Nov

8

An Strange Question, by Kim Zussman

November 8, 2011 | 2 Comments

Why would people PAY the government to take their money?

WSJ: Paying to Give U.S. Money? Some Like Idea [registration may be required]

By MIN ZENG

With yields plummeting on U.S. government bonds, the Treasury Department has quietly asked some banks if they would agree to buy new short-term bills offering yields below zero.

Effectively, the Treasury is asking investors if they are willing to pay the government to take their money. And some big banks have answered, "Yes."

It may sound crazy, but yields on Treasurys of less than three-month maturity are already occasionally trading below zero in the secondary market. Under current auction rules, though, the Treasury can't sell so-called T-bills with a negative yield. In the bond market, however, higher yields mean lower prices, so the Treasury is effectively losing out every time it sells bills with higher yields than the prevailing level in the market.

The question was included in a questionnaire the Treasury delivered on Oct. 14 to the 22 primary dealer banks that are obligated to bid on primary auctions of its debt.

[…]

Gibbons Burke comments:

It is just another form of protection racket. For a small tribute, you can keep your money.

Victor Niederhoffer comments:

The banks are so indebted to the government for their survival and bonuses and trading and purchase of distressed assets, and redeeming of sovereign debt, and capital at the funds rate, and bailouts, and investments et al , and freedom out of hotels that they are happy to accommodate their masters on the Hill with any emoluments like paying the master a fee for the privilege of holding the master's…

Oct

28

Selling Tails to the Middle, by Kim Zussman

October 28, 2011 | 2 Comments

Last night at a fund-raising event I met the chairwoman of the local classical orchestra. They have been struggling financially for years, and worse lately even though the second recession in three years ended this week.

Last night at a fund-raising event I met the chairwoman of the local classical orchestra. They have been struggling financially for years, and worse lately even though the second recession in three years ended this week.

She told me the musicians make $150-250 per day–and I didn't tell her this was about half of what a dental hygienist makes. We lamented that the symphony's efforts to interest young people in classical music had largely failed, and wondered why there wasn't greater interest in classical music. As this lady hailed from a formerly socialist / currently mafia part of the world that gets people kicked off spec-list, I explained that in free capitalist markets financial resources gravitate toward areas of greatest demand. Thus classical music is not much in demand by the majority of people, and marketing to them will not get results.

Afterwards we went to a nice restaurant and had dinner near the bar. The place was very busy–which seemed surprising for a weeknight just after another recession. Apparently the internet age speeds us up. We had a good view of the bar, as well as the two cute hostesses in their twenties. Nearby an older single model with colored hair and unbuttoned shirt was seated at the bar. You could tell because he wore a diagnostic shibboleth that used to be much more common: a necklace with a dangling gold-plated razor blade.

He kept stopping the cuter blond hostess and chatting with her. At first she was too busy, but eventually she heard him out for about five minutes; politely listening and making good eye contact. Suddenly grandpa handed her $100, saying "take this for your four year old".

When I was little an old Jewish man gave me a penny. I quickly did the inflation calculation and realized a value transaction had occurred, and that free markets would never die.

Oct

28

Darwin > Smith? from Kim Zussman

October 28, 2011 | Leave a Comment

"The Darwin Economy: Liberty, Competition and the Common Good"

"The Darwin Economy: Liberty, Competition and the Common Good"

Professor Frank draws comparisons between Adam Smith's "invisible hand" theory and Darwin's innate understanding of competition. As a pioneering naturalist and not an economist himself, Frank states that Darwin helps describe the economic reality of our current world much more accurately than Smith's and predicts that Darwin will be seen by most economists as the intellectual founder of their discipline within the next century. The book expands on this theory, elaborates on how Darwin's theories relate to our current situation, and how Darwin's insights can help us in the future.

Oct

27

The Other Greek Tragedy (Averted Again), from Kim Zussman

October 27, 2011 | Leave a Comment

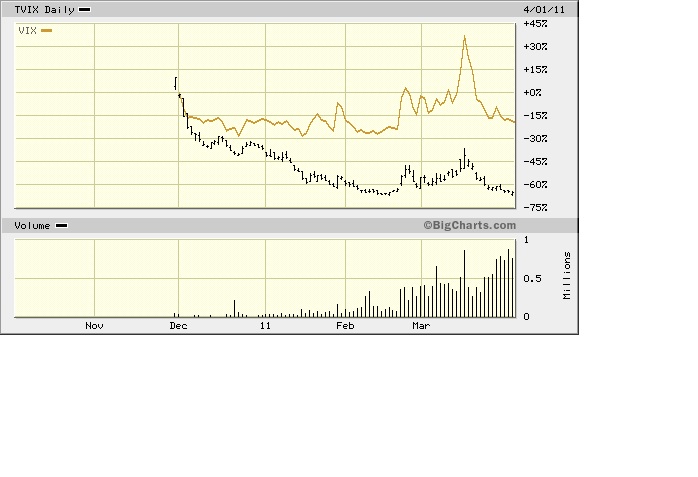

In less than a month, by virtue of modern technology, the story went from near-certain Greek government default and coordinated/global ECRI-vetted recession to……. this. [Just for fun… Stimpy cartoon, 3 minutes]

Oct

26

Income Mobility 1996-2005, from Kim Zussman

October 26, 2011 | Leave a Comment

Interesting study from the US Treasury (2007):

Income Mobility in the U.S. from 1996 to 2005

Some excerpts:

• There is considerable income mobility of individuals in the U.S. economy over the 1996 through 2005 period. More than half of taxpayers (56 percent by one measure and 55 percent by another measure) moved to a different income quintile between 1996 and 2005. About half (58 percent by one measure and 45 percent by another measure) of those in the bottom income quintile in 1996 moved to a higher income group by 2005.

• Median incomes of taxpayers in the sample increased by 24 percent after adjusting for inflation. The real incomes of two-thirds of all taxpayers increased over this period. Further, the median incomes of those initially in the lowest income groups increased more in percentage terms than the median incomes of those in the higher income groups. The median inflation-adjusted incomes of the taxpayers who were in the very highest income groups in 1996 declined by 2005.

• The composition of the very top income groups changes dramatically over time. Less than half (40 percent or 43 percent depending on the measure) of those in the top 1 percent in 1996 were still in the top 1 percent in 2005. Only about 25 percent of the individuals in the top 1/100th percent in 1996 remained in the top 1/100th percent in

2005.• The degree of relative income mobility among income groups over the 1996 to 2005 period is very similar to that over the prior decade (1987 to 1996). To the extent that increasing income inequality widened income gaps, this was offset by increased absolute income mobility so that relative income mobility has neither increased nor decreased over the past 20 years [emphasis added]

Oct

6

A Thought for Today October 6, 2011, from Kim Zussman

October 6, 2011 | 2 Comments

It is tempting to think the recent market top marked by the death of an agent of destruction of free will, creation, and human progress (Osama Bin Laden, D-5/2/11), will be book-ended by a bottom on the passing of an emblem of unafraid creativity, entrepreneurial spirit, and inspired human curiosity (Steve Jobs, D-10/5/11).

The memory of his life recalls the transition from Carter's malaise to Reagan's unashamed patriotism, only this time it is for capitalism.

Steve Jobs Stanford Commencement Speech 2005

Oct

5

The Behavior of Volatility in October, from Kim Zussman

October 5, 2011 | Leave a Comment

Daily SPY was used to calculate volatility as normalized range:

norm range = (H-L) / {(H+L)/2}

The attached compares mean normalized daily range by month; first period was 2000-2005, and the second period 2006-sept 2011.

In both periods, mean normalized daily range for Octobers (month 10) exceeds the global mean.

Oct

5

Where Are They Now?, by Vince Fulco

October 5, 2011 | Leave a Comment

Since the Fed Head expressed great satisfaction with asset inflation through the capital markets, particularly stocks, just a short time ago, surely he can't throw his theory and intervention(s) out of the window so soon? Blunt instrument indeed.

Kim Zussman comments:

BBQ phase change from warming the corporate economy to juicing the protesters and the electorate.

Oct

3

From Dept of ETF-Everything: SPLV, from Kim Zussman

October 3, 2011 | Leave a Comment

SPLV is an ETF with the 100 lowest-volatility stocks in the SP500, which started trading May 2011. Using close-close daily returns, here is regression of SPLV vs SPY:

The regression equation is SPLV = 0.000693 + 0.697 SPY

Predictor Coef SE Coef T P

Constant 0.0007 0.00038 1.83 0.070

SPY 0.69662 0.02207 31.57 0.000

S = 0.00383423 R-Sq = 90.8% R-Sq(adj) = 90.7%

beta of SPLV is 0.7, and alpha for the 4-month down period is almost significant 0.07%.

And so far SPLV is indeed less volatile than SPY (comparison of variance of daily returns):

Test for Equal Variances: SPLV, SPY

95% Bonferroni confidence intervals for standard deviations

N Lower StDev Upper

SPLV 103 0.0108657 0.0125769 0.0148974

SPY 103 0.0148627 0.0172035 0.0203776

F-Test (normal distribution) Test statistic = 0.53, p-value = 0.002

Levene's Test (any continuous distribution) Test statistic = 4.72, p-value = 0.031

Oct

2

Interesting Chart of the Day, from Victor Niederhoffer

October 2, 2011 | Leave a Comment

Interesting chart of the day.

Kim Zussman adds:

Plotting Intrade vs SPY shows congruence over the period (including sell-the-news post Osama). However the daily change is not significantly correlated:

Pearson correlation of chg spy and ch barry = 0.109

P-Value = 0.138

Oct

2

Perfunctory Quarter Study, from Kim Zussman

October 2, 2011 | 1 Comment

The calendar quarter just ended saw the SP500 lose 14.4%. Since 1951 there have been 17 quarters with SP500 return less than -10%. The subsequent quarters had mean return of 5%, though not significantly different from all quarters 1951-2011:

Two-sample T for next Q vs all Q

N Mean StDev SE Mean

nxt Q 17 0.0495 0.0985 0.024 T=1.2

all Q 245 0.0209 0.0779 0.0050

Date qtr ret nxt Q

Sep-10 -0.119 0.107

Jun-09 -0.117 0.152

Mar-09 -0.226 -0.117

Dec-02 -0.176 0.079

Sep-02 -0.137 -0.176

Dec-01 -0.150 0.103

Jun-01 -0.121 0.055

Dec-98 -0.103 0.209

Dec-90 -0.145 0.079

Mar-88 -0.232 0.048

Dec-81 -0.115 0.055

Dec-75 -0.119 0.075

Dec-74 -0.261 0.079

Mar-74 -0.100 -0.037

Sep-70 -0.189 0.159

Sep-62 -0.213 0.028

Dec-57 -0.104 -0.057

Sep

29

When Things Change, from anonymous

September 29, 2011 | Leave a Comment

One posits that dependency on the past is sacrosanct to all trading/ investing, and when past relationships break down there is always the question whether the current instance is a temporary state or regime change. (2008-09 contained many such, as well as a few more recent examples).

This reduces further to how well success in markets (life, etc) tightly correlate with intelligence, learning from study and experience, and discipline, and what happens to successful trend followers (which all living creatures are) when the trend dies and nature deals out an extinction. The quaint notion that fear is conserved in the genome for a reason.

Ralph Vince writes:

As the Old Frenchman would have put it, stamping out his Gitane on the dashboard itself, "Adaptation…..The first rule of survival."

anonymous writes:

Clearly, it would be best to know in advance if things that worked in the past stop working. But aside from a very very few circumstances (true arb is the only one that comes to mind, and even that relies on technology working), do traders ever have this knowledge? Instead, isn't money management of some sort used?

With respect, for example, enter a tiny amount, if it works, put on more, if it doesn't work, but the idea remains the same, take off some and wait for a truly outrageous spread to try again, if it never works, exit and take it off the screen or something etc.

Ralph Vince talks about not needing to predict movement to make money and I keep thinking about this.

Sep

28

The Marathon Record Indicator, from Russ Sears

September 28, 2011 | Leave a Comment

The men's marathon record was broken this week end at the Berlin Marathon, pending ratification, by Patrick Makau with time of 2:03:38. Beating the old record Sept. 2008 record by Haile Gebrselassie by 21 seconds. The record has been broken with some regularity since the mid 1930s when the depression caused men to look for any way to make a living or bolster their reputation to get and keep a job.

The men's marathon record was broken this week end at the Berlin Marathon, pending ratification, by Patrick Makau with time of 2:03:38. Beating the old record Sept. 2008 record by Haile Gebrselassie by 21 seconds. The record has been broken with some regularity since the mid 1930s when the depression caused men to look for any way to make a living or bolster their reputation to get and keep a job.

It has occurred to me that the record tends to be broken when the economy is in long term trouble and when the young are having hard time finding opportunity elsewhere. The record broken by decade is as follows: 1930, 3; 1940, 1; 1950 6; 1960 9;1970 3; 1980, 5; 1990 2, 2000 4, 2010 1st last weekend. Marathoning is a tough way to make a living and the competition, at least in my time, has appeared to get stronger as the stock market tanks and gets weaker as it is about to take off. I missed my opportunity by not taking up serious marathoning in 1992 but waiting till 1996, 1992 was when I was at my peak and the competition was weakest.

Below is a comma delineated file with the month the record was broken, the % change in the Dow Index 12 months prior (counting month record broke), and the 12 month after % change in Dow index.

Here are some key statistics:

12 month prior avg. 3.22% stdev 13.64% count 34 negative count 15

12 month after avg 13.59% stdev 21.06% count 33 negative count 7

Student T test 2 different stdev one tail, 1.14%

It would appear that the marathon tends to be broke at the turning points in the Dow, however with a wider deviation than prior and the last 2 times this did not work. A similar result occur taking out all but the first occurrence when the record is broke within 12 months of the last time, except the student T test is higher due to fewer occurrences.

Month Record Broke,Prior 12 month % change in Dow,Next 12 month % change in Dow, New Record

3/1/1935,0.47%,55.13%,2:27:49

4/1/1935,8.92%,55.13%,2:26:44

11/1/1935,38.27%,26.77%,2:26:42

4/1/1947,-17.47%,0.00%,2:25:39

5/1/1952,5.32%,6.65%,2:20:42

6/1/1953,-2.19%,20.28%,2:18:40

10/1/1953,2.44%,36.52%,2:18:35

6/1/1954,24.33%,29.73%,2:17:39

8/1/1956,7.23%,-1.79%,2:18:05

8/1/1958,5.01%,34.17%,2:15:17

9/1/1960,-8.16%,15.01%,2:15:16

2/1/1963,-6.37%,15.01%,2:15:16

5/1/1963,18.52%,12.97%,2:14:28

7/1/1963,16.31%,17.63%,2:14:43

6/1/1964,17.63%,11.88%,2:13:55

10/1/1964,15.60%,6.31%,2:12:12

6/1/1965,4.39%,-3.70%,2:12:00

12/1/1967,15.20%,12.48% 2:09:36

5/1/1969,4.29%,-22.53% 2:08:34

7/1/1970,-9.98%,30.37% 2:09:29

12/3/1973,-16.58%,-17.75% 2:09:12

2/1/1978,-20.75%,9.00% 2:09:06

4/1/1980,-4.43%,27.76% 2:09:01

12/1/1981,-9.23%,16.91% 2:08:18

10/1/1984,-1.45%,10.10% 2:08:05

4/1/1985,7.46%,43.56% 2:07:12

3/1/1988,-13.74%,9.02% 2:06:50

9/1/1998,-1.29%,43.64% 2:06:05

10/1/1999,24.88%,3.04% 2:05:42

4/1/2002,-7.35%,-23.18% 2:05:38

8/1/2003,8.68%,9.81% 2:04:55

8/1/2007,17.37%,-21.91% 2:04:26

8/1/2008,-13.58%,-19.39% 2:03:59

9/1/2011 -0.15%, ?, 2:03:38

Kim Zussman queries:

Russ, in your opinion, will the 2 hour mark be broken in our lifetime (you and I are about the same age)?

The 12 records since 1980 have dropped in a roughly linear fashion, which if continued extrapolates to about 2035

Russ Sears replies:

If you would have asked me in the 90s about this, I would have said no way, they are beginning to form an asymptote. However, I believe sport science has made considerable progress in 2 areas critical to lowering this record below 2 hours.

1. There is a much better understanding of the altitude effect has in endurance training and how to maximize this effect.

2. There are now much more creative ways to exercise more with less detrimental stress but maintaining the positive stress and exercise specifics. See zero gravity treadmills and water running treadmills for example.

And perhaps it simply is competition creates its own opportunity and it is clear to me we are in a new competitive era for distance running.

Hopefully it will continue for the rest of our lives. But not because the economy will continue to flounder. Especially for the young, ambitious and talented.

Larry Williams comments:

The math is all a runner has to do is knock 8 seconds a mile of his/her pace. Much easier said than done, but it's a goal within reach. 2:00:00 will be broken in next 10 years is my forecast. Mostly because of what Russ said–better training habits and knowledge. With science, a runner with lots of personal angst will break through. Must have personal angst (see current frank shorter article in Runners World) to get through the pain.

Sep

25

SP500 Level and Yield Curve, from Kim Zussman

September 25, 2011 | Leave a Comment

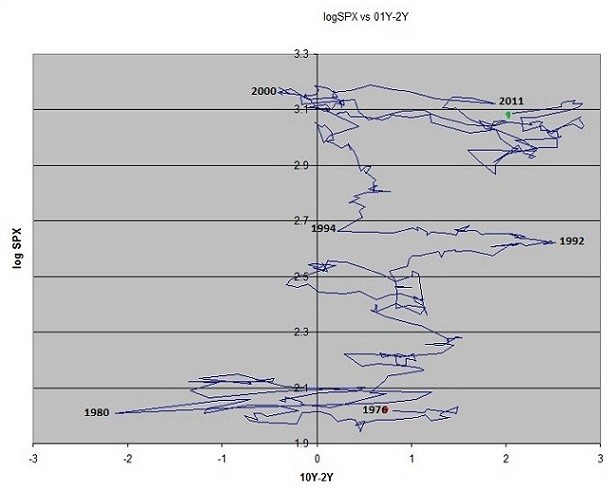

The attached is a plot of log SPX vs contemporaneous yield curve (10Y-2Y), monthly 1976-August 2011. Dates are not shown, but the plot is a continuous (albeit mathematically not one-to-one) and shows various regimes between log SPX and 10Y-2Y.

The series starts in 1976 at the red dot near the bottom. Stocks (vertical axis) made little headway while 10Y-2Y varied above and below zero, making a series low about -2 in 1980. From the early 1980's to 1990's, stocks moved sharply upward, with 10Y-2Y varying between slightly negative and +1.5. From 1990 to 1992 (~Iraq I), stocks moved up while 10Y-2Y widened. From 1992-94, stocks went up while 10Y-2Y narrowed. From 1994-2000, stocks rose strongly while 10Y-2Y remained in a tight range (activist FED?), and 10Y-2Y went negative when stocks peaked in 2000. From 2000 - 2011 (green dot), 10Y-2Y varied considerably from -0.4 to +2.8 while log SPX was range-bound with considerable variation.

The recent picture - range-bound stocks with varying yield curve - resembles the late 1970's, and the overall pattern suggests no consistent relationship between stock levels and 10Y-2Y.

Steve Ellison writes:

Attached is a regression graph of 1981-2010 S&P 500 annual returns vs. the difference between the 10-year yield and 3-month yield at the beginning of the year. N0, t=1.06, p=0.30, Rsq=0.04

The results I posted earlier that showed significance were the second year's S&P 500 returns regressed against the 10-year/3-month yield differential. That result seems suspicious–why should year-old data be more predictive than current data? 2011 so far is not going according to form.

George Zachar adds:

Because between Volcker's rise and Lehman's fall, the main way the curve steepened was when the Fed lowered rates in the front end, stimulating the economy and stocks, months down the road.

Sep

25

Silver and Gold, from Kim Zussman

September 25, 2011 | Leave a Comment

This is a chart of ratio GLD/SLV (gold and silver ETFs, daily, from SLV inception 2006 to last Friday).

The big move down (=relative SLV up) began with the inception of QE2 in Aug 2010, and stopped around the recent top in stocks April 2011.

Just for fun: listen to "Silver and Gold" on youtube.

Sep

25

Risk Free Assets, from Charles Pennington

September 25, 2011 | Leave a Comment

If yields on all treasuries of all durations are going to zero forever and ever, it seems possible that a bubble could develop in the Falkenstein-ish safety stocks, the Proctor and Gambles, the Pepsis, the Philip Morrises–anything that has a 2-3 percent dividend yield that's expected to grow slowly with minimal risk and minimal connection to the economy.

Kim Zussman writes:

Relatedly, what exactly is a risk-free asset?

Sep

9

Bell Bottom Blues, from Kim Zussman

September 9, 2011 | 1 Comment

This is a plot of log SP500 for the period 2/66-2/82, along with a time-shifted / log adjusted plot of log SP500 from 8/00-present. Both plots were aligned so they originate at what was then a local maximum, and show (not adjusted for dividends or inflation) what happened to stocks in ensuing years.

The first 10 years of these periods are similar as there is no "upward drift". During the recent 11 years stocks made three major highs and two major lows, whereas the similar (net/flat) period 66-77 had 4 major tops and 3 major bottoms. In addition to the recent period's less frequent periods, the peak/valley has been far less than the older interval.

Interesting also to consider other differences not shown on the chart, including results of US military action, inflation levels, bond yields, age of depression-era children, age of post-war baby boomers, evolution of the equity culture, widespread indexation, and globalization of economies and markets.

Stefan Jovanovich replies:

Great stuff, Kim. My feeble model compares the present to the late 70s/early 80s. The difference is the world's Bond Markets, which are now the opposite of what they were during that period. Good credits are now as much overbought as they were oversold then. Gold's price is equally high because then people were hedging against cost-push inflation while now they are hedging against deliberate currency depreciation by the central banks. Back then the gold market was disappointed when further cost-push inflation failed to materialize after Reagan and Thatcher made it clear they were not going to give in to the unions. This time the fears of further currency depreciation will be disappointed as the electorates in the U.S., U.K. and Germany decide that they want the central banks to tear up their credit cards and drain the punch bowl. Gold will then have to compete with actual returns for CDs and other conventional savings. But, then, how can stock prices rise? The answer is that the cost of borrowed capital is now a negligible part of the overall expense of currently doing business and irrelevant to consumer demand. The promise of diminished regulatory and steady (i.e. no longer rising) commodity costs will offset the added costs of higher interest rates for businesses 10 or even 100 times over; and - miracle of miracles - there will be an increased consumer demand from the savers - i.e. the people living off the interest rates from CDs. This is, of course, exactly the opposite of the Fed's diagnosis that we need to somehow reduce lending rates further to "prime" the economic pump so the borrowers can go more cheaply in debt; but then, what would you expect from people who walk by Woodrow Wilson's statue every day without gagging.

Aug

29

HPQ Pinned, from Kim Zussman

August 29, 2011 | Leave a Comment

Though stocks rose steadily through the day, Hewlett-Packard rose in the morning then was pinned at or near 26 for 3 hours before floating up a bit more in the last hour.

Anatoly Veltman writes:

A very unusual chart indeed! HPQ was noted among Paulson's holdings. One might guess that other "size people" that Paulson talks to MAY well be stuck with it as well. We're in the era when HFT's sit ahead of any offer they've sniffed — so getting out is problematic…

Aug

24

Thoughts on the Federal Reserve Bank of SF Paper on Middle Savers and Old Spenders, from Mr. M.G.

August 24, 2011 | Leave a Comment

There is a paper making the rounds from the FRBSF that looks at the predictive relationship between "middle" savers (40-49) and "old" spenders (60-69) for equity market P/E ratios. The paper demonstrates a relationship between the M/O ratio and historical market P/E ratios from 1954-2010. The paper is a quick read.

The conclusion that is getting the attention reads:

Historical data indicate a strong relationship between the age distribution of the U.S. population and stock market performance. A key demographic trend is the aging of the baby boom generation. As they reach retirement age, they are likely to shift from buying stocks to selling their equity holdings to finance retirement. Statistical models suggest that this shift could be a factor holding down equity valuations over the next two decades.

A couple of quick points on the FRBSF economic letter:

1) The key paragraphs in terms of stock implications are:

Since we have forecast a path for the P/E ratio, predicting stock prices is straightforward if we can project earnings, the E part of the ratio. For this purpose, we assume that, in the next decade, real earnings will grow steadily at the same average 3.42% annual rate by which they grew from 1954 to 2010. To obtain real earnings, we deflate nominal earnings by the consumer price index.

The model-generated path for real stock prices implied by demographic trends is quite bearish. Real stock prices follow a downward trend until 2021, cumulatively declining about 13% relative to 2010. The subsequent recovery is quite slow. Indeed, real stock prices are not expected to return to their 2010 level until 2027. On the brighter side, as the M/O ratio rebounds in 2025, we should expect a strong stock price recovery. By 2030, our calculations suggest that the real value of equities will be about 20% higher than in 2010.

Note that they are using "real" stock prices. Converting this to nominal using currently depressed inflation expectations of 2.01% over the next decade (from TIP breakevens) implies an increase in stock prices that is roughly 50% higher than what is priced into long-term S&P options. If they are right (and I think they are wrong), then the returns to equities using long-term options should be around 3.7% over the next decade (better than government bonds) while the returns to holding the S&P should be roughly the same 3.65% due to dividends received over the next decade.

They are also making an assumption that trend earnings growth mimics that of 1954-2010. They are calculating this using a straight line two point growth. Fortunately, they ignore that 1954 earnings were roughly 50% above long-term trend lines while 2010 earnings are roughly 30% below trend. Using an actual trend line (rather than point to point) growth would imply that S&P earnings should grow 10% per year over the next decade (this makes more sense if you forget about "peak margin" nonsense and recognize the current profit levels are against a very depressed economic output line). Using their other data (dubious for reasons articulated above and below) and trend earnings would imply the S&P should rise roughly 83% over the next decade (to ~2,100). This would yield returns from long-term options of 22.3% per year over the next decade while holders of the S&P should receive returns of 8.1% per year.

2) They "fit" data from 1954 to 2010. There is a reason for this choice of data sets — it's the only one that works. The demographic data offers zero explanatory power for periods prior to 1954 for one very simple reason — the proportion of the population that was aged 60-69 (their "old" people who are supposedly liquidating assets) was far, far lower. This would imply that P/E ratios should have been stratospheric in the pre-1954 period. We can see a tease of this in their chart that shows rising P/E ratios from 1964-1954 on their "model generated" line. Pre-1954, this model generated P/E would have risen dramatically. In contrast, they were depressed. As a result, I would strongly question whether we can generate any real insights on the forward direction of P/E ratios from this analysis.

The reality of all this nonsense is that when equity markets are low and falling, most people will offer explanations for why they are low and falling. Those arguments will sound intelligent until equity prices begin rising inexplicably. Then they will rage against the "bubble" until they suddenly see the light and argue we are at a permanently higher plateau.

Kim Zussman writes:

This is a variant of the "sell to whom" question posed by Jeremy Siegel in "Stocks for the Long Run". ie, when boomers retire and they change from saving to consumption, who will buy their stocks?

Siegel's suggestion was younger people of developing nations / emerging markets. Given the known tendency for people to invest closer to home, why wouldn't up and coming Indians and Chinese buy domestic vehicles rather than SPY?

Jason Ruspini writes:

Whatever problems we think we see with such studies, it is an embarrassment for economics that the effects of demographics, globalization, and diffusion of technologies are not more widely studied and understood. This provides cover for all sorts of claims like "tax rates were higher in 1950 and 1990 and we had excellent growth then…"

Russ Sears adds:

While I agree that studying the effects of the predictable real economy on the real economy should get more study. Further I agree with your implication, that jumping from fiscal/monetary policy to real economy often hides a large amount of nonsense. However, I can not encourage a tunneled vision approach of narrow real effect to narrow real effect. Especially when I see the design of the study to be such that its intent is to keep people from following their natural ambitions and make sure the individual is smaller than he needs to be by discouraging investing in capitalism. They (the govt) only do these studies when this is the case. The nonsense comes by narrowing the line of vision to reach the conclusion that we need them to protect us from ourselves.

Jason Ruspini replies:

This sort of criticism was behind some of the controversy with Tyler's Cowen's book. To those on the right it sounded dangerously like " 'We' should do something! " To those on the left, " 'We' are poor and can't do anything…"

But I don't see why low average rates of return should discourage entrepreneurs. Situations like Apple and Facebook suggest that where there is growth in a low growth environment, money funnels to the innovators just the same if not more vigorously. Regarding Facebook, my sense is that part of the "problem" with current technologies as compared to those of the 19th-20th century is that the latter often compressed time in terms of more efficient communication, travel and production while the former largely serves to fill time with questionable effects on production and average asset returns. Additionally, the diffusion of the latter 20th century type across the world is now past its inflection point.

One other point..

Japan in the '80s through present might be a better complement to the Fed study than the pre-1950s world as suggested in Mr. Green's original email. Equity returns aside, all things equal, more retirees should translate to lower rates. Given sovereign debt, I guess one should say lower real rates.

Russ Sears responds:

The government is in competition with the private sector for capital…In the fiscal world should the retiriees give their capital to Government and let them continue to spend or should they give it to entrepreneuars and let them spend it.

In either case fewer real world projects will begin to those who loss the competition for capital. All things being equal if less money goes to the stock market, few projects are begun and cost of captial is raised. If they cannot get capital from issuing stock, they must issue more debt, real cost of borrowing goes up.

But if real demand for private sector goods are raised and fewer project in the private sector were funded, cost of loans will go up and the profits per $ in the stock market would also increase.

If more money goes to government, the more our government becomes addicted to the low cost of capital, and the more it spends on less and less productive projects.

Am I missing something?

Which do you think will raise the overall wealth the most? Would you believe a government study suggesting investing in the private sector is doomed to low real returns for decades?

Jul

23

European Version of QE, from Paolo Pezzutti

July 23, 2011 | Leave a Comment

After euro leaders announced a new (big) aid package for Greece and measures to prevent bond yields rising further in Spain and Italy, it seems that Europe has solved its sovereign debt problems…. Markets celebrate the European version of QE. Also Europeans (we'll see what Americans will now do about it, but I think the answer is pretty clear and markets know it) can now delay any tough decisions on deficits. Someone else will pay the bill. Pretty sad. However, markets go up and everybody is happy so far.

After euro leaders announced a new (big) aid package for Greece and measures to prevent bond yields rising further in Spain and Italy, it seems that Europe has solved its sovereign debt problems…. Markets celebrate the European version of QE. Also Europeans (we'll see what Americans will now do about it, but I think the answer is pretty clear and markets know it) can now delay any tough decisions on deficits. Someone else will pay the bill. Pretty sad. However, markets go up and everybody is happy so far.

Kim Zussman writes:

Do not recall the oft-heard warning that a Greek default or failure to raise US debt limit will result in financial Armageddon prior to the Lehman collapse. That not yet distant memory still has usable power. Perhaps a day's meal in that.

Bruno Ombreux writes:

The 100s of billions will mainly come from the pockets of the German, French and Dutch taxpayers, since the ECB printing powers are limited. As for the Greek, they have lost their sovereignty but they will find freedom though work. You know. Arbeit macht frei. That is at least for the next few months until bailout 3 is needed and the whole show starts again.

Also, about the question from the bleachers: How are the ECB's "printing powers" more limited than the U.S. Federal Reserve's?

read this: European Central Bank

They need to maintain some capital and this capital is provided by the central banks of the member states. They cannot do too outrageously stupid things, because they can get bankrupt if some member state central banks stop capitalizing them.

And you can be sure that the German or Dutch have an uncle point.

Politically, the ECB is also far less inclined to print than the Fed:

- It has only one mandate, low inflation, whereas the Fed has a dual mandate: inflation and economic growth. In effect, the ECB doesn't really care about economic growth. - The German have been paranoid about inflation since Weimar and would not let the ECB go too far. - If you look at the ECB board, it is predominantly hawkish according to analysts and observers that spie every word uttered by these guys.

But the main reason they have less power to print than the Fed is that they have to please a lot of member states. Which creates checks and balances. Whereas the Fed only has to please one guy, the US president, who nominates board members.

John Floyd adds:

Leaving any debates on what is considered QE and what is not.

The ECB has lent to the periphery through its rediscount window Euro 330 billion, this is in addition to the Euro 75 billion in secondary market purchases of peripheral country bonds. The ECB has a capital cushion of about Euro 10 billion. One could argue this might be a stretch of the single mandate of the ECB's 1998 charter.

To Ireland alone the ECB has exposure of Euro 180 billion, or about 100% of Irish GDP.

Other thoughts on the most recent Euro summit:

The general reaction in markets and the street research has been this plan delivers slightly more than expected and is a bold plan. Not surprisingly this has been the analysis of most of the rescue packages globally since 2008. Yet, the failure of the packages on so many levels is fairly evident if one looks at economic growth, interest rate spreads, etc.

The most recent package clearly will buy some time. How much is an open ended question but I expect much less than previous packages as the Pavlovian reaction wears thin.

Amongst the many issues of implementation, political approval, private sector etc. I think the key failings are:

1) There was no increase in the size of EFSF. Furthermore, even the relatively paltry and debatable rating of current EFSF has yet to approved. To cover Spain and Italy would require 1.5-2.0 trillion Euros.

2) Concessions on rates and maturity extensions for Ireland and Portugal are nice but small relative to the fiscal adjustment required.

3) The debt relief to Greece is insignificant and will bring debt to GDP from 172% to around 150-160%, depending on whose estimates you are using.

4) Given that there is not much debt relief and the fiscal adjustment is massive there cannot be much hope that the domestic political willingness in Greece will be there to stay the course.

Jul

19

Finance Sector Factoid, from Kim Zussman

July 19, 2011 | Leave a Comment

In the SP500 Financial sector over the past 3-years, REITs comprised 9 of the top 20 performers and 2 of the bottom 20:

Symbol Company Name Industry Total Return 3 Year

DFS Discover Financial Svcs Consumer Finance 96.97%

AVB AvalonBay Communities Real Estate Investment Trusts (REITs) 76.37%

EQR Equity Residential Real Estate Investment Trusts (REITs) 75.15%

PSA Public Storage Real Estate Investment Trusts (REITs) 60.62%

FHN First Horizon Natl Commercial Banks 58.61%

BEN Franklin Resources Capital Markets 56.50%

SPG Simon Property Group Real Estate Investment Trusts (REITs) 51.61%

VTR Ventas Inc Real Estate Investment Trusts (REITs) 48.09%

AMP Ameriprise Financial Capital Markets 47.82%

TRV Travelers Cos Insurance 42.68%

HCN Health Care REIT Real Estate Investment Trusts (REITs) 40.75%

HCP HCP Inc Real Estate Investment Trusts (REITs) 40.66%

COF Capital One Financial Consumer Finance 38.45%

CB Chubb Corp Insurance 38.35%

AXP Amer Express Consumer Finance 37.44%

HST Host Hotels & Resorts Real Estate Investment Trusts (REITs) 37.21%

CMA Comerica Inc Commercial Banks 36.35%

CINF Cincinnati Financial Insurance 36.01%

MTB M&T Bank Commercial Banks 34.60%

BXP Boston Properties Real Estate Investment Trusts (REITs) 30.82%

Symbol Company Name Industry Total Return 3 Year

PFG Principal Financial Grp Insurance -23.03%

STT State Street Corp Capital Markets -23.64%

KEY KeyCorp Commercial Banks -24.81%

BK Bank of New York Mellon Capital Markets -26.70%

ALL Allstate Corp Insurance -28.30%

NTRS Northern Trust Capital Markets -31.10%

KIM Kimco Realty Real Estate Investment Trusts (REITs) -32.92%

MS Morgan Stanley Capital Markets -35.63%

GNW Genworth Financial'A' Insurance -39.22%

RF Regions Financial Commercial Banks -40.30%

AIZ Assurant Inc Insurance -45.39%

HCBK Hudson City Bancorp Thrifts & Mortgage Finance -45.74%

BAC Bank of America Diversified Financial Services -52.23%

HIG Hartford Finl Svcs Gp Insurance -56.92%

ETFC E Trade Financial Capital Markets -57.54%

JNS Janus Capital Group Capital Markets -59.93%

PLD ProLogis Inc Real Estate Investment Trusts (REITs) -61.70%

C Citigroup Inc Diversified Financial Services -75.05%

AIG Amer Intl Group Insurance -93.36%

Jul

15

Only the Shadow Knows, from Victor Niederhoffer

July 15, 2011 | 1 Comment

I never look at the news, but I usually can tell what the news is from the market moves, and I would guess at 7 pm, S&P issued their catch up warning on rating change, and yes, I would guess that those selling at 3:55 pm bringing the market to 1301.5 knew that the S&P would join. But they were temporarily discommed by the Google announcement but then baled out by the 7 pm announcement, and then people thought that the first announcement by Moodies did not make the market open down, so maybe like the last announcement that dropped the market to 1301 this one will not have a staying influence, and then the problem is that the options expiration is tomorrow and the "market makers" usually have positions bearish when the market has been going down and 1300 is a target. How to play it? What evil lies in the hearts of men. Only the Shadow knows.

I never look at the news, but I usually can tell what the news is from the market moves, and I would guess at 7 pm, S&P issued their catch up warning on rating change, and yes, I would guess that those selling at 3:55 pm bringing the market to 1301.5 knew that the S&P would join. But they were temporarily discommed by the Google announcement but then baled out by the 7 pm announcement, and then people thought that the first announcement by Moodies did not make the market open down, so maybe like the last announcement that dropped the market to 1301 this one will not have a staying influence, and then the problem is that the options expiration is tomorrow and the "market makers" usually have positions bearish when the market has been going down and 1300 is a target. How to play it? What evil lies in the hearts of men. Only the Shadow knows.

Ken Drees writes:

Skulduggery indeed. That darn Google is messing up my arrangements. Tessio, the underboss who brokered the meeting with Barzini.

Alston Mabry writes:

This sounds like revolution to me. Bond vigilantes riding through the night, striking fear into the hearts of the king's men.

Kim Zussman adds:

"why Moody's or S&P or Fitch or anyone else's rating on US Government debt should have had, or continue to have, any obvious and/or immediate effect on the S&P500 price"

Perhaps in part a conservation process: a back-and-forth conversion of equity capital to political capital. Markets regained much of 08-09 losses in great measure due to government interventions, creating a debt for the beneficiaries. Payment by the class that owns stocks can take the form of higher taxes or lower asset values, in either case accruing to the creditors.

Jul

13

If I Were a Rich Man, from Kim Zussman

July 13, 2011 | 1 Comment

Market mavens and Shtetl life; what besides women and money can bring man to his knees:

Market mavens and Shtetl life; what besides women and money can bring man to his knees:

"The attitudes and thought habits characteristic of the learning tradition are as evident in the street and market place as the yeshiva. The popular picture of the Jew in Eastern Europe, held by Jew and Gentile alike, is true to the Talmudic tradition. The picture includes the tendency to examine, analyze and re-analyze, to seek meanings behind meanings and for implications and secondary consequences. It includes also a dependence on deductive logic as a basis for practical conclusions and actions. In life, as in the Torah, it is assumed that everything has deeper and secondary meanings, which must be probed. All subjects have implications and ramifications. Moreover, the person who makes a statement must have a reason, and this too must be probed. Often a comment will evoke an answer to the assumed reason behind it or to the meaning believed to lie beneath it, or to the remote consequences to which it leads. The process that produces such a response—often with lightning speed—is a modest reproduction of the pilpul process.

Not only did the Jews of the shtetl speak a unique language (Yiddish), but they also had a unique rhetorical style, rooted in traditions of Talmudic learning: In keeping with his own conception of contradictory reality, the man of the shtetl is noted both for volubility and for laconic, allusive speech. Both pictures are true, and both are characteristic of the yeshiva as well as the market places. When the scholar converses with his intellectual peers, incomplete sentences, a hint, a gesture, may replace a whole paragraph. The listener is expected to understand the full meaning on the basis of a word or even a sound… Such a conversation, prolonged and animated, may be as incomprehensible to the uninitiated as if the excited discussants were talking in tongues. The same verbal economy may be found in domestic or business circles.

Jul

8

“Unexpected” Poor Jobs Report, from Dan Grossman

July 8, 2011 | 1 Comment

Is it perhaps an indication of the media's solicitude for the current President that every poor economic report is termed "unexpected"?

Is it perhaps an indication of the media's solicitude for the current President that every poor economic report is termed "unexpected"?

While poor economic results under the prior President were somehow not so surprising since he was such an incompetent boob?

Kim Zussman adds:

As with many time series this month was similar to the prior month, which was different from the month before.

Victor Niederhoffer adds:

All are part of the regression fallacy.

Ken Drees writes:

So now we wander into "needed and now expected qe3" type thinking and should not the market go up due to this stimulus?

Sam Marx adds:

Three Thoughts on the Reported Unemployment Rate.

1) The Unemployment Rate is probably higher than the government reported.

2) Compared to the Reagan Recovery this Administration's economic plan is a failure

3) With Socialistic Policies you have high employment rates and I don't see much hope for great improvement.

George Zachar writes:

As luck would have it, Bernanke delivers one of his regular reports to Congress next week.

No doubt, this report will put that question high up on the agenda, and he'll be spending the weekend formulating his response.

Jun

27

Starting with an example, assume yesterday's close was above the simple 10D moving average: will today's close be below the 10D moving average?

Two things change from yesterday to today - today's close will be added to the series, and the close 10 days ago which was part of the moving average will be dropped (as it becomes 11 days ago).

C1 = today's close

C2 = yesterday's close

C10 = close 10 days ago

MAt = 10DMA as of today

MAt = sum(C10:C1)/10 (sum of C10 through C1)

The statement that "today's close < MAt " can be written

C1 < sum(C10:C1)/10

10C1 < sum(C10:C1)

10C1 < C1 + sum(C10:C2) ( Using: sum(C10:C1) = C1 + sum(C10:C2) )

9C1 < sum(C10:C2)

C1 < sum(C10:C2)/9

The right hand side is the 9 day moving average as of yesterday.

Thus today's close is below the ten day moving average if and only if today's close is below yesterday's 9 day moving average.

Jun

23

Protect the Bondholders, from Kim Zussman

June 23, 2011 | Leave a Comment

Reinhart and Rogoff said governments usually get out of debt crises by default/decree or printing inflation. The next edition will include a chapter on what happens to sovereign debt when a government doesn't control its own currency.

Reinhart and Rogoff said governments usually get out of debt crises by default/decree or printing inflation. The next edition will include a chapter on what happens to sovereign debt when a government doesn't control its own currency.

Gary Rogan writes:

When Einstein was a boy, seeing a magnetic compass convinced him that

there had to be "something behind things, something deeply hidden."

This is the same way, there is something deeply hidden behind things.

The world doesn't work as most people expected it to work, but they are

finally getting clued in.

Jun

19

Stock Selection vs. Market Index Timing, from Kim Zussman

June 19, 2011 | 1 Comment

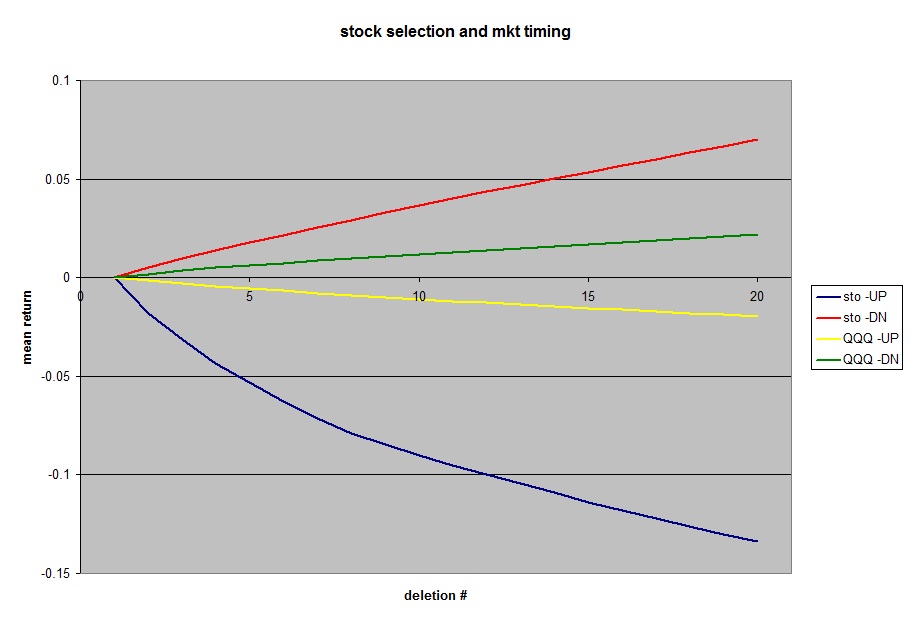

How can we compare the relative importance of stock selection and market timing?

The removal from a portfolio of the best or worst performing stock(s) gives some idea of the importance of stock selection. The removal from a stock market index time series of excellent or dismal time periods gives an illustration of market timing.

The chart below plots mean return for successive deletion of extreme winners and losers, both for skipping extreme winner and loser stocks in the stock portfolio as well as extreme gain and loss months in QQQ monthly time-series. Both series were scaled to start at zero origin, and the much larger dispersion of returns in stocks over the index is seen.

Green and yellow are the effects on mean QQQ return for skipping extreme winning and losing months. The effect is quite symmetrical in penalizing missing top gaining months and rewarding skipping bottom loser months.

Red and blue are the effects on mean stock portfolio returns for skipping extreme winning and losing stocks. The effect is asymmetrical, penalizing missing top gaining stocks more than rewarding deletion of bottom losing months.

One interpretation is that skew is more significant for stock returns within a portfolio than index returns within a period, and there is more penalty missing big individual gaining stocks within a period than missing index gains within a period.

Jun

7

Goat’s Milk, Raw, from Kim Zussman

June 7, 2011 | 1 Comment

This morning for the first time drank fresh, raw, warm goat's milk.

This morning for the first time drank fresh, raw, warm goat's milk.

We live in an area of small ranches, where the caretaker for the neighbor across the street keeps a small herd of goats — including milkers. A visiting relative from Moscow was fascinated — as Russian belief is that goat's milk is "verry good for you".

We fed the goats recently. One is a large black one-horned goat that Inessa named "Old Woman", because she looks haggard, has a droopy udder, and when we feed she butts the others away and gets most of the carrots — once butting so hard she sent a juvenile tumbling head over tail.

Old Woman is big and tough but not brilliant. When you try to feed other goats she quickly knocks them away: goats have horizontal pupils to increase their lateral depth of field, so they can watch for predators as well as competitors for food. Eventually I out-smarted her, and learned to hold onto a carrot through the fence and make her chew it– distracting her while Inessa fed the more demure ladies.

This morning on my run I asked the care-taker, Victor, if we could have some goat milk. He milks daily — drinking some himself and sharing with his constant companion mutt Zapato. He happily obliged and we finally got something back from Old Woman. He knelt next to her and pinned her hind leg in the crook of his bent knee. He slapped her udder several times to bring down the milk– mimicking what the kids do before nursing. In about 7 minutes he milked about 1.5 quarts into my plastic container, and I jogged the warm foamy jug up to the house.

They recommend goat's milk be pasteurized but Inessa insisted it be drunk raw. So we filtered it through gauze and gave it a try. Mild milk - very good, actually. A little sweeter and richer than non-fat cow's milk I'm used to.

Driving to work I noticed the udder drivers along side me. How funny they were with their shiny embellished vehicles and coiffed hair, determined and headed toward important appointments of a higher nature– while I rode contentedly digesting the friendly secretions of another animal.

Jun

2

A Taxonomy of Bubbles, from Kim Zussman

June 2, 2011 | 1 Comment

Two recent ostensible bubbles were the Nasdaq and US house prices. Prof. Shiller's nominal house price data was scaled to match the high of Nasdaq stock market, and shifted in time so the two peaks concurred (HPIQ2 2006 = NASQ1 2000).

Consistent with liquidity differences the Nasdaq bubble formed and burst much faster than housing. And neglecting effects of mortgage leverage, the housing bubble gain/loss was much less than Nasdaq.

Though the Nasdaq bubble was much more dramatic, ostensibly housing effects many more people. This, along with the fact that stocks are less in demand than places to live and market distortions due to foreclosures, suggests different bubble dynamics. Nasdaq began rallying about 2 years after its peak wheras housing continues to decline now some 5 years post-high.

Art Cooper writes:

Isn't "the effect of mortgage leverage" an enormous thing to neglect? Obviously, leverage is employed far more in housing than in the purchase of NASDAQ stocks.

Kim Zussman adds:

One could make the case that homeowners key less on loan-to-value (or value of equity) in a home than what the house next door just sold for.

May

27

Round Number Crosses, from Kim Zussman

May 27, 2011 | 2 Comments

The attached chart plots crosses of major SP500 levels of 1000,1100,1200,1300 from 6/97-present. Each colored vertical band represents a daily cross from below or above for each level.

Colors for each cross:

1000=turquoise

1100=yellow

1200=magenta

1300=blue

The middle section 2002-06 shows lengthening oscillations with 1000,1100, and 1200, but shorter shaking with 1300. From 10/09-8/10 1100 yellow was popular again - as it was in 03-04, 01-02, and 1998.

May

25

A Hairy Rule of Thumb, from Victor Niederhoffer

May 25, 2011 | Leave a Comment

There is a hairy rule of thumb that sleeping in the buff is healthier for you than not. It relates I believe to the actual tested idea that sleeping with open windows is much healthier and gives much less respiratory disease than sleeping with closed windows as Asian women are all too prone to do, especially those living in air conditioned countries like Singapore. And it should be tested whether their respiratory diseases are much more common than they should be to their decreased longevity. We should ask Keeley what his tests on this show, or Louis L' Amour's study of wildlife.

There is a hairy rule of thumb that sleeping in the buff is healthier for you than not. It relates I believe to the actual tested idea that sleeping with open windows is much healthier and gives much less respiratory disease than sleeping with closed windows as Asian women are all too prone to do, especially those living in air conditioned countries like Singapore. And it should be tested whether their respiratory diseases are much more common than they should be to their decreased longevity. We should ask Keeley what his tests on this show, or Louis L' Amour's study of wildlife.

As for its relation to markets, one comes back to the idea of playing canasta against 5 men named Doc. Impossible to win when markets are inactive as flexions must take their overhead out. Thus one must deal with the Asians, and the hotter the country, the greater the dishonesty I believe.

Jeff Watson writes:

Florida's a pretty hot place and I refuse to do business with any brokers or money people in this state because of the general lack of honesty. Something about the sun, surf, and sand that attracts people of questionable character.

Kim Zussman writes:

Corruption looks to be (inversely) related to latitude, with the obvious glaring exception of The Motherland.

Gary Rogan writes:

Speaking of hot dishonest Asian countries, I coincidentally just came across this story about the black market in Indonesia in RIM playbooks and other things.

John Floyd writes:

There is a somewhat new science that recommends "compression clothing" and I have been experimenting with it for both sleeping and exercise. I have found some merit to use.

In terms of fresh air as I recall the studies I have read indicate the high levels of air pollutants that accumulate inside a building, within in air ducts, etc. I always sleep with windows open regardless of the temperature outside and also use a hospital grade air purifier.

In Japanese there is a saying "Renma" meaning always polishing and improving. I think we can look at air circulation and blood circulation in the same way. Same is true for trading and the more we foment new ideas and ways to improve hopefully the better we become and avoid staleness.

Having lived in the Caribbean for several years and experienced months of absence from the heat while in New England winters I can tell you the adjust to the heat without air conditioning does take at least a day. But I found within a day I was fully adjusted. I think it becomes more difficult if you switch back and forth from A/C to non A/C in a hot climate. Again the trading link here may be one of consistency and allowing for adjustment processes that may be bring one out of their comfort zone.

In terms of the various prevalence of crime, corruption, work ethic, etc. across regions that I think is for one to do some research and analysis that would include Charles Murray's findings, geopolitical history, and personal experiences to reach their own conclusions.

Of course one would need to draw upon a sufficient sample size to determine for example whether those in Korea, Japan, Hong Kong or the Caribbean, etc. have a certain characteristics.

May

18

Query of the Day, from Kim Zussman

May 18, 2011 | 1 Comment

Does the incessant parade of illegal/insider trading, government manipulations, etc, of smart Ivy grads evidence the difficulty of getting rich in markets, or simply that dishonesty and greed is pervasive at all intelligence levels?

Gary Rogan writes:

It's probably evidence of both, but also of the illusion that highly successful people often seem to have of being invulnerable to normal negative forces, such as being punished for attacking hotel maids or being revealed for having a secret "love child" while running for the Governorship of California, or having an easily identifiable affair while running for the presidency.

Bill Rafter writes:

Don't the B Schools all have required ethics classes? Come to think of it, doesn't the industry regulators also require ethics classics?

Rocky Humbert writes:

The United States has an incarceration rate of 743/100,000 population.

The New York City's financial industry employees 344,700 employees.

If the pro-rata incarceration rate for Wall Streeters were at the national average, there would be 2,561 Wall Streeters in the Big House right now. Or, with 35,400 employees, 263 of these people would be Goldman Sachs employees.

Since neither of these facts are true, the inescapable conclusion is that Wall Streeters are either more lawful than the national average (or they have better defense lawyers).

QED

May

17

An Interesting Article, from Victor Niederhoffer

May 17, 2011 | 2 Comments

Here is an interesting article on the age of chief executives versus chances of acquisition. It shows that older CEO's are more likely to accept deals and also lower premiums. It's part and parcel of my investigation of how romantic urges of older CEO's often lead to hurtful results for stockholders from the Midwest to the coaches.

Rocky Humbert writes:

Interesting paper. But if I understand their methodology, they note that the chances of a bid is about 5.5% for geezers over 65, and under 4% for the younger CEO's. But their study seemingly only looked at the CEO's of companies that received takeover bids. They didn't look at companies which did NOT receive takeover bids. Hence, the subset that they analyzed has an obvious bias…. and it's possible that the stock of a company w/ an old geezer CEO of a company (which doesn't get a bid) has generated better long term performance than the stock of a company with a younger CEO. Surely there must be a paper out there which regresses CEO age versus stock price performance (over time). Doctor Z — have you seen such a study?

Victor Niederhoffer writes:

How could they come up with the chances of a bid without the total sample? Even an academic other than Sornette or the derivatives expert wouldn't make that mistake.

Rocky Humbert replies:

I didn't read the paper cover to cover, but section 3.1.2. and 3.1.2 defines their sample. Their study ONLY used the SDC US Merger and Acquisition Database….and CEO's who fell into that database.

The results are still interesting– but they would be much more interesting if they had looked at the bigger question.

Kim Zussman adds:

Here are some somewhat relevant papers from SSRN:

This paper examines the influence of CEO career horizon on the future performance of firms. Specifically, we argue that CEOs with shorter career horizons (as measured by their age) will adopt risk-averse strategies that will, on average, adversely influence future firm performance. Further, we argue that at relatively high levels of CEO ownership control, this relationship is exacerbated. Using a sample of US-based firms from the S&P 500, we find that future financial and market performance are significantly lower for firms with older CEOs but only when those CEOs have strong ownership positions. We conclude by discussing the implications of CEO career horizons in the content of various levels of CEO ownership power.

The announcement of a forced CEO resignation is hailed favourably by the market with a small but significantly positive abnormal return of 0.5%. The market may have anticipated the forced turnover since the abnormal return over a one-month period prior to the turnover amounts to 6%. Whereas voluntary resignations do not cause a price reactions, age-related turnover triggers a small negative price reaction.

While individually age and tenure are only weakly correlated with the stock price reaction to a sudden death, the reaction is strongly positive (5 to 7%) if (1) the executive's tenure exceeds ten years and (2) abnormal stock returns over the last three years are negative. In a number of cases, part of the reason for the positive stock reaction to sudden executive deaths is apparently because in the stockholders' view, an obstacle to a takeover has been removed.

In this paper we examine the cross-sectional determinants of idiosyncratic volatility of biotech IPO firms. We extend current research in two directions. First, we test whether CEO stock options impact on idiosyncratic volatility. Second, we test new hypotheses that relate some easily identifiable managerial characteristics to idiosyncratic volatility. We find that the CEO stock options, resource dependence capabilities, and the age of board members help predict idiosyncratic volatility

A dailyspec classic:

This paper shows that the time of year of a person's birth is an important factor in the likelihood they become a CEO, and conditional on becoming a CEO, on the performance of the firms they manage. Based on a sample of 321 CEOs of S&P 500 companies from 1992 to 2006 we find that (1) the number of CEOs born in the summer is disproportionately small, and (2) firms with CEOs born in the summer have higher market valuation than firms headed by non-summer-born CEOs. Furthermore, an investment strategy that bought firms with CEOs born in the summer and sold firms with CEOs born in other seasons would have earned an abnormal return of 8.32 percent per year during the sample period. Our evidence is consistent with the so-called "relative-age effect" due to school admissions grouping together children with age differences up to one year, with summer-born children being younger than their non-summer-born classmates. The relative-age effect has been demonstrated in numerous sporting and other contexts to last to adulthood and to favor older children within a school grade. Those younger children who nevertheless succeed by overcoming their disadvantage have to be particularly capable within their cohort. Together, the advantage enjoyed by older children and the particularly high capability of successful young children explain the statistically and economically significant findings.

And just a few more:

Regardless of retention , shareholders of acquired firms whose CEO is at retirement age receive lower premiums than shareholders of acquired firms with younger CEOs. This lower premium seems to be explained by the apparent reduced acquisition value of firms led by retirement age CEOs rather than by the target CEO conflict of interest.

Using U.S. plant-level data for firms across a broad spectrum of industries, we compare how career concerns affect the real investment decisions of younger and older CEOs. In contrast to prior research which has examined some specialized labor markets, we find that younger CEOs undertake more active, bolder investment activities, consistent with an attempt on their part to signal confidence and superior abilities. They are more likely to enter new lines of business, as well as exit other existing businesses. They prefer growth through acquisitions, while older CEOs prefer to build new plants. This busier investment style of the younger CEOs appears to be relatively successful since younger CEOs are associated with higher plant-level efficiency compared to older CEOs.

May

17

Proposition bet 2012, from Kim Zussman

May 17, 2011 | Leave a Comment

I read this interesting thought today:

"You hear a rustle in the grass. Is it the wind or a dangerous predator?

If you guess that it's a dangerous predator but it's just the wind, you've made a mistake—believing that something is real when it's not (a "false positive," as cognitive scientists call it)—but a rather harmless one. On the other hand, if you guess that the rustle in the grass is the wind but it turns out to be a hungry lion, your mistake is more serious: The lion was real but you thought it wasn't (a "false negative"). In this case, you're lunch, and you won't get the chance to be more cautious next time."

If today a similarly evolved lady expressed a great deal of anxiety over the possibility the world would end in 2012, bet her $1000 ($1T, etc) it wouldn't, because:

1. If you are right she pays

2. If you are wrong, you don't have to.

May

14

Pre and Post 911 VIX, from Kim Zussman

May 14, 2011 | 1 Comment

Here is a study comparing VIX levels of 8 trading days prior to (and sometimes including) September 11's to 8 trading days following September 11's, 2002-2010. First comparing the mean pre-911's to post 911's for all study years:

Two-sample T for pre 911 vs post 911

N Mean StDev SE Mean

pre 911 72 21.45 7.39 0.87 T=-0.2

post 911 72 21.70 8.64 1.0

No difference in mean VIX between 8 days prior to and following 911 dates. Here is the same comparison by year, with the T-score for difference between pre911 and post911:

YR VIX T

2010 2.7

2009 3.1

2008 -6.9

2007 1.9

2006 4.1

2005 1.5

2004 0.8

2003 1.1

2002 -1.7

The omniscient market (and even more omniscient options market) was not concerned about repeat terror attacks in the 4 years following 9/11/01. In 2008 financial markets were probably more worried about self-inflicted damage. However pre-911 was significantly higher than post-911 in 2006 - the 5th anniversary of the attack; which fits with public information that other attacks were considered on notable anniversary dates. Evidently Osama also hoped for commemoration on 9/11/11, and it remains to be seen whether there will be a run on insurance under his new tenure as fish food.

May

8

A Question for Counters, from Dan Grossman

May 8, 2011 | Leave a Comment

Speaking of commodity spillover, I'd be interested to know the historical effect on near-term stock prices when commodities hit a "high" and then decline.

Many thanks,

Dan

Russ Sears writes:

One data point that may be applicable is Silver Thursday

Mar 27 1980 S&P closed 98.2

next day 100.68

5 trading days 102.25

21 days (April 28) 105.64

June 27 116.00

Looks pretty bullish.

Tim Hesslesweet adds:

Kim Zussman writes:

Using Tim's linked data for Cushing WTI spot crude weekly prices, constructed the attached comparison plot of log (spot crude) and log (sp500). Log (spx) was scaled -1 log unit (divided by 10) in order to readily compare the two.

The chart shows a similar gain for crude and SPX over the interval, 1/87-5/11. Crude remained relatively flat through the 90's while stocks gained. Oil bottomed in 1998, and from this bottom to the peak in 5/08 gained about 10X.

IQ1 marks the 1st Iraq war, with an expected spike in crude price and drop in stocks. Both stocks and oil were near many-year highs in 9/00, and both declined together until a few months after 9/11, when stocks continued to drop but crude rose. At the outset of IQ2, oil spiked and stocks sagged - like the prior Iraq war. From this point SPX rose consistently, and after a few months oil followed.

Stocks hit a many year high in 9/07 before turning down, and crude did the same 8 months later in 5/08. Subsequently oil bottomed faster - in 12/08 - and stocks in 3/09.

For crude and SPX there does not seem to be a clear relation between peaks and valleys, though there was a contemporaneous inverse relationship with two wars in the middle East.

May

6

Daddy’s on the Floor, from Kim Zussman

May 6, 2011 | Leave a Comment

One of my favorite employees has a funny husband. Raised in the Midwest, his folksy sayings are often quoted by her during surgery. "Daddy's on the floor!" he shouts, in the morning once he's arisen from a night's slumber; out of bed, ready for a day's enlightenment (in retirement). The man of the house has arisen….and to every one and the only listener, he requires the family's attention.

One of my favorite employees has a funny husband. Raised in the Midwest, his folksy sayings are often quoted by her during surgery. "Daddy's on the floor!" he shouts, in the morning once he's arisen from a night's slumber; out of bed, ready for a day's enlightenment (in retirement). The man of the house has arisen….and to every one and the only listener, he requires the family's attention.

This phrase again came to mind with yesterday's image of an Osama lieutenant; lying executed next to a child's fluorescent green toy water pistol. Some children have mass murderers for fathers, and I wondered if as a result this child is less a child and father is less a father.

We read they lived in full purdah– wives are required to not slumber with their husbands. And that the master killer wore a traditional salwar kameez when posing for the described portraits. Cultural traditions that seem different from ours, but in framework the same. The daughter who witnessed her father's disassembly was named for a spy who "killed a Jewish spy at the time of the prophet"; though it was as not so much this kind of spy that laid him down as it was cowboys of different cultures.

Dan Grossman writes:

I admire Kim's lending a little sanity to the Administration's celebration of the event.

I myself have no problem with sending Navy Seals to execute someone we are at war with, who planned the terror attack that took the lives of 3,000 Americans and that has cost us all years and hundreds of billions of dollars of delay, pat-down, and other sniveling procedures as we continue to allow the government (in what is more a "theatre of security" than anything effective) to permanently disrupt the lives of 310,000,000 of us. What I do feel uncomfortable about is:

1. Having the raid televised back to the White House situation room so that Obama (who was so crucial to the planning that he was actually on the golf course and had to rush back), Panetta, Hillary et al. could watch every step. This had to make the raid less efficient and more dangerous to the Seals, and why was it at all necessary other than to give the situation room viewers the false thrill of video-game-like participation?

2. The Administration's putting out the story (presumably to somehow justify the execution) that the unarmed OBL acted in a "cowardly fashion" when the Seals burst into the bedroom where he was with his family. Let us imagine how Obama himself, Panetta, Hillary or any of us might act if we are in our bedroom with our family and armed executioners burst in about to shoot us in the head.

And if Obama had to fly to Ground Zero and then fly to the Navy Seal base to keep the favorable publicity going (but of course not "to spike the ball"), it would have been classy to have invited George W. Bush to appear at Ground Zero with him. For all his faults, Bush did have a calming effect on the country and show personally bravery by, among other things, throwing out the first pitch at Yankee Stadium at a time when there was great fear of another attack and credible rumors of a nuclear weapon in NYC.

May

6

The Value of Doing Nothing, from George Parkanyi

May 6, 2011 | 2 Comments

A while back, someone asked about the value of doing nothing. I had two positions on going into this morning - short S&P, and short natural gas. Had I not turned on a computer today, I would have made enough money to forgive many a sin of the first quarter. As it is, I ended the day breaking even when I had started out being significantly short two markets that gapped in my favour and then later basically went over a cliff. I won't go into the gory details of what and why I traded - nor share my feelings - but I'm pretty convinced that I'm going to have to hire a guy with a gun who, after I've set up the trade and the risk management, under contractual obligation is required to say to me "Sir, step away from the keyboard, or I'm going to have to shoot you in the head."

A while back, someone asked about the value of doing nothing. I had two positions on going into this morning - short S&P, and short natural gas. Had I not turned on a computer today, I would have made enough money to forgive many a sin of the first quarter. As it is, I ended the day breaking even when I had started out being significantly short two markets that gapped in my favour and then later basically went over a cliff. I won't go into the gory details of what and why I traded - nor share my feelings - but I'm pretty convinced that I'm going to have to hire a guy with a gun who, after I've set up the trade and the risk management, under contractual obligation is required to say to me "Sir, step away from the keyboard, or I'm going to have to shoot you in the head."

I would say there is value in doing nothing.

Speaking of doing nothing, the hockey game is on and the couch beckons.

Alston Mabry comments:

One sympathizes. It brings to mind this proverb.

Kim Zussman writes:

Randomly speaking, the market might have just as easily shot up and you could have avoided regret.

Gordon Haave writes:

Whenever I am in a business meeting and someone has come to it with some pressing need we have to react to right away, I always ask "what if we do nothing?". Everyone is always stunned.. they haven't even considered not doing anything. After asking that usually the consensus become to, in fact, do nothing.

Alston Mabry writes:

I would say that the over-arching issue is that the Market Mistress can torment her lovers in many, many ways. And experience would lead one to believe that tormenting her lovers is, in fact, her main obsession.

George Parkanyi replies:

Oh sure, Kim, you're right about that. But I had my risk management in place. Stops. But the point is, I had my idea right, and the method of executing basically set up to exploit the anticipated scenario. That would have played out very well, since there was nothing more that I needed to do at that point. Then I started changing stuff …

I don't mind being wrong, because that always happens in the markets, and you plan for it. What really gets me angry at myself is when I'm right and then I get in my own way. What other people do, I can't control, but what I do I SHOULD be able to control. Not being able to maintain self-discipline is a character flaw that has to be actively managed, and today it got the best of me. Doesn't always, but today it did. (Tomorrow may not be so good either, because before the close I went long a little silver.)

Jim Sogi writes:

Well, the next best thing to doing nothing is doing just a little to see what happens. If you're wrong, not such a big deal, but a small sample gives a good sign. Like Commodore when the guy gives him a hot tip in Reminiscences of a Speculator. See how it gets swallowed up.

Jeff Watson writes:

Jim mentioned probably the best thing I ever learned in my speculation game which is still going since 1973. "See how it gets swallowed up." Second best lesson I ever learned, but it only works with big orders and can tell so much about the markets, where they are, where they're going, who want's what, etc. Many things can be said with words, but until the order is put to the market, one can't say anything. The order getting digested is where the rubber hits the road and contains so much information(even in these electronic days), almost 10,000 pages per order if one is willing to keep an open mind and analyze it. The Commodore's system still works well in the grains, more than any other market I've seen and has been responsible for much of my limited success.

Vince Fulco writes:

The multi-day swing boys and the deep pockets are the big winners in GC1 so far tonight. Late afternoon, the contract came in like a ton of bricks as ES tumbled, with modest movement in equities after hours, zoom goes Gold as if the latter part of the day didn't even matter. The solid long moves all seem to be held "in reserve" till the day traders are flat.

Jim Sogi responds: