Jan

7

Inauspicious Starts, from Kim Zussman

January 7, 2014 | Leave a Comment

The first 3 trading days of 2014 have been declines in the S&P 500. Going back to 1960, there have been only 6 other years starting with 3 consecutive down days. Here are the returns of the following 3-day intervals:

Date DDD nxt3

1/3/2005 0.005

1/2/1991 -0.030

1/2/1985 0.009

1/3/1978 -0.028

1/3/1977 0.004

1/2/1968 0.012

avg -0.004

Jan

7

Power Prices, from Carder Dimitroff

January 7, 2014 | Leave a Comment

I've never seen anything like this. Power prices in the Mid-Atlantic region are normally $30 to $40 this time of day for this time of year. Right now, prices are over $1,800 system wide. The lack of price diversity suggests there are no transmission constraints of consequence. It also suggests "the grid" does not have enough generation.

There will be consequences. Planners will be forced to rethink their reliability models. This could be good news for Exelon, NRG Energy, Calpine, Dynegy and Atlantic Power.

Jan

7

Most Important Lessons and What We Can Learn From Sports, from Brett Steenbarger

January 7, 2014 | Leave a Comment

Here are the three most important things I've learned from you and the DailySpec.

Here are the three most important things I've learned from you and the DailySpec.

1. Count. Then count some more. If you see something you think is promising, capture it in a statistical test and see–first hand–how correlated it is with what you already know and how much variance in prospective price change it truly accounts for. There is no better antidote for overconfidence bias (and no better stimulus for humility, objectivity, and perspective) than to rigorously test one's ideas.

2. Explore. What you observe in nature, human events, music, and so many other facets of life can teach you a great deal about people and markets. Some of the best market inspirations come from being away from markets and absorbing wisdom from insightful people, good books, and the arts and sciences.

3. Achieve. Half of life's battle is staying young-hearted and benevolent in spirit. There is no better barometer of a person's sense of life than seeing his or her emotional response to great achievement. Being young hearted means staying inspired and always pursuing new vistas. It means reveling in the best of others and thereby fueling the best within us.

Victor Niederhoffer writes:

I believe that most of us including me, consider Brett one of the most sagacious personages we've ever had contact with. He says explore exploring "what you observe in nature, human events, music, and so many other facets of life can teach you a great deal about people and markets. Some of the best market inspirations come from being away from markets and absorbing wisdom from insightful people, good books, and the arts and sciences."

I thought it might be useful to explore if there are some things we learn from sports that might be useful in markets. I have some ideas along these lines like offense wins the game more than defense. The home team always wins. The first blow is half the battle. Wins by a few points are not indicative of future success. The lucky shots and lucky wins tend to reverse. The end of the game tells the form. Slow and steady wins the game. The horses change at the beginning of new season. Start young if you wish to achieve mastery. Don't play your opponent's best game. You can't run with the hounds and play with the foxes. I haven't quantified many of these ideas, but some I have. But Brett seems to imply that big ideas even when not quantified (perhaps the counting can come later ) can be useful. I'd like to hear if any of you have ideas from sports helpful for markets, (other than that Smith and Antoni are the curses from the Bad One).

John Floyd writes:

Focus on developing a good base of fundamentals(trading principles/methodology) and follow them, gimmicks and tricks will only go so far at higher levels.

Play to your strengths, don't trade others ideas or positions.

Longevity and being able to stay in the game is key, you can't win if you are ejected from the game.

Maintain balance, overreaching and thinking you can master many markets often spreads one too thin.

Cross market feedback mechanisms(how does a slowdown in China impact Brazil, etc.), skills in one sport are often complementary to others.

Discipline and routine, when this change it is all too easy get off track.

Jim Sogi writes:

1. Big waves come in sets, and rarely is the first the biggest. Never take the first wave.

2. Trust your board. Stay on it as long as you can. Riding until the end of the wave is the safest exit.

Jan

6

Review: The Wolf of Wall Street, from Marion Dreyfus

January 6, 2014 | Leave a Comment

I went to see Wolf with a friend who has zero investments. As we watched the film, which for all its 3-hour length flew by in a compulsively sickening but sustained high-wire act of what's next?, he commented that she owns no securities. Now, watching this debauchery, he would never invest with this species of human infection.

I went to see Wolf with a friend who has zero investments. As we watched the film, which for all its 3-hour length flew by in a compulsively sickening but sustained high-wire act of what's next?, he commented that she owns no securities. Now, watching this debauchery, he would never invest with this species of human infection.

When I spoke with my account manager after the film, I admit that even I–much more sophisticated than my friend, if far less knowledgeable than anyone in finance or the Speclist–also spoke with some shaded caution, as the film reminded me of the storied excesses that were tamped down in the 80s, 90s and aughts.

The initial article in Forbes that depicted Jordan Belfort as an ethics-challenged trader-wolf, Scorsese or the Belfort biographer would have us believe, initiated a tsunami of voracious young money-hungry who washed up in waves, excited by what they had read. But our reaction through the 3 hours, never less than interest, was yet never more than soured observation. Monitoring my reactions as the film unspooled, I was troubled, often found myself grimacing, disbelieving and disgusted. The man gave nothing back, and treated those who behaved less avariciously than he with oblivious cruelty. The single person who benefited from his early largesse, we are told in the film, is a female stockbroker who was given $25,000 at the start of her company tenure. We don't know if that is even true.

What is true, but got not one second of screen-time, were the pigeons, the wealthy and mostly not-so-wealthy who lost their savings, their IRAs, or their families in the wholesale losses engendered by the unscrupulous stockbrokers of Stratton Oakmont.

Earlier films in the same genre—Wall Street and sequel, Boiler Room, Glengarry Glen Ross, even the current American Hustle—spare a reel or two for the sorry shards of those impacted by all the coked-out fleecing. Though Belfort has by now served several years for his fraud and illegalities, he makes five-figures for motivational talks. Few of his numerous victims have yet gotten a dollar-for-dollar restitution. We see the Whee! rollercoaster, never the people vomiting outside the ticket booth. Belfort's sleazy partner, played by Jonah Hill, almost chokes to death from a failure of coordination brought on by heedless blow inebriation—but in real life, there must have been more casualties, directly, from that rampaging copulative and pharmacopic careening.

The core group of clueless dufusses who began the company with DiCaprio/Belfort discuss what they can and cannot do when they debate hiring dwarves to toss at a Velcro money wheel. The thought that such a subcivil act is abhorrent on the face of it never enters their mind. They are concerned only with the lawyers' codicils on what is actionable insofar as law and crossing the line goes.

The drug-taking is endless, such that one doubts they would not have suffered cardiac arrests after even a few months of such pharmaceutical free-basing. Similarly, the women, prostitutes and for-hire, blur into a montage of backsides and breasts. The coarseness of everyone in major focus, and their vulgarity, is worse than that seen in the more resonant film, AMERICAN HUSTLE, where a few people could claim righteousness (or the movie poked fun equally at all societal tiers, frauds and famed, lawyers and lawmen, layers and layettes. In Wolf, only the FBI seems above greed and compromise for lucre, and even that's dicey for most of the film. Though Belfort clearly adores his second wife, he sees no problem whatsoever in orgies on planes, the office loo and anywhere else with anyone handy, even grading their whores in three levels for the audience's benefit. Oh, yes, he breaks the fourth wall frequently, in the manner of another Scorsese exemplar, Casino, to speak directly to us.

The drug-taking is endless, such that one doubts they would not have suffered cardiac arrests after even a few months of such pharmaceutical free-basing. Similarly, the women, prostitutes and for-hire, blur into a montage of backsides and breasts. The coarseness of everyone in major focus, and their vulgarity, is worse than that seen in the more resonant film, AMERICAN HUSTLE, where a few people could claim righteousness (or the movie poked fun equally at all societal tiers, frauds and famed, lawyers and lawmen, layers and layettes. In Wolf, only the FBI seems above greed and compromise for lucre, and even that's dicey for most of the film. Though Belfort clearly adores his second wife, he sees no problem whatsoever in orgies on planes, the office loo and anywhere else with anyone handy, even grading their whores in three levels for the audience's benefit. Oh, yes, he breaks the fourth wall frequently, in the manner of another Scorsese exemplar, Casino, to speak directly to us.

Scorsese's protagonists' motto, seen in this character as well as his other top-ten draws in Goodfellas, according to most of his oeuvre, is Want. Take. Simple. They snort enough nose-candy to mantle the Matterhorn an inch deep.

This was not prehistory: Didn't the female associates in pump-and-dump Stratton Oakmont feel devalued and denigrated by the disrespect and freak-show testosteronic hedony by their male colleagues? Didn't anyone get socially transmitted diseases?

And just sayin': Didn't the female associates in pump and dump Stratton Oakmont feel devalued and denigrated by the disrespect and egregious freak-show hedony by their male colleagues? Didn't anyone get socially transmitted diseases? Sexual harassment was well-known at the time: Did no one ever sue in this rank tank? Even Belfort's father, played by Rob Reiner as a shreier [screamer]against obscenely high T-and-E ("T-and-A" in the story) receipts, comes across as wistful he came along a generation too soon to enjoy the same… avocations his son is enjoying. More amorality.

There was no electric effervescence in the theatre, as you get from many movies that goose the public sensibility. Everyone sat in his or her private funk, watching the limitless crashing of our tradition-taught ethics. There was no laughter, not even any humor. There was silence and glumness at the spectacle of such dishonor. Worse to tell, this occurred in the late 80s and early 90s. But we are scarcely shed of this back-room bacchanalia even today. Much of what Scorsese shows could easily be updated with Madoff and his collective successors.

Do the corrupt goings-on and relentless abuse of women and bodily functions entertain, or do they instruct the young and impressionable that, say what you will, such unregulated frat-party-room excess pays off in the end. Babes. Pills. Candling backsides. Casual betrayals. Incestuous aunts. Exotic homes, cars, yachts. But also: Broken homes. Divorces. Swindled masses. Ruined lives. Children traumatized.

Does such a shocking glam-flam-stank-you,-ma'am make viewers less inclined to try to pull off such a litany of larcenous trespass, or does it instead encourage hot-breathed replication at any cost?

Is Wolf a howl of indictment, or an ode to the overdone olfactory?

Jan

6

Stats Songs, from Duncan Coker

January 6, 2014 | Leave a Comment

This may be already be obvious, but there is an amazing similarity between statistical analysis and writing country music songs. In song writing, you have two or three verses and a chorus to try to convey one idea and maybe a supporting storyline. The chorus has to be convincing, and if you accompany this with a nice melody the song will have an emotional impact on the audience.

This may be already be obvious, but there is an amazing similarity between statistical analysis and writing country music songs. In song writing, you have two or three verses and a chorus to try to convey one idea and maybe a supporting storyline. The chorus has to be convincing, and if you accompany this with a nice melody the song will have an emotional impact on the audience.

The same is true in statistics. The best graphs, tables and charts are the simple ones that can easily convey one big idea. Statistics when presented well have an emotional impact, just like a song, that wow affect. True it is hard to hum confidence intervals or t-scores, but otherwise they are not to far removed.

Jan

6

Tyler Cowen on Why Bitcoin Will Plummet and Why it Won’t, from Gordon Haave

January 6, 2014 | 1 Comment

Tyler Cowen recently wrote and article about "how and why bitcoin will plummet in price".

Tyler Cowen recently wrote and article about "how and why bitcoin will plummet in price".

I think the argument is 100% flawed. A currency works because everyone agrees that it does — nothing more and nothing less. Even the Gold Bugs don't seem to understand that. That is, you accept dollars for your product or service because you think that you can use the dollars to pay employees and vendors and then use the leftover money to buy stuff for yourself. People accept Bitcoin's now because at some level at least they are confident that they can spend them on goods that they want. (and that there won't be a Zimbabwe like debasing of the currency in the meantime).

From his post he writes: "For purposes of argument, let's say that a year from now Bitcoin is priced at $500. Then you want some Bitcoin, let's say to buy some drugs. And you find someone willing to sell you Bitcoin for about $500."

And he follows up with an explanation of a theoretically superior digital currency and says: "So you buy some newly minted QuitCoin for $400, and its price springs up pretty quickly, at which point you buy the drugs with it."

Here's the flaw: No, you don't. Why not? Because the drug dealer isn't going to take the Quitcoin because he hasn't heard of it and doesn't know what he will do with it when he gets it. Tyler than argues that the Quitcoin isn't going to work either because a digital coin superiorior to the Quitcoin is going to come along, and so it goes.

But that only supports the Bitcoin, actually. People will keep taking bitcoins and keep transacting in Bitcoins because people take them now. The thought that there is an infinite other amount of digital currencies that will just come along is only going to get people to just stick with what they already know.

Bitcoin is simply an agreed upon medium of exchange.

That being said I don't personally think that it will survive in the long run. I can't imagine any government allowing it to succeed. With the total market value of bitcoins outstanding it wouldn't cost all that much for a government to engineer massive run-ups followed by crashes in order to scare people away from them. I wouldn't be surprised if that is what we are in the middle of right now, but I don't want to get too political in this forum.

Jan

6

Rock and Roll Lost a Great One Today, from Scott Brooks

January 6, 2014 | Leave a Comment

As children we grow up listening to our parents music, but over time we develop our tastes. No matter how much my tastes changed, there was no amount of Led Zeppelin or Lyndard Skynard that made me stop loving what I heard on the AM radio driving down the road in my parents car.

As children we grow up listening to our parents music, but over time we develop our tastes. No matter how much my tastes changed, there was no amount of Led Zeppelin or Lyndard Skynard that made me stop loving what I heard on the AM radio driving down the road in my parents car.

One of those groups that I always enjoyed was the Everly Brothers.

Wake up Little Susie, Bye Bye Love, and my personal favorite "Bird Dog".

Well, a chapter of Rock and Roll was closed yesterday as we lost Phil Everly.

In my opinion, the Everly Brothers were one of the defining sounds of the early days of Rock and Roll. For those not familiar the Everly Brothers, here's a sampling…..

Jan

6

An Investment Ideas Wiki, from Richard Owen

January 6, 2014 | Leave a Comment

An interesting idea I heard is to apply open source principals to speculation.

I started thinking, where has open source historically been successful? Software. And it interesting to note that many of the titans in open source software were quite zealous left-libertarians who believe in things like "information wants to be free". Profit was not high on their lists. What we do here is, already, perhaps somewhat akin to this, but quite unstructured. There is a lot of thoughtful debate, but relatively few actionable investment ideas. But that's not to say that the debate doesn't spur profitable thought processes.

The problem with actual investment ideas is 1. trade signals dissipate once published, 2. investment is a bit like the Chinese civil service exam, in that one must state everything that one knows in order to answer the question successfully. That's probably why Izzy Englander settled on a. a track record, b. fiduciary checks, and c. some investment of his own assets in selecting managers, rather than heavy diligence of the investment ideas themselves.

Similarly, there is an analogy to the Chair's book. It was full of structural ideas, but not full of trade signals. I believe someone followed up by publishing a book of the Chair's trade signals. I do not know what impact that had upon the signals.

One could say that the theoretical academic finance arena is a little like the open source version. And the profit potential of published finance papers is… mixed.

Open source cars are probably somewhat about fulfilling the product desires of "hobbyists" and its interesting to see how that scales. But is "hot rod" design part of the spectrum of things like stabling a racing horse and sponsoring an off-broadway show, for which the rate of return is typically low, because the wealthy, intentionally or otherwise, provide subsidised funds for their passion.

Product design feedback, hobbyism, and scaling profitable products all have intersections, but blending them is difficult. Where this sort of thing has existed with fund managers is a creating a virtuous circle of high quality investors, who will sometimes feedback their own investment ideas, as it will improve their product experience.

Obviously one needs to counterbalance that against just upping the noise signal.

Jan

6

When you look at markets that have natural long/short hedge interests (such as physical commodities) I think that there is an interesting point that occurs when movement in the market puts one side's (long or short hedgers) primary business at risk. In either late 2010 or early 2011 (I think around then), I looked up the quarterly reports of coffee processors/roasters and tried to get an understanding of how their hedge program was structured, and how they were dealing/had dealt with the price spike.

When you look at markets that have natural long/short hedge interests (such as physical commodities) I think that there is an interesting point that occurs when movement in the market puts one side's (long or short hedgers) primary business at risk. In either late 2010 or early 2011 (I think around then), I looked up the quarterly reports of coffee processors/roasters and tried to get an understanding of how their hedge program was structured, and how they were dealing/had dealt with the price spike.

I remember one of the companies (A CA based roaster if I remember) talked about expanding their hedge program — they reached the "uncle" point where they needed to hedge out more risk "in case it gets worse" and motivated by that fear, started a program that was ultimately very costly — as costly as it was necessary.

And I know that for a period after that, once the bull trend faded, a very steep contango developed that was/has been quite persistent.

I read the Starbucks CEO's biography years ago. I remember him describing a horrible bull market in coffee, and how they ended up expanding the hedge program huge at just the wrong time in a way that (with hindsight) hurt profitability for years. They, in other words, hit the uncle point — and the continuing need to buy coffee meant they put that hedge premium into the market for years.

The above was not very articulate, but my point is that I think there is a sweet spot in speculation. When the other side feels forced to act, substantial premiums can set up on the other side that become persistent, and this can be partly seen and is reflected in things like the forward curve. Kind of basic stuff, but I think very useful when looking for large profit opportunities.

Jan

3

David Goodhill on the Abuses of Our Medical System, from Victor Niederhoffer

January 3, 2014 | Leave a Comment

David Goodhill gave an interesting talk at the Junto last night based on his book "Catastrophic Care: how American Healthcare Killed my Father and How We Could Fix It." He pointed out that cost controls don't work, that costs are skyrocketing to 15% of GNP versus 5 % 50 years ago, that the ACA won't neccessarily increase the number of insured, that there is no relation between the amount spent on health care and life expectancy, that numerous excess costs, excess treatments, errors in doctors treatments, and inadequacies and inefficiencies in the insurance that people buy and other problems that occur in our medical system.

David Goodhill gave an interesting talk at the Junto last night based on his book "Catastrophic Care: how American Healthcare Killed my Father and How We Could Fix It." He pointed out that cost controls don't work, that costs are skyrocketing to 15% of GNP versus 5 % 50 years ago, that the ACA won't neccessarily increase the number of insured, that there is no relation between the amount spent on health care and life expectancy, that numerous excess costs, excess treatments, errors in doctors treatments, and inadequacies and inefficiencies in the insurance that people buy and other problems that occur in our medical system.

He had many solutions that at the margin would remedy some of these problems, including competition in say 5% of the treatments like they have in Singapore. He was upset that many patients receive treatments and prescriptions that statistical studies say have costs much higher than the benefits, especially in states with many doctors. Statins and colonoscopies were pointed to as very guilty and excessive remedies and procedures, and he had many quillets and quiddities in his presentation that had a quasi economic ring to them, like "why is it that in states that have a disproportionate number of docs that the costs aren't lower— this violates the law of supply and demand." He is also upset that hospitals make so many errors compared to other professions, 1 in 140 for non-contagious treatments, and he seemed to have no understanding of decision making under uncertainty and the necessity of making errors in areas of changing dynamic information and alternative treatments that are possible.

Regrettably, he missed the forest for the trees. He had no understanding that the basic problem is the monopoly nature of the medical system. Things like the licensing of Drs, the restrictions on treatments, the unholy alliance between the FDA and the drug companies and hospitals, the lack of competition between drs, and hundred of other violations of how the free market and competition has been abolished that are covered in such seminal articles as Reuben Kessel's on Price Discrimination and Monopoly in the medical profession.

All the problems that he found were guaranteed to happen. Friedman proposed a solution in Capitalism and Freedom starting with the abolition of licensing of drs, and the restrictions on starting hospitals, and the treatments allowed by the various regulatory agencies. In general David Goodhill served as what might be classified as somewhat between the "your own man" says that what we need is just a little more regulations and the useful idiot Rand quant type study that is a honey net for criticism by the opposition.

Here is a good article that teaches some good economics while explaining what's going on in health care.

Jan

3

Things Might Get Worse…or Better, from Jim Sogi

January 3, 2014 | Leave a Comment

Risk is when things might go wrong or get worse. News often focuses on the possibility that things might get worse. People ask, aren't you afraid of getting killed? But things might get better.

Risk is when things might go wrong or get worse. News often focuses on the possibility that things might get worse. People ask, aren't you afraid of getting killed? But things might get better.

A few days ago there were big waves in the 15 foot range. Upon arriving at the beach it was windy, cold and bumpy and rainy. I really had to drag myself into the water. When I got out into the line up conditions were terrible. Just me and my neighbor Alistair were out in the water. But then all of a sudden the wind died down, the rain stopped, and the waves started lining up real nice. There we were, just two of out in these really nice big waves. I love when that happens.

I watch the weather and wave reports and know when a good swell is about to hit. It's really a good feeling to go out when no one is out, and just as you get there the big swell hits.

It's a similar feeling when the market is tanking, things look might grim and you jump in, and lo and behold, things turn around. It's great to be in early.

In the big picture, old people say they regret the things they didn't do the most. It's important to jump in. Life is fragile. Drink deep while you can.

Jan

3

Cruel to be Kind, from Victor Niederhoffer

January 3, 2014 | Leave a Comment

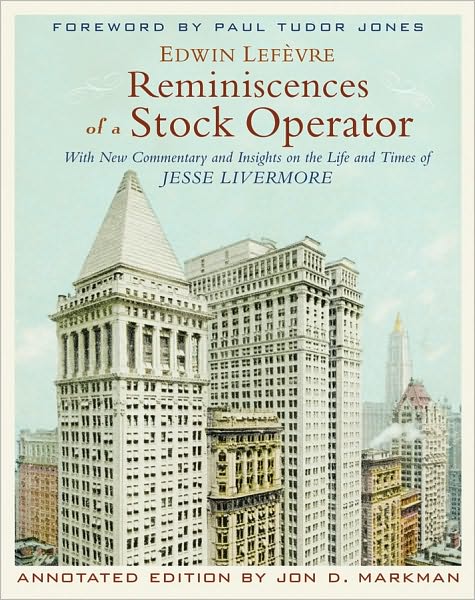

"History Lessons for Investors: An annotated reissue of Edwin LeFevre's

Reminiscences of a Stock Operator is reviewed by hedge-fund manager and

author Victor Niederhoffer."

IMAGINE THAT MASTER NOVELIST and chess

aficionado Vladimir Nabokov wrote a fictional memoir about

Capablanca—the 1920s world champion who never made a mistake on the

board—and that Bobby Fisher then published an updated and annotated

version, incorporating all of the important developments of modern

chess strategy, along with a foreword by Anatoly Karpov.A similar multilayered feast on investment is now available, with minor differences. Edwin Lefevre's Reminiscences of a Stock Operator

is a novel told in the first person by a character inspired by

legendary trader Jesse Livermore. This classic is now graced with

extensive annotations by investment advisor Jon Markman and a foreword

by hedge-fund manager Paul Tudor Jones.The result is big and beautiful, cutting across two centuries of

booms and busts and market and economic history, with a myriad of

vintage historical photos and instructive historical charts throughout.One of Lefevre's favorite adages is that there's nothing new on Wall

Street. The similarity between the financial panic of 2008 and the 1907

panic recounted in the book is a prime example.The numerous squeezes, manipulations,

insider trading, government hauling in of scapegoats and frauds settled

for pennies on the dollar that Lefevre and Markman recount are horses

that are found as well in the modern stable.

Full article here.

Jan

3

Mavericks, from Victor Niederhoffer

January 3, 2014 | Leave a Comment

When someone talks about tinkering with the data, I think about how one of Louis L'Amour's favorite words was tinker, and many heroes of his stories are tinkers, who were door to door fix up people and salesman for the Sacketts.

When someone talks about tinkering with the data, I think about how one of Louis L'Amour's favorite words was tinker, and many heroes of his stories are tinkers, who were door to door fix up people and salesman for the Sacketts.

However, I repeat that Jack Schaefer surpasses L'Amour as a writer, story teller, and benevolent personage by a mile. I would recommend his book Mavericks for all about mustangs captured for Barnum, a horse race, horse thieves, and more.

Very beautiful.

Almost as good as Monte Walsh or Milo Bennet.

Jan

3

Local Motors, from Victor Niederhoffer

January 3, 2014 | Leave a Comment

Here's an introductory article on Local Motors at its inception with the idea that I think would be worth developing here. One wonders if we could apply it here.

Jim Sogi writes:

I've been looking at making a 4×4 E350 camper van for various adventures. You can buy a new one set up for $150K, or you can buy a empty van and build it up your self to your own design. It seems like a fun and exciting project. There is a North Carolina 4×4 conversion kit.

Jan

2

Feedback in Real Life, from Victor Niederhoffer

January 2, 2014 | Leave a Comment

If market or individual stock a has a positive predictive correlation with market b, and b had a positive predictive correlation with market a, then there is positive feedback, and an explosive growth when a is up would occur. Similarly, if there is a positive predictive correlation, i.e. the serial correlation of a with b say one day forward is 0.2, then market a goes down. If there is a negative predictive correlation of market a with market b, then when a goes up, b will tend to go down, and vice versa, and there will be a stable equilibrium between the two with each pulling the other in opposite directions.

If market or individual stock a has a positive predictive correlation with market b, and b had a positive predictive correlation with market a, then there is positive feedback, and an explosive growth when a is up would occur. Similarly, if there is a positive predictive correlation, i.e. the serial correlation of a with b say one day forward is 0.2, then market a goes down. If there is a negative predictive correlation of market a with market b, then when a goes up, b will tend to go down, and vice versa, and there will be a stable equilibrium between the two with each pulling the other in opposite directions.

The situation is very similar to what occurs in all feedback circuits in electronics, including what you seen in any kind of amplifiers where there is negative feedback to maintain stability.

What are the markets that have positive predictive correlation with each other, i.e. when a is up today, b tends to go up tomorrow, and when b is up today, a tends to go up tomorrow? There aren't many. And when such occurs, it is only for a limited time. So you have to be on your toes if you wish to use positive feedback. All this can be quantified with varying degrees of reality and rigor.

Steve Ellison writes:

I evaluated the correlations of the 1-day change (16:00 to 16:00 US Eastern time) in 6 markets with the following 1-day change in each of the 6 markets. The 1-day correlations from September 13, 2010 to September 4, 2012 (498 trading days) were as follows:

S&P 500 10-year bond crude oil gold silver euro

S&P 500 -0.08 0.12 -0.05 0.05 0.11 -0.11

10-year bond 0.01 -0.05 0.04 0.05 -0.02 0.04

crude oil -0.04 0.05 -0.06 0.00 0.04 -0.05

gold 0.01 0.00 -0.01 -0.01 -0.01 0.03

silver -0.03 0.03 -0.01 0.02 0.05 -0.01

euro -0.05 0.07 -0.03 0.06 0.06 0.03

By randomly reshuffling the daily changes in each market and running 1000 iterations of a simulation, I identified that a correlation with an absolute value greater than or equal to 0.09 was significant. Hence there were only 3 correlations that were significant, and 2 of them were positive:

10-year bond vs. previous day S&P 500: 0.12

Silver vs. previous day S&P 500: 0.11

Euro vs. previous day S&P 500: -0.11

None of these correlations held up in later data. From September 5, 2012 to May 2, 2013, the correlations of the 10-year bond with the previous day S&P 500 and silver with the previous day S&P 500 were negative. The correlation between the euro and the previous day's S&P 500 was -0.08. However, from May 3 to December 27, 2013, the correlation of the euro with the previous day S&P 500 was positive.

Rocky Humbert writes:

An apochryphal tale: Rocky was hired to be the operations manager of a local towing company/garage and instructed to optimize his manpower work schedules and resource utilization to improve profitability.

An apochryphal tale: Rocky was hired to be the operations manager of a local towing company/garage and instructed to optimize his manpower work schedules and resource utilization to improve profitability.

Rocky noticed that tow truck drivers sat around idly drinking coffee at certain times of the day. But then there would be a surge of demand and customers might have to wait many hours to get a jumpstart or tow (and the garage would lose business to competitors).

It was a classic operation research/queueing theory problem. Under pressure to quickly turn the company around, and with a HBA MBA plus a PhD in applied mathematics in tow, Rocky conducted a study looking at six months of trailing data (between November 1st and April 1st) and discovered that the peak demand for service was daily between 7am and 8:45 am. His p-values were low. His T-tests were high. He was highly confident and energized to put his statistics to work concluding that batteries must die sitting unused overnight. So he changed his company's work roster to have more staff at the peak 7:00-8:45 hours and implemented the changes effective May 1st. Lo and behold, starting around May 15th, there were almost no customer calls between 7:00 and 8:45 and instead the demand spiked between 4:00 and 6:00.

So instead of improving things, he screwed them up and by September, Rocky concluded that the prior data must have been faulty and re-jiggered the staff to meet the afternoon demand — and implemented the changes effective November 1st. (Yup, the demand shifted yet again just in time for the chilly autumn air ).

Rocky was fired and became a successful money manager and annoying DailySpec poster. The moral of the story is that all of the cool statistical analyses should produce the QUESTIONS. Not the ANSWERS. What is the underlying process at work????

There will be times when stocks and bonds correlate. There will be times when stocks and bonds negatively correlate. Rocky submits that at some point in the not-too-distant future good news for the economy will be bad news for stocks (which is the opposite of the current regime). This isn't ever changing cycles. It's common sense. Or as Rocky's dad (a pioneer in digital computing) liked to say: GIGO.

Jan

2

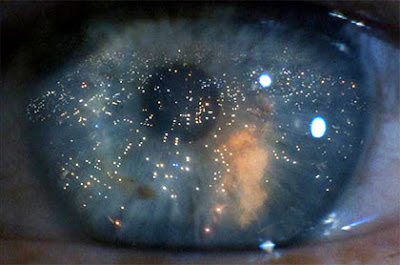

It Would Be Interesting, from Victor Niederhoffer

January 2, 2014 | Leave a Comment

It would be interesting if the all seeing eye could see the reasoning behind all the typical reactions to a number like ISM manufacturing or employment. Let's say it's like 57.4 up versus 57.6 like today's number. First a rise in S&P because it's down. That means the Fed is less likely to taper. Second, a rise because it's only down 0.4 and it's still way above 50. Third, a decline because it means that the economy isn't strong. Fourth, a rise as the flexions cover their short. They were told the number was going to be down but most of them didn't get the exact number and it's only down a little. Fifth, a decline as the economic forecasters alert their readers that the number was down. Sixth, a further decline because Germany is down a tremendous amount more than the US. Many other cross currents also. All ephemeral and designed to unleash the weak from their chips.

It would be interesting if the all seeing eye could see the reasoning behind all the typical reactions to a number like ISM manufacturing or employment. Let's say it's like 57.4 up versus 57.6 like today's number. First a rise in S&P because it's down. That means the Fed is less likely to taper. Second, a rise because it's only down 0.4 and it's still way above 50. Third, a decline because it means that the economy isn't strong. Fourth, a rise as the flexions cover their short. They were told the number was going to be down but most of them didn't get the exact number and it's only down a little. Fifth, a decline as the economic forecasters alert their readers that the number was down. Sixth, a further decline because Germany is down a tremendous amount more than the US. Many other cross currents also. All ephemeral and designed to unleash the weak from their chips.

Gary Rogan writes:

It seems like reacting to any news of that nature in any way is counterproductive unless you had the information in advance. And yet 'everybody does it'. Why do people feel compelled to act on information even if they don't know what it means (relative to the reaction that has already occurred by the time they can act)?

Craig Mee writes:

There was an ex deputy treasure secretary on CNBC Asia yesterday, (he may have held the top job for 4 days and I missed his name). His insights were little better than the rhetoric from a standard middle range company CEO, however he did appear straight down the line. Possibly the government at the highest levels is not necessarily implicit in the flexionic behavior of others. Many may not quite understand what they have available to them or that lower ranks are happy to take cut deals for peanuts on partial info. Big business, on the other hand, is able to squeeze every ounce of juice from all and sundry to create the beast that marches forward to all others' misfortune.

Jan

2

Periodic Table of Investment Returns, from Pitt T. Maner III

January 2, 2014 | Leave a Comment

Here is a Periodic Table of Asset Classes and Yearly Returns. It needs updating for 2013, but it's interesting to see how the Emerging Markets box moves from worst to best during several years (like Lithium, Li, volatile when exposed to air or water) or stays near the bottom (1994-1998) or top (2002-2007) over an extended time period.

Perhaps further detail would be useful to break out individual countries and sub-categories and stocks driving index returns and to make chart more interactive.

1. Callan Periodic Table of Investment Returns

2. Lithium

Jan

2

Facebook, from Charles Pennington

January 2, 2014 | Leave a Comment

It was in July 13, 2012, more than a few months ago, when Specs were voicing concerns about Facebook, including that it was valued at an "astronomical" amount, and daughters were reporting their friends were getting bored with it. FB was at $31 then; it's at $55 now. It must be very bullish for a stock if kids are getting bored with it.

It was in July 13, 2012, more than a few months ago, when Specs were voicing concerns about Facebook, including that it was valued at an "astronomical" amount, and daughters were reporting their friends were getting bored with it. FB was at $31 then; it's at $55 now. It must be very bullish for a stock if kids are getting bored with it.

Jim Sogi writes:

I'd agree with the Professor. Just because it's not in style with kids doesn't matter. When Boomers and Grandmas use it, it's become very successful and more likely to last than a fad. I use FB to stay in touch with kids and friends in a nice way. It's a better tool than email in many ways as a killer app. There are flaws, and they are making it worse, but the idea is the same.

Jan

2

Review of The Wolf of Wall Street, from Dylan Distasio

January 2, 2014 | Leave a Comment

The movie was a biopic of a complete scumbag given to excessive drug use and hookers (not that I have a problem with drugs and hookers). He worked the financial system illegally defrauding a lot of innocent people in the process and worst of all, in my opinion, was a rat. I think Leo captured his magnetic personality very well, and I think Scorsese made a very entertaining film about one example of testosterone driven excess. I really enjoyed the movie and feel that it holds its own with any of Scorsese's canon. It also appears to stick pretty closely to the details put forth in Belfort's purported memoirs and the legal record. I think he presented the story well; it WAS a story about debauchery and depravity. Also, small nit to pick, that was a Lambo he destroyed.

The movie was a biopic of a complete scumbag given to excessive drug use and hookers (not that I have a problem with drugs and hookers). He worked the financial system illegally defrauding a lot of innocent people in the process and worst of all, in my opinion, was a rat. I think Leo captured his magnetic personality very well, and I think Scorsese made a very entertaining film about one example of testosterone driven excess. I really enjoyed the movie and feel that it holds its own with any of Scorsese's canon. It also appears to stick pretty closely to the details put forth in Belfort's purported memoirs and the legal record. I think he presented the story well; it WAS a story about debauchery and depravity. Also, small nit to pick, that was a Lambo he destroyed.

Jan

2

Grains, from Jeff Watson

January 2, 2014 | Leave a Comment

We're off to a rollicking start for the grains in the new year. The form still hasn't changed and so far one can still sell strength with impunity. How long it will last is anyone's guess, since I'm loathe to pick tops or bottoms, or to even try to predict what these crazy markets are doing. This form has lasted for months, but I've seen it go this way for years back in the 80s-90s. Prediction and prognostication is way above my pay grade. I'm still at the observation stage, where I see what is happening and trade according to my rules. I've always been that way, trading within my rules, and that defines my comfort zone. It's also my downfall as I could probably be remembered as a great like Cutten and not a bivalve filtering up detritus in the brackish waters inland.

We're off to a rollicking start for the grains in the new year. The form still hasn't changed and so far one can still sell strength with impunity. How long it will last is anyone's guess, since I'm loathe to pick tops or bottoms, or to even try to predict what these crazy markets are doing. This form has lasted for months, but I've seen it go this way for years back in the 80s-90s. Prediction and prognostication is way above my pay grade. I'm still at the observation stage, where I see what is happening and trade according to my rules. I've always been that way, trading within my rules, and that defines my comfort zone. It's also my downfall as I could probably be remembered as a great like Cutten and not a bivalve filtering up detritus in the brackish waters inland.

Jan

2

How E-Commerce is Taking Over, from Pitt T. Maner III

January 2, 2014 | Leave a Comment

My sun loving family has just completed its 13th RV school break drive out to Disney! As always, there was another family coming with us from NYC, but this time was different, thanks to emergence of TravelPony start-up in an unmistakably competitive cyber-travel industry. TravelPony says that billions are spent daily by the industry on advertising, but that they're a rebel who pays their customer direct for cyber referrals, to foster a word-of-mouth pyramid.

My sun loving family has just completed its 13th RV school break drive out to Disney! As always, there was another family coming with us from NYC, but this time was different, thanks to emergence of TravelPony start-up in an unmistakably competitive cyber-travel industry. TravelPony says that billions are spent daily by the industry on advertising, but that they're a rebel who pays their customer direct for cyber referrals, to foster a word-of-mouth pyramid.

I'll share with the list what I did: I bid on a smaller RV this time to transport to FL, thus improving my fuel-economy by a third (10mpg vs 7mpg over the 1100-mile one-way). Additionally, AMEX had a tremendous 20% off gas just to sync your CC via twitter and enroll in BP award offer, which paid back $5 on every $25 fill-up thru 12/31/13. So all I had to do to fill my 55-gallon tank in VA and SC at $3.039 regular pump was to replace the nozzle 4-5 times, registering separate $25.01, $25.02, $25.03, $25.04, $25.05 AMEX charges. Mind you that Blue Cash card stacks 3% cash-back on top, and also enrollment in the regular BP program knocks further 10 cents/gallon: the secret to any TRUE deal is necessarily stackable discounts!

So my fuel bill this time was handily downsized, but now (with a 3-bed RV vs. our usual 4-bed RV) I had to lodge the guest family in Disney proximity — and that's where Travel Pony trotted in. I did this:

1. Have my guest family email their Topcashback.com referral link to my email addresses, so they would earn $15 Paypal cash for EACH of my Topcashback.com email address that spends it's way to an at least a $12 cash back reward.

2. Log into Topcashback.com and click thru to TravelPony for 4-10% cash back on hotel/taxes spend. Once travelpony site opens in separate window, replace it with my referral , where I get $25 travelpony spend credit for the first purchase that every referred email account completes.

3. As every email account Signs Up for a travelpony account through my link, they will each instantly get a $35 spend credit into each email-based account they create. I also provide them discount code VIPONY2013 for 10% off of the already competitive Travelpony hotel rates (which are 10-20% below Expedia, Travelocity, Priceline, Orbitz, hotel.com, booking.com and such to start with).

4. TravelPony listed named (not anonymous) three-star resorts in Disney area at $29-45 double queen room! With a few practiced clicks thru, one email account at a time and one room at a time, I managed to string up effectively an entire week of complimentary stays: just utilizing the initial $35 per travelpony email account credits, my own $25 travelpony referral credits, topcashback percentage, Topcashback $15 per account referral cash and cashback on CC programs. I'm always available for any travel question, and we are looking forward to Feb 15-24 President Week break, followed by Spring Break April 11-22.

Orlando weather was a real treat this Xmas: in every resort, we actually opted for non-heated pool+jacuzzi combination, avoiding the more crowded heated pools. Happy New Year everyone!

Jan

2

Crow Like a Squirrel, from Kim Zussman

January 2, 2014 | Leave a Comment

One notes the SP500 (SPY) has gained 5.6% for the two month period November-December, since the statistical study below was posted:

"The Jan-October return of the SP500 index for the period just ended was +23%. This 10 month return is 4th highest since 1971 (4th out of 42 years).

Over this period, for Jan-Oct returns over +10%, the following two month returns were up (2-month return of the next Nov+Dec), an average of 4.9% with 16/18 positive:

Date Jan-Oct nxt Nov-Dec

10/1/1975 0.299 0.013

10/2/1995 0.266 0.059

10/1/1997 0.235 0.061

10/2/1989 0.226 0.038

10/1/2003 0.194 0.058

10/1/1991 0.188 0.063

10/1/1980 0.181 0.065

10/3/1983 0.163 0.008

10/1/1986 0.155 -0.007

10/1/2009 0.147 0.076

10/1/1996 0.145 0.050

10/1/1976 0.141 0.044

10/1/1985 0.135 0.113

10/1/1998 0.132 0.119

10/3/1988 0.129 -0.004

10/1/2012 0.123 0.010

10/1/1999 0.109 0.078

10/2/2006 0.104 0.029

Jan

2

New Years Predictions, from Sushil Kedia

January 2, 2014 | Leave a Comment

I surmise, for the New Year, that this year shall be:

1. much more kind to the permabears in equities,

2. much more kind to the wounded Gold Bugs

3. more kind to the Greenback

4. an affirmation of Labogalas, almost everywhere

5. definitive in affirming the permanent value of humility & establishing the evidence that complacence suffers.

What are the surmises of Daily Spec readers?

Jan

2

Observation of the Day, from Richard Owen

January 2, 2014 | Leave a Comment

On the highway, speeding down the outside lane (I only drive at 69.9 mph), one's mind is concentrated. It is much safer. The dings and bumps come on windy country roads at 40 mph. But very occasionally, the former kills you stone dead and you survive the latter, but your passengers get mad and take the train next time and tell everyone you're an incompetent.

On the highway, speeding down the outside lane (I only drive at 69.9 mph), one's mind is concentrated. It is much safer. The dings and bumps come on windy country roads at 40 mph. But very occasionally, the former kills you stone dead and you survive the latter, but your passengers get mad and take the train next time and tell everyone you're an incompetent.

Archives

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles