Apr

14

Briefly Speaking, from Victor Niederhoffer

April 14, 2010 |

1. One notes a too smart by half breach of the round today in the DJIA. What fools the g_ds must think the mortals must be.

1. One notes a too smart by half breach of the round today in the DJIA. What fools the g_ds must think the mortals must be.

2. For yet another time, the bonds have suffered a grievous decline before 10 and 30 year auctions, threatened breaching the 4% and 5% levels, and bounced back with alacrity to levels that do not threaten the economy. How many times can history repeat? One is reminded of Crocodile Steve who always said that when he ran the show, the crocs were particularly vicious because they all remembered it was he who caught them. Thus, he never entered the arena at the same spot twice as they waited in ambush for him at the last place.

3. We frequently talk about what fields as disparate as rodeo and radio can teach us about markets, but not as often do we consider what we can learn about life from markets. One has been considering the general question of happiness. What can we learn about it from markets?

Here's a interesting gambit. It is well known that after monthly maximums the variance of the move in the S&P the following day is considerably less, indeed 1/5 as great as the variance after monthly minima, and a mere 40% as great as after normal days. The standard F tests for comparing equality of variances by looking at their ratios, which has a critical value of 1 at the 1% level of significance show that these divergences are quite impossible under randonmess. What does this tell us about human happiness, and yes, what does it tell us about markets, also taking into consideration that the maxes occur twice as frequently as the mins over the past 15 years.

4. "The Knicks never lead, falling behind 4-0 in a sign of things to come" in losing 118-90 to Portland on March 31. What can we learn from that?

Jeff Watson writes:

A corollary to point number 4. In 1969, the Chicago Cubs were in first place all season long. At the beginning of September, they had a 84-52 record and were a solid 5 games ahead of the NY Mets. By mid-season, the Cubs were already getting ready for the series, and they even wrote many songs about them.The Cubs choked and lost 17 of their final 23 games while the Mets went on a tear with a 23-7 record, overtaking the Cubs and ultimately finishing 8 games ahead. The Mets ultimately went on to win the World Series, while the Cubs quickly regained their status in the cellar. Still, Chicagoans love the Cubs, win or lose, as there's nothing like a good day at Wrigley eating hot dogs, peanuts, cracker jack, and plenty of beer to wash it down.

A corollary to point number 4. In 1969, the Chicago Cubs were in first place all season long. At the beginning of September, they had a 84-52 record and were a solid 5 games ahead of the NY Mets. By mid-season, the Cubs were already getting ready for the series, and they even wrote many songs about them.The Cubs choked and lost 17 of their final 23 games while the Mets went on a tear with a 23-7 record, overtaking the Cubs and ultimately finishing 8 games ahead. The Mets ultimately went on to win the World Series, while the Cubs quickly regained their status in the cellar. Still, Chicagoans love the Cubs, win or lose, as there's nothing like a good day at Wrigley eating hot dogs, peanuts, cracker jack, and plenty of beer to wash it down.

Nick White responds:

I immediately think of case studies of Olympians– especially Olympic Champions– as they try to adjust back to normal life, post-Games. It's not an easy transition. Post-competition depression is a real thing and the market being what it is, probably can teach us much about how to handle ourselves after a major peak or trough.

Livestrong gives a good summary of the problem:

Many athletes spend years preparing for a narrow window of opportunity–a college career, the Olympics or professional sports limited to certain ages. Intense preparation, daily practice and adjusting life to meet the sport's needs may dominate an athlete's life. After the particular event, an athlete may lose his sense of purpose and have a hard time reintegrating into a routine that does not focus solely on the sport. An athlete may experience depression if he is unprepared for the transition.

To follow the example you provided, on the day (or weeks) following their victory, Olympic champions are unlikely to go 'round the village, find their competitors from the event they just won, and then challenge them to repeat their world-best performance again…there's consolidation, reflection, relaxation. An entirely appropriate response. Without further stimulus there is rapid atrophy and de-training. There are dozens of studies of the de-training effect. With well-timed, appropriate breaks there will almost certainly be the possibility of greater physiological improvements (see any of the literature following Bompa et al on training macro, meso and micro - cycles).

This sounds remarkably like the behaviour of the market. The sports physiology literature probably has much to teach us about the extrema of markets and the conditions of extension in such situations.

Furthermore, not everyone puts themselves into an intense period of stress and competition that they have been preparing for for a prolonged period of time, yet the market does this reasonably frequently. So, being a collective representation of human emotions and biases, it's probably fair to hypothesize that the manner in which the market responds after minima or maxima is probably a fair aggregate of how we can expect humans to behave on aggregate when experiencing highs or lows in their personal lives. Hence the market can perhaps teach us something and, from that base, we can then perhaps devise strategies to more efficiently handle such periods in our personal lives.

What also of the incidence of disorder when a highly focussed instrument loses its purpose–temporarily or permanently? But, your proposed study begs a question of logic– is it possible for the market to teach its creator something directly? The market doesn't have independent existence from its participants or a character of its own any more than a violin is capable of playing music lest someone pick it up and play it. So is it better to just to review the behavioral literature directly?

Rocky Humbert writes:

The question posed is a variation on the much debated question as to whether stock markets decline faster than they rise. The past 19 months are additional fodder for those (including myself) who believe that they do.

Because the phenomenon of lower volatility at monthly maximums is much less prevalent in commodity futures markets, I posit that the phenomenon is related to the three facts: (1) that the S&P is a "net long" market; (2)fear is a stronger motivator than greed; (3)stop/loss sell stops are more prevalent than take/profit limit orders.

I'm not being facile when I observe that the reason most people own stocks is to make money. Hence after markets are rising for a time, most people sit back, relax, and enjoy the ride. However, when markets are declining, the fear instinct kicks in– and people feel the need to "protect their gains," "stop the bleeding," or the all-too-familiar, "I can't afford to lose any more money."I would additionally observe that markets which go a long time without a correction have more violent corrections. This can be quantified and is consistent with all of the observations above.

I have been an unabashed bull on these pages for the past two years, largely because I believe that the valuation and sentiment at one's entry point are the best determinant of one's long-term return. I am now growing more cautious– and just as I was buying stocks on a scale-to-oblivion in February, 2009, I am starting to sell-long on a scale-to-oblivion now. I am not shorting. Rather I simply observe that the same simple and timeless logic that predicted a 5 year double-digit return during the dark hours, now predicts a low single-digit return over a 5 year time horizon. I wish I knew where the S&P will be in a week, a month, or a year — but any claim of that ability would be pretense.

Ultimately, the markets' lesson of the past 24 months has once again been, "Be greedy when others are fearful, and be fearful when others are greedy."

Sam Marx writes:

I believe one more stock market action occurs that was omitted in paragraph four. That is in a rising market when there is pullback or slight sell off, buyers come in to buy the dips and the market starts its upward climb again.

Fear kicks in when the market continues to dip, maybe around 10% down, and then selling picks up.

Steve Ellison writes:

Many athletes go into sales after their playing days are over. In sales, like athletics, all that matters is performance, and the top salesman makes far more money than the VP of sales. Some sales managers go out of their way to hire athletes because athletes are competitive, disciplined, and focused.

Jeff Watson adds:

There were a lot of athletically inclined people on the trading floors back in the day. It took an athletic person to handle the rough and tumble of the pits, even the smaller pits. A four hour trading session in the pit would be like a 15 hour shift in any other job. It was absolutely physically and mentally exhausting.

Rocky Humbert writes:

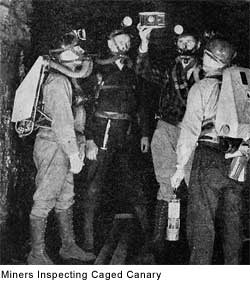

One answer might be that miners are lured into a false sense of security when their canaries are singing a cheerful melody– comfortable in the knowledge that the levels of methane, hydrogen sulphide, and carbon dioxide are within acceptable bonds — but over time, becoming increasingly oblivious to the growing risks of mining-induced seismicity and unstable mine stopes– until there is a violent catastrophe.

One answer might be that miners are lured into a false sense of security when their canaries are singing a cheerful melody– comfortable in the knowledge that the levels of methane, hydrogen sulphide, and carbon dioxide are within acceptable bonds — but over time, becoming increasingly oblivious to the growing risks of mining-induced seismicity and unstable mine stopes– until there is a violent catastrophe.

Likewise, the increasing happiness of market participants in a low-volatility, monotonically rising market are like the miners with their singing canaries– the violence and magnitude of the potential, but unpredictable and unknowable and unnecessary tragedy is directly related to the length of time between tragedies as the institutional memory of previous tragedies fade. The miners are alert after a recent tragedy, but after months/years of traquility, the happiness may mask carelessness.

The recent tragedy is probably still too fresh in the institutional memory to be immediately repeated — but those with excess liquidity were able to profit from the most recent tragedy, and those with excess liquidity will be able to profit from the next tragedy. These men are like spiders — patiently waiting for opportunity that only occurs once every several years.

The wisest man can see the future, he is indeed a happy man.

Victor Niederhoffer comments:

One would adduce inspired by the token liberal rocket scientist that the ratio of variances during the past 3 years has been 9 as opposed to the paltry 5 previously addresses. And his very interesting post brings back many pleasant memories of the meetings of the Royal Society adduced by O'Brian. A certain member when talking about nondescript features of this or that mollusk on the Mauritius was well known to steer the transactions and his talk into a discussion of the nesting y practices of a certain species of bird that I believe liked to test in coal declivities. What does the reduced variance following the bigs have to do with the tendency for declines to be more violent? A talk at the Society might be apt.

Stefan Jovanovich writes:

What miners have been saying is that "yes, setting off explosives will shake the ground" but it does not "cause earthquakes or increase their frequency". The miners - poor fools - have some direct experience with the amount of force it takes to move rock so they find the direct causal association between their cat-scratchings in a litter box and an earthquake a bit laughable. What defeats their sense of humor is the realization that "mining-induced seismicity" is yet another scientific theory whose postulate is close the mine. "Mining induced seismicity" in the sense that blasting = greater probability of earthquakes has not been proven; on the contrary, most of the statistical evidence suggests that this is an affinity fallacy: man-made explosions shake the earth, therefore naturally-occurring earth-shaking is caused by man-made explosions. The quality of science that accepts this fallacy seems to be on a par with the fans of CO2-induced global warming. (What a surprise!)

What has been helpful is to measure earth-movement activity as a predictor of roof-falls using fuzzy logic.

Of course, CO2 is a problem in mines, but it is not a "worry" compared to methane. If the ventilation fails, then people die from the same cause that occurs when they fall into a brewing vat or get stuck, without an oxygen supply, when cleaning out a grain storage bin or cargo hold. It the lack of oxygen kills them, not the CO2. Acidosis is unpleasant but it is not often fatal. The reason they put CO2 in fire extinguishers is that it is the one safest, most non-toxic gas that can be stored and then used under pressure to displace the oxygen supply.

Comments

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles