Feb

2

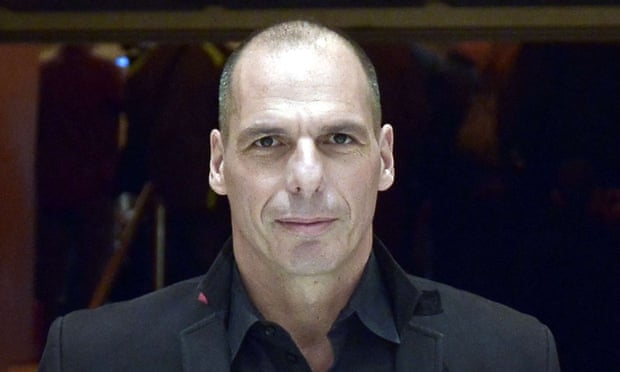

The Greek Finance Minister, from Ken Drees

February 2, 2015 |

The Greek finance minister is very astute with game theory forte. So far he has made a credible threat of a willingness to blow out of the EU–not a bad first move from a disadvantaged starting position.

The Greek finance minister is very astute with game theory forte. So far he has made a credible threat of a willingness to blow out of the EU–not a bad first move from a disadvantaged starting position.

John Floyd writes:

Many excellent points are being made in our discussions on Greece, Europe, and related topics such as Russia's 1998 default. Inclusive in the comments are the micro, macro, political, and social influences. Stefan is always excellent at bringing some historical context. Fittingly I am listening to the American Colossus at the moment.

One of, if not the KEY question, as a speculator is how best to extract capital from markets given a specific view, market, potential, catalysts, time frame, risk level, etc. A close friend, Dr. Ari Kiev, used to say to me when I would elaborate on a market thesis "John, that is great and makes a lot of sense. But, how is the best way to make money from it? What are the specific goals, etc.?".

The economics and politics of the European situation are fairly straight forward. I have followed them, more fastidiously than I care to admit for many, many years. I have included everything from men on the ground following bank deposits, meetings with current and past leaders and the 10,000 foot view of how this may play out on a broad macro level. Milton Friedman made some typically prescient comments upon the forming of the single currency, and they are panning out. Many of the same issues and characteristics were present in the European Rate Mechanism (ERM). Those more learned than I might also weigh on the potential utility of different currencies in the present day U.S., the Confederate currencies, etc.

Directly from a market perspective though I would consider some key points and questions:

How do previous crises provide some examples for a potential playbook? In the past few decades for examples…how was the Tequila Crisis backstopped? What about the ERM crises? The Argentine peg removal? Hungary's revaluations and devaluations? The currency policy of Egypt in the mid 1990's?

Does the size of the problem relate to the size of the market impact? The Russian default was relatively small and debt held by a limited number of participants. I can remember sitting in a conference room with a group who held about 80% of the local debt. But the market impact globally was very large. What was the macroeconomic situation at the time? Why did the default happen when it did? Further a butterfly flapping it's wings in tiny Iceland had a demonstrably large global impact.

If a country leaves the single currency, Eurozone, etc. does the Euro go up or down? What happens to rates, equities, etc.? What is the path and what market instruments can be best employed? The flash crash, October 2014 market moves, and more recently SNB move all would point to the need to try and answer this question.

What is the sequence and through which markets and how fast is this likely to play out? I can remember positioning for wider spreads between Germany and Spain in 2005 at about 25 basis points on the same thesis that is playing out now. But, that view has required quite a bit of timing, frustration, etc.

What is the broader thesis guiding what is happening and where else and how is it likely to play out?

This is just a quick list. What else is there to consider?

Comments

1 Comment so far

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles

I’ve got a headache reading those let alone thinking up any other considerations … problem with doing a statistical comparison is this situation is quite unique (correct me if I have missed an angle here). How can we compare the Greek situation to ERM, Russia or Iceland?

Looking at Game Theory here .. I think the new Greek Finance Minister (I will call him GFM) realises that to leave the Eurozone now would be a disaster. He wants to stay in as otherwise the country would go into economic meltdown.

However, he wants to scrap the austerity conditions or at least some of them. He also wants a debt write down.

He will hold his position and I believe settle for some of the austerity conditions to be watered down & the debt to be extended in some way and / or financially engineered in some way.

Result .. Greek exposure is worth taking on, but at what level and when? Hmm ..