Aug

3

Destroyed in Seconds, from Rocky Humbert

August 3, 2012 | Leave a Comment

To my knowledge, there has NEVER before been a case (except in war or natural disaster) when a legitimate business has been destroyed so quickly — as what Knight Capital Group (KCG) experienced.

To my knowledge, there has NEVER before been a case (except in war or natural disaster) when a legitimate business has been destroyed so quickly — as what Knight Capital Group (KCG) experienced.

Every business takes risks. Every business can experience disasters. But in screening businesses, what are the idiosyncratic risks that can (permanently) destroy a legitimate enterprise in a time frame so short that long-term investors have almost their entire investment vaporized before they even bring in the morning paper? Does Mr. Market correctly value these low-probability risks? If one isn't Mr. Nassim Taleb, how does an investor calculate the probability of such an event (and still be a profitable long-term investor)? Are certain business more prone to (as the Discovery Channel TV show is called) "Destroyed in Seconds" ?

Here are some examples:

1. Single factory. In 2008, Imperial Sugar had their only mill explode and burn down. They had business interruption insurance, but never fully recovered and were eventually acquired by Louis Dreyfus corporation.

2. Concentrated Customer. Businesses that have more than 50% of revenues associated with a single customer can have a virtual firestorm. There are numerous examples of this, but the implosion is usually associated with a credit/liquidity event.

3. Concentrated Lender. Businesses that are dependent on a single source of funding (e.g. Bear Stearns) can implode when that liquidity disappears.

4. Supplier. Businesses are vulnerable to the "weakest link." If a supplier that makes a tiny, but critical, widget fails to deliver — it can bring an elephant to its knees. This is an insidious risk, since investors know about the largest customers, but they probably don't know about the tiny providers on the supply chain.

5. Fraud. Employee/Executive fraud and embezzlement can go on for years with only very subtle warning signs. Unless the CEO/CFO is involved, it's rare that the fraud is sufficiently large to bring down the entire company. And I'm sure there are dozens of others. What is the theme and lesson here? Interestingly, it's the same lesson for successful investors: Diversification reduces risk of disaster. Insurance reduces risk of disaster. Multiple sources of liquidity and reasonable leverage reduce risk of disaster. Reasoned human judgement reduces the risk of disaster. But in the case of Knight Capital (in which I am not an investor), I'm left scratching my head. How is it even possible that any business could burn through their entire balance sheet before the grownups pull the plug out of the wall outlet? The only answer is stupidity. And that they did blow up is bittersweet — because it means capitalism is working. (And if you are an investor in Interactive Brokers, you should probably hope that Mr. Peterffy is a bit smarter than that.)

Aug

3

The old 1-2 and Ropa Dopa, from Jim Sogi

August 3, 2012 | 1 Comment

When boxing, combinations of punches are much more effective at knocking out the opponent. Just a jab, jab, won't do much other than set up a combination. We had a good solid two days of light jabs. A good combination is a fake to the head, when the hands go up, punch to the stomach, when the opponent doubles over from the stomach punch a sharp upper cut to the chin will usually ring his bells as the head snaps back, and then a finishing round house to the side of the head is a good recipe for a knock out.

When boxing, combinations of punches are much more effective at knocking out the opponent. Just a jab, jab, won't do much other than set up a combination. We had a good solid two days of light jabs. A good combination is a fake to the head, when the hands go up, punch to the stomach, when the opponent doubles over from the stomach punch a sharp upper cut to the chin will usually ring his bells as the head snaps back, and then a finishing round house to the side of the head is a good recipe for a knock out.

Markets are full on brawls, and combination moves like the Fed disappointment, then the EC disappointment today is a good combination that can ring the bulls bells and set them back on their feet and make them feel pretty unsteady. It's pretty discouraging to ride three legs down if you're caught on the first move, and can lead to a knock out if not careful.

Like Clint said in Million Dollar Baby, "Always protect yourself" even when the bell has rung. Funny business goes on in the aftermarket and overseas at night.

Mohammed Ali's "Ropa dopa" strategy was a masterpiece. Just put up the glove around the head and forearms protecting the stomach, and let the opponent tire himself out punching away. When the opponent is tired, fire him up. Market strategies might match this fighting method.

Aug

2

Nature is Made Lovely by Capitalism, from Don Boudreaux

August 2, 2012 | Leave a Comment

I just love this quotation from Macaulay; I've used it before.

I just love this quotation from Macaulay; I've used it before.

…………..

2 August 2012

Editor, The New York Times

620 Eighth Avenue

New York, NY 10018

Dear Editor:

Good for Kianna Scott that she found comfort by spending time in the wilderness before entering college (Letters, Aug. 2). But lest we forget that the kindness and inspiration that we moderns find in the wilderness are consequences of the riches, leisure, and security that we enjoy chiefly because of industrial capitalism, I offer here an observation from Thomas Babington Macaulay's History of England:

Indeed, law and police, trade and industry, have done far more than

people of romantic dispositions will readily admit, to develop in our

minds a sense of the wilder beauties of nature. A traveler must be

freed from all apprehension of being murdered or starved before he can

be charmed by the bold outlines and rich tints of the hills. He is not

likely to be thrown into ecstasies by the abruptness of a precipice from

which he is in imminent danger of falling two thousand feet

perpendicular; by the boiling waves of a torrent which suddenly whirls

away his baggage and forces him to run for his life; by the gloomy

grandeur of a pass where he finds a corpse which marauders have just

stripped and mangled; or by the screams of those eagles whose next meal

may probably be on his own eyes….It was not till roads had been cut out of the rocks, till bridges

had been flung over the courses of the rivulets, till inns had succeeded

to dens of robbers … that strangers could be enchanted by the blue

dimples of lakes and by the rainbows which overhung the waterfalls, and

could derive a solemn pleasure even from the clouds and tempests which

lowered on the mountain tops.*

Sincerely,

Donald J. Boudreaux

Professor of Economics

George Mason University

Fairfax, VA 22030

* Thomas Babington Macaulay, The History of England, Vol. 6 (Boston: Houghton, Mifflin and Co., 1900), pp. 55-56.

Aug

2

Knight Capital, from Victor Niederhoffer

August 2, 2012 | 2 Comments

Why is Knight Capital down so much in price, down 1/3 to 6.95?

Why is Knight Capital down so much in price, down 1/3 to 6.95?

Rocky Humbert replies:

I was traveling for the past two days and missed this Nite saga.

BUT:

1. For all you folks who love to 'diss the HFT folks (because they have a license to mint money), here is a company that managed to lose $440 million (see this morning's press release) in about 15 minutes. That's 2.6 YEARS of pre-tax income in the blink of an eye. What the not-so-great hft folks are realizing is that the business has become crowded and seems now to resemble the old brokerage business: One leveraged client going belly-up can put you out of business. (Here, one software bug can put you out of business. And at least with a deadbeat customer, you can beat them up in the alley, so to speak.)

2. One is appreciative of the Chair's humility in using the phrase "famous last word." On a quantitative note, I wonder whether severe gap down moves IN INDIVIDUAL STOCKS have any predictive ability — for either continuation or a bounce (in a multi-day/multi-week timeframe.) Over the years, I've stopped buying falling knives of this sort as I concluded that the person hitting my bid probably knew more than me. But I've never tested this carefully, nor would I know how to test without introducing biases. (The S&P Index is very different of course…)

Aug

2

My Goodness, from Victor Niederhoffer

August 2, 2012 | Leave a Comment

My Goodness, the market is up a reasonable amount overnight, very much unchanged from Wednesday close, and there were many very positive things in the fed statement. "They will be monitoring the situation closely", which usually means an interim intervention. Remember, "the threat is worse than the execution". The statement of the Fed had many threats that they would intervene to buy assets with the slightest provocation. There was nothing bearish about what the Fed did, and only 10% expected the Fed to do something different. All this talk about throwing O to the wolves is non-market talk, like me talking about the chip industry when I know nothing about it. "The wish is father to the thought".

Gary Rogan writes:

How can we judge by the market reaction whether the Fed did "all they could"? Of course in any rational universe the lack of immediate drastic action will be judged positively, especially with a slight delay, because just about any QE3 at this point is likely to be counterproductive. It also not THAT fantastic to suppose, and that has been done recently several times, that any conclusions about anti-O intentions will themselves be interpreted positively by the market.

When just yesterday Geithner was urging the Congress, not in so many words but clearly implied, to go on some sort of a wild spending spree to take advantage of the low borrowing costs, while paying lip service to long term solutions, would it not be reasonable to suppose that he would want the fed to undertake some major mortgage purchasing program? When Schumer asked for and DeMint warned against more quantitative easing two weeks ago, would it be hard to guess which one of them would be more satisfied with the Fed's immediate action or lack thereof?

If there is some fantastic jobs report announced on Friday and 300K jobs are created than it will be clear that that was the rationale. The actual ADP trend was down, so I'm not sure how today we can say with certainty that the Fed was being absolutely as helpful to the regime as it could be.

Aug

1

The Market if Touched, from Victor Niederhoffer

August 1, 2012 | Leave a Comment

The market if touched would seem to be an exact replica of the spider's attacking when the thread is tripped. The brokers have a variant of that called a "ghost order" that is not on the books anywhere but is triggered whenever a bid or offer hits the price electronically that maintains the privacy of the spider's plan.

The market if touched would seem to be an exact replica of the spider's attacking when the thread is tripped. The brokers have a variant of that called a "ghost order" that is not on the books anywhere but is triggered whenever a bid or offer hits the price electronically that maintains the privacy of the spider's plan.

Gibbons Burke writes:

In the days of the dinosaur, when physical pit trading reigned supreme, the would-be spiders with resting M.I.T. orders could be gauged by the size of the deck of order tickets held in big-fish client's brokers hands. The hunting raids mounted by locals called "gunning for the stops" often caused the would-be predators to become prey.

This game is now being played by the new locals (co-locals?) - the HFT bots at the speed of light.

Speaking of the speed of light, and a different order of M.I.T., some smart fellows there have created a camera which is so fast (a trillion frames per second) it can take a movie of a packet of photons - a laser light bullet a millimeter in length - traveling through a soft drink bottle:

Here is a nice TED talk from Ramesh Raskar on "imaging at a trillion frames per second".

Victor Niederhoffer writes:

One believes that a buy market if touched order rests below the current price. And a sell market if touched order rests above the current price but the spirit of taking advantage of the weak is the same.

Jeff Watson writes:

Furthermore, MIT orders, buy stops, sell stops, GTC orders, etc if held at the exchange or their servers become part of the market and are served to the inside players as delectable morsels to snack on.

William Weaver writes:

Even orders that are held on a broker server can be seen by others within that brokerage… I was exploring Bberg the other day and found a function that allowed me to see what other orders rested within the firm. I've been keeping orders personal server, or CPU side for a while, but after that discovery I've become even more paranoid (not that I am a big enough player to get attention, but sometimes it seems like it is statistically improbable for prices to all but reach my take profit only to reverse and get almost to negative where I exit flat).

Anatoly Veltman writes:

Just to remind us, today's slippage on filled orders is only one tick, or even half-tick. It is the slippage on unabled limit orders that's a real killer. In the previous discussion of how HST effects long-term investors, who are "forced" to wait in queue for execution…yes, the sheer volume of short-term predatory activity, which occupies certain time on exchange server, and could go awry - could spill into a more illogical (random) near-term direction. Long-term is a series of short-terms to a degree - and all this short-term activity may be adding to randomness. This is liable to confuse the heck out of longer-term thinker and leave him entirely outside of the trade: we hear more and more how this or that traditional indicator has become a victim of fake-outs.

Aug

1

Let Us Understand, from Victor Niederhoffer

August 1, 2012 | 1 Comment

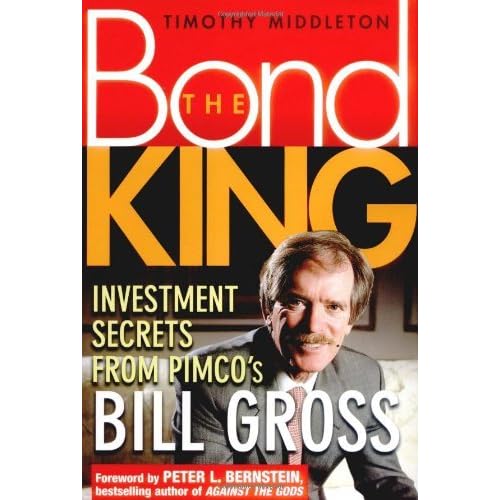

Let us understand that in addition to being one of the worlds greatest liberal poseurs on a par with the sage and other sanctimonious scoundrels, the bond king likes to stand on his head for an hour a day before the yoga.

Let us understand that in addition to being one of the worlds greatest liberal poseurs on a par with the sage and other sanctimonious scoundrels, the bond king likes to stand on his head for an hour a day before the yoga.

Jason Ruspini writes:

His inequality angle aside, I still feel that the main psychological "national enquirer" message that flows through such pieces is not that man is small next to the state but rather that the state, pensions & entitlements are likely essentially bankrupt, and that arguments citing robust past growth under high tax rates aren't admissible. Note that "left" econ bloggers like DeLong , Yglesias on Slate and Justin Wolfers and Blodget all began promulgating rebuttals to Gross almost immediately. They certainly did not perceive this output as friendly to their fiscal views. They did not seem to read it as "the state should make up for this shortfall", "fund the state instead of business" etc, but rather seemed threatened by it.

Aug

1

Junk Mail, from Jack Tierney

August 1, 2012 | Leave a Comment

Readers of the dailyspec are far too like-minded to give "junk mail" a balanced hearing. Once upon a time I provided copy for "junk mail" pieces — in return I received a much needed supplement to my income. Those who paid me also received an income from these pieces….prior to the internet a huge number of new investors entered the equity markets through direct mail "junk" pieces. The WSJ, NYT, and Forbes/Fortune/Business Week may have been the journals for the well-heeled, but junk mail went a long way in getting the uninitiated involved - at the time, it appeared they were being introduced to a new and exciting road to wealth creation.

Readers of the dailyspec are far too like-minded to give "junk mail" a balanced hearing. Once upon a time I provided copy for "junk mail" pieces — in return I received a much needed supplement to my income. Those who paid me also received an income from these pieces….prior to the internet a huge number of new investors entered the equity markets through direct mail "junk" pieces. The WSJ, NYT, and Forbes/Fortune/Business Week may have been the journals for the well-heeled, but junk mail went a long way in getting the uninitiated involved - at the time, it appeared they were being introduced to a new and exciting road to wealth creation.

And for many it worked out that way. For others it did not. In fact, it really grinds on me every time I hear them referred to as "sheeple." It's difficult to get through a day of posts without coming across at least one that heralds the market as capitalism's glorious tool which, when judiciously utilized, can provide the "common man' with an uncommonly abundant life. Contrarily, they are also viewed (along with us) as the prey upon which the flexions feast. They are probably both, but one cannot deny that through their participation, the markets have become bigger, richer, and more opportunistic fields in which to play.

Junk mail is far more than that, though. For many companies (and churches, charities, and publishing enterprises) it is the most cost-effective way to reach its "target market." It has been suggested that junk mail's existence is largely due to rural markets - I doubt that many here recall the Sears catalog, but it was the earliest and, arguably, the most successful of the junk mail genre. So, to an extent, the rural market argument carries some validity. However, catalogs became widely anticipated and popular vehicles for merchants in a wide variety of businesses. And for years, their junk mail pieces provided lots of income and lots of profits.

The modern urban dweller also benefits from direct mail. Take a close look at some to the pieces you receive before junking them. Many, you will discover, feature coupons - I realize there exists an element which looks with scorn upon the couponing experience. For that group, I would suggest hanging around an urban supermarket and watching the many who use them - they're exceeded only by those you'll find at 12:01 a.m. at a rural Wal-Mart on the 1st of any given month (food stamp day).

Most in this group are, if not well-off, relatively comfortable. This can't be said for most of those who eagerly await the next delivery and its assortment of coupons, two-for-one deals, Revival notices, and pieces announcing Poker Runs for the family down the road whose double-wide burned to the ground a month ago.

Should the Post Office go out of business, I would expect one of the current for-profit deliverers to institute a similar service - if not, the market will create an economical way of getting these messages out - and you'll still open that box and see "junk-mail." You can't kill a service on which so many depend, benefit, and profit.

Aug

1

One Night in the Jungle, from Bo Keely

August 1, 2012 | Leave a Comment

The Amazon comes alive after sunset with interesting creatures.

These are from one night´s four hour hike:

Aug

1

Article of the Day, from Victor Niederhoffer

August 1, 2012 | Leave a Comment

"Geithner Urges U.S. Congress, Europe to Spur Economic Growth"

"Geithner Urges U.S. Congress, Europe to Spur Economic Growth"

A shot across the bow before the Wednesday announcement?

Garrett Baldwin writes:

I'm out at Indiana this week for my Purdue residency, and the first thing that I heard out of the trade econ professor's mouth is KEYNES, KEYNES, KEYNES justification…

Time to break out the spoons and start digging. We'll eventually make it to China so we can pay them back.

I am attempting to justify a question on this. How do you print or borrow the size of a stimulus you want… at trillions… and expect our economic and political system to somehow get the targeted stimulus that they proclaim possible? There will be buy-offs, write-offs, handshakes, and so one… And by the time we get down to it, the very areas they want to stimulate that have any economic merit will be 3 percent of the money spent. I'd rather just go with the helicopter plan.

« go back —Archives

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles