Mar

7

A Fool and His Money are Soon Parted, from Jeff Watson

March 7, 2013 | 1 Comment

This is a story of a downfall, fortunes lost, amateurs, amateur mistakes, and tons of hubris.

"The Rise and Fall of Andy Zaky".

Mar

7

One has a subscription to Nature magazine. A weekly. And it's very scientific. Has about 15 "letters" each week, with an average of 42 authors for each letter. Titles like "specialized appendages in furzanhuliirids and the head organization of early eurathropods". (link ). You would think that with articles like this that each article would not be propaganda for more funding and egalitarianism. But I've found that in order to get into the publication, it has to have a conclusion like exact quote: "Evolutionary rescue from extinction is contingent on a lower rate of environmental change". 6 authors. They had a great pitt article on influence of rain on agricultural productivity with 100 authors in the last issue, and it showed that no matter how much rain there was, the productivity was about the same. The conclusion of the authors was not that the ecosystem adjusts and is very adaptable, but that in the horrible conditions of drought that are predicted and caused by the greenhouse gases, that because the efficiency is the same, we are in dire need of more government funding and transparency. One wants to cry.

img.imageResizerActiveClass{cursor:nw-resize !important;outline:1px dashed black !important;} img.imageResizerChangedClass{z-index:300 !important;max-width:none !important;max-height:none !important;} img.imageResizerBoxClass{margin:auto; z-index:99999 !important; position:fixed; top:0; left:0; right:0; bottom:0; border:1px solid white; outline:1px solid black;}

Mar

6

3d Printed Cars Almost Ready, from Leo Jia

March 6, 2013 | Leave a Comment

"3D Printed Car is Strong, Light and Close to Production":

The car is strong as steel, half the weight of a conventional vehicle, and can be manufactured in a warehouse full of plastic-spraying 3D printers.

The teardrop-shaped 3D-printed car is an ecologically sound hybrid, and it looks cool, too.

Aerodynamic and futuristic, this car could be a total game-changer for the automobile industry, leading to a rise of small-batch automakers.

Mar

6

Verse on a Window, from T.K Marks

March 6, 2013 | Leave a Comment

I'm looking right now at some verse etched into the frosted glass of a medical center's lobby. Written by the prominent American poet, Robinson Jeffers, I found it poignant enough to pass on.

I'm looking right now at some verse etched into the frosted glass of a medical center's lobby. Written by the prominent American poet, Robinson Jeffers, I found it poignant enough to pass on.

It's a less prosaic way of saying: Nothing changes.

The cycles surely will, as Jeffers attests, but not the grand cycle.

It's the immovable and ineffable force which ensures that the inevitable underlying shifts happen in the first place. As such, the following reads like an ode to the law of ever-changing cycles. And Jeffer's use of the term "Someone", could easily be viewed as an oblique nod to the immovable force.

Someone whispered into my ear

when I was very young

Someone whispered that

what was gone returns;

what has been, is;

what will be, was;

The future is a farther past.

— Robinson Jeffers

Gary Rogan writes:

Totally true unless found in an e-mail with "Sent from my iPhone" at the very bottom.

Mar

6

Italy, from anonymous

March 6, 2013 | Leave a Comment

For anyone who thought the worst is definitely over for the EMU, it might be helpful to watch Italy over the next couple of months. The irresistible force meeting the unmovable rock sort of thing, as the Germans preaching austerity are met by Italians saying no way as they head home for their mid-day pennichella. I thought the European banks were close to being buyable again, but I guess I was wrong. As Carder observed, beware the Ides of March. They seem to be an interesting time for things happening in Rome.

For anyone who thought the worst is definitely over for the EMU, it might be helpful to watch Italy over the next couple of months. The irresistible force meeting the unmovable rock sort of thing, as the Germans preaching austerity are met by Italians saying no way as they head home for their mid-day pennichella. I thought the European banks were close to being buyable again, but I guess I was wrong. As Carder observed, beware the Ides of March. They seem to be an interesting time for things happening in Rome.

Paolo Pezzutti writes:

As an Italian once again I have to observe how prejudices are still widespread. I don't know many people in my country who head home for the mid-day pennichella. I work at least 12 hours a day and like me there many who work pretty hard. Often with low salaries and unfair contracts. This article references the position of the left party (Democratic Party) which is bringing forward, very similarly to other countries in Europe like France, the idea that the kind of austerity we are implementing has very tough implications socially and on the economy (we entered in a deep recession because of higher taxes). One can agree with this position or not, but frankly speaking, I don't think this kind of silly humor is appropriate.

Mar

6

Fly First, Then Land, from Leo Jia

March 6, 2013 | Leave a Comment

You may be extremely upset by serious troubles just happening, but in 10 years, you will be feeling just fine about the current events.

You may be extremely upset by serious troubles just happening, but in 10 years, you will be feeling just fine about the current events.

"Persist until you bleed — otherwise it's not hurting enough." This article is for musicians, but I think it applies well for traders as well.

"Fly First, Then Land: Tips for Classical Musicians" by Cesar Aviles

Mar

6

New New High, from Kim Zussman

March 6, 2013 | Leave a Comment

Yesterday (3/5/2013) the DJIA passed its all-time high (not adjusted for inflation); the SP500 has only a couple % to do the same.

Going back to 1950, daily SP500 closing prices were identified which were both an all-time high (starting at 1950), AND the first such occurrence in 100 trading days. There were 19 such instances. For these 19 new all time highs, checked the return for the next 1 day, 5d, 10d, and 20d - here comparing the means to zero:

One-Sample T: 1d, 5d, 10d, 20d

Test of mu = 0 vs not = 0

Variable N Mean StDev SE Mean 95% CI T P

1d 19 0.0010 0.0059 0.0013 (-0.0018, 0.0038) 0.77 0.451

5d 19 0.0047 0.0117 0.0026 (-0.0008, 0.0104) 1.78 0.092

10d 19 0.0040 0.0185 0.0042 (-0.0048, 0.0129) 0.95 0.354

20d 19 0.0061 0.0257 0.0059 (-0.0062, 0.0185) 1.05 0.309

>>not much; the most promising being the 5 days after new all time highs. Below are the dates:

Date

5/30/2007

2/14/1995

8/19/1993

7/29/1992

2/13/1991

5/29/1990

7/26/1989

1/21/1985

11/3/1982

7/17/1980

3/6/1972

4/29/1968

5/4/1967

9/3/1963

11/1/1961

1/27/1961

9/24/1958

3/11/1954

6/25/1952

Mar

6

Ricardo Lives, from Stefan Jovanovich

March 6, 2013 | Leave a Comment

In his "Essay on the Funding System" (1820) Ricardo concluded that raising money from taxes did nothing to "save" the government the cost of borrowing. Whether the Crown borrowed the money and paid it back with interest or raised the excise immediately, the effect on the public would be the same. With consols yielding 5% (and having, as they did, an infinite maturity but the usual amortization of 45 years) "there is no real difference in either of the modes, for 20 millions in one payment, 1 million per annum for ever, or £1,200,000 for forty-five years are precisely of the same value. To raise the money immediately the excise would have to be increased; and nothing in human experience suggested that the government would the reduce taxes once it had collected the 20 millions. As a result people would be saving more and spending less in anticipation of permanently higher taxes, and the higher excise rates would produce less revenues than the exchequer (or our current CBO) would predict.

In his "Essay on the Funding System" (1820) Ricardo concluded that raising money from taxes did nothing to "save" the government the cost of borrowing. Whether the Crown borrowed the money and paid it back with interest or raised the excise immediately, the effect on the public would be the same. With consols yielding 5% (and having, as they did, an infinite maturity but the usual amortization of 45 years) "there is no real difference in either of the modes, for 20 millions in one payment, 1 million per annum for ever, or £1,200,000 for forty-five years are precisely of the same value. To raise the money immediately the excise would have to be increased; and nothing in human experience suggested that the government would the reduce taxes once it had collected the 20 millions. As a result people would be saving more and spending less in anticipation of permanently higher taxes, and the higher excise rates would produce less revenues than the exchequer (or our current CBO) would predict.

If, instead, the government borrowed the money, more taxes would have to be collected to pay off the interest. But, people's wealth would be undiminished and their expectations about taxes would remain unchanged. As a result the excise would be able to collect, from growth, enough additional revenue to amortize the debt. Ricardo was himself somewhat puzzled by this result; it was confirmed by the facts he had gathered from the experiences of the Napoleonic Wars, but he wondered if the "equivalence" that he had found should be relied on as an economic law. Ever since then economists have emphasized Ricardo's doubts and done their best to ignore the inconvenient evidence.

Reagan had the advantage of understanding Ricardo without ever having read him. As President he had the temerity to reduce the level of growth in government spending in his first budget (1983). His compromise with Speaker O'Neill required the government to commit the sin of continuing to borrow more money to pay the bills already due. Still worse, it resisted the call to virtue by "conservatives" (sic) who wanted to balance the budget by taking more from the people who already paid the taxes taxes. For the next 5 years Federal spending grew but at less than half the percentage growth in private sector wages, incomes and output. This is now entirely attributed to Reagan's dumb luck.

In he year of the Clinton-Bush election, President Bush had already displayed his family's inimitable political tone-deafness by raising tax rates; and candidate Clinton did his best to follow suit by arguing that the rich had not been taxed enough. (One can hear echoes of the Hoover - Roosevelt contest over who would be less profligate.) Yet, in the next 6 years, largely because of the 1994 Congressional revolt, outlays by the Federal government increased at only 20% of the rate at which the economy grew.

We seem to have come to the same place once again. The prospect of ever increasing deficits has made people look for places to squirrel their money away, in bonds, stocks and now - possibly - in real estate. And now, for the first time in 15 years, there is a hint that the government might reduce the rate of growth in its spending. It will be a miracle, of course, if that happens. Given the current intellectual certainty that Keynes had the final explanation for how the earth and the other planets move (never mind Mercury, er, the record of the United States from 1869-1899), it will be even more surprising if economic growth revives. What can be guaranteed is that future textbooks will explain such growth, like that in the 1990s, as attributable solely to the tax increases courageously fought for by a Democrat President.

Here is Ricardo's essay.

The reference to Mercury is a crude shout out to Einstein and Arthur Stanley Eddington. The BBC movie about them is definitely worth seeing. Caution: in typical fashion the BBC offers a postscript which consigns Eddington to obscurity for having, like Darwin, managed to strengthen his faith in God through his scientific discoveries. For us fans of cosmology that brought a laugh. It is precisely Einstein's determinism, which gave strength to his Socialist convictions, that now seems quaintly dated. Eddington's speculations about the universe being "mind-stuff" are, on the other hand, precisely where physics seems to be going.

img.imageResizerActiveClass{cursor:nw-resize !important;outline:1px dashed black !important;} img.imageResizerChangedClass{z-index:300 !important;max-width:none !important;max-height:none !important;} img.imageResizerBoxClass{margin:auto; z-index:99999 !important; position:fixed; top:0; left:0; right:0; bottom:0; border:1px solid white; outline:1px solid black;}

Mar

5

Market Efficiency, from Rudolf Hauser

March 5, 2013 | Leave a Comment

When people talk about market efficiency, they are talking about two different concepts. In one sense, the market can be said to be efficient if no one can consistently outperform the market based on skill. A somewhat weaker form would be more lenient when it comes to consistency. Some would be expected to outperform just based on random luck. If some outperform it, it can't be said for sure that it might not have been based on skill rather than just on luck.

The other sense of efficiency is that the market price is a good judge of the true fundamental value of a security. If this were the case the overall market would not be a volatile as it is. In an efficient market in which the market was indeed a good judge of fundamental values, the annual market return would not deviate much from the long-term required return on the market. All factors that influence value would be correctly evaluated and priced into the securities. But we are not good at forecasting the future. Let us say an unexpected recession hits the economy. We know we will have recessions. The unexpected nature of that recession might just be a matter of timing. But say it is an additional recession. It would mean a year of disappointing earnings, and one would expect the stock to decline by the amount of earnings shortfall. Now if there was a change in the assumption about the nature of the economy it might also require a change in risk premiums demanded. But this occurs much too frequently to blame that. If one does what Hetty Green did and buys in panics and sells in booms, one could do well. The problems come in that the market in this that there are too many factors in the future for any to forecast correctly and psychology influences markets in shorter time spans as do liquidity premiums. If the market deviates from efficient values in this sense, someone who could consistently forecast fundamental values could still fail to outperform because they cannot forecast how much the market will deviate from that true value. They might not have the staying power hold out until the market does return to that true fundamental value. Clearly this becomes more of a problem the shorter one's time horizon. In the very short time span of a trader, fundamental values might have little importance and other market factors might be dominant. Then only the first definition of market efficiency would have any relevance.

In sum, I ask the question are the markets efficiently smart or efficiently stupid and conclude the latter is more likely than the former.

Jonathan Bower writes:

I'd say markets are efficient depending on your time frame and expected holding period. For every fundamental investor that sees a "fair" price, there are a dozen other participants who see a mispricing and vice versa.

Mar

5

Charlie Parker´s 1954 Saxophone and Byron the Con Man in a Dark Alley in Iquitos, from Bo Keely

March 5, 2013 | Leave a Comment

People don't venture after dark onto the Iquitos waterfront because of the rats with two or four legs. So, three years ago when a shadow cast by a yellow lamplight danced over my shoulder I reflected that it belonged to someone who wanted me to know his approach.

People don't venture after dark onto the Iquitos waterfront because of the rats with two or four legs. So, three years ago when a shadow cast by a yellow lamplight danced over my shoulder I reflected that it belonged to someone who wanted me to know his approach.

´Excuse, mate!´ hailed a cheery tenor. I whirled to peer down on a wiry man with a crooked grin and blue eyes that sparkled in the night. ´Tourists shouldn't come here, ya know.´

I laughed, and thrust my hand; as he withdrew and hid his behind his back. With his left he grasped the outside of my fingers and shook, saying, ´Let me explain.´

´Please.´

´I was just robbed! Two blocks away two teen Peruvian thugs flashed a broken fluorescent light in my face. ´I'm a Brit!´ I retorted, and the next instant we were rolling on the ground. One pinned me, the other stuck the bulb in my hand, and as I swooned from pain they stole every Dollar, Pound and Sole I own.´

Slowly, he brought around the right that was bleeding with the little finger stuck out at an awkward angle.

´What are you going to do?´

´That´s the pity. I make my living playing the saxophone, and unless I get 100 Soles ($40) to fix the hand…´ he nearly shed tears.

´Look,´ I advised. I wouldn't be down here looking for a hostel if I had a lot of money. Here’s ten Soles to get you in a doctor's door, and then just plead your case.´

´Thanks!´ he gushed. ´If you see any more tourists out tonight, tell ém Byron the Brit is still searching…´

´I hope I haven't heard the end of your saxophone playing…´ and he vaporized along the wharf.

The next morning I stopped by the Yellow Rose of Texas Café for a macho omelette, and related the incident to Gerald Mayeaux, the expat owner and living record of Iquitos, whom I’ve known for thirteen years. He shook his head, and filled in a remarkable backdrop.

´

Byron is the most prolific con man in the history of Iquitos…´ He hunts for unsuspecting tourists along the streets of downriver Iquitos telling sob stories and tall tales for a few Soles to support his drug habit. He used to be an upstanding young man playing beautiful saxophone at La Noche and along the malecon for a few years until he gradually grew disheveled and strung out. Now hornless, he is the only gringo tough enough to live in the Belen waterfront where he crashes in crack houses, and prowls the streets at night for tourists. He has conned his way into the souls of old ladies and exclusive hotels where he smokes pasta with the air conditioning running, flicking cable channels. His face is on wanted posters around town and he’s been beaten up by robbed victims, but always rebounds as charming as ever.

´But his bleeding hand…´

´The prey was no doubt the predator,´ Gerald insisted. ´I’m truly sorry since it was a great sax hand. I listened to his music for years, and loaned him money… until my heart strings wore out. One day my wife gave him $100, and a week later he showed up desperate for more and ready to cut a deal. I wanted our money back, and so loaned him another $300 and took his hock ticket for the sax at a local pawn shop. After two years the deal wasn't closed, and I took the ticket to the pawn shop and paid $60 to get it out of hock. I didn't know its worth, except that for once I had out-con the Con Man of his saxophone.´

She was a diamond in the rough. The Selmer Mark VI is considered Henri Selmer´s finest saxophone. It is universally regarded as one of the best saxophone models ever produced by any manufacturer and was preferred by the most famous jazz musicians. The first models came out of France in 1954 with the Selmer engraving on the bell and serial numbers. It is called the most famous horn on the planet.

Gerald in the telling brought up Kaleb Whitaker, another expat businessman and musician I've known who would write an account of the sax in his blog Jungle Love. ´I offered Gerald a thousand dollars cash, on the spot, for the sax,´ says Kaleb. He never did take me up on my offer… Yes,the sax is Gerald´s now and, with a broken pinkie, will Byron be able to play like Charlie Parker?´

Charlie who? Jazz may be defined in the four words Charlie Parker and Louis Armstrong. Parker was a jazz soloist and leading developer of Bebop with fast tempos, virtuosic technique and improvisation. His tone ranged from clean penetration to cherry sweet through jazz and on into Blues, Latin and Classical. He was an ideal in the hipster and later Beat Generation subcultures. He blew many saxophones over the years, and toward the end of his life on March 12, 1955 he blew the earliest Mark VI´s.

She was stolen from a display case at the Hard Rock Café in Hong Kong by Byron and his Brit sidekick whom I’ll call Noel. Noel testified to Gerald and Kaleb that one year he and Byron broke a display case at the Hard Rock Cafe which claimed it was Charlie Parker’s horn. It wasn't their first globetrotting nick. Byron simply wanted to play it.

I haven't seen Byron since the night he conned me, but he’s reported still running around the streets of Iquitos trying to kick the habit, buy his horn back, and get his life in shape. He is called by the poor under the dim lamplight the Robin Hood of Iquitos who prefers to give away everything he doesn´t need at the end of the day, and starting out fresh each morning without a dime in his pocket. So who conned whom?

He’s crushed the sax is gone but is unaware the Selmer Mark VI was just appraised and refurbished by a New Orleans virtuoso. It is a vintage 1954 Selmer Mark VI with a serial number that dates the production in Paris on April 27, 1954, one of the first Mark VI´s ever produced. A Selmer Mark VI sells at Ebay and auction houses in the $8-20,000 range. Did Charlie Parker blow on it ´Ýardbird Suite´and ´What Price Love´?

Likely, and the most a Charlie Parker saxophone has brought is $267,000.

Mar

5

Car Sales Plunge 10% in Germany, 12% in France, 17% in Italy; US Plunge Coming Up, from Jim Lackey

March 5, 2013 | Leave a Comment

I see that headline from a finzv blog headline machine. It caught my eye as I am having one heck of a time buying used carz. To find deals to "trade for profit" forget about that last year.. To find one to buy, it's frustrating as all hades and I am wasting too much time looking for a good 10-12k 06-07 used BMX type vehicle.

Of course we know all of this as production fell from 18mm units to 8.5 mm in the crash. So off lease carz lets call them 09's and 2010's are very steep in price. What this does is causes all used cars to go up …seemingly… I talked to a guy this weekend. He had a clean car for me. When I looked up loan value… never mind dealer wholesale I asked him where in the world did you get 11k price? he said its +++ what he paid for it.. I asked what did you pay for it… "you don't want to know" but I guess he can make his 800 off the unknowing.

There is a flood of rebuilt titles due to the extreme high costs of rebuilds. That is a new business. Of course I don't want a rebuilt car… and after Sandy I am sure there will be a flood of flooded out carz.. So this problem is Nashville to Fla.. used car prices are a total rip off and its much better to buy new. Yet I have no idea what the +- over production is a GM vs F and the Koreans are giving cars away with very high residual values with leases. Reminds me of the Japanese when they built Lexus brands in late 90's.

Mar

5

Balancing the Weight of a Feather, from Scott Brooks

March 5, 2013 | Leave a Comment

I found this video fascinating and mesmerizing…….especially the ending.

I found this video fascinating and mesmerizing…….especially the ending.

Ralph Vince writes:

"The intricacies of designing a proper portfolio can often balance on the weight of a feather."

There's a LOT in that statement. The generally-practiced mean-variance style portfolio constructions miss this point however — that a single component can readily offset all other components in the portoflio over time — even if that single component is profitable!

Mar

4

Danger in Deep Skills, Soft Plays, and an Audience, from Greg Rehmke

March 4, 2013 | Leave a Comment

This table tennis video shows a crowd-pleasing point and players with strong skills.

This table tennis video shows a crowd-pleasing point and players with strong skills.

But the contest is held at a casino and the big dramatic play seems as much to entertain the crowd as to win the point.

It is fun to play way back and with experience, a surprising number of deep shots can be returned, just as many NBA players can regularly hit 30- and 40-foot jumpers.

Still, skills for winning a game differ from skills that entertain audiences. Flashy tennis players can return shots between their legs, but just because they can doesn't mean they should. Sinking a jump shot from half-court is impressive, but also signals bad judgement, poor planning, or both. When the shot goes in, the crowd goes wild, but whether a hit or miss, few reflect on the poor play that forced the desperate shot.

So when does the fun of wowing an audience with rare skills overwhelm caution and get us into trouble in the first place? Is a steady and modest return so boring that the chance for a flashy score draws us to danger? In table tennis, when the room is large enough, it is so easy to hit a soft shot then move back to try some deep returns. But if your opponent is skilled and serious, you'll quickly be crushed.

In markets, how often do skilled players drift toward difficult positions where they believe their deep speculating skills can be called upon to save the play, as an approving audience looks on?

Mar

4

Herbert Spencer, from Victor Niederhoffer

March 4, 2013 | Leave a Comment

Herbert Spencer was known for his many unusual hypotheses, all of them untested except for his automatic stair climber. Galton remarked that Spencer was subject to more terrible moments than any as many of his hypotheses were tested by members of The Royal Society and confronted with facts that disproved them. I felt the same way recently with a hypothesis based on trying to capture the vig. If only one could make money by capturing the vig rather than paying it. Well, of course, one of our own, and many others have concluded that selling the etf's short would do the trick. They must pay fortunes in disguised big asked spreads, commissions, churning, sales costs, management fees, assets held in abeyance, and general sluggishness relative to prices paid at the end of days. Well, I decided to test it to see exactly which ones and how to do it. I was ably assisted by 5 or 7 of the best minds and researchers that I know. They did a great job. And one came up with the best methods of doing it, when, and where, and how to rebalance. Finally the only stone left unturned— how much it would cost to do it. The fact that the hypothesis turned on. Regrettably, turns out that borrowing is very costly, so costly in fact that it ruins the profitability. One knows what Herbert Spencer felt like when the Members gave him their sympathies, and raised their eyebrows at the Athenium as they passed him in the Reading Room.

Herbert Spencer was known for his many unusual hypotheses, all of them untested except for his automatic stair climber. Galton remarked that Spencer was subject to more terrible moments than any as many of his hypotheses were tested by members of The Royal Society and confronted with facts that disproved them. I felt the same way recently with a hypothesis based on trying to capture the vig. If only one could make money by capturing the vig rather than paying it. Well, of course, one of our own, and many others have concluded that selling the etf's short would do the trick. They must pay fortunes in disguised big asked spreads, commissions, churning, sales costs, management fees, assets held in abeyance, and general sluggishness relative to prices paid at the end of days. Well, I decided to test it to see exactly which ones and how to do it. I was ably assisted by 5 or 7 of the best minds and researchers that I know. They did a great job. And one came up with the best methods of doing it, when, and where, and how to rebalance. Finally the only stone left unturned— how much it would cost to do it. The fact that the hypothesis turned on. Regrettably, turns out that borrowing is very costly, so costly in fact that it ruins the profitability. One knows what Herbert Spencer felt like when the Members gave him their sympathies, and raised their eyebrows at the Athenium as they passed him in the Reading Room.

A commenter writes:

Thanks for breaking this down. A successful HFT once quizzed me on ETFs, without revealing the purpose. I now hazard a guess that their purpose was indeed on the flip side of what I first suspected After all, they may not be forced to borrow. The interview also included the intricacy of what I had capitalized on for decades: the obligatory decay of certain contracts, primarily Wednesday nights, due to two-day banking settlements. I suspect they have eventually figured out how to arbitrage both.

Steve Stigler writes:

Very nice. You of course recall the passage from Galton's "Memories". Here is a paragraph from a paper of mine in 2007 where I used it:

Very nice. You of course recall the passage from Galton's "Memories". Here is a paragraph from a paper of mine in 2007 where I used it:

In the 1860s a small group of young English intellectuals formed what they called the X Club. The name was taken as the mathematical symbol for the unknown, and the plan was to meet for dinner once a month and let the conversation take them where chance would have it. The group included the Darwinian biologist Thomas Henry Huxley and the social philosopher-scientist Herbert Spencer. One evening about 1870 they met for dinner at the Athenaeum Club in London, and that evening included one exchange that so struck those present that it was repeated on several occasions. Francis Galton was not present at the dinner, but he heard separate accounts from three men who were, and he recorded it in his own memoirs. As Galton reported it, during a pause in the conversation Herbert Spencer said, ³You would little think it, but I once wrote a tragedy.² Huxley answered promptly, ³I know the catastrophe.² Spencer declared it was impossible, for he had never spoken about it before then. Huxley insisted. Spencer asked what it was. Huxley replied, ³A beautiful theory, killed by a nasty, ugly little fact.² (Galton, 1908, p. 258)

Gary Rogan writes:

These days what seems to be popular is for inconvenient facts to be killed by theories, and for the arguments to be about whether the theory is beautiful or ugly.

Mar

4

There are numerous books on Survival Statistics. Here's a good one. And this one that covers trials that end before all patients have the disease. The hazard rate is the failure rate, and it's the key opposite of the success rate. It has simple statistics to determine it's departure from randomness and estimated confidence intervals. I don't like to use cox regression as it's a mixed bag of log, and multiple comparisons that isn't meant for the distributions we deal with. Nor does it do anything but add another 3 names to the 30 average names in all medical papers these days. It obscures the expected life expectancy from the treatment which should always be the end point rather than the phony stuff about succumbing to disease or not. Similarly the expected duration from failure to success which is in the program that so many on this list have relieved from me, is not a very good measure either as who cares how long if the expectations don't jive.

Mar

4

10 Things We Can Learn from Charles Darwin, from Victor Niederhoffer

March 4, 2013 | Leave a Comment

In honor of Pitt.

In honor of Pitt.

Smithsonian has an interesting article on Darwin's house that might be of interest to specs: "The House Where Darwin Lived".

Darwin lived there with his 10 kids and wife for 40 years, and the home adapted to his research and family. Here are 10 things that we might learn from Darwin's house about speculation.

1. Bear in mind at the outset that when Darwin was asked by Galton to fill out a questionnaire concerning his main talents in the 1850s, Darwin said his main talent was speculating in the consols.

2. Darwin established a routine. Every day was mapped out the same way for 40 years. Walk before breakfast, work until 11 am. Walk the dog. Listen to wife Emma read the family letters. Lunch. Read the newspapers (to check on his holdings and plan future speculative undertakings and to see what important flexions he could get on his side. Take a nap. Work from 4:30 to 6:30. Small dinner. Play backgammon or billiards. Listen to wife play piano. Such a routine enables you to speculate when you are prepared and not to let emotions interfere.

3. He listened to music every day. The wife played very well. An interlude to take the mind off the fray of the day, and to enjoy another language, gives one insight into the battle for investment survival.

4. Play some backgammon with the kids. Important to stay young at heart or else you'll be unable to adjust to the new things and ever changing cycles.

5. He had a secret mirror to warn of the approach of uninvited guests so he could absent hide and pretend not to be home. (Gino Paoloochi had a similar trick, although he often supplemented it by always wearing a hat so he could say "of glad to see you. Sorry I am just going out.")

6. Darwin always studied his worms, and beetles each day. We are part of a community with nature, and the same principles that govern nature apply to speculation. Trollope's maid who worked as a governess for Darwin confided to him that she felt very sorry for Darwin as he was so bored that he spent hours at a time just sitting on his sand path, with his looking glass studying worms.

6. Darwin always studied his worms, and beetles each day. We are part of a community with nature, and the same principles that govern nature apply to speculation. Trollope's maid who worked as a governess for Darwin confided to him that she felt very sorry for Darwin as he was so bored that he spent hours at a time just sitting on his sand path, with his looking glass studying worms.

7. Plant a seed properly and a strong oak will grow. "It may be doubted whether there are many other animals which have played so important a part in the history of the human race than these lowly organized creatures".

8. Keep good records. He kept notebooks with all his observations including the play of his children. He watched them play and laugh and cry, keeping notebooks of the human animals they were.

9. Live near the exchange. Darwin lived only 15 miles from London so he would be able to attend the important meetings of the societies, flexionize, and keep in touch with his brokers, and solicitors.

10. Always be ready to change. He was constantly building new paths and extensions to the house as he had to keep up with the change in his circumstances.

In closing the story about the Down House in Kent which is open to the public, the author cites some poetry by Darwin which is timeless and bracing for all speculators.

It is interesting to contemplate an entangled bank, clothed with many plants of many kinds, with birds singing in the bushes, and various insects flitting about, and with worms crawling through the damp earth, and to reflect that these elaborately constructed forms, have all been produced by laws acting upon us. Thus, from the war of nature, from famine and death, the most exalted objects which we are capable of seeing, namely the production of the higher animals directly follows. From so simple a beginning, endless forms most beautiful and most wonderful have been and are being evolved.

Mar

4

Movie Review: Hating Breitbart, by Marion Dreyfus

March 4, 2013 | 4 Comments

You may know a man by his enemies. So goes the adage, which is the guiding principle behind "Hating Breitbart." It fits. A summary of this intense documentary would be a man with a website who forever changed the narrative journalistic paradigm, upending the traditional press and changing the ground-rules of political journalism.

You may know a man by his enemies. So goes the adage, which is the guiding principle behind "Hating Breitbart." It fits. A summary of this intense documentary would be a man with a website who forever changed the narrative journalistic paradigm, upending the traditional press and changing the ground-rules of political journalism.

A year after the passing of media gadfly and truth messiah Andrew Breitbart, an exemplary doc on the brilliant and passionate advocate who was Andrew Breitbart is a biting, often hilarious, usually provocative leave-behind for those who noted his Olympian fight against lies, government distortions and, especially, media skew the size of the Andes.

He died, we were told, of a massive heart attack at 43. What some might not know going in is that Andrew (like his sister, who has strong Mexican blood) was adopted, so his genetic predisposition to heart or related ills was not known. Intriguing factoid: His close friend confided to me that she thought he was related to George Washington's family, since there is a resemblance [of sorts]. She added that Breitbart had tossed the idea around with her, too, so perhaps it tickled his fancy that as an acknowledged, rambunctious avatar of STTP–speaking truth to power– his DNA may have hailed from the Father of the country he so boisterously, and corruscatingly defended to his last breath.

The filmmakers culled his impish wit in hotels,conferences, panels; in cars on the move, with his ever-evident laptop a constant companion as he prepared to speak before appreciative, adoring crowds; in CPAC and at Tea Party gatherings. I attended several of the events he appeared at, where newsies massed in plantations of mics and notebooks around him for impromptu pressers, more often than not attacking him with unwarranted, even bizarre, accusations–desperate to take him down in their zeal to defend against his (what Gandhi called satyagraha) truth force. We see Blazing torrents of righteousness and sardonicism. His take-no-survivors full-on fury at those who tried not to correct the lies he pointed out, but to smear and barrage him from getting to the public with his message, make for amazing viewing. He did not back down when people of note accused the Tea Party protesting fiscal irresponsibility and waste (sound like the current sequester LP saga, eh?) of (baseless) racism. He offered, as we recall, the impressive sum of first $10,000 to anyone who could document even a single call against various black congressmen and "war heroes"–then, when nothing came forward, $100,000 to bring any solid video evidence of anyone calling out the N-word, let alone "15 people calling it out 15 times." With the thousands of cell phones and electronics, cameras and TV crews in evidence, not a single instance of any name-calling or deliberate "spitting" could be adduced or brought forth: No one collected. The charges were fiction.

Same thing happened with Breitbart as he broke the news of Anthony Weiner's …weiner being a public offering on Twitter and perhaps elsewhere. The first thing the press did, again, was to attack Breitbart; Anthony himself spent a good few days denying the evidence of his own underwear and his own privates on parade to college coeds and others of indeterminate but female non-wifehood. The scabrous attacks against him continued. When the truth emerged, and Weiner finally acknowledged his genitalia had 'unwittingly' made the news via his irrepressible obliviousness to how public the social media had become, not a soul of all the cackling hyena media apologized. The cheering section for the Administration failed to apologize for their insistent misstatements and distortions.

There are excerpts from TV interviews on all the major news channels, as well as those prominent for being unwatched but vociferous and consistently against the Fox channel. In most instances, tellingly, the razzing press indict themselves by their crude and unmodulated baying and nonsensical charges.

Breitbart's part in getting ACORN's flagrant abuses against ethical government and lawful policies is another major feature of this riveting doc. We see the two now-famous intrepid young journalists affecting prostitute and pimp as they ask office people in various cities how to cheat the government and get subsidized for bringing in underage South American girls for brothel use. The ACORN-hired and -trained workers colluding in practices both abhorrent and illegal are soon fired. Better, as we know, all of ACORN is exposed for the scam it has long been. Although they have changed their name and still operate under different guises, exposing this scurrilous tentacled scam was a major public service. Likewise, Congressional racism in the Shirley Sherrod case is also covered, with the usual suspects coming under scrutiny and eventual discrediting.

The focus is unswerving and blistering. Righteous indignation rises in the gorge of all viewers (or should). It is also the eponymous name of Breitbart's well-received and popular political scathe, Righteous Indignation. His impish humor is on display throughout, but when he is correctly exercised at media abuses, and they are legion, even today, he is unremitting in his salty censure. Not backing down from absurd charges, he relished his encounters with interviewers less prepared than he for a Brobdingnaggian fray and bruising back-and-forth.

Since no one knew his genetic parents, although he had had premonitions and signs of heart weakness, in the end, he could not, apparently, joust against the only combatant he could not shout down with mirth, brio and witty, palpable integrity. His like will not soon be matched.

In another century, in another country, he would have been an honored presence, a holy jester of counteraction. A year post-attack, Breitbart is sorely missed: He would have lots to merrily debunk.

Mar

4

The Art of the Pump, from Brian Cauthen

March 4, 2013 | Leave a Comment

Dear Laurel and Victor,

Dear Laurel and Victor,

I wanted to thank you both for your inspiration and detailed analysis through your website and books. I am the proud owner of The Education of a Speculator, Practical Speculation, and Fifty Years on Wall Street. Victor's teachings have taught me to look at markets from a different viewpoint. His views on capital markets are unprecedented and his lessons are invaluable. For that I thank you both.

I currently am 26 year old, full time trader and researcher. I have been working on a piece (see attached) after observing the fallacy of trading euphoria as I call it. I know I may not be as experienced as some of the other contributors to the site but I'm hoping that you may find the article informative at the least and worthy of a post on the website. If not no worries, thank you again for your time and consideration.

Keep up the great work.

Sincerely,

Brian Cauthen

= = = = = = = = = = = = = = = = = = = = = = = = = = = = =

The Art of the Pump by Brian Cauthen

I had the privilege of watching the $CBMX "pump and dump" on Thursday afternoon. Within one day this stock rose from $2.86 to a high of $7.64 off nothing more than hype from a simple news article.

Although some variables tend to differ, the majority of pumped stocks over the years have similar basic characteristics.

A Pumped stock churns higher at obscene fundamental levels with high spreads and no predictability in a short span of time.

Within minutes manipulation swarms social media fueled with frauds and pumpers talking about long term valuation and balance sheet statistics of the pump.

PR's, blogs, insiders and online "trade rooms" help promote the stocks as they advance and squeeze, catching initial shorts by the pants.

All at once the rug is pulled, sending longs into a panic dumping shares. The insiders and front runners are way out by now. We may see an additional attempt to regain footing back to highs but that is usually overtaken by hesitant longs begging to get out due to new uncertainty.

Social media ramps back up with gurus claiming how they mentioned the high and are now short the stock catching easy gains. The bag holders are screwed losing large amounts of cash, vowing to never get fooled again.

The SEC charges the PR firm and insiders with fraud. The parties admit no wrong doing and settle for fractions of the profits made off the pump.

Wash, rinse, repeat.

Some of the most notable pumps of all time include $LEXG(April 2011) $BVSN ( March 2012) and $ROSG (August 2011 and May 2012).

Deceit and promotion for self advancement at the expense of others is nothing new on the Street. The part that worries me is that it's becoming the norm.

By the close Friday afternoon $CBMX was trading at $5.27, down 30% from the highs.

Mar

4

The Market Mistress is Stalking You, from Craig Mee

March 4, 2013 | 2 Comments

Have you ever had to deal with a stalker? It could just as easily be the Market Mistress.

Have you ever had to deal with a stalker? It could just as easily be the Market Mistress.

And to understand the market mistress we must better understand each of the

following:

Common Stalker Characteristics

- Jealous

- Manipulative

- Narcissistic

- Deceptive

- Obsessive and compulsive

- Falls instantly in love

- Socially awkward or uncomfortable

- Needs to be in control

- Depends on others for sense of self

- Unable to cope with rejection

- Sense of entitlement (you owe me!)

- Unable to take NO for an answer

- Does not take responsibility for own feelings or actions.

Mar

4

How Things Fall Apart, from Jim Sogi

March 4, 2013 | Leave a Comment

Complicated things of high quality don't just break down in a big cataclysm. Take a modern car. They are well built. The engine will last for half a million miles if properly maintained. However it is the little things that start breaking: the plastic ashtray falls out, the rubber seals wear, the bearing start getting loose, the fabric tears. These little things can get more serious. If the seal leaks, and the oil is low, the engine can wear prematurely. The shocks wear, and the ball joints go. The steering gets loose. Small things can lead to bigger problems. Take a modern city, like New York in the 70s. First it's some graffitti, then some broken windows, soon vagrants move in, garbage piles up and the city head to bankruptcy. It's the small things first. Take a huge economy like the US. The GDP isn't going to fall apart. Employment probably won't go off a cliff. It's going to be small things first. Take a corporation. The earning won't collapse right off. It will be receivables up, inventory up, sales down, or even smaller things. Maintenance up, or down. Take a market like the Nasdaq.

Complicated things of high quality don't just break down in a big cataclysm. Take a modern car. They are well built. The engine will last for half a million miles if properly maintained. However it is the little things that start breaking: the plastic ashtray falls out, the rubber seals wear, the bearing start getting loose, the fabric tears. These little things can get more serious. If the seal leaks, and the oil is low, the engine can wear prematurely. The shocks wear, and the ball joints go. The steering gets loose. Small things can lead to bigger problems. Take a modern city, like New York in the 70s. First it's some graffitti, then some broken windows, soon vagrants move in, garbage piles up and the city head to bankruptcy. It's the small things first. Take a huge economy like the US. The GDP isn't going to fall apart. Employment probably won't go off a cliff. It's going to be small things first. Take a corporation. The earning won't collapse right off. It will be receivables up, inventory up, sales down, or even smaller things. Maintenance up, or down. Take a market like the Nasdaq.

Leo Jia writes:

These are very insightful. Our bodies are about the same. And while the destruction process happens this way, it is interesting to note the creation process is also quite like this. First, small trivial things get created, then the large more significant things. All things seem to move like this in circles. Bubbles start small, grow big, then shrink a little, then burst.

Jim Lackey adds:

Hold on ther' hoss. The first thing we do, it wash, feed and stable the horses before the cowboys. This car post caught my eye. If the simplest part breaks, a mass air flow sensor, the engine runs rich and bad things happen. Yet we have a dummy light! Even back in the day we had dummy lights for high temp, or low oil pressure. These little 25-200 dollar parts break on brand new machines. Take the worn out 100k 7 year old car. Yes what you say is true. 35 years ago the 100k car may be dead in the crusher for scrap. Today what people thing of the heart of the car is the engine. With CNC , CAD and CAM all short for, computers do not have UAW contract for, tired nor sick nor go out of whack and slap together the last V-8 at the end of bowling night. Therefore the engines are designed and build and installed to Engineer spec. They do last for 250k. Most but not all of them do 250k except for the short cut copy cat Far East red flag waiving commies BYD my 6.

The little things that are build to spec yet cant possibly last for 7-12 years as you say rubber O rings, Balls joints, tie rod end,s brake rotors struts all must be changed or maintained. The most complex and weakest link of the chain on new cars is automatic transmissions. I made one the of the worst mistakes trading this week. I was taught about racing cars bikes and anything with an engine, failures. In a way we kept track of the max min wait time on a failure of a part. We change them at or before the median failure time. I forgot all about that for our trading. Didn't lose, it was much worse than that to a racer not winning is as painful as being on fire.

One spec posted a customer service report on cars and diamonds weeks ago. The gist was one man said change all parts. The other man said wait 5,000 miles. The implication was the second man said wait, and was best. What wasn't taken into account was two things. The performance of the car and his safety and time of a second trip to the shop. Other was the parts probably were not in stock at dealer B. There fore the guy simply told what most want to hear, no money today rather than we will have to keep your car over night as the parts are coming off the ship from Japan.

The discussion also goes to medical. too much of medicine is based on illness. When talking to my Docs and their ranges for normal I burst out and said, your kidding right? How do basic stats escape Medical training? How much better can we all feel if we did X and Y do the the people all wait until a breakdown and see the Doc for solution which prescribed as X. I know why. I did the same thing last week on my trading. I didn't consider wellness. I was waiting for the market to become sick then do trade X. My trading doc even warned me and kept me from having a bad loss. He was focused on wellness ( is best I can describe) I was looking for the illness. (Okay so the markets went 1530 to 1490 and I said why not wait for 1475 to come in? I pull my racing pits cap over my head and tell the wife, at least I didn't lose short)

How much better will a car perform with New tires brakes and rotors vs a car with 5,000 miles of anecdotal testimony to wait. I can give you the stats on new vs 20k or 40k miles and after one race on a real car. Racers change brakes and tires after each and every weekend. We rebuild engines most every weekend depending on class. In some pro classes we rebuilt engines after every single 1/4 mile run, new pistons, rods and bearings, Valve sprints and retainers, all seals and gaskets.

What the anecdote above states is the engine will run for 250,000 so then to should the car. Yet the car will not move with a broken ball joint. The engine will die with a broken timing belt and over heat with a bad water pump, that now last to 110,000 miles. So the engine system is still only good to run for 110,000 miles. The trans and rear end gears all die at 125-150 and the fuel pumps and all do the same. The catalytic converters die way before this. Most cars have a 5 year 100,000 mile warranty on the drive train. Its only 3/36 or 5/50k on bumper to bumper.. The emission control systems or parts are now only good for 80,000 miles.

So in theory your car is now worse than a 1969 model. It will break down and be non drive able 20,000 miles before the 1969 model died and went to the crusher. Yet your correct, at 80k miles your car will be fixed for 1,000 bucks and in 69 you needed a new engine trans and every hose belt and switch was dead.

This entire deal of failures was burned into my trading memory banks for life. I used it in some ad hoc way since MR Vic showed me in 2004. Yet the advances in his technology on how to quickly repair the trading engine and have it on the road to profitability was lacking by lackey.

The story I wrote about my teenager failing to appreciate the need for trans fluid made me dump the BMX van for 25% above scrap rates to a new friend. I am now shopping for a good used van. There is also a meme on pricing of used vs new cars. We try not use never always when it comes to life. Yet the financial advice out there has man a never and always do.

Too many men are all over the past 10 year return of stock at or about nil. The we are in a range trader calls have been falsified many times this decade. The SPU made a high in 07 the Russel or what ever made a high this year. Yet its true and maybe always is tr that not all stocks make a new high as the joke is many stocks fail to exist, survivor ship bias. Its all mumbo as they use all or this or that index.

Then to say all new cars have engines that run to 250k miles and do not fall apart all at once.. is also false. A brand new car has the ability to shit down or go into safe mode. Its broken according to our ladies who drive. It can only be idled at 35mph to your local shop. With palladium and platinum are such high prices the emission control systems are too expensive. The cars heart is not the engine, it never was the brain. It used to be the driver and the mechanic. Now its a computer. We have fire trucks that will not start if the diesel engines emission system is on soot burn mode.

Now we have computers in control of making markets for the global stock and futures markets. All economic reality seems to be lost in the short term. If political hack from Berlin says A and EU hack said confirm A and US is about to have a press conference you can forget about the next four hours prices being predictive. The markets computers go into safe mode. They will move and shut down quickly and we must, as traders idle at 35 MPH to our local dealer of data to find out what happens next after that part failure.

For what ever reasons I have gained my passion for markets back. Of course we know where we lost it. What makes men take risk? What makes risk takers skip a generation? Is that true? I had a friend as me this week about becoming a spec. I asked him to answer this one question. Would you rather trade your money and take risk per 500k account to eeke out a living or use another mans money and take 20% of profits yet no fees? I have asked this Q so many times and it reveals much about a mans capacity to take risk, yet most important to take pain. Ya see racers, we do not care about losing crashing or getting hurt. Its part of the game. We do not like losing, yet not winning that is so painful, like I said we wear fire suits and not winning is as bad as completely destroying your car on driver error and being on fire.

The gist of the answer is if your rather trad OPM you do not belong in the hours 1/2 day markets, ever. Do not do it..It has to be the hardest way to make a living. The easiest way if you have any capacity to sell or raise money is ride the tides and collect a fee. I am sure you can find a way to make a firm stand on the middle ground. Some fine research and pick some fine stocks and short some over plus commodities after the bubble has been busted and hold that roll that for years. Now you have the ability to take down a small fee and a profit incentive.

What has changed my attitude is being certain about one thing. These markets change direction and patterns change so quickly its fast, like racing and Fun! Where in the hades have I been the past few years not to look at all of this as a positive thing for, me. I love to go fast. lack

My motivational quotes for this week attached.

August 1908 issue of a periodical for bicyclists called "Bassett's Scrap Book". A short item contrasted the modern age to ancient times and presented a variation of the epigraph:

"Naram Sin, 5000 B.C. We have fallen upon evil times, the world has waxed old and wicked. Politics are very corrupt. Children are no longer respectful to their elders. Each man wants to make himself conspicuous and write a book."Johnson's often-quoted definition of genius, "the infinite capacity for taking pains."

"genius is inspiration, talent and perspiration." Kate Sanborn

The President of the Old Speculator's Club, Jack Tierney, writes:

I seem to recall the name

Carnegie's "Gospel of Wealth" idea took his peers by storm at the very moment the great school transformation began—the idea that the wealthy owed society a duty to take over everything in the public interest, was an uncanny echo of Carnegie's experience as a boy watching the elite establishment of Britain and the teachings of its state religion…Since Aristotle, thinkers have understood that work is the vital theater of self-knowledge. Schooling in concert with a controlled workplace is the most effective way to foreclose the development of imagination ever devised. But where did these radical doctrines of true belief come from? Who spread them? We get at least part of the answer from the tantalizing clue Walt Whitman left when he said "only Hegel is fit for America." Hegel was the protean Prussian philosopher capable of shaping Karl Marx on one hand and J.P. Morgan on the other; the man who taught a generation of prominent Americans that history itself could be controlled by the deliberate provoking of crises. Carnegie used his own considerable influence to keep this expatriate New England Hegelian the U.S. Commissioner of Education for sixteen years, long enough to set the stage for an era of "scientific management" (or "Fordism" as the Soviets called it) in American schooling. Long enough to bring about the rise of the multilayered school bureaucracy. But it would be a huge mistake to regard Harris and other true believers as merely tools of business interests; what they were about was the creation of a modern living faith to replace the Christian one which had died for them. It was their good fortune to live at precisely the moment when the dreamers of the empire of business (to use emperor Carnegie's label) for an Anglo-American world state were beginning to consider worldwide schooling as the most direct route to that destination.

Mr. Krisrock writes:

This happens when there is a world price for labor…that American foundations arranged for 100 years.

Jack Tierney responds:

I'll go along with the parts played by American foundations, but not the 100 years. In a recent book by David Horowitz, "The New Leviathan," he points out that many of the great foundations we still hear so much about have wandered substantially from the goals envisioned by their founders.

Among them are the Ford and Rockefeller foundations, as well as those of Pew and John MacArthur. Each accumulated substantial fortunes in very capitalistic endeavors…and expected their trusts to continue to promote efforts in that direction.

At first this worked as the initial appointed trustees were chosen by the benefactor. Over the years, however, (and this relates to my initial post) subsequent trustees went off in their own, very contrary direction. inevitably, they labeled these modifications as "progressive," a catchall phrase that seems to excuse almost any perversion of original intent.

Most of these changes in direction have occurred over the last 50 years as the original trustees passed away or retired. Only Olin was prescient enough to "sunset" his trust to forestall this drift.

Mar

4

“You Can’t Time the Market”, from Peter Saint-Andre

March 4, 2013 | Leave a Comment

One of the mantras of those who would convince us individual investors to buy and hold is "you can't time the market". The slogan seems to mean that you can't precisely time the exact bottom and exact top of any given market cycle. But that's a strawman: you don't need to buy on the very day that the market bottoms and sell on the very day that the market tops. Instead you only need to avoid buying when the market is overbought, overbullish, and overvalued, when cyclically adjusted P/E ratios are high, when the Q ratio is high, etc.; and similarly for selling.

One of the mantras of those who would convince us individual investors to buy and hold is "you can't time the market". The slogan seems to mean that you can't precisely time the exact bottom and exact top of any given market cycle. But that's a strawman: you don't need to buy on the very day that the market bottoms and sell on the very day that the market tops. Instead you only need to avoid buying when the market is overbought, overbullish, and overvalued, when cyclically adjusted P/E ratios are high, when the Q ratio is high, etc.; and similarly for selling.

Other than broker marketing materials, does anyone here have a good citation for the source of this old bit of market "wisdom"?

George Parkanyi writes:

It's the mantra of the mutual fund industry (a) they want you to stay put so they can keep the fee stream going (they make money whether you win or lose), and (b) don't like you moving the money around from fund to fund because then they have the hassle of redemptions/re-balancing and/or parking your money in lower MER funds such as money-market for extended periods of time.

Ralph Vince writes:

I've met people who can time the market.

And I would also say that it isn't necessary to do so.

There are many ways to be successful at this. It's a matter of finding what works for the individual, to find his groove. And it is precisely THAT which is the hard part.

Mar

4

Florida Sinkholes, from Pitt T. Maner III

March 4, 2013 | Leave a Comment

1. A sad story.

1. A sad story.

'Officials at the Seffner home where a sinkhole swallowed a man late Thursday call it a "chasm" and say it will continue to grow.

At a news conference this evening, Hillsborough County sheriff's Deputy Douglas Duvall, the first emergency responder on the scene, said he didn't know what to expect when he entered the house. Inside, he found the entire bedroom floor had collapsed, and Jeremy Bush was in a hole 10 feet deep, trying to climb out. Duvall managed to pull Bush out.

Jeremy Bush jumped into the hole trying to rescue his brother Jeffrey Bush, who was in bed when the sinkhole opened up beneath him.

Engineer Larry Madrid called the situation "unprecedented" and that the edges of the hole are very steep and very unstable, which means it is likely to continue to expand.'

2. The Florida Geological Survey website on sinkholes.

3. The Winter Park Sinkhole swallowed a Porsche dealership in 1981.

4. "You can almost predict sinkholes will occur when it's dry and lots of pumping occurs or when water levels are low and we get a big rain, or when there's a need to pump large quantities of groundwater over a short period of time," Ann Tihansky, a scientist with the U.S. Geological Survey, told The Times. "They are definitely tied to specific conditions or events."

5. Tihansky's paper on sinkholes in west-central Florida (good overview of the problem).

Mar

4

Chinese Eugenics Article, from Tim Melvin

March 4, 2013 | 2 Comments

Sorry for the link but I found this article fascinating and worthy of the share…

Sorry for the link but I found this article fascinating and worthy of the share…

"What Should We Be Worried About"

Chinese Eugenics

China has been running the world's largest and most successful eugenics program for more than thirty years, driving China's ever-faster rise as the global superpower. I worry that this poses some existential threat to Western civilization. Yet the most likely result is that America and Europe linger around a few hundred more years as also-rans on the world-historical stage, nursing our anti-hereditarian political correctness to the bitter end.

…

David Lilienfeld comments:

Four thoughts on reading this piece:

1. Every time someone tries to selectively breed a population, you get lots of unexpected diseases showing up. Sometimes, those diseases affect only a small segment of the target population. Other times, a larger segment. I doubt that this effort will be any different in result–and it may result in a higher rate than the Chinese are prepared to accept. Imagine, for example, that the process results in 5% of the target population having an accelerated version of dementia, perhaps starting in the early teens–before these individuals have much ability to use their IQs to advantage (contributing to the society). The costs of care will challenge China in ways it hadn't anticipated, particularly given the population implosion already in place. Moreover, one doesn't know if these alleles code for a protein, serve a regulatory function, or both. Taking the alleles out of the genome could, potentially, interrupt their ability to function in the manner expected. So I don't think it's necessarily "game over".

2. Malcolm Gladwell noted in Outliers the value given in East Asian societies to patience, something lacking profoundly in Western societies these days. However, if one starts to breed a specific genome, do those individuals have the same willingness for patience? I don't think that we know that this advantage in East Asia is simply cultural. There's also the need for innovation. East Asian societies do well in innovations in quantitative areas, but translating that strength to the consumer/business arena hasn't been so straightforward. Until there's a demonstration of consistent innovation from those societies, this will be a question mark. Now, how long before such innovation becomes visible? I have no clue. Perhaps this activity is already present and I've just missed it (in which case I'm sure those on this list won't hesitate to provide some education of the fact).

3. There's a related issue: the social dimension. What sort of society results from such breeding? I'm reminded of the Foundation trilogy–the First Foundation engages in all manner of production advances–lots of innovation, etc. There's rumored to be a Second Foundation, but it's not really clear what that entity is all about, or even if it exists. (Spoiler alert): It's the Second Foundation, with its sociological orientation that comes into play and addresses the sociological and related problems resulting from the First Foundation's success. (The trilogy makes for short reading, and it's some of Asimov's best science fiction.)

4. The sociological dimension isn't a minor one in China. Chinese sociology isn't one of the country's strengths, and I think that's part of the reason Chinese epidemiology is weak. Even if this area becomes a focus of development by the Chinese government, it seems unlikely to change for at least one generation, more likely two or three. The nature of sociology works against efforts to speed up capacity and capability in it. I suppose one could let any social changes occur and deal with them piecemeal (as we have with our drug problem–locking up 2-3% of the population), but I don't know that that would be acceptable in such a new society. I'm speculating, though.

Just some initial thoughts. It is provocative, I agree.

Russ Sears writes:

The reason eugenics does not work on humans is simple. They are using the wrong evolutionary strategy for our species. We are not a survival of the fittest species. We are a "Survival of the First" species. We have dominated a vast new land called abstract thought. Further, we are a species of super cooperators when the cooperation is through mutual respect and trade-offs we exponentially increase each others wealth. Putting this together we, have captured vast new resources of wealth.

If you want a superior more competitive people you do not measure by the conformist standard of the "greatest" in XY or Z. Even if X, Y, and Z are abstract thoughts, it is not NEW abstract thought, it is standardized testable conformist abstract thought. You measure in how much risk they willing to take, how much they want to be the "first", how they want to try new things, how they look at failure not as a step back, but one less step to the right path and how much they value Liberty and unsupervised willingness to risk failure for the chance at great success. You give yourself a group of people willing to risk losing everything for a fresh new start, because they believe working together, they have what it takes to create a new world for themselves. You breed those entrepreneurs with those who love entrepreneurs. Then you have people that create new wealth, because they did not do what they were told. They had a dream and saw a vast new land in being the first in this new niche area. Once the path to this vast new wealth are clear, then many people will willingly follow. If you want to live where leaders believe they earned their authority by superior skills, NOT correct risk taking, then you will find a world where the leaders are those best at tearing everyone down, do not value diverse thinking from their expertise and taking from those that took correct risk to create the wealth.

Mar

4

The Junto will be held Thurs. March 7th

The Junto will be held Thurs. March 7th

Time: 7:30 pm

Place: 20 West 44th St., ground floor

Cato Institute senior fellow Brink Lindsey will speak about "The Folly of Nostalgianomics," his term for the celebration of the post-World War II quarter century that has been popular among commentators like Paul Krugman.

Brink has written me:

"I'll address the puzzle of the 'Golden Age' of the post-WWII quarter-century, which was a period of (a) impressive economic gains and (b) heavy government intervention in markets. I will resolve the puzzle by showing that conditions for economic growth were much more favorable then than subsequently–and therefore even very bad economic policies were consistent with strong economic performance.

"Accordingly, the claim that we should go back to 90% top tax rates and heavy unionization (or equivalent types of government intervention) because we had those and high growth in the 50s and 60s is on a par with claiming we should institute widespread corruption and censorship because China has them and is growing rapidly.

"I can also address claims that living standards haven't improved since the 70s. This is demonstrably untrue, although it is true that (measured) productivity growth since the 70s has slowed down and so have (measured) income gains, especially for less skilled workers."

As is usual with Junto meetings, the evening will be highly interactive, with plenty of opportunity for comments and questions.

Hope you can make it!

Gene Epstein

Junto Moderator

Mar

4

Smith, from Victor Niederhoffer

March 4, 2013 | Leave a Comment

Smith is like the perfect example of the regression bias. Whenever he scores a lucky 3 pointer, they give it to him the next 5 times, and then luck is random, and his below average skill takes over and the Knicks lose the way they did to Miami today as they have so often in past, and especially when they take Stoudemire out and leave Smith in. Shades of Gallinari and Antoni.

Mar

3

Legacy of the Bolivarian, from Pitt T. Maner III

March 3, 2013 | Leave a Comment

Chávez's sustained electoral success is remarkable because he managed to achieve it despite a dismal economic and social performance. Since 1999, the year he took over the presidency, Venezuela has had the lowest average GDP per capita growth rate and the highest inflation of any Latin American country except Haiti. It has also seen a fivefold increase in assassinations to arguably the highest murder rate in the world. In spite of having the largest oil reserves in the planet, he managed to reduce Venezuela's share of OPEC oil output from 4.8% to around 3%. He also managed to stimulate the largest out-migration of Venezuelans in memory.

David Lillienfeld writes:

Your operating assumption is that the election was an honest one. I don't think one can assume that.

Pitt T. Maner III comments:

I think the writer of the article, Ricardo Hausmann, an economics professor at Harvard (Director of the Center for International Development there and also a former Venezuelan Minister of Planning) makes it fairly clear that Chavez held on to power dishonestly using a mixture of 4 techniques. The techniques have a certain familiar sound and have been used by others in the region. A touch of Machiavelli. With cronyism on a massive scale using enormous petroleum revenues and additional borrowing.

One wonders how successful the post-Chavez transition will be and what impacts it will have on oil and regional affairs.

At any rate, Hausmann writes in the article of Chavez's methods:

"First, undermine checks and balances. You can use it to eliminate any separation between party and state, so as to make government social programs a privilege of the loyal, not a right of all deserving citizens. Create a very large civilian army of political activists that are handsomely compensated by the state for their party work. Limit individual rights, expand controls on everything, including prices and access to foreign currency, and give yourself the power to nationalize any business you choose. That way, people will not want to get on your bad side. "Judicialize" politics by using the courts to put your enemies in jail or threaten them with prosecution. Make it really costly for people to oppose you. Let your collaborators steal generously, and make sure that they know you know about it. That way, they will never dare to betray you.

Second, dominate the airwaves. Limit the airing of critical views with carrots, such as government spending on ads, or by threats of fines, jail or expropriation. Act on these threats with some regularity to refresh people's memory. Leave some room to your adversaries but make sure you achieve a 30-to-1 balance of airtime. That way you can create your own narrative and prevent them from creating theirs.

Third, in choosing your narrative, be creative. Don't be limited by truth, reality or common sense. If your country does not have an external enemy, invent one. Whenever you fail, blame a conspiracy. Given your control of the airwaves, by the time people find out there is no truth to your old lies, you will have created 20 new ones.

Fourth, dehumanize your adversaries. Don't debate them or grant them any form of moral recognition. Never extend the phrase "my fellow citizens" to include those that don't vote for you. Borrow a page from the 1930s and adopt a worldview in which institutional formalities only lead to gridlock, to the benefit of the enemy. Ask for complete delegation of power from the "people" to their "dear leader" so that he can crush the enemy. Dispense with other complicated formalities. "

Mar

1

Conservation of Energy, from Victor Niederhoffer

March 1, 2013 | Leave a Comment

Conservation of energy moved from stocks to gold around 8am with gold going up fast 20 bucks. Now one will see if stocks imitates the gold like the spider the caterpillar.

This chart shows rise in S&P that began at 9:40 as well as rapid rise in gold that occurred about 8:00.

sp (yellow) and gold (white) on same chart.

Mar

1

World’s Oldest Trader, from Pitt T. Maner III

March 1, 2013 | 2 Comments

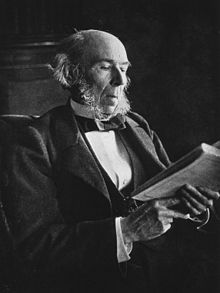

Irving Kahn is the oldest trader on Wall Street.

Irving Kahn is the oldest trader on Wall Street.

Here is a picture of Irving Kahn included in special free section of Nature on aging.

Mr. Kahn is now 107.

Correction:

World's oldest Value Investor. Duly noted (hat tip to Mr. Melvin) that Irving Kahn is a former Ben Graham assistant and likes to buy and hold for long time– and not really a "trader" per se.

From the WSJ:

Discipline has been a key for Mr. Kahn. He still works five days a week, slacking off only on the occasional Friday. He reads voraciously, including at least two newspapers every day and numerous magazines and books, especially about science. His abiding goal, he told me, is "to know much more about the stock I'm buying than the man who's selling does." What has enabled him to live so long? "No secret," he said. "Just nature's way." He added, speaking of unwholesome lifestyles: "Millions of people die every year of something they could cure themselves: lack of wisdom and lack of ability to control their impulses."

Here is a link to his current portfolio (he includes a land-based driller).

Leo Jia adds:

Wondering if the strategy of buy-and-hold can make one live longer than the strategies of short-term trading. It may seem to have some merit in the sense that a buy-and-hold'er has a very long-term prospect, and the long-term mind in-turn affect his body in ways of body-mind interaction.

Mar

1

Guidance from the Exchange, from Vince Fulco