markets.

The great ascent of Lady Gaga from an also-ran performer in the Lower East Side techno-rock clubs a few years ago to number one selling recording artist in five countries, four million albums sold, and 20 million singles, rivals nothing so much as the ascent of Killmanjaro in 5½ hours or Apple's 4000% rise from 5 to 210 and the fourth largest market cap company in four years. Here are some of the things we can learn from her about how to be successful in the markets.

1. The Lady has a core of admirers she can always count on: the gay community. "I've got so many gay fans and they're loyal to me. They'll always stand by me and I"ll always stand by them." Apple's loyal fans are those that started out with them making music on their first computers and the minority group that liked the Apple operating system over and above the mainstream Microsoft one.

2. The prouct must be packaged and designed with great care and verve. Gaga has a special team, the Haus of Gaga, that designs all her clothes and stage performances. "When I'm writing music I'm thinking about what I'm going to wear on stage." Apple's packaging, its vivid colors, its compactness, directness, ease of use is crucial to its success.

3. You have to be technical to be a success. Gaga was playing by ear at the age of four, planning to go to Juilliard at 13. She writes her own music and her voice was good enough to attract Akon to sign her. The companies that have had the highest returns are people by engineers and computer scientistis with technical degrees.

4. You need a vision to be successful. Gaga didn't try to be the world's #1 singer or its most profitable. But she had a vision to combine glam rock with simple melodies. The best performing companies, Apple or Cisco or Whole Foods, have a product that makes life better for their customers, and they aim to be the best at it, and stick to their knitting.

5. She gets great reviews from the critics and this filters to the masses. All the best-performing companies reach out to the idea that has the world in its grip. They are all huge supporters of the current administration and reach out to unisex and redisbrituive policies so that the critics who share their persuasion will be sure to nominate them for awards. The most popular song of Gaga makes fun of rich kids that want material goods. When will she be invited to the Oval?

6. She has a simple product and a simple name. It's four letters and two syllables. And she combines simple movements, simple melodies, and simple rock rhythms in her songs. The price to weight ratio of Apple products is comparable to her own.

7. She stands on the shoulders of giants. She has borrowed from all the most popular idols that preceded her including Michael Jackson, Madonna, Blondie, and Andy Warhol. To be successful you need the base of fans that your predeceessors have accummulated.

8. She is shocking and exuberant in the things she does. The bubbles that she wore in Rolling Stone remind me of the glass houses Apple sells their products in, and her performances on stage are reminiscent of the conventions where Apple unleashes its products.

9. She has a completely integrated operation, writing her own songs, dancing them, designing her own clothes, and distributing them through a company she owns. The control of product from start to finish a la Apple's designed marketing and then retailing their own products is crucial nowadays to the most successful companies.

10. She is always ready to seek the limelight. She strives to have the best product, is proud of it, and will stop at nothing to popularize her brand. If it requires appearing nude, why that's just more publicity that her critics and core fans will love.

Kim Zussman comments:

This wonderful analysis also convincingly articulates the ugly, banal, cynical, pandering con of capitalism in general and investing in particular. Presumably the patina of beauty derives from the knowledge that it is facade.

Add to AAPL's list recruitment of the left, which targets Wintel for viruses but leaves MacAlone - encouraging climate coolers to take the path of least resistance.

Relatedly, Madam Gaga also evidences survivor-bias: How many thousands of performers try different angles but don't make it, then with the benefit of hindsight we ascribe causality to the at least partly accidental qualities of the successful?

Vince Fulco adds:

I would venture Lady Gag Gag's actions, as I like to call her, is bleeding into other artists' styles. Forced to watch Shakira's latest DVD by my significant other yesterday, it was obvious she's leaning much more risque in movements, outfits and dance routines. She certainly doesn't need to given her voice, lyrics and natural beauty. Beyonce seems to be doing the same. Although I catch these performers infrequently, who passes up an undulating set of hips that the wife gives free pass on viewing?

I would venture Lady Gag Gag's actions, as I like to call her, is bleeding into other artists' styles. Forced to watch Shakira's latest DVD by my significant other yesterday, it was obvious she's leaning much more risque in movements, outfits and dance routines. She certainly doesn't need to given her voice, lyrics and natural beauty. Beyonce seems to be doing the same. Although I catch these performers infrequently, who passes up an undulating set of hips that the wife gives free pass on viewing?

Dec

14

The Blind Side, from Victor Niederhoffer

December 14, 2009 | Leave a Comment

The Blind Side is one of those movies that makes life worth living forever. What other such movies, plays, music, literature would you put in that category?

Vince Fulco replies:

Movies:

The Road to Perdition– everyone who participated in it was at the top of their game from writers, actors (primary & secondary), producer, director, cinematographer, musical director. It made for a polished period piece with tons of emotionally charged moments and an unexpected ending.

Boondock Saints– obscure, independent type movie; very novel story telling seen both by the vantage point of the perpetrators (Irish Mob in South Boston) as well as the talented detective trying to unravel a recent flair-up in gang on gang activities (Willem Dafoe). A great example of the grey areas in life; i.e. if you are using extreme violence against a rival gang to protect one's innocent neighborhood residents, are you a saint or sinner?

Gandhi– A masterpiece in so many ways, no more needs to be said.

Laurence of Arabia– ditto.

I am a sucker for underdog movies where the lead character rises from his own self involvement and selfishness to sacrifice everything for the greater good. Not 'Laurence'–obviously his striving for personal greatness led to its own extraordinary achievements but as I get older, the accomplishment of creating these complex, grand movie projects is inspiring in its own right.

Books:

Shogun by James Clavell

Shogun by James Clavell

Anna Karenina

Two monumental undertakings by the authors which fully develop their characters and keep the reader engrossed from cover to cover. As for the latter, although it has been years, as I recall, the ability to interweave multiple complete stories and have them entertaining and believable was sheer genius.

music:

Anything by Yo-Yo Ma and separately Tan Dun.

Nick White responds:

Martha Argerich's rendition of the first movement of Rachmaninov's 3rd Piano Concerto with the Radio Symphonie Orchester Berlin and Riccardo Chailly conducting.

Martha Argerich's rendition of the first movement of Rachmaninov's 3rd Piano Concerto with the Radio Symphonie Orchester Berlin and Riccardo Chailly conducting.

Her magisterial expression of the full range of human emotion in this performance is, in my opinion, unparalleled in any other work.

Thomas Miller adds:

Miracle on 34th Street and It's a Wonderful Life. Both made shortly after end of WWll. Still immensely popular 60 + years later.

Jeff Watson writes:

"Surfing for Life", is one of those special movies that makes one want to live forever. That's the movie that deals with all the old people who still surf well into their 80's.

James Lackey writes:

Cinderella Man (2005) …. Crowe as Jim Braddock is a good one. Invincible 2006 Wahlberg plays Based on the story of Vince Papale, a 30-year-old bartender from South Philadelphia who overcame long odds to play for the NFL's Philadelphia Eagles in 1976..

Ironic, I watched It's A Wonderful Life with my kids last night. What cracked me up is my quest to please my wife.I remember 10 years ago when my boy was 4, I said "you're a bad boy" she said No no no what he did was bad, he is not bad. Ever since I have been working on my syntax to get the exact same point across with out damaging my own kids for life. ha.

Yet in It's A wonderful life the mom calls her sons idiots. It cracked me up as she was kidding sit down and eat you two idiots. The druggist smacked little George Baily around for being lazy. Baily tells the biggest backer and connected man in the county off countless times..turns down a 10x salary increase because he knew it wasn't best to sell his beliefs for money, but all the while hating his town his nickel and dime business where he cant profit much by helping others. He complained all along..which was hilarious "trapped"

Man on Porch: Why don't you kiss her instead of talking her to death? George Bailey: You want me to kiss her, huh? Man on Porch: Ah, youth is wasted on the wrong people.

George Bailey: Merry Christmas, Mr. Potter! Mr. Potter: And Happy New Year, In Jail! They're At Your House Right Now!

George Bailey: [yelling at Uncle Billy] Where's that money, you silly stupid old fool? Where's that money? Do you realize what this means? It means bankruptcy and scandal and prison. That's what it means. One of us is going to jail - well, it's not gonna be me.

Mary: I feel like a bootlegger's wife!

Stefan Jovanovich writes:

It's A Wonderful Life is certainly popular now, but it was a bust at the box office when it was released in 1946. Its flop effectively ended Capra's career. The actors - Jimmy Stewart, Donna Read - went on to further success; but the plot reminded people of the bank runs of the pre-War era (hardly a happy memory) and they stayed away in droves. The Best Years of Our Lives was the hit that year; it was (among other things) about a banker who returned to work from the war and decided to lend a farmer money, not about depositors clamoring for their money back from an over-extended S&L.

It's A Wonderful Life is certainly popular now, but it was a bust at the box office when it was released in 1946. Its flop effectively ended Capra's career. The actors - Jimmy Stewart, Donna Read - went on to further success; but the plot reminded people of the bank runs of the pre-War era (hardly a happy memory) and they stayed away in droves. The Best Years of Our Lives was the hit that year; it was (among other things) about a banker who returned to work from the war and decided to lend a farmer money, not about depositors clamoring for their money back from an over-extended S&L.

Nick Procyk adds:

I would second Cinderella Man and Invincible.

March of the Penguins is a true-life movie about a group of emperor penguins that survive the harsh polar winter, breed, search for food — all captured in amazing photography.

Eight Below is another heartwarming movie based on a true story about a guide and his eight sled dogs. The guide is driven to reunite with his canine friends after they were stranded in Antartica during the brutal winter. It's a wonderful story about friendship, courage, and faith.

Riz Din writes:

The Rocky films, all of 'em. I guess they just caught me at the right time. The first is the best, and Balboa doesn't even win the final bout. His victory is of another sort. The rest of the series works on several levels. You have both the quality of the Rocky films and Stallone's actual career ebbing and flowing with the ups and downs of Rocky's character. The score is everyone's 'go to' music when they want to get pumped up and motivated, the dialogue is wonderful, the characters memorable, and there are many lessons that can be drawn from the storyline, both good and bad.

The Rocky films, all of 'em. I guess they just caught me at the right time. The first is the best, and Balboa doesn't even win the final bout. His victory is of another sort. The rest of the series works on several levels. You have both the quality of the Rocky films and Stallone's actual career ebbing and flowing with the ups and downs of Rocky's character. The score is everyone's 'go to' music when they want to get pumped up and motivated, the dialogue is wonderful, the characters memorable, and there are many lessons that can be drawn from the storyline, both good and bad.

From the first film:

Rocky: I been comin' here for six years, and for six years ya been stickin' it to me, an' I wanna know how come!

Mickey: Ya don't wanna know!

Rocky: I wanna know how come!

Mickey: Ya wanna know?

Rocky: I WANNA KNOW HOW!

Mickey: OK, I'm gonna tell ya! You had the talent to become a good

fighter, but instead of that, you become a legbreaker to some cheap, second rate loanshark!

Rocky: It's a living.

Mickey: IT'S A WASTE OF LIFE!

John Lamberg writes:

Life worth living forever? Well, none of the following make that cut, but my favorites are:

Hans Christian Andersen's works. (The Little Match Girl is perhaps the saddest story I ever read, and it stuck with me since childhood. We'll see if Gregory Maguire's "Matchless", a re-imagination of the story compares.)

Holst, The Planets

Bodysnatchers (original)

Forbidden Planet (not for the acting or script, but for Dr. Morbius' secret)

Vincent Andres adds:

The Last Kings of Thule - Jean Malaurie, about ordinary heroes

Many of Giono's books, eg Regain - J. Giono (in french onl)

Many of Pierre Magnan books

Dava Sobel's Longitude

Order Out of Chaos by I. Prigogine

L'imprévu by I. Ekeland (in french only)

Des rythmes au chaos by P. Bergé, Y. Pomeau, M. Dubois-Gance, 1994.

For pointing an interesting trail, Deep Simplicity: Bringing Order to Chaos and Complexity by John Gribbin.

The Foundations of Ethology by K. Lorenz

Studies in Animal and Human Behavior by- K. Lorenz

The First Three Minutes: A Modern View Of The Origin Of The Universe by Steven Weinberg

Mon oncle d'Amérique by A. Resnais (in French only)

Dec

11

Whither Japan? from Dan Grossman

December 11, 2009 | 4 Comments

I used to do a lot of business in Japan and I think very highly of Japanese businessmen (unfortunately they rarely include women at high levels). They have an industrious, highly intelligent population, are very interested in business, and a good base as the second largest economy in the world.

I used to do a lot of business in Japan and I think very highly of Japanese businessmen (unfortunately they rarely include women at high levels). They have an industrious, highly intelligent population, are very interested in business, and a good base as the second largest economy in the world.

It is a great mystery to me why they (and their stock market) have not done better in recent years and I have never seen any good explanation of it. Okay, they had a bubble that burst, government policies that were not great, and they have an aging population. But so what? They had plenty of opportunity to recover on their own in spite of whatever the government has been doing. (BTW their government policies could not be any worse than our current ones, so if government policies are the test, we're in big trouble.)

Has anyone seen or can anyone give a decent explanation of why Japan has lagged?

Ken Drees writes:

1. LDP party out of power after 55 years.

2. Exports and profits slumping via USA trade like others Asian exporters.

3. Big(gest) holder of USD denominated debt.

4. Aging populaton (nothing new), but 81 billion spending package just announced, more internal stimulus to follow?

5. Need to diversify their surplus holdings like others (China, Brazil, Russia, et. al.)?

6. New party administration playing a little differently with USA — recent Obama trip no real results, prior to that some grumblings about USA debt, etc.

7. Japan equities — bottoms in 1998, 2003, 2009 — skewed symetric reverse head & shoulders – or just bumping along the bottom?

8. Will need to strengthen export markets everywhere and keep USA markets open and profitable. Japan's growth lies with its neighbors if USA doesn't fix itself.

9. Yen carry trade over, yen rising — conflicts with strategic direction that exports and export profits need to be robust.