Jul

11

Notes From the Field, from Alan Millhone

July 11, 2011 | Leave a Comment

Noted that ending the space shuttles will end 9,000 jobs. One man interviewed who is losing his 60,000 per year job hopes to start an internet business. I suppose the laid off will draw off unemployment and be eligible for federally funded job retraining and keep all health benefits and the list continues for miles. How will the 9,000 be crookedly figured in job loss and unemployment numbers ?

Noted that ending the space shuttles will end 9,000 jobs. One man interviewed who is losing his 60,000 per year job hopes to start an internet business. I suppose the laid off will draw off unemployment and be eligible for federally funded job retraining and keep all health benefits and the list continues for miles. How will the 9,000 be crookedly figured in job loss and unemployment numbers ?

Regards,

Alan

Tim Melvin writes:

I was in South Texas last week and all the headlines in area papers are related to job losses and lost income form shuttle programs.

Btw those who would like a seaside vacation without the crowds but all the amenities of a great town would do well to check out Rockport/ Fulton area of Texas. It really reminds me of west coast of Florida twenty years ago…with a Texas flair of course. Lots of great mexican and bqq joints….

Jul

11

Mobile Phones, from Victor Niederhoffer

July 11, 2011 | 3 Comments

Mobile phones in prisons are worth 3000 a month. To get one in England a dead pigeon was thrown over the wall, and inside was the phone.

Mobile phones in prisons are worth 3000 a month. To get one in England a dead pigeon was thrown over the wall, and inside was the phone.

Alan Millhone writes:

Dear Chair.

Ran into a fellow today who spent two years in an Ohio prison. He never

saw one but knew they existed and said they were like Gold to have one.

Your post reminds me "a bird in the hand".

How would we function today without cell phones and texting and internet?

I love the camera feature on my Blackberry Torch. Many business uses.

Two years ago with the camera I sent photos of storm damage to three

buildings to an adjuster in Wisconsin and measurements etc and basically

adjusted over my phone.

Sincerely,

Alan

Jul

11

The Fatal Flaws of Reason, from Mel Meljay

July 11, 2011 | 2 Comments

You at dailyspec say you are "animated by a desire to apply systematic, tested reasoning to improve our understanding, not by appeals to authority or the transition of charts."

To understand why you do not achieve your goal see:

"Why Do Humans Reason? Arguments for an Argumentative Theory" by Hugo Mercier and Dan Sperber

There is also discussion about it here and other places.

The claim is that human reasoning developed to win arguments and not to discover the truth. There is evidence for it at every meeting of the NYC Junto. The theory does a pretty good job of explaining phenomena like "confirmation bias" (i.e. your speakers basically confirm your beliefs) and that people first "emotionally" come to a conclusion and then find facts to support what they "feel" (as evidenced by audience comments and questions).

Jul

10

Home Run Indicator, from Steve Ellison

July 10, 2011 | Leave a Comment

Phillies general manager Ruben Amaro is quoted in Sports Illustrated saying, "Baseball has made a U-turn. We've gone back to pitching and defense and speed. You don't see the power numbers of 15, 20 years ago. There's a change in how games are won."

Phillies general manager Ruben Amaro is quoted in Sports Illustrated saying, "Baseball has made a U-turn. We've gone back to pitching and defense and speed. You don't see the power numbers of 15, 20 years ago. There's a change in how games are won."

Tom Verducci writes in the same article, "National League teams are averaging the fewest runs per game (4.09) since 1982. American League teams (4.29) haven't scored at a worse clip since 1973, and the league's batting average (.254) is the worst in the 38-year history of the designated hitter."

David Hillman writes:

Well worth a look-see. A thought…..perhaps the home run indicator should have, as should the home run records have, an asterisk for those years.

On a related note, here's a nice piece on a genuine player. The mention of another 3000 hit club member who played his entire career with one team and lived an honorable life is appropriate, and is also, for many of us who were around then to see him play, heartwarmingly nostalgic.

Another thought…..In the spirit of 'asking the right question', it seems I feel differently about the game now than I did in my youth, but I wonder if it's the game that's changed so much, or if, instead, I've done the changing?

Stefan Jovanovich writes:

The "old guys" on the Giants - Aubrey Huff, Pat Burrell, Miguel Tejada - see things this way.

The young pitchers now know how to change speeds without tipping their pitches and they only throw to corners. "The kids maintain the same arm angles, body turns and strides for all the stuff they throw. You can't read them." Madison Bumgarner, who helped the Giants win the Series last year at the age of 21, is representative; he throws everything on the black. When he doesn't, he gets lit up just the way pitchers always have if they can't throw 98+. Against the Twins recently he tied the Major League record for futility by a pitcher at the beginning of a game. "Bumgarner faced 10 batters and retired only pitcher Carl Pavano, becoming the first player in baseball's modern era to allow as many as nine hits while recording fewer than two outs in a 9-2 loss to the Twins at AT&T Park. The Twins' stunning, eight-run first inning went like so: Single, double, single, double, single, double, single, double, strikeout, double." In his next start against Cleveland he went 7 innings, struck out 11 (his career best) and gave up 1 run.

When either the plate umpires or the batters take away the corners, the home runs will come back. They always do. What we will then see is a return of knock-down pitches and fights. We had a preview yesterday in the Baltimore-Red Sox game.

Jul

9

Bases Per Game, from Alston Mabry

July 9, 2011 | 2 Comments

Mr Ellison's home run indicator got me hungry for looking at some sports stats, so first I downloaded Sean Lahman's baseball database. Then I looked at the team stats and calculated the bases per game:

(singles + 2xdoubles + 3xtriples + 4xhomers) / number of games

for each team, and then the average bases per game for all teams for each year 1970-2010. Attached is the chart, and it shows interesting fluctuations. Big jump in the early '90s. Tapering off now.

Jul

8

Nothing Underlines the Absurdity More Than Today, from Victor Niederhoffer

July 8, 2011 | Leave a Comment

Nothing underlines the absurdity of the announcements more than today. The standard errors or two samples of 245,000 and 345,000 out of a million are of the order of 1/1000 of the number estimated. Normally it would be 1/500 but when you take a sample of 1/2 of the total as the ADM and BLS did, the standard error must be reduced accordingly. "It's an art as much as a science," the BLS said in describing their seasonal adjustment that takes account of the teachers that were out of work, and such seasonal things as semi-pro hockey players who work just 6 months of year.

Nothing underlines the absurdity of the announcements more than today. The standard errors or two samples of 245,000 and 345,000 out of a million are of the order of 1/1000 of the number estimated. Normally it would be 1/500 but when you take a sample of 1/2 of the total as the ADM and BLS did, the standard error must be reduced accordingly. "It's an art as much as a science," the BLS said in describing their seasonal adjustment that takes account of the teachers that were out of work, and such seasonal things as semi-pro hockey players who work just 6 months of year.

What a joke. What a travesty. What a display that the numbers are motivated by factors not related to anything real. And that the next number they'll be double careful to give the side of the aisle what they want. Mr. Sogi critiques my flexionic posts very justly but in each of my posts, I try to contain a quantitative meal for a life time.

Jul

8

A Question Emerges, from Victor Niederhoffer

July 8, 2011 | Leave a Comment

A question emerges as to why the big flexionic institutions are paid off as in Lehman with 29 billion the day before filed for bankruptcy. Okay, the short answer is that no one else will lend to countries like Argentina or Greece so they are given 'preferred creditor status' ahead of everyone as a condition of the loan, and that status does not preclude being paid off the day before bankruptcy or insolvency and that's why those institutions never lose money. But I think this might be only part of the answer as why would all the creditors allow some entity to come in ahead of them and get secured debt first in line when they are holding debt that will be of a more junior status. I believe it's a variant of what my friend and former boss, the Markster likes to say: "its always been this way from the beginning of time. The purpose of markets is to make money for the flexions".

A question emerges as to why the big flexionic institutions are paid off as in Lehman with 29 billion the day before filed for bankruptcy. Okay, the short answer is that no one else will lend to countries like Argentina or Greece so they are given 'preferred creditor status' ahead of everyone as a condition of the loan, and that status does not preclude being paid off the day before bankruptcy or insolvency and that's why those institutions never lose money. But I think this might be only part of the answer as why would all the creditors allow some entity to come in ahead of them and get secured debt first in line when they are holding debt that will be of a more junior status. I believe it's a variant of what my friend and former boss, the Markster likes to say: "its always been this way from the beginning of time. The purpose of markets is to make money for the flexions".

Jul

8

What political and flexionic announcements could have been used to predict the unemployment rate increase? The flexionic moves after the random numbers reported in the previous days, especially last friday's manufacturing increase should also be considered.

Jul

8

Some Books of Interest, from Richard Kostelanetz

July 8, 2011 | Leave a Comment

May I announce that some major books of mine are now available on amazon kindle for single digit prices (cheap). Some are criticism.

May I announce that some major books of mine are now available on amazon kindle for single digit prices (cheap). Some are criticism.

The Art of Radio in North America:

This offers chapter-length appreciations acoustic excellence in radio comedy, John Cage, Norman Corwin, Glenn Gould, et. al.

Jewish Writings So Far:

What a surprise it was for me to recognize that I’d been writing about Jewish subjects or out of the Jewish tradition for more than four decades. Since there wasn't enough material to make a printed book, Jewish Writings So Far seemed an appropriate addition to my website, particularly in collecting materials unavailable elsewhere. This 2011 edition expands an earlier Kindle/Website text.

On Sports and Sportsmen:

This book collects essays written over the past four decades about sports and sportsmen. It reprints a New York Times Magazine profile of the legendary orthopedic surgeon James Nicholas, long the team physician for the New York Jets, as well as the profile of Detlef Schrimpf, the first German professional basketball player in America, “Working/Playing a Long Way from Leverkusen.” The book also contains an appreciation of European soccer and a critique of a patently under-researched book about baseball in Latin America. I include two essays on the esthetic and the esthetes’ appreciation of spectator sports —”Artistry in Football” & “The Opiate of the Intellectuals.”

A Book of Kostis:

Not unlike other prolific writers, I regard some of my texts as more classic than others; these represent my choices for My Most Classic under these topics: Abridgement, Abstract Film, Acoustic Fiction, Alternative “Poetry Readings”, Alternative Exposition, Alternative Publishing, Aphorisms, Art Prints, Arts History, Audio Documentary, Audiovideotapes, Autohistoriography, Avant-Garde Criticism , Book Art, Book Composition, Book Reviewing, Cameraless video, Choreographic scores, City Anti-Planning, Collective Translation, Conceptual scripts, Connecting people, Creative Nonfiction, Creative Photography, Critical Policing, Curating Exhibitions, Digital Art, Documentary Film, Documentary Photography, Drawing, Electro-Acoustic Composition, Exhaustive Narrative Film, Experimental Prose, Extended Interviews, Film & Video Criticism, Grants Criticism, Hörspiel (German Ear-Plays), Humor, Innovative Erotica, Intellectual History, Intellectual Portraiture, Interior design, Internet Correspondence, Inventing Categories, Investigative Reporting, Jewish Art, Journalism, Kinetic installations, Literary Criticism , Literary Demolition, Literary History, Literary Journal Editing, Live Media Presentations, Memoir, Minimal Literature, Multiplex Holography, Music Criticism, Music Journalism, Musical Composition, Musicology, Numerical Art, Numerical Literature, Organizing Assemblings, Performance Studies, Performance Texts, Photolinens, Political Commentary, Polyartist Criticism, Public Art Proposals, Public Intellectual , Radio Features, Radio Scripts, Randomly Accessed DVDs, Satire , Scenarios, Scholarship, Simultaneous Translation, Social History, Sound Poetry, Sports Writing, Straight Prose, Taste-Making Anthologies, Text objects, Texts for Composers, Theatrical Scripts, Thematic collecting, Humor, Thematic Dictionaries, Transmission Holography, Travel Writing, Urban Studies, Verbal Fiction, Verbal Poetry, Video Documentary, Video Narration, Video Poems & Stories, Visual Arts Criticism, Visual Fiction, Visual Poetry, Workshops in Innovative Writing

These others are cultural history:

The Maturity of American Thought:

This was begun in the late 1960s, with the help of a Guggenheim Fellowship. It was meant to be a comprehensive intellectual history of post-WWII America (1945-68), and its thesis was that only in the post-War period did American thinking in many fields achieve first-rank importance and major international influence. My strategy in writing this book was less to prove this thesis, which I took to be virtually self-evident to those who knew (and cared) than to identify and summarize what this major thinking was. I completed several chapters before putting the project aside to complete something else; it was never resumed. The chapters I finished beyond the introduction covered “Historiography,” “Sociology,” “Social Philosophy,” “Government,” “Anthropology,” “Esthetics,” “Architecture,” and “Literary Criticism.”

Autobiography:

Categories:

An elaborate summary of my work in several domains conventionally understood.

Remembering Everyone Met:

Short descriptions of many people remembered recently—my life entirely through others.

Fiction:

More Openings & Closings:

These stories are meant to be, alternately, the opening sentences or closing sentences in otherwise nonexistent fictions. They are differentiated in print with the Openings in roman type and the Closings in italics type. This text supplements, without duplication, the "Openings & Closings" published more than three decades ago.Openings: Just the opening sentences of otherwise nonexistent fictions.

Epiphanies Complete:

Just the heightened moments, no more than a single sentence long, in a multitude of stories, mostly written decades ago.

1001 Stories Enumerated:

One thousand One single-sentence fictions, each with its own number, as a contribution to Richard Kostelanetz's continuing exploration of minimal fiction–work frequently acknowledged in histories and encyclopedias of contemporary literature.

Minimal Audio Plays:

A large number of exchanges between two speakers, for self-reading or performances.

Lovings:

Several hundred erotic stories no more than a single sentence long.

Poetry:

English Incredible English:

Thousands of unfamiliar English words, in an extended investigation into “found poetry.”

OTHERS COMPLIMENT PREVIOUISLY PUBLISHED BOOKS:

Preambles to the New reprints all the prefaces written for previous books both published and unpublished over the past five decades.

Additions to the Rise and Fall of Artists’ SoHo has a chapter missing from the first edition as well as elaborations and updates.

to come soon:

Autobiographies @ 70

There No Such Thing as a “No-Cost Delay”

New Entries Toward a Third Edition of my Dictionary of the Avant-Gardes

The Rockaways: Fall & Rise of NYC’s Beach Towns

Jul

8

Boots and All, from Craig Mee

July 8, 2011 | Leave a Comment

With more than his fair share of grand final appearances Ewen McKensie, in Australia Rugby might be able to teach us a thing or two about success. In this article he talks about how:

With more than his fair share of grand final appearances Ewen McKensie, in Australia Rugby might be able to teach us a thing or two about success. In this article he talks about how:

• You haven't won the match until you actually win it.

• favouritism and big names don't guarantee you anything in a final.

• The winning habit, once developed, became ingrained.

• the fear of failure is always a good motivator

• Get the detail right.

• ensure you get your selection right. (Fit verses healthy and experience verses youth were all selection dilemmas prior to the match and ones which you face before every encounter).

• trust your systems of play that got you there and don't wonder after the game if you could have done more. Play to win and not to lose (probably the biggest problem as a black swan trader or any strategy, where losses outnumber wins- not good for the head)

• it's what you do on the day and the attitude you bring which is the key.

Jul

8

David Brooks, from Scott Brooks

July 8, 2011 | 1 Comment

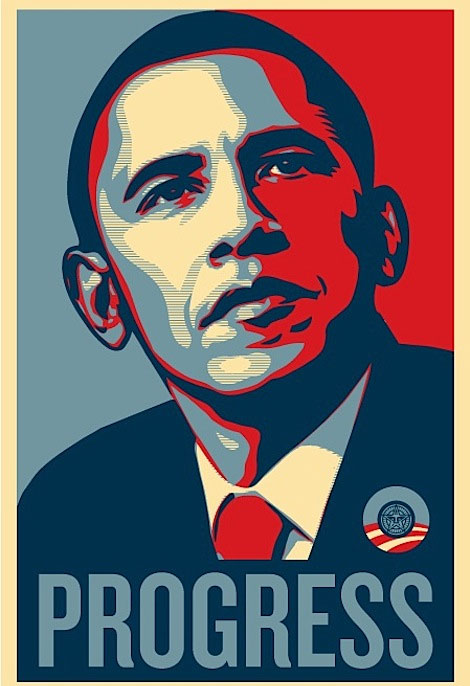

David Brooks is a "useful idiot" for the left who masquerades as a conservative in much the same way GWB masqueraded as a republican. Heck, if I were the head "Progressive" (or whatever sexy euphemism the statist are using at the moment to disguise themselves), I would take my talented writers/journalists and make them all put their names in a hat. I would then draw out a few names and say, "Your guys' job is to (pretend to) be "conservative writers", and fool the naive' conservatives into buying into creeping statism, while the rest of the Progressive writers/journalists in the statist MSM will, from time to time, refer to you as a "sensible conservative" who is merely pointing out how ridiculous and unreasonable the real capitalist are".

David Brooks is a "useful idiot" for the left who masquerades as a conservative in much the same way GWB masqueraded as a republican. Heck, if I were the head "Progressive" (or whatever sexy euphemism the statist are using at the moment to disguise themselves), I would take my talented writers/journalists and make them all put their names in a hat. I would then draw out a few names and say, "Your guys' job is to (pretend to) be "conservative writers", and fool the naive' conservatives into buying into creeping statism, while the rest of the Progressive writers/journalists in the statist MSM will, from time to time, refer to you as a "sensible conservative" who is merely pointing out how ridiculous and unreasonable the real capitalist are".

Jul

8

“Unexpected” Poor Jobs Report, from Dan Grossman

July 8, 2011 | 1 Comment

Is it perhaps an indication of the media's solicitude for the current President that every poor economic report is termed "unexpected"?

Is it perhaps an indication of the media's solicitude for the current President that every poor economic report is termed "unexpected"?

While poor economic results under the prior President were somehow not so surprising since he was such an incompetent boob?

Kim Zussman adds:

As with many time series this month was similar to the prior month, which was different from the month before.

Victor Niederhoffer adds:

All are part of the regression fallacy.

Ken Drees writes:

So now we wander into "needed and now expected qe3" type thinking and should not the market go up due to this stimulus?

Sam Marx adds:

Three Thoughts on the Reported Unemployment Rate.

1) The Unemployment Rate is probably higher than the government reported.

2) Compared to the Reagan Recovery this Administration's economic plan is a failure

3) With Socialistic Policies you have high employment rates and I don't see much hope for great improvement.

George Zachar writes:

As luck would have it, Bernanke delivers one of his regular reports to Congress next week.

No doubt, this report will put that question high up on the agenda, and he'll be spending the weekend formulating his response.

Jul

8

The Wrestler & the Grocer, from Sushil Kedia

July 8, 2011 | 1 Comment

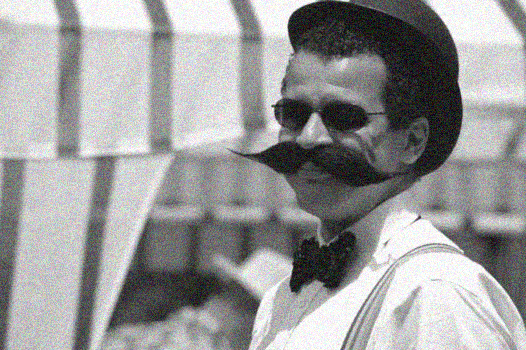

A village wrestler in the rustic state of Haryana in India, so goes the story, used to be the only one to keep huge moustaches. Tipped nicely and pointing to the sky it stood clear to all the moustaches were a mark of his power over the villagers.

A village wrestler in the rustic state of Haryana in India, so goes the story, used to be the only one to keep huge moustaches. Tipped nicely and pointing to the sky it stood clear to all the moustaches were a mark of his power over the villagers.

One day, the village grocer decided its time for him to sport similar moustaches. He grew his. Tipped nicely and pointing to the sky his moustaches matched the apparent mojo the wrestler’s displayed.

Now, in a village only one could be the supreme. The wrestler presented himself promptly at the grocer’s on hearing about the other big moustache. He challenged the grocer into a duel. The one who wins should be the one entitled to keep his mouche.

The grocer scratched his head. He proffered, why create a fight and enmity that will go on forever. Whoever loses will leave his kin come forward and challenge another duel and so on and so forth. So, instead he proposed that they should fix up a date for a full fledged fight between the two clans – the grocer’s vs the wrestler’s and a time and day three months from then was finalized. Both agreed to assemble all there relatives, friends and well wishers to partake from their sides.

The wrestler sent over message to all the nearby villages calling for all his kind to assemble and build bodies and prepare for the coming fight in 90 days. The grocer continued to sell goods at his grocery. The wrestlers bought milk, butter, cheese, fruits, meats and nuts day in and day out. The big wrestler with the mouche was of course financing the preparation of bodies for the big fight. Scores of wrestlers were keeping gobbling the goodies, pushing iron, pressing benches and raising the village dust for 90 days.

On the day of the appointed fight the wrestler roared outside the grocer’s establishment with his well built battalion of four scores of other wrestlers, all well fed and well prepared.

The grocer came out of his shop. Surveyed the well built bodies, folded both his hands in obeisance and twirled his own moustache down and offered to shave it off conceding defeat. The wrestlers laughed at his cowardice. The grocer still said he was sorry and went back to his shop, took a razor and shaved off the moustache immediately before all.

The wrestlers went back to their respective villages The big wrestler was left with his huge moustache all alone again in the village. He was also left now with a pawned house, sold off oxens and a pile of debt on his head.

Moral of the story:

1) There is no money in ego.

2) Money is power. Power may not be money.

3) Humility, at the right time, pays.

Now, in the global village one worries if China is the village wrestler or the village grocer.

On one hand West has kept on funding one bubble after another. Bubble not in the traditional financial markets’ context, but a more simplistic one, funding consumption beyond the means of the consumers. Yet on the other hand China has been supplying to global consumers at prices below which no sensible producer of any goods should be selling.

China too has gone ahead funding its asset financing spirals. Company A listed on the stock market in Shanghai holds 30% of Company B listed there which holds 30% in company C and so on and so forth. Talking about the opacity of Chinese numbers, whether at the Corporate level or at the level of aggregate Government released data is as good as passe’. No one bothers to even talk about it now.

One wonders if after a 100 years a bestseller would be written with the title, “Extraordinary delusions of Economists and Madness of Central Bankers” based on what this world is right now doing and pushing itself to.

Every Government, every Central Banker and every Treasury Chancellor in today’s world has is mouche twirled up and pointing to the sky. Lets see who will turn out to be humble, wise grocer shaving the mouche off, in time. Any thoughts?

Jul

8

Short Squeeze? from Jim Sogi

July 8, 2011 | Leave a Comment

CNBC is calling this a short squeeze rally. Is it? They say short interest is high. Is it? 100 points in 9 days! Gold, crude, Nik, all back up.

Jul

8

Thoughts, from Paolo Pezzutti

July 8, 2011 | Leave a Comment

These loans are the price to keep things going with public money as usual. Strong forces in Europe are pushing in this direction. I am not sure if the Euro is in danger or not but German and French leaders do not want their banks be hit by this situation. Also because it would be a setback as elections get closer. On another level Greece is a piece of a puzzle in the war among economic areas; and to many a weaker Europe would be an advantage.

Jul

7

Tyler Cowen at Junto Tonight, from Victor Niederhoffer

July 7, 2011 | 1 Comment

Tyler Cowen will be speaking at the New York Junto, tonight, July 7th, on "the great stagnation of capitalism" at the Mechanics Institute at 8 pm. All are welcome.

Jul

7

The Guardians of the Markets, from Paolo Pezzutti

July 7, 2011 | Leave a Comment

Moody's late yesterday slashed Portugal four levels to Ba2 from Baa1 with a negative outlook. The decision came two months after Portugal got a 78 billion-aid package ($112 billion) and hours before today's sale of 1 billion euros of treasury bills.

Moody's late yesterday slashed Portugal four levels to Ba2 from Baa1 with a negative outlook. The decision came two months after Portugal got a 78 billion-aid package ($112 billion) and hours before today's sale of 1 billion euros of treasury bills.

The sovereign debt crisis is not going away throwing money at the problem. The participation of the private sector in the Greek debt restructuring could impact Portugal ability to access the capital markets. The public sector had to save the private sector almost 3 years ago. Funny how after the huge transfer of money to the banks, governments now ask the private sector to step in and help them buy time. And time is getting more and more expensive as the crisis progresses and the effect of their injections of "trust in the system" are shorter and shorter. They look like an ostrich who does not want to raise its head from the hole. Almost pathetic are also ratings agencies that rise up championing the cause of "guardians of the markets" when they lost their credibility in the events that led to the crisis of 2008.

Jul

7

Article of the Day, from Paolo Pezzutti

July 7, 2011 | Leave a Comment

This is a great article about the NYSE, capitalism and nostalgia.

Jul

7

Jeffrey, the Wizard of Gundlach, from Stefan Jovanovich

July 7, 2011 | 1 Comment

Here are one person's notes on a recent talk by Jeffrey the wizard of Gundlach:

Gundlach: As a percentage of GDP, government debt rose from 161% when Reagan took office, to 279% when George W. Bush became president, to 353% when Barack Obama entered the Oval Office. Gundlach said he was "sympathetic" to those who advocated the U.S. should simply "print and pay" its way out of the current predicament and hope inflation would devalue existing debt so that it becomes easier to pay down. But he added there were too many deflationary forces to render such an outcome likely. The jobless recovery has created "a huge generational class" of unemployed people who are likely to make their voices heard at the ballot box. While the current mood in Washington centers on austerity and spending reductions, Gundlach says that could potentially exacerbate the unemployment problem. At that point, "print and pay" might become more palatable than a Depression." Gundlach did not seem fazed by a failure by Congress to approve a new debt ceiling limit in the short term, arguing it would not matter that much if the government was late "with one coupon payment." Another major problem he noted was housing, which he said could fall another 10%.

Jul

7

Review: Sholem Aleichem: Laughing in the Darkness, from Marion Dreyfus

July 7, 2011 | Leave a Comment

This is a remarkable but somewhat painful film, "Sholem Aleichem: Laughing in the Darkness." Notwithstanding the film title, one does not remember a single laughter anywhere in this faithful picture of the past century of tsarist pogroms and Stalinist anti-Semitic attacks against innocent scapegoat citizens of their colder and less hospitable vastnesses. It is a source of wonder to see how a 93-minute biography of a man whose life occurred largely before the advent of moving pictures, and before the art of photography was quite invested in the world, could be made using just an assemblage of photos, newsreel clips and world-renowned Yiddishists and literary recalls, plus photos that may be B/W and faded, but startlingly fresh. But director Dorman has achieved something great, and greatly moving.

This is a remarkable but somewhat painful film, "Sholem Aleichem: Laughing in the Darkness." Notwithstanding the film title, one does not remember a single laughter anywhere in this faithful picture of the past century of tsarist pogroms and Stalinist anti-Semitic attacks against innocent scapegoat citizens of their colder and less hospitable vastnesses. It is a source of wonder to see how a 93-minute biography of a man whose life occurred largely before the advent of moving pictures, and before the art of photography was quite invested in the world, could be made using just an assemblage of photos, newsreel clips and world-renowned Yiddishists and literary recalls, plus photos that may be B/W and faded, but startlingly fresh. But director Dorman has achieved something great, and greatly moving.

Aleichem's granddaughter, the famed writer Bel Kaufman, contributes poignant family stories from her own recollections at her grandfather's knee, along with Harvard scholars (Ruth Wisse), think-tank mavens, archivists and literary figures. The archival research involved in such a film is amazing. That the filmmaker succeeded in creating such a lively recall of the brilliant folklorist and writer of Yiddish parables and classics is commendable. But well-done homage to a man who lived through so much horror and ugliness to Jews in Russia, in Poland, in Europe, and here and there, all the time writing his remarkable stories and books in Yiddish, a disregarded, almost despised but virile language, is not to say this is an easy entertainment to sit through. Perhaps it is this reviewer, whose history seems to be so interwoven with its passages of sadness and movement, of shifting and readjusting–the great writer's birth name, Rabinowitz, was this reviewer's family name before it was what it is now–and the knowledge that this man was a forebear that was cause for some thoughtful mulling and gestational processing.

Born Sholem Rabinowitz in 1859 in today's Ukraine, Aleichem was a champion of the common people who saw in him their muse and Homer. When the volk heard a reading, saw a play or read a story by this taleteller, they resonated to its tumultuous rhythms and precarious adventures, since no one, with few exceptions (much later, Isaac Bashevis Singer being a notable standout) wrote in this language that spanned the continents, and in many ways joined the Jewish people in disparate countries and extremises. His contemporaries wrote in literate Hebrew or, not Jewish, Russian (Gogol, Tolstoy, Dostoievsky). Jews could converse with each other if they came from Greece or Bulgaria, from Argentina or Lithuania—everyone, old and young, wealthy (who spoke French and Russian, as well as Yiddish) or poor could speak voluminously with anyone from other countries who also spoke their momma loshen—mother tongue.

Yiddish is as rich a language as any the world has seen: It incorporates wildly colorful shtetl phrases with the raffish black humor emerging from centuries of murderous rampages in all of Europe, with phraseology from the French, German and Russian, with bits and pieces of Polish, Hungarian, even English and other languages that have hosted Jews for their transit through hectored anguish and emergent industry. It is the lingua franca of Jews the world over—even, to an extent, the Hebrew-dominant Israel—because it bespeaks and subsumes their turbulent lives in each of these sometime-hosts. Aleichem's idea to write in this 'subterranean low language' of the people was itself a revolutionary recognition of its myriad charms and multiple inflections. As to Yiddish humor, the Larry Davids, Jackie Masons and Woody Allens would not exist but for the choice to live, and laugh, through the nonstop vale of tears.

Born quite poor, Aleichem was fascinated by the stock market. Once he was married to the daughter of a wealthy merchant, he could indulge and play the market all day, every day. Then write far into the night. He was convinced he would make a fortune from his perambulations in stocks and bonds. Why not? Others seemed to do it.

When, late in his career, no longer wealthy (he lost 30,000 rubles in one fell swoop, an inconceivable fortune in the early 20th century) because of market debts incurred in one catastrophic market crash (what we might fashionably call a big 'correction') when he lived in Kiev, his mother-in-law then supported him and his family for years, but never spoke to him again, once he lost the inheritance from her husband. He came to the United States, lofted on the shoulders of thousands in New York, and his name–which in Yiddish means Hello! How are you! Well be it with you! As well as So long–was shouted in approbation, Sholem Aleichem! This was the creator of Tevye the Milkman, Fiddler on the Roof Tevya, and countless other beloved if bittersweet icons of Jewish folklore. But his two plays in the Yiddish theatre in the Lower East Side were poorly received by the critics, and he returned to Europe, to London, where eking out a living was always difficult. Sick with diseases he would have eliminated or managed to a large extent had he lived today–TB, prostate, diabetes–and alone without his wife and six children…he had accomplished much though he died too young.

Of the United States, he knew, and stated, that for Jews, the United States was "the best country for Jews that had ever been." He was widely considered the Yiddish Mark Twain.

A telling anecdote: When asked what he thought of the peregrinational, quintessential Yiddish writer, Mark Twain called himself "the English-speaking Sholem Aleichem." This biography offers an extraordinary wealth of rare pictures, even remarkable photographs of the writer's 1916 funeral in New York, where an unprecedented throng of some 200,000 showed up, making it probably the city's largest funeral attendance to date.

Incidentally, when someone hails you with Sholem aleichem, the correct response is Aleichem sholem! Go in peace. For lovers of the written and spoken word, this is vivid, involving biography-transcription. This portrait of a genius adroitly, if with weltsmertz, captures the world of chrysalis birthing, through acerbic and painful humor, as a brilliant observer explored the struggle to fashion a modern Jewish identity

Ironically, Aleichem's seesaw finances improved considerably after his death. His estate is worth a great deal more than he could have ever imagined in 1916. As someone famously remarked about the ever-popular and fiscally sound Elvis after his premature demise: Dying– a smart career move.

Jul

7

What is a Bull Market Trend Like? from Jim Sogi

July 7, 2011 | Leave a Comment

What is a bull market trend like? What are the characteristics that define it and differentiate it from the preceding bear move?

What is a bull market trend like? What are the characteristics that define it and differentiate it from the preceding bear move?

1. The big violent up move off the bottom.

2. The relentless move up against steady selling pressure.

3. The absence of any pullbacks.

4. As it tires, the slowness of the ticks and the lack of up and down motion, low absolute volatility.

5. Broad participation by both sellers and buyers.

6. Regular new highs, higher lows.

What are the other characteristics? What is the dividing line between the bear and the bull market both on the bottom and on the top? The $64 question.

Craig Mee adds:

Maybe also the release of some large pressure valve that had its foot on its throat, and the reluctant push lower from the beginning of the decline (especially when looking at near term correlated inter market relationships).

Jul

6

The enclosed picture tells more than a thousand words. It shows Lubabolo N. Kondlo, the second ranked checker player in the world, who resides in Port Elizabeth, one of the poorest provinces in SA playing in a tournament held in a museum honoring him and his club. I believe you know from your stay in Robin Island how much pleasure and skill the game of checkers can bring. One can imagine how hard it must have been for Mr. Lubabolo to become second best in world considering he can't afford a computer, an internet connection, or membership in a club and what an achievement it has been.

The enclosed picture tells more than a thousand words. It shows Lubabolo N. Kondlo, the second ranked checker player in the world, who resides in Port Elizabeth, one of the poorest provinces in SA playing in a tournament held in a museum honoring him and his club. I believe you know from your stay in Robin Island how much pleasure and skill the game of checkers can bring. One can imagine how hard it must have been for Mr. Lubabolo to become second best in world considering he can't afford a computer, an internet connection, or membership in a club and what an achievement it has been.

There is a world tournament for players of board games called the Mind Games Championships being held in San Remo, Italy, October 19-22, and I believe Mr. Lubabalo is not currently being considered to play. Perhaps you can guess the reason why from the picture. I would think it must be very hard for the above contestants in the tournament to get the money, the persona, the invites, and the social graces to get into the clubs that might qualify them for this tournament. And if they did, I would imagine it might be hard for them to tilt the powers that be to send such a person to the tournament. That's just a guess on my part from my own experience.

I was once the National Champion in Squash in the United States. I couldn't defend my title for the National Tournament held in Chicago because I couldn't get into a club that was a member club of the official association. I couldn't get into the club either because I didn't have enough money or I didn't fit the image that the club members had (in those days there was one Jewish member in all the squash playing clubs in Chicago where I was from. Fortuitously after not playing for 4 years after my exclusion, I won the tournament four more times.)

I wonder if the same situation is happening in part to Luba. I wonder if he can't get into a club because he doesn't have the money or the social attributes. I wonder if he can't get into the tournament because the tournaments require an official club to sponsor. It's what they call Catch 22 in the United States.

One could understand this in the United States 50 years ago. But it is hard to believe that it might still be happening in South Africa today in 2011 after all that has been accomplished, after all the efforts to give the kind of men pictured above an equal chance to excel in all intellectual, social, athletic, and commercial pursuits. It is especially jarring now as the latest World Cup exemplifies, South Africa has become a symbol of inclusion and renewed hope for the continent and beyond.

Perhaps it would be worth looking into this and perhaps the relevant ministers of sports and equal opportunity might see if there is any rectification appropriate for this situation. Surely there are official reasons that might have given rise to a situation like this. I know there were many in my case. I suspect however that these official reasons would seem daunting to many a man playing checkers in pictures such as above.

One might anticipate that one of the official reasons given for such a situation arising is that a qualifying tournament could not be held? Or that an entry fee of several dollars had not been paid? Doubtless there are other official reasons that might be given. These official reasons should certainly be given a fair hearing.

One realizes that despite the millions of checker players around the world, checkers or draughts is still a minor sport. But even a situation like this in a sport can send a signal. I believe it would be very good for South Africa, and the game of checkers if Mr. Lubabolo were given a chance to compete for a spot in the Mind Games.

P.S. As is always the case in such situations, there is a question of money involved. It is likely that I would consider paying Mr. Lubabolo's expenses to this tournament in the hopeful event that he is able to overcome the official barriers to entering that might be placed in his way, and/or he be given a fair chance to compete in such a tournament through any reasonable procedures.

Sincerely,

Victor Niederhoffer

Jul

6

Aversion to risk hinders medical innovation:

"Now, experts say, there is an often-unspoken fear of risk that threatens to kill the spirit of biomedical innovation. Whether it's avoiding the risk of spending money on possible breakthrough treatments or trying to screen out risk by extending regulatory reviews of new drugs or vaccines, society has responded to that fear in ways that may keep innovation sidelined."

An article in "Innovation News Daily" suggests that we are not taking enough risk to move away from established approaches that worked in the past to produce only more slight improvements to more entirely new ways if we wish to keep finding ways to really extent good health and life expectancy.

Jul

6

The Friday Move, from Victor Niederhoffer

July 6, 2011 | 1 Comment

The Friday move in stocks and bonds was particularly disruptive it being the 5th rise in a row, a 60 day extreme price and the highest single day rise in a month. One wonders if such disruptive moves have any predictive value. It is relatively easy to test this in a number of ways I believe. One notes for example that the highest point change of the last 30 days has occurred 103 times since 1999 and the average % of rise 3 days later is 52% with a small negative expectation.

Jul

6

Principles of Checkers, from Victor Niederhoffer

July 6, 2011 | Leave a Comment

I have been reading Ginsberg's Principles of Checkers. He states that there are 5 or 6 positions that come up in almost every game. And if you know how to maneuver from these middle game positions you will be among the best. I wonder if there are any comparable positions in markets. 5 of 6 that capture the essence of what's happening say at 11 am that lead to various paths that are taken during the day. The use of similarities comparing various positions of say the major 4 markets to each other changes et al from the close and the week might be a good start. Perhaps discriminant analysis could be used to shed light on the descriptive aspects of the problem. Would make a good PhD thesis.

Jul

4

Why So Few Monday Outside Days? from Alston Mabry

July 4, 2011 | Leave a Comment

Recently, Dr Z chastised justly, with: "What happened to numbers on the table?" Mea culpa. So here is some counting:

Russ's post from a couple of weeks ago, on inside and outside days, got me thinking and counting. Russ's stats showed that there were an unusually small number of Mondays that qualified as outside days. I ran a sim that randomly resorted the actual weekday designations among all the actual days (e.g., a Tuesday might be randomly reassigned to be a Friday, etc.), and then counted the number of Monday-inside days, Monday-outside days, Tuesday-inside days, and so on, for each run of the simulation, to 10,000 runs. The sim results confirmed all of Russ's binomial calculations closely, using SPY data from 1 January, 2000, to 22 June, 2011:

weekday-type/total/%tile

Mon-in 68 84.93%

Mon-out 35 0.01%

Tue-in 65 41.85%

Tue-out 80 99.30%

Wed-in 54 2.77%

Wed-out 82 99.65%

Thu-in 63 36.56%

Thu-out 54 10.77%

Fri-in 72 85.36%

Fri-out 55 15.51%

There were only 35 Monday outside days, and this number was at the

0.01%tile of the distribution of 10,000 sim run results (the minimum total for Monday outside days in the 10,000 sim runs was 34). Why? Is Monday less volatile than the other days? Mr. Sogi did some counting that indicated not. What other factors could be involved?

It turns out that SPY tends to go ex-div on Fridays, so could that be the reason for so few Mondays being outside days? A quick check of the 35 Mondays that followed ex-div Fridays shows that two of them were outside days. That's 5.7%, which is consistent with the 6.4% outside days in the total sample of 543 Mondays. So no indication that ex-div Fridays are a factor.

But inside and outside days are like a basketball going through a basket: the ball has to be small enough to fit through the basket, the basket big enough to let the ball through. But what if you also

*move* the basket? To account for "basket movement", we also have to look at the Close-to-Open moves preceding the days in question:

SD of Close-Open % moves:

(Note that holidays are included, so that some "Mon-Tue" moves are actually "Fri-Tue" moves, etc.)

Fri-Mon: 0.829%

Mon-Tue: 0.705%

Tue-Wed: 0.626%

Wed-Thu: 0.633%

Thu-Fri: 0.811%

So we see that the SD of the Friday-Monday move is the largest. To explore the effect of the Close-Open gap, I ran another simulation that used the actual Fridays and Mondays, but replaced the actual Close-Open % move with a value drawn from a normal distribution with the same mean and SD (+0.038% and 0.829%, respectively) as the actual Friday-Monday Close-Open values. The sim randomly assigned new Close-Open % changes to the actual data and then counted the number of inside and outside days in each of 1000 runs:

mean # inside days: 58.4, sd: 6.08

mean # outside days: 40.8, sd: 5.27

Then I ran the sim again, changing the SD of the Close-Open distribution from 0.829%:

SD: 0.629%

mean # inside days: 64.6, sd: 6.15

mean # outside days: 44.7 sd: 5.27

SD: 0.429%

mean # inside days: 71.1, sd: 6.32

mean # outside days: 49.4 sd: 5.21

We can see that the number of inside and outside days increases as the Close-Open gap gets smaller.

When the SD for the Close-Open distribution is set to the actual value of 0.829%, the sim doesn't produce the same result as the actual data. This is because the Close-Open % changes are not normally distributed; rather, the distribution has long tails. Here are probability plots for three sets of Close-Open % moves for the actual SPY data: Friday-Monday, Monday-Tuesday, and Tuesday-Wednesday:

The distribution of Close-Open moves for Friday-Monday has a greater range and denser tails, and the additional extreme values, or extra "basket movement", reduces the number of Monday outside days.

Monday also has the smallest mean High-Low range of all the weekdays:

mean High-Low ranges:

Mon 1.502%

Tue 1.571%

Wed 1.602%

Thu 1.636%

Fri 1.559%

So, between the greater volatility of the Friday-Monday Close-Open move, and the smaller Monday High-Low range, we seem to have a pretty good explanation for the low count of Monday outside days.

Jul

4

I had meant to post this a while back about Intel making the leap to 3d transistor design in the commercial environment. From a layman's perspective, this appears to be a big deal. Intel has been working on this since the early 2000s and is now ready to ship by early next year. The 22nm design is a step forward as it allows more transistors per area than the 32nm one, but the big news is the tri-gate design. It should result in very low power chips potentially, with less leakage at the transistor gate.

I had meant to post this a while back about Intel making the leap to 3d transistor design in the commercial environment. From a layman's perspective, this appears to be a big deal. Intel has been working on this since the early 2000s and is now ready to ship by early next year. The 22nm design is a step forward as it allows more transistors per area than the 32nm one, but the big news is the tri-gate design. It should result in very low power chips potentially, with less leakage at the transistor gate.

I would be interested to hear Gary's thoughts on the technology, but I believe this once again demonstrates Intel's technical prowess and continued innovation. TSMC, a large competitor foundry, is nowhere close to the commercial deployment of this technology. They are not planning on commercial production until 2015-16 when they move to 14nm structures. The low power possibilities of these chips may open up the smartphone market to Intel and fire a shot across the bow of ARM Holdings which currently dominates the space. Intel may finally be able to grab marketshare in the smartphone and tablet market with Atom processors running this tech.

I have been considering picking up some Intel as a long term holding in my IRA based on a number of factors including their relatively fat dividend yield. The above would point to a solid game plan going forward. I think Intel is doing some interesting things from the technology standpoint right now:

Intel is taking nano-scale chip design literally to another level. After more than five decades of putting flat (or planar) transistors to work in billions of chips in billions of digital devices ranging from big-iron mainframes to minuscule embedded sensors, Intel said May 4 that it now will build the tiny processing units in three dimensions, instead of two. They are called Tri-Gates, and Intel first disclosed the technology that goes into this chip design in 2002. Intel's 3D Tri-Gate transistors enable chips to operate at lower voltage with lower leakage, providing a combination of improved performance and energy efficiency never before seen in the chip industry, Intel Senior Fellow Mark Bohr said.

The channels of electricity on three sides of the vertical fin structure make up the 3D nature of the transistor. The 22-nanometer 3D Tri-Gate transistors (a nanometer is one-billionth of a meter) provide up to 37 percent performance increase at low voltage compared with Intel's currently shipping 32nm planar transistors. This significant gain signifies that they are ideal for use in small handheld devices. These new transistors will reside on Intel's soon-to-come 22nm Ivy Bridge processors, due out late this year.

More in-depth analysis here.

Jul

4

Mystic Seaport, from Duncan Coker

July 4, 2011 | Leave a Comment

Our family visited Mystic historic seaport this weekend. Though most of the day was spent chasing a rambunctious toddler across the village square, we did manage to board a few of the Tall Ships and Schooners on display. One interesting fact is some of the 100 foot schooners were working long line fishing vessels up into the 1950s. The advantages of sail and maneuverability severed them well into the modern age. They would fish the Grand Banks off Newfoundland and would stay at sea for up to a month if they were salting fish, versus icing them which allowed only for shorter trips. It is impressive to see a design that functioned so well for over 100 years. Looking at any of these old boats at port one can almost sense their pining for the distant seas again.

Our family visited Mystic historic seaport this weekend. Though most of the day was spent chasing a rambunctious toddler across the village square, we did manage to board a few of the Tall Ships and Schooners on display. One interesting fact is some of the 100 foot schooners were working long line fishing vessels up into the 1950s. The advantages of sail and maneuverability severed them well into the modern age. They would fish the Grand Banks off Newfoundland and would stay at sea for up to a month if they were salting fish, versus icing them which allowed only for shorter trips. It is impressive to see a design that functioned so well for over 100 years. Looking at any of these old boats at port one can almost sense their pining for the distant seas again.

Happy 4th to all,

Duncan

Jul

4

Final Cross Country Musings, form Jim Wildman

July 4, 2011 | Leave a Comment

Some final cross country musings, mostly about business models.

Some final cross country musings, mostly about business models.

On Scott's advice we stopped by Lambert's Cafe in Sikeston, MO. Delightful Americana decor and food (too much, go hungry, return stuffed). It is a large barn like structure with a small (maybe 5') sign on the outside (easily missed) that says "cash only". The entrance is full of stuff that obstructs your view of the receptionist (about 30' from the door). Naturally you wait in line. Having waited for your turn to be seated, you are now facing a VERY large "Cash only" sign. Not much choice here, circle back to the convenient ATM in the alcove in the lobby, say yes to the $3.00 fee and go eat. The cash only rule obviously saves credit card costs, bad charge fees, adds on some commission from the ATM, and gives you cash to tip the piano player. Clever. They do have a 'sticky' clientele as there really is nowhere else to eat and they are catering to travelers who've been reading the signs for 50 miles…

I needed some lug bolts and a tire remounted for my trailer while we were near Cleveland. Google located a nearby trailer store (which was recommended by the locals as well). Small fenced lot with a smattering of trailers for sale and a new Ford F550 parked. The proprietor showed up on a nice Gold Wing (Geezer Glide as my son called it). Big "cash only" sign inside, along with a sign that said "try our new finance plan, 100% down, no interest, no payments". The owner dug through some boxes for 8 lug bolts, remounted our tire, insisted we take the old one with us (along with his opinion of the laws that won't let him burn them), then asked if I needed a receipt. I said no, and it was $20. The remount and disposal alone would have cost more than that in most places. Not sure what the charge was if I needed a receipt, but I would guess $40. Again, no credit card fees, no bad debt and probably no taxes. Also no inventory system (other than his head) and no paper work headache. He has what he wants and the government ain't getting any of it if he can help.

I expect the cash only sector of the economy to make a comeback, though by its nature, it will remain hidden.

On paying for gas. What happened to the zip code authorization on self pay pumps? At least half of the ones I used did not require it. Sample from 6 states, with the same cards. Some stations did, some didn't. I thought it was a requirement??

On fast food chains I don't really like McDonald's food, but.. McDonald's

- is the only fast food restaurant that can consistently staff and use the double drive through windows

- figured out how to use the spoon as a disposable stirrer for their ice cream treat. (It is square, hollow and fits over the shaft of the machine. Nothing to clean).

- is the only one whose lids consistently stay on the cup without leaking

- the food 'quality' and service do not seem to vary with the area of the country or neighborhood. (Chick Fil A is good on this one as well)

Really liked Russ's analysis of the gas prices vs. speed on the website. The truckers I know personally are making over $50K per year.

Jul

4

The Tree of Life Review, from Ralph Vince

July 4, 2011 | 1 Comment

Don't know what else to say about this movie, except that it is the best movie I have seen — the most compelling, poignant thing I have seen, since Babel.

Don't know what else to say about this movie, except that it is the best movie I have seen — the most compelling, poignant thing I have seen, since Babel.

I know everyone wont like it. I would say 30% of the audience walked out in the first 20 minutes — though I was riveted from the opening scene throughout.

I must say, I don't know if anyone else will even like it — but I was quite in awe of it.

Jul

3

4th of July Shout Out to the NY District Attorney, from John Tierney, the President of the Old Speculator’s Club

July 3, 2011 | 2 Comments

It is, as usual, all about money. One has to question how a relatively poorly paid maid, already represented by NY's formidable prosecutorial team, found it necessary (or affordable) to hire barristers Kenneth Thompson, Jeffrey Shapiro, and Norman Siegel to represent her interests.

It is, as usual, all about money. One has to question how a relatively poorly paid maid, already represented by NY's formidable prosecutorial team, found it necessary (or affordable) to hire barristers Kenneth Thompson, Jeffrey Shapiro, and Norman Siegel to represent her interests.

True enough she has since economized, releasing both Shapiro and Siegel, while retaining Thompson (who gave a real stem-twister presentation of her case immediately following the NY announcement that GSK would be given a longer leash).

The points underscored by Thompson clearly indicate that while the criminal case may be in doubt, the civil case still has legs. The always-available Susan Allred was brought on to re-emphasize the important "preponderance of evidence" guidelines that make civil cases (supposedly) easier to win.

However, there are still a few rarely referenced voices out there harping on the fact that besides GSK's "threat" to Sarkozy, the man had expressed the heretical idea that perhaps the bond holders, and not the public, should be tagged with any losses incurred with past and present bail-out packages.

In short, a dangerous man (to certain political and financial interests) has been effectively removed from the board. Frankly, what I find most disturbing about this case and other similar ones, is the government's increasing willingness to "leak" highly prejudicial information well ahead of it being substantiated.

Topping off this questionable (if not unethical) conduct is the burgeoning of coverage by Nancy Grace and her spawn. These so-called "legal experts" and their guests remind one of Madame Defarge (with little possibility of her eventual comeuppance) and her compatriots.

Sad to say, my wife is a huge fan of this programming (Casey Anthony being the villainess du jour). If that case, or any other like it, ever ends up with a hung jury (an unlikely event), one wonders if much of the jury pool for any subsequent trial is irrevocably poisoned.

I sure as heck would give serious consideration to pleading down (regardless of my innocence and/or bankroll) before giving those supposedly non- biased vultures a second crack at my bleeding (but still-breathing) body.

Stefan may disagree, but the price of justice is just way too high for the average guy to get his (equitable) day in court. Many of us would stand a better chance if we were to go back to "trial by ordeal." There, though overmatched against a seasoned knight of the realm, we might get lucky with a wild swing of the broad sword. Though unlikely, the procedure would be faster, far less expensive, and neither party would have to share with an "advocate" whose interests might well not extend beyond the pecuniary.

Rocky Humbert writes:

Although these pages were filled with cynical comments regarding DSK; there has been "radio silence" since we discovered that his rape accuser has a credibility problem (to say the least). My point is not to criticize fashionable Speclist cynicism, but rather to salute the hardworking (and comparatively low-paid) lawyers in the NY District Attorney's office on this Independence Day weekend. The DA has a sworn constitutional duty to upload our laws — and when he discovered that his case had some serious problems — the office promptly disclosed this to the Court and the Defense — rather than burying the facts in a back desk drawer (and hoping the defense wouldn't find the same facts.) If this case is dismissed (as it should be — in a he-said/she-said case where the accuser has no credibility and/or is deported for immigration fraud), then it will be an embarrassing political setback for Cy Vance Jr. (the DA), but a testament to the greatness of the US criminal justice system. Lady Justice is not only blindfolded, but her head swivels too!

Here is a copy of the DA's letter. It says that the DA's investigators discovered DSK's accuser:

1) Lied abut her whereabouts and activities after the tryst…

2) Admitted to felony tax fraud.

3) Admitted to perjury regarding on her asylum application to the USA.

4) And other juicy tidbits….(And she had a good lawyer too.)

Marion Dreyfus writes:

Tarnishing one's reputation is a huge malevolence that cannot be expunged easily. I abhor women who accuse their soon-to-be-ex husbands of rape or abuse of their minor children if these are false. These charges are beyond ugly, and the man is often pilloried with no proof of wrongdoing– such women ought to be jailed and fined if their lies are uncovered.

He may be guilty, but her new facts are certainly exculpatory for his having 'raped' or 'forced' her– she was deliberately gunning for him, and she was less a maid than … made.

Jul

3

Dragonflies and the Market, from Bill Rafter

July 3, 2011 | Leave a Comment

Yesterday after the market close I put on my bathing trunks and went to take a swim in the ocean. On my short walk I was surrounded by perhaps 50 dragonflies. That didn't bother me in the least as I know dragonflies do not bother humans and that they eat black flies and mosquitoes that do bother humans. The west wind that we have had for days brought in the flies and mosquitoes, but also their predators. Well here I was in the middle of the swarm, and it occurred to me that I was being used by the dragonflies as bait. That says a lot about their intelligence, which would also be indicated by their exceptionally large eyes. It made me wonder if I have ever been used as bait by other market participants, perhaps with less mutualism in mind.

Yesterday after the market close I put on my bathing trunks and went to take a swim in the ocean. On my short walk I was surrounded by perhaps 50 dragonflies. That didn't bother me in the least as I know dragonflies do not bother humans and that they eat black flies and mosquitoes that do bother humans. The west wind that we have had for days brought in the flies and mosquitoes, but also their predators. Well here I was in the middle of the swarm, and it occurred to me that I was being used by the dragonflies as bait. That says a lot about their intelligence, which would also be indicated by their exceptionally large eyes. It made me wonder if I have ever been used as bait by other market participants, perhaps with less mutualism in mind.

Archives

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles