Dec

31

A New Years Praise of the Exponential Growth Function (And a Few Words of Warning) from Russ Sears

December 31, 2016 |

As time is counted, the earth has once again made another lap around the sun. The stock market has for another year continued on in its optimist triumphant. I would like to praise those that value time, honor it, and consistently strive with discipline and faith in self and others to pursue exponential growth.

As time is counted, the earth has once again made another lap around the sun. The stock market has for another year continued on in its optimist triumphant. I would like to praise those that value time, honor it, and consistently strive with discipline and faith in self and others to pursue exponential growth.

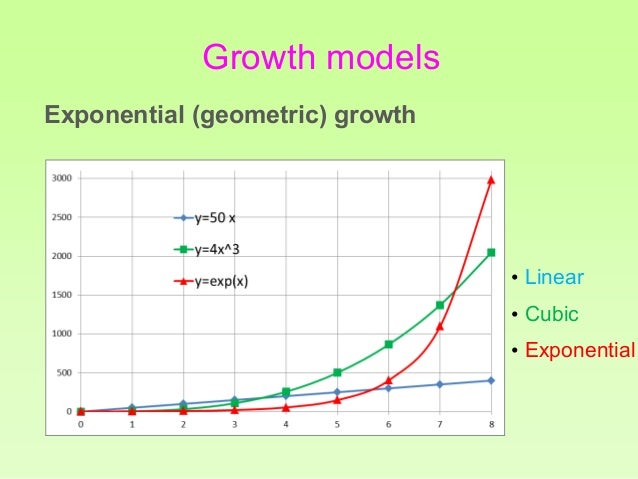

It is my belief that an intuitive understanding of the exponential function, its power, persistence (perhaps even an eternal legacy) is the basis of a person's success and happiness however one defines it. If its power is denied, it ensures one's failure.

It is said that the polite do not talk of illicit sex, dogmatic fanaticism (often found in the most political or the pious religious) and gambling. I would suggest that these forbidden desires are rooted in our natural instinct for exponential growth, either to fool ourselves into believing we are pursuing exponential growth or by short cutting time.

However, if you talk about saving and investing in business acumen, marriage and family and building a solid reputation, even the most conformist among us will approve. These are much slower but more respected historically proven methods to build one's fortune, establish one's family dynasty or build a legacy, and if one endures the short term trials and pain, successful ways to pursue exponential growth.

It would appear that people have a natural respect for the slow persistence of having an edge but taking a short term risk. Nature has in it a reward system that respects those that honor time but can endure short term risk. But the exponential growth model tests our faith in time, humankind and even those closest to us. It is in these times of vulnerability however, that if one accepts this vulnerability and commits more, one is most likely to receive the most from this faith.

Yet this model of growth can be easy to fake. Love, financial advisors, and moralists are the trifecta for con-men. Further it can be difficult to distinguish a linear growth model from an exponential growth model. Scatter plots of an exponential growth often are highly correlated to linear growth model making it hard to distinguish. Further, after growth, time alone often make it clear if the growth is because of a trustworthy foundation, or if the growth was artificial creating by borrowing from the future, creating an exponential decay of debt. Further, as Yogi said, "It's difficult to make predictions especially about the future."

With exponential growth, comes reoccurring compounding. But the hallmark of the "chaos model" also has a similar compounding. A small seemingly insignificant compromise can cause a collapse of such a growth model if resources become strained and great power or wealth are too concentrated, like the flap of the wings of a butterfly can change the course of a hurricane. The best of plans can be derailed by a slight change in the environment sending the growth plan into dogmatism, centralized power and concentration of wealth by systematization rather than market forces.

But exponential growth gets its power not just from patience and time, but from each other. Most powerful is small groups of people banded together by mutual trust to work together for the long term good of each other. When an engineer and a machinist get together with a scientist and a business man the combination can be much bigger than four added together. Their entwined strengths can combine and their weaknesses can be covered.

Families are perhaps the most rewarding and enduring growth model, but they also can be the most difficult to try to predict. This of course can be difficult to see day to day when the follicles of those closest to you are so apparent , or when a T-Rex of centralized power is hunting for you.

An insistence that second order and higher effects are fully understood and controlled beyond reason, if everything is always roses, consistency of only positive returns and the advertisement thereof are all signs that a marriage, business and reputation are about to implode. It takes faith in one's self, in those that love you and that you trust in, to those you agreed to do business with and the markets in general to ask for accountability, as vulnerabilities are exposed, to ask, to test and prove to yourself that all are still pursuing exponential growth…rather than faking it. But one must be willing to ask, to test and confront those challenges sure to arise from building a long term plan. One must be willing to admit that the higher order effects of pursuing exponential growth creates uncertainties that will be met. Rather than pretend that you have already tamed exponential growth and it must be submissive to you.

May your faith in the power of humankind to solve problems, be fruitful, and those closest to you to share one another's vulnerability intertwined together bringing all super but all to human strength, another year.

Comments

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles