Feb

2

What Market Situation is Similar to The Seahawks, from Victor Niederhoffer

February 2, 2015 | 1 Comment

Okay. What market situation is similar to The Seahawks decisions to pass with first and goal on The Patriots 1 yard line with 1 minute to go which pass was intercepted.

Okay. What market situation is similar to The Seahawks decisions to pass with first and goal on The Patriots 1 yard line with 1 minute to go which pass was intercepted.

anonymous writes:

Working a bid/offer to get flat with a profit ahead of an announcement only for it to come out 1 minute early and go the wrong way resulting in a painful loss.

Andrew Goodwin writes:

That play call will go down in the annals of history as one of the worst calls ever. The folks who gathered to watch where I watched included one most vocal who cried for Lynch to get the ball to run. Many were calling for the run.

Let us call this a trick play that backfired. The deception factor was high but the pass call was otherwise a poor decision.

David Lilienfeld writes:

Respectfully, with the benefit of a good night's sleep on it, I disagree. Go take a look at the defensive line. Where was he going to run. The line had been getting a surge. I'm not sure that's the exact passing play to use. A screen might have been better, but a run wasn't going to necessarily do the trick, and with time running down, an incomplete pass buys time for another play. Bad passing call, but going to the pass makes sense. Just not that play. Something a little harder for New England to read would have been better, though.

Chris Cooper writes:

I'm in the middle of reading Scorecasting: The Hidden Influences Behind How Sports Are Played And Games Are Won by Werheim and Moskowitz. The authors do an exceptionally good job of demonstrating how conventional wisdom in such situations can remain wrong. I would not be surprised to find that this particular example was a theoretically correct call which nonetheless always leads to opprobrium by the masses.

I recommend the book, and note that it is on the Chair's reading list as well. The insight into referees is particularly well expounded. Likely many market lessons.

Tim Collins writes:

At the very least, you try the run. Lynch is truly hard to take down. Call time out if he doesn't make it. Use a QB roll out on 3rd down. Throw it away if not there. That would leave any play open for fourth.

anonymous writes:

The play made sense in terms of clock management. It was about NOT giving a guy like Brady an extra 20 seconds to come back and beat you. Further, one must wonder why Seattle didn;t let the play clcok run down to :01 and call a timeout at that point.

A similar analog occurred at 2:02 left in the fourth quarter, when NE kicked off winning 28-24. I was certain they could kick the ball short, allow for a run back, let the clock burn on the play and then stop for the 2 minute nonsense, rather than giving away a pass play for free by kicking a touchback.

NE didn't do that of course, and by the two minute warning, the ball was at midfield.

The point is,running down the clock, or not, is not without its risks. The hypothetical — give the ball to Lynch, could have been a fumble as well. The game is comprised of such things, and no play is without risk, as is no trade, hanging out there by its lonesome.

Tim Collins replies:

Fourth down play doesn't matter, so you have one run and one pass with the one time out. As long as my QB doesn't take a sack on the rollout, I'm fine. Plus, I thought they took too long to get to the line. There was 55 when they huddled up/lined up. Seattle took over 30 seconds to run that 2nd down play. Either way, I run on 2nd down. I'm stopped short and call time out. I now have roughly 20 seconds (plenty more if I actually get lined up in a timely fashion and run), so my QB rolls out. He is told to throw it away if there is not a wide open lane to the end zone or no one is open. As long as he does what he is told, I have plenty of time to run one last play from the 1 yard line. It doesn't matter what the last play is. I either score or the game is over as I will turn over the ball.

Sure, you could switch these and run the roll out on 2nd and the running play on 3rd down. I might even leave that decision up to Wilson based on his read of the defense, but these are my 2nd and 3rd plays. And, yes, I would run it again with Lynch on 4th down from the 1.

Pitt T. Maner III writes:

My 2 cents and second guessing– Don't lead the receiver. Aim at his body so he boxes out the defensive back(s). The bigger and stronger the receiver you run across the middle the better. More chance of a defensive interference call. It was a play with poor execution. Lynch can catch the ball too as was seen– one would rather have him fight a rookie DB over a short pass. A fade to the corner with your tallest receiver might have been good too. It's all about size and position and ball placement.

Victor Niederhoffer adds:

"Seattle Coach Pete Carroll Stands By Decision to Pass"

Scott Brooks disagrees:

I disagree.

He had one time left and The Beast in the backfield. Run the ball twice and then use your timeout. At the very least, he Belichik would have been forced to call a time out to preserve the clock in the (likely) event that Seattle could have Beasted that ball across the goal line.

Worst case scenario, if you pass, do a fade route to the corner.

The Pats were stacked in the middle prepared to take on Lynch, why throw it into a sea of blue?

They even had time to do a play action and give Wilson time to improvise and still throw it away if there's nothing there. Then run two running plays and use the timeout in between.

It was a stunningly poor call, one that will haunt Carrol for the rest of his career.

Pitt T. Maner III writes:

Think of the money involved (excluding endorsements and lots of other things): "This year, the salary bonus for players on Super Bowl teams has inched up a bit to $97,000 (up from $92,000 a year ago) for each winning player, compared with $49,000 for players on the losing squad ($46,000 a year ago). So the total gap between the game's winners and losers should be a bit higher than it was last year, when the difference was just under $3 million."

anonymous writes:

Read a paper earlier this year that the most statically reliable goal line play was the slant pass. The least was the fade pass. In my observation the receiver needed to be about 2 yards deeper. He was too shallow to get separation.

Craig Mee comments:

This reminds me of turning a winning position into a loser. We have probably all achieved this in a number of ways. Spreading off risk and turning over possession has got to be up there. I must include talking to a fellow trader and after the chat swinging your position from net long to net short, and watching the market go limit long.

anonymous writes:

What about the quarterback sneak?

Would be good to have stats on how many inches/feet can be reliably picked up on a quarterback sneak, even if everybody knows it's coming:

"Around the time Pro-Football-Reference added the Game Play Finder in 2012, I used it to look up Tom Brady's rushing success in short-yardage situations (third or fourth down, 1-2 yards to go). The results were staggering. Including last season, in his regular-season career Brady is 88 out of 91 (96.7 percent) on these runs, including 56 straight conversions. That's almost as efficient as the extra point. After researching some other quarterbacks, I found that most of them had great conversion rates. This is largely due to the quarterback sneak, which has worked 85.9 percent of the time since 2009".

Feb

2

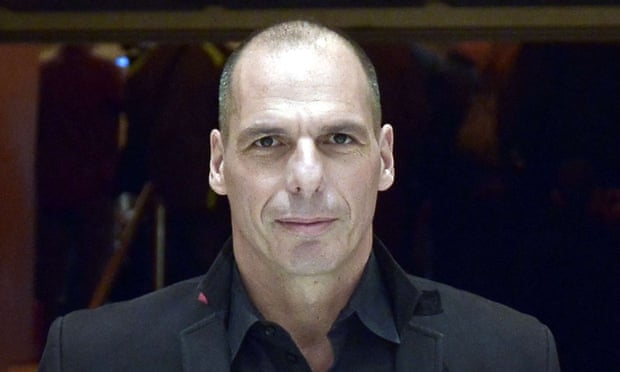

The Greek Finance Minister, from Ken Drees

February 2, 2015 | 1 Comment

The Greek finance minister is very astute with game theory forte. So far he has made a credible threat of a willingness to blow out of the EU–not a bad first move from a disadvantaged starting position.

The Greek finance minister is very astute with game theory forte. So far he has made a credible threat of a willingness to blow out of the EU–not a bad first move from a disadvantaged starting position.

John Floyd writes:

Many excellent points are being made in our discussions on Greece, Europe, and related topics such as Russia's 1998 default. Inclusive in the comments are the micro, macro, political, and social influences. Stefan is always excellent at bringing some historical context. Fittingly I am listening to the American Colossus at the moment.

One of, if not the KEY question, as a speculator is how best to extract capital from markets given a specific view, market, potential, catalysts, time frame, risk level, etc. A close friend, Dr. Ari Kiev, used to say to me when I would elaborate on a market thesis "John, that is great and makes a lot of sense. But, how is the best way to make money from it? What are the specific goals, etc.?".

The economics and politics of the European situation are fairly straight forward. I have followed them, more fastidiously than I care to admit for many, many years. I have included everything from men on the ground following bank deposits, meetings with current and past leaders and the 10,000 foot view of how this may play out on a broad macro level. Milton Friedman made some typically prescient comments upon the forming of the single currency, and they are panning out. Many of the same issues and characteristics were present in the European Rate Mechanism (ERM). Those more learned than I might also weigh on the potential utility of different currencies in the present day U.S., the Confederate currencies, etc.

Directly from a market perspective though I would consider some key points and questions:

How do previous crises provide some examples for a potential playbook? In the past few decades for examples…how was the Tequila Crisis backstopped? What about the ERM crises? The Argentine peg removal? Hungary's revaluations and devaluations? The currency policy of Egypt in the mid 1990's?

Does the size of the problem relate to the size of the market impact? The Russian default was relatively small and debt held by a limited number of participants. I can remember sitting in a conference room with a group who held about 80% of the local debt. But the market impact globally was very large. What was the macroeconomic situation at the time? Why did the default happen when it did? Further a butterfly flapping it's wings in tiny Iceland had a demonstrably large global impact.

If a country leaves the single currency, Eurozone, etc. does the Euro go up or down? What happens to rates, equities, etc.? What is the path and what market instruments can be best employed? The flash crash, October 2014 market moves, and more recently SNB move all would point to the need to try and answer this question.

What is the sequence and through which markets and how fast is this likely to play out? I can remember positioning for wider spreads between Germany and Spain in 2005 at about 25 basis points on the same thesis that is playing out now. But, that view has required quite a bit of timing, frustration, etc.

What is the broader thesis guiding what is happening and where else and how is it likely to play out?

This is just a quick list. What else is there to consider?

Feb

2

Talk About a Biased Study, from Victor Niederhoffer

February 2, 2015 | Leave a Comment

Talk about a biased study where if you get to the top 1% of course you're growth was way up but if you are in the bottom, you ended up way down. A regression fallacy designed to create egalitarianism and agrarianism. Could have been financed by the forces of collectivism.

Talk about a biased study where if you get to the top 1% of course you're growth was way up but if you are in the bottom, you ended up way down. A regression fallacy designed to create egalitarianism and agrarianism. Could have been financed by the forces of collectivism.

"1450% Income Growth Is What You Need to Join the 1%":

By Gail Degeorge (Bloomberg Business) — New research shows that not only are rich Americans making more money than you, they're also making money faster than you. A lot faster.

"Average earnings growth over the life cycle varies strongly with the level of lifetime earnings: the median individual by lifetime earnings experiences an earnings growth of 38 percent from ages 25 to 55, whereas for individuals in the 95th percentile, this figure is 230 percent," according to a paper published in January by the National Bureau of Economic Research, by four authors including one at the Federal Reserve Bank of New York. "For those in the 99th percentile, this figure is almost 1,500 percent."

For those in that top 1 percent, that means going from making about $50,000 when you're 25 to about $750,000 when you're 55, said Fatih Guvenen of the University of Minnesota, one of the study's authors.

"Every year, the median worker between ages 25-55 experiences 1 percent annual growth," he said in an interview. "For the top 1 percent, it's about 9 percent per year. And because of compounding, their incomes grow by 15 fold." Age also makes a difference — and the early years really count.

"Across the board, the bulk of earnings growth happens during the first decade," according to the study, which drew on a sample size of more than 200 million men between ages 25 and 60 from 1978 to 2010.

Meanwhile, momentum in earnings growth slows as workers age. For those older than 45, the only groups with earnings growth on average were those in the top 2 percent.

The research also showed that the richer or older someone is, the harder they can fall. Earnings shocks that workers encounter are usually harmful and become "more severe as individuals get older or their earnings increase (or both)," the paper said. This is because earnings growth slows as workers age, and there's an increasing risk of having a sharp fall in income after the age of 45.

Feb

2

Hard Work, from Jonathan Bower

February 2, 2015 | Leave a Comment

Giving a shout out to my 8 year old who spent 7+ hours walking around our neighborhood over the last two weekends selling chocolate bars to raise money for her school. She managed to beat last year's total (315) and her goal (400) and sold 534, not including the parental contribution. A great lesson in working hard and achieving goals. Given that 80% of the kids at her school are Title I and 20% are technically homeless, the PTO definitely needs the money to support the teachers and students. Below is her "pitch":

Hi my name is Kealoha. I am in 3rd grade at Putnam Elementary School. I am selling "the world's finest chocolate" to raise money for my school. Last year I sold 315 bars, this year my goal is to sell 400. Would you like to help me reach my goal? It will be just in time for Valentine's Day.

Feb

2

Article of the Day, from Craig Mee

February 2, 2015 | Leave a Comment

You could possibly say that the more a market folds and bends with contours, the more secure and accommodative it becomes.

Feb

1

Free Lunch and Correlations? from Stefan Martinek

February 1, 2015 | Leave a Comment

Finance professors teach their students that diversification is the only "free lunch" they can get. Recently, I looked at eight market groups (period 1995-2014). High correlations within individual groups could be expected. More interesting is what is happening on a wider scale over time. I recall that media were writing around 2008 that the "free lunch" is gone and that all markets behave like one big correlated monster, like Dracula. Between 2007-2012 we could see increased numbers, but recently we moved back to the normal. I have attached a figure for the year 2014 (server did not allow more pictures - 100k limit; for those who are interested all data can be found here).

Ralph Vince comments:

Correlations have NO relevance in allocation decisions — they are not only not constant, they don't address the relationship properly (as a copula does). Using the latter, one see the effect of those oddball days of immense danger, and can then craft their allocation strategy accordingly. Straight correlations tend to mask this.

Stefan Martinek replies:

I agree Ralph. I like things balanced between equities, fixed income, currencies, and commodities. We can ignore Markowitz + half Chicago. But it is still interesting to see where we are now in comparison to history and whether things somehow degenerate.

Feb

1

Stock Market Vigilantes Create Greek Moussakis Delight, from Victor Niederhoffer

February 1, 2015 | Leave a Comment

"Tsipras Targets Deal With Euro Area After Market Pummeling"

By Nikos Chrysoloras and Corina Ruhe (Bloomberg) — Greek Prime Minister Alexis Tsipras sought to repair relations with creditors after a week-long selloff in bonds and stocks, a move welcomed by euro area officials concerned they were headed for a showdown with the bloc's most indebted nation.

Greece will repay its debts to the European Central Bank and the International Monetary Fund and reach a deal "soon" with the euro-area nations that funded most of the country's financial rescue, Tsipras said in a statement e-mailed to Bloomberg News on Saturday.

"The deliberation with our European partners has just begun," Tsipras said. "Despite the fact that there are differences in perspective, I am absolutely confident that we will soon manage to reach a mutually beneficial agreement, both for Greece and for Europe as a whole."

Bond yields surged on Friday after Finance Minister Yanis Varoufakis said the new government will turn its back on the rescue program that allowed Greece to pay pensions and public wages for the past five years in exchange for a punishing regime of spending cuts that wiped out 25 percent of its economy.

Gary Rogan writes:

You'd think that almost 3,000 years after inventing Western Civilization they'd have enough sense not to believe the "No more bailouts, no more submission, no more blackmailing" promises of a wild-eyed radical.

Feb

1

The Endangered Species, from David Lillienfeld

February 1, 2015 | Leave a Comment

It's less three weeks before the Orioles pitchers and catchers report (Scott: same day for Cards pitchers and catchers; any other teams of note, please let me know off-line). So it seemed like a good time to kvetch about one of my pet peeves in modern baseball: the intentional base-on-balls. I can get the infield shifts, much as I dislike it (though Boog Powell's 1970 stats are as good an indication that even a shift can be defeated). Supposedly, hitting instructors in the minors have already begun training batters to use the whole field. As Buck Showalter put it, "You don't golf with just a 9-iron, you don't hit just to one side of the infield."

It's less three weeks before the Orioles pitchers and catchers report (Scott: same day for Cards pitchers and catchers; any other teams of note, please let me know off-line). So it seemed like a good time to kvetch about one of my pet peeves in modern baseball: the intentional base-on-balls. I can get the infield shifts, much as I dislike it (though Boog Powell's 1970 stats are as good an indication that even a shift can be defeated). Supposedly, hitting instructors in the minors have already begun training batters to use the whole field. As Buck Showalter put it, "You don't golf with just a 9-iron, you don't hit just to one side of the infield."

An intentional base-on-balls is when a pitcher wants to assure that a batter who might pose more of a hitting threat than the succeeding batter is thrown 4 unmistakable balls. Alternatively, a player might draw the IBB to set-up a double play. The decision to give a batter an IBB is often left to the manager, but some senior pitchers will issue them on their own initiative. In the Baltimore I grew up in, there was only one Earl—Earl Weaver, and Earl assiduously never used the IBB. An advocate of "walks will haunt," he wanted his players to walk, but he refused to give up a base if he had the choice; to him, an IBB was simply a base. (Then again, Weaver despised the 5 man rotation, asking why you let a 5th guy pitch when you had 4 who were better. I'm in agreement with him on both counts.)

The first IBB was in 1896, when a Giants manager Kid Gleason directed his pitcher, Jouett Meekin, to give a base on balls to Chicago (eventually known as the Cubs) batter Jimmy Ryan (he who scored more runs than any other play not in the HoF) so that he could to pitch to George Decker (who was hardly the threat Ryan presented). Decker struck out, the game was done, and the gambit worked.

The IBB caught on enough that the owners viewed it as something that took away offense (it took the bat out of someone who could presumably do some baseball damage with it) and prolonged the game. They tried to ban before the 1920 season (that being just before the BlackSox came to attention), but umpire-manager Hank O'Day lobbied against the move—and his argument prevailed. The compromise was that if the catcher moved out of the catcher's box behind home place before the pitcher threw the ball, it would be a balk, and the runners on base would advance. That's still the rule. Most of the IBBs I've seen have had the catcher not even crouch to take the pitch, so getting wide of home plate to catch the ball shouldn't be too challenging.

Whether the IBB should be eliminated or at least changed to something where the pitcher or manager indicates that there's an IBB in process, have been around for a while. The argument is that it would speed up the game. Speeding up the national pastime. Wouldn't be much of a pastime anymore. But as any parent who's taken their kids to the games knows, keeping kids focused on the game means having them watch hitting—and that's something the IBB certainly doesn't do.

The only instance I know of in which a batter got a hit in an IBB setting was Miguel Cabrera in 1986. Perhaps Stefan knows of some; I don't.

The trend in IBBs is decidedly down—at least since the early 1990s. Maybe it's that managers are more diligent in using the IBB, but as Weaver observed, it's still a base that's being given up. So it appears the iBB is becoming an endangered species.

I can only hope that it become extinct soon, though I sure there are the purists who think otherwise. We'll see what the coming season brings.

Play ball!

Feb

1

Double Rent on Skid Row and Psych Wards, from Bo Keely

February 1, 2015 | Leave a Comment

In my hoboing days, when the Los Angeles cops knocked on my door at the Rainbow hotel down from the library, and barged in, cuffed and hauled me to the nut hatch… I thought to ask them in route, 'Why?'

The reason is I had paid a week in advance at the hotel and not left the room, having returned from world travel with a need to hole up. The manager had called the police, I believe, because the hotel was full and he wanted the room to collect double rent.

On skid row there are all sorts of tricks like this to generate income, and off skid row.

The hatch they stuck me in is considered LA's finest. After checking in, while refusing to sign the registry, I was labeled dangerous as a former professional athlete. The nurse gave me a Thorazine pill to swallow that I used sleight of hand to stick it in an apple. Otherwise I could have been stuck in that place for a decade of mandatory doping doing the 'Thorazine shuffle' up and down the halls like a bear in a zoo.

The California law requires that a new patient be observed during a '72 Hour Hold', and then is evaluated by a psychiatrist to see if the patient should be held for a further period of observation, or released. Fortunately, the evaluating shrink was a compassionate, intelligent zookeeper. He knew that, as in County Jails, the government pays a stipend for the initial three days an inmate is held, and after that it's his duty to shoo the client out to make room for the next money maker.

The evaluating psychiatrist asked me to prove my wild claim that I was a veterinarian, and I told him his wife's poodle's gestation period was 63 days. Then he said, 'If you were me, would you let yourself out?' I answered by requesting a couple of dollar bills from his wallet, and quickly memorized the serial numbers, returned the bills, and rattled off the 20 digits. He signed the release, and pointed me to the checkout counter.

Now it was another double rent situation, because the clerk tried to get me to pay for three days lodging, that couldn't be enforced because I hadn't signed their register.

I escaped on a technicality, and, instead of returning to settle the score with the Rainbow Hotel manager, I got out of town on a freight train and slept in the woods.

Feb

1

Psychic of the Day, from Bo Keely

February 1, 2015 | 2 Comments

So-called psychic James Hydrick was different from your run-of-mill overnight swindlers. He was born poor in the Deep South, chained to a tree as a child, fed dog food, but a spark kept him striving to find his real self. As a teen, he was shuttled from orphanages to foster homes, only to run away again and again, chased by the hounds. He escaped to Hollywood, in search of a cinematic dream, where tryouts for parts didn't develop. He modeled, took part time jobs, and earned a black belt in karate. By his early twenties, his timing was exquisite and body like an oak when he ran afoul of the law.

So-called psychic James Hydrick was different from your run-of-mill overnight swindlers. He was born poor in the Deep South, chained to a tree as a child, fed dog food, but a spark kept him striving to find his real self. As a teen, he was shuttled from orphanages to foster homes, only to run away again and again, chased by the hounds. He escaped to Hollywood, in search of a cinematic dream, where tryouts for parts didn't develop. He modeled, took part time jobs, and earned a black belt in karate. By his early twenties, his timing was exquisite and body like an oak when he ran afoul of the law.

He robbed a van, fenced the merchandise, got caught, and thrown in the LA county Jail that is the bowels of hell with 2000 screaming inmates. (I know because I once landed there myself on a trumped up jaywalking ticket.) He became, according to the County Jail shrink I talked to, the King of the inmates. He decked the Black Gorillas gang leader in the shower room for soliciting homosexual favors and, with a bounty on his head, was thrown into a 15' cube solitary cell on the lowest level. The LA County Jail is normally a transit facility, however he was a special protective case, and spent two years there in solitary, where he spent thousands of hours working out and learning how to move objects without touching them.

On trips to the Big House shrink he stole and stuck pins and paperclips under his skin as lock picks, that eventually were found on x-rays but not surgically removed because of the cost to the County. He developed a close relationship with the Catholic monk while in solitary who, upon Hydrick's release, understood that the ex-con needed to be sent far away, and chose Salt Lake as his new home during probation. He was quartered with a hulking retired marine officer and staunch Mormon business executive and his family to live with under control.

I met Hydrick one day in 1980 in Salt Lake where I was doing a racquetball camp. I noticed a lone figure in the gym taking five running steps, jumping, inverting in mid-air, and touching a basketball rim 10' off the floor with one foot. We adjourned to a desk where, without touching, he moved pencils, papers and other small objects from a distance of up to 5'. I smelled a story. We became apartment mates for six months, as he started a dojo and local tour of his stunts, and I wrote and photographed them. (Some of my photos would appear uncredited in martial art and online magazines.) Soon sport and psychic apprentices from around the country arrived at the dojo doorsteps to learn Hydrick's 'powers'.

From 1980-1 he appeared on That's Incredible, What's My Line, and the Danny Korem Show. Then I was in the wind, and he was reported moving pyramids in Egypt with a new host of devotees. The next thing I knew he was picked up on an outstanding warrant when a policeman recognized him on a 1989 Sally Jessy Raphael episode. He has been incarcerated to this day, except for one short respite last year, at the Coalinga State Hospital Maximum Security Hospital for the violent mentally disturbed that opened its door for the first time, as if for Hydrick, in 2005. James is not mentally disturbed, just misunderstood from the aforementioned childhood trauma. He used to take knives and swords and strike within an inch of my body, without touching the skin, when we sparred.

My family was worried about my getting taken into the Hydrick cult and sent a deprogrammer to Salt Lake to rescue. After a short discussion, I was convinced he was off his rocker, but acquiesced out of respect to my family, and ducked out of Hydrick's life.

To pick up on details, I went to LA and traded racquetball lessons with four turnkeys at the County Jail for an introduction to the psychiatric staff. They vouched that Hydrick had been the King of the LA County Jail and showed me radiographs of a half-dozen metal objects under his skin. I met and buddied with the Catholic Chaplin to a dozen monasteries throughout the Southwest.

According to Hydrick's transcript, the deputies in the County Jail were frightened of him, thought him possessed. The Chaplin taught him to read and write, and gave him a Bible. To pass time in a timeless place, Hydrick proselytized, converting up to twenty inmates a day like a prophet. He opened the Bible and commanded, 'Hold the Bible. Father, in the name of Jesus Christ make these pages move. And the pages would flutter and turn.'

Hydrick's telekinetic powers were common magician tricks mastered to a high art in solitaire, plus one that was never discussed. I believe he could blow out the tear ducts on the medial side of each eye, small openings that drain tears into the nasal passage. I found in a 1950s Ripley's Believe it or Not a reference to a 19th century Englishman who blew out candles 'through his eyes' from 6' away.

He was released from Coalinga on probation for a few months in 2014, and was reported as having taken a day-to-day room in the San Diego Gaslamp Quarter. No address was given, but there is only one, where I used to stay while doing the Sports Arena Swap Meet. I visited the Golden West hotel on 4th Avenue where they told me he had left, and is reported back in Coalinga.

The lesson is to keep your eyes open when you dabble in the esoteric.

Feb

1

Inflation, from Russ Sears

February 1, 2015 | Leave a Comment

Inflation or deflation spending has more to do with risk taking than we think. Beyond the filled holes or broken windows and useless buildings, it discourages risk taking businesses. Subcontract with the Government is safe and discourages taking risk on businesses that might fail.

In the past the risk adverse old age savers put money in the banks and pooled their funds to get those who were willing to take risk and had the know how and quantity of scale to invest efficiently with diversified risk taking putting that money back into the economy. The problem right now with deflation and QE is that the government is basically paying banks to deleverage, hence as the boomers become less risk adverse and stuff money into banks and safe investments. Those receiving the "savings" are being discouraged to take any real risk with it and told to leave it in Fannie and Freddie, now really government institutions with a very thin glass wall between them.. Instead of quantity of scale and diversified risk taking knowledge, now you have quantity of To Big to Fail and government insiders.

So basically you have those risk adverse savers giving money to risk adverse bankers with "connections" BUT no real expertise or incentive to take risk with it.

« go back —Archives

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles