Jan

11

Briefly Speaking, by Victor Niederhoffer

January 11, 2007 |

As usual for the beginning of the year, the weak and rigid made a contribution to the strong and flexible. In markets the best of recent years performed the worst, and the worst performed the best. The NASDAQ was up a mere 7% last year, versus the S&P 500 's 15%, but now is up 4 % this year already, whilst the S&P is struggling along unchanged. Oil, the best performing market over the previous two years, is down 10%, and the dollar which was, at the worst of last year relative to its normal variability, down 10%, is now up 3%.

As usual for the beginning of the year, the weak and rigid made a contribution to the strong and flexible. In markets the best of recent years performed the worst, and the worst performed the best. The NASDAQ was up a mere 7% last year, versus the S&P 500 's 15%, but now is up 4 % this year already, whilst the S&P is struggling along unchanged. Oil, the best performing market over the previous two years, is down 10%, and the dollar which was, at the worst of last year relative to its normal variability, down 10%, is now up 3%.

It is a similar story for the ten best individual stocks in the S&P 500 last year — ati, nvda, cmx, cbs.v, big, merq, bls, pd, hpc, nue — they are down 2% so far this year. The ten worst stocks last year — donaq, apol, adct, amd, jbl, ebay, bsx, novl, kbh, stj — are now up about 2%. Good old blue.

In Japan when a big stock sets a milestone there is singing on the exchange. There should have been an opera for IBM yesterday as it broke through 100 for the first time since April 2002. What a show of resilience — a milestone for the market, similar to the Dow breaking 12,000. This show of strength had a gravitational pull enough to outweigh the pseudo event of Gov. Moskow in Iowa stating that the Fed. would have to remain vigilant on inflation and raise rates again if economic growth quickens in 2007. When will someone explain to Fed. Governors that the stronger the economy, the less likelihood there is of inflation, as there is expansion to absorb the money supply.

pt (price times trade) = a constant to a first approx., and if t is up then p is down.

But of course the Iowa speech was a staged classic pseudo event of the kind that Boorstin would have used as a cardinal example, if his interests were not so aligned with the collective and it would not have offended his sponsors. Nevertheless, it was picture perfect. At precisely 12:30 e.s.t., the market swooned to 1415, down a nice 1% on the year, when the word "vigilant " came across the tape, and within 4 hours, the market had recovered the full 1% so it could play footsie with unchanged levels again, and get the boys who anticipated the pseudo Jan. barometer to reverse.

The major mistake that they make in fundamental statistical research, in my opinion, even above and beyond the use of retrospective files and out of date data, is to assume that the number of independent observations is somehow related to the company years in the study. If you are considering 1000 stocks say, value versus growth, over ten years, then you have ten independent observations, not 10,000. That is because in any given year, a certain style does well or badly, and the rising tide lifts all boats designed in such a way, and therefore the results in that year are completely predictable from five of six of the company years, and the rest of the 995 are redundant and non-informative.

I always get a kick from the key level boys who say "1398 is the key level." They do not tell you whether it's bullish or bearish, when you should act on it, or which index they're talking about. But if five days later the index or the futures is well above 1398, why then they say "we were on record with that 1398 was the key level to buy." If 5 days later it's 1350 then they tell you that the big boys got you again.

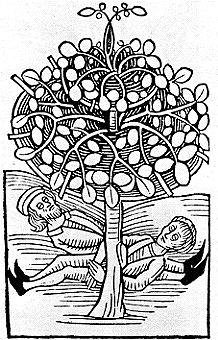

Now someone is going to tell me that 1398 was not a key level but the problem is that the key levels that I have heard talk of never got near for the futures, and were broken below for the index by three, so my goodness, what fools they must think we mortals are. What a terrible Upas tree of self destruction is wrought by such key level analysis.

Kevin Eilian comments:

When will someone explain to Fed Governors that the stronger the economy, the less likely there is for inflation as there's expansion to absorb the money supply pt( price times trade) = a constant to a first approx and if t is up then p is down.

This concept that real economic growth reduces the likelihood of inflation is something that is rarely explicitly mentioned. In fact, even on this list, this is the first I've heard it put this way, and it makes sense. The only other place I've seen it is in Wanniski's works and essays.

Growth is a result of "demand for liquidity," which is defined as demand for liquid funds (money) to be invested directly into the economy. Lower taxes increase demand for liquidity, since it lowers the cost of capital (and rewards to capital).

The result is an "expansion to absorb the money supply." Now, if the money supply increases, but the desire to invest decreases or goes away (say, because of new regulations or suddenly sharp, higher marginal tax rates), there is a) less expansion (investment) and b) higher inflation (less supply of goods and services).

In the case of this higher inflation, the money bids up the prices of goods and services, and/or is stashed away in "inflation hedges" (or perceived inflation hedges), as people observe increases in nominal prices.

Comments

Archives

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles