Aug

6

China’s Equity Markets, from Leo Jia

August 6, 2013 | 1 Comment

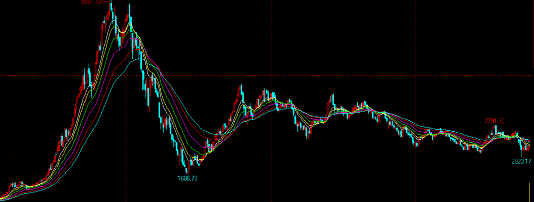

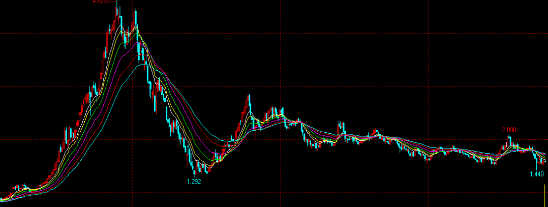

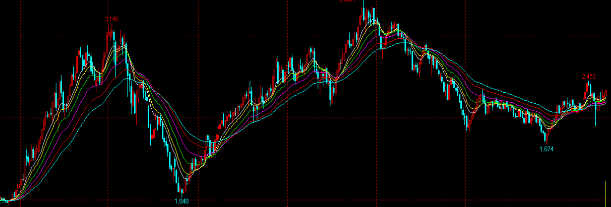

To give a fuller perspective of the Chinese stocks, I attach some charts of the different markets. All these are weekly charts from 2006 to now.

To start with,the first here is the Shanghai-Shenzhen 300 Index, comprising the 300 largest stocks on both exchanges. This is the base of the Index futures currently traded on Shanghai Financial Futures Exchange.

The Second is the Shanghai 50 Index, comprising the 50 largest stocks on the Shanghai Exchange.

Most stocks in the above two indexes are of state owned enterprises.

These stocks and the index futures are only available to domestic Chinese and are priced in Chinese Yuan.

As we can see, both are at quite depressing levels.

Third is the index of small caps on the Shenzhen exchange. This comprises stocks of all small, and most importantly, private businesses. Again these are only available to domestic Chinese and are priced in Chinese Yuan.

To compare with the two large cap indexes, this is not nearly as depressing.

Now here are two indexes of stocks priced in other currencies and available for international traders.

The first is Shanghai B-shares index. It comprises all of the less than 100 stocks priced in USD on the Shanghai exchange.

The second is the Shenzhen B-shares index. It comprises all of the less than 100 stocks priced in HKD on the Shenzhen exchange.

While the Shanghai index not too depressing, the Shenzhen index is actually somewhat strong.

Aug

6

Aaron Clauset and Terrorist Attack Data, from Pitt T. Maner III

August 6, 2013 | 1 Comment

This is an interesting article for the statisticians on this site:

This is an interesting article for the statisticians on this site:

"How Aaron Clauset Discovered a Pattern Behind Terrorist Attacks…and What it Told Him":

"Another concern remained: The data was too clear, the pattern too obvious. "Surely, someone has thought of this before," Clauset recalls thinking. But the only example they could find of similar research was the work of Lewis Fry Richardson, an English mathematician and Quaker pacifist who drove an ambulance in World War I. Along with doing major work in the fields of weather forecasting and fractals, Richardson would go on to analyze all the wars from 1815 to 1945 and conclude that they followed a power-law distribution; he found the same pattern in gang killings in Chicago and Shanghai"

and

"At the prestigious Joint Statistical Meetings this August, however, Clauset and Woodard will return to the prediction issue: They will present new research concluding that if the level of terrorism violence remains stable — as it has, more or less, for decades — there's roughly a 30 percent chance of an attack similar to 9/11 in the next decade. To hedge their bets, they'll also note that if terrorism violence begins to ebb, that chance drops to just 7 or 8 percent. But if terrorism gets worse, the chances of another 9/11 increase significantly — to 80 percent."

Stefan Jovanovich writes:

Richardson's fundamental observation is one that anyone of sense has to agree with - "world" wars are disastrous beyond measure. The 2 World Wars– the only magnitude 7s in Richardson's classifications — were responsible for 3 out of every 5 wartime deaths in the period between the end of the Napoleonic War and VJ-Day. But those of us who cannot hack the math find one aspect of Richardson's study to be just plain bad history. By using logarithms he manages to fit a number of wars of fundamentally different importance into the same "magnitude" — a Richardson 6 war can have anywhere from 316,228 to 3,162,278 deaths.

One other random observation: those of us who love the 18th century above all others (Mozart, Washington, Watt, and Lavoisier) have this fact in our favor — the 1700s were the one period in modern (i.e. post 1400) history that had a complete absence of mass killing in war.

Statistics from Peter Brecke, Georgia Tech.

Aug

6

Flexionism of the Day, from Dylan Drury

August 6, 2013 | Leave a Comment

There is an apparent flexionism transpiring in the current market environment. The fed flexes their views in deciduous media blurbs while trying to manipulate an asymptotic rise in asset prices.

One is reminded of the war strategies used by the ancient Nuntsekai warriors of the Middle East in the 12th century.The strategy was initially applied with commingling of deceit maneuvers in association with subordinated and mischievous assemblance of morale loss. What then followed was a stochastic attack maneuver which created chaos and confusion in the midst of initial optimism.

Aug

6

A Blog Post by the Dalai Lama, from Leo Jia

August 6, 2013 | Leave a Comment

I just stumbled upon this inspiring post: "20 Ways to Get Good Karma" by the Dalai Lama. Many teachings can be directly applied to trading, such as:

I just stumbled upon this inspiring post: "20 Ways to Get Good Karma" by the Dalai Lama. Many teachings can be directly applied to trading, such as:

1. Take into account that great love and great achievements involve great risk.

2. When you lose, don't lose the lesson.

3. Follow the three R's:

- Respect for self,

- Respect for others and

- Responsibility for all your actions.

5. Learn the rules so you know how to break them properly.

7. When you realize you've made a mistake, take immediate steps to correct it.

8. Open your arms to change, but don't let go of your values.

18. Judge your success by what you had to give up in order to get it.

Aug

6

I heard there is a new open source Python library 'PySEC' allows easy access to all of the SEC's filings.

I heard there is a new open source Python library 'PySEC' allows easy access to all of the SEC's filings.

This is interesting primarily because we are in our 11th week of programming to do essentially what this guy says he has done. Our goal is to glean all of the SEC submissions without human intervention. Many of the commercial data suppliers use the "thousand scribes" method in which they hire a thousand people in a developing nation to manually record and categorize data. And those commercial suppliers charge huge fees for that suspect data.

Does the Python programmer really have something? Have our 11 weeks (to date) been a fruitless exercise?

Prior to 2010 the SEC required submission of quarterly and annual reports to be postable on the web. However there are all manner of idiosyncratic ways in which that information can be posted. Most of the submissions can be mined by a computer, but the fact that we are still programming after 11 weeks suggests it isn't simple.

The vast majority of files are text files. However that does not make mining easy, as labeling of the data is not consistent. Many data items within a given 10-Q may be labeled "total assets" perhaps for each subsidiary. Total liabilities are frequently called something else, or not labeled at all. Then in 2010 it was required that the files be submitted in HTML. Then that requirement was changed to XML, but HTML has appeared to survive. Within submissions we occasionally see an extraneous dingbat dropped into a label, which screws up the mining operation. There is only one submission that has completely stymied us - where the company presented their financial results as an attached GIF file.

We are highly suspect of data that is difficult to mine. Maybe extraneous dingbats have been put there deliberately to foil such a search, or maybe the person responsible is merely trying to impress a boss. But it is enough for us to log the difficulties and research subsequent performance of those problematic submitters. That we will provide to the list, but we will most likely have to abstain from providing a list of the miscreants. We would be happy to hear from any lawyers on the list about that one.

The Python program appears to have made some progress in mining the XML submissions from 2010 but it is a tedious one-by-one search. And now that many of the submissions are back in HTML, the miner has much more work to do for the same effort. So we certainly aren't going to give up our work and pay homage to the Python program.

Aug

6

Summertime, from Duncan Coker

August 6, 2013 | 1 Comment

Gershwin's Summertime is written in a minor key which gives it a dark, listless feeling like floating down a river on a hot, humid day. The generally optimistic lyrics are incongruent with the minor key of the melody. If it was written in a major key it would be completely different, but he chose minor. The song gives the listener a sense that things are not really so wonderful and the "living is– not really that– easy".

Gershwin's Summertime is written in a minor key which gives it a dark, listless feeling like floating down a river on a hot, humid day. The generally optimistic lyrics are incongruent with the minor key of the melody. If it was written in a major key it would be completely different, but he chose minor. The song gives the listener a sense that things are not really so wonderful and the "living is– not really that– easy".

As the optimistic stocks market drifts ever higher and higher in the summer heat, the bond market is playing a minor key melody. Bond volatility is higher than stocks, and their role as substitutes for one another has changed, giving the listener a sense that the living is not that easy. Then again, maybe it is just summertime trading.

Aug

6

Pentatonic Power, from Jeff Watson

August 6, 2013 | Leave a Comment

Bobby McFerrin demonstrates the power of the pentatonic scale in this video.

What market lessons can this offer?

Aug

5

The Science of Fear, from Victor Niederhoffer

August 5, 2013 | 8 Comments

In talking about what I learned in the last 10 years, which I wish had been more, I concentrated on four factors. Everything is deception. Fear creates tremendous non-random underperformance. The purpose of markets is to take from the weak. The cycles are ever-changing (they recently changed again for bond stocks) and the solution is to buy and hold. I quantified several aspects of the fear of underperformance and alluded to a study by Mr. Curve that by selling at the fear point, traders lose 4 percentage points a year. That's big.

I'm reading some books on fear. Namely The Science of Fear by Daniel Gardner. The great praise it received is that it's as good as Gladwell. My goodness, at least it had no references so far to the Expert. However, I came across an idiot reference to one of the contrived Kahneman references that supposedly shows that fear is ubiquitous. The naval research bureau which reached such height with Osborne's stock market work, swings to the other side of the pendulum by supporting the masters of part whole biased answers to contrived question. The Kahneman group asks students: "heads you win 150, tails you lose 100." Would you take it. Amazingly to those who wish to show that rationality don't exist, the students don't take it. With these kinds of ridiculous questions and the choices to the answers are again designed by Pam Alikes to guarantee that the hypothesis will be chosen, the supposed irrationality is built; :"Why Investors Make the Wrong Choice".

What kind of world do we live in when the very rational response of students that they don't have 100 bucks to lose, or their liquidity doesn't permit it relative to frat parties, beer and dates, leads to a whole science of behavioral irrationality which Arnold Zellner tells me is called the promiscuous science around the faculty clubs at Chicago.

Gary Rogan writes:

Everything makes perfect sense especially the buy and hold conclusion and the fear factor, and the useless behaviorist bias experiments and the whole aura of ridiculousness of the same behaviorist conclusions being rehashed as new science for over 30 years, but I'm still searching for some way to see whether markets have a purpose. To me they seem to just exist. What gives them purpose? Why do they have to have any more purpose than the ocean which you can surf, in which you can swim and fish and ride boats, or drown or lose a house if it's next to it?

Anatoly Veltman adds:

An intriguing subject to be sure, and I'm certain that someone will be able to quantify fear. Personally, I only get fearful at dizzying new highs — not at scary lows. But yes, the mass psychology seems to err on that count.

I don't know what to do about buy and hold, fully four years and counting of correctionless appreciation. In the current case from 667 to over 1700 so far… I suspect individual stock picking is of increased importance at this point, as I don't believe the indexes' survivorship bias provides any edge during the Bullish phase.

This time it may be different, as I've noticed marked difference in Chair's attitude toward commodities and Gold in particular. I recall stopping by the Junto in early summer 2007 to quite an ear full about stocks having risen 10000 over half century, but Gold barely a handful. And good meal at a favorite SF eatery only a three fold or so. I couldn't understand why this statistic made a Bullish case for stocks and not Bullish for commodities, at that junction. But in the course of this year, Chair has appeared partial to any sweet dip in Gold. I can only suspect, that the liquidity opium has rightfully impressed just about everyone on the planet. And little distinction is being made any more about what exactly to buy and hold! A true contrarian might begin to suspect that, maybe…nothing? Might be soon, too. Are market manipulators really bigger than market - this seems to be the question to answer in 2013. And yet, over the centuries, all of this may just prove statistical noise.

Commenter Kevin adds:

"Everything is deception". Is that in markets…or life…or both! I kind of know the answer but the latter is kind of depressing. What's real!?

Gary Rogan writes:

The trick is to fear neither the highs nor the lows, that's what buy and hold is all about. They are just blips on the exponential rise towards infinity. That's for stocks, not gold or anything that's in it's final form. The ability of people to create more wealth will increase until everything collapses, hopefully many many years from now, but commodities are just things that are produced for as little as someone can figure out how to produce them. Yes, they are a hedge against all the currency debasement and gold is special, but there is no intelligent force making them better and better. I like the lows because then I can buy, but that's not essential. Sooner or later this market will crash hard, but when? And then it will get a hold of itself and will resume it's climb up. And unlike the bond rates it won't be for a few decades or a few years but forever, sort of.

Gary Phillips comments:

Or perhaps the optimists edge is the next piece of low hanging fruit to be picked and traded out of the market.

Sam Marx comments:

With so much apprehension at this point may mean that the S&P has further to go up.

Anatoly Veltman adds:

Why not Sam. Yet up how much before down how much? Is 17 trillion deficit realistically manageable just like the 3 trillion was — within the economy that haven't been pacing near that? Eventually, something will have to be cut — and the spiral will quickly shave some 90% off the top. And of course, the records will be regained again over decades, and compound again. Alas, a pattern like THAT only loosely resembles commonly defined drift. I put forward that it's extremely rewarding to partake of drift from any cyclical bottom; but also that records can't serve as bottoms, by any reasonable method.

Stefan Jovanovich adds:

Vic, you said:

1. everything is deception

2. fear creates tremendous non-random underperformance

3. the purpose of markets is to take from the weak

4. the cycles are ever changing

5. the solution is to buy and hold

That is an excellent concision. I suggest the challenge is to buy and hold, over any chosen time frame.

If I might add my own, they would be:

1. understanding is itself a necessary self-deception c.f. Hume's Inquiry

2. fear in investing comes from envying other people's successes and wanting, out of envy, to ridicule other people's failures

3. the purpose of markets is to test everyone's strength of mind — the rich can be as weak-minded as anyone else

4. cycles exist because we need to see patterns which may, or may not, actually be there - see 1 above

5. only the steadfast survive the second-by-second test of not knowing whether or not there is a spoon

Aug

5

I Am Often Asked, from a rocky speculator

August 5, 2013 | Leave a Comment

I am often asked if I really believe that all the technicians, and specialists and Phd's from Harvard and other places, the ges 10's and above making 6 figures on the steps with their 25% increases for the discomfort of living in NY, SF or DC, and the ses's with their even highers, and all their educations, including Harvard Phds and research positions at important public minded institutions, and teaching positions at top 10 universities, e.g. the head of a certain department that issues important numbers the first Friday of each month, whether they actually could stoop so low as to fuzzify a number. After all, they have procedures, checks and balances, and many employees going through the revolving door.

In most cases, not counting such things as the 15 foreign embassies that were attacked on that day the dignitary died, before the important election, which was completely suppressed, with the red herring of the documentary video, I don't think such eminent personages would stoop to that level proactively. Thus, the 0.1 decline in the rate if you asked them, they probably would believe it to be completely on the up and up, four square, and totally unbiased.

But let's be reasonable, what kind of people are able to go against the source of their income—- to fail to protect their own house. The invisible hand works. They all know what is necessary to protect their house, and one would presume that 95% of aforementioned higher up would have seen the virtues of keeping the middle class on a beneficent spiral of takings from the upper class and keeping the rest of us small i.e. the idea that has the world in its grip. So without a pencil being pushed, a change being made, an adjustment to the hedonics…it happens. And it's perfectly four square and it happens in accord with the idea, I think.

Aug

5

Teenage Markets, from Craig Mee

August 5, 2013 | Leave a Comment

I'm watching a documentary on the execution of a young 22 year old Australian boy in Singapore for heroin trafficking and hearing his lawyer say, "we have to represent him because he's young and stupid" or words to that effect made me think (besides the thinking I was doing about the poor young bloke's doomed plight) how markets behave the same way and how to quantify the stupidity and mistakes a kid makes and compare that to mistakes of an immature and reckless market. There are

many more similarities no doubt. Should we forgive them, what do they need to show to gain our respect and when should older ones lose it?

At the same time, it made me wonder if there is a risk in being too mature, too educated, and thirsting for too much knowledge and then not being able to turn back and live in the moment. Is there truth in the saying ignorance is bliss. Usually once the whole truth is revealed you realize you were happier being clueless. Knowledge makes you a better person and you can pass on the lessons to yourself and your family. Knowledge brings compassion, understanding and the ability to have an easier life through gaining edges. But it can lead to a blinkered existence for some, striving for goals that do nothing for mankind. The goal becomes cloudy and the initial gains are clearly lost. Ignorance, for some, helps you focus on family and community and the right basic values, while those with knowledge often fail and become confused on their journey.

Aug

5

Saws, Markets, and Life, from Victor Niederhoffer

August 5, 2013 | Leave a Comment

What can we learn from the various kinds of saws and their uses for our profit in markets and life? Is it a fruitful or frivolous question? I was induced to it by looking at the saw tooth pattern of the results from many different patterns, i.e. negative serial correlation of order 1 or n.

Alan Millhone comments:

Dear Chair,

We had hand saws in the early days of carpentry. Akin to stock trading by ticker tape?

Today we have power saws and reciprocating saws for cutting lumber.

Along those advances in sawing we have the computer for making stock trades. Faster sawing (keep hands out of the saw blade path!). Same with that thin finger and trading as being careful when you hit send !

There are also estimating programs for figuring remodels etc. A program does one thing for sure — let's you make mistakes faster!

I prefer pad and pencil for estimating.

Sincerely Alan

Aug

5

Article of the Day, from Shane James

August 5, 2013 | Leave a Comment

An amusing piece from out Japanese friends.

"Tokyo Traders Gear Up for the 'Curse of Ghibli'"

Aug

5

A former CLSA guy does a Monday morning quarterback review on Tony Bolton (and others) failures in the Chinese equity markets.

A former CLSA guy does a Monday morning quarterback review on Tony Bolton (and others) failures in the Chinese equity markets.

anonymous writes:

The disconnect between the professional research community's views and the performance of the Chinese equities available for non locals to trade over the last 5 years is quite depressing.

I remember two years ago stock brokers closing down by the score in the UAE …. The markets had not shared in the wider worlds rally since Mar 09. The performance of the UAE since has been far superior. I fear China is nowhere near this type of 'uncle point'. The demographic , 500 million joining the middle class in China etc etc etc. was priced into the super exponential rally that ended a few years ago.

Take a look at a weekend newspaper Sunday personal finance supplement from a few years ago. Nothing but Asia this & Asia that….

How about this — the next 50 years to be about the economic resurgence of the United States!

We'll see this story in the papers after after the USA outperforms China over the next 5 years or so.

Aug

2

At the Junto, from Victor Niederhoffer

August 2, 2013 | Leave a Comment

After putting up a chart of the Dimson, Marsh and Staunton very thorough enumeration of buying every stock in the US, from 1899 to date showing that $1 grew rather steadily to 25507 (the 1929 and 2008 declines look like blips), my college roommate Jim Wynne, in the audience, who recently won the equivalent of the Nobel prize in engineering for inventing laser surgery asked, "how could you say buy and hold" which was sung beautifully by Tamra Paselk (to the tune of "Night and Day"), is great when stocks like Kodak and Xerox have fallen on such hard times or gone bust and so few of the Dow stocks of 1899 are here today.

After putting up a chart of the Dimson, Marsh and Staunton very thorough enumeration of buying every stock in the US, from 1899 to date showing that $1 grew rather steadily to 25507 (the 1929 and 2008 declines look like blips), my college roommate Jim Wynne, in the audience, who recently won the equivalent of the Nobel prize in engineering for inventing laser surgery asked, "how could you say buy and hold" which was sung beautifully by Tamra Paselk (to the tune of "Night and Day"), is great when stocks like Kodak and Xerox have fallen on such hard times or gone bust and so few of the Dow stocks of 1899 are here today.

I explained that the complete enumeration of the triumphal trio covers all bad and all good (they even take account of the total zero of Russian stocks in 1914 and China in 1944), and there are many bad and many good that make up the totality. But on the spot, I couldn't think of a physical example to show that taking one instance of an experiment, an anecdotal approach, the flash of one outlying proton in a collider, did not determine the average results, and that diversification of 12 stocks would give a correlation of 95% or so with the results of the trio.

I explained that the complete enumeration of the triumphal trio covers all bad and all good (they even take account of the total zero of Russian stocks in 1914 and China in 1944), and there are many bad and many good that make up the totality. But on the spot, I couldn't think of a physical example to show that taking one instance of an experiment, an anecdotal approach, the flash of one outlying proton in a collider, did not determine the average results, and that diversification of 12 stocks would give a correlation of 95% or so with the results of the trio.

What physical analogy should I have used to educate my erudite former roommate who is now working on a cure for skin cancer with the same lasers he used to create laser surgery.

Shane James writes:

What about the growth a Sequoia Tree. More generally the Allometry involved. The tree grows out & up even though some branches fall by the wayside and die.

Pitt T. Maner adds:

I would imagine that there are some biological curves under certain restrained conditions that could be overlain for effect and be quite memorable.

Or groundwater testing where pumps are turned on and off over intervals and cause drawdowns that quickly rebound once the pumps are turned off.

Victor Niederhoffer adds:

As to the reason that it goes up 30,000 a century, I attribute it to the power of compounding along with the required rate of return on investments, and the amount that the entrepreneurs must pay the investor to obtain risk capital, with the spillover effect to publicly traded issues. Amazing a 9 % compounding leads to 200 times as much as a 5% compounding (from memory) after 100 years. That's why Asian stocks are so much better values than ours.

Steve Ellison adds:

An event that is vivid, such as the failure of a once-giant company, may not be at all representative. Consider airplane crashes, for example, which cause many to fear flying. At one moment in 2011, for example, over 5000 airplanes were airborne over the US. How many of them crashed? Probably none.

Similarly, 20 times as many people are killed by falling coconuts as by sharks. I'm still waiting for the movie Return of the Killer Coconuts.

Gary Rogan writes:

The simplest, albeit imperfect, analogy seems to be the number of species on earth. It is estimated that over 98% of all known species are extinct and it's likely that well over 99% of all species that ever existed are extinct.

In addition to the constant relatively steady elimination of species there are mass extinctions:

"In the past 540 million years there have been five major events when over 50% of animal species died."

And yet, will all of that biodiversity has increased over time:

"Based on analyses of fossils, scientists estimate that marine biodiversity today is about twice the average level that existed over the past 600 million years, and that biodiversity among terrestrial organisms is about twice the average since life adapted to land about 440 million years ago. Fossil records also indicate that on average species exist for about 5 to 10 million years, which corresponds to an extinction rate of 0.1 to 1 species per million."

Aug

2

(BN) *FED WON'T RAISE FUNDS RATE UNTIL 2016, PIMCO'S CRESCENZI SAYS

But didn't he say pretty much the opposite yesterday that it would be in Sep if it hit 175. It was nice of Erica to take 0.1 off the rate to keep man small. Exactly what Laurel and Tamra talked about last Nite. "Whenever it looks like your opponent has given you an opening, remember the story of the spider and the fly".

Aug

2

Article of the Day, shared by Richard Owen

August 2, 2013 | 1 Comment

I found this article by Rory Sutherland quite on point.

I found this article by Rory Sutherland quite on point.

"Why I'm Hiring Graduates with Thirds This Year":

It's hard to tell the difference between a university and a business school nowadays. Where are all the hippies, the potheads and the commies? And why is everyone so intently serious and sober all the time? "Oh, it's simple," a friend explained. "If you don't get a 2:1 or a first nowadays, employers won't look at your CV."

So, as a keen game-theorist, I struck on an idea. Recruiting next year's graduate intake for Ogilvy would be easy. We could simply place ads in student newspapers: 'Headed for a 2:2 or a third? Finish your joint and come and work for us.'

Let me explain. I have asked around, and nobody has any evidence to suggest that, for any given university, recruits with first-class degrees turn into better employees than those with thirds (if anything the correlation operates in reverse). There are some specialised fields which may demand spectacular mathematical ability, say, but these are relatively few.

So my game theoretic instincts suggest that if we confine our recruitment efforts to people in the lower half of the degree ladder we shall have an exclusive appeal to a large body of people no less valuable than anyone else. And such people will be far more loyal hires, since we won't be competing for their attention with deep-pocketed pimps in investment banking.

The logic is inarguable: the best people to hire (or date) are those undervalued by the market. (An expat friend of mine always dated Brooklyn girls for this reason: their accent seemed exotically alluring to him but was repellent to most New Yorkers.)

Aug

2

Breastfeeding, from Charles Pennington

August 2, 2013 | 2 Comments

A news article from yesterday's WSJ reports on a new study from Harvard that purports to demonstrate that breastfeeding enhances a baby's IQ by about 4 points, and that the effect has been isolated from other confounding variables. A pet peeve of mine is that as usual I don't have access to the original publication, which covered research that very likely received some form of funding via my tax dollars. Anyway, just from the news account, I am skeptical.

A news article from yesterday's WSJ reports on a new study from Harvard that purports to demonstrate that breastfeeding enhances a baby's IQ by about 4 points, and that the effect has been isolated from other confounding variables. A pet peeve of mine is that as usual I don't have access to the original publication, which covered research that very likely received some form of funding via my tax dollars. Anyway, just from the news account, I am skeptical.

The study "followed 1,312 babies and mothers from 1999 to 2010..and then tested the children's intelligence at ages 3 and 7"

OK. Well I read elsewhere that:

"A large number of studies have suggested that low [omega fatty acids DHA and ARA] might be associated with problems with intelligence, vision, and behavior. Children fed standard formulas may have IQ's 5-9 points lower than breast-fed babies, even after correcting for other factors."

and that:

"until 2002, [omega fatty acid additives including DHA] were not present in the infant formulas available in the United States".

The new Harvard study covered 1999-2010, but the kids were assessed at age 7, so I assume that means that the kids' birth dates ranged only from 1999 to 2003. Therefore, essentially all of the formula-fed babies in the study were getting formula without the DHA and other additives that were added in 2002. So shouldn't I expect their IQs to be "5-9 points lower", simply because they were using pre-2002 formula? If so, that renders the study irrelevant and unnecessarily alarming to parents today who aren't able to breastfeed for whatever reason, and who are using today's omega-enhanced formulas (which is the only thing that is available anyway).

If that objection is somehow mistaken, then I have further skepticism about how ~1000 cases could be an adequate sample size, given what they need to show.

If they look at IQ vs only a single independent variable — breastfeeding — then it's pretty clear that their "N" is adequate. On a "back of the envelope" basis, I think they're claiming something like a 13% correlation between breastfeeding (measured on a continuum from no breastfeeding it all to >1 year of exclusive breastfeeding) and IQ, and I believe that a sample size of just a few hundred would be adequate. The measured correlation have something like 1/sqrt(N) ~ 3% standard error, much smaller than 13%.

However, they claim to be able to isolate the effect of breastfeeding from other confounding variables. The biggie is the mother's own IQ, which is highly correlated (50%?) with the baby's IQ, but also with breastfeeding, since smart moms on average are more likely to breastfeed. I hope that some statistics experts can help on this, but I do have the impression that it's notoriously difficult to isolate the effects of independent variables when they're strongly correlated with each other. Again, it would help if the original paper were accessible to the public, who probably paid for part or all of the research and have a real practical need to understand the results.

Aug

2

Sunspots and the Stock Market, from Phil McDonnell

August 2, 2013 | 2 Comments

Kim Zussman sent me this paper "Sunspots, GDP, and the Stock Market"

Kim Zussman sent me this paper "Sunspots, GDP, and the Stock Market"

The paper strikes me as an affront to the scientific methodology. Here are a few dubious quotes from the Conclusion:

The calculations yield a rock-bottom level of 7919 for the DJIA in early 2014,

On the contrary, one is surprised that the correlation between DJIA and GDP turns out to be scientifically insignificant. Are our scientific criteria too stringent in this case?

If one accepts that there must be some correlation between GDP growth and stock-market growth as displayed in Fig. 5, then one cannot use the lack of scientific proof as an argument against the existence of correlation between the stock market and sunspots (Fig. 2), or between GDP and sunspots (Fig. 4).

Aug

1

The $10 Trillion Miss in GDP, from Victor Niederhoffer

August 1, 2013 | Leave a Comment

What is the cause of this 10 trillion miss if not the opportunity cost of the bailout and buying of bonds and mortgages by the Fed, the expansion of their asset base, the main accepted principle of macro economics that providing high powered money will create a multiplied effect on output.

"Is Life Still Good If You Miss Out on $10 Trillion?"

"A new analysis from the Federal Reserve Bank of Dallas provides a broader perspective on the weakness of this recovery and the damage caused by the crisis. They estimate that the shortfall in GDP from 2008 through 2023 amounts to about $10 trillion in today's dollars."

anonymous writes:

Retrospectively, It would have been fascinating to see if the animal spirits could have sorted things out better than the 'rescue packages' of our overlords. I suspect that with the same level of regulation as we had pre-'crisis' the difference would have been, inter alia, that we would have lost two or three of the 'global banks'.

The volatility of economic conditions would have been a little higher for a short time. There would be more smaller competitors now in many industries providing better levels of service and competition. The distribution of the economic gains since the lows would have been shared amongst a wider set of private enterprises rather than the 'semi private' banking sector.

« go back —Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles