Jan

11

Oil and Free and Easy Money, from Stefan Jovanovich

January 11, 2016 |

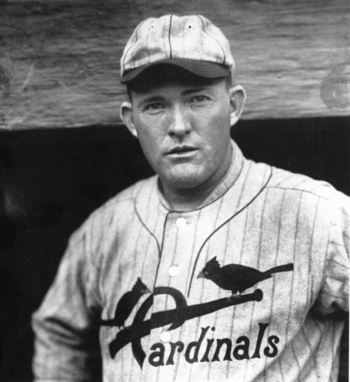

These are hard times for those of us who live in a Rogers Hornsby world. When asked what he did after the baseball season, Hornsby replied, "Look out the window and wait until spring". Note: he said spring, not spring training. It is only baseball when the games count. So, one is left with the short-timer calendar and idle thoughts.

These are hard times for those of us who live in a Rogers Hornsby world. When asked what he did after the baseball season, Hornsby replied, "Look out the window and wait until spring". Note: he said spring, not spring training. It is only baseball when the games count. So, one is left with the short-timer calendar and idle thoughts.

The idle thought for today is this: the fundamental correlation with stock prices is not "the economy" or even expectations about "the economy". What moves quotes is the supply of free and easy money. Leverage, through central bank and government guarantee lending, offers easy money; but the stuff that is both free and easy is never borrowed. It is the cash flow from businesses, colonies, possessions, conquests that have wonderful margins between what they cost and what they earn. The great bubbles of the early years of stock trading all came from one source: the discovery of a new territory that would duplicate the wealth that the Spanish had enjoyed for nearly two centuries from their ownership of the mines of the New World. "Mississippi" and the "South Sea" were going to produce the same fabulous returns. (Secondary idle thought: bubbles are created when pricing reacts not to the flows of free and easy money but to mattress money - the stuff people have been saving - that is tired of its meager returns.)

Since 1973 the free and easy money of the world has come from one source: the Middle Eastern oil fields. For the third of a century after the embargo that quadrupled the "normal" price of oil, the spread between what it cost to produce the black gold and what it reliably sold for was never less than 20 times the profit margins of everyone else's business. The collapse in prices in 2008-2009 was the first time that the sovereign wealth funds of the oil-exporting countries had had to examine the question of what to sell rather than what to buy. The current episode is a repeat, with the added pressure of the end of the Iranian embargo.

Is there any free and easy money left? The answer may be "yes, but not from energy but from American business itself". The Byron Wiens of this world have no idea of what regulation and taxation do to "average" profit margins. How could they? They live in a city where space itself is rationed by the government. If Mr. Wien's prediction about the Queen of the Night's election proves false, we may have one of those infrequent "ah-hah" moments in American political history when a significant number of the regulators are sent packing. Grant's election in 1868 was one; the Schlesingeristas in academia are still trying to square the circle of how the last third of the 19th century saw the country's greatest ever explosion of wealth, immigration and technology during a period of what they called "ruinous deflation". Harding and Coolidge's election in 1920 was another. 2016 might be yet another. After all, it is another even year. Go Giants!

Vince Fulco writes:

Every seven years, roughly, since 1973/4 at least, we have seen spots of liquidity vacuums, and as I have made mention on here before, it's the liquidity vacuums that re the thing to fear, not the proverbial "bear markets" (though they can coincide, see 80/81). Yes, 94 wasn't much of anything, but the recent action (go look at the opening on big, broad stocks on August 24, 2015) and it all fits the cyclical pattern of 7 year liquidity messes (and translates out into the future years of troubling asteroid flyby's coming up).

Is the liquidity vacuum that began in August over? Or do we have another wave coming? Either way, every single one of these situations we have seen, the market has moved on to higher highs in very short order, and I can;t find any compelling reason for that not to be the case here.

Comments

Archives

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles