Dec

25

Some Year End Thoughts, from Steve Leslie

December 25, 2007 |

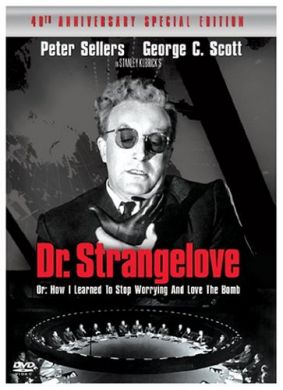

Or, how I learned to stop worrying and love the market.

Or, how I learned to stop worrying and love the market.

The really old people on this site (myself included), will realize that this is a reference to the classic satire film Dr. Strangelove, one of the great cult movies of all time. It presents a scenario as to how simple it could be to effectively start a nuclear war. The storyline is about a Lt. Colonel who goes insane and orders a nuclear attack on the Soviet Union. Only the President of the United States (impeccably played by Peter Sellers) can avert the tragedy. Is this comedy? Is it drama? Stanley Kubrick, who directed the movie, leaves it up to the audience to decide, by marvelously weaving a tapestry of twists and turns that, in the end, leaves the audience wondering: can something like this really happen?

I mention the movie because I am fascinated by the human condition and moreover I marvel at the predictability and unpredictability of man and his impact on the markets. What does this have to do with the speculator? I think this has everything to do with the speculator.

While watching CNBC this morning, I noticed that the staff and producers are reaching into their bag of tricks to fill in air time on a truncated day due in part to the market's being attenuated by closing at 1PM and traders having other thoughts on their minds with visions of sugarplums dancing in their heads. Many have already left their stations and either have taken the week off or might even have taken the rest of the year off.

The show is bringing on the same old tired guests with the same old stories and banging the same old drums. Seemingly anyone who can fog a mirror is invited to appear. Original thought is all but absent. Where is the best place to invest for 2008? What year end strategies should be practiced at this time? On and on goes the same old tired wheel and its grinds and it grinds.

How might the speculator take advantage of this.

First and foremost, I would begin by putting in the effort during this slow time to evaluate the effectiveness of whatever investment strategies you utilized this past year. Now is the time to be brutally candid with yourself and determine where you had your greatest successes where you failed and where you might improve. Most importantly, how did such strategies and methodologies translate in money over the year. How can the successful strategies be replicated and which ones need to be abandoned.

If done properly, this will take some time. It is not a 15 minute exercise. Many of us will not do this as it is far easier to avoid pain than it is to seek pleasure. Or as Al Pacino said in "Scent of a Woman", for me I knew there were two paths that I could take the easy path and the hard path and I chose the easy path because the other one was just too damn hard.

Bear Bryant said The price of success is high. That is why many are not successful. They just do not want to put in the extra effort. They want the success, they just don't want to work for it.

Secondly, if you have not already done so, start your business plan for the next year. Remember there is no time like the present to do this. Also remember that most speculators do not do this. The successful ones do. I believe that the number one reason why people are not successful in investing is that they do not take the time to work on their craft. And many more wait too long to put their plan into place.

Someone also said successful people hate doing the same things that unsuccessful people hate doing but they do it anyway. And if it is worth doing at all, it is worth doing well.

It is an interesting phenomenon that Health Clubs experience their greatest membership increase during the month of January. They also witness the largest attendance to be on the first day of the week. By the end of the week, many health clubs are like ghost towns. The ones who experience the largest results and the ones who treat December like January and Sunday like Monday.

Donald Trump regularly states that the main reason that he was able to survive through the late 1980's and early 1990's and ultimately prosper in the latter years is that he never gave up. He kept pushing onward long after the writers stopped writing about his demise. Say what you will about Trump and love him or hate him, he does have some qualities that can be studied and embraced. Tenacity could very well be one of them.

Thirdly, the speculator understands that in order to be successful that they need to learn to respond to the markets and not react. It is better to respond than react. When a physician prescribes medicine for you, if the results are positive he states that you are responding to the medication, if the results are negative, you are reacting to it. Anticipate and then adjust. Aye there's the rub!

Finally, the speculator understands that there is no quick fix to anything. That investing is a journey rather than a destination and in essence they never arrive the evolve. Markets are to be played by the year and not the day. Work each day with focus and clarity and the year will take care of itself. The highs and lows will ultimately be flattened out and the median will become defined and hopefully, they will experience some joy along the way to make the journey worthwhile.

I hope that this holiday season is one of enjoyment and pleasure and the New Year brings you everything that you hope and dream for.

Comments

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles