Apr

2

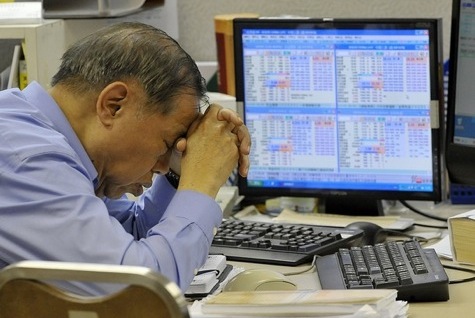

A Trader’s Pain, from Jim Sogi

April 2, 2013 | Leave a Comment

Pain is a subject with which traders are probably familiar. There is psychic pain and physical pain. The amount or intensity of both kinds of pain is not commensurate with the amount of the loss in all cases. There is not a direct correlation between the increasing amount of loss and the increase in the amount of pain. For example, the pain of losing 100,000 is not a hundred times the pain of losing $1000, and the pain does not increase in a linear fashion. The pain of losing a loved one is not 1000 times more painful than losing say $100,000. (multiply amounts for wealthy readers). The pain of a small burn can be as painful as a major illness.

Pain is a subject with which traders are probably familiar. There is psychic pain and physical pain. The amount or intensity of both kinds of pain is not commensurate with the amount of the loss in all cases. There is not a direct correlation between the increasing amount of loss and the increase in the amount of pain. For example, the pain of losing 100,000 is not a hundred times the pain of losing $1000, and the pain does not increase in a linear fashion. The pain of losing a loved one is not 1000 times more painful than losing say $100,000. (multiply amounts for wealthy readers). The pain of a small burn can be as painful as a major illness.

The other curious thing about pain is that it ends and its hard to remember after its gone. Experiments have shown that in time people tend to revert to their mean disposition even after horrific personal losses. Some people can handle pain better than others or recover at different speeds. When one is tired, small things can feel more painful. Pain and sadness are closely related to anger. There are mental techniques to handle psychic pain and effective drugs to deaden physical pain. I suppose one could write a book on the subject.

Sushil Kedia adds:

Pain is a signal to consciousness or to the mind to search for changing the situation. Those traders who are not experiencing pain up to a level of loss are "willing" to lose that much and will thus have lost that much.

Like all of our perceptions, pain too is relative and there is no absolute measure feasible such as the measurement of temperature. Varying wealth levels or varying risk perceptions will, for one example for traders, bring varying intensity, length or sensitivity to pain.

For another example, in a simple surge-protector the fuse is expected to blow up before "paining" the computer to a point that the computer blows up. Some traders believe their stop loss strategies akin to this surge protector. Others believe their computers can withstand any power-surge, by placing some probabilistic calculations that having a surge protector will increase the probability of a power surge. Different hourses, different courses.

Jeff Watson adds:

The real sad thing is that you can be 100% right and the mistress of the market won't stop flogging you. Need to have my head examined.

Apr

2

Rain, from David Lilienfeld

April 2, 2013 | Leave a Comment

As was discussed pretty well on this site last summer, the US corn crop last year was hardly bountiful, courtesy of a drought. In Texas, the drought resulted in the base of many lakes being visible as sheets of dried/drying mud, with piers off in the sky above. I assume that the rattlesnakes didn't fare too well either, but as a severe herptophobe, I won't get into that.

As was discussed pretty well on this site last summer, the US corn crop last year was hardly bountiful, courtesy of a drought. In Texas, the drought resulted in the base of many lakes being visible as sheets of dried/drying mud, with piers off in the sky above. I assume that the rattlesnakes didn't fare too well either, but as a severe herptophobe, I won't get into that.

It appears that the drought is here to stay for a spell. At some point, even the CPI will record the resulting increase in grain prices.

Russ Sears writes:

While reading about a drought is interesting from a historical perspective, it is a sure way to trade yourself into the poor house. If yesterday's weather is not already built into the grain markets; then the thousands of farmers who experience it and for years have bet the families bread, do not know what they are doing and should pack up and move to town and find work in auto repair, factory work or construction where they can still work with their hands but predicting the future is not part of the job. The joke on the farm is that these articles always start popping up when the local sail boat lake is once again in business and the next 4 days call for 3 inches of rain… as it is here in OK.

Apr

1

Does Anyone, from Leo Jia

April 1, 2013 | Leave a Comment

Does anyone feel like an idiot when your system encounters a series of losses? I know it is not warranted, but subconsciously I have that feeling and I don't have a good way of getting rid of it. Any advice please.

Apr

1

A Framework, from Newton Linchen

April 1, 2013 | Leave a Comment

In trading stocks (and stock index futures) I'm finding most useful to put things in a proper framework, so I can compare apples with apples.

I'm working for a few months with a seasonality framework for the daily changes, within a month.

Taking the last month's close as the "Equator Line", I would divide the month in 3, having, thus:

1: The first third of the month, while above last month's close (LMC);

2: The second third, above LMC;

3: The third and final period of the month, above LMC;

-1: The first third, but below LMC;

-2: The second third, below LMC;

-3: The end of month (3rd third), also below LMC.

What I found is that a daily change of - % or + % has different significance in each of this "seasonality sectors".

One two-day strategy I was researching showed profits only at the -3 (end of month below last month's close).

Some strategies show profits only in sector 1, or 2, etc.

The rationale behind it would be the mutual fund industry, which have to release a monthly report, therefore having the incentive to buy in the end of a bad month, to give a least horrible report, etc.

But I could be lulling myself into error, so I would like the Specs contribution.

Apr

1

FLA, from Jim Lackey

April 1, 2013 | 1 Comment

The Family just returned from Florida. One can see a boom or a bust around every corner. On one hand (econ joke) you can see the boom– new real estate projects, Disney full to capacity as of noon. On the other hand the bust– the Space coast Condos at whole sale prices 89k a few hundred meter walk to the most beautiful beaches.

The Family just returned from Florida. One can see a boom or a bust around every corner. On one hand (econ joke) you can see the boom– new real estate projects, Disney full to capacity as of noon. On the other hand the bust– the Space coast Condos at whole sale prices 89k a few hundred meter walk to the most beautiful beaches.

What is remarkable to me is to see and hear of old friends doing the same things as 11 years ago. Yes, the bucket shoppes are back with 50 men screen watching.

I love Florida. My family and friends are there. The weather was a bit cold for a few days, then it was perfect. The Atlantic waves were a blast with the full moon set to the West and the magnificent sunrise over the ocean. What a perfect way to start the day.

After a 12 hour drive into the Nashville rain, with the grass a bit greener, a few leaves on the trees, it is a very late spring here. I asked the wife, FLA? She replied, not a chance. Make some money honey and buy one of those condos with in walking distance and do learn how to surf.

Kudos to Watson and Sogi… what a workout those waves are! One may never forget how to ride a bike, but when it comes to the waves, I put on the towel. Not sure if I'll ever learn.

« go back —Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles