Dec

1

It is Interesting to Reflect, from Victor Niederhoffer

December 1, 2013 | Leave a Comment

It is interesting to reflect that since 1996 there have been 113 days when the SPU was down 300 or more big points (i.e. 900 to 600), and the average change the next day was down 3 points. There were 11 first such occurrences and the moves the next two days were slightly different. There was no occurrences during the last 18 years when SPU was up more than 300 big points in the previous 100 days. The reflections stemmed from an untested hypothesis of mine that the stock market might be more bullish when there had been a huge rise in the previous 6 months or so. I found no evidence to support this reflection.

Dec

1

Diary of a a Retailer, 4, from Laurel Kenner

December 1, 2013 | Leave a Comment

Black Friday lived up to its reputation as the biggest shopping day of the year at my little store yesterday. We just about sold out of the glass water bottles, priced below my cost as a promotional item. Sales topped our record by 70%. I opened shop this morning ready for a big rake-in.

Black Friday lived up to its reputation as the biggest shopping day of the year at my little store yesterday. We just about sold out of the glass water bottles, priced below my cost as a promotional item. Sales topped our record by 70%. I opened shop this morning ready for a big rake-in.

Four hours into the day, I have sold one $5 water bottle. People come in and say, "How cute," and shuffle off. Perhaps the overdid it with the credit cards yesterday and are feeling too guilty and burdened to further extend themselves?

Nothing has changed except for one thing. My Jamaican assistant, who has taken care of me and various family members since 2002, was at work yesterday. Chair and I have employed Lorna as nurse's aide, nanny and housekeeper. We appreciated her as a person of brains and discretion. We knew she once had a T-shirt business back in Jamaica. But we little suspected that beneath that gracious exterior were sales and bargaining abilities so profound as to put even the most expert diamond trader or car salesman to shame.

When I tell people I have a special deal for them their lip curls. Disbelief glints in their eyes. When Lorna tells them, they believe. Better yet, they buy. She tells them we are throwing extra bottle seals to show our love. The believe that too! I couldn't even think of saying it with a straight face. All I have to do is show a mild interest in the customer to send them running for the door.

Aubrey is another great sales talent. We first noticed this when he invented a, what shall I call it, a sales dance when we set him up in the lemonade business at age 4. A customer comes into the booth and he jumps to their side, explaining, demonstrating…and ringing up the sale on the iPad.

Dec

1

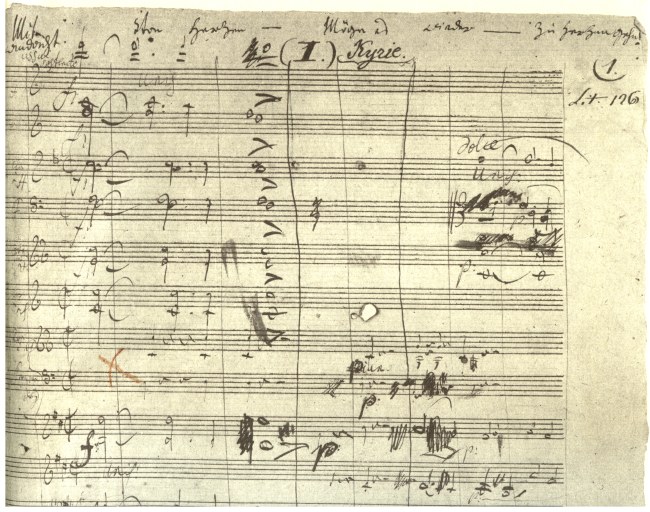

In a Biography of Beethoven I Just Read, from Victor Niederhoffer

December 1, 2013 | Leave a Comment

In a biography of Beethoven I just read it makes the point that he always had a big idea in mind whenever he wrote a piece. An idea that would live forever that "everyone would understand soon enough". Yet he planned his music in microscopic detail sometimes taking 5 years to get all the harmonies, rhythms, and melodies, into order, e.g. the missa solemnis. He also was very good at the negotiations which he turned over to his brother or Schindler often selling the same piece 3 times to 3 separate publishers all of whom thought they had exclusives. What a great model for speculators for the new year.

In a biography of Beethoven I just read it makes the point that he always had a big idea in mind whenever he wrote a piece. An idea that would live forever that "everyone would understand soon enough". Yet he planned his music in microscopic detail sometimes taking 5 years to get all the harmonies, rhythms, and melodies, into order, e.g. the missa solemnis. He also was very good at the negotiations which he turned over to his brother or Schindler often selling the same piece 3 times to 3 separate publishers all of whom thought they had exclusives. What a great model for speculators for the new year.

Dec

1

Waiting, from Kim Zussman

December 1, 2013 | Leave a Comment

Should junior buy (and try to hold) at new lows or new highs?

Checking SP500 monthly closes 1955-present, there were 9 closes which were 5-year lows. 5-year highs occurred 173 times.

Holding each buy to the present (SP at 1807), the average return of each buy (not including dividends) was:

5YLo (9): 1152.0% 5YHi (173): 1152.8%

Evidently waiting for rare 5Y lows meant missing out on numerous entries when the market was up but destined to go up further

Waiting for Godot- Lucky Speech

Dec

1

Simpson & His Investment Simulator, from Richard Owen

December 1, 2013 | Leave a Comment

"No, it's not a exactly time machine," said Prosser. "It's much more exciting than that." Prosser handed his companion a black glove. "Put this on, please," he asked and pulled on a similar garment.

"No, it's not a exactly time machine," said Prosser. "It's much more exciting than that." Prosser handed his companion a black glove. "Put this on, please," he asked and pulled on a similar garment.

Simpson was skeptical, but did as he was told. He trusted Prosser implicitly. Luck had it that he had financed many of Simpson's early inventions. And boy had the investment gods smiled upon them. It was kismet: no other financial partnership had been more blessed since Edwin Land and the Morgans.

There were too many hits to remember. One of Simpson's favourites had been Hypnerall. It compressed the average individual's sleep cycle from eight hours to five and a half. Sixty-five percent of the US population used it daily, all on a one-cent royalty. They could have charged far more, but Simpson knew when to keep a low profile. More controversially there was UrDat. A steganographic method of storing binary data in a urine soluble genetic compound. With it, a user could carry around a petabyte of mission critical bladder-water, completely undetectable. And now this.

"So explain it again, and what's this glove?"

"It's a quantum investment simulator. The glove records your quantum signature and allows it to be mapped into the the simulation. A time machine would allow you to skip around time. The simulator, and your glove, allows you to skip around universes. In effect."

"But the universes aren't real, right?" cautioned Simpson.

"Well… that depends on your philosophy."

"And what's your philosophy?"

"ProSim Capital doesn't pay me to philosophise. It pays me for investment returns."

"And the application?"

"Our initial focus has been on modelling economic and investment scenarios. Close your eyes, please. Witnessing the boot-up phase is too disorienting for most people." Simpson obeyed. Prosser grasped Simpson's gloved thumb and squeezed.

"Open your eyes," instructed Prosser.

Simpson looked around. Two seconds ago he had been standing in a laboratory. Now… Simpson did a three-sixty. "Where are we?"

"We're inside the first simulation. Value World."

"Value World?"

"Yes, we took the regular world but edited the gene pool to make every financial professional biased towards value investing. So what do you notice?" asked Prosser.

Simpson scanned the street up and down. It looked pretty normal to him. "Looks pretty much status quo to me."

"But what if I told you that I programmed the simulator to take us to 2080?"

Simpson looked blankly at Prosser.

"It's sixty years on, Simpson! And nothing has changed. When we made everyone favour value investment, nobody could get any venture capital financed. Nothing higher than twelve times earnings could attract capital. Investors demanded earnings distributions close to 100%. When management didn't oblige, activists came knocking. Then management lobbied congress for support, and hey presto, new and improved poison pills were legislated and installed. It has ended up a mexican stand-off between investors and boards and, corporately speaking, time and technology has stood still ever since." Prosser squeezed Simpson's thumb again.

Simpson looked up and down the same street. It seemed identical, except… wait. All the signs were in a foreign language. Simpson looked at Prosser and raised an eyebrow.

"It's Hungarian."

"Explain."

"In this simulation, we made everybody day traders. It was a boon to Wall Street. Commissions climbed exponentially. Income to the exchanges exploded, returns to capital crashed and everyone's equity holdings gradually dissipated to nothing."

"And the Hungarian?"

"Well, Interactive Brokers cleaned up. Thomas Peterffy merged his assets into all of the major global exchanges and became the world's richest man by a factor of twenty to one. Peterffy had a pet theory about old Hungarian providing some sort of cognitive boost to reasoning through its use of complex morphology and sponsored it to become the lingua franca."

"Bizarre. What else have you simulated?

"There was Keynes World. We spliced John Maynard Keynes' genetics into the whole investment population. We expected something spectacular to happen, but nothing seemed to change financially or economically, except…"

"Except?"

"Well, there was a population boom. Everyone had much better sex." Prosser smiled. "There's one simulation we should visit. Thumb please." He squeezed.

"Where are we now?" Simpson asked.

"Let's go into this diner," said Prosser, pointing across the street.

As Simpson entered, there was near silence. Everyone looked depressed. They took a seat and a waitress came over.

"Can I get… your order… pl…" The waitress broke into tears.

"Why is everyone so upset?" asked Simpson.

"In this scenario we made all of the investment managers favour market-neutral hedge fund investing. Equity managers had 100% of stock out on borrow to themselves. Due to an accident by one of clearing houses, all of the stock was simultaneously recalled one day. The funds couldn't delta hedge their exposure fast enough and started to take on net-long positions. It caused a month long, exponential short squeeze in which everyone's portfolio traded at close to infinity. And for one beautiful month, the whole population thought they had got rich. Until it crashed. Nobody has got over it since."

"How can you have 100% out on borrow to yourself?" asked Simpson innocently.

"Look, the details are complex. Anyway, what else have we simulated? Well, there was Macro World - don't ask. And then Options World, where everyone sold gamma. For a decade or two everything went much better than normal, but suddenly everyone went bankrupt and it ended up in a kind of Mad Max scenario."

"What has all this cost us so far?" asked Simpson.

"ProSim Capital has spent negative $1.5bn and growing. It's the ultimate cash machine."

"And what happens if you simulate out the current investment environment without changing it?" queried Simpson.

Prosser stared blankly into the distance. "Everything ends up being owned by a textile mill controlled by the Gates Foundation."

« go back —Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles