May

21

Tournament Backgammon and Trading, from Ken Drees

May 21, 2015 |

This winter in order to stave off the polar vortex II, I joined the USBGF and tuned up a forgotten game, played online and re-read some books. My goal was to play in my first over the board USBGF tourney in the spring here in Cleveland. It was a very difficult yet rewarding. I wound up playing in the intermediate flight, and lost in the semi finals (money match) to a Ben Franklin looking naturalist from the woods of Pennsylvania. He went on to beat the next man and win the section. I hedged with him and as the loser –still won my entry fee back and then some, so I exceeded my expectations as a first timer. I played with professionals and held my own.

This winter in order to stave off the polar vortex II, I joined the USBGF and tuned up a forgotten game, played online and re-read some books. My goal was to play in my first over the board USBGF tourney in the spring here in Cleveland. It was a very difficult yet rewarding. I wound up playing in the intermediate flight, and lost in the semi finals (money match) to a Ben Franklin looking naturalist from the woods of Pennsylvania. He went on to beat the next man and win the section. I hedged with him and as the loser –still won my entry fee back and then some, so I exceeded my expectations as a first timer. I played with professionals and held my own.

Backgammon sharpens the mind, dampens the swinging emotions surrounding wins (highs) and lows (losses). It makes you perform quickly and decisively. The sport seems to be having a slow rebirth. Many backgammon experts went over to the poker tables over the last 15 years. Maybe this is a patch for me to exploit. Everyone there were very friendly. Not many people under 30 at all. Probably 25% women at the tourney. There is a lot of wager money in this game. I played on a $3000 custom board with a dice rolling tower during one game. There is quite a "gambler" mentality there that I felt could be expolited–I avoided a lot of side bets, skipped the drinking and just ground it out. I was exhausted afterward and also satisfied.

In honor of the 36 possible backgammon dice combinations:

Backgammon and Trading Markets

1. Match play is a grind. Every game, like a trade needs to be executed, and evaluated and reexamined roll after roll due to the changing landscape conditions. In an 11 point match, you could wind up playing 21 games.

2. Expect to lose. As in trading, you must minimize drawdown. Losing a game is no big deal during a match, but getting gammoned sometimes or backgammoned will cause you most likely a match.

3. You need to be physically fit. Playing 20 hours of tournament backgammon over the board in two days takes a physical toll. Food and diet usually fall off, sitting and not being in routine makes your body fall out of rhythm. Trading foreign markets comes to mind here. Tourneys usually begin the day's play around 11:00am and end late into the evening. If you are a morning person, you need to change your habits.

4. Fatigue can make one loose with the cube, or willing to take risks with hits or leaving blots. It can also be exploited of your opponent. Your opponent due to fatigue, may just take a risky double. Or you may decide to play a grinding, long slow back-game with complexity in order to really move him into deep water when he is tired.

5. As in trading, don't let a brilliant win go to your head, or an unexpected loss go to one's soul.

5. As in trading, don't let a brilliant win go to your head, or an unexpected loss go to one's soul.

6. Backgammon opponents are like different markets. Some are binary, robotic, calculated. Some can be cagey, erratic. Watch your next opponent before you play him or her. Study your intended market before you trade it. Watch out for the delicate little old lady, and pray you don't get paired against the hot looking woman.

7. Be ready for everything to go foul and stay foul. Cut your losses quick, play safe, concede one point games. The dice are not to be blamed–but when your opponent blames the dice agree with him or her that indeed the dice are not good for them today. Kindly reinforce their beliefs. Don't make excuses for your losses.

8. Blitz! Hit loose, blitz in, keep hitting, slot your points and keep it up till it runs out, then double if its correct–especially early if the chance arises. So take that quick hit winning trade, just bank it and move to the next trade.

9. Be ready to be put on a camera under bright lights or in a featured table for live feed against a big star opponent. In trading this may be like a sudden streak of wins when spouse says nice things or maybe when you are called by a friend for your "expert" opinion.

10. Remember, that everyone else may be tired too, or hungry or in discomfort of sorts. You are not the only one

11. Match equity rises and falls for each opponent on each roll of the dice and subsequent move. Each trade has a heartbeat, an ebb and flow, prices change. BG is a pricing game to a degree. You need to know if you are over valued, even, or under all the time.

11. Match equity rises and falls for each opponent on each roll of the dice and subsequent move. Each trade has a heartbeat, an ebb and flow, prices change. BG is a pricing game to a degree. You need to know if you are over valued, even, or under all the time.

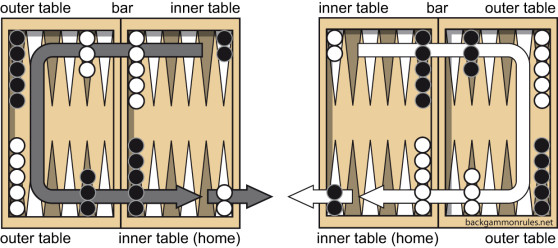

12. What is the trading plan; what is the game plan? Are you running, priming/blockading or are you playing an intentional back game. You need to review your plan prior to making your move –does your roll help or hinder what you are doing. Did your trade look suddenly different from its planned start?

13. Sometimes too much success leads to failures, multiple doubles in a row tend to get you off to a great start that actually pushes you way past your optimal timing leading to a forced stacked up game. You now find yourself out of position. Don't overtrade, do not double up because you feel bulletproof.

14. In a short length match, seize upon a good starting position and double. Your opponent may shrink and pass since he will judge the risk as too great at this early stage to gamble. You must have a good start and his must be neutral or lagging.

15.Every play is a potential cube turn. Ask yourself if you should be doubling before you roll. In trading, once again–review your plan at each logical turn.

16. Be ready for the quick re-double right back in your face. Now the stakes are way up if you take, funny how your position shrinks up on a redouble? Akin to a whipsaw or a flash crash, the market has just gone 180 degrees from where you were. Where you ready for that?

17. What will my opponent do if I double? What will the market do if I take that offer?

18. I have just been doubled, is it a take, a pass, a redouble or is it quite impossible to judge? Use Woolsey's law then and take the double. As in trading, sometimes its better to take the trade on with insufficient knowledge and then do some analysis rather than pass it up.

19. At Crawford game during match play the doubling cube is not used. It gives the players one game where they must play through without upping the stakes. A trading holiday, a risk off breather is always a good thing once in a while. The Crawford game happens when either opponent is one game away from winning a match. It stops an automatic cube double from the lagging player.

20. If you make it into the money matches in a tournament, it is usually wise to hedge with your opponent so if you lose you don't leave empty handed. Do not be greedy and demand whole hog. Many market examples can be found regarding hubris.

21. What is the pip count? You must be able to size up the score mentally and quickly. Backgammon play is expected to be brisk and in matches slow play is frowned upon. In trading, being aware of the current (daily, hourly) conditions is essential. You can't call a time out in BG, likewise you can't stop the market while you think things through.

22. Leave a blot, but leave it properly, either far away or very close. Leave it so that if it's hit you may be able to recapture. Close out your trades properly.

23. Make points that hinder your opponent's big winners. Block his potentiality. Beware of and block if possible the "miracle" opponent's role, the double threes that get him out of danger and puts you in irons. Set your blots on points that he needs for getting back in. What miracle market move lies in wait to swamp your trade?

24. Again, don't get locked into one type of game, be flexible and take what the dice give you. Take what the market gives, don't hold out for a round number sale.

25. When it's time to run–then Run. Sometimes one gets focused too myopic on trapping and blocking and thus fails to prep for a freeing attempt. In trading, maybe

this is an example of just going with a major momentum swing and forgetting the chop trades.

26. Double hit if possible. Putting two men on the opponent's bar is a powerful move. Keeps him out of the game, for the time being. This gives you leverage. Possible cross over to using derivatives in a trade to maximize an expectation.

27. Hitting a blot takes half your opponent's role away. It is usually wise to hit versus not, yet not always. Automatic action can be seen in some players who always hit no matter what. I like to play against these types. Some markets behave on "autoplay" –use this tendency for planning a trade.

28. The safe move is usually not the best. You need to slot points, fight for the 5 point and be aggressive. Playing safe in the markets may be akin to being long the "favored sectors", last year's winners.

29. Lay out decoy blots. This tactic lures your opponent off his strong point and hopefully gives you compensating re-hit chances, and recycles a man to aid in your timing. Decoy methods and markets are well discussed.

30. Hitting loose is a decision that must be made with a goal in mind–needs to be justified. Taking a market risk that is usually cavalier needs to be justified and quantified. Hitting loose describes hitting a blot when your risk of re-hit is great. Its making the best of bad choices.

31. Know your basics inside and out. 6 x 6 dice table, %chance of rolling any single number, %chance of making a high number versus a low one. Know the percentages faced when getting back in from the bar. Holding a losing trade is not playing the percentages.

32. Aggression is awarded in backgammon in that you need to hit blots, fight for points, and resolve oneself to being hit and thrown back. Its a regenerative cycle and one needs to be able to define the worth/price of the position roll to roll. In trading you need similar levels of mental engagement–how to go for a small victory every venture, yet be ready to turn that into a major winner if the right odds come to the fore.

33. Opening, middle and late game positions, cube decisions during those stages, the match score or cash game level at the time of the stake double. Balance is key –maintain your forces as best as possible under the given dice. Know the landscape when the double arrives. Anticipate your opponent's moves. What is the market telling me at this moment?

34. What is my best move? Why is it that the best moves sometimes are the hardest to do? The best move usually looks risky/naked. Buying when all is lost, when the cane is in your hand is when you are right.

35. Why do I usually win the Crawford game–the game where no doubling is allowed? Why do I win the small trades and lose the bigger ones? Maybe I should be looking over my past trades with a critical eye—do some more work.

36. If I win game one of an odd numbered match, I tend to relax and just grind higher. All I need to do (as in baseball) is win a series. Am I in gammon save mode or gammon-go. Sometimes you need to protect against the double up or go for the double up as your goal when starting a new game. Is the trade a limited one to begin with or an attack strike? Do you realize that each roll can help or hinder that goal and adjustments sometimes need to be made. Or simply waiting is the right answer-

-a move that keeps the position static.

Victor Niederhoffer writes:

To Mr. Drees's excellent post an observation. I have known several dissipate drunk squash players who often asked me to set up a game of backgammon with my wealthy friends including Jim Lorie who paid his way through Cornell with backgammon. The dissipate players were all National Champions at backgammon and hustled for a living. To play against them was ruinous and fortuitously I prevented Jim from playing against my player opponent Claude Beers. One should never play markets against men named doc or those who pretend to be dissipate.

Andrew Goodwin adds:

When I held a seat on the NYFE, there was a trader whose badge number was mine with only the order of two digits varying. We shared an execution broker. The trader's name was doc, and I had to check in with the clearing firm each day because only his losing trades would end up in my account. Not once did I get one of his winners. One can lose to doc in ways other than merely playing against him.

Comments

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles