Sep

25

Side-by-Side Predicted vs. Actual Abelson Up and Down Wall Street, from the Minister of Non-Predictive Studies, Professor Charles Pennington

September 25, 2006 |

A note from Vic — the Minister first wrote and posted his 'predicted' column on September 17th, whilst the 'actual' column came out on September 23rd.

Predicted. A one Mr. G. Reaper just can't leave alone a certain Ms. Anna Nicole Smith, last seen in these pages on her betrothal to a somewhat more elderly gentleman who then accommodatingly perished, leaving her a not entirely parsimonious sum for her efforts. We return to her story now, having forgone, ahem, ample opportunities in the past, on the occasion of the near simultaneous birth of her daughter and passing of her son David, of causes that, at the time we grudgingly go to press, remain altogether undisclosed.

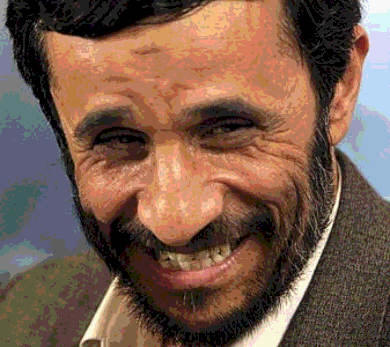

Actual. Unless the portents are all wet, there will soon be a number of vacancies on the board of Hewlett-Packard, a company, to its profound regret, much in the news these days. We'd like to suggest some possible candidates to fill those vacant directorships. We hasten to add that no one in authority at the company has asked us for our suggestions, but we're sure that's only because they're so preoccupied preparing their forthcoming testimony before a congressional committee on Thursday…Our proposed additions to Hewlett-Packard's board are: Mahmoud Ahmadinejad and Hugo Chavez, the presidents, respectively, of Iran and Venezuela.

Predicted. One can hardly breathe a word regarding Ms. Smith (and indeed she leaves us breathless) without pausing to think of the not altogether totally dissimilar predicament in which the up-until-very-recent Prime Minister of Thailand finds himself. Thai one on indeed! As Mr. PM sat in traffic here in our fair city, a subset of his countrymen, who one would have expected to be cooing over the tabloid travails of Ms. Smith, were instead coup-ing him right out of office. As he rested his constitution in the back seat of his darkened limo, they wrested the country's heretofore constitutional system and installed martial law!

Actual. The notion of weirdo and whacko as HP directors may strike you as absurd, although one could argue that recent disclosures about the company's approach to corporate governance strongly indicate they might fit right in. We're well aware, too, both suffer from some evident drawbacks. To wit: To judge by his history, Mr.Chavez, if irritated enough by bickering among the board, might easily be tempted to stage a coup, which we've not the slightest doubt would rub the present directors the wrong way. Even more serious, Mr. Ahmadinejad doesn't own a tie, a clear violation of the company's dress code, which mandates zero tolerance for such a major infraction, and, to make matters worse, he doesn't shave anywhere near often enough, either.

Predicted. Fitting for such an eventful week, we found ourselves privileged to meet with one Mr. Julian Smith, a name with which loyal readers over the past one score and ten years may not find themselves totally unfamiliar. He haunts the august chambers of Morgan Goldman, plying the trade of economist-in-chief, which, we aver, we do not hold against him. Mr. Smith's duties include not only the standard bottle-washing fare, but also the task of making predictions, moreover with regard to the future.

We found Mr. Smith in a mood that we would necessarily describe as not so completely altogether sanguine, if not to say perhaps a wee bit bearish, or even just a tad cranky, as this bold prognosticator directed us to the display below, showing the tortuous path followed over the past 160 seasons by his firm's Super-Sentiment-Indicator (SSI). Effusive as always, our perspicacious soothsayer observes that the reading today is higher, yes higher, than it was in December of 1974, reflecting the current effervescence seen both in the current markets and in the bosom of his namesake, the aforementioned Ms. Smith. He hastens to point out the silver lining of this billowing grey mass, that those far off levels of thirty and two years ago, just south of 600 in our old friend the Dow, represent what he avers is true "pound the table" opportunity for our bullish brethren, offering a dividend yield (remember those?) of 132%. Keep the powder dry.

Actual. The most obvious explanation for the market's recent favorable action just might be the favorable action itself, which invariably has a tonic effect on investors, as witness the steadily increasing chortling over the prospect of new highs in the averages. While, as we've noted, sentiment hasn't reached ridiculous levels of bullishness, it has been growing increasingly buoyant. At the very least, that's cause for caution.

As a shrewd market-watcher we know points out, for several months now this market has been prone, even while it was edging higher, to sudden reversals. No sooner do the bulls gear up for a sustained march higher than stocks do an about face, and no sooner do the bears start to enjoy life than the decline comes to a sudden end and share prices bounce.

He suspects, though, that such short-term swings of direction as they become the norm lull investors into anticipating an enduring pattern and set them up for a more pronounced and extended move. He further suspects such a move will be down, although he feels we need more febrile and widespread optimism before that happens.

We heartily second that forecast…this time, we fear, what we're in for is … a taste of the inevitable.

Comments

Archives

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles