Oct

22

Fundamentals and Technicals, from David Lillienfeld

October 22, 2013 | Leave a Comment

There's lots of talk, understandably, on this list about trading patterns and technicals. All well and good. But I'm a fundamentals kind of guy (back in the 1970s, I was a fundamentalist, I guess, but that word has a different meaning altogether these days). And, as Rocky can attest based on numerous emails, technicals remain something I'm still figuring out. So it was with interest that this choice article appeared yesterday in the NYTimes about the making of Fiddler on the Roof.

There's lots of talk, understandably, on this list about trading patterns and technicals. All well and good. But I'm a fundamentals kind of guy (back in the 1970s, I was a fundamentalist, I guess, but that word has a different meaning altogether these days). And, as Rocky can attest based on numerous emails, technicals remain something I'm still figuring out. So it was with interest that this choice article appeared yesterday in the NYTimes about the making of Fiddler on the Roof.

Many may suggest that the show was a success because it was such a compelling story–and it was/is, particularly for the 1960s, with its celebration of the centrality of the family in the journey of life. I don't mean to get off into the high grass on that topic. Rather, there's a comment in the story about when Zero Mostel went through a doorway and touched the mezzuzah, the piece of parchment on the doorpost ("You shall write them on the doorposts of your house and on your gates", Deut 6:9).

Some have suggested that the mezzuzah represents the painting of the doorways by the Israelites during the last of the 10 plagues, but it's not inferential. Robbins, who had little interest in Judaism and detested any suggestion that his parents were immigrants, changed his name to minimize his connection with a Jewish heritage. On the other hand, having been raised in an observant household, Mostel could not conceive of Tevye, the lead character of the show, going through the door without touching the mezzuzah. (Not noted in the article is Robbins' previous collaboration with Mostel in A Funny Thing Happened on the Way to the Forum.) Robbins, the director stood his ground, and Mostel deferred. The next time Mostel went through the door, he crossed himself, and touching the mezzuzah went back into the show.

The point of this story, on the Dailyspec, is its demonstration of two different views of the world. Robbins, in the here and now, could have cared less about the historical roots of Tevye and the rest of the plot. All that mattered to him was what just happened, more or less. Authenticity? Robbins wasn't bothered–it didn't affect the pattern, it wasn't therefore of interest. He was a technician, basically. If there was a pattern that might be present, he wanted to find it and use it to advantage. His choreography reflects that approach.

In contrast, Mostel had essentially lived Tevye's life, not so much in Europe as from an observance perspective. His approach to Tevye wasn't based on the here-and-now of Robbins, but rather on the fundamentals of Tevye's character.

In contrast, Mostel had essentially lived Tevye's life, not so much in Europe as from an observance perspective. His approach to Tevye wasn't based on the here-and-now of Robbins, but rather on the fundamentals of Tevye's character.

This isn't to say that fundamentalists and technicians need be at loggerheads, just that they are complementary views of the world, not merely different methods of addressing a given situation, and not limited to the activities usually of concern to list readers.

I thought I'd share that synthesis with the list–it provides some insights into what we do and why we do it, not merely how we do it–in life.

All of which is preamble to my question of the day: Does anyone have more than a passing familiarity with 3D printing? Please contact me off list if you do. I'm looking into the area for an investment for my grandchildren's college funds. Yes, there's a bubble now, but there won't always be.

Stefan Jovanovich writes:

"Mostel had essentially lived Tevye's life from an observance perspective."

Err, no. Zero had no fear of the Czar or the Cossacks; on the contrary, he expected to be the one wearing the uniform. (He was a member of R.O.T.C. when he was at CCNY.) Tevye was a successful dairyman; Mostel's family were such poor farmers that they fled Connecticut for the Lower East Side, and thereafter his father worked in an office as a chemist. Mostel was, like practically everyone who worked for PWAP, a communist; it is impossible to imagine Tevye being a communist or having any more success with the Leninists than any other "rich" (sic) peasants did — assuming he survived the war.

David Lillienfeld responds:

I'll go by what my grandfather and aunt, both of whom lived in the Settlement, and offer that Tevye was hardly a successful milkman–at least by community standards. The butcher was a major, wealthy member of the community, not so the diary man. There's Tevye's comment somewhere in Fiddler about having 5 daughters. That meant 5 dowries, and for a milkman to so provide as one of the lower folks on the economic totem pole was a challenge.

As for Mostel, the fact remains he was raised in an observant household. Whether he aligned with socialists, communists, Paulsenites, or whatever, isn't relevant to the discussion at hand. Both my parents were raised in observant households–my maternal grandfather was one of the founders of the Ner Israel Yeshiva back in the early 1930s and my mother used to regale my siblings and me with stories of the students who would room in my grandfather's house during the 1930s. Both of my parents were pretty liberal, my mother slightly less so than my father. That didn't impact on either's understanding of orthodox observance. One of my earliest memories of my father these days is his arguing with the Ner Israel Rosh Yeshiva (head of the yeshiva) about how one performs a bris, a circumcision. I don't remember the specifics any more, except that there was one point where my father started to curse at the Rosh Yeshiva in Yiddish, and you could tell from the RY's face that that was the last thing he was expecting. Years later, when the RY's wife was diagnosed with breast cancer, my father was the physician he consulted on what an optimal treatment might be. I guess whatever my father said during that argument didn't impact that aversely on my father.

In any case, neither Tevye's nor Mostel's political beliefs are relevant. Unless you're suggesting that Mostel was making a political statement by kissing the mezzuzah?

Oct

18

The San Diego Housing Market, from David Lillienfeld

October 18, 2013 | 1 Comment

Out here in SoCal land, specifically San Diego, life has been good. 70 degrees every day, no rain, usually no clouds, etc. But all is not as it appears: the housing market is weakening.

Out here in SoCal land, specifically San Diego, life has been good. 70 degrees every day, no rain, usually no clouds, etc. But all is not as it appears: the housing market is weakening.

For those not aware, in San Diego, the military is a major employer. By some estimates, directly or indirectly, between 20 and 30 percent of the economy of San Diego is based on federal spending. The home base for the USN Pacific Fleet is in San Diego. Also Miramar (think Top Gun), Camp Pendleton, among others (and there are others).

While the softness in the housing market out here isn't solely due to the sequester, even local economists of the conservative persuasion acknowledge that the sequester is having an impact locally. The assertions from some that the effects of the sequester are minor do not seem to ring true, at least not out here. I expect that while there are housing markets that will be less affected by the sequester than San Diego's, there will be an affect.

Staying away for the moment from housing-related stocks seems a prudent course of action.

a commenter adds:

Second best city in the world behind Sydney.

Oct

17

Regeneron, from David Lillienfeld

October 17, 2013 | Leave a Comment

Those who follow the biotech world may have seen that Regeneron reported some fantastic results on its lipid-lowering drug. Much more efficacy than statins. Safety data was not reported but it seems safe to say that suggestions of hepatotoxicity that first appeared with the early statins and seem to be a fixture in use of statins for the first 6 months is a segment of the population, were not present; FDA wouldn't have hesitated to intervene if there had been such suggestion, since in FDA's eyes there are already "safe" lipid-lowering drugs on the market.

Those who follow the biotech world may have seen that Regeneron reported some fantastic results on its lipid-lowering drug. Much more efficacy than statins. Safety data was not reported but it seems safe to say that suggestions of hepatotoxicity that first appeared with the early statins and seem to be a fixture in use of statins for the first 6 months is a segment of the population, were not present; FDA wouldn't have hesitated to intervene if there had been such suggestion, since in FDA's eyes there are already "safe" lipid-lowering drugs on the market.

The same is true for rhabdomyolysis–essentially break down of muscle (some thing the muscle soreness often associated with statin use may be a pre-rhabdomyolysis state, but the data are anything but clear on that). It was rhabdomyolysis that was the reason Bayer's Baychol was withdrawn from the market.

There are some caveats:

1. There has long been the observation that if cholesterol levels are brought below 90-100, there is little gain in mortality (some studies suggest there may even be an increase) and that cancer risk in particular goes up. Of course, recovering from a heart attack has a higher probability than doing so from cancer. Unfortunately, I can't tell you which sites–I just don't remember.

2. There are some established drugs in the lipid-lowering space. Lipitor and Crestor come to mind. The former is generic, and it is probably finally making it onto many P&T committee lists. The latter is still patent protected and, not surprisingly, costs a bit more than the former. That's not to say that Crestor is more efficacious than Lipitor. In a given patient, one may prove to be less efficacious or better tolerated than the other. YMMV.

3. The thing that made the statin market what it is today was a series of studies by Bristol-Myers Squibb and Merck showing that use of statins was associated with lower mortality–quite a bit in fact. Since the effect of Pravachol from BMS in mortality reduction was greater than might be expected if only lipid-lowering were the explanation, there has been a persistent question over what exactly it is that statins are doing besides lowering lipids. There are suggestions that they reduce chronic inflammation (considered part of the pathophysiological process underlying atherosclerosis), reduce risk of osteoporosis (very controversial), reduce risk of gingivitis and periodontitis (Dr. Zussman is better positioned to opine on that one than I am), and some suggestions of reduced risk of Alzheimer's disease, among others. Will Regeneron's drug do any of these? We don't know. Will it even lower mortality? Again, we don't know. Such studies take some time to complete, and I'm not sure if they've even been started. There's also the comparative effectiveness matter. How much this drug will cost for each QALY (quality-adjusted life years) gained isn't yet know, and whether the drug is seen to be as good a value as the statins were when they first came to market isn't known. However, make no mistake, all of these factors will enter into the calculus of how successful, if at all, Regeneron's drug might be.

4. As one who has taken Lipitor for 13 years (horrible family history of heart disease–I keep my total cholesterol below a 100 and LDL below 75), I'm not particularly interested in switching drugs, never mind drug classes. There are many patients taking statins who, I think it's probable, think likewise. That most statins are now well off patent (and cheap generics) is another reason to stay with something of known efficacy in a particular patient. That presents a problem for Regeneron: How to convince physicians to put new patients on its drug and to convert those on statins to switch. The former may be straightforward, though the issue will be one of how much more growth can there/will there be in the lipid-lowering market. I'm agnostic-to-skeptical that there's a whole group of patients needing another lipid-lowering drug. That's not to say there aren't some, though. On the other hand, obtaining health insurance coverage may be problematic, as I'm sure that Regeneron will price the drug in the "near and dear" category (to use industry parlance), meaning high. Very high. I doubt that Regeneron will follow the Pfizer strategy of pricing the drug 10% below the leading statins (or in this case, perhaps, Crestor) for two years to gain some traction in the market, but I could be wrong. One thing to consider is that biotechs are not used to pricing competitively. Usually, they are the long entity in a market space, and they will price accordingly. As for switching patients off of statins, I guess if there are those not getting enough of a reduction, perhaps with LDLs over 140-150, there's a chance of a switch being made. There aren't that many of such people, though. All of this means that Regeneron will have some work cut out on the marketing end to get newly diagnosed hyperlipidemics onto its drug, as well as getting insurance reimbursement.

The long and short of it is the Regeneron's drug may be a game-changer in heart disease–but we just don't know enough as yet about it. The data released yesterday seem compelling, yet they are only in terms of reduction in lipid levels. Fine, except we know from the statins that something may be needed to get much benefit from a lipid-lowering drug.

For those of you liking growth stocks or story stocks, this is a company with a nice story to follow, perhaps to take a position in. For value investors (read: Mr. Melvin), enjoy using the drug (if it gets to market) but don't even thing about looking at this stock. It won't be a "value" one for a decade or two at least.

The President of the Old Speculator's Club writes:

I wonder if any studies have been done on the increased cancer risk. A little while ago, a scientist did a study and claimed that a cancer cure could save something like $5 trillion a year. However, tagged on to the end of the study was a one sentence disclaimer to the effect that the suggested savings did not take into account that while a cancer cure could well cut down on costs, survivors might find that their longer life brought on equally (or more) expensive disabilities - like diabetes or, more likely various dementias. I've been in two post-operative cardiac exercise programs - both for several years. In that time, quite a few individuals come through - most stay for the minimum period; others, like myself continue on. One thing we long-timers watched for was the continued health of those who stayed and, if possible, those who left. The nurses at one hospital were especially diligent in keeping in touch with members of both groups. Over the years (18 to be exact), as one would expect, there have been numerous deaths. However, very, very few were due to cardiac problems - more often, cancer was the cause. So, here's the question: is the propensity for cancer among cardiac survivors an inevitable result of their survival, or can (and should) their deaths be attributed to statins. I know the latter is a popular one, but hell's bells, lawyers couldn't make a dime if it proved out that longevity was the real cause.

Kim Zussman writes:

Life should be more expensive than death because it is more valuable, especially to survivors. The problem is that the disease lottery is zero sum: you will die of something. As medical / nutrition science advances, death rate due to some diseases has plummeted - and survivors go on to die of something else.

Hand (and voter) wringers over increasing medical expenses should start by blaming antibiotics:

"Historical Diseases Death Rates" (see first table)

The progress made with infectious and cardiovascular disease has been faster than cancer treatment (and cheaper). So don't smoke, eat fish, hit the gym, wash your hands, and prepare for the final fight with unregulated cell division.

Oct

11

Who is Wagging Whom? from Gary Rogan

October 11, 2013 | Leave a Comment

Since Bamster has apparently figured out that de-linking the CR and the debt increase isn't in his interest, isn't it clear that political strategy is now the dog and the market is the tail? If the market is so smart, why can't it see more than a day ahead, and why does it swing wildly based on words, leaks, conjectures?

Rocky Humbert writes:

When this whole thing started, I wrote: "This slow motion train wreck will probably continue (and stock guys will keep denying it) until CNBC puts the 1 month Tbill on the side of their price montage. Once that happens, you'll know it's safe to go back into the water. (I'm only half kidding)."

Remarkably, that happened late on Wednesday and the WSJ dutifully carried a large news story about the breakdown in money markets after the close Wednesday and in the print edition of Thursday. The current Obama administration is pretty light on people who understand the systemic importance of the money markets and what would have happened if the panic continued to accelerate.

I suspect that they (and perhaps you) got an impromptu lecture from the NY Fed Open Market Desk and understand this better now. (Or perhaps you consider the timing of the stop-gap, face-saving 6 week extension headline to be total coincidence???) The plumbing of our entire economy is the money markets. Not the stock market. Not the bond market. The money markets. It's the dog. And everything else is the tail. 2008/2009 demonstrated this powerfully. If you've ever been in an argument with your wife and both noticed a serious plumbing leak in the midst of your argument, you stop arguing and call the plumber. It took a spike in yields of roughly 5,000% to get the politicians back to the table. The dog wagged the tail.

Gary Rogan replies:

I appreciate this line of thinking, it's very instructive. But help me out with one thing: my model of how Obama operates is that he would LOVE to crash the economy if he could blame it on the Republicans. While I can see how the Republicans would be forced to negotiate, is there any real pressure on Obama, Fed lectures or not? Perhaps than this is a recipe for the total Republican surrender, since they are the only side with the market pressure on them, but still: is Obama in any sense motivated to solve the market problem as opposed to find a way to assign the blame to the opposition?

David Lillienfeld writes:

So you subscribe to the thesis that the GOP crashed the economy in 2007 to blame it on Barney Frank and get Dodd-Frank repealed?

Gary Rogan replies:

No, this is a random thought that has never occurred to me. The GOP would never crash the economy on purpose because they are not Marxist revolutionaries and because they are largely beholden to a lot of business owners and operators. It would also be hard to believe that as a party they would want to hand the victory to the Democratic Presidential candidate in the following year, so this is an absurd suggestion.

Obama has clearly demonstrated that he personally only cares about the following things: (a) income transfer to the "unfortunate" (b) gay rights (c) Muslim rights (d) black rights (e) triumphing over any opposition regardless of any collateral damage" You can see that he has a tin ear for what's important in the "flyover country" by his handling of the "death benefit". Getting him to act normally is like trying to explain human behavior to a creature from some Alien movie: they can certainly pretend most of the time, but once in a while the algorithms fail and a few humans bite the dust.

David Lillienfeld retorts:

Sorry, but you'd have to go back to the DNC's decision in 1972 to have George McGovern give his acceptance speech at 3 AM (at least I think it was 3 AM–I was pretty sleepy at the time) rolling all the way forward to McGovern's declaration of "1000%" support for his Vice Presidential candidate a few days before the latter withdrew to find anything rivaling the political stupidity and naivite evidenced in the GOP's actions in the past couple of months. As for the biggest absurdity in the present situation is the GOP's apparent suicide wish. I had thought after the last election, there was some desire in the GOP to come to terms with its growing political isolation, that it understood that the American electorate was not amused at the sight of an 82 year old man lecturing an empty chair on a stage. Apparently I was wrong. I also find your premise that business owners and the like are beholden to the GOP. That's starting to change, though I don't think that means they will be any more interested in aligning with the Democrats than they are right now. The effect of the shutdown and even moreso the debt ceiling doings on business has hardly been a positive one.

Not everyone in the Democratic Party is a Marxist and not everyone working in the White House is a Marxist (the idea of Chuck Hagel as a Marxist is humorous, though, I grant you, and ditto for Jack Lew). Not everyone who voted for Obama is a Marxist. And there are those who voted for him while not supportive of everything he says or does if only because of the choices they were confronted with. Just because someone disagrees with you doesn't make them a Marxist, either.

I lived through the "America: Love it or leave it" period in the late 1960s and 1970s, and I'd like to think that we're past that as a society.

Stefan Jovanovich clarifies:

David is too good a scientist not to know that public opinion polls have become suspect precisely because so much of the actual electorate chooses not to answer the phone or answer the questionnaires. In fact, for more and more people answering Gallup's questions is considered to be the equivalent of voting - i.e. I answered the poll questions so I don't need to get an absentee ballot. Some of us made this mistake in predicting the last Presidential election; David seems determined to repeat our error by taking the "public's voice" for being equivalent to the electorate's.

As for the description of the Democrat Party, I am afraid my answer is "yes, they are all Marxists". To say that, I have to rely on my own peculiar definition of Marxism; but I think it is an accurate precis of what Marx, Engels and Lenin all thought. In their world a person always and everywhere believed that labor had a value independent of (and almost always superior to) its market price? Since the late 1950s, when I first started following politics, I have never met a Democrat, left, center or right, who did not agree with that assertion. It is hardly an odd opinion; for most of my life it has been shared by not only all Democrats but also a majority of Republicans. Both parties have shared the fantasy that there are two "sectors" in an aggregation called the economy and that the prices for the "public" sector and those for the "private" can be directly compared to one another. That is why, even now, a majority of the Congress supports labor unions, Davis Bacon, non-judicial regulation and all the other forms of soft and hard government-enforced monopoly.

All this upsets Gary - understandably. It would upset me if I were not a hopeless optimist. The idea of actual liberty - of people being absolutely free to paint their houses whatever colors they liked, swap fluids with whatever consenting adults they chose, eat, drink and smoke things that are "bad" for them, believe in Joseph Smith's golden plates, heavenly virgins, Darwin's universe, whatever - has always been a truly radical idea. That it has never yet been the majority opinion is no reason to believe that it will not someday become the "common sense" of humanity. The dedicated Communists who were my grandfather's friends - the ones who actually went to Spain to fight Franco and the Nationalists - had, in their own way, the same stubborn faith. They thought Stalin was a monster, but that not shake their belief that someday the dictatorship of the proletariat would not longer be necessary and we would all be free. Grandfather agreed. He just thought we could skip all that petty and monstrous bossing around of other people and get straight to the Don't Tread on Me that had been his reason for coming here in the first place.

Sep

30

The Last Game, from David Lillienfeld

September 30, 2013 | Leave a Comment

Today marks the close of the regular baseball season. For those of us old enough to remember, one might have expected the World Series to begin on Tuesday, possibly a night game, but more likely a day one. Now with the post-season trifectas, it's amazing the October classic isn't played in November.

Today marks the close of the regular baseball season. For those of us old enough to remember, one might have expected the World Series to begin on Tuesday, possibly a night game, but more likely a day one. Now with the post-season trifectas, it's amazing the October classic isn't played in November.

Pardon the curmudgeonliness, but the Os finished 85-77. The season closed on a high point, and Jim Johnson continued in his quest to rival Don "Two Packs" Stanhouse for how close one can come to blowing a save without actually doing so while garnering his 50th save. Chris Davis finished the year leading the league (AL) in RBIs and HRs–he made it over 50, only the second Oriole in history to eclipse Frank Robinson's epic 1966 Triple Crown season with 49. Despite that, and despite Adam Jones' 3rd place in the AL RBI standings, the Os generally didn't produce what they needed to in order to get to that October/November classic. Pitching was weak. Actually, weak would have been an improvement. There was one starter on the staff with any consistency, and lots of games the bullpen blew. Still, given the prediction that last year was a fluke and the Os would return to the AL East cellar, there is some satisfaction to be had in the omnipresent cry at the end of the season, "Wait 'til next year!" I'm also betting that Buck keeps his job. And after two decades of baseball folly, to have two winning seasons in a row, well, it just puts the season into perspective.

As Tim Melvin has observed, it's now time to become re-aquainted with the Kindle. Personally, I'm looking around for a copy of "Birds on the Wing"; it's pre-Kindle, but since it's a physical book, neither of my kids will have touched it, so it will be exactly where I put it a couple of years ago (pre-Buck). If you grew up in Baltimore during the 1960s/early 70s, I'm sure you know of the book. That and Freedom's Forge should get me to Halloween. Then the countdown to spring training can begin anew.

There was an interesting piece in today's NYTimes about what ails baseball. I found myself in disagreement with the analysis–at least part of it. But I want to give the matter some more thought, and I'll get back to fellow dailyspecs with some comments in the next couple of weeks. After all, there's a cold winter to be navigated yet, and 4 months of quiet before hope springs eternal again and the cry goes out, "Play ball!"

Steve Ellison writes:

In PracSpec, the Chair and Collab postulated that baseball was a mirror of American culture. Eras when baseball emphasized fundamentals and hard work, such as the present, tended to be followed by favorable economic periods. It was the long-ball eras that heralded trouble ahead for the economy and stock market.

Stefan Jovanovich writes:

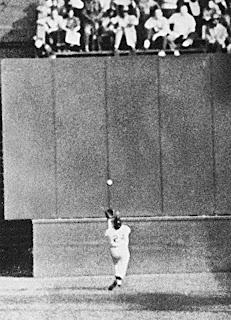

Yesterday was the anniversary of Willie Mays' catch and throw in Game 1 of the 1954 World Series. Since I played hookie from school every day the Giants were in town during the summers of 1952, 1953, 1954 and the spring of 1955. (The NY Public Schools in Harlem and the Bronx were so stuffed with boomed babies that no one missed me.) As a life-long Giants fan I have no more nostalgia for the Polo Grounds than for Candlestick. As Joe Torre (born in Brooklyn but smart enough to be a Giants fan) said, "I never hated the Yankees; I just wanted our Giants to be as good a franchise as they were.)

Yesterday was the anniversary of Willie Mays' catch and throw in Game 1 of the 1954 World Series. Since I played hookie from school every day the Giants were in town during the summers of 1952, 1953, 1954 and the spring of 1955. (The NY Public Schools in Harlem and the Bronx were so stuffed with boomed babies that no one missed me.) As a life-long Giants fan I have no more nostalgia for the Polo Grounds than for Candlestick. As Joe Torre (born in Brooklyn but smart enough to be a Giants fan) said, "I never hated the Yankees; I just wanted our Giants to be as good a franchise as they were.)

From the beginning the Yankees were smart enough to build a stadium that rewarded their left-handed dead pull hitters. (Ruth didn't build the stadium; Rupert built it for him.) With the Polo Grounds it was the exact opposite. The stadium absolutely killed the teams that I grew up with. They had a wealth of talent; but their best players were - like so many of the great Southern ball players of that era (Aaron, Matthews) - brought up in the Ty Cobb school. They were gap hitters with power. But, instead of getting County Stadium (where Mays hit his 4 home runs and Aaron and Mathews had the careers made), my Giants got the impossibly deep alleys of the Polo Grounds - the places where Monte Irvin's and Willie Mays' homers regularly went to become outs in Richie Ashburn's glove. The only genuine sluggers the Giants ever had in all the years at the Polo Grounds were the baby Ruthies - Mel Ott and Johnny Mize - dead-pull left-hand hitters who were late on the ball if it went anywhere left of right field. (Mize thought he had died and gone to heaven when he was traded to the Yankees late in his career. The right field fence in the Polo Grounds was 15 feet high; in Yankee Stadium it was 3 feet.)

As dreadful as Candlestick was, it was not that bad; Willie Mays and McCovey could reach the right center fence without having to take steroids. But, with the wind blowing in from the north (which it still does almost all the time), only Dave Kingman had the strength to regularly hit it out to left field. To his credit Peter Macgowan had the sense to remember the Polo Grounds and Candlestick and build the former and now again AT&T Park with a short right field so that his Babe Ruth (Mr. Bonds) could find the seats. It was the making of the franchise, which sold out - again - this year even though the team only tied for third in a weak division on the final day of the season - also yesterday.

P.S. Go Cleveland, Go Pirates!

Aug

19

Leaves and the Market, from Victor Niederhoffer

August 19, 2013 | Leave a Comment

On a visit to the Botanical Gardens today, I found myself thinking about the purpose of leaves in trees as a way of improving my knowledge of markets. I picked up some oak leaves and tulip tree leaves and saw many veins in them. The veins seem to provide more paths to exchange nutrients and perform photosynthesis. The leaves are very light, so they maximize their surface area relative to volume, thus giving them more opportunity for photosynthesis, and probably preventing an excess of loss of water through evaporation. But in handling the leaves, I was amazed at their toughness, like a abalone. In researching the subject, I learned that toughness of leaves, i.e. the amount of cellulose in them, is now considered the main way that leaves survive. It also reduces their palatability to predators.

On a visit to the Botanical Gardens today, I found myself thinking about the purpose of leaves in trees as a way of improving my knowledge of markets. I picked up some oak leaves and tulip tree leaves and saw many veins in them. The veins seem to provide more paths to exchange nutrients and perform photosynthesis. The leaves are very light, so they maximize their surface area relative to volume, thus giving them more opportunity for photosynthesis, and probably preventing an excess of loss of water through evaporation. But in handling the leaves, I was amazed at their toughness, like a abalone. In researching the subject, I learned that toughness of leaves, i.e. the amount of cellulose in them, is now considered the main way that leaves survive. It also reduces their palatability to predators.

What can we learn from leaves about markets. Perhaps a wider range at a price below increases their resistance to death? Perhaps a stronger book of limit orders (in contrast to Mamis's dictum that the larger the buy limits the worse the price?).

What can we learn from the roots of trees? I wish all my people would learn to have strong roots rather than deferring to the latest fashion or predictive hour? In general the trees change with the seasons? Can we learn from trees about ever changing cycles? The summer has been very different from the previous spring and winter this year. It always seems to be. Strong moves in one market, i.e. the bonds have overwhelmed the rest. And of course my favorites, the theory of uniform distribution, — why do trees together reach the same height,and my favorite of favorites, the theory of least effort which relates in part to how branches curve to have the same forces on them at all levels of the branch. But I know nothing about trees compared to the rest of you. What can we learn? How can it help us?

David Lillienfeld writes:

Let's play with this idea a bit further. We know that photosynthesis occurs in response to the presence of sunlight, and varies in response to such presence. The process takes place in specialized organelles. Might the organelles be like market makers? Without them, the leaf dies, ie, they are vital for providing the liquidity (energy) the system needs to survives. They need an external energy source to function, and in the absence of that energy, the supporting system (the leaf) dies. Though I'm not certain of the fact, I would expect that in the presence of sunlight, chloroplast number increases, much as market makers increase in the face of liquidity.

The analogy works to a degree, but I'm not sure where it might take us.

Alan Millhone writes:

I am not a stock forrester but can relate how the leaf veins branch out into many openings found in British Draughts Player.

The lines of play that go in many directions and studied and learned well gives you solid footing and deep roots of knowledge for a strong game at the board.

I can see where stock research in a methodical way can benefit the trader.

Aug

19

Backbone, from David Lillienfeld

August 19, 2013 | Leave a Comment

In this society, the notion of someone having any backbone is quaint. It is also wonderfully discordant with the realities of the society. Expediency has become our byword. Vision and courage are in short supply. Let's face it, few will take a risk unless it's with someone else's money.

In this society, the notion of someone having any backbone is quaint. It is also wonderfully discordant with the realities of the society. Expediency has become our byword. Vision and courage are in short supply. Let's face it, few will take a risk unless it's with someone else's money.

And our government is the best at using OPM's to mitigate risk…..well, the risk of their political cronies.

Jeff Watson writes:

The aforementioned men can be found on the few trading floors that are left, in back offices trading their own accounts. Ayn rand summarized it best when she said:

"The symbol of all relationships among [rational] men, the moral symbol of respect for human beings, is the trader. We, who live by values, not by loot, are traders, both in matter and in spirit. A trader is a man who earns what he gets and does not give or take the undeserved. A trader does not ask to be paid for his failures, nor does he ask to be loved for his flaws. A trader does not squander his body as fodder or his soul as alms. Just as he does not give his work except in trade for material values, so he does not give the values of his spirit—his love, his friendship, his esteem—except in payment and in trade for human virtues, in payment for his own selfish pleasure, which he receives from men he can respect. The mystic parasites who have, throughout the ages, reviled the traders and held them in contempt, while honoring the beggars and the looters, have known the secret motive of their sneers: a trader is the entity they dread—a man of justice."

Jul

25

Teamwork, from David Lillienfeld

July 25, 2013 | Leave a Comment

Back in the 1980s, when the concern was with Japan, Inc, the fad sweeping the US was teamwork. Japan, it was said, was in its ascendancy because of teamwork, and the US needed to focus more on teams if it wants to compete with Japan. So the US focused on teamwork. Guess what. When you focus on teamwork, the individual's approach to his/her own work takes on a different hue. Ketchum is just picking up on that.

Jul

24

The Muni Market, from David Lillienfeld

July 24, 2013 | Leave a Comment

In talking with several DailySpec listers the last week about Detroit, I was told that the bankruptcy filing to be (or then a fait accompli) had already been priced into the general muni market and there likely wouldn't be much reaction to the event itself. Now there's a suggestion that state law may have some role to play.

In talking with several DailySpec listers the last week about Detroit, I was told that the bankruptcy filing to be (or then a fait accompli) had already been priced into the general muni market and there likely wouldn't be much reaction to the event itself. Now there's a suggestion that state law may have some role to play.

Question to those in the muni market–what's the likely impact on the muni market if pension benefits are considered out of bounds for the bankruptcy court and the payment to creditors is reduced even further. Will the muni market exact a premium for future muni issuances from Michigan alone? For all munis? Or is this a non-issue?

Part of my curiosity is that I expect a lot of infrastructure spending to be supported by muni bonds. If there's a premium for the Detroit mess, that's less funding available for the IS work itself.

Jul

24

Apple, from David Lillienfeld

July 24, 2013 | Leave a Comment

I heard something on NPR this morning (from the CEO of Mashable) which got me thinking about Apple. Consider: Back in the early 1980s, Apple was flying high–it occupied the high margin section of the emerging PC industry and it was making lots of money. Its CEO Steve Jobs was seen as a major entrepreneur. However, by the mid 1980s, Apple had lost its way, as it maintained its margins even as it lost market share. Jobs had been jettisoned in favor of someone with no computer industry marketing experience. Apple maintained many of Jobs' hires as Apple saw its market share shrivel. The high flyer then was a software company whose offerings ran on a host of hardware platforms–Microsoft. Everyone could use Windows and everyone could use Office. Now, fast forward a generation: Apple is again flying high, determined to hold its profit margin even as it loses market share. But there's a new kid on the block offering a mobile operating system used with different hardware platforms: Android. And Jobs is no longer running Apple. And Apple is again run by someone lacking computer industry (or consumer electronics) marketing experience.

I heard something on NPR this morning (from the CEO of Mashable) which got me thinking about Apple. Consider: Back in the early 1980s, Apple was flying high–it occupied the high margin section of the emerging PC industry and it was making lots of money. Its CEO Steve Jobs was seen as a major entrepreneur. However, by the mid 1980s, Apple had lost its way, as it maintained its margins even as it lost market share. Jobs had been jettisoned in favor of someone with no computer industry marketing experience. Apple maintained many of Jobs' hires as Apple saw its market share shrivel. The high flyer then was a software company whose offerings ran on a host of hardware platforms–Microsoft. Everyone could use Windows and everyone could use Office. Now, fast forward a generation: Apple is again flying high, determined to hold its profit margin even as it loses market share. But there's a new kid on the block offering a mobile operating system used with different hardware platforms: Android. And Jobs is no longer running Apple. And Apple is again run by someone lacking computer industry (or consumer electronics) marketing experience.

Looking at this picture, I have to wonder if it isn't deja vu all over again. Now, I know that Apple has gazillions of cash that it can use to buy companies, but I'm looking at which of its acquisitions has been that helpful to its bottom line. Not much help that I can see. Kind of like Cisco during and soon after the dot-com boom and bust. Lots of money, not much to show for it. Its products are looking dated (and some products, like AppleTV, haven't appeared at all), several products have been introduced though they no longer elicit the oohs and ahs that characterized the products commanding the profit margins associated with Apple. Its execution on the software side has been little short of awful (the cloud in particular is something Apple doesn't get), and it no longer commands the attention of young engineers in the manner that it once did. And while it's PE is low, there's nothing to suggest that earnings will stay healthy, particularly if profit margins give way.

Is history repeating itself?

Gary Rogan writes:

Apple is followed by zillions of super-smart people who track every available piece of information, many in real time. It also has a lot of moving parts and a lot of very smart people working for them. I doubt it's feasible to make money by out-thinking them all without some identifiable edge.

anonymous writes:

Didn't they say the same thing about Japan in the mid 80's?

Gary Rogan responds:

Did Japan have a P/E of 10 and down almost 50% from its recent peak? There doesn't seem to be either irrational exuberance or irrational despair about AAPL but there is frenetic interest. It's latest numbers resulted in some pretty healthy volume after hours and a reasonable jump. Who knew how much it would jump and in which directions? Someone probably did, but it wasn't on the basis that Apple doesn't get the cloud. The point is, if there was ever an efficient market this is it. Not always, not for all time, but for here and now.

Jeff Watson writes:

Isn't every stock that's not on the Pink Sheets followed by a bunch of super smart people who get tons of info in real time? Do you think the market makers have a pretty good estimate of the value of the stock? Don't insiders in their particular companies know if their stock is too cheap or too expensive? Just because AAPL is a cultist type of phenomena, please don't ascribe mystical powers to the stock. It's going to do what it's going to do, without any regard for the super smart people who follow and trade it. In fact, personal experience tells me that the super smart people are going to feel the most pain.

Gary Rogan retorts:

I don't ascribe any mystical powers to it at all. It's a stock constantly in the spotlight. In my experience, there are "sleepy" stocks and there are highly followed stocks, in the sense of constant attention being paid to them everywhere. The market seems less efficient in the stocks that are not in the news all the time. If you have a long time horizon, and the highly followed stocks is showing signs of a mania, it may be a good short candidate, and the opposite if there is widespread despair, but it's hard to know. Of course it will do what it will do, I never claimed otherwise, but ruminating that their CEO, who at some point was in charge of worldwide sales, doesn't get marketing or the company doesn't get the cloud, or that Jobs is dead, or that there is this new kid on the block called Android would get you about as much as edge as me claiming that the world population is growing and needs more wheat and therefore going long wheat.

David Lillienfeld weighs in:

Let's deal with these one at a time, and keep the emotion out of it.

First, Tim Cook was EVP for Sales and Operations, but insofar as he's never held a marketing position in his career (certainly not as long as he's been at Apple), this position seems as much organizational as anything else. His marketing value-add seems to be pretty small, if not nil. Fact. Cook's role has been manufacturing, and he executed pretty well. But that's quite a ways away from marketing, I think you'll agree. There isn't any report suggested that Cook has ever had any involvement in marketing other than this title, and one must note that at the time Cook was placed into the position, Jobs was handling marketing himself. Fact.

Right now, Android is doing to iOS exactly what Windows did to Mac OS in the 1980s. Fact. Apple kept a closed system and IBM/Microsoft an open one. Guess what. The open system won. When the Mac came out, one of the things seen in its favor at the time was that, much as happened with the Apple 2, there was software around to run on it. Same thing today–except it's now in the form of the App Store. Again, fact. We're now seeing the same thing happen in mobile. Google may not be able to monetize Android, but that's probably a matter that will be dealt with once someone figures out how to monetize mobile. (That's opinion, but one I think is supported by facts.) Do you deny that Android has taken market share from Apple, that it's more widely used than iOS, or that iOS doesn't seem to have much place in the low margin East Asia market? Moreover, Apple focused on maintaining margins rather than going after market share–both during the 1980s and also during the recent period. Fact. Earlier, that turned out not to be the way to success. Fact.

As for Apple being followed, that's irrelevant. Apple was heavily followed in the first half of the 1980s. I remember it well. By the latter half of the 1980s, it was no longer followed because it was in the process of becoming irrelevant in the face of Windows. By 1997, the company was on the verge of bankruptcy with 90 days of payroll in the bank. Fact. That's hardly the setting for a followed enterprise. Successful companies are followed. When success disappears, so does the following.

Lastly, if you think Apple gets the cloud, then I suggest you review how Apple's efforts in that space have fared compared with its competitors. I know of few who would opine in favor of Apple's efforts, even the cultists. Let's not forget that fantastic roll out of Apple Maps. Fact. Enough said.

I also noted that Apple has lots of money to work with, but then again, back in the early 1980s, it did too. (It's worth remembering Microsoft was similarly fortuitous–and well followed–and I don't know that it has a similar following today as it did in years past.)

That a generation has grown up since Apple's last appearance in similar circumstances of adulation also suggests that the younger minions may have forgotten that Apple's earlier escapade didn't result in hegemony–far from it. Fact.

As for Jobs, the reality is that since Jobs died, Apple hasn't functioned anything close to what it did when he was around–and he was active until about a month prior to his death. Fact. He may have picked the management team to succeed him, but much as happened back in the 1980s, without Jobs, that team didn't perform well. The contrast with, say, Alfred P. Sloan or Andrew Carnegie, or John D. Rockefeller, or David Hewitt or Adolph Ochs, or Robert Noyce or … I could go on, but the one thing that separates this group of CEOs is that when they stepped down as CEO, it took at least two generations of managers after before the company hit much of a bump. That's the mark of a great CEO–in addition to what happened to the company on the CEO's watch. Jobs didn't do so well with it in the 1980s, and it appears he didn't do so now.

If you don't like the facts, that's fine. Don't like them. But those are the facts. I'll leave the other elements of your comments for some other time.

But let's stick to the facts.

anonymous writes:

Let's cut to the chase. Tell me the long term growth rate of AAPL's earnings and I'll tell you (+/- 10-20%) what the stock is worth today. The bloomberg consensus growth rate is 19%, so the stock is worth about 1090/share.

If you cut it to 10%, the stock is worth 512/share.If you use a 5% long term growth rate, the stock is wroth 340/share.

The primary reason that 19% is wrong is that AAPL is simply too big to grow at that rate — or it would suck all of the oxygen out of room. At 442, it's priced for about a 8.25% growth rate. Not crazy, but 8% is still a lot of growth for such a big company. But their buyback can provide a lot of help in achieving EPS growth. BUT — the chart looks good!

Jul

1

Egypt, from David Lillienfeld

July 1, 2013 | Leave a Comment

The military's ultimatum to Morsi seems destined to set off the powder keg now known as Egypt. At first, I thought this strange, since Morsi was threatening to go to war with Ethiopia. That's means going through Sudan and South Sudan (two countries not world renowned for their ability to co-operate with one another). But if the military, with its hands deep in the economic cookie jar, feels it's losing money with Morsi in office, it would likely move to oust him.

The military's ultimatum to Morsi seems destined to set off the powder keg now known as Egypt. At first, I thought this strange, since Morsi was threatening to go to war with Ethiopia. That's means going through Sudan and South Sudan (two countries not world renowned for their ability to co-operate with one another). But if the military, with its hands deep in the economic cookie jar, feels it's losing money with Morsi in office, it would likely move to oust him.

Egypt sent heavy armor to the Sinai-Gaza border and since I doubt that the tank crews are going to sunbathe in the summer sun, I'm concerned about their presence. Add in that Morsi has essentially destroyed the summer tourism season (or what little of it there was) with his appointment of a strict Islamist as governor of Luxor, and one senses that Egypt is in a pretty unstable state.

Did I mention that the country has only 4-5 months of foreign reserves available to purchase food and just about every other commodity needed (of which there are a lot)? Maybe that situation is forcing the military's hand.

Jun

24

Letter from San Diego, from David Lillienfeld

June 24, 2013 | 1 Comment

I moved to San Diego with my family for a new job about 3 years ago. While San Diego is nice (the weather can't be beat–even in comparison with Hawaii's), it's not San Francisco. Having renovated our house on the peninsula south of SF (we're in the northern part of Silicon Valley) to suit our needs and tastes only accentuates what we miss about the being by the Bay. I guess we're NorCal, not SoCal people.

I moved to San Diego with my family for a new job about 3 years ago. While San Diego is nice (the weather can't be beat–even in comparison with Hawaii's), it's not San Francisco. Having renovated our house on the peninsula south of SF (we're in the northern part of Silicon Valley) to suit our needs and tastes only accentuates what we miss about the being by the Bay. I guess we're NorCal, not SoCal people.

The one thing no one in my family misses in the Northeast winters (I keep telling them that they had it good compared to the hearty souls in Minneapolis, where I took my residency training.) There are lots of things upended in moving 500 miles, things that one may not consider particularly significant. Examples include finding a new physician, finding a new racquetball partner, figuring out if there's any place to find a good bagel (Izzy's in Palo Alto wasn't quite at the old H&H level, but it was close)–we're still working on this one, and so on.

Something that one might dismiss as one of those myriad things one needs to feel "settled" in an area is a barber. In San Diego, barbers run from $5 (I can't recommend at least two–I thought the shears likely had some Hep B and/or C) all the way up to V's which charges $25 for basically the same haircut, albeit in a place with wood paneling (I guess the wood paneling adds somehow to one's appearance, but I remain unsure as to how).

I found a barber who charges $8 for a pretty good cut. The shop is down near the navy base, and her husband is, not surprisingly, a sailor, now deployed someplace in the Pacific/Indian Oceans. My guess is that she's in her mid-20s, no children. She and her husband have decided against starting a family as yet. Between his deployments and her constantly working at the barber shop, they didn't think having children made sense for themselves just yet.

I went for a haircut yesterday. She wasn't as jovial as she usually has been. For the past 3 months, as the sequester has taken hold, she's observed a fall-off in business. It's been noticeable. She said that she and her husband had already begun cutting back on expenditures, expecting there to be some impact of the sequester on her (and their) income. They've already eliminated any vacations and some clothing purchases for the foreseeable future. She volunteered that some of her friends (with at least one spouse in the military) are using food stamps. She also mentioned that her brother-in-law is an aviator out of Miramar and his flying times are being reduced, supposedly by the sequester. Regina commented that her immediate worry is with their apartment. Their lease is up at the end of August (I think that's what she said), and the landlord told her yesterday that their rent will be going up to cover additional interest costs since borrowing costs are going up.

In northern San Diego County, away from the navy base (south of downtown), one might have expected less of an impact of the sequester. However, there has been something felt by some of the businesses–probably because of Camp Pendleton, which occupies a spit of land between San Diego and Orange County. Asking some of the merchants at the outlet mall in Carlsbad about business, there's some suggestion of softness, but there's been layoffs in the mall, at least not yet. What happens next though, is a (to use Yul Brenner's phrase) a "puzzlement."

The local biotech industry is slowing making its way back from the premature death sustained when Biogen Idec closed its local campus. Health in general, though, seems to be in growth mode. So is mobile engineering. And there's some suggestions of an improvement in the local tourism trade, with the opening of non-stop service to Tokyo. (The inaugural flight was greeted by about 200 cheering individuals positioned just off the edge of the runway. They clapped when they saw the plane overhead as it was landing.)

Most are aware of the weakness of the economy–the employment growth numbers remove the little doubt about that condition. Though we are used to looking at number, there are people behind those numbers. As an epidemiologist during the early and mid-1980s, it was possible to become numb to the statistics behind the AIDS epidemic. The numbers were unlike anything seen in the US for many years. Each of the persons represented by those numbers was someone's son or daughter; someone's husband, boyfriend, girlfriend, wife; someone's brother or sister; and so on.

It's easy to forget about the people when looking at the data. Data don't have faces. They don't have arms and legs. And most of the time, they don't have voices. That shouldn't remove the reality that there are people behind those numbers. At the same time, one must remember that there are still real ills present in our economy, that dealing with them will require dealing with real pain and that, since we are a globalized economy, the effects of what ever actions we take are likely to have impact far from our shores (I'm thinking of something more than the butterfly effect). How we go about doing it, with what level of rancor and disdain (which seem omnipresent in DC these days, which isn't surprising I guess given the absence of political leadership by just about anyone), will say provide its own Rorschach Test result about what the US is all about, how we want to be perceived, and what values do we hold dear and which are just "so much fluff.

As Regina was telling me about her family's situation, I wondered when do we, as a nation, begin to have an economy growing sufficiently that Regina and her husband feel they can start a family, that they can take a vacation (even if only to Palm Springs overnight), that we unite rather split apart, and that not merely allows civil discourse about our society and what we want it to look like and function but rather encourages it. At its core, it's about how we interact with one another as people, how much we value someone else as an individual and not a statistic in a table or a model. Perhaps it's a matter of giving the country more time to address its ills. I'm not so sure that time will make that much difference by itself.

I think with all of the activities in our daily lives, we are quick to stereotype–almost like zombies–someone based on an utterance or two. It's faster that way. It's also the lazy approach. It takes effort to get to know someone, to see them as more than a statistic on a page or in a table. Let's hope that we, as a country, get past zombie mode and move the country forward. For all of our ills (and there are many of them), the US remains as the sole superpower on the face of the Earth. Let's not squander the opportunities to fashion our world and realize all of its potential. Until then, however, I think I'm going to think about letting my hair grow longer.

Jun

14

A Father’s Day Tribute, from David Lillienfeld

June 14, 2013 | Leave a Comment

My home office adjoins my daughter's room. Her last day of high school (and therefore public school) was today, and now that she's finished it, she's home finally clearing out her room of the school year's detritus. It's amazing how much "stuff" she managed to keep in her bedroom. Walking by that room's door brings to mind the scene in A Night at the Opera of the ship's storage locker holding something like 10-15 people. Tomorrow, she will join her class at graduation; at some time, she and some of her peers will be saluted for academic achievement. I'm told that that's the top 5% of the class. Given the nature of the high school, that's a better result than my wife and I had expected. Her high school is rigorous–almost to a fault. During spring break, some of her friends now freshmen at MIT and Cal Tech came by for some pizza. The frosh from both schools kept commenting on how much they were enjoying college. It was easier, for some courses much easier, than high school. Both my wife and I were shocked, but perhaps these kids aren't aberrant in their assessments.

My home office adjoins my daughter's room. Her last day of high school (and therefore public school) was today, and now that she's finished it, she's home finally clearing out her room of the school year's detritus. It's amazing how much "stuff" she managed to keep in her bedroom. Walking by that room's door brings to mind the scene in A Night at the Opera of the ship's storage locker holding something like 10-15 people. Tomorrow, she will join her class at graduation; at some time, she and some of her peers will be saluted for academic achievement. I'm told that that's the top 5% of the class. Given the nature of the high school, that's a better result than my wife and I had expected. Her high school is rigorous–almost to a fault. During spring break, some of her friends now freshmen at MIT and Cal Tech came by for some pizza. The frosh from both schools kept commenting on how much they were enjoying college. It was easier, for some courses much easier, than high school. Both my wife and I were shocked, but perhaps these kids aren't aberrant in their assessments.

That my daughter, our youngest child, will be graduating within 24 hours brought to mind my graduation. For my daughter, the biggest graduation in her life thus far will be the one tomorrow; for me, it was 29 years ago when I graduated from medical school. It's not that it was the last graduation I would share with my father, though it was–or even the last time I would see him, though it was that as well. It's not that I thrived in medical school. Hardly, having bombed in biochemistry (I think it's psychological moreso than the material, but that's for another thread) and having a simply awful experience with one medical resident (I nearly dropped out of school in my third year–almost unheard of; on hearing of my interest, the Dean inquired as to what was my reason, and when I explained, she promptly called in that year's class of 2nd year residents in medicine and read them the riot act about abusing the 3rd year medical students. My classmates were aware of the situation, and when the abuses stopped-at least for my rotation–many thanked me, though I told them it wasn't altruistic on my part, it was survival), I saw my graduation from medical school as a triumph. It's not the degree of which I am most proud–that would be my MSEngineering, and it's not the one I worked hardest for–that would be my MBA in marketing, nor even the degree which most of my peers associate me with–that would my MPH in epidemiology. It is, however, the degree with which I most identify, the one most enmeshed in my identity.

There are parts of medical school I would dearly love to forget–but I can't, though I have no doubt that I am a better physician for having lived through them. Telling the mother of a 3 month old kicking and screaming with a 103 degree fever a few hours later that her son had died, being told of the attempted suicide of a pregnant 15 year old girl I had attended to at clinic three days before and diagnosed her pregnancy (she wanted an abortion and was terrified of what her parents–both alcoholic drug users (they were also "practicing" Catholics–at least that's what they said–who later informed me they wouldn't have consented to an abortion for their "slutty daughter"–might do to her if she asked for their permission), digging elbows deep into someone perforated bowels at 3 AM and dealing with seeming endless human waste–yes it's life saving, but that doesn't mitigate the stench and it doesn't stop the waves of nausea or the multiple re-gownings and re-glovings, the 17 year old who decided to take on a tree while riding his snowmobile during a blizzard–the tree won and he sustained multiple organ failure, including a closed head wound that left him in a vegetative state even as he recovered from a severed liver that a decade earlier would have rendered the head injury meaningless as he would have died of the hepatic damage, my first patient during my medical rotation–Mr. B–who had classic hypothyroidism–the confirmatory lab test had to be sent to the VA central lab in Ohio instead of the local lab and the results weren't due back until Monday; unfortunately, Mr. B developed a pneumonia, becoming septic, and dying on the Sunday before, and the too many meetings of the Baltimore Knife and Gun Club on Friday and, especially, Saturday nights. As bad as telling the mom about her dead baby (threw up afterwards, and my attending, cued in by my resident, had the good grace to sit down and talk with me about it; I asked her how she managed to deal with such things, and she responded that you don't, and that if you did, it was time to leave medicine. That may seem a bit harsh, I realize, but I've come to understand what she meant.

In medical school, during the first year intro to clinical diagnosis, there's much effort expended on trying to get med students to empathize with patients, though not sympathizing with them. I began to understand the idea much better after talking with my attending what was meant by the empathic physician that we strive to be, that our patients need if we are to be effective in helping them maintain or improve their health.

In medical school, during the first year intro to clinical diagnosis, there's much effort expended on trying to get med students to empathize with patients, though not sympathizing with them. I began to understand the idea much better after talking with my attending what was meant by the empathic physician that we strive to be, that our patients need if we are to be effective in helping them maintain or improve their health.

Among the "ghosts" in my memory is the 20 year old man who presented at surgery clinic with his partner. He came from a religious family out west and had come to Baltimore when he was 16 to get as far away from his family as after he came out to his parents, they told him he would burn in hell, that he should forget that he was a member of their family, that his brother and sister were to be told he had died and that they should forget him, and requested that, as they kicked him out of the house without so much as a change of clothing, he change his name so no one would associate him with their family. He had met his partner while homeless on the street, and the two bonded. He managed to put his life together enough to gain admission one of the local colleges on full scholarship as his partner became got a job on a construction crew digging ditches (also a story for a different thread). He presented to surgery clinic with groin swellings. It was the fall of 1983, the AIDS epidemic was in full swing with every sign indicating that it was a infectious disease. (At that time, I doubt that the 2/3s of gay men resident in San Francisco in 1981 realized that they would die from HIV infection.) Understandably, he and his partner were terrified about these swellings. We biopsied them–it's the only time I've quadruple-gloved. He had a lymphoma, and in short order, developed pneumocystis carinii. Long story short, he had AIDS. I wasn't on the medical team treating him but I kept up with what was happening to him in hospital and I managed to stop in and talk with him a few times. He was a bright guy, witty too. He was thinking of becoming an engineer–he enjoyed math and dreamt of using that knowledge to change the world. He was dead within 6 months. I don't know what happened to his partner.

Those experiences contrast with some of the other ones, perhaps less emotionally challenging, perhaps not, such as my first appendectomy (not holding the retractors but doing the surgery; what should have been 30 minutes under anesthesia for the patient became 60 minutes for me–not unusual, I'm told), trying not to cut too deeply, hoping to pick up the peritoneum, all of 4 cells in thickness, sweat pouring out of my brow (and being attended to by a fortunately doting circulating nurse) even as the temperature in the OR stayed a steady 63 degrees. The patient came through the procedure OK. For many medical students, their surgery rotation, while grueling, is also the most fun one. One gets to see the pathology present, instead of surmising it the way an internist would. At the same time, one comes to appreciate that being a surgeon takes a certain personality–not just bravado or ego but also perspective on the role of a physician in the treatment of a patient. A surgeon is cutting on a patient to help the patient therapeutically. She cuts on living flesh seemingly on a daily basis. Granted, it's with anesthesia, but even so, it is a concept which in the abstract may not seem challenging, or even when one's encounters with the surgeon are infrequent. Seeing surgery daily, though, is different, whether it's the surgeon, the surgical nurses, or the anesthesiologist. I think the former two have the most challenge. It's one thing to nick someone's skin for a biopsy, it's another to open a chest to transplant a lung. There's the old joke about the surgical resident at the poker game tossing $20 into the pot with an ace-high hand, while the medical resident hems and haws about whether to raise a nickel with a full house. It fits better than most might appreciate.

Graduating from medical school meant a change not merely in life but in me as a person, in my identity. I don't know that that was true for all of my classmates, at least not that they were willing to say come reunion time. It was for me.

As my daughter graduates, so will my wife and I. Empty-nester syndrome may hit, hopefully not. My daughter will move on to the next phase of her life, to begin adulthood. Both my wife and I wish that she comes through her college experience as enriched as she has her high school one.

In 24 hours, her world will change in ways she won't appreciate for years to come. Perhaps her mother's and father's will do so too?

May

26

Memorial Day, from David Lillienfeld

May 26, 2013 | 1 Comment

By tradition, in the United States, Memorial Day has come to mean the start of summer. Swimming pools open, schoolchildren begin to think of school being out (and the interminable playing of Alice Cooper to drive home the point), and for some (like my daughter), it's prom season, graduation and for others, a walk down the aisle and up to the alter. On Sunday, the Indy 500 will take place. There are all manner of other activities associated with this weekend.

By tradition, in the United States, Memorial Day has come to mean the start of summer. Swimming pools open, schoolchildren begin to think of school being out (and the interminable playing of Alice Cooper to drive home the point), and for some (like my daughter), it's prom season, graduation and for others, a walk down the aisle and up to the alter. On Sunday, the Indy 500 will take place. There are all manner of other activities associated with this weekend.

But none of these activities relate to Memorial Day itself (except insofar as we can undertake these activities). As I look out my window and watch the cars coming out of Camp Pendleton onto i-5, it is hard not to be reminded about the meaning of this holiday, designated to remember those who "gave the last full measure of devotion" to ensure that we could continue to enjoy the freedoms provided by this nation. When I lived in the SF Bay area, we would go over to the national cemetery in San Bruno for the memorial service. Though there are national cemeteries in the San Diego area, we finally found one with such a service, and we will go there on Monday.

My grandfather used to tell my father that while, as an immigrant, he could not appreciate the liberties afforded by the United States as much as my father (born in the US) did, he could understand them better than my father could. He told my father that as someone who did not grow up enjoying those liberties, they were not inculcated into the engrams of his mind as they would be with my father's. Though I'm sure there may be those on this list who will take me to task for placing the issue in such terms, it nonetheless captures for me and my family the spirit of Memorial Day, not merely remembering the fallen, but also what they fell for. It matters.

As we have since my wife and I married back in 1989, we will play "Find the cost of freedom" on Monday evening. When our kids were born, they didn't understand why we put this song on the hifi (and then the CD player, and finally, iTunes). As they grew, they have come to understand the reasons. I can only hope that they impart that understanding to their children. I also hope that while many head off to the beaches or the backyards for BBQs and the like, they take a moment to remember. It matters.

Have a happy, safe, meaningful holiday–I am sure everyone will take a moment on Monday to remember.

May

21

For Baseball Buffs, from Scott Brooks

May 21, 2013 | Leave a Comment

David, you are obviously much more knowledgeable about the game of baseball than I, so I'd like to ask your opinion on Gibson and Koufax.

How do you think they would have fared in today's modern game and how would they have been used by their teams?

David Lilienfeld writes:

Thank you, but I doubt the premise of your question is true. Gibson and Koufax would likely still anchor their respective teams, but neither would likely get more than 25, maybe 26 starts, tops. I doubt that their arms would have been as strong–they wouldn't have developed to be, they would also throw only 100-110 pitches/game (sorry, having seen the great Orioles pitching staff of the late 1960s/early 1970s, I'm a big believer in strong arms that throw complete games). Their control would continue to have been outstanding. The thing about both Gibson and Koufax is that they pitched enough innings and in enough games that when they got tired and they knew the bullpen staff was pitched out arm sore, they would suck it up and make a go of it. They would change their set-ups, mix-up pitches more and so on. But a pitcher can only be that mature if given the opportunity to play–and that's something verboten today. So while both of these folks would have excelled, I doubt they would have been the dominant forces that they were in their day.

Take a look at their records, or throw in Jim Palmer and Denny McLain too, if you want. They routinely pitched more than 270 innings–good seasons and bad. It wasn't until Koufax started throwing more than 220 or so innings that he came into his own. Heck, even in his last season, when his elbow had been so threaded by arthritis that he needed to soak it in ice for 2 hours after each game, he threw 27 complete games. I guess you could say that his career would have lasted longer if he hadn't pitched as much as he did–except that that's how he found his groove.

It's not as though this was something that characterized only the greats of the day. Jim Kaat started 42 games one season–and he played for more than two decades. Never mind that he won 280 games and was never elected to the HoF. Take a look at Steve Carlton. These guys were good, sure, but I think that, like Koufax, part of their greatness was that they were worked hard.

I'm sure there are those on this list who will say everything's fine with how pitching staffs are managed today, that I'm a dinosaur for taking such a risk with someone's arm to let them pitch so many innings, start so many games–that that experiences really isn't necessary for pitching excellence, never mind greatness along the likes of Koufax and Gibson. Much as I think the days of someone as competitive as Frank Robinson are passed, so too are the days of the dominant pitcher. Consider Jim Lonborg, who pitched more than 270 innings in his CYA year (1967). During the World Series, he pitched game 7 on two days rest. Two days! Would any manager even think of doing that today? I doubt. it. I could hear the players union rep going to court about it violating some contract clause. His wife might complain that he's being asked to do the impossible–3 days rest is pushing it as it is. Nope, the days of the strong pitcher are done.

Koufax and Gibson: we likely won't see their likes again anytime soon. Probably not in my lifetime, at least. And I doubt that if they came up today, they wouldn't be nearly as dominant, good as they might be. They would never be given the chance in the first place. It's almost five decades since Koufax retired, and people still talk about the devastating Koufax curve. The same is true of Gibson and his fastball. You need someone with the insights of a Branch Rickey to go back to the four man rotation that produced a Koufax, a Gibson. Do you see a Branch Rickey around? Me neither.

All of which may not be surprising. 100 pitches isn't very many, after all.

(Sorry for the long-winded answer, but pitch counts are a tender topic for me. I don't like coddled arms–just a sign of a pussy-wussy approach to managing the bull pen.)

Stefan Jovanovich comments:

Koufax and Gibson would most certainly be stars no but so would Bob Feller and Christy Mathewson (Tom Glavine as a right-hander). What has changed in baseball is that starters can't start at 80% and then work up to full capacity the way they did in the good old days. Matt Cain's innings pitched have matched the old timers but what he and other top-line starters have painfully discovered is that they now have to pitch the first and second innings with intensity. The technology revolution has allowed all hitters to diagnose their own swings and pitchers deliveries the way only a genius like Ted Williams once could do with only his own eyes. Felipe Alou sat down with his son Moises when the Giants got their first screen analyzer; his comment was "I never understood my own swing". The pitch count is stupid because it is a hopelessly crude metric. 75 pitches at Coors is a solid performance; at AT&T the same effort should produce 95-100. But no one now can go as long as pitchers once did; hitters aided by video study won't let them.

http://en.wikipedia.org/wiki/Felipe_Alou

David Lilienfeld replies:

Respectfully, Cain doesn't have the innings pitched numbers of past cohorts. And I disagree on the "new" need for intensity. You don't pitch an ERA of 1.1 without that same intensity, and while analysis of one's swing is helpful, pitch selection is moreso. You could have an optimal swing, you still couldn't hit a Koufax curve. Palmer's slider wasn't quite so devastating, but if he was on his game, it didn't much matter how good a hitter you were, you weren't going to hit the ball.

The thinking these days seems to be that with all the money being paid to pitchers, no one wants to risk an injured arm from over use (!). Hence the five man rotation.

Maybe we're just going to have to agree to disagree.

May

15

MOOCS, from David Lillienfeld

May 15, 2013 | Leave a Comment