Oct

3

A Chart, from Victor Niederhoffer

October 3, 2013 | 1 Comment

"Business Insider: The Stock Market Looks Like 1967 All Over Again"

"Business Insider: The Stock Market Looks Like 1967 All Over Again"

A chart overlay showing similarities between the S&P in 1993 and this year appears below in this article. I have seen other overlays by the bespoke group showing almost exactitude with this market and I believe 1926 or some such. Harry Roberts, where are you, with your proof that random charts look just like stock market charts. What are the chances that such idempotent overlays would occur by chance if you could pick out the closes match over the last 93 years or so.

Rocky Humbert adds:

And 1954 too. From that link:

U.S. stocks are trading virtually in lockstep with 1954, the best year for American equity and the time when shares finally recovered all their losses from the Great Depression.

The Standard & Poor's 500 Index's returns in 2013 are tracking day-to-day price moves in 1954 almost identically, according to data compiled by Bespoke Investment Group and Bloomberg.

In no other year are the trading patterns more similar to 2013 since data on the index began 86 years ago. The correlation coefficient between this year and 1954, when the benchmark gauge rose 45 percent, is 0.95 out of a maximum of 1.

Kim Zussman writes in:

Using SP500 weekly returns for 2013 (Jan - Sept), checked correlation of these 39 weekly returns with weekly returns of prior 39 week periods back to 1950.

Here are the 10 most correlated:

Date Correl Month

09/30/13 1.000 9

01/05/70 0.506 1

04/11/55 0.506 4

02/19/80 0.482 2

07/26/65 0.479 7

11/12/12 0.476 11

07/21/97 0.450 7

06/21/04 0.448 6

09/21/64 0.436 9

04/08/85 0.431 4

The current 39 week period correlates perfectly with the current 39 week period.

Next closest correlation was the period ending January 1970.

The most correlated Jan-Sept period ended Sept 1964, which along with $7.95 will buy a cup of coffee.

Oct

3

Employment, from Duncan Coker

October 3, 2013 | Leave a Comment

There is a second derivative of deception on tomorrow's employment data. Not only don't we know the number, we don't know when they plan to release the unknown number. And since all is closed, we don't know when they will even announce when they will announce the unknown numbers. The markets, the great discounters of all information, will have to work extra hard.

Oct

2

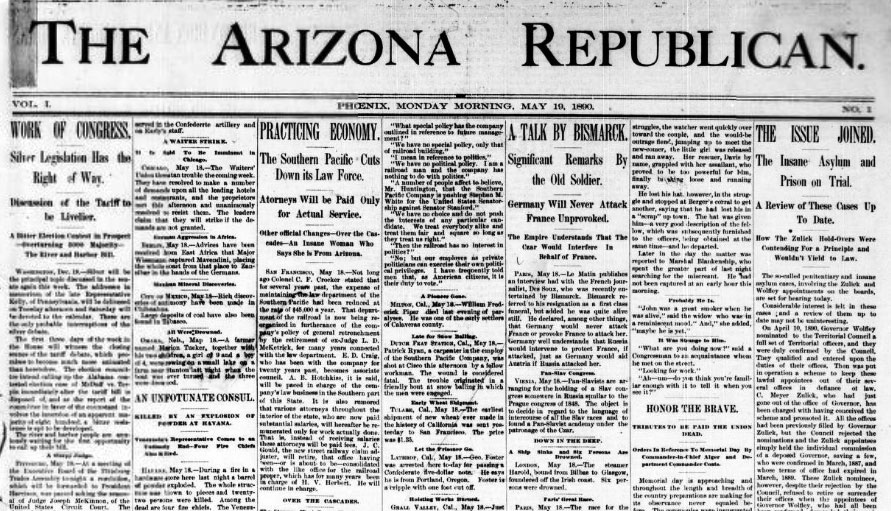

From the front page of The Arizona Republican, Phoenix, Arizona, May 19th, 1890:

From the front page of The Arizona Republican, Phoenix, Arizona, May 19th, 1890:

WORK OF CONGRESS. Silver Legislation Has the Right of Way. Discussion of the Tariff to be Livelier. The River and Harbor Bill. Washington, May 18. - Silver will be the principal topic discussed in the senate again this week. The addresses in memorium of the late Representative Kelly, of Pennsylvania, will be delivered on Tuesday afternoon and Saturday will be devoted to the calendar. These are the only probably interruptions of the silver debate. The fist three days of the week in the House will witness the closing scenes of the tariff debate, which promises to become much more animated than heretofore. The river and harbor people are anxiously waiting for the first opportunity to call up their bill.

A TALK BY BISMARCK. Significant Remarks by the Old Soldier. Germany Will Never Attack France Unprovoked. The Empire Understands That The Czar Would Interfere In Behalf of France. PARIS, May 18. - Le Matin publishes an interview had with the French journalist, Des Soux, who was recently entertained by Bismarck. Bismarck referred to his resignation as a first class funeral, but added he was quite alive still. He declared, among other things, that Germany would never attack France or provoke France to attack her. Germany well understands that Russia would intervene to protect France, if attacked, just as Germany would aid Austria if Russia attacked her.

CUNNING SECRETAN. How the Frenchman bulled the Copper Market. Paris, May 18. - At the trial of the copper syndicate men it has been proved that Secretan, as director of the Societe des Metaux, distributed fictitious profits for 1887, and used improper means to bull copper, raising the price from 1000 francs per ton to over 2000 francs, and clearing within two months 10,000,000 francs. The defence is that the article of the penal code on the which the charge is based does not apply to this particular case. Hentsch, on being examined, admitted that while he was chairman of the Comptair Escompte he knew nothing of the dealings of that institution with the Societe des Metaux. He also testified that the board rarely listened to the manager's reports, simply letting things slide.

CHINAMAN BAPTIZED. He Sacrifices His Queue and Adopts the Christian Faith. Traver, Cal., May 18. - Yuen Lung, a Chinaman of more than ordinary intelligence, had his queue shaved off some time since, and to-day was baptized in the Christian faith by Rev. Mr. Hawkins. He has adopted the name of Charley Delzante. He conducts the dining room of the Delzante Hotel at this place.

WARLIKE ATTITUDE. The Czar Talks Business to the Porte. Constantinople, May 18. - The Porte has not yet replied to Russia's claim for the payment of the arrears of the war indemnity. The Russian Ambassador, in an urgent note to the Porte, demands the payment of arrears from the loan, otherwise, he adds, Russia will reserve the right to take further measures.

AN OCEAN RACE. Three Great Atlantic Steamers Struggling For Supremacy. London, May 18. - The Anchor Line steamer City of Rome sailed from Queenstown at 12:30 to-day. The Guion Line steamer Alaska sailed at 12:30 and the the Cunard steamer Aurania at 2 p.m. All went ahead on full steam directly after they cleared Queenstown harbor. There is heavy betting on the result of the race.

Oct

2

Jobs Report, from Bill Rafter

October 2, 2013 | Leave a Comment

It's funny that the jobs report is not compiled yet. The Labor Dept. must have the data they use, as that report consists of happenings through 9/12. We use Dept. of Treasury as our source and we have that information through 9/27. The Treasury data is generated electronically and we might get the 9/30 report later today unless they intervene.

It's funny that the jobs report is not compiled yet. The Labor Dept. must have the data they use, as that report consists of happenings through 9/12. We use Dept. of Treasury as our source and we have that information through 9/27. The Treasury data is generated electronically and we might get the 9/30 report later today unless they intervene.

Bottom Line: The YOY growth in payroll tax receipts (seasonally adjusted), which is our substitute for employment, is at the lowest level of the year, whether you mean calendar year or adjusted fiscal year. But of course, you might never see that report.

Let's say you were in charge of the Administration of a country in a similar circumstance. If you knew the jobs data was fantastic, would you release it? A good economic report might be taken to mean that the country was not as fragile as previously thought, and could therefore withstand a shutdown for a while. On the other hand, if the jobs data were bad, it might mean the country was very fragile, and that the Administration should compromise quickly, effectively forcing your hand. And of course in the latter scenario you should be embarrassed by the fact that nothing you had done economically for 5 years had been successful. Your best option might be to wait until you needed a trump card, and then pull it out of the hat. Plus (if you wanted) you would have additional time to massage the data.

Oct

2

Navy v. Airforce Big Game Shutdown, from Dan Grossman

October 2, 2013 | 1 Comment

We're all well accustomed to the closing of the National Parks, the Smithsonian, the Statue of Liberty and similar government attractions, in order to maximize the hardship of the government shutdown on schoolchildren and other innocents.

We're all well accustomed to the closing of the National Parks, the Smithsonian, the Statue of Liberty and similar government attractions, in order to maximize the hardship of the government shutdown on schoolchildren and other innocents.

But suspending the Navy v. Air Force game seems a new height in ridiculousness. Surely the costs of the football programs have already been incurred and the ticket and other revenue from the game would have been a major financial plus to these government schools.

I see at least some game tickets were previously selling online in the $100 range. Assuming an average price less than half of this would yield a couple of million dollars from ticket revenue alone. Plus food and other concession revenues. Plus the largest of all, the schools' share of TV and other broadcast revenues.

But what better way to bring home to citizens the terrible consequences of interfering with the government's normal modus operandi?

Oct

2

Structured Notes, from Yanki Onen

October 2, 2013 | Leave a Comment

Right before the mortgage craze, we were dazzled by the alphabet soup: CDOs, COOs…Now the excitement is in structured notes based on stocks performance as an example.

Now here comes the Money question. Guess which stock had the largest issue in 2012?

And the answer is…. Makes you wonder…

Anonymous writes:

Here is a way to sell options to retail clients with a few advantages for banks:

1. no options paperwork since it's structured as a note

2. by focusing on attractive features "yield of x", "principle protection of y", they don't disclose implied vol/vig

3. illiquid so fee opportunity for early termination

Oct

1

The Power of Brands, from Ed Stewart

October 1, 2013 | Leave a Comment

One thing I have been considering lately from an investor's perspective is the power of consumer brands.

One thing I have been considering lately from an investor's perspective is the power of consumer brands.

What is the value of a well known brand? My inquiry is motivated by a few different angles, but I think what has most stimulated the question is my study of a a "prestigious" company that has been growing by purchasing OTC medicine-type brands from the major consumer goods and drug companies.

At face value it seems like a great strategy. The shorter term economics look favorable. Yet, when I look in my families medicine cabinet, I notice my wife buys almost exclusively store brands when it comes to things like cold medicine, etc. It only takes choosing the low cost option one time to realize that the store brands (Costco, Walgreens, Roundy's etc) work just as well as the higher cost name brands.

Will the familiarity of an old brand have staying power that can allow for an above average roe over time, or are they wasting assets? How long can reputation last when the underlying reality is not particularly distinguished?

A family relation of mine owns a fashion design/women's retail business. One discovery this person made in the manufacturing process (working with contract manufacturers) is that the big names in mainstream "luxury" goods often have completely average quality or only slightly above average quality in terms of material and construction. The desirability factor is almost 100% psychological - what other people will think, a giffin good type effect. This might seem reasonable with regards to items people use to create their public persona or to establish a sense of status. But what about consumer staples? It seems like a much tougher sell. I know that when I go to Costco, I instinctively grab the store brand and am very rarely disappointed. When presented with two very similar, low risk options, even a 50 cent difference can feel significant at the moment when one must reach for an item off the shelf (or maybe I am particularly cheap?)

So the question is, how to evaluate brands in a competitive, relatively uniform (in terms of quality) market. When are they worth investing in over time (in terms of long-term roe?) I see two big things:

1. Need for reliability/high trust in product (condoms vs. hand soap)

2. Items that signify status (LV logo vs. generic)

To bring things to a specific context, I am presently evaluating if the company Prestige brand's (PBH) strategy of buying "known" but relatively mundane brands will have staying power over time (say next 15-20 years). The short term economics look good, but what about staying power in these competitive markets where stores have an incentive to sell their proprietary brands?

Any thoughts are welcome.

Russ Herrold writes:

Historically Sears also historically perfected the 'Good, Better, Best' model of offering several lines at varying price points.

Historically Sears also historically perfected the 'Good, Better, Best' model of offering several lines at varying price points.

That brand has huge value, at least out here in Flyover Country.

Jim Wildman adds:

Good, Better, Best has been adopted by John Deere as to their lawn equipment as well. 1xx series are cheapos, designed to compete at the low end with the Craftsmen and MTD's. 2xx are better, but still not what one thinks of with a Deere. For those you need the 3xx series, which are what I grew up with as a kid.

Easy to tell the difference once you know where to look as well (pressed metal vs cast pieces, bolted vs welded, etc, etc)

Oct

1

Why Buy a Newspaper, from Henry Gifford

October 1, 2013 | 1 Comment

Newspapers can influence elections, and that makes them very valuable to politicians. The economics of buying a newspaper is easy to understand when you remember that politicians spend millions of dollars to get hired for their job that pays a few hundred thousand dollars per year.

« go back —Archives

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles