May

7

Emotional Intelligence, from Sushil Kedia

May 7, 2009 | 2 Comments

Bollinger Bands provide so many utilities in figuring out different aspects of the market. I discovered one few years ago and find it pretty useful in getting the broad sense of the fear and greed state of the market. You can try it as follows:

Bollinger Bands provide so many utilities in figuring out different aspects of the market. I discovered one few years ago and find it pretty useful in getting the broad sense of the fear and greed state of the market. You can try it as follows:

((Next Expiry Futures - Current Expiry) / Current Expiry) X No. of contract rollovers in a year X 100 is the underlying variable you want to calculate and then throw around Bollinger Bands over its ongoing plot. I use the upper standard deviation at +2 and the lower one at -3 standard deviations.

This variable basically plots a cost of carry / yield equivalent of the futures contract differential on a rolling basis. The reason I do not use Current Expiry - Cash is that at expirations there would be huge noise as well as one would have to multiply the ratio by the No. of times the current contracts could rollover found by dividing 365 days by days left to expiry. A bit cumbersome. Also, Cash and futures comparison requires finding out dividend declarations, dates of ex-dividends for various index components. So the formula I have chosen is simpler, easier to build (you can use the CIX function on Bloomberg to build this for example in a minute).

As the reading gets closer to the upper standard deviation line it is a fair indication of the long risk taking capacity exhaustion in the current state & as it slips closer to the lower (deeper) standard deviation line it is the extreme of risk aversion. The %B indicator of Mr. Bollinger provides additional qualifier often. Whenever there is a divergence between the main indicator and %B that is the indicator makes a higher high or a lower low while %B did not it becomes an even securer reading. Trade entry decisions made with other tools thus come with a greater confidence as to whether one is trying venturing into a turning tide or into a running tide.

A perspective of observing the market through such a lens provides to my own psychology a more positive frame of mind. Someone who aspires to consistently be paid by the market can take the attitude of providing some utility and service to the market for which it should be compensated regularly. When the market is at +2 line indicating a state of avarice you supply to the stretched out demand and when the market is at the -3 line indicating a state of panic you demand courage. That way an attitude of being a consistent service provider looking for consistent rewards helps one overcome one's own emotions of fear and greed that cold otherwise arise much more easily with a sense of competition with the system. I find, for myself, that an attitude to serve the emotionally unintelligent is the reason for them to pay me consistently.

John Bollinger adds:

There is a little-used method of calculating a constant-maturity futures contract that constantly looks n days into the future that is sometimes called a perpetual contract. Comparing two of these perpetual contracts with differing look forward lengths, say 10 and 30, would be quite helpful for Sushil's type of analysis.

Apr

27

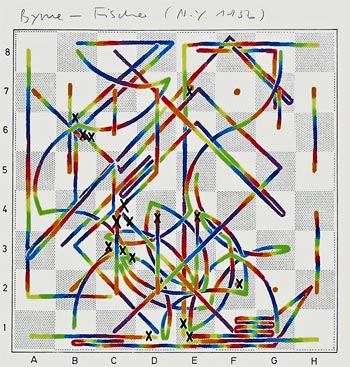

Enclosed picture of the price movement of Fast Retailing, largest weightage stock on the Nikkei 225, broke under what may be called the dreaded Diamond pattern since there is no place where a diamond has been defined except for the statements that it is powerful, it is rare and it forms a formidable top and that it looks like a pattern similar to a rhombus (explained by the usage of a few such pictures)

If however, this drop under the latest line and outside this said pattern does make me money I do not mind calling it the "A Japanese Kite with a Long Whipping Tail". After all, the Japanese have a very expressive language and all the patterns from there are described in vivid detail and so what if it is not yet a pattern as man times quoted as a diamond, it would still be as rare as that as a pattern. When enough data of such occurrences come some may be able to test it. Until then, let me add to the library of patterns The Japanese Kite with a Long Whipping Tail. Yes it should begin with The and not A.

I think with one look, you should get to see the Long Whipping Tail. No? Try once more you would get it easily. Remember, it's a rare pattern since I saw it the first time myself.

Apr

27

Scrabble, a Good Book and this Summer, by Sushil Kedia

April 27, 2009 | Leave a Comment

How to Build a Better Vocabulary by Nurnberg & Rosenblum is the sort of book I want my daughters to steal and grab away from me so that they adopt it now while they are half the same age compared to the age at which I found a certain zealous attachment to this book.

So, with the recently started summer vacations of the schools me and my wife brought over a new Scrabble Board. The two of us have been playing a few rounds every day creating much WWF style mental teasing at the wins and losses. In the resultant spike of competitive spirits the daughters have started playing the game of Scrabble for far many more hours of the days and the evenings.

In some days we are hoping that the competitive spirits would have soared to a point betwixt the two daughters that they would come to improvising and get at beating Dad at his own game. That's when I intend to leave the very old copy of this book which I used in the ever-competitive MBA entrance tests in India for the vocabulary sections of the exam under a pillow. I am hoping that a surreptitious caught red-handed look on the face would just be the finale of my act at selling the best book on the subject to my daughters at the age where they could gain most by beginning to build a system of continuously enriching their vocabulary.

Across the years, I have yet to discover a better system of building as rich and as utilitarian a vocabulary as this one book has in between its covers. It's a system that it helps with its readers acquire rather than just a focus on memorisation of word lists.

The closing sentence at the preface of the book says it all what lies ahead in the pages, "I love you" is all you would still need to say when you need to despite a vocabulary of the sort you are going to build with this book.

Commonsense, systematic approach to building a knowledge structure on the origin of words, outstanding ways on classifying and connecting with the origin, usage, context and meanings of words are just some of the things I would say in praise here. The rest of the weight of the recommendation would have already been gauged from my sales plan. Think of getting a Scrabble, this book and your own ingenious plan for this summer. Kids would grow up richer with access to more words and stronger with a richer power of expression, over course.

Adam Robinson comments:

Word Power Made Easy by Norman Lewis is the best vocabulary book out there, bar none, even better than mine (though I took a more scientific approach to which words to include, whereas the inimitable Lewis chose words that lent themselves to easy etymological analysis).

An excellent, excellent game, for children and adults, is Rush Hour, which has graduated challenges so can be done by 6 year old (or an Aubrey-esque 3 year old, no doubt!!), or a 60 year old. What I love about the game is that to advance one must be willing to move backwards. Reculer pour mieux sauter, for those who speak French (a good martial proverb in any event).

Apr

26

The Good, the Bad, and the Ugly (Part II), by Sushil Kedia

April 26, 2009 | 1 Comment

If Tuco was the to look ugly being the short-seller into the action of last week and Blondie the good profit taker, they both by now have broken off their partnership to make good off the bounties of Tuco. In the process the two have met up with a horse carriage loaded with dead bodies and have learnt from the only survivor Bill Carson that he and a few others have buried gold in a cemetery. Tuco could only find where the Cemetery is and Blondie could find the name on the grave. Angel Eyes, the Bad man who always finishes a task if paid is now out to look for Tuco & Blondie.

Thus for the road ahead in the week next and the one after I want to remember what Tuco and Blondie said to each other in the movie:

TUCO: There are two kinds of people in the world, my friend. Those with a rope around their neck and the people who have the job of doing the cutting. Listen, the neck at the end of the rope is mine! I run the risks. So the next time, I want more than half.

BLONDIE: You may run the risks, my friend, but I do the cutting. If we cut down my percentage… cigar? Liable to interfere with my aim.

TUCO: But if you miss you had better miss very well. Whoever double-crosses me and leaves me alive, he understands nothing about Tuco. Nothing!

Blondie also said, "You never had a rope around your neck. Well, I'm going to tell you something. When that rope starts to pull tight, you can feel the Devil bite your ass."

Closer to the Climax of the entire drama, when at the cemetery with the gold:

ANGEL EYES: Two can dig a lot quicker than one. Dig. (To Blondie) You're not diggin'.

BLONDIE: (Lights his cigar. Angel Eyes cocks his gun.) If you shoot me, you won't see a cent of that money.

ANGEL EYES: Why?

BLONDIE: I'll tell you why… (kicks lid off coffin, revealing only Arch Stanton's skeleton) Cause there's nothing in there.

TUCO: (Raises shovel to strike Blondie) Why you son-of-a….!

BLONDIE: You thought I'd trust you? Two hundred thousand dollars is a lot of money. We're gonna have to earn it.

So for the fortnight ahead, I would go back and watch this movie once more for the useful lessons in speculation it has to offer at every turn. By their very name we know the Bad ain't the ones who would get the gold. So, between the ex-partnership of the Ugly and the Good and the collective crisis brought upon them by the Bad to forge back into a strongest kind of team, we know there is a cemetery and there is gold & the road to the riches is not movin' in a straight line cause it never did.

Good movie, old classic, works most of the time. Take a look. Oh Ya, the Angel(s) in the marts have the Eyes on them, this time round for sure. Am I saying the Profit taker was Good and that the road to the cemetery would go back through the horse carriage yet again? Why don't you watch this movie over the weekend and see if Good took the Profits or not ultimately?

Before Hans or some others tell me that this ain't such an exceptional movie when you look at the box office collections of recent years all I got to offer humbly is that either you adjust the present to history or the history to present if either is possible to do with workable accuracy & then we are both doing fine.

Apr

26

Pilot Fish: First Right of Passage?, by Sushil Kedia

April 26, 2009 | Leave a Comment

Enclosed humble .gif of Samsung Electronics, the largest market cap stock on the KOSPI200 Index with a 16% weightage, shows a drop of 6% on Friday while the Index itself closed marginally higher.

Would observations from other major equity indices in this world suggest that moves of dissonance such as these are another kind of pilot fish. The first right of passage to the leader for reversing ahead while the smaller within the shoal are still lead into the way prevalent?

Apr

18

The Good, the Bad and the Ugly, by Sushil Kedia

April 18, 2009 | 13 Comments

On the one hand it is said that those funds, individuals, traders who could not get on in the 30% plus move across every equity index in the world will destroy this rally, yet on the other it is argued that because this market has remained under-bought any pullbacks will be bought into. These are both opinions, not facts.

On the one hand it is said that those funds, individuals, traders who could not get on in the 30% plus move across every equity index in the world will destroy this rally, yet on the other it is argued that because this market has remained under-bought any pullbacks will be bought into. These are both opinions, not facts.

Let me ask those who did not buy in because they did not like the news then or those who did not buy because they did not like the patterns in the data they read will they buy the next dip? News-readers will become ticker tape readers or those who are reading the news now of so many remaining under-bought will be able to sell the tape now?

Blondie said in the movie, "The good, the bad and the ugly" that, "You see, in this world, there's two kinds of people, my friend. Those with loaded guns, and those who dig. You dig."

Those who seek incentives of anticipating will anticipate and those who seek benefits of being followers will continue to follow. Nature of men does not change.

So, who is going to shoot this rally, whenever it does get shot? It likely will be those who are not digging (the guns) and those who indeed had the guns at the last set of lows. Those who shoot this rally will also then have a loaded gun to shoot the next drop when it comes. Yes, Blondie has been so correct, those who dig would dig, those who shoot would shoot.

Apr

9

Reading People, from Jeff Watson

April 9, 2009 | Leave a Comment

A very good exercise for increasing one's mental capabilities is to learn how to read people accurately. Reading people and sizing them up is essential in every walk of life, and one who can make a good read has a built in edge in everything. I like to do a lot of people watching, constantly making a read, and have found the exercise to be very stimulating and illuminating. One starts a read by looking at a person's outward appearance, dress, the condition of their shoes, hands, and what kind of haircut they have.

A very good exercise for increasing one's mental capabilities is to learn how to read people accurately. Reading people and sizing them up is essential in every walk of life, and one who can make a good read has a built in edge in everything. I like to do a lot of people watching, constantly making a read, and have found the exercise to be very stimulating and illuminating. One starts a read by looking at a person's outward appearance, dress, the condition of their shoes, hands, and what kind of haircut they have.

Moving along, one notices things like posture, gestures, and facial expressions. Do they have a smile, a twinkle in their eye, or do they have dour personalities? Do they speak softly, or loud? Are they well spoken or not? What kind of affectations do they have? I like to observe exactly what people are doing, and the body motions they use, comparing the data to past observations of other people.

People readers get an added bonus is when a person is interacting with another, or in a group. Interactions between two or more people can give volumes of information regarding things like temper, character, and and general mental state. Subtle, nonverbal clues can let you know if the person is a dominant person or a follower, information which can prove to be valuable.

A good reader can tell you the socioeconomic status of the man by sight, can tell you if he has kids, and get a good estimate of what his spouse is like. An experienced reader can make a good estimate of one's income, marital status, level of either happiness or desperation.

The best place to start learning how to make a read is by going to a mall and watching the men sitting by while waiting for their wives who are shopping Practice on men at the mall allows you to size them up, and then check the accuracy of your observations when the wife shows up. This allows one to hone their skills in reading people.

I attempt to read people as a mental exercise, everywhere I go from a restaurant to an airport. Recently, I was at a very nice restaurant and startled my companion with the accuracy of my reads of the various patrons. I learned to read people from too many hours at the poker tables and the wheat pit. In today's electronic markets, reading people might not be as important, but the same thought process and mind set is a very valuable tool in the arsenal of the speculator. Incidentally, some of the best readers are car salesmen, and people in retail.

Reading skills can be learned, although it takes great self discipline and an open mind. Beginning readers will get things wrong but as their skill level increases, their accuracy will approach 80% or more. Learning to read people is a very fun exercise, and will develop critical thinking skills that will ennoble your mind.

Steve Ellison writes:

Paul Ekman has studied the movements of every facial muscle and what thoughts these movements convey…here he is as described by Malcolm Gladwell in a wonderful article.

Paul Ekman has studied the movements of every facial muscle and what thoughts these movements convey…here he is as described by Malcolm Gladwell in a wonderful article.

Ekman recalls the first time he saw Bill Clinton, during the 1992 Democratic primaries. "I was watching his facial expressions, and I said to my wife, 'This is Peck's Bad Boy,' " Ekman says. "This is a guy who wants to be caught with his hand in the cookie jar, and have us love him for it anyway. There was this expression that's one of his favorites. It's that hand-in-the-cookie-jar, love-me-Mommy-because-I'm-a-rascal look. It's A.U. twelve, fifteen, seventeen, and twenty-four, with an eye roll." Ekman paused, then reconstructed that particular sequence of expressions on his face. He contracted his zygomatic major, A.U. twelve, in a classic smile, then tugged the corners of his lips down with his triangularis, A.U. fifteen. He flexed the mentalis, A.U. seventeen, which raises the chin, slightly pressed his lips together in A.U. twenty-four, and finally rolled his eyes–and it was as if Slick Willie himself were suddenly in the room.

Jordan Low comments:

It is interesting how we can get different views over different topics from books. Almost similar to how movies come in pairs — Deep Impact and Armageddon, for example. In Gladwell's book The Tipping Point, the NYC crime rate decrease from a host of factors that tipped the scale contrasts with Freakonomics explanation of legalization of abortion lagged 16 or so years. In What Every Body Is Saying by Navarro, he claims that facial movements are the least accurate. The most accurate body part is the feet and as we move up, the conscious brain can fake responses.

It is interesting how we can get different views over different topics from books. Almost similar to how movies come in pairs — Deep Impact and Armageddon, for example. In Gladwell's book The Tipping Point, the NYC crime rate decrease from a host of factors that tipped the scale contrasts with Freakonomics explanation of legalization of abortion lagged 16 or so years. In What Every Body Is Saying by Navarro, he claims that facial movements are the least accurate. The most accurate body part is the feet and as we move up, the conscious brain can fake responses.

Sushil Kedia adds:

Desmond Morris. I urge everyone interested in the subject of watching, understanding non verbal behavior, deception & an endless array of related subjects to search this name on google. He is a maestro at this social science.

Desmond Morris. I urge everyone interested in the subject of watching, understanding non verbal behavior, deception & an endless array of related subjects to search this name on google. He is a maestro at this social science.

For over two decades I have been searching to obtain his lost title Ape Watching. One of my most revered teachers during my school days had shown me his copy and it was etched deeply in my mind. Resplendent pictures of apes capturing tell-tale nuances. Each picture therein is a unique shade of primal emotions. Just a glimpse through this tome, a flip across the hundreds of pictures taken by Morris was breathtaking. Based on a twenty year old memory, I reccomend you grab howsoever old and tattered a copy of this particular title if you see it. Amazon, google books, many other usual hunting pots in cyberia for books do not even mention it. Wonder if someone who has a serious interest in behavior studies has ensured that this title just vanishes. His numerous other works are fascinating as well, but Ape Watching would stand above any other book on any other subject I have ever seen.

Apr

4

Question, from Sushil Kedia

April 4, 2009 | 3 Comments

What may be a good way for generating synthetic series of stock prices that shows OHLC for each day? What assumptions are reasonable to make in this endeavor?

Adam G Replies:

How about bootstrapping an existing series to remove any serial correlation (which also would remove any persistence of vol shocks)? Could carry further and mix and match daily “bars” from various instruments into one synthetic in random order.

Mar

23

Optical Illusions, from Sushil Kedia

March 23, 2009 | 13 Comments

A search for the phrase optical illusions on Google throws up a variety of very interesting websites. For a speculator I feel there are many pertinent questions that arise from a survey of these sites and the ensconced illusions in them.

A search for the phrase optical illusions on Google throws up a variety of very interesting websites. For a speculator I feel there are many pertinent questions that arise from a survey of these sites and the ensconced illusions in them.

- Why is there an illusion of motion, inter-connected spaces, impossible possibilities in the pictures carrying optical illusions, when actually there is none?

- What market situations produce an illusion of motion and life, when actually there is none?

- Which analytical tools are taken by the illusion of motion and or direction in markets, when actually there is none?

- What attributes of any one analytical technique or set of techniques together would save one from believing the non-existent?

There is a long list of many questions possible when exploring some optical illusions that a student of markets will find. Why not identify some questions that are more relevant to the markets and then try to answer them?

The usual first hand cliché would be that chart-watching is an optical illusion, but it perhaps is better for us to avoid that, so as to get to more useful ideas.

Mar

15

Friday the 13th, from Sushil Kedia

March 15, 2009 | 1 Comment

Dhirubhai H Ambani, India's largest wealth-creator and whose sons are currently on the Forbes list, chased the number 13 with an unusual vigor. What everyone called unlucky and hence under priced became his favorite bargain. The number plates of his cars totaled 13, the office floors that he would be happy to buy were 13 and so on and so forth. A perfect contrarian risk taker he was always, including in the choice of what constitutes luck. February 7th, 2001, I met him, perhaps primarily on the merit of the duration of the meeting that I sought with him was for 13 minutes. It was simple to decipher from the number plates of his cars what it would take to get me to meet him.

Dhirubhai H Ambani, India's largest wealth-creator and whose sons are currently on the Forbes list, chased the number 13 with an unusual vigor. What everyone called unlucky and hence under priced became his favorite bargain. The number plates of his cars totaled 13, the office floors that he would be happy to buy were 13 and so on and so forth. A perfect contrarian risk taker he was always, including in the choice of what constitutes luck. February 7th, 2001, I met him, perhaps primarily on the merit of the duration of the meeting that I sought with him was for 13 minutes. It was simple to decipher from the number plates of his cars what it would take to get me to meet him.

The day after I sent the letter seeking this meeting, his secretary called up asking why would I need to see Mr. Ambani.

I promptly replied to his secretary that, "I assume you must be someone close to him if you are aware that I have sought to meet him. However, without meeting him yet I do not have his permission to reveal to any other the need for which I seek to meet him."

His secretary fumed at me, "What should I tell my boss then?"

I quietly told him on the phone, "If I were in your position I would tell my boss exactly what I hear, though I am not going to the extent of suggesting to you how you should be doing your job."

The Secretary dropped the receiver.

Thirty minutes later he called up informing me that his boss wanted to see me the next morning at 11.30 a.m.

Dhirubhai was known throughout his career for his ingenuity and I hoped through this conversation with his secretary to communicate to him until I met him a certain level of ingenuity in my enterprise.

However, when I got to see him the next day, the charm and charisma of an all time tycoon gripped me very quickly.

At the end of a very motivating 13 minutes or so when I rose to greet him and bid good wishes I still continued to see a plain face.

However, as I reached the exit of his huge personal office I could hear him burst out in a hearty laughter. I looked back at him in amazement and he said, "Son, you have had your tea but you forgot to put the sugar in it."

I recalled his secretary had specifically asked if I would take a tea with sugar or without and I had requested some on the side.

Back in the elevator I thus realized, at the ripe age at which Dhirubhai was then, the power of such minute observation, the persistence to scan through a person without disturbing the process of observation and to derive pure innocent joy that only a child could from things understood minute by others is perhaps the hallmark of a visionary of any times.

Victor Niederhoffer comments:

Just to inject a bit of quantitative mumbo into the picture, the last 23 friday the 13ths have been visited with a rise of 1/4 of % in SPU and unchanged in bonds. Completely insignificant in each.

Feb

12

Lessons From a Life Well Lived, from Jeff Watson

February 12, 2009 | 5 Comments

My grandfather (1885-1989) was the greatest teacher and influence in my life. His love of life and adventure was unparalleled. A true Renaissance man, he was comfortable with everyone from janitors to presidents. Since he always wrote everything down and was making lists, he once gave me a list on how to live my life. A truncated version:

My grandfather (1885-1989) was the greatest teacher and influence in my life. His love of life and adventure was unparalleled. A true Renaissance man, he was comfortable with everyone from janitors to presidents. Since he always wrote everything down and was making lists, he once gave me a list on how to live my life. A truncated version:

1. Pay your bills on time

2. Pay your gambling debts first.

3. Never do business with a friend, but allow a friendship to develop out of a business.

4. Never, ever, cosign on a note.

5. Always buy bonds when they hit 60.

6. Always treat everybody at a business, from the bottom up, like he was the president of the company.

7. Always buy real-estate on the cheap.

8. Never touch the capital, and save part of the interest.

9. Live well below your means.

10. Never allow friends to know how much money you have and always "cry poor."

11. Spread your money and investments around.

12. Never lend more than pocket change to friends.

13. Family first in everything.

14. Congratulate your opponent when he wins, and be gracious when he loses.

15. Don't be a deal hog, and leave something for the next guy.

16. Speak little and listen a lot.

17. Never be afraid to say no.

18. Learn poetry, history, philosophy, and a second language.

19. Keep current in events, and keep an ear on the street for opportunities.

20. Learn good manners.

21. Treat every woman like she was going to be your future wife.

22. Don't trust the government, and never trust politicians.

23. Circumnavigate the globe at least once in your life.

24. Big game fishing is a manly pursuit.

25. Don't ever get drunk in public.

26. Don't ever embarrass yourself or family.

27. Never complain about your family to outsiders.

28. Teach someone your business and pass your skills along.

29. Never listen to race track touts or tipsters of any kind.

30. If they're selling it, why is it such a great deal or opportunity.

31. Never cheat at anything, nor be dishonest.

32. Never welsh on a deal or wager.

33. Always keep your promises.

34. Pay your people a fair wage.

35. Never pay retail for anything, but don't be a hog.

36. Allow your opponents to save face.

37. Never keep a mistress within 300 miles of your home.

38. Always give a guy on hard times some spare change.

39. Support a charity.

40. Be a stand up guy in all areas of your life.

41. Respect the flag.

42. Respect and listen to old people, as they know more than you do.

43. Work as hard as you can and play as hard as you can.

44. Keep your house and business tidy.

45. Allow your kids to be themselves and have fun.

46. Learn to play at least one musical instrument.

48. Respect other races and nationalities.

49. Never argue religion or politics.

50. If it sounds too good to be true, it probably is.

My grandfather was full of life lessons, and I listened.

Sushil Kedia adds:

Here are some more important lessons to consider:

1. Other Points of View (OPV): Accepting, rather than denial or immobilizing fear, is the beginning. The situation definitely gets refined when one looks at it from Other Points of View. One must look at the situation from the views of ones adversaries as well as from the perspective of an unengaged onlooker. Dispassionate observation is facilitated by comparing OPVs with one's own view and building up a strategic process that is always computing the odds.

2. Grow beyond wrong and right: Anger originates as sequence of feeling wronged and guilt originates as a sequence of having done wrong. In winning, it is crucial to be beyond computations of wrong and right. Focus instead on what defines winning for you and what is appropriate for achieving that win.

3. Economy of Movement: Decisive action including communicating the bare minimum necessary innuendos (action as well its absence are both communications) not only helps conserve energy it consumes the energy of the adversarial situation or people.

4. You are the problem: The same situation involving another man has another solution. Recognize your unique gifts and the precious effort that must go in to defending and growing this uniqueness. No handicap is thus in the middle of battle a drain on your resources. Viewing the complete picture with you at the center of the problem is necessary to identify the path of least effort applicable to you.

5. Be your own decision maker: Responsibility for all outcomes is the facilitator for achieving a focus beyond destiny and helplessness. Assume no help will come but will have to be obtained.

6. Don't celebrate your success, in the usual way: Deception is an ingredient of every contest. Feign strength when weak and display weakness when strong is something Sun Tzu taught centuries ago, in any case.

7. The Pain gain formula: Nothing comes free. Pain & gain are often the two sides of the same coin. Always check if an advantage achieved or to be achieved has not come or will not come at an unfair cost incurred unknowingly elsewhere. With such a focus the need to enjoy the journey is extraneous. What may begin with pain could be the ticket to gain and vice versa. The driver of joy being the final destination, the journey will become worth engaging in all situations.

8. Beautiful mind: Beauty of cause is a state of the mind. Being conscious that the mind has states and one can by conscious choice alter those states one may overcome the definition of mind as espoused by Edward de Bono that, "mind is a self organizing pattern seeking system." You and the situation together are the problem. Be conscious of your cognitive states.

9. Believe that you will succeed: You cannot argue with this point since as much as is true that seeing is believing so also is it true that believing is seeing. The solution and the current moment are separated in time. In traveling across the correct strand of time, one would need to traverse the correct strand of time. Believing is the lens to find the correct strand.

10. Be the witness: Changing the perspective from being the doer to one who is a witness to the struggle drives objective and rational sides of the self organizing pattern seeking system called the mind. Fear and hope that are the normal controls of minds in normal states need to be put aside whilst input and output control need to take over.

11. Do, only whatever is necessary: One can always be aware of not creating more problems while solving the ones at hand.

12. Give up when required, only temporarily: need for rest, rejuvenation, re-organizing apart. Many times silence, inaction, inactivity provide the ultimate deceptive veil for more lethal and smashing action.

Jim Sogi comments:

The Pain gain formula: Nothing comes free. Pain & gain are often the two sides of the same coin.

I love this, and Jeff's list too. But I wonder why pain and gain are so correlated? Is it the issue of going against the herd vs the genetic urge to comply? It applies in physical fitness. I sure would appreciate some ideas on this one.

Jim Rogers replies:

Pain is a necessary, but not sufficient, condition for gain.

Additionally, not all pain produces gain, but both concepts are relative. Because of the differences in both pain "tolerance" and measurements of gain (in terms of "value"), it's pretty difficult to turn this observation into any type of concrete maxim.

Finally, it seems that there are occasions where the value of a gain outweighs the pain endured, indicating some type of arbitrage situation. However, the pain of spending one's time looking for free lunches (combined with the "pain" of acquiring the skills to recognize arb opportunities) may minimize the net gain.

Alston Mabry writes:

What about that special pain the Mistress inflicts with volatility? One takes a position that then goes against, and one has to try to wait it out until it turns back in one's favor. So many times one gives in, escapes the position and the pain, only to watch the fulfillment come in exactly as predicted. Book the loss, learn the lesson, try again.

Marion Dreyfus responds:

You cannot win a great body without heavy working out. You don't fall into piles of earnings and wealth–you invest judiciously. Pain is obviously correlated to gain — otherwise we would leave the womb and float through life with strawberry sundaes glissando-ing off our lanais as we polish off language texts in the Copacabana with cognac fountains spurting gleefully in the front 40. We don't. We have to work to elicit goodies.

Feb

3

Self Appraisal, from Sushil Kedia

February 3, 2009 | Leave a Comment

A little boy went into a drug store, reached for a soda carton and pulled it over to the telephone. He climbed onto the carton so that he could reach the buttons on the phone and proceeded to punch in seven digits.

A little boy went into a drug store, reached for a soda carton and pulled it over to the telephone. He climbed onto the carton so that he could reach the buttons on the phone and proceeded to punch in seven digits.

The store-owner observed and listened to the conversation:

Boy: 'Lady, Can you give me the job of cutting your lawn?'

Woman: (at the other end of the phone line): 'I already have someone to cut my lawn.'

Boy: 'Lady, I will cut your lawn for half the price of the person who cuts your lawn now.'

Woman: 'I'm very satisfied with the person who is presently cutting my lawn.'

Boy: (with more perseverance): 'Lady, I'll even sweep your curb and your sidewalk, so on Sunday you will have the prettiest lawn in all of Palm Beach.'

Woman: 'No, thank you.'

With a smile on his face, the little boy replaced the receiver. The store-owner, who was listening to all this, walked over to the boy.

Store Owner: 'Son… I like your attitude; I like that positive spirit and would like to offer you a job.'

Boy: 'No thanks.'

Store Owner: 'But you were really pleading for one.'

Boy: 'No Sir, I was just checking my performance at the job I already have. I am the one who is working for that lady I was talking to!'

This is what a friend sent to me with the label self-appraisal.

I have been left wondering since reading this if the market is not that phenomenon where such a self appraisal is an ongoing activity.

Jan

25

Slumdog Millionaire, from Sushil Kedia

January 25, 2009 | 3 Comments

After ten academy awards nominations, Slumdog Millionaire has suddenly caught the fancy of every Indian, including other film-makers, artists and the likes. I got to view this movie today.

After ten academy awards nominations, Slumdog Millionaire has suddenly caught the fancy of every Indian, including other film-makers, artists and the likes. I got to view this movie today.

What struck me was a rather ingenious business mind that is securely and fairly quickly taking over the Bollywood masala-movie-making adventurorium. Think about what such a movie would have done during "good times" unlike the "gloomy times" surrounding the globe today.

It's about a dream-run wherein the least expected of any — a slumdog gets to win the ultimate game of acceptable avarice, who wants to be a millionaire, igniting the passions, the morale & the imagination of a world grappling with a meltdown. Throw in high-strung contrasts of skyscrapers jutting out of vast slums spinning a yarn of a rare positive black swan wherein the entire life-sequence of a guy growing with the flow (sounds familiar with the traders' going with the flow) comes to be captured in a set of twenty or so questions. Any probabiliticist would be inspired to see how a rarest of rare flukes gets enacted out, wherein each travesty of a man carried in its womb the answer to each critical question to his final glory.

Luck, chance, bravado, the persistent human spirit and most importantly the all important element of hope in these times spin around. Each of the three child/adolescent actors who portrayed the growing ages of the central character has done some brilliant acting bringing out the made-of-steel character in equal measure. So, perhaps this movie instead of getting a best actors award (since perhaps it cannot be given to three individuals for playing the same character together) could be deserving of the best director's award for bringing such performance out of new actors.

A catch line in the movie where the malleable brother of the slumdog who has already sold his soul to a gang lord surmises that India is today at the center of the world and he is at the center of the center is the ring fence around the commerce of this movie. The Chindia fears of the West stand diluted in the backdrop of the pain of the slums and yet on the other hand this same moment ignites the global morale back again. A beautiful deploy of the transferred epithet. The other line that comes into justifying my assertion happens when Slumdog yelps to his tourist clients at the Taj Mahal, "You wanted to see the real India, here it is" on being bashed by the tourists' chauffeur when they all return to find that the car tyres and everything else that could have been dismantled have been and taken away by the cronies of the slumdog kid. In sympathy the American Tourists pass on a hundred dollar bill. Yes, this movie tells the Americans that howsoever much goodness you would dole out the real world "Out there" is just what has been shown — a deceitful, emotionless slum!

A catch line in the movie where the malleable brother of the slumdog who has already sold his soul to a gang lord surmises that India is today at the center of the world and he is at the center of the center is the ring fence around the commerce of this movie. The Chindia fears of the West stand diluted in the backdrop of the pain of the slums and yet on the other hand this same moment ignites the global morale back again. A beautiful deploy of the transferred epithet. The other line that comes into justifying my assertion happens when Slumdog yelps to his tourist clients at the Taj Mahal, "You wanted to see the real India, here it is" on being bashed by the tourists' chauffeur when they all return to find that the car tyres and everything else that could have been dismantled have been and taken away by the cronies of the slumdog kid. In sympathy the American Tourists pass on a hundred dollar bill. Yes, this movie tells the Americans that howsoever much goodness you would dole out the real world "Out there" is just what has been shown — a deceitful, emotionless slum!

Even with my critical eyes, I switched off the screen and the player with an elevated morale, that one could just do it, even after landing in a slum.

A savvy commercial play on the mass emotions of the times, produced with one of the lowest budgets with which a film has been made in Bollywood. It perhaps is on its way to jingle the cash boxes in an unprecedented way.

But then, in a free market economy wouldn't the consumer get what it needs most? Here it gets, the "Slumdog Millionaire."

Jan

12

Constants, from James Sogi

January 12, 2009 | 5 Comments

There are mathematical constants such as the ratio of a circle to its radius we all know as pi, the relationship of a line u and a segment such that u/u+v=u/v or the golden mean, and lim x -> 0+, (1+x)^ 1/x Seattle Phil's favorite constant, "e" a valuable computational tool allowing additive solutions. "e" allows doing complex calculations with relative ease, by replacing multiplications with additions. Pi is used in statistical computations involving the Gaussian distribution. They don't really know who discovered e. Archimedes discovered pi. Such ideas had commercial application in practical things as determining whether the coins were fake, or the volume of the King's golden crown. The curious thing about each is that no computer can state the number since some are irrational or transcendental. Each is critical to whole fields of prediction. Identification of market constants might uncover some regularities otherwise hidden and allow calculations and solutions. Some say market moves often follow the golden mean. I have been pondering what other important but unused constants might exist in the markets. Time, of course, is a constant. The vig is another. The use of the normal distribution might be viewed as a constant for computational ease and allow use of constant ratios such as standard deviation, mean, median. In the past, gold or the dollar might have been a constant but globalization and floating currencies stopped that one. The ratios are important still. What other constants might be in the markets?

There are mathematical constants such as the ratio of a circle to its radius we all know as pi, the relationship of a line u and a segment such that u/u+v=u/v or the golden mean, and lim x -> 0+, (1+x)^ 1/x Seattle Phil's favorite constant, "e" a valuable computational tool allowing additive solutions. "e" allows doing complex calculations with relative ease, by replacing multiplications with additions. Pi is used in statistical computations involving the Gaussian distribution. They don't really know who discovered e. Archimedes discovered pi. Such ideas had commercial application in practical things as determining whether the coins were fake, or the volume of the King's golden crown. The curious thing about each is that no computer can state the number since some are irrational or transcendental. Each is critical to whole fields of prediction. Identification of market constants might uncover some regularities otherwise hidden and allow calculations and solutions. Some say market moves often follow the golden mean. I have been pondering what other important but unused constants might exist in the markets. Time, of course, is a constant. The vig is another. The use of the normal distribution might be viewed as a constant for computational ease and allow use of constant ratios such as standard deviation, mean, median. In the past, gold or the dollar might have been a constant but globalization and floating currencies stopped that one. The ratios are important still. What other constants might be in the markets?

Sushil Kedia writes:

I am visualizing two broad categories of market constants. The first category that is a list of constants for all participants and the later one which contains transitory constants for individual participants and varying values of the same constant for different types of participants at a given point in time.

The first variety of constants are relating to the sense/measure of time, of the variety:

1) Minimum Tick Size for each contract / market

2) The weekend

3) Market opening & closing time

4) National & other regular Holidays

6) Occurrence of earnings announcement seasons

7) Presidential Elections (every four years)

8) Options & Futures expiration cycles

… so on and so forth

The second classification of constants comes from a less easy to describe and more amenable to visualize variety that most of us are more often interested in are the price related constants. I would surmise that given any particular state of a trader the amount a particular trader is willing to risk on the next trade is a constant in the near vicinity of his recent wealth / income / consumption matrix. Thus, it may be useful to visualize a +/-2 Standard deviation price move in a day/week/month measured over the same units of time say at 20, 50 and 100 day/week/month span could be that constant threshold which evokes sense of pain/gain for say traders, speculators and investors. Variable constant for different types of participants varying for each over their journeys inside markets and varying across different participants at any given point in time is what makes the market a self sustaining, self perpetuating contest.

If one assumes that a disciplined trader is making repetitive constant sized bets (the search for that "optimal F") and Value at Risk is changing due to changes in volatility at a chosen time horizon then eventually this class of individual state dependent constants are again connecting back to the individual sense of time.

The search for thoughts on market constants is thus taking one back in a loop of figuring out if there is an inner market time.

Nov

11

Recession Prediction by the Markets, from Russ Sears

November 11, 2008 | 2 Comments

It has been mentioned several times here that stocks (S&P 500 index) predict the economy six months in advance. What about interest rate spreads, do they look forward six months in advance?

To test both ideas I looked at stocks' six month prior return before a recession started as defined by NBER. I defined this as the predicted "start" of the recession. I also looked at the six month change in spreads of Moody's BBB index to 10 yr Treasurys. I used the last nine recessions (first one in 1954) and assumed we have begun the 10th one.

Further I defined the predicted middle of a recession as the period from start to six months before the recession ends. Not all recession have a middle as the 1980 recession lasted only six months.

Finally, I predicted the end as the period six months to the end of the recession.

My hypothesis: If the markets "predict" a recession to start six months prior, returns should be negative for stocks and the spread change should be positive (spreads increase). Likewise if the recession is to continue. And opposite if it is to end.

The table displays the results.

. Predicted Predicted

. by by Overall

Predicting Spreads Stocks Count

Start 7 7 10

Middle 6 6 8

End 3 8 9

While most of the hypothesis seems solid, it would seem that credit risk continues to increase even with the recession ending.

I will leave it to the reader to calculate the magnitude of the changes. It is tricky partially because the "start" of the current recession, if there is to be one as I assumed, is not yet defined; and the magnitude of change of prior 6 months greatly depends on the starting month, but not so its being negative.

But to whet the readers appetite, the starts totals changes are not too large in size. The middle is bigger and so are the ends.

And since the scale of the current spread increase and stock decrease is the largest of these, let me refute a meme. It appears that the prior 9 spread change magnitudes at the start had a negative correlation ( r ^2 near 50%) to length of the recession. Perhaps because if the spreads did not predict a recession the dead weight dragged down the economy, but if it did predict and raise competitive cost to borrow, the dead weight died quicker and better capital allocation speeded the recovery. Further, the stock magnitude correlation was near 0.

As noted both indicators are currently more pronounced than the prior 9, so clearly in some ways "this time it is different". But the implication would seem the opposite of the meme from the press. And as for the analysts, let's remember they had a vested interest in keeping the markets booming in the dot com days, as their left hand had a great thirst for leverage and risk then. Perhaps now, with their left hand deleveraging and shunning risk, they would like stocks to remain cheap till they can participate again.

James Sogi adds:

What is so amazing is the speed from which just a little over a year ago the markets were at an all time high and all seemed so rosey. Then so suddenly everything turned so sour in everyone's mind and the entire system seemed so at risk. A good example is the speed of the decline in Iceland. There certainly is a wall of worry in place. The last big bull run started with a bang, literally, even if it didn't shock and awe the Iraqis. Things looked pretty bad in March 2003, and the dot.com crash had wiped out many. One of the characteristics of the last bull run was the low volatility, and the steadiness of the rise, such that buying almost any drop was a winning strategy. Perhaps a retrospective thing to look at is when the market started to go up in relation to the end of the recession.

Sushil Kedia comments:

The Hindi movie superstar of yesteryears — Rajkumar — immortalized in the movie Waqt (meaning time) the line that translates to roughly, "Trees that refuse to bend lower will break down".

If the markets, economies and hoi polloi in general knew that there existed a large unresolved credit problem and still markets were being pushed higher and higher it could very well be that the last skeptic (read the permabear) was being cleaned out. Once achieving the minimum possible pessimism the time varying nature of variance then goes on to catch up (sic down) in a hurry. Trees (read: price structures) that weren't agreeable to bending lower in a timely fashion were then forced to be broken down with time.

Memetics, discussed and mentioned earlier, is about acknowledging that a meme shall prevail until it has got the largest possible number of believers. And so, while things are hurtling lower for now, it too could be that the inertia of observing minds will prevail on a pessimistic mood while prices (the new meme) would uncoil ahead of the perceived economic environment.

Oct

23

More on Volatility: the Cost of (In)decision, from Sushil Kedia

October 23, 2008 | Leave a Comment

Andrew McCauley says, "Volatility itself can be a decision: Long or short volatility."

Andrew McCauley says, "Volatility itself can be a decision: Long or short volatility."

That is stretching the point which then can be elucidated by the fact that the cost of (in)decision question would then address the volatility of volatility as the relevant metric.

Stephen Knipe says, "If people were totally indecisive and no trading decisions were made then volatility would equal 0."

Well that's one specific situation in which volatility could be zero. The other situations could be where there is a linear or otherwise perfectly predictable price curve. Could it not be said that since there is uncertainty and / or volatility people trade and not vice versa? In the absence of any trading activity the reading of volatility will keep dropping closer and closer to zero.

Perhaps my own original question suffers from the limitations of language at expressing. I may be able to convey my query better hopefully by paraphrasing that should one lean onto trading strategies / practises / ideas/ habits/ programs whatever anyone follows that tend to increase the frequency of trading as the PRICE of volatility goes up?

We have discussed this before on the lists and I have written that the price of volatility is what is observed in the markets whereas the value of volatility is unique and different for each unique participant in the same was that the price of the underlying security is same for everyone but the value of the underlying is different for each unique participant.

There is a another possible way to visualize the response mechanism of each participant as to what is volatile and what is not volatile that when a price series spends more time within the boundaries of moves around the mean change over the relevant (for each participant) time span that trigger the sense of pain and gain for each participant it gets increasingly volatile. The less time a security price series spends within the pain and gain definition bounds of a trader / trading system the more number of profitable or loss making trades it generates. I conclude that as each individual's value assessment of volatility increases each individual is induced to trade more. Another twist exists that the law of diminishing marginal utility might not be ruled out here. As the individual sense of volatility goes past a certain optimal threshold for each the desired frequency of trading does come down. In such a context, when the commonly accepted and agreed upon price (not value) of volatility is going up (option implied volatilities or the vix index) the actual prices of the security are jumping around the mean path more widely triggering crossovers of pain and gain thresh-holds with a larger frequency. However the paradox then arises that options writers (volatility sellers) are providing to the options buyers (getting more uncertain about market in the coming future) a protection from the perils (expected by the option buyers) of taking decisions. By such an argument is it then not true that at any given point in time the buyers of options or protection are those whose optimal point for increasing the number of decisions with rising volatility has already been reached while the writers of options have an optimal point on the volatility vs trading frequency curve further ahead?

Volume, I would like to submit to Mr. Knipe, according to me is the struggle for the discovery of price. Volume itself can be erratic or steadily rising or falling. Perhaps, akin to the kind of insight the volatility of volatility could provide about the state of markets the volatility of volume may aide in understanding the market's willingness in contesting or not contesting the discovery of price. Volume I do not agree is the "decisiveness to trade" but it perhaps is the anti-thesis of the prevailing price meme in that a rising volume provides a rising chance / facility to trade rather than a rising willingness to trade.

If the volatility-frequency of trading relationship can be tested to the applicability of the law of diminishing marginal returns of volatility in inducing trading then it may be possible to demonstrate that strategies that are pegged on buying large packets of insurance with an aim to living under long periods of non-achievement to gain some day on the unpredictability of dooming uncertainty arising at some point are rather than getting fooled aiming to fool the rest on the concept of randomness.

Oct

19

Volatility: Cost of (In)decision? from Sushil Kedia

October 19, 2008 | 6 Comments

In the context of markets, a cost is a reduction in equity or a forgone opportunity of enhancing equity. A decision, in the context of markets, is a new trade. A rise in the price of volatility is, in general, accompanied by a fall in the price of the underlying and vice versa.

In the context of markets, a cost is a reduction in equity or a forgone opportunity of enhancing equity. A decision, in the context of markets, is a new trade. A rise in the price of volatility is, in general, accompanied by a fall in the price of the underlying and vice versa.

A rise in the price of volatility is a reflections of the higher cost of protection market participants are willing to pay for their indecisiveness.

Hence, volatility is the cost of unwillingness to decide. Should one then, being a contrarian, not be keen to take a larger number of decisions during periods of higher volatility? How may one be able to study and understand if volatility is the cost of decisions or the cost of not making the decisions?

Matt Johnson comments:

Volatility is an expression of uncertainty (risk), not an ‘unwillingness to decide.’ For me, an unwillingness to decide is the lack of a clear trading plan. I make most of my money in periods of higher vol, but I’m in at the beginning, when I’m most uncertain — not at the end.

Sep

19

The Mother of All Short Squeezes, from Victor Niederhoffer

September 19, 2008 | Leave a Comment

This is similar to what happened to the H#nt brothers when they made money from buying silver and gold. Not only did they lose their gains,…

Nigel Davies adds:

It's difficult not to feel some sympathy for the shorts. The chess equivalent would be for the tournament director to take a look at your position and, on seeing your rooks poised to penetrate the opposing ranks, declare that for the next ten moves they could move only backwards.

Kim Zussman agrees:

Who wants to compete in games where the rules are unstable?

Victor Niederhoffer comments:

When the exchange rules on silver were suspended, the gold and silver markets ceased to exist for about eight years, especially in Chicago. I wonder if many people feel as Dr. Zussman does, and whether this will lead to a tremendous diminution of trading.

Sushil Kedia writes:

A short position, in general, turns out to be a postponement of purchases. Even though they are intended to be opened with an objective of purchasing lower, it is just a potential demand in the future; since buying may happen lower or higher out of a short position.

A short position, in general, turns out to be a postponement of purchases. Even though they are intended to be opened with an objective of purchasing lower, it is just a potential demand in the future; since buying may happen lower or higher out of a short position.

With short sales not existent or not allowed afresh this one key source of periodic demand into the future is absent. Such markets tend to go down with way more ease than those markets that do have an existing short interest. A large subset of emotive responses that can be forced into buying the dips or the squeezes is non-existent.

Likewise, a ban on short sales rather than solving the problem of weak markets only postpones the inevitable weakness into states where there are only herds of long only hands turned into sellers and no motivated buyers to step into the dips.

This perhaps can be studied, if data can be obtained, by comparing the downside swings during periods when short selling was not available and since when it has.

Kevin Depew sees another historical parallel:

Arthur "Bull" Cutten some 70-odd years ago was trotted out before the grain futures commission where he was declared guilty on six counts of "price manipulation." Same type of villification of short sellers occurred then too. I wrote about this in June during the "oil speculator" hearings because I found his declaration after the trial quite apt. I don't wish to self promote my article, the gist of it is this:

Some 70-odd years ago, the Grain Futures Commission declared that Cutten was guilty on six of the price manipulation counts he was charged with and ordered him suspended from all U.S. grain exchanges for two years. After the verdict Cutten declared, "What's the use of trading? The market doesn't move."

Jul

13

I find the paper Simulating Collective Misbeliefs in the Journal of Artificial Societies Simulation interesting.

Notable how it predicts a tendency for cults to grow based on the beliefs of dead individuals.

I think the same techniques may be applied to look at trading systems and trends, as shared beliefs can become self-fulfilling prophecies, sometimes weakened when a bubble bursts. In life it is equally hard to distinguish between consensus belief and reality. Even time and space are human concepts, although when people look for aliens they scan with their telescopes the vast reaches of outer space.

Sushil Kedia adds:

Wonderful. May I be permitted to generalize Mr. Glazier's statement further that everything that mankind debates as within the possible and not within the possible is again a matter of the human cognitive faculties. Recognition is subjugate to cognition. Observation, testing, conclusion is but a chain in the ever improving cognitive processes.

What would the list suggest be a good way to read, learn and think about the history and or the evolution of human cognition? What may be the must read sequence of works in that area?

"Cogito, Ergo Sum" - Rene desCartes

Jun

28

Reading Atlas Shrugged, from Sushil Kedia

June 28, 2008 | 4 Comments

Finally I could invest the time to start reading Atlas Shrugged. I have chosen the word invest advisedly here; I have finished reading Part I and decided to take a pause at the end of page 312.

Finally I could invest the time to start reading Atlas Shrugged. I have chosen the word invest advisedly here; I have finished reading Part I and decided to take a pause at the end of page 312.

Bearing fully in mind the introduction by Leonard Peikoff that begins by stating that Ayn Rand held that art is a “re-creation of reality according to an artist’s metaphysical value judgments”, it strikes me very hard to seek your opinion if really in the America of the last century there indeed were characters such as Jim Taggart, Orren Boyle and the sort of hoi polloi that has been described continuously in these 312 pages. I have no doubt that there were a lot of Dagny Taggarts, Hank Reardens, Ellis Wyatts who helped (re)build modern America further, but it beats me if really there was a time when the over-riding thought and action of the day was being shaped by Jim Taggart and Orren Boyle types as well. What do you think? Has the author erred in stretching the shadows far longer to produce the effect or was there really an America like that also?

Alex Castaldo attempts a reply:

You are not the first non-US reader of Ayn Rand to be puzzled by this question. As a foreign-born American I was surprised that her books were set in the US when you could easily come up with better examples of government/business connivance from other countries. Americans can consider themselves lucky that they are better off in this respect than some others. Indeed I have often asked myself where is the Italian Ayn Rand who would speak up about how some of Italy's wealthiest people have made their fortune largely through political connections and improper operations, and explain the difference between this and true entrepreneurship. Sadly he/she does not seem to exist (possibly for lack of readers).

Part of the answer may be that Ayn Rand was most familiar with Russia and the US, so of course she chose to write about these countries. Also, she was concerned about trends and developments rather than the immediate situation; the US in her books is perhaps the model of what could happen to any country if the disturbing developments she saw around her were to continue. Her books are, among other things, a plea for the US to retain (and improve) its traditional values and not adopt those of the then ruling class in Soviet Russia.

Jun

26

Seven Years, from Sushil Kedia

June 26, 2008 | Leave a Comment

Someone I met recently told me that in about seven years time each and every atom is replaced in our bodies. Then how come the much analyzed chemical reactions of the body and brain retain memories and learning acquired across years? Irrespective of the proverbial seven year itch arising in the 7th, 6th or 8th is it then about revisiting the premises left now only in memories upon which the original pleasance of the relationship rests still upon?

Like in a computer where one keeps on upgrading each and every component and on average ending up replacing every part in about seven years when nothing existing today was in the original computer the data, the feel of the desktop remain the same and we still call it the same computer. Is life and the kind of computing the human brain does more similar to network computing? What else might a social process be similar to from the world of computing? Can principles of computer networking be applied to find valid applications in a social process called the stock market?

Is life using more of google spreadsheets kind of structures than using the locally resident ex*el type utilities? How come across generations within family trees certain patterns of thought, action and being are ingrained? What then is the reason for a flapping of a butterfly's wings in one nook of the Earth bringing about a typhoon in another corner of this planet if life being a seamless network of information and matter is really incidental to its carriage?

Would a market be over N years not replacing each and everything that existed before that period and still be the same market? DJIA has just one original stock for an example. It is still the same market. It is the same stories and folklores. What is the value of that N for each different security, each different market sector etc. etc. Will the differences in N reveal any differences about the markets, assuming measurement of such an N will be feasible somehow?

Is reality, in the markets and otherwise, just a continuum of information while matter keeps getting replaced, regurgitated, re-structured, re-invented etc. etc.? Why does then someone as successful as the Sage proffer wisdom that one ought to own companies that do the same routine thing that we would require all our lives? The coke is the same as it was twenty years ago? It perhaps is getting different again at its own pace. In the same vein then why is there only one company such as 3M yet that persists on achieving not less than 60% of its sales from products that did not exist three years ago?

May be a good point to begin on this trail is to first imagine and find which variable(s) from the characteristics of securities or companies can be those that which change completely in N years across a set of securities, value of N being then the next variable to study?

Jun

1

Sleeping and Trading, from Sushil Kedia

June 1, 2008 | 3 Comments

My father handed over the wealth of his knowledge from a lifetime of speculating the night before I was leaving home and starting a career in the markets of Mumbai:

1) Sleep well and enough and at regular hours. Deprived sleep doesn't get compensated by catching up.

2) Eat well and at regular hours. An upset stomach makes the mind waver. Drink lots of water.

3) Speak only when necessary. Never loudly.

4) Listen.

5) Gather facts, steer clear of opinions.

6) Stay away from losses. Money will come from chance.

7) Don't trust anyone completely. But trust.

8) Write your books of accounts everyday.

9) Adjust sleep if any of these don't work well.

Dad wrote this list to me many times in several of his letters again and again across years. I am still trying to improve. He tells me his father gave him this list.

Mar

20

Another Way to Look at Volatility, from Nigel Davies

March 20, 2008 | 1 Comment

Another way to look at changes in volatility (increase/decrease in price swings per unit time) is to view it as having a typical overall move in price but with the time scale expanding and contracting. This might offer some additional insights, for example point and figure charts by ignoring time also ignore volatility. So if you test these they'll produce a quite different set of patterns which are essentially 'volatility blind.'

Sushil Kedia replies:

A filtration process such as Point & Figure is essentially based on defining one's tolerance for noise in the price series. The box size achieves that. Point & Figure is the only method in Technical Analysis to not plot the time axis. It is perhaps the only method of looking at prices which has a nature similar to the time/distance equivalence in Einsteinian physics. There perhaps is a case for finding a congruence in defining a unit of time for a particular security based on a certain standard movement in its price.

Bill Rafter explains:

Point & Figure purports to separate "signal" from "noise" and discard the latter. Every time you run data through a filter, you eliminate both some signal and some noise. The short-term data that you assume to be all noise contain substantial signal. Thus, it is illogical to assume that you will improve results by discarding information. Further, and most-importantly, we applied Point & Figure filtering to all of our trading methodologies and the degradation of results was universal.

Phil McDonnell expands:

The Grand Master poses an interesting question and Mr. Kedia wisely suggested an analogy to Einstein's relativity theory. There is much to be learned from these ideas.

The Grand Master poses an interesting question and Mr. Kedia wisely suggested an analogy to Einstein's relativity theory. There is much to be learned from these ideas.

Suppose we have two assets which substitute for each other in investment portfolios. For example they might be stocks (s) and bonds (b). Given that there is only a constant supply of funds (m) available for these two investments we can posit that their combined value would be equal to:

m ~= ( s^2 + b^2 )^.5

The above is essentially the equation of a circle of radius m. One possible flaw is that the market for s may be much smaller than the market for b. Thus a given fixed disinvestment from b might move s by considerably more. Our model would therefore no longer be a circle. Without loss of generality we can assume the fixed quantity m to be 1 (100% of all the money). Then we have:

1 = ( s^2 / a^2 + b^2 / d^2 )^.5

where a and d are two constants of proportionality which relate to how quickly the two markets move. Thus each market now has its own ease of movement parameter in this new elliptical model.

One of the key properties of the theory of relativity is that as one approaches the speed of light both time and space are distorted. In particular the Lorentz transformation governs this process and is given by:

gamma = 1 / ( 1 - v^2 / c^2 ) ^ .5

where v is the velocity of the spaceship and c is the speed of light. This represents the transformation in the x direction which we shall assume is the direction of acceleration. Referring back to the elliptical model formula above we see that the one dimensional form looks remarkably similar to the denominator of the Lorentz transform (gamma).

Qualitatively such a model would be consistent with the Davies/Kedia conjectures. Time would slow down as the market moved faster. Magnitude in the price direction would dilate as well as a function of velocity.

Having a theoretical model of the market is all very nice but unless the market follows it then it is useless. To test this a study was done of the above stock to bond relationship using SPY and TLT ETFs. Fitting the parameters a and d to past data one finds that the constants were 200 and 100 respectively. Then the fitted model was compared to the actual past history of SPY and TLT and found to provide very good agreement. Perhaps we may look at these constants as the speed of financial information (light) in the stock and bond medium respectively.

Feb

23

Guaranteed to Happen, from Victor Niederhoffer

February 23, 2008 | 10 Comments

What must not be gainsaid is that the rise of 22 points in S&P futures from 3:30pm to 4:00pm on February 22 from 1334 to 1356 was the greatest rise in history. The rise of 24 points from 3:00pm to 4:00pm from 1332 to 1356 was the second greatest in history, failing by only a point to match the Société Générale rally on 01/17. It was beautiful the way the market set up exactly the same way it did the Friday before all the money was made by frontrunning and running stops associated with the $7 billion loss. Also beautiful was the way the move from 1327 to 1357 (low to high) on Friday basically recapitulated in half an hour the entire range of the last two weeks. That's what a classical symphony is supposed to do at the end of the piece, recapitulate all the themes, bring them together and close with a bang. Also of note was the sentinel function of the bonds in the entire mass, staying down nicely even while the market at the two week lows. It was all guaranteed to happen.

What must not be gainsaid is that the rise of 22 points in S&P futures from 3:30pm to 4:00pm on February 22 from 1334 to 1356 was the greatest rise in history. The rise of 24 points from 3:00pm to 4:00pm from 1332 to 1356 was the second greatest in history, failing by only a point to match the Société Générale rally on 01/17. It was beautiful the way the market set up exactly the same way it did the Friday before all the money was made by frontrunning and running stops associated with the $7 billion loss. Also beautiful was the way the move from 1327 to 1357 (low to high) on Friday basically recapitulated in half an hour the entire range of the last two weeks. That's what a classical symphony is supposed to do at the end of the piece, recapitulate all the themes, bring them together and close with a bang. Also of note was the sentinel function of the bonds in the entire mass, staying down nicely even while the market at the two week lows. It was all guaranteed to happen.

J.P. Highland adds:

Natural gas also had a nice day, settling above $9 for the first since February 2006. It's been quite a run since December 2007 when it was trading below $7. Nearby months are selling at discount, but open interest is decreasing.

Jeff Watson noticed:

While the S&P rallied today at the close, there was also great volatility in the wheat market. The nearby months in Minneapolis did a mongoose/cobra dance today, and the mongoose won. There aren't any shorts in Minneapolis wheat who are making money right now.

Kim Zussman studies:

In relation to the joyful pop near Friday's close, I was wondering how to design an experiment in which subjects obsess about short-term gratification in a system with long-term utility.

(ES on Friday from open to 1130 PST was -18, and from 1130-cl was +25.25. Over recent 100 days, when op-1130 < -10, 1130-cl average= -1.5, T=-0.7)

During recent 100 days , lucky longs celebrated some or all of the following:

Yet during the entire period, the net change was -217.

The mean O-C was a dull -2, but certainly there was much along the way to self-flagellate or congratulate over, depending on the spin of the wheel:

Lon Evans queries:

In regards to "It was all guaranteed to happen": Why so?

Note that the AmBac information was released towards the end of a Friday's afternoon session, replete with low volume and high volatility. Note, as well, that the news was released as the S&P was tumbling dangerously close to the dreaded 1320 level. Take also into account that no (pesky) details were included in the given information. Finally, acknowledge that the Bush administration is actively involved in the bail-out considerations (which suggest but another timely release of disinformation from a cabal that would rather climb a greased pole to tell the lie, than stand on the ground to tell the truth).

Without the mentioned announcement, was Friday's reversal "guaranteed?"

Let's consider another scenario. Friday closes at 1324, after bouncing off 1320. We awake on Monday to Asia's having sold off heavily in a tidal wave of red. Spitzer, again, rattles his saber in demanding that the rating agencies come clean with timely and honest evaluations of the monolines' status. And a credible evaluation of accelerating inflation hits the wires.

Given the above scenario, would a Monday's close below 1320 have been a reasonable possibility?

Where is the science in your predictive model? It seems to me that all you've done is demand that a arbitrary result validate a biased opinion. Other than betting upon an "inevitable" inevitable, I don't understand that your system of analysis is any more logical than that of a friend who utilizes tarot cards to guide his investment strategy.

No one can argue that Friday was very profitable for the quick-witted daytrader (full disclosure: I was among the less acute, managing to cover my short with only a couple handle loss, and just as my limit was so close I could smell it). But having cut my teeth on a day-trading floor during the dot-com boom/bust, I'm as aware as any what an accumulation of the quick-witted can impel given the intraday scenario, particularly a Friday scenario.