Jul

4

“1900,” from Gordon Haave

July 4, 2007 | Leave a Comment

I have a theory about the best movies (and also the best stocks): some really hate them, others really like them.

This is also true of movie scenes. The best example of this is the wedding scene in The Deer Hunter. It is either loved as beautiful, and as an extensive bit of character development that is important to understanding the film in its entirety or it is hated as long, boring, and of little consequence.

Recently I purchased the film 1900 from Amazon. Robert DeNiro, Gerard Depardiu, Burt Lancaster, Donald Sutherland, five hours long!

The film is historically, either loved or hated. Why? As it so turns out, the entire movie is like the wedding scene in The Deer Hunter, stunningly beautiful, a masterpiece of filmmaking. Yet, ultimately nothing really "happens".

So, let me give this advice: If you liked the wedding scene in The Deer Hunter, you will love this movie. If not, you will likely find it a bore.

Jul

3

A July 4th Tribute, from Scott Brooks

July 3, 2007 | Leave a Comment

My two favorite holidays are July 4th and Memorial Day. Those are the days we can and should all give thanks for the freedoms we have today. I usually take the time to write my thoughts of thankfulness on these two glorious days, but not today. Instead, I offer the following.

My two favorite holidays are July 4th and Memorial Day. Those are the days we can and should all give thanks for the freedoms we have today. I usually take the time to write my thoughts of thankfulness on these two glorious days, but not today. Instead, I offer the following.

In one of the greatest ironies of history, John Adams and Thomas Jefferson died on the same day, July 4th, 1826. It was 50 years to day after the Continental Congress adopted the final draft of what is known as the Declaration of Independence!

Today I submit a part of a speech delivered by Daniel Webster, one of the greatest orators our country has ever produced. He gave this speech six weeks after the passing of the two great men. The speech was given at Faneuil Hall in Boston on August 26, 1826. It was meant as a eulogy and I hope that we can all take the time to read these words and ponder the meaning behind them. We owe men like Jefferson and Adams so much!

This is an unaccustomed spectacle. For the first time, fellow-citizens, badges of mourning shroud the columns and overhang the arches of this hall. These walls, which were consecrated, so long ago, to the cause of American liberty, which witnessed her infant struggles and rung with the shouts of her earliest victories, proclaim, now, that distinguished friends and champions of that great cause have fallen. It is right that it should be thus. The tears which flow, and the honors that are paid, when the founders of the republic die, give hope that the republic itself may be immortal. It is fit that, by public assembly and solemn observance, by anthem and by eulogy, we commemorate the services of national benefactors, extol their virtues, and render thanks to God for eminent blessings, early given and long continued, through their agency, to our favored country.

Adams and Jefferson are no more; and we are assembled, fellow-citizens, the aged, the middle-aged, and the young, by the spontaneous impulse of all, under the authority of the municipal government, with the presence of the chief magistrate of the Commonwealth, and others its official representatives, the University, and the learned societies, to bear our part in these manifestations of respect and gratitude which pervade the whole land. Adams and Jefferson are no more. On our fiftieth anniversary, the great day of national jubilee, in the very hour of public rejoicing, in the midst of echoing and reechoing voices of thanksgiving, while their own names were on all tongues, they took their flight together to the world of spirits.

If it be true that no one can safely be pronounced happy while he lives, if that event which terminates life can alone crown its honors and its glory, what felicity is here! The great epic of their lives, how happily concluded! Poetry itself has hardly terminated illustrious lives, and finished the career of earthly renown, by such a consummation. If we had the power, we could not wish to reverse this dispensation of the Divine Providence. The great objects of life were accomplished, the drama was ready to be closed. It has closed; our patriots have fallen; but so fallen, at such age, with such coincidence, on such a day, that we cannot rationally lament that the end has come, which we knew could not be long deferred.

Neither of these great men, fellow-citizens, could have died, at any time, without leaving an immense void in our American society. They have been so intimately, and for so long a time, blended with the history of the country, and especially so united, in our thoughts and recollections, with the events of the Revolution, that the death of either of them would have touched the chords of public sympathy. We should have felt that one great link, connecting us with former times, was broken; that we had lost something more, as it were, of the presence of the Revolution itself, and of the act of independence, and were driven on, by another great remove from the days of our country's early distinction, to meet posterity and to mix with the future. Like the mariner, whom the currents of the ocean and the winds carry along until he sees the stars which have directed his course and lighted his pathless way descend one by one, beneath the rising horizon, we should have felt that the stream of time had borne us onward till another great luminary, whose light had cheered us and whose guidance we had followed, had sunk away from our sight.

But the concurrence of their death on the anniversary of Independence has naturally awakened stronger emotions. Both had been President, both had lived to great age, both were early patriots, and both were distinguished and ever honored by their immediate agency in the act of independence. It cannot but seem striking and extraordinary, that these two should live to see the fiftieth year from the date of that act; that they should complete that year; and that then, on the day which had fast linked for ever their own fame with their country's glory, the heavens should open to receive them both at once. As their lives themselves were the gifts of Providence, who is not willing to recognize in their happy termination, as well as in their long continuance, proofs that our country and its benefactors are objects of His care?

Adams and Jefferson, I have said, are no more. As human beings, indeed, they are no more. They are no more, as in 1776, bold and fearless advocates of independence; no more, as at subsequent periods, the head of the government; no more, as we have recently seen them, aged and venerable objects of admiration and regard. They are no more. They are dead. But how little is there of the great and good which can die! To their country they yet live, and live forever. They live in all that perpetuates the remembrance of men on earth; in the recorded proofs of their own great actions, in the offspring of their intellect, in the deep-engraved lines of public gratitude, and in the respect and homage of mankind. They live in their example; and they live, emphatically, and will live, in the influence which their lives and efforts, their principles and opinions, now exercise, and will continue to exercise, on the affairs of men, not only in their own country but throughout the civilized world.

The tears which flow, and the honors that are paid, when the founders of the republic die, give hope that the republic itself may be immortal.

Daniel Webster 1782 - 1852.

Jul

3

"Money is cheap because there's too much of it to be expensive. Furthermore, and I may be wrong here, perhaps it is also the case that because money is cheap there is too much of it." Riz Din (regular D'Spec contributor)

What does the yen going up or down have to do with money being cheap? Well, if the yen goes up, you get more dollars per shorted yen, so you can buy more stocks. On the other hand, if you're already shorted yen and it goes up you may have to cover and sell stocks. Contrary explanations and predictions.

Conversely, if the yen falls you get fewer dollars per yen so you can buy fewer stocks. On the other hand, if you were already short yen you just made some money that could be reinvested. Which is it? Is there any countable way of favoring one narrative over another?

Jul

3

Does a businessman say on his death bed that he wish he spent more time at the office?

No. But I think it happens often that people look back on their lives and wish they had had more courage to take risks, and one interpretation of that may be that they wish they had worked harder to achieve their goals.

I've personally heard such things from several older people, including my grandfather. When he was a young man, he had a chance to get involved with a startup that went on to become a huge success. He passed on the opportunity, and regretted it for the rest of his life. Instead of taking his shot at controlling his own destiny (and yes, probably having to put in long hours for a few years), he took the safe path and was stuck in a boring, 9-5, middle management job for decades, working for others and never feeling that he had done anything significant. I vowed a long time ago never to let that happen to me.

Jul

3

Showing the green behind my ears, this is the first time in the 10-plus years that I've been in this wonderful industry that M&A has been so plentiful and shown the effects on the markets it has with one-liner headlines.

Showing the green behind my ears, this is the first time in the 10-plus years that I've been in this wonderful industry that M&A has been so plentiful and shown the effects on the markets it has with one-liner headlines.

The one thing that I have had experience with, though, is the IPO markets and remembering what they did to emotions of investors once companies came to market, and the stampeding that they created to pump up equities and expectations.

Why isn't anyone discussing the IPO market and the deals that are taking place and the capital that is being raised for future profits?

To borrow from Troy Smith (last pick in the NFL draft) when the rookies all sat down with Commissioner Roger Goodell had him tell them of the cracking down on the negative image that players portray, "Why aren't you focusing on the positives" of the many? When perplexed, confused, and on the spot Mr. Goodell simply dodged the question and Mr. Smith the recent Heisman Trophy Winner hit the high hard one back saying, "You didn't answer my question".

Why can't the brainwashed, negative, half empty glassed people out there see that there exists an unabated movement that is called drift that is picked up and carried magically by things that they don't even see or acknowledge? Can't they see that the engine gets greased and refueled daily, weekly, monthly, quarterly, and yearly? Do they not understand the Van Halen lyrics, "Everybody wants some, I want some too"?

Scott Brooks comments:

I love how J T wove in a great philosophical lesson and tied it to the markets and sports, then brought it all together with a semi-obscure 1980 Van Halen reference. Of course, referencing that song also ties into what is one of the biggest drivers of the markets: Sex!

Here's an interesting site to reference for song facts.

Jul

2

Technical Obsolescence, from Victor Niederhoffer

July 2, 2007 | 6 Comments

George Zachar comments:

Technology acceptance is heavily influenced by network effects and compatibility issues that make the diffusion of digital products take a different trajectory from their non-digital predecessors.

John Floyd adds:

"Leapfrogging" is a real danger. It is also evident in the way Japan evolved in car manufacturing in the 1960s and 1970s. I can remember driving in my uncle's "nouveau Datsun" as a five-year-old and hearing him tell me about the benefits in terms of cost, fuel efficiency, luxury, etc.

From a stock performance perspective I would imagine tests exist and can be done to look at stock performance post introduction of a new product for a variety of markets and products, Apple obviously included. What seems likely difficult to quantify is the "wow" factor: the market's potential to extrapolate huge multiples going forward based on various forms of growth, as happened in cases like the Internet stocks.

Henrik Andersson writes:

It seems like Apple is holding on to their market share for portable music players even though it might not have a superior technology. I can envision the same happening for the phone, which I think would be very suitable for WiMax in the US rather than 3G.

James Lackey writes:

There are so many elegant angles to the iPhone. When you look at the products vs. cycles, prices and innovation, many examples of car production vs. tech can be used. Examples include the furious competition, lower prices, and leaps of innovation.

The iPhone may be a leap of innovation. Of course others will adapt and prices will fall. What is uncertain is how much innovation and cost will trickle down to the sedan market of cell phones. Perhaps that equation, how the mass market accepts it and is willing to pay for the new bells and whistles, will set the pricing and production of future iPhones. Will the iPhone be a sporty two-seater high performance vehicle or just another used sedan at 50% off current retail in five years?

Barry Gitarts writes:

I think your questions apply to the smart phones which have been on the market for years from companies like RIMM or PALM and the iPhone is the answer.

To paraphrase Steve Jobs, people are used to thinking that something is wrong with them, when the real problem is the phone they are using. But Apple is not an iPod or iPhone story, it is a Steve Jobs story. Just look at how Apple did when Jobs was at the helm and then when he left and then when he came back. Is there any doubt he is the man responsible for the value creation reflected in Apple stock?

When I watch Jobs talk about his products, his passion and dedication reminds me of Howard Hughes and Airliners as portrayed in The Aviator. While there is no doubt that new technology will come out that will give the old technology a run for its money, how does one know the new technology will not be developed by those who developed the old one?

J.P. Highland writes:

It won't be about someone producing a better phone, but someone being capable of delivering a cooler phone. The IPod might not be the best mp3 player in the market, but there's something irrational about it. People love it and will keep buying unless the meme fades. But so far people are in love with Apple and the success of the IPod has permeated to the iPhone and the PowerBooks are doing well.

Jul

2

Technology Corner, started by Steve Leslie

July 2, 2007 | 2 Comments

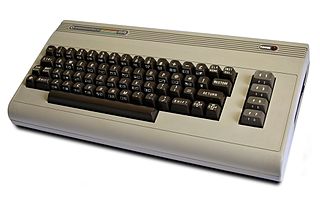

I remember back in the mid 1980s, the huge battle when AT&T and IBM entered the personal computer market. The Commodore 64 was the product that first entered the market place as I remember, in 1982, and it was an amazing hit. Then everyone else decided to pile in.

I remember back in the mid 1980s, the huge battle when AT&T and IBM entered the personal computer market. The Commodore 64 was the product that first entered the market place as I remember, in 1982, and it was an amazing hit. Then everyone else decided to pile in.

I also recall the Bowmar Brain that was so popular as a hand held calculator. Bowmar was later overtaken in market share and technology by Texas Instruments, Hewlett Packard, and others.

AT&T, after years of losing money, exited the PC business and left it to HP, Apple and Dell to charge forward. IBM is as strong and as powerful as any technology company ever was — they did not get the name "Big Blue" for nothing.

Ultimately IBM decided to leave the PC business and focus on their bread and butter mainframe business. Technology can be a very very difficult boat to steer, and it can be extremely hazardous and dangerous to stay ahead of consumer needs, wants, and demands.

Andrew Moe comments:

Talking of advancing technology, these guys are in the news today after taking apart an iPhone step by step, and identifying all the parts by make and model. If the profits are ephemeral, they won't be for Apple alone.

James Lackey adds:

The iPhone may be a leap of innovation, but of course others will adapt, and prices will fall. What is uncertain is how much innovation and cost will trickle down to the sedan market of cell phones. Perhaps that equation, how the mass market accepts and is willing to pay for the new bells and whistles, will set the pricing and production of future iPhones? Will the iPhone still be a sporty two seater high performance vehicle, or just another used sedan at 50% off current retail, in five years time.

Greg Calvin offers:

The fear of competition eating away market share of the iPod has been one of the chief concerns for aapl shareholders over the last few years. Somehow its market share has held up, despite an array of competitors entering the arena, including Microsoft and Sony. The iPod, and it would increasingly seem Apple themselves, have garnered cache, or an enviable 'cool' factor. Cache, when ingrained into the social consciousness, draws and retains business, wards off even possibly superior competition, and protects profits that would all but disappear with commoditization. Sony had it, and for the most part lost it.

The first generation iPhone needs a good number of improvements, notably Web speed, voice rec., an expansion slot, and availability of keyboard in landscape mode. A shame not to have GPS with that big beautiful display. If Apple can address the most critical of these issues, the challenge of attaining 1% market share might be done more with brand than technical wizardry. Who knows what the competition might come up with however. Advanced voice recognition apps, maybe.

Just a few of the countless names that still do at least reasonably well and lever their brand names to command premium over cheaper generic and/or superior competition include Coke, Bayer, Nyquil, Listerine, Marlboro, Intel, Rolex, Bose Wave $400 alarm clocks, Oakley, diamonds, Baskin Robbins, Harley Davidson, Jim Beam, Windows, Rolls Royce, Foster Farms, Chanel, Federal Express and Starbucks.

Alan Millhone adds:

In 1964 my parents took my to NYC for the World's Fair. My father worked all his life for the telephone company and I remember going to the 'Ma Bell' exhibit with them. There we saw things of the future like being able to see one another when you talk!

Scott Brooks adds:

I am reminded of two things from college (1982 - 1986) at little 'ol Southeast Missouri State University.

I took a statistics class and we had what I believe were Texas Instrument calculators. They were a bit bigger and bulkier than the units we have available today (maybe the size of two or three calculators stacked on top of each other). Their read-outs were all and you had to push the buttons real hard to the point where they "clicked". But what I remember most about them was that they were "caged" to the desks. Literally attached to the desk by some sort of metal unit that prevented them from being stolen.

The other thing I remember was that the statistics professor, who was also a psychology instructor, had me do an experiment with him of the effects of Scopolamine Hydrobromide on mice. It was pretty cool. I got to give mice shots of SHB, and put them in spinning apparatus to make them dizzy. Then the coolest part was that I got to do brain surgery on the mice.

At the end of the experiment, I had to type up a paper on my findings and notes. Bob, one of my fraternity brothers, had this typewriter looking thing that had a small screen on the front of it (similar in size to the read out screen on an calculator). You could type the words and see them scroll across the screen. As a result, you could proof read what you were typing, but only one or two words at a time. And there was no spell check so you’d better know how to spell. If memory serves me right the read out was so small that I couldn't even fit big words or phrases on the screen at the same time.

It was a very slow and tedious way to type a paper. Finally Bob, who was a computer science major, decided to type it for me since he figured he'd need the practice to be ready for the real world. I remember thinking to myself that he wasted his college career on a worthless major. I couldn't see how computers were ever going to catch on. There was no way that this tedious machine with a small 10 or so letter screen was ever going to achieve wide spread public acceptance!

I don't know what ever became of Bob. What I do know is that I was completely wrong about computers. I've never forgotten that lesson and try to apply it to my life everyday, especially when confronted with something that I think is stupid and a waste of time. I try to look beyond whatever that something is today and see what it can become tomorrow!

Jul

2

Oil at Seventy Dollars per Barrel, from Sam Marx

July 2, 2007 | 2 Comments

Oil is again trading at over $70 per barrel. However, as I understand it we (the US) have more oil in four states than there is in Saudi Arabia, locked in shale, and it can be extracted profitably at less than $35 per barrel.

Oil is again trading at over $70 per barrel. However, as I understand it we (the US) have more oil in four states than there is in Saudi Arabia, locked in shale, and it can be extracted profitably at less than $35 per barrel.

Meanwhile the U.S. is pursuing and subsidizing ethanol from corn, driving up corn and meat prices. I think that a policy of extracting oil from shale should be our primary policy. What am I missing?

Of course, more than 30 Senators are from farm states and a policy of oil from shale, tar sands (under $30/barrel), or coal ($40/barrel) would drive down oil prices.

Jaime Klein writes:

Exploiting shale requires immense investments as well as a change in environmental regulations. Historically, oil markets suffer from cycles of overproduction followed by tight supply (like recent years). Investment in oil production has a long maturation period and is very risky. Any number of events, such as an outbreak of stability in Iraq, opening up Iran to foreign investments in oil, Hugo Chavez retired by a military coup, strengthening of demand destruction (in many developed countries oil demand is falling), could cause crude prices to collapse and then settle at its historical level (maybe half of its current price). I am shorting oil.

Sam Marx replies:

If oil goes below $50, Saudi Arabia will cut production as it has in the past.

Alan Millhone comments:

Yes, then a 'created' scarcity. Alternative fuels, hybrid cars, etc. have been 'beat around' for years, but little done. In Vegas they have built an elevated monorail from MGM to the Sahara and talk is to extend it all the way to the airport. Taxi drivers are against this, but something has to be done to ease traffic congestion and fuel consumption in one isolated area of the US. America has always had a love affair with the automobile.

In Europe you can get a passenger train to about any location and buses and subways are readily available. I drove in Paris once and quickly realized I would not want to have a car there. Problem is not many of us are willing to 'cut back' on our driving.

Sam Marx writes:

I believe that the only "alternative" fuel that will work is oil produced in this country. That means drilling in Alaska, offshore, and very deep drilling on land. Aside from that are oil produced from shale, coal, and tar sands (Canada). Money and necessity should be the solution to environmental problems.

I believe that by hybrid cars you mean they also use ethanol. For many reasons I don't believe that ethanol is the solution. As for smaller cars, it is my understanding that since 1972, an additional 50,000 people have died in auto accidents in the U.S. because they were in a small car, but would've survived if protected by being in a larger car.

During WW II , Germany had to resort to oil from coal. After everything is considered and there is rational leadership in this country, willing to stand up to big oil, I believe we will have to resort to oil from shale, tar sand, or coal also.

I don't believe that there is a conspiracy by big oil to drive up prices, but I do believe that they don't want prices to come down and oil from shale, tar sands, or coal would do that.

Henry Gifford writes:

A man named Peter Judd did a study of the amount of fuel used to make heat and hot water for each of thousands of apartments in New York City in the 1980s. He divided the buildings into five categories: old law tenements (pre 1901), new law tenements, pre WW2, post war, and post 1974 oil embargo. The average use for each category was about the same, except for some improvement in the post 74 buildings, which when credit for more bulk and therefore a lower surface area/floor area ratio is considered, means there has been approximately zero progress in 100 years.

The most interesting thing he discovered was the spread between the best and the worst buildings - about 700% when the unusually high and low consumption buildings were tossed out of the mix. The spread persisted in all categories.

The main exception were the buildings gut renovated in the 1980s, which had new double pane windows, insulation for the first time, and new boilers and controls. They used 50% more fuel than the average of the existing housing stock. Since they were renovated by the government, and Peter was a government employee, he was moved to a do-nothing job, and soon left. His counting skills are now put to use in producing off-off-Broadway theatre.

The lesson I took from this is that some buildings use 1/7 of what others use, while providing better comfort. Meanwhile, this is all done unintentionally, as it wasn't until the mid 1990s that anyone even claimed to be making energy efficient houses in NYC. The extra cost of course was zero. I think this argues that there is a lot of potential gain from conservation.

It turns out there is a field called "Building Science" which is a study of the factors which effect comfort and building durability and energy use, which is widely ignored by the industry. But the science to explain this exists, as does the counting to show what is possible. Knowledge of these things has led me to believe that buildings could be built that use 10% or 20% of the energy that existing, average buildings use, and be built this way for no extra cost. I have done this, and am one of the only people in the field who shows fuel bills to back up claims. Of course, zero extra cost has its own problems, not the least of which is that there are approximately four people in the US who work on energy efficiency in buildings and are not paid by the government. This causes many conversations to start with "money is available for…" instead of "energy can be saved by…", which of course is an impediment to innovation.

I cannot predict how widespread sound building practices will become, but have no doubt that from a technical perspective, all the necessary technology has existed for decades, and is currently for sale in Home Depot. It's just that the industry that knows how to design and build such buildings mostly does not exist.

As for oil from coal, it is true the Germans did it, but at a high cost, and only in the face of severe shortages. The rumor that fuel was so scarce in Germany that the first jet planes in history were towed to the runway with horses is simply not true. They used cows, because the army was using all the horses. I think fuel will get more scarce before oil shale is economically viable.

One of the costs is the energy used in the process. The Canadians say that it will take the energy from two barrels of oil shale to produce a third barrel. Perhaps in our milder climate the numbers will be a bit better, but probably not by much. At best, it will be a costly and difficult process.

Jul

2

For the Promotion Skeptics, from Nat Stewart

July 2, 2007 | Leave a Comment

My perception is that when advertising or self-promotion is mentioned it is often viewed in a negative context. The promoter is viewed as crass or a "sell out" regardless of the quality of the product. The counterpoint is: Who here would not be richer/better off with more effective promotion?

My perception is that when advertising or self-promotion is mentioned it is often viewed in a negative context. The promoter is viewed as crass or a "sell out" regardless of the quality of the product. The counterpoint is: Who here would not be richer/better off with more effective promotion?

I am reminded Of Von Mises’ thoughts on the subject:

"The tricks and artifices of advertising are available to the seller of the better product no less than to the seller of the poorer product. But only the former enjoys the advantage derived from the better quality of his product.

"Business propaganda must be obtrusive and blatant. It is its aim to attract the attention of slow people, to rouse latent wishes, to entice men to substitute innovation for inert clinging to traditional routine. In order to succeed, advertising must be adjusted to the mentality of the people courted. It must suit their tastes and speak their idiom. Advertising is shrill, noisy, coarse, puffing, because the public does not react to dignified allusions. It is the bad taste of the public that forces the advertisers to display bad taste in their publicity campaigns. The art of advertising has evolved into a branch of applied psychology, a sister discipline of pedagogy.

"Like all things designed to suit the taste of the masses, advertising is repellent to people of delicate feeling. This abhorrence influences the appraisal of business propaganda. Advertising and all other methods of business propaganda are condemned as one of the most outrageous outgrowths of unlimited competition. It should be forbidden. The consumers should be instructed by impartial experts; the public schools, the "nonpartisan" press, and cooperatives should perform this task."

Jul

2

"Investors are being enticed into exotic assets such as diamonds, oriental art and even violins to cash in on the biggest boom in alternative investments since the late 1980s." Cash in On the Global Wealth Boom by David Budworth, Sunday Times, July 2, 2007

From the article there looks to be quite a run on to develop the specialized funds to meet the niche collectible areas favored by the multi-national, new, super rich.

A little more detail on the numbers (the world economies all seem to be doing quite nicely), and the approach to marketing these individuals, is presented in the Merrill Lynch/CapGemini Global Wealth report.

In the 80s rare coins became quite the investment. Prices on such esoteric items as MS-65 (grade), Full Bell Line (FBL) Franklin halves soared. American Morgan (the standard of investment coins) and Peace Silver Dollars were "slabbed" (graded by "experts" on both sides of the coin and encased in non-tarnishing clear plastics) as the buying frenzy moved along. Novice coin buyers often overpaid on the buy side and were killed by the esoteric and qualitative aspects of coin grading on the sell side.

At one point there was even a story of two coins being slabbed together that happened to have very different grades on both sides of the coin. The two coins were made to appear as if they were one "super" graded coin and sold at a very high price many times their individual value. Collectibles it seems are a ripe area for excessive markups and deception. Much better in most cases to consider them a hobby unless you have the time to develop the necessary valuation expertise.

Jul

1

Investment and Animal Behavior, from Steve Bal

July 1, 2007 | Leave a Comment

In the animal world, ground hogs will make a certain noise to signal that a hawk is overhead. Other animals have similar patterns such as bees doing a dance to signal the source of food. It would thus reason that investments that share characteristics would behave in patterns familiar to people using a value or style method.

In the animal world, ground hogs will make a certain noise to signal that a hawk is overhead. Other animals have similar patterns such as bees doing a dance to signal the source of food. It would thus reason that investments that share characteristics would behave in patterns familiar to people using a value or style method.

Animals left to themselves find a natural stable point between predator and prey but this becomes unstable with people as there is a need to get ahead in the short term at the expense of others. In business this issue is often resolved with methods of price-fixing.

Finally, groups may behave unlike the random investor who will attempt to profit from trial and error in this sector or another. It would appear that a stable group of (long term) investors has come to conclusions about the future of the sector and random (some such as small caps are larger) fluctuations just come with the investment.

Scott Brooks writes:

Studies have shown that white-tailed deer that are left to themselves, or orphaned (assuming this is after they are weaned) actually do just as well as their counterparts with a mother.

Another interesting aspect to this phenomena is that if you want to keep the buck fawns on your property, it is best to shoot the momma deer and leave the fawns alone. Once the momma goes into estrus, she will run off the button buck (buck fawn). It is believed that this is an instinctual action to that lessens inbreeding. The buttons are left to fend for themselves and find a new home range. They usually travel for several miles, and are disproportionately killed in the hunts. If the mother dies or is killed, there is no one there to run off the button buck, and he will almost certainly stay in his familiar home range. This actually has been shown to increase his chances of survival.

There is a definite cyclical instability in wild in predator prey models. One of the easiest ways to observe this is by watching the rabbit population vs. the coyote population. They definitely ebb and flow opposite each other, never seeming to reach an equilibrium.

The problem is not so pronounced in a well managed whitetail herd. Man is the whitetails biggest predator and man does a pretty good job of keeping the whitetail in check. Due to our ability to use reason and logic, we do a pretty good job of holding the whitetail population in check and stable.

What I find interesting is that in the area's where the whitetail population is out of control, such as cities, it's usually because people are not using logic and reason to solve the problem they're using emotions. I'm reminded of when John Galt said to Dagny, that when you're confronted with a choice and your head and heart are conflicted, always go with your head. ) The point being that in cities, people let their emotions get in the way of doing what is best for maintaining the healthiest most well balanced deer herd possible.

I always find it interesting when city people complain about the deer, but then are all aghast at the idea of harvesting the renewal resource. They always seem to want to try the same tried and failed methods.

This is similar to investing. Most people that invest in the markets really don't have a fixed system that is researched and tested and proven to work. They invest in the emotion of the markets and end up buying the investment that they wish they'd bought last year. As a result, they never reach a consistent equilibrium in the markets and as a result, greatly under perform the 10% long-term positive drift.

The Market Mistress loves to swoop in and devour the portfolio of the unexpecting. But her older sister, Mother Nature, is a vicious task mistress and makes the Mistress look tame by comparison.

Yishen Kuik comments:

I think it has been mentioned here before that classic predator-prey models show cyclical instability instead of steady equilibrium.

James Sogi writes:

Fish cluster in schools. The edges of the clusters are quite defined. None of the fish want to stray far beyond the pack. Same with traders. Look at how the closing price over the last six days, except Tuesday, clustered together despite wild swings.

Panicking is the worst thing to do around sharks. They don't bother humans or fish, only things that are injured or dead, easy prey. They never bother a strong confident swimmer or surfer, only things that look injured or panicked which is a good market lesson as well.

Jul

1

Some Random Thoughts, from Victor Niederhoffer

July 1, 2007 | Leave a Comment

The specialist in panics, from The Ticker magazine of 1908, went through a three year period while he waited for the steel markets to crack: ten, twenty, thirty percent on the day, and it was very hard for him. All of his friends were making money, and going to Delmonico's and fancy watering spots like the Brighton and Sheepshead race tracks. Even the hack drivers were moving up in the world as they opened up trading accounts too.

Many speculators must feel the same way about the markets now, where the reasons for bearishness seem so flimsy and so labored. First it was an increase in bond yields, but then the bonds went up three points in two weeks, and all yields go to or below, five percent, and the curve isn't inverted any more.

It's the bomb scare in Boston, or the smoking car outside the night club in London, or the other events of this kind that the bears like to jump on to increase the fear factor. When these blow over, it's the hedge fund that lost money, or the lender that called the high risk mortgage market wrong, or the contagion from all those unwanted dollars from foreign sources, or the risk for the layman in derivatives (a'la the Sage), or the risk of a global economic meltdown (a'la the star CNBC Dow 5000 advertiser).

Needless to say, this has been the same beat we've been hearing since 2002, and it's amazing that those who are hoping they can catch the next bear move still have the mojo to communicate and strut after losing so much during the doubling of the S&P that has taken place during these years. Yet they persist, and if it's a slow Friday, they can knock it down a fast 1% in 10 minutes, on a sighting of a stranger or straggler.

I believe the differential between the five percent on bonds, and the sixteen percent on equities, will eventually come through and be of higher significance than the recent end of world stories. Those who wait for that opportune time to get out of stocks, and into the fixed income, as recommended in the (much too harshly reviewed by me) Ken Fisher book, will have no more luck in overcoming the drift in stocks, than all the palookas and poseurs who would have you believe that they see the debacle coming off the back of one or another scare stories.

Of course, this is just my qualitative opinion, and except for the counting on our web site that we have done with the Fed Model, there is no reason that my insights on this should be valid.

Alan Millhone writes:

A few years ago I was being kind of coached for the then upcoming ACF National Tournament and was asking Dr. Gerry Lopez for some advice on lines I could play at the [checkers] Nationals. One of the lines of play I was considering was not the best and a bit suspect. Gerry told me something that carries over into the market. He said "Alan, why play a weak line? Stick with the best lines and openings that you can vs. your opponent".

In checkers or the market one needs to 'hammer' out your best plan of attack and stay the course. Gerry has told me on several occasions that he has kept a manuscript of familiar mid-game landings that are diagrammed for review and study. Those in the market need to do the same thing and keep careful records for constant reference if one is to keep ahead of the game, or at least even for the most part.

In late July the ACF will be hosting a GAYP (Go-As-You-Please) National Tournament at the Plaza Hotel/Casino in Las Vegas. I am doing my best to study and learn the strongest lines of play either as my opening move or as my rejoinder to my opponents’ opener. Staying with the winners (openings checker moves) would apply to those who follow and invest in the market. Why select a 'shaky' stock when you can find those who are good performers and have the potential for steady growth?

So in checkers find your best lines and stick with same, in the market pick a portfolio of good performers and don't deviate. Just some thoughts from an average checker player.

Jul

1

The July 2007 issue of National Geographic contains an extremely interesting article by Peter Miller on "Swarm Theory". Swarm Theory attempts to quantify how individual actions of unintelligent individuals develop into the complex behavior of a group. The way ants or bee colonies work together for the good of the group is discussed in detail then how this can be applied to complex human/business systems. For instance, Marco Dorigo, a computer scientist at Universite' Libre in Brussels modeled ant behavior to solve logistical truck routing problems. One company specializing in artificial intelligence applies algorithms gleaned from the foraging activity of Argentinean Ants to manage industrial plant applications.

The July 2007 issue of National Geographic contains an extremely interesting article by Peter Miller on "Swarm Theory". Swarm Theory attempts to quantify how individual actions of unintelligent individuals develop into the complex behavior of a group. The way ants or bee colonies work together for the good of the group is discussed in detail then how this can be applied to complex human/business systems. For instance, Marco Dorigo, a computer scientist at Universite' Libre in Brussels modeled ant behavior to solve logistical truck routing problems. One company specializing in artificial intelligence applies algorithms gleaned from the foraging activity of Argentinean Ants to manage industrial plant applications.

Upon reading this piece, I immediately considered how these ideas can be applied to the markets, stock indexes in particular. The base factors appear to be similar regarding the unintelligent individual player/relative small group. (unintelligent in regard to the unknown future price movement). Complex group behavior resulting in the changing cyclical nature of indexes, etc. This is definitely something worthy of additional study.

Steve Bal adds:

I have looked at this in the past reviewing such theories as flocking and how ants lay trails for other ants to follow (like the ants found in trees that seem to follow a perfect zigzag pattern). However, most animals have a rapid maturing process unlike humans and thus their environment has a smaller role in their behavior. It would appear that ants and bees act according to pre-programmed genes and evolve over time as laid out by Darwin.

One area of interest to me has been how birds act as a group with group coherency and no need for a formal leader of the pack. I would think this may be similar in the markets as the smart money is the one that makes the most noise and pilots the crowd in its direction of change.

« go back —Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles