Mar

30

Falling Apart Without Falling to Pieces, from Dr. Janice Dorn

March 30, 2010 |

The promise given was a necessity of the past: the word broken is a necessity of the present– Aparna

The promise given was a necessity of the past: the word broken is a necessity of the present– Aparna

Two weeks ago, 700 residents of a small, affluent mountain community were stunned to learn that at least 90 million dollars they had entrusted to a pillar of their community was gone. The man who seemed to have it all-a sprawling mansion, the fanciest cars, the trophy girlfriend and the most reputable business in the state– declared personal and company bankruptcy. The town is reeling from this, TV cameras are going house to house and many say they were "completely wiped out and don't know what to do or where to go." They have fallen apart and are going to pieces.

Sparing you the details, the essence of this story is that there were too many secrets lies and false promises. The more secrets you have, the sicker you are. This applies to all aspects of personal and business life. The more secrets you keep about who you really are, what you are doing with your money (the last great taboo of our culture), the sicker you are.

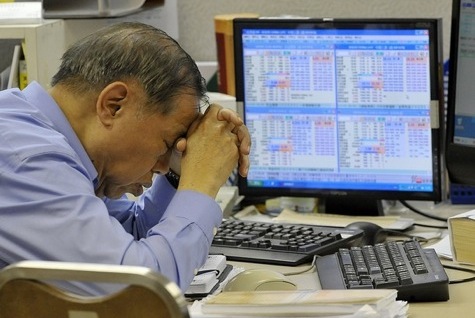

This is nowhere more true than in trading. If you do not get right with yourself and those who believe you and believe in you, you are in sickness and stinking thinking. The most important way to begin falling apart without going to pieces is to tell the truth. If you are hiding your losses from a loved one, step up and tell that person. Don't pretend you are a winner when you are losing. Don't allow your pride to get in the way because pride (especially if built on a false and crumbling foundation) leads to misery, falling apart and, for some, going to pieces.

What happens when you go to pieces? Addictions, acting out behavior, depression, continued lying to self and others, and all manner of mental, physical and spiritual DIS-ease. It is only through telling the truth and being radically honest and taking personal responsibility that you find true freedom. This is exactly what happens every day in life and in the markets. There is so much hype, deception, misinformation and disinformation. You search desperately because you want to find the truth. But most of it is not the truth. The truth is often intolerable to bear. Denial, rationalization and the search for confirmation of your biases are much easier. No one wants to fail, but failure is a part of life. Failure is a part of trading and investing. Losing in the markets and life is often the beginning of winning. It's OK to fall apart without falling to pieces. It's necessary to get stopped out, to preserve capital, to embrace risk and take total personal responsibility for your thoughts and actions. Winners fall apart, but they quickly regroup. They don't crumble and hide in the corner or lie to others about how great they are.

It's freeing to admit that we are human beings, that we are fallible and we make mistakes. It's OK to make mistakes. It's not OK to lie about them and pretend they don't exist. In time, the truth will be revealed but at this moment, hundreds of suffering people have lost trust. Trust is a commodity in very short supply today, yet it is the bedrock of any relationship. People will not trust you if you lie to them. You will never learn to trust yourself if you continue to lie to yourself. It's a vicious cycle of denial and obfuscation that leads to self-destructive behavior and further self-sabotage.

There are many lessons for trading and living in this story. Here are a few ways to keep from going to pieces when it all falls apart:

Always tell the truth to yourself and those you love and who love you.

Trust, but validate and verify everything.

Don't trust anyone but yourself when it comes to your money.

If something seems too good to be true, it probably is.

Don't assume anyone has your back. Take full and total responsibility for your actions and don't sit around waiting for someone to bring you flowers or make money for you

Just because something has worked in the past, don't assume it will keep working. Linear thinking is complacent thinking and leads to a false sense of security and comfort.

Don't get greedy. Remember, bulls and bears make money-pigs get slaughtered.

Don't put all your eggs in one basket. Diversify whenever possible.

Everything you thought and dreamed for your future can be gone in the blink of an eye.

Hope is not a viable strategy for trading or investing in anything.

Stay really strong in body, mind and spirit because you never know when the tsunami is going to hit.

Prepare for the worst and expect the best. Have a backup plan. Have three backup plans.

When it all falls apart, you can and will survive if you don't fall to pieces.

If you once forfeit the confidence of your fellow citizens, you can never regain their respect and esteem. It is true that you may fool all of the people some of the time; you can even fool some of the people all of the time; but you can't fool all of the people all of the time–Abraham Lincoln

Comments

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles