|

|

Daily Speculations

The

Web Site of Victor Niederhoffer and Laurel Kenner

Dedicated to the scientific method, free markets, ballyhoo deflation, value creation, and laughter.

A forum for us to use our meager abilities to make the world of specinvestments a better

place.

|

Home

Write to us at:

(address is not clickable)

(address is not clickable)

The Daily Spec Archives

May 2005 Posts

5/31/2005

The Iceman, by Victor

Niederhoffer

Oetzi the iceman was freeze-dried about 5300 years ago near

Northern Italy and discovered by a German tourist on a walking

expedition. A replica is in the

Smithsonian Natural History

Museum

and the original in a refrigerator in an Italian museum. His

clothes, with nicely layered grass with wood seams, show

evidence of a tailor. Perhaps an ingeniously developed snowshoe

or backpack is visible. His copper weapons, his bow and arrow,

and his fire-making tools (including a flint, an axe and knife)

show considerable ingenuity, use of mechanics, and know-how. His

grain diet and many other wondrous aspects of his life have been

reconstructed from the remains.

What would a similar reconstruction of a trader-analyst show

if he were examined 5000 years from now? I can only speculate --

a book on candlestick analysis, some stochastics (with spurious

moving averages), a price earnings ratio (without interest

rates), a head and shoulders template, a protractor,

perhaps a ticket to a seminar on advanced derivatives analysis,

and a magazine story on Buffettology advising staying away from

individual stocks because they were too expensive an the

beginning of the 21st century, and shorting the dollar because

of the trade deficit -- you fill in the blanks.

I wonder if we all will fare as well, as archaeologists

recast the tools and know-how of traders of today.

Sushil Kedia replies:

5000 years hence might be roughly 20 times bigger a chunk of time than the

roughly 250 years history that the exchange markets and organized trading has

seen so far. Assuming that the growth function is a non-linear,

arithmetico-geometric kind of function the degree of complexity in the tools of

the trader then might at this moment appear like one which is not even captured

in the most verbose sci-fi movies of our times. Letting imagination run loose

for a while, here's my visual of Oetzi2005 in 2007:

- The nano-computing devices being in vogue by then and ones that would be

embedded in the palm-tops (may be thumb-nail-tops by then) that might be

soliciting mega-servers scattered in distant corners of the universe with

less lethal versions of gamma-ray-type connecting carriers would still be

driving delight on the archaeological find from the huge desk-top size

servers being accessed by the laptop in the hands of the Oetzi2005.

- The debate about history being created by victors or not existed in 2005 AD

would be accessed from one of these digital archives connecting to reverse

engineer the architecture of the laptop so found and a reference to Mr. Sogi's

argument on recency being found so valid even then would cause the

archaeological find to drive further excitement. For the debate would still be

relevant. Because despite the development of all tools in 2005 like the fax and

the SMS devices becoming absolutely cheap then even in 7005, "The public would

always remain behind the form." The relevance of the Fifth Discipline being

still there in 7005 would be exciting then that the dilemma was identified as

long ago.

- Returns would still not be sought without assuming some risk then and the

discovery of scanned pages from the Prac Spec on the hard disk of the laptop

would corroborate the understanding of the man of 2005 to have caught the idea

sufficiently early. Man would possibly till then be living with the equation

that, Certainty = probability + uncertainty and will continue to debate the

degree of accuracy in the philosophy in the equation above being contradictional

to the very definition of uncertainty. Language that would continue to have the

same limitations as have been identified by now would make Oetzi2005 a great

find in 7005 proving that the debate existed at least 5000 years ago, but even

in those times as in 7005 there will be doers who continued to operate while

there would still be skeptics who would chose to abandon doing in the absence of

a certain idea of uncertainty. The Oetzi2005 find would corroborate further that

it is in doing that all the difference exists.

- The Rolex on the wrist of the Oetzi2005 and the Gucci adorning his feet

would still confirm the prevailing theme in 7005 that perception drives value

and that issues like need, want, reality is different for different people.

Branding and super-value would be found then to be ideas that are 5000 years

old. The voodooistic "world's number 1 trading system" rankings of 7005 would

find their origins and confirmations from the Rolex and the Gucci. Value being

different for different people making the same price attractive for buying and

selling for two different traders would be confirmed from a

"trans-planetary-debate" on the possible implications of the Rolex and the Gucci

names printed respectively on the two objects and certainly a credit-card slip

payment found in the coat-pockets of the trader would confirm the perceived

value of the same because two different cards, each exhausting the remaining

credit limit from each of the purchases would corroborate that.

- A voters' slip would possibly be found on the Oetzi2005 proving again to the

archaeologist in 7005 that the struggle to control the creation of money is at

least 5000 years old and not a recent phenomenon of the 7000s.

- The under-garments of Oetzi2005 with markings such as, "Made in China,

Child-labor free, 100% natural" would corroborate to the mankind of 7005 that

emotion sells and that scarcity motivated purchase decisions than any advantages

of natural ingredients and that global trade had 5000 years ago achieved such

glory to have been able to incentivize the manufacture of under-garments in one

corner of the globe, labeled in another and sold in yet another.

- A compilation of e-books on a CD spanning from the Hebrew Kaballah to

Buddhism on one hand and from Japanese Candlesticks to Statistical Inference on

another would be in addition to a detailed psychometric testing report on

mind-body profile ensconced on a dat-tape would prove beyond doubt to the

audience sitting before a blaring C#BC even in 7005 that traders would allow

themselves to be as confused and as bewildered as much as the % drawn-down

tolerated by the risk-management desk of the hedge funds they work for right

since 2005.

- A post-it note affixed neatly inside the Oetzi 2005's wallet reminding about

the deadline for the 'returns-finalizing' meeting with the tax-attorney, visit

to the dentist and an over-due visit to the monthly get together of the Parent

Teachers' Association meeting are all on the same day would confirm that time

management is a challenge for the trader that is about at least 5000 years old.

John Bollinger responds:

Assuming our future archaeologist is a trader, I suspect he

would recognize our tools and techniques with little problem.

Technician, quant, fundie; all are concerned with the same

thing, a proper understanding of the supply/demand curve. While

our future observer might think our tools and techniques quaint,

they'll be facing the same challenge we face and would likely

recognize a kindred spirit. Perhaps he might even find our work

of interest, much as we draw inspiration from past masters.

Kim Zussman responds:

Also interesting that Otzi was

evidently murdered. Detailed scans reveal a flint arrowhead

lodged in his shoulder, so he probably exsanguinated or died of

infection. Maybe a margin call?

James Sogi responds:

Modern technological changes are small steps compared to

the ancient technology of agriculture, fire, stone blade,

metal, wheel, clothing. The phenomenon of recency magnifies

recent developments.

Consider that human capital is the amount of production

of one person in excess of subsistence. Consider the growth

in productivity over the ages combined with the population

explosion since Oetzi's time, and its no wonder that the

course of human existence is bullish. Growth should parallel

the rate of productivity growth and population growth. Until

one cancels the other world growth should continue unabated

over the centuries.

Phil McDonnell responds:

A true archeologist would make the safe choice. As can be

seen from hundreds of years of archeology the safe theory to

explain dimly understood artifacts and structures is always

to claim they had religious significance. The spurious

cycles induced by moving averages could easily appear to

relate to cycles of the moon and planets. The dark and light

of candlestick charts would document the periods in which

the forces of good and evil prevailed. Head and shoulders

patterns are easily interpreted as tracking sunspot activity

for some poorly understood religious purpose. A protractor

would seem indispensable for calculations involving the

conjunctions and alignments of astronomical bodies. There

can be little doubt that the religious hypothesis would be

the safe one for any future archeologist.

Although I believe the religious theory has been greatly

overused in archeology simply because it is always safe and

hard to disprove, nevertheless in the case cited above it

would be the correct theory.

Thomas Miller offers:

In the future, there wont be any trace of these books and

indicators with spurious moving averages. When enough people

lose more money than "they have a right to," these

"techniques" will be thrown away, replaced by the next "holy

grail." Future archeologists will find evidence that

successful traders, of our day and future, used scientific

methods of counting and testing and the latest revelations

in psychology. Some laws from physical sciences such as

biology will be applied to investing, like they were applied

to economics back in the day. Two books that will survive

into the future are the Chair's books; his arguments will

have been proven correct and finally accepted by the

investing community. Don't ask me when this will happen.

5/30/2005

The Moscow Rules, by Victor

Niederhoffer

Back from that reverse horn of plenty called Washington,

I'll share some spy techniques that undercover U.S.

operatives developed to deal with their lethally deceptive

opponents in Cold War era Moscow.

The Moscow Rules, a laconic set of principles from the

firing line, provide a proper basis not only for spies

hoping to survive the game, but for speculators hoping to

profit and to defend their lives against the market

mistress. A few examples, with thoughts on their

applications in the market:

- Assume nothing. Test, test, test.

- Never look back. You are never completely alone.

There is always inside information about every announcement

and event.

- Any operation can be aborted. Once you enter a

trade, do consider closing it out. You don't have to lose

everything.

- Maintain a natural pace. Don't play

double-or-nothing or risk everything or rush to put the

trade on. It will attract the enemy.

- Lull them into a sense of complacency. Do not boast

about your profits and always let them know about your

losses. No big quantities at limits.

- Build in opportunity. Prepare to change your battle

plan as conditions improve or worsen.

- Don't harass the opposition. Let the other side

have its moments of glory, its seminars, its degrees in

derivatives expertise, or whatever.

- Once is an accident. Twice is a coincidence. Three

times is an enemy action. This one must be tested.

Bcoached

responds:

Most human beings are hardwired to make bad financial

decisions because of the limbic rat brain. The rat brain is

not capable of evaluating risks and projecting them into the

future. It reacts immediately, instinctually and without

thought. Inexperienced traders, and even some of the most

experienced, when faced with a conflict between rationality

and emotions, will act on emotions. The old rat brain wins

the battle and it wins over and over again.

Aversion to loss, which is a disproportionate fear of

risk makes a lot of sense from an evolutionary standpoint

when we were in the jungle running from wild animals, but

makes no sense whatsoever in the markets. When we see a

stock or future position falling, our brain (and body, but

that is another topic altogether) reacts as if we are being

threatened. Dumping a position when you see it falling is

like running up a tree because you think a lion might

be lurking. Running up a tree won't hurt you, but dumping a

position on emotion can wipe you out. That is panic selling.

How often have you done this? Panicked out of a position

only to see it turn around without minutes to days? That is

your rat brain in charge and your logical (new) brain

completely taken over by emotion.

It also works the other way. When you see a stock going

up and up every day, the rat brain tells you that it will

continue to go up and you better get in now because you are

missing out. This is panic buying. You get in and the stock

starts to fall so you panic out of it as well.

The rat brain loves heuristics. These are mental

shortcuts which link past patterns to potential rewards or

losses. Such is the case with irrational exuberance and

irrational nonexuberance. This is why most traders buy high

and sell low. Their rat brain takes over and they are

powerless against it. The rat brain wants results now.

The new (non-rat) brain is patient and waits and analyzes.

Dr. Robert Gilbertson responds:

Excellent point,

Bcoached!

As one of the first card counters in Nevada in 1963, my

limbic system kicked in full tilt for the first few days. As

the inevitable loss runs occurred, I tended to avoid putting

up enough money at the proper time. If I had too much money

bet, I sometimes refused to double down or split on

mathematically close calls. Since my advantage was about one

percent, this was enough to eliminate my profits. To solve

this problem, I stopped betting money and only bet chips!

This may seem a ridiculous distinction, but it works.

Upon entering a casino, I would buy $1,000 worth of chips at

the cashier and mentally turn them into green, red and black

chips to be used at the appropriate times. It worked so well

that I never lost over any 4 hour period until I retired a

year later.

I use the same approach to investing in the market. There

are many days when my personal portfolios decline more than

$100,000 but I experience no panic or even negative

feelings. Why? Because I have established the probability

that I will always win in the long run by years of "playing"

and, prior to that, by extensive mathematical modeling.

Therefore, I bet the correct number of "chips" every time.

Grandmaster Nigel Davies

responds:

There's been a lot written about rat/lizard brains on the

list lately, yet my experience as a chess player has taught

me that my 'gut feel' for a position is usually right, even

when I can't quite put my finger on the 'reason'. Perhaps I

can find the 'proof' after the game, perhaps not. But it's

'feel' that guides a chess player in his choice of candidate

moves and positional assessments. Relying on purely

systematic thinking and conscious methodology we'd be

hopelessly 'wooden'.

I think that the list has been missing something here and

that the gut of a master craftsman (honed on massive

experience) is a very different thing to the untrained

instincts of a rat or lizard brain. Perhaps one of our

resident psychologists can explain this!? Of course then

there's a problem in identifying which is which, is it your

rat brain working or the gradually awakening instincts of an

apprentice craftsman?

The following position is an interesting example of

Grandmasterly intuition vs. computer or the intuition of a

weaker player.

1.d4 Nf6 2.c4 e6 3.Nc3 Bb4 4.e3 c5 5.a3 Bxc3+ 6.bxc3 b6

7.Bd3 Bb7 8.f3 Nc6 9.Ne2 0-0 10.0-0 Na5 11.e4

Chess computers (calculations unlimited) want to play

11...d6 here (11...d5 is also considered). Beginners will

make the same choice. But the majority of Grandmasters will

play 11...Ne8 without thinking about it for a second.

This move would not even occur to players below a certain

level because it is a 'retreat'. So how come it would be the

instinctive choice of Grandmasters?

Dr. Bill Egan responds:

The key for me is that in my profession I try to explain

those feelings (I am a chemist/statistician who works in

pharma on drug design).

Dr. Brett has

studied how to accelerate the learning curve in trading by

exposing traders to many more trades/virtual days of trading

to move them further along the learning curve than where

their actual experience puts them. Similarly, in the last

seven years I have spent much more time than many colleagues

digging through the scientific literature and databases of

molecules in order to better understand what makes or does

not make a drug. This is a big help because it broadens my

experience base tremendously. The situation for traders is

that they need experience, but by the time they get it, they

are broke. Study history, or you will just make all the old

mistakes again. Someone else paid that tuition bill; don't

you pay it, too.

When I look at a molecule a chemist is proposing to make,

I often have a strong gut reaction. I have spent a great

deal of time trying to understand my instinctual responses,

and relate them back to the many studies of drugs, clinical

candidates, non-drugs, and failed drugs I have performed. In

each new study, I first get a gut feel from the molecules,

and then work to explain and understand it. There are too

many molecules (and too many days of trading) to memorize

all the specific examples. What is the rule? Is it

statistically significant? Is there a mechanism we know is

valid, even in only a few situations? Is the molecule too

greasy? Too polar? Both? This leads to insolubility and/or

poor gut absorption. Do I like it because I have seen a

similar core structure or chemical fragments among oral

drugs? Do I think it is "weird" because that core

structure/fragment has never been used in oral drugs before

(or at least I don't recall it)? Is one of the parts of the

molecule similar to part of a toxic drug or a withdrawn

drug, and we know why it's bad? Is the fragment pattern for

cardiac toxicity present? Unlike chess, drug discovery is a

team effort, and I have to frequently explain to colleagues

why I want a test done, or a molecule made, or not made, to

get them to do it. Not so different from trading in a group,

and dealing with the boss watching your trades or trying to

understand the collective exposure/risks of all the traders-

"why do you want to make that trade? why did you take that

position, you idiot/genius?!"

Explain the gut feelings. Why do you like/not like the

market action today? Drill down and ask specifics. Volume?

Speed of move? Extent of move? Relation of move to recent

action pattern? Some combination of all the above? And

sometimes you can't, but you can still use the feelings if

you have a solid base of experience to draw on while doing

so. The mistake is using the feelings too early and not

understanding them better, so you do something dumb. Young

chemists new to the industry make all kinds of classic

mistakes, and part of my job is to teach our new chemists

the "lessons learned" so they don't learn them the hard way.

Vic teaches that counting is the way to approach the market,

and that is so correct, because it lets you explore these

instincts, insights, and observations and test their

validity. You learn the lessons earlier, and thus survive

longer, and maybe even prosper.

Sushil Kedia responds:

Intuition and instinct in many of its qualified

nomenclatures like for example, 'cop-instinct',

'woman's-intuition' etc. do bring to mind a question

repetitively that has been to my mind answered in the

positive by the GM bang on the point: "Is intuition a class

of mental algorithms that are organized through experiences

and which comes to elegant solutions without the mind having

recognized the structure of those algorithms?"

Now, would someone agree at some point, 'experiences' are

again modeling, testing and thus programming borne out of

mind's observations. Mind, as Edward de Bono describes is a

self-organizing pattern seeking system.

Connecting at this point the difference between seeing

and observing that was discussed recently adds up to gaining

perspective. I have 'felt' the gradual gain of perspective

helps survive situations of deception in prices,

the false breakouts, the oscillations of the emotions

that hits several times inevitably during the course of

holding an average position and all things including

oscillations in prices that are contrary to the direction of

your trade.

Often read, "know not only the rules, but know enough

when to break them". Guess, that level of consciousness is

achieved when one starts attaining perspective - that is

borne out of sharpened intuition, evaluated experiences and

matured observing.

Gibbons Burke responds:

The tradecraft known as "Moscow Rules", complete with

brass tacks, yellow chalk, and fallbacks, figure prominently

in the plot of John le Carré's

Smiley's

People, the excellent BBC mini-series TV production of

which is available on DVD along with its predecessor,

Tinker,

Tailor, Soldier, Spy. Alec Guiness becomes George Smiley

in both. Highly recommended.

George Smiley: You are Counselor Anton

Grigoriev of the Soviet Embassy in Bern, yes? Anton

Grigoriov: Grigoriev? I am Grigoriev. Yes, well done! I am

Grigoriev! And who are you, please? Al Capone? Who are you?

And why do you rumble at me like a commissar? George Smiley:

Then, Counselor, since we cannot afford to delay, I suggest

you study the incriminating photographs on the table beside

you.

5/31/05

With Apologies to Superchicken, by

George Zachar

Composing alternative verses to

fondly remembered childhood cartoon theme songs is better

than "forcing" trades on a quiet day.

When you see a bunch of bubbles,

When the debtors ask for trouble,

When Donald Trump's the idol of all men.

There is someone frowning,

Who will hurry up and bury you.

His name... is Alan Greenspan.

If you think the curve is sacred,

And won't invert,

You're just a simple yield hog

and a carry pervert.

He will ratchet rates much higher,

And your outlook will be dire.

He'll retire to a book-filled den.

There is one thing you should know,

Before your clients' cash is blown,

Watch for Alan Greenspan!

Watch for Alan Greenspan!

5/31/2005

Against all Odds, by Deon Gouws

Deon Gouws is CEO of Sanlam Multi-Manager, based in

London.

Against all odds?

FA Cup Final, 21 May 2005: Arsenal beats Manchester

United 5-4 in penalty shoot-out, after 0-0 draw

European Cup Final, 25 May 2005: Liverpool beats AC Milan

3-2 in penalty shoot-out, after 3-3 draw

In the past ten days, the supporters of two English

football clubs had much reason to celebrate. Not only did

Arsenal and Liverpool win two of the most important trophies

in the game in a breathtaking five-day period, but both

these teams also did so in a manner that defied all odds.

Numerous lessons for financial market participants were

to be found in the FA Cup and European Cup finals, both of

which ended in improbable penalty shoot-outs, with the

spoils going to the eventual underdogs in each instance. If

one equates betting on the outcome of a soccer match to

investing in shares, I can just imagine the way in which the

typical portfolio manager might have rationalised his "stock

calls" to clients after one of the most amazing weeks in the

history of English soccer. "This was never supposed to

happen" he might say, or "no-one could have predicted such

an outcome". The more statistically-minded ones might even

go as far as stating that either or both of these results

amounted to "six sigma events".

To be fair, the actual results in these two cup finals

were not all that unlikely if one assessed the matches in

advance of the kick-off (or on an ex ante basis, as

investment professionals often like to say when they try and

impress an audience). Not only had Arsenal, for example,

finished higher than FA Cup Final rivals Manchester United

in the Premiership, but they also did so by scoring more

goals (at a much higher strike rate) than Sir Alex

Ferguson's team. However, Thierry Henry, who had been

responsible for most of Arsenal's goals this year, would

miss the final due to an Achilles tendon injury. And don't

forget that Manchester United were the victors the last time

these two teams met in the league... All in all, one might

say the match was quite nicely poised.

Fewer neutral followers of football, on the other hand,

would have given Liverpool much of a chance before last

week's European Cup Final. AC Milan was a team that

practically owned the trophy, with their captain playing in

his seventh final, having already been part of the winning

team on four previous occasions. And against them you had

Liverpool, a team that many (with the exception, possibly,

of die-hard Liverpudlians) would agree should never even

have been in the final: they qualified for this year's

Eurpean cup by finishing only fourth in the Premiership last

season (and then went on to slip one more position this

season, finishing in fifth spot); they were also massive

outsiders who had to beat some of the toughest teams in this

year's competition, such as Juventus and Chelsea.

Before the match started, Liverpool knew that, in the

very unlikely event that they went on to win, they would not

even be able to defend their title as they had not managed

to end high enough in the English Premiership this year. And

they very nearly did not even get through to the knock-out

phase of the European Cup, with Olimpiakos being a mere

three minutes away from eliminating them before a sublime

volley by captain Steven Gerrard saved the day. Then the

team from Beatles country went on to beat more fancied

rivals Bayer Leverkusen, Juventus and Chelsea in a

succession of low-scoring matches, all with most unlikely

outcomes. And there are of course still question marks about

that last "goal" which put Chelsea out of the competition,

the one that never actually crossed the line according to

state-of-the-art computer analysis... Importantly, however,

AC Milan looked jaded in their last few outings before the

final following the disappointment of losing the 'must-win'

match to fellow Seria A title contenders Juventus on 8th

May. Arsene Wenger, the manager of Arsenal, even predicted

that Milan would lose against Liverpool - was his opinion

based on the five goals AC Milan had conceded in their last

two league games? "Probably", as Carlsberg, the proud shirt

sponsors of Liverpool might choose to reply!

Investment Lesson number 1: The most unlikely investment

opportunities sometimes lead to the biggest gains.

It was however the way in which the victories of Arsenal

and Liverpool were achieved that was beyond belief, defying

all statistical analysis. The FA Cup Final has not finished

in a goalless draw in more than 90 years, and the home of

the trophy has never been decided in a penalty shoot-out

(although it has to be said that the Football Association's

decision which makes such a conclusion to the match possible

was only taken relatively recently).

Investment Lesson number 2: The fact that something has

never happened before, or that it hasn't happened for a very

long time, does not mean that it won't happen next time when

you choose to invest.

In addition, Arsenal only attempted four shots at goal in

the 120 minutes of the FA Cup Final (including extra time),

against the 23 of Manchester United. More importantly,

however, United had eight shots on target (they even hit the

woodwork twice!); this, compared to one singular attempt by

Arsenal. Furthermore, United had no less than 12 corners,

Arsenal again only one. And so one can go on: in nearly

every important statistical category, the boys from north

London were thoroughly outclassed and outplayed by their

arch-rivals from Manchester... except of course in the final

score-line. Arsenal might never really have featured in the

match, but they did manage to take home the trophy; the

surprised look etched on the players' faces after coming

through the game and winning on penalties was there for all

to see after Patrick Vieira scored his penalty.

All these statistics from the Arsenal-United encounter

beg the question: if you could rewind the clock to the

period between the end of extra time, and the start of the

penalty shoot-out, who would you put your money on to go on

and win the match? Yes, this is now an academic question,

and many people might now pick Arsenal with the benefit of

hindsight. But most analysts will surely agree that a bet on

Manchester United would have been the most rational one at

most points after the start of the match... even though this

would ultimately prove to be a losing bet.

Investment Lesson number 3: Sound fundamental analysis

does not always guarantee investment success.

A mere four days later, Liverpool took the field against

AC Milan in the final of the European Cup. Everybody

predicted a low-scoring match: Liverpool had, after all, not

conceded a goal in nearly 300 minutes in this competition,

and AC Milan are also notorious in defence. Surely the two

sides would play a classic defensive match, hope for either

a 1-0 win or at worst a 0-0 draw, and then try and emulate

Arsenal's most recent achievement by winning on a penalty

shoot-out. Or would they?

As it happened, 300 minutes without goals proved to be

about as useful a statistic as historic rainfall numbers

might have been at the time that Noah was building his ark.

Less than a minute into the match, Milan's captain Paolo

Maldini found the back of Liverpool's net. And before the

half-time whistle blew, the score was 3-0. In the build-up

to the match, there were many who said that Liverpool should

never even have been in the fnal; by the time the second

half started, most of their supporters probably wished they

weren't.

I wonder if Arsene Wenger had actually placed a bet on

Liverpool, given that he had made such a prophetic

prediction a few days before the match? And if he had, I

wonder if he stayed with his position when he saw the

scoreline going against him (assuming he had access to a

real-time betting exchange, on the internet for example,

where he would have been able to close out his position at

any stage in the first half of the match - albeit at a

sizeable loss)?

Investment Lesson number 4: Some market winners will

often look like losers for a very long time; the market will

often test your patience and conviction as an investor.

Speaking of betting on the internet, it is interesting to

note that losing bets amounting to GBP242,208 were matched

on just one such site (Betfair) at odds of 1 to 100 at

half-time, i.e. people risking 100 pounds (or multiples

thereof) in order to win just one pound. In addition, a

total of GBP249,407 were lost on Milan at odds of 1 to 50.

In short, there were lots and lots of people who were

betting that Milan could just not lose from such a strong

position; this was a sure bet, if ever there was one...

Investment Lesson number 5: There is no such thing as a

"sure bet" in the market.

But it's also important to remember that this form of

betting is a zero-sum game, and there was an equal number of

hopeful punters who were taking the other side of a bet

which may have seemed most unlikely at the time. The rest is

of course history: in six glorious minutes at the beginning

of the second half, Liverpool drew level, and they went on

to win the most nerve-racking of penalty shoot-outs. Those

who were betting on the long shot at half time were indeed

handsomely rewarded...

Perhaps the most important lesson of all, is that many of

those outcomes that appear the most unlikely, do in fact

occur much more often than most of us would ever guess. This

is true in sport, it is true in the stock market, and it is

true in life. Tiger Woods does not win every golf

tournament, and even Warren Buffett loses money sometimes.

It is in fact not possible for the human brain, even when

armed with the most sophisticated quantitative techniques

and computer processing capability, to estimate the true

probability of a range of uncertain outcomes. It seems trite

to say that there is never actually any certain answer

before the event, but this is in fact the reason why

financial markets exist in the first place. And this is also

why none of us should ever put all our eggs into only one

basket, or expect of any portfolio manager to consistently

perform better than all others.

Jens Carsten Jackwerth and Mark Rubinstein, as quoted by

Roger Lowenstein in "When Genius Failed" (an excellent book

describing the failure of hedge fund firm Long-Term Capital

Management in 1998) state that, based on historic

volatility, the odds would still have been against the

now-famous stock market crash of 1987, even if the market

had been open every day since the creation of the Universe.

"In fact, had the life of the Universe been repeated one

billion times, such a crash would still have been

theoretically 'unlikely'" (Lowenstein, 2001, p.72).

Yet, it happened. And, of course, many investors lost

huge amounts of money in the process. What's more, chances

are that, one day, something like that might happen again.

In the meantime it is however important to make hay while

the sun shines. Which means that investors would be

well-advised to follow a diversified strategy, to place

their money with proven and trusted managers, and to have

realistic expectations.

You might not agree; you may in fact believe that

lightning never strikes in the same place twice. In which

case you should probably never bet on Liverpool again,

either. But, as some of my friends who have steadfastly

refused to take off their red shirts over the last seven

days now insist, you will do so at your peril...

5/31/2005

The Four Percent Solution, by

George Zachar

For

round numba groupies, in bondland we're wearing a groove in

the screens as benchmark on-the-run 10 year treasuries

re-re-re-flirt with the four percent yield level, but can't

seem to trade though and print with a three percent

"handle".

I have no deep thoughts here, other than musing about

what notions are running through the minds of the Fed Chair

and the Sage today.

5/31/2005

Sogi-won-jim-sogi reports from the Pololu system:

Oh

Masters of the Speci Council. I send greetings. The Speci

Knights perform well when Fear and Confusion do not cloud

their judgment in difficult situations. Mastery of the

physical aspects of their counting skills and mastery of

themselves, their emotions, give the power to perform calmly

and well under difficult circumstances against powerful

opponents. Greed and jealousy avoid, we must. Counting,

practice it, you should.

Fear, pessimism, negativity all lead to the short side.

An imbalance in the Market-Force, there is. Sense the

Short-Side strong, I do. Beware the Short-Side of the

Market-Force.

May the Market-Force be with you.

5/30/2005

For NYC flora lovers, by

George Zachar

During my tour of the Rose Garden at the

NY Botanic Garden today, I

learned that every year the facility manages its

bloom/blossom schedule to generate a floral explosion for

the last week of September, to coincide with a fundraising

extravaganza.

As autumn is counterintuitive for such

an exposition, it's likely a good time to go up there for

some uncrowded flower gazing.

5/30/2005

On the Euro, by Shui Mitsuda

I lived in Europe between

1972 - 1976 and 1988 -1994. I traveled in over 20 countries

by rail and was amazed by the difference in people's

behavior, just across the country border.

Germans and French are very different. Swedes and

Spaniards, Turks and Norwegians are nowhere near. Even

within Italy, northern Italians and southern Italians behave

differently, and likewise in Yugoslavia as the Bosnian war

proved.

In 1992 I never thought single currency concept for the

EU would be possible, simply because productivity of each

country in Europe was so different and yet every government

wanted to take hold of the power of currency control. In

fact who is currently controlling the euro currency? I

wonder.

Anyway my European colleagues say the single currency

system has smoothed business transactions tremendously

across Europe.

Despite the difficulty, I hope the European currency will

be successful, because it sets the example of my dream.

Though it is unlikely, my biggest dream if for a single

currency for the whole world - fair opportunities for all.

5/30/2005

Ask the Chair

Allen Gillespie: I believe

the lastest

Sports Illustrated requires

me to ask the Chair for his thoughts.

"Baseball's

Incredible Shrinking Slugger (It's not just the juice) Why

the Home Run Era is Going...Going..Gone."

Key article points and stats:

Compared to last

year:

1) Complete games up 50% through May 22

2) Complete game shutouts up 47%

3) Runs per game down 4% (down 15% from May 22 of 2000)

4) Home runs per game down 9% (down 25% from May 22, 2000)

At the current pace home runs will be down 668 this year

and down 910 compared to 2000.

Cardinals pitcher Matt Morris says, "That pitch down and

away is a fly ball out, whereas five years ago it was out of

the park."

"This year 38 of the 62 pitchers with an ERA better than

4.00 are in their 20s."

"People are going to put it at steroids doorstep," Astros

manager Phil Garner says. "But I see better pitching coming

into our game, and I think the offensive numbers would have

been down no matter what. I think we're going to go through

the Decade of Pitching now."

5/30/2005

Protectionism is no Dead Horse, by

Don Boudreaux

Sadly, protectionism is no dead horse. So as long as it's

still kicking, I'll kick it back.

31 May 2005

Editor, The Washington Post

Dear Editor:

According to Rep. Sherrod Brown ("An Unbalanced Trade

Policy", May 31), improving the well-being of people in poor

countries requires legislation and treaties that guarantee

worker safety, clean environments, and other benefits that

we Americans enjoy. Therefore, he opposes trade agreements

that do not mandate such benefits.

Rep. Brown has matters backwards. Safer working

conditions, cleaner environments, higher wages, and most

other material benefits that people everywhere desire are

not and cannot be prosperity's preconditions. Rather, they

are prosperity's results. Because freer trade is key to

increasing prosperity, Rep. Brown's rejection of freer trade

with poor countries helps condemn people there to the very

tribulations that he claims he wants to save them from.

Sincerely, Don Boudreaux

5/30/2005

Forbes CEO Compensation, 2000-2005, by Gabe Carbone

The tendency for markets to work harder and reverse after a

bad year has been well-documented in both

EdSpec

and PracSpec.

Contrary to the idea that performance reflects pay, I

hypothesized that low-paid CEOs will show a tendency to

"work harder"; and that their companies' stock prices would

benefit from same.

To test my hypothesis, I examined

the Forbes CEO compensation survey from 2000 through 2004.

The ranking information is available on or about May 1 of a

given year, so I used stock price performance from May 1

through Dec. 31 of a given year. I compared the performance

of the companies with the top 10 highest paid CEOs with the

performance of the bottom 10 paid CEOs.

In summary,

the low paid CEO companies did underperform the high paid

CEOs over the period, although the results were not

significant. Interesting as well is the performance of the

10 low-paid stocks relative to market in any given year, as

they beat both the high-paid stocks and the S&P in every

year except 2000, where they underperformed badly. Results

below:

Average (%) Return by Year and HIPAY/LOPAY

Classification:

| 2000 | 2001 | 2002 | 2003 |

2004 | Mean | Stdev |

|---|

| HIPAY | -9.9 | -16.7 | -20.9 |

21.8 | 11.5 | -2.6 | 31.4 |

|---|

|

LOPAY | -32.5 | -0.8 | -16.9 |

43.8 | 29.6 | 3.8 | 49.7 |

|---|

|

S&P | -3.9 | -10.0 | -19.8 |

17.4 | 5.4 | | |

|---|

5/31/2005

Citarella opening in Harlem, by

George Zachar

High-end NYC grocer

Citarella is opening an outlet on West 125th St.

While I always expected Harlem to "come up", I never quite

expected to see *this*.

Tony Corso

responds:

They are next door to

Fairway on the

Upper West Side, and now they are next door to Fairway in

Harlem . . . . . this is under the iron work overpass of the

Riverside Drive [the ironwork that holds up the drive as you

pass Grant's tomb] Dinosaur bar-b-que is right nearby and a

great place to watch a game and grab some ribs and beer on a

Saturday afternoon whilst your better half is shopping

Fairway and Citarella. . .['though "RUB" bar-b-que on 23rd

street is easier has prettier scenery, possibly better

bar-b-que, and the additional attraction of deep fried

snickers and Ore os]

5/27/2005

An In-Depth Look into Mark

Hirschey's Book "Tech Stock Valuation" by Victor

Niederhoffer

It is a pleasure to recommend the book

Tech Stock Valuation by Mark Hirschey as one of the best

books on investment of all time and a worthy successor and

follow-up read to the

Dimson, Marsh and Staunton book, The Triumph of the

Optimists. Hirschey's book contains 10 chapters:

-

The Tech Bubble

- What Caused the Tech Bubble?

- Investment Advice on the Internet

- A Dissertation on Tulips and America Online

- The Crash of 2000-2002 and Imminent Rebound

- Stock-Price Effects of Research and Development Expenditures

- Valuation Effects of Patent Quality

- Goodwill Write-off Decisions: Do They Matter?

- Shark Repellents and Research and Development: Does Management Have a

Long-Run Perspective?

- Corporate Governance and the Legal Environment

In an interview with

Mark Hirschey, he told the Chair the lessons he'd like the

reader to come away with after reading the book are:

-

Most stocks, most of the time appear to be fairly priced.

There are always a few, say 30 or more, that are out of

whack with economic reality. They might be outright frauds,

or short squeezes, or unfairly dumped long-term winners.

What was so unusual about the market peak in 2000 is that 30

stocks with silly prices were so big.

- In the long run, stock prices follow economic fundamentals. In the short

run, investor psychology can take over.

- Investors should be fearful after periods of exceptionally positive

stock-market returns; investors should be greedy after periods of exceptionally

negative stock-market returns.

The interview started with the following

exchange:

Chair: "What is the foundation for your work

in this field?"

Hirschey: "That knowledge of

microeconomics is the key to success in investments. That

things like barriers to entry, the structure of an industry,

the stages, the cross elasticities, competition, pricing

practices, are the key variables. It's amazing that

economists like Stigler, Caves, Porter, haven't applied

their work more directly to investments. However, the

greatest micro-economist of all time is.. . Warren Buffett."

(Every year, Hirschey leads

a

pilgrimage of his students to the Berkshire annual

meeting in Nebraska as a practical tribute to the Sage.)

Those who know the Chair's thoughts on this subject will

realize that Hirschey's views are not geared to garnering a

favorable review, but it's a mark of the book's excellence

that despite Hirschey's completely erroneous and harmful

views on this subject the Chair can still recommend the

book, along with the Aswath Damodaran's

Investment Fables: Exposing the Myths of "Can't Miss"

Investment Strategies as among the best of the last

five years.

The problem with most investment books is

that they are either written by practitioners who don't have

the scholarly background to support their points with

analytical principles and scientific inquiry, or scholars

who are so far behind the form or out of line with

reasonable applications that the book belongs in an ivory

tower. The former are motivated in the main by a desire to

promote their current or future activities in the field, and

the latter by an effort to cement their positions, or

memorialize their previous credentials.

Hirschey gets

around this because he is a practitioner. He is the kind of

researcher who likes to go through Value Line page by page

to find great undervalued stocks that have been hit by a

one-off event and are ready to bounce back when the problem

is solved. He has obviously lived and lost and made a

fortune in the tech bubble, and is wealthy enough and has

written enough (his book on Managerial Economics is a

classic, already in its 10th edition) and is established

enough as a professor at the University of Kansas that he

has no need to impress.

The heart of the book's

argument that tech is ready to rebound is contained in

Chapter 5. The book was published in 2003 and was finished

in the middle of 2002 when the Nasdaq 100 was hovering at

the 1000 level, down from 5000 in April 2000, amid calls for

Nasdaq 300 by the chronic bears, the cults led by the Weekly

Financial Columnist and by Hirschey's mentor. The current

level of 1500 vindicates Hirschey's main point.

However, the thrust of the argument is a statistical one --

that annual returns in the major averages tend to be

negatively correlated. That since the Nasdaq was down 50% by

the end of 2001, an imminent reversion to the mean was in

the cards. The problem with the author's evidence on this

score is that it is highly dependent on the time period and

methodology chosen. The author carelessly glosses over such

things as the fact that it is guaranteed to happen that

after "a sustained market correction" a bull market is

likely (in retrospect), and after the 10 worst markets it is

likely that no subsequent months will be among the worst.

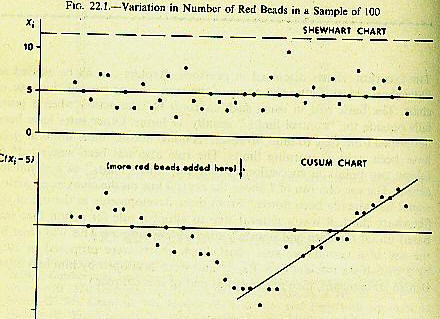

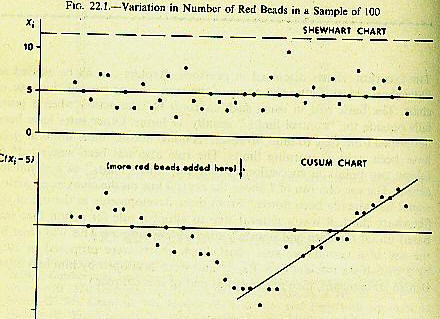

His use of cumulative overlapping 12 month returns (see

chart below) is also guaranteed to lead to the appearance of

spurious cycles as Slutsky and Yule have pointed out in

their academic papers on spurious cycles in moving averages,

and all technicians using oscillators and stochastics find

out in practice.

He reports as statistically significant a negative 10%

correlation in annual returns for Nasdaq from 1971 to 2002

but with only 30 observations the standard error of the

correlation coefficient is approximately 2.5 times as great

as the retrospective time sensitive correlation he observes.

(Indeed an investor who bought Nasdaq on its negative path

from 5000 to 1000 based on negative correlation would have

found himself a dead duck)

Hirschey's argument for the

the rebound in Nasdaq is on much firmer ground with the

foundation he lays from microeconomics, with such factors

as: stocks in industries with high barriers to entry can

maintain higher returns than those with few barriers, that

technology and patents make for great barriers, that the

major technology companies are becoming like the phone

companies of the past as computers become used for

communications as well as computing, and that because of the

risk involved with constantly changing technology tech

investors are graced with higher returns.

The chapters

on how investments can be geared to balance sheet analysis

are refined and resilient. Particularly interesting is the

post-announcement effect on goodwill write-off, where

negative moves of 11 % after the announcement continue over

the next year. The results on corporate governance and

enforcement actions by the SEC are not as clear-cut, as most

of the effect occurs during the announcement period, and the

effects after the announcement are marred by multiple

comparisons.

The Shark Repellent chapter, while very interesting, is also not as useful.

The major conclusion is that companies adopting them are good companies with

better than average performance measures. Similarly, the chapters on research

and development and patent quality while highly suggestive from a barrier to

entry economic analysis standpoint but are too granular for any practical

investment conclusions to be drawn.

Some of the best chapters in the book

involve a description of the woes of the Japanese Economy

and AOL, and the excesses of the Tulipmania. The anecdotes

here are interesting but the problem is that it's hard to

find a bubble prospectively. And despite his poor results

from shorting, Hirschey does not draw the conclusion that

one should never short stocks as the inevitable upward tidal

movement over time, and the irrational heights that bullish

sentiment can reach, are too difficult to overcome.

The book raises so many interesting points, the analytical

framework is so good, and the presentation of the data is so

clear-cut, that despite my reservations about much of the

methodology, and many of the conclusions, there are golden

nuggets available, lines of inquiries to pursue, and

potential investments to make for all readers. This book

definitely belongs on every investors' bookshelf.

Mark Hirschey adds: I greatly appreciate your kind comments on

my Tech Stock Valuation book. Still, your comments make me think I could be

clearer in making my point.

In Ch. 5 of my book, I try to distinguish between the

familiar statistical "regression to the mean" concept, and

what I call "return reversal." They are distinctly

different. The return reversal concept is based upon

economic theory concerning the mean reversion in business

profits over time, and the overreaction hypothesis, which is

based on investor psychology.

1. For both companies and industries, expansion and

contraction occurs based upon the relationship between the

internal rate of return on investment and the marginal cost

of capital. Capital expenditures rise when the internal rate

of return on investment exceeds the marginal cost of

capital. Capital expenditures fall when the internal rate of

return on investment is less than the marginal cost of

capital. At any point in time, firm and industry profit

rates vary widely. Over time, however, expansion and

contraction cause these profit rates to converge toward the

overall average annual rate of return on invested capital.

During the twentieth century, the overall average annual

rate of return on invested capital has averaged roughly 10

per cent per year. During the Post World War II period, the

overall average annual rate of return on invested capital

has averaged roughly 12-14 per cent per year.

2. Experienced and rational investors know that

competitor entry and growth in highly profitable industries

with minimal barriers to entry causes above-normal profits

to regress toward the mean. Conversely, bankruptcy and exit

allow the below-normal profits of depressed industries to

rise toward the mean. However, inexperienced and emotional

investors appear to extrapolate recently good or recently

bad industry performance into the future. This causes

positive overreaction and stock prices that are "too high"

in periods following robust firm revenue and earnings

performance, and negative overreaction and stock prices that

are "too low" in periods following poor revenue and earnings

performance

3. For some investors, especially those with a strong

background in statistics, the idea of return reversal in

market returns might be misinterpreted as a simple

"regression to the mean." However, the statistical

regression to the mean concept fails to explain return

reversals in the S&P 500, where returns following vicious

bear markets substantially exceed long-term averages rather

than regress toward long-term market norms. The regression

to the mean concept also fails to explain return reversals

in Nasdaq following vicious bear markets and boisterous bull

markets.

In short, the statistical regression to the mean concept

predicts normal stock-market returns in periods following

either abnormally good or abnormally bad performance. The

return reversal concept, based on economic theory and

investor psychology, predicts abnormally good long-term

(12-month) returns following long (12-month) periods of

abnormally bad stock-market performance. The return reversal

concept also predicts abnormally bad long-term (12-month)

returns after long (12-month) periods of abnormally good

performance.

Nobody should be surprised about the lack of negative

serial correlation in daily, weekly or monthly returns.

That's just noise. For the effects of investor psychology to

come into play, longer time frames must come into play. Bull

markets have height and duration. Bear markets have depth

and duration. In a bear market, like 2000-02, investors

eventually "puke out" their positions when the bad news

never seems to stop. You could say that I looked at 12-month

returns to get a simple and convenient handle on return

reversal over an arbitrary "long" period. However, many

investment managers are paid on an annual basis, and my

results suggest that 12-months may be as much indigestion as

the pros can stand before "puking" out their losing

positions.

I was predicting abnormally good tech stock performance

in the period following 2002, not merely normal market

returns.

I hope this clears up my point.

Vic asks Professor Hirschey:

I wonder if your worship of your mentor extends to his

analysis of balance of payments accounting and his reasons

for being short the dollar, as well as his avoidance of

individual stocks?

Professor Hirschey responds:

I also enjoyed your comments about Buffett. My

college-age daughter Jessica jokingly refers to Buffett as

my hero. I've followed him since 1969, hold lots of BRK.A

(but less than Jimmy Buffett does), and carefully consider

everything he has to say. He's a really smart guy, and I do

find him interesting, but the "hero" idea seems a stretch.

He's had an odd personal life, living in Omaha for years

with a woman that his wife (who lived in San Francisco)

introduced him to. Buffett has also had a much less than

ideal relationship with his kids, which put his current

comments about the importance of family in an interesting

light. He's older and perhaps wiser now, and trying to make

amends, I guess.

Buffett has also made lots of arbitrage investments that

do not square with his public persona to buy and hold

quality companies. Buying into the airlines (US Air) and the

investment bankers (Solomon) with convertible bonds were

mistakes, despite the advantages of fixed income instruments

for an insurance company. Buying shoe companies was also a

(now admitted) mistake; I think he may also come to regret

taking on a big position in furniture retailing, a business

that is now morphing into very risky electronics retailing.

Power utility stocks look like a sensible way to 10% returns

going forward, but they are no path to big returns, that's

for sure. Buffett's currency bet is a big departure for

Berkshire shareholders. I also think it's a bad bet. I could

be wrong, of course.

IMHO, Buffett is very, very good. He's also been very

lucky at key points (Washington Post, Cap Cities, Buffalo

News). He's been very good and very lucky. His $43.2 billion

payoff is at the way upper tail of a reasonable distribution

of what might be expected. I've attached a spreadsheet that

might give some perspective on Buffett's performance. As

$43.2 billion, Buffett's results are such an incredible

outlier that they just shouldn't be able to occur (you

really couldn't flip a coin and get heads that many times).

The only way I could get any kind of odds on it was to set

up the simulation assuming that you have the best of the

best manage a portfolio with an average return of 15% with a

standard deviation of 20% and let them take over in 1966

with $25 million. If you would have done that you would have

had a 3.74% chance of ending with $43 billion. The catch is,

of course, that Buffett earned a 29.5% annual return for 13

years to get to $25 million in 1966.

Essentially, most mortals have little chance of becoming

the next Warren Buffett. Not me, for sure. I'm working real

hard, and I'm not worth 1/10,000th as much.

5/27/2005

Alacritous Buying, by Victor

Niederhoffer

The alacrity with which the managers are

rushing to take the remaining contracts and shares at the

1200 S&P level reminds me of what

Art

Bisguier always used to say after I got myself into a

bad position and then reflected as I tried to get out of it:

"Now... you're thinking ?!"

Much more helpful was the approach of

Tom Wiswell who would

scratch the cap or cane 50 moves before and quietly say "You have a good move".

Such can help you build a stately mansion on the "board".

5/27/2005

Up the Ladder, Down the Chute, by Chris Hammond

and Charles Pennington

Laszlo Birinyi's firm recently prepared a table that

partitioned the time from 1962 through the present into

periods of rally and decline for the S&P. Among the

questions it suggested, one of the most prominent was "Is

this behavior consistent with randomness?" Before we could

begin to answer this question, we had to first decide how to

reconstruct the data using some algorithm. Using monthly

data for the S&P since 1953, we settled on the following

procedure:

- Select a point as being a potential

maximum if the price of the S&P at the close of the month is

greater than the price at the close of the previous six

months as well as the next six months (which means, of

course, that one cannot identify such a point until six

months after it has occurred). Minima are selected in the

same fashion.

- Order the set of all maxima and minima. If there are several maxima before a

minimum, throw away all but the last one. Do likewise for minima. One is left

with a set of points partitioning the time from 1953 to 2005.

- The periods from a minimum to a maximum will be called rallies, and the

periods from a maximum to a minimum will be called declines.

The results

of performing this procedure to the S&P are shown below. For

each period, we take note of its duration in months, and the

annualized percent change in price over the period. This

provides a reasonable approximation to the Birinyi table.

However, it is also a little finer, giving us a larger data

set.

In order to address the question posed, we found

the percent change over each month, and we stored it in a

list. We then simulated the S&P time series by starting at

the same initial value and moving to the next month's value

by randomly selecting one of the percent changes in our list

and using that as the current month's percent change. We

sample without replacement, i.e., we use all of the same

values but in a random order. We perform our algorithm on

each of the simulated time series and keep track of the

data. Twenty trials were performed.

We find a

significant distinction between the actual S&P data and the

simulations. The average duration of a rally in the S&P is

22 months, and there were 17 rallies. For each simulation,

there was an average rally duration. Taking the average of

these yields 15 months, with 25 rallies on average. The

standard deviation is 3.4 months. The actual value for the

average rally duration is about 4 standard deviations away

from the mean, a significant finding. This indicates that

actual rallies tend to last longer than in the simulations.

This could be the result of correlation in returns between

successive months, meaning that when you are rising, you

tend to continue doing so, making for a longer run. When you

remove these correlations, you get choppier time series.

However, there are some misgivings regarding this approach.

One objection is that "If its not predictive, then it is

consistent with randomness," and our study has no predictive

value. These are questions that ought to be addressed and

which will require significant thought.

Table 1: Rallies and Declines in the S&P 500 Since 1953, Monthly Data

Duration Annualized Return

Stage Start End Rally Decline Rally Decline

Rally Aug-53 Jul-56 35 0.29

Decline Jul-56 Feb-57 7 -0.20

Rally Feb-57 Jul-57 5 0.28

Decline Jul-57 Dec-57 5 -0.35

Rally Dec-57 Jul-59 19 0.30

Decline Jul-59 Oct-60 15 -0.10

Rally Oct-60 Dec-61 14 0.29

Decline Dec-61 Jun-62 6 -0.41

Rally Jun-62 Jan-66 43 0.16

Decline Jan-66 Sep-66 8 -0.25

Rally Sep-66 Sep-67 12 0.26

Decline Sep-67 Feb-68 5 -0.17

Rally Feb-68 Nov-68 9 0.29

Decline Nov-68 Jun-70 19 -0.22

Rally Jun-70 Apr-71 10 0.54

Decline Apr-71 Nov-71 7 -0.16

Rally Nov-71 Dec-72 13 0.23

Decline Dec-72 Sep-74 21 -0.30

Rally Sep-74 Jun-75 9 0.71

Decline Jun-75 Feb-78 32 -0.03

Rally Feb-78 Aug-78 6 0.41

Decline Aug-78 Oct-78 2 -0.43

Rally Oct-78 Nov-80 25 0.22

Decline Nov-80 Jul-82 20 -0.15

Rally Jul-82 Jun-83 11 0.63

Decline Jun-83 May-84 11 -0.11

Rally May-84 Aug-87 39 0.27

Decline Aug-87 Nov-87 3 -0.76

Rally Nov-87 May-90 30 0.20

Decline May-90 Oct-90 5 -0.34

Rally Oct-90 Dec-91 14 0.31

Decline Dec-91 Jun-94 30 -0.02

Rally Jun-94 Aug-00 74 0.22

Decline Aug-00 Sep-01 13 -0.29

Rally Sep-01 Feb-04 29 0.04

Average 22.1 12.3 0.31 -0.25

Table 2: Results of Simulating the S&P Time Series

Rallies Declines

Number Duration StDev Annualized Number Duration StDev Annualized

Return Return

Average 24.55 14.94 11.80 0.33 24.55 10.40 8.74 -0.23

StDev 2.52 1.68 3.40 0.05 2.40 2.04 3.11 0.03

StErr 0.56 0.38 0.76 0.01 0.54 0.46 0.70 0.01

Actual 17 22.06 17.47 0.31 16 12.29 8.94 -0.25

T-score -2.99 4.23 1.67 -0.41 -3.57 0.93 0.06 -0.64

5/27/2005

Summer Reading: Jack Welch's

Winning and

Bill Gross

on Investing, by Victor Niederhoffer

"Winning" by

Jack and Suzy Welch has a testimonial from Warren Buffett on

the front cover -- "No other management book will ever be

needed" -- and that says it all. If you really believe the

way to run a business is to try to be No. 1 or 2 in every

division and to the devil with rates of return, and if you

really believe that you should tell by words and

deeds one-tenth of the people that they're on the firing

list, and another eight-tenths they're drones, and another

one-tenth reward with celebrations and perks and options,

you'll love this travesty.

"Bill Gross on Investing" is even worse. Almost every

page is pure egotism, Dow 5000 is here unless you buy bonds,

and untested dogma to help his positions along, leavened

with religious and hateful dogma. The one good thing is the

anecdote about his son Nick who, when asked by the father

what would be the one thing he would like most from G-d,

said it would be "not to go to church."

Greg Cohen comments:

I bought and

read "Winning" after Jack Welch came to Wharton to give a

lecture on "leadership" and the like. Unlike the gracious

authors of

PracSpec, Welch pretty much used his entire speaking

opportunity to promote his book and probably came on the

condition that the school bought tons of his books, which he

spent hours signing after his talk. I did not get the book

signed but lots of people waited in the long line to do so.

Consensus was that his speech was not that great given he

was "manager of the century" and the No. 1 choice to join a

company board. Instead, he was rather unprepared and spent a

lot of the time talking about how he should have fired

people sooner than he did; note: when you fire someone,

don't allow them the easy way out by citing personal

problems; hang them for all to see and let everyone know

they screwed up so it doesn't happen again; defending his

ethics; note: he received the apartment, use of the plane,

the rest of the compensation package five years before he

retired; and talked about things like the

4 E's (stuff which is obvious) and the standard plug of

Six Sigma (although not in detail); and how he actually

blew up a plant in Pittsfield back in the day.

Perhaps the most amusing part of Welch's talk, however,

was when the interviewer asked him to defend his ethics

regarding the comp package and his affair with Suzy, who was

head of the Harvard Business Review at the time, etc. To an

eruption of applause he said, You want to ask me about

ethics? Why don't you ask my wife! And pretty much dodged

the question as far as I can remember. But I only heard him

for an hour in a talk at a business school, not a great

place to see the man's persona when he is actually at work.

Laurel Kenner adds:

Some of the maxims in "Winning"

seem reasonable, if a bit obvious (e.g., "reward good

performance with money and recognition"). Recommended

Practice #1, "Elevate Human Resources to a position of power

and primacy in the organization," is usually a tip-off that

a company is about to start sliding toward mediocrity. As

Greg's report suggests, Jack does go into great detail on

firing -- but that's the sort of thing that the HR types

spend a lot of time writing detailed procedures for in their

manuals, which are typically pastiches of other HR manuals

from completely unrelated companies.

The chapters on strategy all sound very fine, but I

recommend

Dr. Ross

Miller's insider account

Rigged, available

free online.

5/27/2005

Strategy and

Tactics, by Nigel Davies

Strategy and tactics require

two entirely different types of thinking. A good strategist

needs to see ideas in flowing, general terms whereas a

tactician must be very concrete.

Usually people are

capable of either one or the other and at some stage find

themselves coming up against barriers to improvement. But

the best players can do both and integrate these two aspects

seamlessly.

5/27/2005

Why Count? And, Count What? by Hanny Saad

There is no doubt that counting, testing and quantifying

plays a significant role in trading. I would be the last

person to argue this fact (I am using the word fact here in

the Popperian sense) as I try to incorporate the scientific

method to the best of my limited abilities. Counting is the

cornerstone of many of the list's speculators and Vic's

correspondents.

I would like to go back to the basics of counting. I

don't mean technical definitions of standard deviations, Z

scores and so forth (you can find that in any decent stats

book). What I mean here is the whys and whats of counting.

Why do we count? The "why" in my mind is not so

complicated. We count to gain an edge in the markets, a

verifiable and testable edge. It's as simple as that.

What do we count? This is the more complicated question.

What do we really count? Is it only today's price action

compared with yesterday's, last week's, last month's or some

other period? In my opinion it's more complicated than that.

This is where my theory of observing versus seeing comes in.

This theory plays an important part in my trading. In order

to make my point clear, I have to cite a couple of stories

that taught me much.

I was approached in 2002 by a trader who labeled himself

"a quant". He showed me, by the numbers, how similar this

"1999 bear market" is to the 1929 crash and how we will not

recover for a long time. His presentation was very eloquent

and convincing as he "saw" and made me "see", by the

numbers, the similarities between both periods. He saw that

in his charts but didn't stop to observe for a minute that

the market evolved much since 1929 and that any testing for

more than 5 to 7 years back is almost irrelevant since

neither the economy nor the stock market is static; both are

constantly evolving, dynamic animals. The market evolved a

million times since 1929 or it would have not survived

today. His naive counting made him very confident to sell

short and hold. I got the same pitch from chartists, value

investors, and quants. The chartists "saw" similarities

between the charts of the two periodsts, the value investors

couldn't find value anywhere around and the quants were

counting the wrong thing to reach the wrong conclusion.

I was reminded of this story as I read the Anonymous Mapo

Tofu Chef's magnificent post about China. It's magnificent

because not only is the analysis so comprehensive but it's

contrary to the mainstream public opinion. While the

globetrotting capitalist (and very public personage) saw

value in China to the point of trying to learn Chinese and

hiring a nanny to teach his infant daughter Cantonese, the

Mapo Chef observed bureaucracy and corruption.

My second story is unrelated to trading but makes the

same point of "seeing" versus "observing." The Egyptian

president Nasser allied with the Russians in his wars

against Israel that ended in a shameful defeat of the

Egyptian troops. He found the Russians, unlike the

Americans, organized and trustworthy as they always went

through the proper channels of communication before signing

any deals whether related to arms or otherwise. While Nasser

"saw," his successor Sadat, on his first dealing with the

Russians, "observed" how bureaucratic they were and how

allying with them could be detrimental to his plans and the

speed of his actions. He left Russia surprised how a nation

with this much bureaucracy not only survived but became one

of the two major world powers. He predicted openly to the

government officials who accompanied him on his trip a fall

of the Russian empire. Remember, this was in the '70s. Sadat

subsequently expelled the Russians and allied with the

Americans. While both men looked at the same thing, one

"observed" and one "saw."

The moral: While counting is a major factor in trading, a

trader, in order to stand out, has to count and test what he

observes and not what he sees. You see, everyone sees the

same thing but what sets us apart is observing. The more

indirect your observation the higher the profit

possibilities as long as it's counted and tested. Analogies

between trees and markets, animal kingdom and markets,

purchases of certain eBay high-end items and tops and

bottoms are all indirect observations that if quantified,

tested and verified can be more profitable than following

the obvious chart that everyone else looks at.

Tom Ryan

comments:

I believe that forensic sciences, such as archaeology

and, yes, geology, can help us in our counting to the extent

that these are sciences that very much rely on counting of

things, but show us how the counting is most effectively

used when that counting is put into a context. This is also

one of the more important lessons at the University of Hard

Knocks. You can count, but without placing it within a

context, "your mileage may vary" -- e.g., a recent mention

of the positive context between bonds and the refunding at

this particular time of year.

For another example, one could count three-day patterns

for stocks for all data going back for so many years, or one

could look at the same three-day patterns for the context

when bonds were up in that period versus down. Or you could

look at the context of the number of days expired since the

last big down day, or the context relative to the time

expired since the last x-day hi/lo, or the proximity to the

x-day hi/lo.

In the markets can be observed an infinite variety of

ever-changing circumstances or contexts that go beyond the

pure "if-then" nested loop in the code of your choice. The

Chair often posts many of these contextual ideas with the

hope that we will pursue such clues with some follow-up

counting. I take this as what Mr. Saad means by "observing."

And this is of course another reason why fixed systems

ultimately fail, as they don't take into account the