Dec

5

Buying the S&P, from Ken Drees

December 5, 2009 | 3 Comments

Buying the S&P today [2009/12/04] after the run up since March, throwing in the towel because this employment news means the economy is turning around, is akin to buying that stout, fat blood bay gelding team hitched to the most beautiful painted wagon ever seen. Arsenic fortified fiends, a la Ben Green. As soon as you buy them, they start losing weight, losing pep, losing beauty, losing power — powder on a knife, turn your back and walk away.

Kim Zussman questions:

How would you participate as a market Asperger if the market:

- Became a vehicle of change for the powers of evil

- Cheers only the flaws and mistakes of capitalism and human nature

- Makes you money only when your bets are cynical, or in the opposite direction of your beliefs

- Moves are 100% random, with an occasional bone thrown to keep you paying vig and (especially now) taxes

Dec

5

The Village Idiot’s Take on COT, from George Parkanyi

December 5, 2009 | 4 Comments

I looked at my little COT summarization service and the conclusion is one has a pretty one-sided speculative long trade in commodities. Funds are buying, commercials are selling.

Here are the markets that, in the past 18 months, large specs have never been as net-long, and commercials never as net-short as of this past Tuesday …

- Cocoa

- Gold

- NASDAQ

- Platinum

- Lumber

- Rice

- Soybean Oil

- Mexican Peso

- Hogs

- VIX

- Swiss Franc

And the ones that are only slightly off the extreme polarization — within the 10% percentile…

- Yen

- Cotton

- Copper

- Orange Juice

- 2 Yr Treasuries

- Australian Dollar

- Kansas Wheat

Expand to the 15% percentile and you pick up…

- Crude Oil

- 10-Year Treasuries Canadian Dollar

- Silver

Within the 10% percentile going the other way — commercials substantially net-long and specs substantially net-short are just…

- Natural gas

- Interest rate swaps

- 30-day Fed Funds

A couple of interesting things:

2 year and 10 year T-notes are very popular with specs, while the 5 year notes are substantially the other way — big divergence. (What — 5's an unlucky number?)

Both commercials and large specs are substantially long against small specs who have a very large net-short position in S&P e-minis.

George Parkanyi, Canadian telecom entrepreneur and ETF trader, blogs at StockAdventures.

Dec

4

Haiku Doublet, from Ken Drees

December 4, 2009 | 1 Comment

Market Mirror Mood

After buying spoos

Energy drains from my face,

I am now hunted.

Market mirror mood.

Unwind and then look again,

I am now haunted.

Dec

4

Rocky Humbert is My New Best Friend, from George Parkanyi

December 4, 2009 | 5 Comments

Yesterday Rocky and I had a little phone chat and we were talking about gold and looking at different scenarios. Gold was well over $1200. Then he said with the conviction of 1+1=2 — "One thing is for sure though, you will see gold back at … (pauses to check something) … $1157."

Yesterday Rocky and I had a little phone chat and we were talking about gold and looking at different scenarios. Gold was well over $1200. Then he said with the conviction of 1+1=2 — "One thing is for sure though, you will see gold back at … (pauses to check something) … $1157."

So today, I've still got the munchies from my post-colonoscopy Valium high, I turn on the TV in the kitchen and there's gold on the crawl at $1156! I just about fell off the stool.

I will now be praying five times a day towards Connecticut. If you too would like to join my new religion, here's Rocky's blog.

George Parkanyi, Canadian telecom entrepreneur and ETF trader, blogs at StockAdventures.

Dec

4

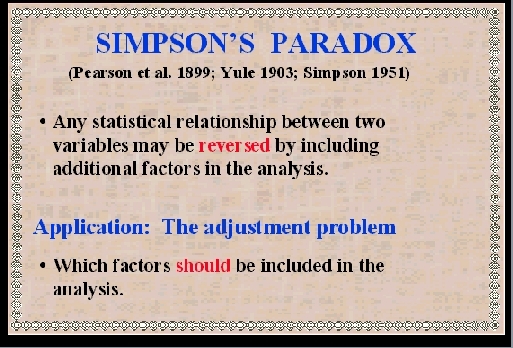

Simpson’s Paradox, from Phil McDonnell

December 4, 2009 | Leave a Comment

There is a very timely article in the Wall Street Journal that discusses Simpson's Paradox (a form of aggregation fallacy) and other statistical myths. A brief snippet:

There is a very timely article in the Wall Street Journal that discusses Simpson's Paradox (a form of aggregation fallacy) and other statistical myths. A brief snippet:

Is the current economic slump worse than the recession of the early 1980s?

Measured by unemployment, the answer appears to be no, or at least not yet. The jobless rate was 10.2% in October, compared with a peak of 10.8% in November and December of 1982.

But viewed another way, the current recession looks worse, not better. The unemployment rate among college graduates is higher than during the 1980s recession. Ditto for workers with some college, high-school graduates and high-school dropouts.

So how can the overall unemployment rate be lower today but higher among each group? The anomaly is an example of Simpson's Paradox — a common but misleading statistical phenomenon rooted in the differing sizes of subgroups. Put simply, Simpson's Paradox reveals that aggregated data can appear to reverse important trends in the numbers being combined.

Dr. McDonnell is the author of Optimal Portfolio Modeling, Wiley, 2008

Stefan Jovanovich writes:

There may be a simpler answer: the BLS is now using a base 12 numbering system. From the report: "About 2.3 million persons were marginally attached to the labor force in November, an increase of 376,000 from a year earlier. (The data are not seasonally adjusted.) These individuals were not in the labor force, wanted and were available for work, and had looked for a job sometime in the prior 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey."

For those who do not know labor-speak, "searched for work" is a term of art. It means that the person did not report a job search to their state Labor department. And why did the unemployed person fail to show up and tell the clerk behind the desk that they had looked for work? In most cases, it is because the person was no longer entitled to receive unemployment benefits and he or she had ceased to find any humor in reading the same stale job listings posted on the bulletin board. In California right now those receiving benefits do not have to report their job searches because the EDD (Employment Development Department - how is that for an Orwellian name?) computer system has crashed. The BLS has not yet excluded California's unemployed who are receiving benefits from the total who are officially counted as unemployed, but that may be coming soon. "Statistics! I'll show you statistics!" said the academic Federales in answer to the question about badges.

Dec

4

Let He Who is Without Sin Cast the First Stone, from Alan Millhone

December 4, 2009 | 2 Comments

Personally I have had enough of Mr. Woods all over the news. We all have more pressing problems with our economy and funding two wars and a host of other problems that are dragging down our great nation. I have empty rentals and no one to fill them. Property taxes and insurance ice the cake and there is always some up keep. Yes, he is newsy, but I have more pressing problems.

Personally I have had enough of Mr. Woods all over the news. We all have more pressing problems with our economy and funding two wars and a host of other problems that are dragging down our great nation. I have empty rentals and no one to fill them. Property taxes and insurance ice the cake and there is always some up keep. Yes, he is newsy, but I have more pressing problems.

.

Dec

4

Productivity, from Jeff Watson

December 4, 2009 | 2 Comments

U.S. nonfarm worker productivity jumped at an annual rate of 8.1% in the third quarter, the biggest rise in productivity since 2003.– News Report.

I own a couple of businesses and am constantly trying to increase productivity. One benchmark for productivity is the study of Items Sold per Labor Hour (IPLH). In my mind, this is the ultimate measure, as it's non-inflationary, and cannot be massaged. I also pay attention to Items per Customer and Sales per SQ Foot. I set goals and hold the managers' feet to the fire if the IPLH suddenly dips. I don't mind paying overtime if it is used to generate extra business, and not used to finish work due to slacking. Being retail oriented, when there is downtime, the employees are expected to clean and front the inventory. We pay our employees a little over the market rate and give quarterly bonuses, yet remind them that they are only as good as their last numbers. Still, our turnover is well below the industry standards. Turnover will kill you as it costs me $1600 to train a new employee and get him up to speed.

I own a couple of businesses and am constantly trying to increase productivity. One benchmark for productivity is the study of Items Sold per Labor Hour (IPLH). In my mind, this is the ultimate measure, as it's non-inflationary, and cannot be massaged. I also pay attention to Items per Customer and Sales per SQ Foot. I set goals and hold the managers' feet to the fire if the IPLH suddenly dips. I don't mind paying overtime if it is used to generate extra business, and not used to finish work due to slacking. Being retail oriented, when there is downtime, the employees are expected to clean and front the inventory. We pay our employees a little over the market rate and give quarterly bonuses, yet remind them that they are only as good as their last numbers. Still, our turnover is well below the industry standards. Turnover will kill you as it costs me $1600 to train a new employee and get him up to speed.

Jeff Watson, surfer, speculator, poker player and art connoisseur, blogs as MasterOfTheUniverse.

Kim Zussman adds:

Possible ways to increase productivity:

Produce more with less

Produce more with the same

Produce a lot more with a little more

Produce the same with less

Produce less with a lot less

For those still employed, fear would seem to be a good motivator to work harder/more efficiently. Especially those making less than the Holy Ceiling of $250,000 per year.

Dec

4

Gold, from Victor Niederhoffer

December 4, 2009 | 5 Comments

One wonders if 1200 is a price of reflection in gold.

Allen Gillespie replies:

Bernanke is a Depression scholar hence he must believe the key to ending the Depression was the end of the gold standard which raised the price to $35 per ounce from $20.67, a full 69%. The decision was made on or around 3/6/09 when he made a deal with the devil at 666 on the S&P and Citigroup reported things were improving. A 69% change in the price level from that date would be 1125 on the S&P, 11200 or so on the Dow and just above 1550 on gold and a level equal to the old S&P high.

A Quant Asset Allocation Spec writes in:

I contemplated the matter and decided Tuesday that enough was enough, and to not further engage in hog-like behavior; although without enough conviction to lean against the powerful move. My greatest concern now is in which asset(s) to establish a new position. Is the re-flation trade nearing an end? Paramount to me is reducing excessive intra-portfolio correlation risk without getting run-over. Is building a larger cash position appropriate, and if it is, in which currency?

Dec

4

A Review of the Nightingale, from Marion Dreyfus

December 4, 2009 | Leave a Comment

Written and performed by Lynn Redgrave

At the City Center, West 55th Street/off Avenue of the Americas

Lynn Redgrave in The Nightingale is moving, intense, stringently talented in a generational true saga of the Redgraves. Tough, teary, even radiant.

Although she could, she does not stoop to detail her shocking marital dissolution from a husband of 32 years who was cavorting with his own daughter-in-law. Nor does she dwell on her Stage IV cancer, from which she has emerged less mobile but still a brilliant, moving actress, no matter how confined her movements. Nor does she reference the tragic ski-accident death of her niece last year, Natassia (wife of Liam Neeson).

Redgrave effects personnae changes by a shift in voice, lighting and speed of delivery. The play runs 85 minutes without intermission.

Not an easy visit, but a powerful and worthy experience of theatre, with one of our iconic greats.

Dec

4

A Chance to Quote Falstaff, from Duncan Coker

December 4, 2009 | 1 Comment

Productivity is one area where of the economy that can not be compelled to improve by those royal powers above. Or as Falstaff once said to Prince Harry over a cup of sack:

Productivity is one area where of the economy that can not be compelled to improve by those royal powers above. Or as Falstaff once said to Prince Harry over a cup of sack:

"What, upon compulsion? 'Zounds, an I were at the strappado, or all the racks in the world, I would not tell you on compulsion. Give you a reason on compulsion! If reasons were as plentiful as blackberries, I would give no man a reason upon compulsion, I."

So Q/Q annualized rate of 8.1% does give me a sense of optimism as that and innovation account for our improved standard of living, wealth and many positive things over the last century.

I looked ahead to SPY performance 1 and 2 quarters later, but the results are not noteworthy in fact there is a negative relationship:

1 month ahead SPY quarter predicted by Prod, correl -.11, slope -.27, intercept .82, rsq .012

2 months ahead SPY quarter predicted by Prod, correl -.04, slope -.12,intercept .41, rsq .002

Serial correl of quarterly Prod -.15, Average annualized rate 2.7%

Serial correl of quarterly SPY .30, Average quarter .3%

Data 1999-2009

Still it is a big headline number, fourth largest over the period, though productivity never gets the same attention that employment will get tomorrow.

Dec

4

The Closing Tens Digit, from Victor Niederhoffer

December 4, 2009 | 1 Comment

It is interesting to contemplate the closing tens digit of the S&P over the last three years. For example, the tens digit of 1075 is 7 and of 1103 is 0.

last digit # of observations

0 73

1 64

2 67

3 76

4 67

5 79

6 74

7 65

8 73

9 59

The average of 70. Standard error about 4.4. Tendency to avoid the neighbors of Mr. Round.

Dec

2

Dubai’s Shot to the Moon, from Vitaliy Katsenelson

December 2, 2009 | 5 Comments

Virtually unlimited access to cheap money blurs lines between what makes economic sense and what doesn’t. If it can be financed it will be built. Dubai’s plan to diversify away from petrochemicals made sense. Maybe it is even destined to become the Las Vegas of the Middle East, the Mecca of business travel and luxury. Dubai, however, is like NASA; both have proven that anything is possible when you ignore economic costs.

Virtually unlimited access to cheap money blurs lines between what makes economic sense and what doesn’t. If it can be financed it will be built. Dubai’s plan to diversify away from petrochemicals made sense. Maybe it is even destined to become the Las Vegas of the Middle East, the Mecca of business travel and luxury. Dubai, however, is like NASA; both have proven that anything is possible when you ignore economic costs.

Many technological discoveries were made in the process of putting a man on the moon; but the project did have, and was expected to have, a negative return on capital. Dubai has followed a similar path. The absolutely impossible category may not include building an underwater hotel or the tallest building in the world, at a cost of $4.1 billion, or a covered ski resort in the middle of a desert, but these projects surely deserve a place in the category of economically impossible. Like putting men on the moon, Dubai’s projects were destined to have a negative return on capital. (At least NASA was up front about it).Dubai’s construction wonders were made possible by high oil prices and, more importantly, unlimited (at the time) global liquidity – subprime global lending on steroids. Today Dubai, a city/state that could do no wrong just a few years ago, is defaulting on the debt it issued to finance its building boom. However, what is happening in Dubai is just the most recent, most vivid example of what took place all over the world until the economic crisis.Economically impossible endeavors with negative returns on capital were everywhere and Dubai is just the latest to go bust. Though everyone is talking about Dubai’s potential default, the scope of the problem is greater. Think about how much energy (oil, coal, natural gas), materials (steel, concrete), and industrial products (cranes, tractors) – in other words, stuff – it took to build these economically impossible wonders. China, the most populous country in the world, also masked its share of economically impossible projects through the guise of “stimulus” and at times outright censorship. China is the birthplace of the largest shopping mall in the world which is empty, and a city built on spec for a million people that remains mostly vacant. These two just scratch the surface.

The rest of the world, including the US (after all, we built a lot of now-empty houses and condos) is swarming with economically impossible projects. How many houses (or in the case of Dubai, mansions), factories, hotels, skyscrapers, shopping malls, and railroads will not be built because there are too many already built? And if this is not convincing enough, funding economically impossible projects will be difficult for a while, as lack of liquidity and insurmountable losses suddenly turn bankers into … bankers. They find religion (at least for a little while) and start giving loans to folks who are expected to actually pay them back.Dubai is the exemplar of economically impossible activities that have taken place everywhere, and why one can’t be optimistic that demand for stuff will return to levels even remotely close to what they were in the days when everything was economically possible and financeable.*Epilogue* My father lives a block away from my office. I stop by his house a few times a week on the way to work. We have breakfast (my stepmother makes a killer fake-egg omelet) and stimulating conversation.

My father is a true renaissance man; he is a gifted teacher, a scientist, an inventor, he holds a PhD in electrical engineering, and to top all that he is a very accomplished artist. The bottom line; he is a very wise man. This morning we discussed this Dubai article.He asked me, “But why would people in Dubai spend billions of dollars on buildings if they have little chance of earning a return on it?” He added, “I would think they’d have rational voices at the table pointing out obvious holes in these multi-billion projects.” At first I tried to explain that if things can get financed they’ll be built. I sensed skepticism. Then I explained how groupthink works, that under crowd pressure, especially after their predictions of the bubble bursting were proven “wrong,” as real estate prices kept climbing, skeptics were either turned into believers, got quiet, or got fired for being doomsayers and not being team players. My father started to see what I saw, and then I told him a joke that I heard from Warren Buffet years back.

A very successful oilman dies. He faces Saint Peter, who says, “You’ve been a good man and normally I’d send you to heaven, but heaven is full. We only have a place in hell.” The oilman says, “Any chance I could talk to other oilmen who are in heaven? Maybe I can convince someone to switch places with me?” Saint Peter says, “It’s never happened before, but sure, I don’t see any harm in it.” The oilman goes to heaven, finds an oilmen convention and yells, “They found a huge oil discovery in hell!” Oilmen are stampeding out of heaven to hell, and our oilman is running with them. Saint Peter asks him “Why are you going to hell with them? I have a spot in heaven, you can stay.” The oilman answers – “Are you kidding, what if it’s true?”

My father got it.

Dec

2

Day of Week and Mood, from Ken Drees

December 2, 2009 | Leave a Comment

If Fridays are the best day of the week (mood wise) and traders are happy and prone to take chances, but lock in profits to be safe. And Mondays are the worst day of the week (mood wise), back to work, the grind–but some energized from the weekend all studied up and ready to go–would not Wednesday morning then be the mid point in terms of mood? Facing the long tiring day–won't be over the hump till next morning, knee deep in the work week, probably surly or strained.

If Fridays are the best day of the week (mood wise) and traders are happy and prone to take chances, but lock in profits to be safe. And Mondays are the worst day of the week (mood wise), back to work, the grind–but some energized from the weekend all studied up and ready to go–would not Wednesday morning then be the mid point in terms of mood? Facing the long tiring day–won't be over the hump till next morning, knee deep in the work week, probably surly or strained.

Tired, stressed and stuck in the middle–how to take advantage?

Victor Niederhoffer writes:

One would count.

Kim Zussman adds:

The weekly cycle in happiness appears to suggest livejournal bloggers don't like work or school. Wednesday is the maximum distance from the weekend, and happiness peaks on Saturday.

I would argue lots of adults are TGIM'ers.

Even without looking at the market, in the old days you could often tell if it's up or down by looking at spec-posts:

Permabull/permabear post ratio and tone.

Adam Robinson comments:

A lot, a lotta work has been done quantifying moods using corpus linguistics. Here's one interesting paper on time of day/day of week mood cycles.

Phil McDonnell replies:

Gallup Daily Poll has done a decent start to confirm that the phenomenon of weekly mood swings is quite real. The linked daily graph of US mood makes it quite clear that there is a weekly cycle. The next step is counting in the market as the Chair suggests.

J.P Highland writes:

My Friday attitude toward trading depends on how the previous 4 days were. If justice was found I play it safe looking not to finish in foul mood and have a sour weekend. If things went bad I become overly aggressive looking to bring my PnL back to green but usually the outcome is bad.

Victor Niederhoffer comments:

This is right out of Bacon I believe with the 8th and 9th race in those days, now the 17th and 18th on the card, being people like us trying to get even by playing the long shots.

Dec

2

An Exercise for the Reader, from Phil McDonnell

December 2, 2009 | Leave a Comment

Most say this rally started on Mar. 9th at the ominous level of 666 on the S&P. It seems to have stalled at about 1110. What number does one get when 1110 is divided by 666?

Kim Zussman writes:

It's 666 raised by 66.6%. Evidencing the Antimistress.

Dec

2

Public Apologies, from Paolo Pezzutti

December 2, 2009 | 1 Comment

Tiger Woods apologized on his website regretting his "transgressions".

Tiger Woods apologized on his website regretting his "transgressions".

He claims his "right to some simple, human measure of privacy". He continues saying that "the virtue of privacy is one that must be protected in matters that are intimate and within one's own family. Personal sins should not require press releases and problems within a family shouldn't have to mean public confessions".

I have sympathy with his view although the public (often morbid) curiosity and the business generated by these kind of news makes them void statements. What I do not understand personally is why he and other public persons in similar situations have to blame themselves publicly for what they have done recognizing it was a mistake with statements such as: "I have not been true to my values and the behavior my family deserves." "I will strive to be a better person and the husband and father that my family deserves."

It is clear that they are saying this only because their affairs have become publicly known. It should have been probably better to be silent on the repentance issue.

Dec

2

Thoughts, from Douglas Dimick

December 2, 2009 | Leave a Comment

No facts. No statistics. No reports. Just headlines and dogma as to how the recovery is proceeding and it is “happy thoughts” every day — after 60 years of glory from “a fool’s errand” (Sum of All Fears). Here at Shanghai University, Agricultural Bank’s branch office just closed. Wires hang from the inoperable ATM. This development is odd… seeing how the school required me to open the account just 3 months ago. Still, perhaps not strange given the central government’s recent cap-call on the big four state-owned, technically bankrupt pillars of capitalism with Chinese characteristics… ah-hem. More to the point, the university is getting screwed, as it requires staff and faculty and students to use this bank. I have yet to find another branch nearby. Guess the university isn’t the one getting screwed… just the students, faculty, staff – as long as school leaders are not inconvenienced, Confucian thinking dictates no speaking. So much for top-down-to-tickle-down-to-keep-95%-down-so-long-as-20%-not-demonstrating-to-incite-80%-that-costs-5%-money economic policies (i.e., this would be the Chinese characteristics). You follow the Chinese math and logic here? Took me three years… Had I learned Mandarin, I would never have got it. Anyway, the Bank of China branch office at the Yanchang (Line 1) shopping mall, across the street from our lovely city campus, has one ATM and three teller stations for a locale that traffics tens of thousands of people per day. Right, you guessed it: the ATM does not have money a fair amount of the time. How about the line(s) for a teller? Forget about it. The mothers and grandparents line up in the morning before the doors open. Note, there is a VIP window upstairs for the Communists, as they are about the only ones with enough money to qualify. So yesterday, I took my dentist and his colleague to lunch at Sal’s (or Salzinaria’s, I think), an Italian food franchise (so quantified as [OliveGarden – PizzaHut = Sals]). Though, true to holism, albeit the parts sum total, the food and pricing and quality are the best that I have seen here in China as far as restaurant ecology may be observed. Anyway, I needed cash – this restaurant does not take cards, any kind of cards accept a pre-paid Sal’s Card. Smart – Sal’s does not seem to trust Chinese bankers either. Right, you guessed correct again. Being within sight of the restaurant, the Bank of China ATM has no money at a key time of the day (lunchtime). Being a barbarian, the foreigner, I do the unthinkable and complain. The nice lady, whom I presume to be the manager (or maybe the only one who speaks English), says that the ATM is waiting for cash to be “put in” but I can go to the ATM at the shopping store two buildings down. In summary, I cannot get cash from my own bank. Mr. Zussman, your USSR theory on “our” tech-bubb is interesting. My study then of that phenomenon was less ecometrics and more social-economic with regard to civilian-commercialization of the Internet. Mr. Jovanovich , concur albeit causation. Clinton’s repeal of Glass-Steagall in 1999, whereby rules-based doctrines and paradigms — that had been developed since the last Great Depression — became (to varying degrees of obfuscated to obliterated) then fundamentally altered within a brief time-period. Mr. Grossman, you hit the nail on the head of that which Dan hammered… ditto (in a Non-Rush context) here in Red China. They still don’t get it at the central government level, because they are afraid – which means, translated to Chinese Thinking, is that they do get it but do not want to do it because it will cost “them” too much money. This accounting scares the Communists, who ironically are afraid, because that is how they rule – with fear. When does the servant become the master? Thus, until US-EU policy mongers and corporate opportunists are replaced with some frontline veterans of trade and finance, who can draw lines instead of circles, whereby social-economic systematics absent of fundamental (First Amendment) human rights are opposed with economic-trade defenses, thereby replacing current free but for unfair trade concoctions of diplomatic, currency-swapped, palm pressing (albeit politically correct) ballyhoo… Communist states will be allowed to linger within if not fester among corruptive, party-centric domains of dysfunction. Ronald Reagan had it right… trust with verification. In terms of legal and accounting compliance, I have seen little of that here, as US-EU state leadership cow-tow to their election-campaign-cuffed, well-lobbied finance streamed (MNC) corporate interests, who prefer non-bargaining labor pools and focused (noncompetitive) consumer segments. As Reagan knew, if you force a communist state to perform based on verification, the system itself will deteriorate from within – until there is internal/external political demand for reform – due to the nontransparent nature of the political ethic. The system is reliant on lying. Stop the lying, stop the system. I do not mean Republican and Democratic lies. They do not have an army standing behind them – just a bunch of lawyers and spinsters… The Chinese government simply hangs or shoots them. As appealing as this approach to conflict-resolution may appear to those of us who hail from the most litigious society in the history of mankind, the point is not quite so absolute in terms of outcome-oriented disposition. The point is that rule of law prevails and is so required for even social-capitalistic constructs as practiced by most neo-communists these days, albeit Cuba and North Korea… stellar examples of how economic justice is reliant upon social justice – NOT. In conclusion, as we may garner from V, focus on your game, practice the shot to a point of mastery, and be patient. Eventually, the Chinese Communists will either do an economic-trade-like Peal Harbor and we will snap out of it or they will be eaten by their own kind. 5,000 years of history tells us so… Enough said.For the past several months, I have been reading these propaganda-like articles to include in the Times. They seem to be generated by some Times(?) writer(s) in Beijing with a contributor in Hong Kong.

Dec

2

Local Shopping vs. Online Shopping, from John Watson

December 2, 2009 | 15 Comments

I like to browse online for goods that I want to purchase, but I rarely buy things online. Sure, it's handy to have goodies end up on my doorstep and on occasion I'll go this way. There is a lot of downside to ordering things online that I think people should keep those things in mind. A local store in my community, chain or otherwise has several things going for it. They pay taxes and employ my neighbors. This improves my local community in a variety of ways, usually including keeping property taxes low. Without employed residents, the quality of life for everyone in my community is reduced — think Detroit, and parts of Appalachia.

I like to browse online for goods that I want to purchase, but I rarely buy things online. Sure, it's handy to have goodies end up on my doorstep and on occasion I'll go this way. There is a lot of downside to ordering things online that I think people should keep those things in mind. A local store in my community, chain or otherwise has several things going for it. They pay taxes and employ my neighbors. This improves my local community in a variety of ways, usually including keeping property taxes low. Without employed residents, the quality of life for everyone in my community is reduced — think Detroit, and parts of Appalachia.

In a real store I can walk in and complain, and/or get answers or action to make things right. If the product is defective or otherwise unsuitable, as is often the case by mail, the return process is immediate, and I save on shipping costs and time. Local merchants also try to maintain goodwill, which cannot be matched, even with those discount codes the online retailers try to lure you in with. Those discount codes are something else, they seem to work on every item in their virtual store except the particular item I want.

If I make a purchase online, few if any taxes go to my local community. Nobody from my town is employed, with the exception of the FedEx guy. The online company has lower margins as they primarily need only warehouse workers and customer service employees. Your local big box retailer probably hires more employees per store than many of these internet companies do for their entire operation. By reducing payroll, it saves the online retailers a great deal of money and is good business for them to cut costs as much as possible. Good for them, but what does it do me?

What do I, the consumer, get out of the internet experience besides convenience and a little saved gas? Online retailers often offer discounts of 5%-20% off retail. Cool! After the purchase is made, then the shipping costs must be added in. These costs are never what the company really pays for shipping and the shipping markup is another profit center to be managed. So the online company saves 30%-60% on operational costs when broken down for each item, and for that I get a measly few percent discount (maybe) after charges.

As the consumer, my job is to maximize what I get out of the purchase. After shipping I end up in many cases having paid roughly the same had I kept my purchase local. My purchase benefits the online company but does little for me or my community. In fact it can be considered counterproductive for me, given the loss of jobs and taxes to my local community.

All in all, I think it's best in most cases to take the time to stop by the neighborhood store if only for the exercise value. If Amazon wants to give me 35% off on the grand total including shipping then we should talk. In the meantime the money that is allegedly saved that doesn't go into my community or my pocket goes to some company outside the community. No thanks from this student. This holiday season, I'll hit Barnes and Noble, where I can have a cup of coffee, a seat, and check out all of the books I want. If you don't have a compelling reason to avoid stopping by a local store, why not give your local economy a boost and ignore those online retailers who offer you no real incentive to shop with them?

Spending money for Christmas in America equals love, and remember that when you shop. Love for family is important, but so is love for your neighbor who might happen to work at that big box retailer. Spend locally and watch the community grow.

Ken Drees comments:

When you walk into a store you may see or check something out that you didn't intend to. You may notice something featured that you never knew about. Maybe now that item you cared nothing for is suddenly appealing. You may interact with other shoppers, ask questions and find out about something even better. You might see something that you forgot that you needed. Reading a physical newspaper is similar, turn the page and suddenly you may find yourself reading an article that you would never choose from an online menu. You may even like the article. You may view a black and white display ad, that would never had appeared as a targeted pop-up on a digital version.

I went to the library the other evening, waiting for my son who was enrolled in a local library program about black bears. I just walked through a stack and found a book about Chicago underground homeless who thrive in their underground, off the books, existence. I read the book for a half hour, forgot about time — found myself thinking about totally non-typical choosable topics. I would not have chosen this book from a list, but there in the library on a random walk, I found a nugget. Digital and virtual are funnels — dropping you into niche. Stores and newspapers have their place. Libraries too.

George Parkanyi adds:

Yeah, and try haggling online…

'Fifteen dollars for a video! Fifteen? What man with a family can afford this? If I had two children maybe, but I have four. And a sick grandmother. My wife would not have s_x with me if I paid $15. A serious person might think about their own grandmother, and consider asking something more like — nine dollars.'

This doesn't even fit in an eBay feedback comment block.

Dec

1

Heyne and Purpose, from Duncan Coker

December 1, 2009 | Leave a Comment

What is my purpose in life, or more accurately what is my comparative advantage?

What is my purpose in life, or more accurately what is my comparative advantage?

I am half way through reading Heyne's Economic Way of Thinking which has been on my list for a while and it has sparked some thoughts about economics but also some thoughts on the bigger questions in life. There is no doubt in my mind that in markets and societies the rules of economics, competition, comparative advantage, low transaction costs, and free exchange all lead to the greatest good for the greatest number of people. But the question I pose is can these same rules be applied to ourselves to answer the big questions we face in life like, what should I pursue as a career, where should I live, should I marry and if so whom, how should I spend my time and doing what, what is my purpose,and where will I be at the end of it all?

As we go through life making decisions and choosing different paths the concept of opportunity cost is ever present, whether we acknowledge it or not. For each road we go down there is another forgone. If we chose to go to Harvard, we give up a chance at going to Yale. If we spend our time trading we give up maybe a job in sales, or time surfing or skiing. We chose what brings the most economic value or perceived wealth. There is a simple but deep definition of wealth in the book, and that is "that which we value." So wealth is a very personal thing, certainly not just money.

Another concept in life and economics that we encounter every day is that of scarcity. Examples of scarcity are everywhere; apartments in New York, school admissions for one's toddler, jobs in trading or openings at a college. Scarcity leads to competition as we vie with others to obtain the things we value. We spend time searching for apartments, studying to be better students and competing to be the best at our careers. But other things in our life are scarce too. The aesthetic things we value are scarce — a sunset over the ocean, the view of the mountains, dinner with your family or friends, reading a non-trading book, watching a fire crackle, time outside. These aesthetic things all have a time scarcity associated with them. Indeed time itself is ultimately our scarcest resource.

Can the economics concepts of scarcity, opportunity cost, competition and comparative advantage which I know to be the best as applied to markets and allocating resources, also help me the individual lead the best, happiest, fullest life I can? When I chose a career I balance the wealth this brings me against the opportunity costs, not only of other jobs, but of the value I place on leisure time as well as those aesthetic things mentioned before. So I suppose the richest among us will be those that get the most of what they value most. If this is a lot of money, so be it. But if you place high value on say fishing or taking walks with your wife and two year old, spending time doing that will make you a wealthy person. We all have to "pay the light bill," but with any luck there is time left over to pursue those things we value most. So I think economics can help in answering those big question mentioned earlier. Also it helps me to prioritize. Once you know what it is you really value it makes going about getting it easier.

Laurence Glazier comments:

A moment of futurology:

As we get deeper into the era where useful things can be produced ever more automatically and cheaply, unsubsidized jobs may become rare, even if shared out part-time. Passage to such a changed society is unlikely to be calm, however it will give people the chance to develop their creativity, an essence-ial part of us all which education quells until, if one remembers, retirement. And those who have jobs would consider it an immense privilege.

It is a future I look forward to (indeed there is no need to wait). Yet, as a chess master once said, "Between the opening and the endgame the gods have placed the middlegame." And society will resist being dragged by the wind of technology to this endgame, as surely as the artist, alone in the studio, resists looking in the pitiless mirror.

Laurence Glazier is a British musician, artist, philosopher, chessplayer and speculator.

Dec

1

Dr. Kiev, from Tom Marks

December 1, 2009 | Leave a Comment

I've seen discussions on this site before about the natural connections between developing athletic skills and trading acumen. And in the Times yesterday there was an obituary of a Dr. Ari Kiev, of whom I had been previously unaware:

I've seen discussions on this site before about the natural connections between developing athletic skills and trading acumen. And in the Times yesterday there was an obituary of a Dr. Ari Kiev, of whom I had been previously unaware:

"His work with athletes caught the attention of Steven A. Cohen, the founder of the hedge fund SAC Capital Advisors, who hired Dr. Kiev in the early 1990s to coach his traders and help them deal with the stress and uncertainties of financial markets…"

He appears to have been a very interesting sort. I think I'll read his books.

Dave Goodboy adds:

I was fortunate to interview Dr. Kiev in 2005. Indeed an interesting polymath.

Ira Brody writes:

Victor's take on the natural connection between developing athletic skills and trading can be describe in few words.

In his quest to become a world champion in squash rackets, Victor learned how to “lose” which ultimately allowed him to become a “winner.” Great pitchers are those who are knocked out of the box in the third inning to boos and critical media judgement about their performance… only to return four or five days later to pitch a game before 50,000 screaming fans and those same critics. If they are haunted by their previous performance they are once again doomed to failure. What makes them great is that they can let go. That what was, was! Today is another day and another time. Let’s go out and play to win.

What makes Vic and other traders exceptional is like great athletes they learn from their mistakes but do not let them affect their ability to take calculated risks… the ingredient that made them winners. They trade to win. They understand that a perfect season though possible is more of a pipe dream than a reality.

Dec

1

Thinking about Serena’s Fine, from Alan Millhone

December 1, 2009 | 4 Comments

Last night my Bible study group met and we shopped for a family through the local Salvation Army. This year our local SA has 100 more families in need than last year. I look at Serena's $82,500 fine and think what that much money would do for the many families in need. The SA gave us a list of gifts wanted, ages, etc. of the family we are helping. Just now I saw a fellow walking who looked down and out and gave him a pair of jersey gloves. This morning I landed a nice garage build and other work and will take part of my profit and use to help those less fortunate than I. In reality I have a warm home, clean sheets on my bed, a fridge and freezer full of food and need little other than good health.

Last night my Bible study group met and we shopped for a family through the local Salvation Army. This year our local SA has 100 more families in need than last year. I look at Serena's $82,500 fine and think what that much money would do for the many families in need. The SA gave us a list of gifts wanted, ages, etc. of the family we are helping. Just now I saw a fellow walking who looked down and out and gave him a pair of jersey gloves. This morning I landed a nice garage build and other work and will take part of my profit and use to help those less fortunate than I. In reality I have a warm home, clean sheets on my bed, a fridge and freezer full of food and need little other than good health.

Dec

1

Folk Art and Markets, by Douglas Roberts Dimick

December 1, 2009 | Leave a Comment

Reflections… Gravitas and Graviton

Reflections… Gravitas and Graviton

After the first year of dad's being diagnosed with Alzheimer’s, we purchased a condo at Polo Island at PBPCC in Florida. Selling the farm in Falmouth for a backbay condo in Portland, the idea was to provide environmental stimuli that minimized environmental conditions not positively impacting emotional, mental, and physical wellbeing for someone like dad – happy in frame and outlook, enjoying the moment and the people where so he found himself.

Cold weather and gray skies had a negative impact on dad’s emotional and psychological tendencies. Old and dark locations were likewise causes of uncertainty and fear relative to his disposition.

After a year, the summer condo in Portland was switched for a lakeside townhouse in Naples (Maine). The problem was that the architecture of the backbay unit was complicated for entry and exit, though the four bedroom unit itself was elegant – formerly owned by dad’s senior, long deceased architectural firm partner, Royal Boston, an MIT graduate with an elevated view of life and art. The townhouse “enabled” dad to swim and sun daily with ease — same with Polo Island.

As a result, father lived through 11 years of Alzheimer’s with an inventiveness and selfless ease that made me and others around him ourselves better folk. It is this sense of commonality that creates ecologies among groupings of people, as with that cognate found among or within a single regimen (or people such as nationalism or the occult), ethic (or philosophy or politic such as conservative and liberal parties), even movements (or cycles or patterns within markets long and short).

China provides an interesting laboratory for such study. The Communists utilize folk art and dance to reinforce party doctrine in such a way to buttress nationalistic domains and trends. Examination of their WTO defenses reflect party leadership attempts to export that same psychology – defending cultural traditions (like corruption and divisive social-economic prejudices) against the “nothingness” of neutrality for international commerce and globalization when compared to nationalist customs and mores.

Are the markets so different?

The Lobagola of that private-public nexus: repeal of Glass-Steagall to permit depository fleecing via toxic derivatives; political prejudice during taxpayer financed corporate bailout; pre/post-crisis selective due process in (SEC and other federal and state) regulatory enforcement and prosecutorial actions; media and entertainment industry-connective hype and backwash of individual and group constituencies based on a “be a good consumer, be a good citizen” themed debt-accumulation edifice fueling nationalist monetarism and fiscal plunder.

Was it not Tolstoy: “We are products of our environment?” Yes, and it is so by the choices we make individually and collectively – such is market and exchange.

Meaning here? Markets make themselves.

Regardless of the day’s fashion, though, the relativity of markets is artificial (or manmade) – constructs that cannot escape the black and white (or red here in the PRC) of the human condition (or good and evil). Debt laden national and world economies, so enslaving folks from household finances to national treasury, and markets (debt, equity, currency, etc…) will find it inescapable eventually, captured by the lore of an implied social-economic realism (or truism) as defined in folk art.

That phenomenon (or form of energy) is the graviton of Quantitative Relativity, operating (or mediating) within exchange systematics. Such then is the form (or idea in a Platonic regard) of a market… Polarity forever remains: war and peace; debt and equity, profit and loss; greed and fear; love and hate; pain and pleasure; birth and death.

Sunny fleets of finance and oceans of unbilled acquisition: who will question?

Put it in a dark place where they play the blues, and you shall become short with life’s despair and the ills apparent. Who, what, when, and how the tune comes to change makes for his daily speculations…

The rest is academic.

Dec

1

A Thought, from Alan Millhone

December 1, 2009 | Leave a Comment

It would take decades if ever to train Afghans, when many cannot read or write, to become soldiers. Our distorted views on political correctness will do nothing but get more of our soldiers killed or injured. Our generals if given a free hand win wars not the politicians.

George Parkanyi comments:

I agree we (Canada is in this too) have to move in force on this. But it is a complex situation — too much force (excessive collateral damage) and you radicalize other parts of Islam; not enough and the existing infestation simply spreads like cancer. The Taliban are already destabilizing Pakistan. Giving them back free rein in Afghanistan will, I believe, seriously and rapidly exacerbate that, making India all the more nervous, never mind the rest of the world. India and Pakistan have nuclear weapons, so allowing the Taliban and their ilk to access even a small portion of these is totally unacceptable.

911 let the genie out of the bottle; the radical element in Islam has seen the possibilities and smelled blood. We don't have the appetite to go on suicide mission after suicide mission - they unfortunately do, and we're in their house. They are not going to give up and will quickly fill any void we leave behind - so withdrawing really is not an option, at least not a sensible one. In that respect we're stuck, and have to finish this thing. I don't necessarily agree that training locals to defend themselves is that futile or being done merely in the interest of political correctness. A key (but not only) element in our strategy must be to continue to embrace and support moderate Islam, help them with resources - both economic and military, and let them get fed up enough with the extremists so that THEY fight back to preserve their way of life (and have plenty in hand to fight back with). They ultimately are the only ones that can permanently resolve this - at least within the borders of Islamic countries.

Stefan Jovanovich adds:

The Pakistanis are in an unenviable position - their sworn historical enemy, the Indians, are richer, better armed and now closer to the Americans. In the past they could rely on the Cold War rivalry and the Congress Party's infatuation with Marxism to keep the Indians separate from the Americans; now, with the financial and military collapse of the Soviet Union the Pakistanis have no choice but to be at least civil towards the Americans and to hope that our desire to "get Bin Laden" will continue to blind us to our real interests in the region. The references to the Taliban are irrelevant; the "rebels" in Afghanistan are now no more political than the ones in Columbia. To the extent that there is a political issue now in Afghanistan, it is purely an ethnic civil war that has always existed between the Pashtuns and the Tajiks and the other minority tribes. There is no likelihood that the Pashtus will "destabilize" the Pakistanis, the majority of whom are not the Pashtuns from the hills but Punjabi lowlanders. Think Scotland in the 17th and early 18th century. For all of their struggles against the English, the lowland Scots never once made common cause with the Highlanders.

Alan's comment about generals also needs a rebuttal. All generals are "politicians"; what we want are ones who are smart politicians. The current bunch are disappointingly short-sighted; they are afraid to tell the truth - namely, that we can largely leave Afghanistan to the Afghans and simply maintain the kind of armed oversight that we have kept in the Balkans for over a decade now. The Punjabis in Pakistan will make certain that the Pashtun faction does not gain the kind of control of Pakistan's own borders that the Taliban once had. (The Pakistani security forces are now doing more of the fighting and dying than anyone else in the region for that very reason.) The truth is that the smaller our presence the more the Punjabis will be willing to reassert their own control over the area without having any temptation to return to flirting with Arab notions of Jihad. The Pakistani's long-term concern is that we not leave them completely at the mercy of the peaceful neighbors in Delhi, who have not forgotten their own recent experience with terrorist bombings or who was behind them. But, it is impossible to imagine that any of our current masters of the Pentagon would be shrewd enough to come to these conclusions. For one thing, there wallets argue otherwise. For years the Democrats have been arguing that "the real enemy" was in Afghanistan; our current generals can't say we have already won. That would risk losing what few appropriations they still hope to get from a Democratic Congress. After all, big money for a pseudo-war is better than small money for an intelligent strategy. What our country needs is to have some 4-stripers put their careers on the line about the real strategic threats (the revolt of the Admirals that occurred in the Truman Administration would be my model), but I doubt very much we will see anything of the sort. On the contrary, the present crop of egg salad warriors are sufficiently dim-witted politically and militarily that they will probably be in favor of bringing back the draft in the name of economy and "national service".

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles

The Nightingale

The Nightingale