May

25

Failed Attempts at a New High, by Victor Niederhoffer

May 25, 2007 |

Remarkably, each of the four days this week the S&P Index has traded above its previous all time high close of 1527.9, but then failed to set a new closing record.

Remarkably, each of the four days this week the S&P Index has traded above its previous all time high close of 1527.9, but then failed to set a new closing record.

| Day | High | Low | Close |

| Mon | 1534 | 1526.6 | 1527.9 |

| Tues | 1533 | 1525 | 1525 |

| Wed | 1535.7 | 1524.3 | 1525.5 |

| Thur | 1532.5 | 1507.8 | 1511.6 |

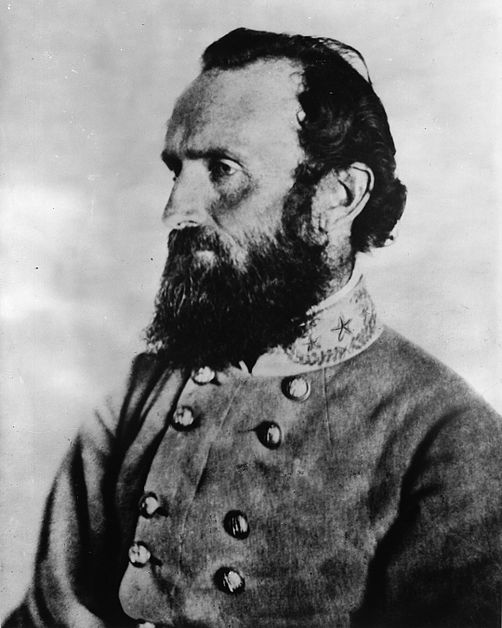

Note the artful way that the market was able to be down on the week by a hair, as of Wednesday, setting up the longs to increase their positions, only to decline 25 fast points the following day. It would take a Rommel or a Stonewall Jackson to duplicate such cunning.

Thursday had the highest single day range since March 21st; it was up seven by 10 a.m., but then down 18 by 3.40 p.m. (NY time). This is about two and a half times the average range of last year, and shows the usual ability of the market to do the unusual.

Finally, there have been four serious down afternoons, and these are presumably related to the fake Drs. feelings about China … let us hope he visits there for a second time soon, as the first time he was only there for a day (with Paulsen, just 1 year ago).

From John Floyd:

I think other contributing factors to the market's retreat are also tied to the cycling of rate expectations, economic data, and "carry trades." The beginning of yesterday's sell-off started not soon after the stronger U.S. economic data and coincided with a sell-off in interest rates and carry.

In addition to the Dr.'s comments, who does seem to be losing some of his "mojo," the directive of the latest comments were towards China and the market has disregarded the comments and moved to new highs since them. The overnight price action in carry and Japanese inflation data continuing to border on deflation should make today interesting.

Also of note, combined with other indicators, is that gold last Memorial Day was at roughly the same level and subsequently fell sharply.

From James Sogi:

Why three times? It's like the old knock, knock joke. Who's there? Always three times of course. Three is the minimum number to create a pattern. "Knock, knock. Who's there? Orange you glad I didn't say banana?" The three tops were also the three-mountaintop candlestick pattern. Seems like the market likes threes. "On your mark, get set, go!" Seems like something deeper, but what? But it's something to ponder over a three-day weekend.

Speaking of weekends, here's a favorite barbecue: Yakitori.

It's great for sitting on the deck because you can eat holding the little stick and still have a free hand for the beverage and you can gesticulate with the little stick to make your points more emphatic. Serve rice of course, or better yet Musubi. Here's how to make Musibi.

From Dylan Distasio:

If you're in the NYC area, check out Yakitori Totto on the West side for awesome organic yakitori and a great sake selection. They actually have an East side location also. My wife and I have eaten at both fairly often, and the food is delicious. They cook most of it over the long slim charcoal grill on skewers, and you can order any piece of a chicken you can imagine (and then some). It's fun to just order an assortment of small skewers and drink some sake. There's a great atmosphere also. I've never been to Japan but it seems pretty authentic. We're often one of the few Caucasians in there; the rest are usually all Japanese-speaking, including the entire staff. I'd highly recommend it.

John Floyd adds:

Actually if you want sake and good food the other place to try is Sakagura on East 43rd street, in the basement of an office building. There are several hundred of types of sake to choose from, anywhere from a few dollars to a hundred dollars for a masu (traditional wooden box cup).

Comments

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles