Archives

May 16-31, 2006

Write to us at:

![]() (not clickable).

(not clickable).

Please include your full name, and omit attachments.

|

Daily Speculations |

|

|

|

Archives Write to us at:

|

31-May-2006

Victor Niederhoffer Reviews Betting on Myself:

Adventures of a Horseplayer and Publisher, by Steven Crist

Crist,

while a medieval English major at Harvard, had an epiphany when he was

introduced to greyhound racing in Wonderland in Boston. Everything he had done

with English seemed irrelevant and everything he loved to do was handicap the

races. He figured out that speed rating in the beginning and the end of a race

were important. He became the racing writer for the NY times, started a

competitor to the Daily Racing Form that was unsuccessful, and then finally

bought the Daily Racing Form.

The book shows that he likes numbers but has no appreciation of how to analyze them quantitatively. He is good at collecting data. And he has a nice ear for seeing what's wrong with racing -- namely that everything starts with the public, but that the public is treated with disdain by the track and owners. His discussion of breakage is interesting in that on show bets on almost all tracks they round 219 down to 210 so the house take goes up by another 5%?

The public in the markets is often treated the same way as the public at the races and there are many good lessons that one can learn from the pitfalls of racing that one can apply to markets. He believes that handicapping horses is a respectable occupation but still thinks it somewhat impossible to overcome the track vigorish. His specialty was the Pick Six, where he was known as king of the Pick Six. However, his methods of handicapping seem qualitative with no system involved. The book suffers from an inability to generalize from his experiences, and a lack of statistical training and worse yet, no attempt at rectifying the situation.

There are some humorous anecdotes, e.g. how Governor Cuomo refused to get off the phone with him, and made him miss a Pick Six that he would have lost, thereby saving him $1400.

The last part of the book describes his takeover of the Racing Form and gives some inside info on what it's really like when you're dealing with hard hitters on the other side. The funniest part there occurs when he's negotiating a 50 million deal while doubling up on his dental work so his third party from the job he was just fired from can still pay.

One of the more erudite and amusing parts of the book comes when Crist discusses the importance of changing the cycles of the speed rating with Andy Beyer, who had dropped out of Harvard 10 years before Crist to write about racing for the Washington Post. They discuss the various speed parameter adjustments that should be made for the weather and wind and the stage of the meeting. It's exactly what the speculator must do if one wishes to keep on top of the changing relations in markets.

In short, a series of anecdotes that provides a cautionary tale of what not to do in racing and markets, and how dangerous gambling is.

31-May-2006

Option Pricing, from Ed Humbert

Assume a stock is trading at 100. An instantaneous change can only result in the price moving up or down by 1. So the stock either goes to 101 or 99. Ignore the time value of money. Let's also say that the probability of the price moving higher is 60% and the probability of the stock moving lower is 40%. These are reasonable assumptions since the stock should at least return the risk free rate or the drift. Pretty simple stuff. What would you pay to own the option?

Most people would say 60 cents. That is entirely sensible. After all, it is the weighted average expected return of both outcomes. [(.6x1) + (.4x0)] or 60 cents. The answer is logical but it is wrong. You paid 10 cents too much if you said 60 cents. I have made this mistake my entire career. This is the difference between the real world and the risk neutral world. The point is that is easy to believe that in the real world, expected returns or probabilities drive prices. The risk neutral world says something entirely different. Look at the four tables below. They illustrate that the option should trade at 50, not 60. Under all scenarios, buying or selling the option with prices rising or falling will result in zero payoffs once you hedge half the underlying. That is the risk neutral world. Notice now that in the risk neutral world, we do not even need probabilities to get the right price.

1. Buy Call & Market ↑ 2. Buy Call & Market ↓ 3. Sell Call & Market ↑ 4. Sell Call & Market ↓

Payoff Premium Delta Option Net 1.Buy Call -.50 -.50 1.0 0.0 2.Buy Call -.50 +.50 0.0 0.0 3.Sell Call +.50 +.50 -1.0 0.0 4.Sell Call +.50 -.50 0.0 0.0

31-May-2006

The Triumphant Trio on Equity Premium, from Dr. Kim Zussman

Here is another recent paper on historical equity premium by Dimson, Marsh, and Staunton:

They look at several international stock markets:

30-May-2006

Letter to a Newborn Son, Part IV: The Importance of Books, by Victor Niederhoffer

If there's one thing that is the essence of the Niederhoffer tradition, one thing that is key to our being, it's the love of books. To put this in perspective, I grew up in a very small 1,000-square-foot apartment. Yet there were more books in that apartment than in the four big libraries that I keep today, which are written up in the "World of Books." The joke is that the reason my family had so many books is that my father, Artie, worked in the book publishing district and all the publishers would beg him to take their books for free so that they didn't have to pay the expense of dumping the books in the East River, which was the only way they had to deal with remainders in those days. But the truth is, my parents loved books and no matter how little money they had there was always money to buy a used one or rent one from a lending library. Five librarians came to my father's funeral, because every week he'd visit the library and take our three or four books and read them and return them with thanks.

From the day I was born, my parents read a book to me every night. I started the same tradition with you. Books are important for so many reasons, but the most important is probably that they can take you anywhere in time or space. A book can take you back hundreds of years, to different countries, into a myriad of different situations. It can give you insight into different kinds of professions. It can arouse any kind of emotion: humor, suspense, happiness, pity.

The other reason books are so important is that they contain lots of knowledge. There's an expert on every subject and when experts have something really enduring to say , they publish it in a book. They do this usually out of a love of their subject, a calling to communicate with posterity. That's one of the keys to books. They are made to last. They contain what's known about a subject that everyone should know as of the time they're written, and that people should still know in a hard form in a hundred years.

We live in a verbal society where people who can use words well gain power and respect. No better way to learn about verbal power than through books, as almost everyone who's good with words eventually writes them. I'm proud to say that my mother and father wrote six, including one they did together, and I wrote one, and I also wrote one with your mother, continuing the tradition. I am also happy that one of your sisters has already written a very good book, and she has another one coming soon. I hope you will be the third generation to do so.

One thing you should know about books: Take them in many forms. Read them, listen to them in the car or at home, listen to your parents or friends when they read them to you, talk about them in book clubs, ask your friends to tell you a story from books , or write some yourself. Each form will develop new levels of knowledge and happiness for you.

I find that the best books were written many years ago -- I like to say 100 years ago. One reason for this is that books in the old days were read by a more thoughtful kind of audience, and books had to be of a higher quality to sell in those days. The other reason is probably related to survivor bias; the books that are old and still around are obviously the ones that still hold up. But I think there's something more involved than survivorship bias; namely, the books of the old days tried to talk about timeless, important things. The audiences were not quite as divided as they are today. The topics that the old books addressed were more expansive, adventurous, heroic. The negative reason that the old books are better is that they didn't have to worry about everybody being a victim in our society and they didn't try to write that people are entitled to thing, the idea that currently has the world in its grip. The old books often were about people using their talents, knowledge and effort to overcome the obstacles to achieve their individual goals.

One way I have of really enjoying good books is to read bestsellers like those of Louis L'Amour or Patrick O'Brian, or Frederick Forsythe, or John LeCarre, or Colleen McCullough, or Tom Clancy. They know what things people are interested in, they can construct a plot that keeps you moving forward and ties together beautifully, they know how to get you excited and then release you, and they know how to talk about important things that make you happy. One thing that ties all these authors together is that they write about important things, and they research their subjects so carefully that you walk away from the book with tremendous knowledge of a new field, as well as enjoying your visit to a new world.

I can't conclude this paen to the importance of books without telling you some of my favorite books. Presumably you won't like all of them now, but I can assure you that they each have been instrumental to the enjoyment and knowledge that I have picked up in my life. The one book that I find that I can read over and over again which people say is the greatest novel ever written is "Don Quixote." It's a book about a heroic quest, to right the wrongs of the world, to protect the weak, to uphold romantic values, to make the world safe for women, to enjoy nature, to uphold friendship. And yes, it's a book about books because the thing that inspired it were all the books about chivalry outstanding at that time that were full of holes and mistakes.

I have a recommended list of books on my site that I'm constantly adding to so I'll refer you there for a little review of some of the essentials that will make your life so much better, and on the other side, not to have read them will make your life so much emptier. Some of the highlights: "Atlas Shrugged," the Patrick O'Brian series about Jack Aubrey, for whom you were named, starting with "Master and Commander" and ending with "Blue at the Mizzen" (which most people who love Jack and Stephen never get to read because they're so sad to come to the end of the series that they don't wish to finish); "Gone with the Wind," by Margaret Mitchell (and be sure to see all the letters I have of hers that show what a great historian and wonderful woman she was); "Old Home Town," by Rose Wilder Lane; "Monte Walsh," by Jack Schaefer; "Moby Dick," by Herman Melville; and a few books by Louis L'Amour -- any will do, but especially "Hondo," "My Yondering Years," "Son of a Wanted Man" and the Bowdrie series; "Memoirs of a Superfluous Man," by Albert Jay Nock; "Memories of my Life" and "The Art of Travel," by Francis Galton; and some Shakespeare since he has shaped the Western mind and is Mr. Literature, and some Mark Twain, because everyone should have a little bit of Tom Sawyer, Huck Finn, the Connecticut Yankee or the Traveler up the Equator, in him.

While you're at it you should read some of the most important investments books, and again these are reviewed on our site: "Triumph of the Optimists" by Dimson et al.; "Trading Exchanges," by Larry Harris; "Horse Tradin'," by Ben Greene; "The Economic Way of Thinking," by Heyne, a good book on valuation by Damodorian, and both of your father's books.

Start a library when you're very young and try to follow your parents' tradition of increasing it to beyond the previous generation. Make the ratio of books to space in your house exceed ours, and let there be a dozen librarians at your funeral. Love, Dad

Pamela van Giessen responds:

Books, whether they are

fiction or non-fiction, give insight, show so many colors that our eyes miss.

There is something about verbal communication that reaches deeper than any other

form of communication or art.

Books, whether they are

fiction or non-fiction, give insight, show so many colors that our eyes miss.

There is something about verbal communication that reaches deeper than any other

form of communication or art.

Books, which are really just collections of words, may also be the final and ultimate refuge of the individual and individual liberties. You can read any book you want, interpret it any way you want. You can write anything you want. Words are the very basis of man's upward and evolving trajectory. Without words, there is no science, no math, no trading, no profits. Without words, there are no ideas. Words propel us.

Read the best books; read the most popular books; read even bad books. Read books by good people, smart people, knowledgeable people, and great storytellers. Read books by mediocre storytellers. And if you can parse what makes a message resonate with a peoples and time, you will be able to use that knowledge to propel your ideas forward.

I think the book is on the spec list reading list but I think that The Road to Serfdom is one of the most profoundly important books to read. It's a potent and necessary reminder that serfdom is just around the corner for all peoples and societies if they are not careful. Thus it is everyone's responsibility to protect words. In protecting words, we protect ideas.

In Memory of Elaine Niederhoffer

30-May-2006

A Pair of Eights, from Ari Siegel

Here's an interesting poker play from a game I played with some friends this

week. Guy next to me accidentally showed me his hand. It was Queen-Ten. I held

Eight-Nine. He raised before the community cards came out. I announced to

him that I saw his cards and then I called his raise. The flop is

Queen-Eight-Three. He bets. I say, "well that flop hit you nice," and I

call. Next card is nothing helpful, he's still beating me with pair Queens

to my pair Eights. He bets again. I go all in, which is about 1.5 times the

pot. But it was all his chips. He thought for long time, then folded.

Here's an interesting poker play from a game I played with some friends this

week. Guy next to me accidentally showed me his hand. It was Queen-Ten. I held

Eight-Nine. He raised before the community cards came out. I announced to

him that I saw his cards and then I called his raise. The flop is

Queen-Eight-Three. He bets. I say, "well that flop hit you nice," and I

call. Next card is nothing helpful, he's still beating me with pair Queens

to my pair Eights. He bets again. I go all in, which is about 1.5 times the

pot. But it was all his chips. He thought for long time, then folded.

30-May-2006

Quote of the Day, by Victor Niederhoffer

"A company shareholder come West and spent a weeks' vacation sleeping in the ranch house, and loafing around on a quiet old horse, and he thought everything was fine, rather stern and hard, but fine, and he never knew the fact he had a quite horse, and the lack of any delighted attention to his tenderfoot antics meant anything at all"

--Monte Walsh, XYZ, a quote about the tension among the men when it was known that one of them had rustled a steer, thereby letting all the others down, but yet, even in 1880 the company shareholders sent their sons to see what it was like to get a little of the West in their boots.

30-May-2006

Bear Necessities, by Grandmaster Nigel Davies

Look for the bear necessities The simple bear necessities Forget about the joyfulness of life I mean the bare necessities The Abelpretchnik recipes That brings the bear necessities of strife Wherever I wander, wherever I roam I couldn't but ponder, my mortgaged home The banks are on a lending spree To make some profits just from me When you look into the smaller print And see that you will soon be skint And maybe drink a few The bear necessities of strife will come to you They'll come to you! Look for the bear necessities The simple bear necessities Forget about the joyfulness of life I mean the bear necessities That's why a bear can't rest at ease Without the bear necessities of strife Now when you pick a growth stock Or a winning fund And it then goes way down Next time beware Don't pick the growth stock on the rise Instead just wait its demise Have I given you a clue? The bear necessities of strife will come to you They'll come to you!

30-May-2006

Cr@mer on Paulson, via Dr. Janice Dorn

I want to be honest about this. You simply could not put John Snow on television without people turning the station. That meant he could not be booked as a guest on key TV shows. He was so unimpressive a salesman that it was the kiss of death to have him on. That will not be the case with Paulson. That's because Paulson has tremendous bearing and is a great "get," meaning he's always wanted as a TV booking. That matters tremendously, perhaps more than anyone who is not behind the scenes realizes.

Now, the other important issues -- and I am adamant that the TV game is important -- have to do with whether Bush continues to consider the Treasury position as a sinecure or salesman post. Ever since Paul O'Neill did such a poor job as Treasury Secretary, I have believed that the job -- or any of the jobs involving economics -- means nothing to Bush. He took his own counsel, perhaps because he was a businessman in previous life. The problem is that Bush, too, is an incredibly inarticulate spokesperson. For goodness sake, he has 5% GDP growth and you would never know it.

I think that's because the chief spokesman obviously had no real touch with the president, the people or the communications people who convey the message. He was, alas, an empty suit.

James Lackey replies:

Oh yea I said the same thing when I saw the tone deaf

one and then snowball on a speech. I wondered how in

the world did these guys ever get the job? Didn't they

take a media class?

Oh yea I said the same thing when I saw the tone deaf

one and then snowball on a speech. I wondered how in

the world did these guys ever get the job? Didn't they

take a media class?

I was impressed by the prolific professors TV performance. When I saw him asking "what color shirt should I wear" I went oh my goodness...as white on TV messes with the "white balance" on the camera and anyone that ever took a production class etc...but he obviously practiced his "pitch" or he is indeed prolific in speech.

All racing boys are taught at a very young age how to do an interview. We never say UGH or huh or what...or repeat as that is military for another artillery barrage "say again" If you don't hear the question, just answer your own question.

A Great (but over used ) transitional words are "SO" for a pause...very subtle you don't notice as they are carefully choosing the correct words...and if conducting an interview "let me ask you" is a pause to find where on you note card "your lost place" etc.

The canned phrases drive me nuts but that is the business "id like to thank my crew or fans or boss or wife" as they scramble for their "My Chevy, Home Depot, interstate batteries car was great today, but we came up a little bit short"

The gist is "practice every day" and over prepare so

you are not nervous. A good spot is your local PBS

station. You can rent or make friends and use their

local set up and practice talking into the camera,

switching cameras, reading teleprompters, dealing with

the heat of the set, until you are an expert. The only

thing "hard" about TV is the weather...that is to

predict and deliver it on the green screen and have

all the maps loaded correctly.

The gist is "practice every day" and over prepare so

you are not nervous. A good spot is your local PBS

station. You can rent or make friends and use their

local set up and practice talking into the camera,

switching cameras, reading teleprompters, dealing with

the heat of the set, until you are an expert. The only

thing "hard" about TV is the weather...that is to

predict and deliver it on the green screen and have

all the maps loaded correctly.

I was fortunate enough to have a PBS station at my high school. My mother was very upset when I chose not to go to school of broadcasting when I was a kid in Chicago. I said "but mom I am already making 3x that now."

30-May-2006

Computer Algorithms for Combining Trading Models, by Bruno Ombreux

Here is an interesting

article. Instead of using speech recognition techniques for investment, the

authors are using an investment technique, Covers's Universal Portfolio

algorithm, for speech recognition. I can't understand half of their lingo, but

their conclusion is striking. Such algorithms give good results when test data

is unknown or changing over time.

Here is an interesting

article. Instead of using speech recognition techniques for investment, the

authors are using an investment technique, Covers's Universal Portfolio

algorithm, for speech recognition. I can't understand half of their lingo, but

their conclusion is striking. Such algorithms give good results when test data

is unknown or changing over time.

Which applied back to finance, means that they could perform well in an environment of ever changing cycles, their use being to identify which dialect is being spoken by the market (dialect = so-called cycle = regime), with the goal of allocating funds to the strategies best suited to the dialect currently spoken by the market.

The good news is that their algorithms have strong ties to hidden Markov models, which have R modules available and are certainly easier to learn than a whole new science (speech recognition).

28-May-2006

Recent Declines, by Victor Niederhoffer

The recent declines in the stock market indexes raise many interesting

questions. Qualitatively speaking, we've had a decline of 82 points in a two-week period, and that decline appears in the same ballpark as the decline in

October relative to the big commodity brokerage that went under, and the Service

decline of April 2005, and the emerging market troubles of October 1997, the

Long Term Credit bailout of August 1998, the anticipatory fake October 1987

decline of July 1986. But it was much smaller than the declines associated with

troubles at the slash VNDVG ranch in summer 2002, the well known and anticipated

activity in downtown Manhattan in September 2001, the bursting of the bubble of

Nasdaq 2000, the interest-rate fear decline of October 1990 and the Secretary of

State Baker decline of October 1987. Those are all the declines I see

qualitatively on a chart that seem to have fallen to more than 50 points in the

S&P or 10% from top to bottom in a reasonable lookback period from highest high

to lowest low in a two-month period over the last 26 years. Many questions emerge

and I donít think it remiss to pose a few hypotheses with my preliminary

qualitative answer before the collective wisdom of my colleagues and partners

puts the pencil and paper to them:

I am interested in any other hypotheses relating to this seemingly somewhat harmonious sweep and generalization relating to living one's life or making or keeping one's stake that are related to such grand moves.

James Sogi on Markov Chains:

Computers can generate random rhythms that also

express an underlying beat that can be easily heard even in a tempo

curve. In this article discussing Markov Chains, the LISP programmers use a

program using a second-order Markov chain to generate random rhythms that

land on the beat and have some coherence. Music is a form of

communication, and we have theorized that the market is communication.

The mathematician hired speech recognition programmers to listen to what

the market is saying. Rhythm is a simple form of communication.

Additional content is understood and communicated in words, but seems to

require repeating three times. Musical rhythm often use triplets,

verses to ballads often are three. A second-order Markov process describes

a triad. Content has a beginning, middle and end. The market shares

these characteristics and the use of threes. Most market moves seem to

have a classic lighting bolt, or ranges have an N pattern. A basic bid

ask market will tend to go ask, bid, ask. Communication is basically send,

receive, and confirm. Market timing or rhythm might have coherence and

is a basic element of communication.

Computers can generate random rhythms that also

express an underlying beat that can be easily heard even in a tempo

curve. In this article discussing Markov Chains, the LISP programmers use a

program using a second-order Markov chain to generate random rhythms that

land on the beat and have some coherence. Music is a form of

communication, and we have theorized that the market is communication.

The mathematician hired speech recognition programmers to listen to what

the market is saying. Rhythm is a simple form of communication.

Additional content is understood and communicated in words, but seems to

require repeating three times. Musical rhythm often use triplets,

verses to ballads often are three. A second-order Markov process describes

a triad. Content has a beginning, middle and end. The market shares

these characteristics and the use of threes. Most market moves seem to

have a classic lighting bolt, or ranges have an N pattern. A basic bid

ask market will tend to go ask, bid, ask. Communication is basically send,

receive, and confirm. Market timing or rhythm might have coherence and

is a basic element of communication.

28-May-2006

A Letter from Victor Niederhoffer to Barron's

Columnist Michael Santoli

It was a welcome refreshment to see your column and it must have helped to cure Mr. Abelson to see that you actually had some testable propositions in your column and that he should come back to preclude that, as well as the curative impact of a market decline which he has been predicting continuously since 1966.

However, while Mr. Abelson is partial to the continuous against-the-wind

prediction of a decline that may have caused more trillions of lost wealth to

individuals than anything else in history, you are subject to the seemingly

sententious statement that is either incapable of falsification or likely to be

true by randomness in 99% of the cases. Such for example is your remark that

"the indexes donít seem poised to stretch to new index highs". Yes, they are

some 3% to 4% below highs of two weeks ago, and with the volatility that is

consistent with the empirical record, it's about 1 in 50 that in the next two weeks they would go above

a high.

However, while Mr. Abelson is partial to the continuous against-the-wind

prediction of a decline that may have caused more trillions of lost wealth to

individuals than anything else in history, you are subject to the seemingly

sententious statement that is either incapable of falsification or likely to be

true by randomness in 99% of the cases. Such for example is your remark that

"the indexes donít seem poised to stretch to new index highs". Yes, they are

some 3% to 4% below highs of two weeks ago, and with the volatility that is

consistent with the empirical record, it's about 1 in 50 that in the next two weeks they would go above

a high.

You talk about proximity to 200-day moving averages, and moves relating to 13 weeks of gain, and levels of the beginning of the year, and unmentioned distance traveled back from 2000-2002 lows. All of these statements could be tested as to their validity, and numerous of a quantitative mode are consistently doing so, taking account of the law of ever-changing cycles, but regrettably the gist of these tests is that following moving averages in stock market trading does consistently lead to above average losses as does trend following.

You talk about qualitative markers of the end of a decline, and certainly that's an interesting subject but I would lean more to the influence of Father Bernanke and his predilection for pretty women, and his promise not to repeat his misstep with Maria, as more symbolic. And more important of all, the symbol of the 5% rate on the 10-year note. Many talk about slingshot moves after they take place as you do, and doubtless if Mr. Abelson were here, he would describe it as a dead cat bounce, but the problem is that right before such bounce, the pundits were as strongly insistent that we were in a new bear market, with pivots and moving averages confirming as you are retrospectively with your 5,000 trading desks with 5,000 buy programs. Regrettably for each such buy trading program there is a sell program among traders and chart watchers that "the bounce is worth selling into."

You talk about stealth weakness in the averages, but is this unusual, consistent with randomness, or bullish or bearish? You seem to have a most undeveloped sense of whether market conventional wisdom from this or that group of traders or chart watchers, with or without an axe to grind is worth following or fading. That's why the pencil and paper is very important. Aside from Mr. Abelson turning a new leaf and your colleague testing the proposition that a decline in the dollar is bearish for stocks, and the refraining from feathering the nest of those old codgers who are consistently bearish and have missed the 10,000-fold return of stocks in the 20th century, that would be the best way in my opinion for you to improve until the date that when stock market does "stretch to new index highs," you are called back into service again, either by general revulsion among your readers or the relapse that such a rise will likely, but hopefully not induce in your venerable colleague.

29-May-2006

Memorial Day in Westport, by Steve Wisdom

Memorial Day is my favorite day of the year in Westport.

Memorial Day is my favorite day of the year in Westport.

Westport is what I imagine all of coastal suburbia will look like in 20 years, as technology advances. A layer of small-town American "locals", overlain with a veneer of sophisticates, commuters/telecommuters/knowledge-workers, who are a bit too fabulous for small-town life and would just as soon be in a big city (Next Year in Manhattan!) but because of circumstance (e.g. small children to raise) find themselves stranded in the suburbs.

But on Memorial Day, it's all small-town mojo, and the "locals" who make up the muscle and sinew of town life are out in force at the parade. Every Mom and Dad needs to choose which affiliation to support (and it's a big deal, gossip goes around the horn for weeks before: "did you hear Elissa and her kids are marching with soccer!"). My wife is a den-mother, so we march with Cub Scouts (in preference to Little League et al).

It's a surprise there's anyone left to spectate (and indeed many do turn out) since it seems everyone has at least one reason to be in the parade. Even ladies of a certain age, long past their soccer-mom years, can choose among the Women's Club, League of Women Voters, Historical Society & etc. And of course the older gentlemen don their Army/Navy/Marines gear from WW II, Korea, Vietnam.

This year the Cub Scouts (along with my five year old, who donned big brother's old Tiger Cub outfit so he could "pass" for the day) carried a 6x10 foot flag lent to the pack by a local collector. A classic flag, 48 stars. I was deeply moved to notice the old soldiers in the crowd who stood ramrod straight (as best they could) and saluted as our crew of little boys carefully carried the flag by.

A crucial moment: the fighter-jets flew over, low and loud, just as the parade crossed the Saugatuck River, on a bridge lined with dozens of flags. Amazingly, there were cheers, rather than bile/curses/fist-shaking/denunciations, even in this seemingly 99% D3m0cr@tic hamlet. Only on Memorial Day...

29-May-2006

Department of Personal Development: Human Be-ings, by Dr. Janice Dorn

There is an old Zen Koan that says: Don't just do something... sit there. How appropriate for these markets.

The most difficult thing for traders to do is to sit there and wait. Why? Because we are in a society that is on a total dopamine binge, and this is never more clearly manifested than by those who absolutely have to be in the markets at all times, absolutely need to be trading, and absolutely cannot wait. They are human do-ings. Continue Reading...

28-May-2006

Dr. Alex Castaldo Reviews a Paper on the Asymmetric Volatility Phenomenon

Dennis, Mayhew & Stivers: Stock returns, Implied Volatility Innovations and the Asymmetric Volatility Phenomenon, Journal of Financial and Quantitative Analysis, June 2006, p. 381

The Asymmetric Volatility Phenomenon (AVP) is the finding that a decline in stock prices leads to higher future volatility while a rise in stock prices is associated with lower future volatility. This phenomenon was described as early as 1976 by Fischer Black. It was evident in the marketplace during the past two weeks and is well known to option market participants. Despite considerable research, academicians have not yet been able to understand the phenomenon to their satisfaction.

This paper examines whether the AVP pertains to individual stocks, or whether it is linked to the behavior of the aggregate stock market. The authors studied both S&P index options and options on 50 individual big cap stocks during the period 1998-1995. (The world of academic research moves at a glacial pace, the data is in this case 10 years old when the article is published!).

The authors use the VIX as a measure of the implied vol of the index, and they compute daily implied vols (IV) for the individual stocks. Because individual stocks respond both to market movements (the so called systematic factor) and to company specific information (the idiosyncratic factor) it is possible to similarly decompose individual stock IV's into an idyosyncratic IV and a systematic IV. The idiosyncratic IV is defined by IV_idiosyncratic = SQRT( IV_stock^2 - Beta^2*VIX^2).

The findings of this paper are clear cut: The correlation between S&P return and change in VIX is large and negative: -0.679, the typical correlation between individual stock returns and the change in idiosyncratic vol is much less, only -0.163. The authors conclude that the AVP is more related to market-wide systematic factors than individual firm-level influences.

The earliest explanation of the AVP, given by Christie in 1982, was a firm-level explanation: when a firm experiences a business setback the stock price goes down and the stock also becomes riskier (if for no other reason that the market value of the firm is now smaller compared to the firm's debt, so that the firm is closer to insolvency) i.e. more volatile. The findings in this paper raise doubts about this (and similar) explanations.

Two other explanations of the AVP are market-wide: According to Bekaert and Wu (2000) increased macro-economic uncertainty causes the market to become more volatile, when this increased risk is taken into account in valuing stocks the stocks have to be marked down to compensate for increased risk. In this expanation then, it is the increased vol that causes prices to drop and not vice versa.

According to the Avramov, Chordia, Goyal (2006) explanation "herding" on the part of traders (that is a tendency to dump stocks during declines and to get back in during rises) is the cause of the increased vol. (I have not read this paper yet and I may not be doing it justice, but the logic sounds plausible to me).

Other findings

The above analysis was essentially univariate. With a more complex, multivariate analysis the role of idiosyncratic volatility falls even lower: a correlation of -0.047 or essentially zero with the stock price change.

The authors also look at the IV smile. Consistent with previous studies they find that the slope for near ATM options is substantially more negative for index options than for individual stock options. The smile is largely an index option phenomenon.

Finally what is the relation between the implied vol and the subsequent realized vol? Although most papers find that it is difficult to beat IV as a forecast of future vols, many papers also find that there is a bias i.e. IV slightly overpredicts the actual vol. In this paper actual vol for the index is found to be equal to 0.813 times the index IV (meaning that the IV is about 18.7% too high), while actual vol for individual firms is 0.991 times the individual IV (i.e essentially the same). Given what we have learned earlier about the AVP, it seems plausible that writers of index options charge higher prices than writers of individual options because they face an additional risk: the AVP risk. While not proven in this paper, it seems a reasonable extrapolation.

Conclusion

Some of us on this list trade index options and some trade individual stock options. This paper is a useful reminder that, despite some superficial similarities, these are two rather different kinds of instruments. We should keep in mind that what applies to one does not necessarily apply to the other.

Alston Mabry replies:

Thanks to Dr. C for the interesting review that provokes thought even amongst

those of us in the nosebleed section, who not only don't see the game clearly

but also aren't always sure which game is being played.

Thanks to Dr. C for the interesting review that provokes thought even amongst

those of us in the nosebleed section, who not only don't see the game clearly

but also aren't always sure which game is being played.

That in mind, one looks at the S&P daily cash 1980-present (src: Yahoo). Compute for each day the log % change for that day and also the "minimal path" as a % of the final close. This would be:

minimum of the absolute point moves of either (Close[-1] -> Open -> High -> Low -> Close[0]) or (Close[-1] -> Open -> Low -> High -> Close[0]), divided by Close[0]

which provides a % measure of volatility during the day (maybe: "churn"), separate from just the net percentage change.

Number "up" days: 3522 Total % move for all "up" days: +2524% Total % minimal path for all "up" days: +6165% % minimal path per % of positive movement: 2.44 Number "down" days: 3143 Total % moves for all "down" days: -2277% Total % minimal path for all "down" days: +6415% % minimal path per % of negative movement: 2.82

Ratio of churn required per % of negative move to churn required for % positive move: 1.154.

Maybe the negative moves have to fight the long-term positive drift.

My membership in the Society for Non-Predictive Studies is now renewed.

29-May-2006

The Art of Shaving, by Prof. Gordon Haave

Sometimes you get what you pay for, even if the price seems outrageous. Such

is the case with shaving supplies from The Art of Shaving.

Sometimes you get what you pay for, even if the price seems outrageous. Such

is the case with shaving supplies from The Art of Shaving.

Some years ago I used to shave with a badger brush and shaving soap. I did this mostly because I had bought a nice brush and accoutrements from the always glorious Nat Sherman in New York City.

Over time, however, I eventually gave it up. For one thing, the nice shaving sets usually are not up to date on the latest Mach 10 razor technology, and furthermore the traditional shaving soap is not very good.

All that changed for me this morning. A few weeks ago I bought a shaving kit from The Art of Shaving at the Galleria mall in Dallas. I just tried it out this morning.

Boy, what a fantastic shave. Definitely the best shave I have ever had. My cheek skin has not felt so smooth since before I had facial hair.

There are a few keys to The Art of Shaving that differ from the fancy brush shaving sets. First, the Art of Shaving sells a pre-shave oil that you carefully rub into your skin. Second, it comes with a real, actual shaving cream as opposed to shaving soap.

The shaving cream comes in a tube, and I found that it lathered up as nicely as Edge Gel.

Third, you use your own razor. I have the latest Gillette with the battery in

the grip.

Third, you use your own razor. I have the latest Gillette with the battery in

the grip.

And fourth, it comes with a nice balm to use in lieu of an alcoholic after shave.

The pricing on the products is quite high, so I suggest recommending it to a family member as a good birthday or fathers day present for you.

Either way, however, if you are at all dissatisfied with your current shave, I highly recommend the Art of Shaving Products.

And no, I have no financial interest in this recommendation.

28-May-2006

Department of Fixed Income:

George Zachar Analyzes

Janet Yellen's Recent Speech

There is a painful grandiosity in Saturday's speech by San Francisco Fed President Janet Yellen. Perhaps it is her physical distance from hypercombative Washington and the capital markets. It's hard to say.

Her repeated references to the Phillips curve and NAIRU certainly lead one to think the Fed no longer pretends its economic role is anything besides calibrating the tradeoff between inflation and unemployment.

"As the logic of the Phillips curve makes apparent, such long-lasting shifts in import prices would indeed require the Fed to adjust its monetary policy to keep overall inflation in the vicinity of the Fed's preferred target. To combat the "headwinds" associated with chronically rising import prices, monetary policy must be tighter, which entails greater slack in the labor market. Tailwinds due to falling import prices, in contrast, lower the degree of slack required to attain a fixed inflation objective. It is in this sense that ongoing negative supply shocks raise the NAIRU, while ongoing positive supply shocks lower the NAIRU."

I think it's fair to say Ms.Yellen might have been more circumspect if she had to face the periodic congressional auto de fe endured by Chairman Bernanke.

"...rapid productivity growth, which the U.S. still enjoys, enabled the Fed to keep unemployment at extraordinarily low levels for an extended period while simultaneously bringing inflation down to levels consistent with price stability."

Enabled the Fed to keep unemployment at extraordinarily low levels?

Perhaps I am old fashioned, but it's just unseemly for unelected technocrats to ascribe such powers to themselves.

"From the perspective of monetary policy, there is one notable asymmetry affecting the Fed's ability to combat any "headwinds" or "tailwinds" associated with globalization. The asymmetry results from the so-called zero bound on nominal interest rates-which sets a lower limit on the federal funds rate below which it cannot go should the Fed need to stimulate the economy to counter deflation. With sufficiently intense deflationary "tailwinds," the Fed could conceivably exhaust its scope for response, at least using conventional policy approaches. In fact such risks became palpable in 2003-for the first time in half a century. This episode stimulated not only thoughtful policy research but also a creative and constructive response on the part of the Fed."

The 2003 deflation scare is memorable for many things, though it is exceedingly UNlikely future historians will consider the era of super-easy money as a "creative and constructive" Fed operation.

28-May-2006

Dollar Declines, Changing Cycles and Aberrations, by Yuri

The past few dollar declines seems to have occurred prior to bullish moves in US stocks. However this most recent dollar decline which started the week of 4/21/06 was followed by a bearish move in stocks which started week of 5/12/06. Two weeks ago on 5/19/06 the dollar started going up, and this past week of 5/26/06 stocks started going up. Is this a sign of changing cycles or just an aberration? How often do aberrations occur over such prolonged periods in highly liquid markets?

27-May-2006

What to Make of Intel and Its New Product, by Victor Niederhoffer

I find it amusing to buy and sell individual stocks as I am such a rank amateur. But the funny thing is: when I buy a stock, invariably all the troubles of the world are crystallized in their news stories. I never knew so many things could go wrong for a company even though I have run quite a few myself and been associated with Dan Grossman in owning dozens more, and through my merger business, hundreds of others.

When I owned Pfizer, every problem that was ever

possible having an impact on health, medicine, hospitals, executives or products

was visited on the company as if it were some Biblical ten curses visited upon the

Pharaoh by Y-hw-h as punishment for his errors. Finally it got too much, as I received the

day by day of the transcript of the patent litigation with the Indians on Lipitor

and it became clear that the company's only viable product was 50-50.

When I owned Pfizer, every problem that was ever

possible having an impact on health, medicine, hospitals, executives or products

was visited on the company as if it were some Biblical ten curses visited upon the

Pharaoh by Y-hw-h as punishment for his errors. Finally it got too much, as I received the

day by day of the transcript of the patent litigation with the Indians on Lipitor

and it became clear that the company's only viable product was 50-50.

Now with Intel, it's even worse. First their seven-foot

tall Chairman prostrated himself before a

gathering of executives and admitted he hadn't done as good a job as Andy. Then

they missed sales, lost customers, reduced margins, failed to compete against a

lower power machine, had excess inventory, had an abysmal marketing strategy that confused everyone with multiple brands

and numbers, wasted its research money, had too much hiring, had 97 of 100 funds reduce their

holding of them in the last quarter, got whacked daily by the Wild Man, constantly

had earnings forecasts reduced, or gurus discuss why they sold out in favor of

other companies, failed like the world's worst commentator colleague of the

dynamic Jon Markman said about Lucent -- that its problem was that people couldn't tell if

it was a value or a growth stock and too high for value and not enough growth

for growth et al, the new executive shouldn't quit because his performance has "not yet been a firing offence," the company isn't paranoid anymore like

Andy

said it should be, smart systematists are short it in pairs et al, downgraded by

this or that, and it gets worse. Every day its price action sinks and it wins

new records as the worst performer in this or that group in this or that period,

be it the Dow, Nasdaq, or last year or this year, what have you.

Now with Intel, it's even worse. First their seven-foot

tall Chairman prostrated himself before a

gathering of executives and admitted he hadn't done as good a job as Andy. Then

they missed sales, lost customers, reduced margins, failed to compete against a

lower power machine, had excess inventory, had an abysmal marketing strategy that confused everyone with multiple brands

and numbers, wasted its research money, had too much hiring, had 97 of 100 funds reduce their

holding of them in the last quarter, got whacked daily by the Wild Man, constantly

had earnings forecasts reduced, or gurus discuss why they sold out in favor of

other companies, failed like the world's worst commentator colleague of the

dynamic Jon Markman said about Lucent -- that its problem was that people couldn't tell if

it was a value or a growth stock and too high for value and not enough growth

for growth et al, the new executive shouldn't quit because his performance has "not yet been a firing offence," the company isn't paranoid anymore like

Andy

said it should be, smart systematists are short it in pairs et al, downgraded by

this or that, and it gets worse. Every day its price action sinks and it wins

new records as the worst performer in this or that group in this or that period,

be it the Dow, Nasdaq, or last year or this year, what have you.

Still, I haven't sold it yet as it's like me, it's so bad it couldn't get worse. Along

those lines

I always ask myself if people are so dumb that when a company misses its

quarterly projections, and they know from past retrospective Compustat studies

that when a company misses, it underperforms, that they will sell it en masse

even though the humbled, almost fired CEO says that they have their biggest new

introduction ever planned for the third quarter. My goodness, everything I know

about business says that when you have a new intro, you get lots of business,

whether it's a hot new thing from the East, or a new product that the testers

say is beautiful. Along these lines, I'm ignorant enough not to know before I

receive this that microprocessors are tested the same way cars are tested by

critics and knowledgeable drivers. It was interesting to see this road test in

this context, and I'm ignorant enough to hold this stock on the grounds that a

company that has 80% of a market with the market growing 15% a year, that has a

20% profit after spending 10% on research, with a major new product that tests well

on target for a quarter shouldn't be that much worse than the tried and true can't

miss Dilly Bar like other companies in the Dow favored by the sanctimonious

Sage. This test drive review was sent to me with the comment, "This is what people who know computers actually read. Important."

Still, I haven't sold it yet as it's like me, it's so bad it couldn't get worse. Along

those lines

I always ask myself if people are so dumb that when a company misses its

quarterly projections, and they know from past retrospective Compustat studies

that when a company misses, it underperforms, that they will sell it en masse

even though the humbled, almost fired CEO says that they have their biggest new

introduction ever planned for the third quarter. My goodness, everything I know

about business says that when you have a new intro, you get lots of business,

whether it's a hot new thing from the East, or a new product that the testers

say is beautiful. Along these lines, I'm ignorant enough not to know before I

receive this that microprocessors are tested the same way cars are tested by

critics and knowledgeable drivers. It was interesting to see this road test in

this context, and I'm ignorant enough to hold this stock on the grounds that a

company that has 80% of a market with the market growing 15% a year, that has a

20% profit after spending 10% on research, with a major new product that tests well

on target for a quarter shouldn't be that much worse than the tried and true can't

miss Dilly Bar like other companies in the Dow favored by the sanctimonious

Sage. This test drive review was sent to me with the comment, "This is what people who know computers actually read. Important."

David Baccile adds:

Let's not forget Intel's $15 billion in cash - equal to that of AMD's entire market cap. INTC is the only other tech stock that makes me feel better about holding MSFT, "at least I'm not as bad off as those lowly INTC holders"...well, both have big new product offers coming out and typically the market is a little forward looking.

Kim Zussman mentions:

One question about Woodcrest, or any new processor breaking last year's speed barriers, is whether Moore's law or its analogies matter anymore. It is many years now that micro-processing is ubiquitous, and many years since latest versions of Windows pair traded with newest Intel mps, but now everything is about the web.

The law of diminishing returns comes into play, as it should when consumers seek new and better services rather than higher computing speed, which makes little difference to 99% of users.

I'll match the badness of my own stock-picking against anyone's, but it seems that when a good company gets beaten down enough the highest probability path is up, a la MRK, PFE, and recently MSFT.

27-May-2006

1280 is a Key Number, by Mr. E

We are at a crucial juncture from 1286 to 1280. The key number is 1280.

David Hillman responds:

Since January of this year, the market has been trying the same level, for the third time. The winds are different this time. In my view the mistress is not treating the level either as a floor or a ceiling. She is testing it, first with small moves, now with bigger ones. She might try even bigger moves and even smaller ones. And the only way I know to play the game is 1. to choose sides and 2. to fight.

from Casablanca.....

Captain Renault: "In 1935, you ran guns to Ethiopia. In 1936, you fought in Spain, on the Loyalist side."

Rick: "I got well paid for it on both occasions."

Captain Renault: "The winning side would have paid you much better."

George Criparacos responds:

One has drawn a horizontal line at the SPX 1280 level since Jan 1999, when the market first went to test that range. Back then it was usual to have 60+ point weekly ranges. Throughout most of 1999 one remembers many times the fight at that level, both before and after the market managed to overcome it. In my notes, one sees many instances where a question prevailed: Why didn't the market trade that level? meaning that it was either treating it as a ceiling, or as a floor but never traded it, let say between 1250 and 1310. Weeks went by until mid Oct.'99 - I had just finished reading ed spec, without which I would never have taken a long position when the market finally went to test, and of which I am greatly thankful to the chair for writing it.

Whatever gains were made the next months were unfortunately given back to the mistress in Feb. and March of 2001 when the same play was attempted, on the same 1280 level . but the gods were against that time around. Again, however, the market treated that level as a ceiling or as a floor but did not trade it.

27-May-2006

The Return of Alan Abelson, by Mr. Krisrock

According to Barron's, Alan Abelson is to return from his illness leave in mid June.

Dr. Phil McDonnell responds:

It is good to hear that the augur of doom will be rejoining us. Somehow it seems ironic that the largest market drop occurred when he was not around to make his maleficent predictions.

David Baccile responds:

Perhaps it was the market drop that prompted his recovery?

26-May-2006

Weekly Commentary from Dick Sears:

"Thirteen Days in May"

26-May-2006

Why Am I Buying That Stock? from Steve Leslie

Whenever I find myself challenged by the confusion of the stock market, I go to my library of favorite investment books to review. I have found invaluable insights time and again from such persons as Gerald Loeb, Ralph Wanger and William O'Neil through a re-read of their books. Each of these great investors have provided me with marvelous nuggets of wisdom that have chartered me through perilous times.

Perhaps, my favorite book dates back to 1989 and is written by the best mutual fund manager of all time. Of course that would be Peter Lynch.

Chapter Seven of Peter Lynch's book "One Up On Wall

Street" is devoted to his description of the six

general categories of stocks. It is titled "I've Got

It-I've Got It-What Is It?"

Chapter Seven of Peter Lynch's book "One Up On Wall

Street" is devoted to his description of the six

general categories of stocks. It is titled "I've Got

It-I've Got It-What Is It?"

Mr. Lynch says that it is imperative that the investor understand six major categories in order to assess the reasons why he should own a particular stock at this time. In fact, when he sits down with his staff of investment managers, they are required to explain their reasons to buy a stock and which category it falls in.

These are in order:

Slow growers. These are the large and aging companies expected to grow slightly faster than the GDP.

Stalwarts. Such as Coca-Cola, Bristol-Myers, and Procter and Gamble.

Fast Growers. These are small, aggressive, new enterprises that grow at 20 to 25 percent a year.

Cyclicals. A company whose sales and profits rise and fall in a regular fashion.

Turnarounds. Battered, and depressed and barely holding on.

Asset Plays. A company sitting on something valuable that Wall Street has overlooked.

Therefore whether an investor is considering General Motors, Exxon, Intel, Microsoft or the company on the cusp of the cure for cancer, we would all do better to classify it first and remind ourselves why we want to own it now at this particular point in time.

26-May-2006

US Inflation brings "Quote of the Day," from Paolo Pezzutti

Two days ago news:

"Commonly used government price indexes overstate the level of inflation in the economy," Federal Reserve Chairman Ben Bernanke said Thursday. In a letter to Rep. James Saxton, R-N.J., responding to questions left over from his recent testimony to the Joint Economic Committee, Bernanke said, "both the consumer price index and the Fed's preferred gauge, the personal consumption expenditure price index, overstate inflation, but show that core inflation is well contained."

The continuous change of attitude towards inflation and interest rates that alternates in various statement from the Fed would be funny, if what is at stake was not investors' money. I would add also that most vulnerable to this approach are those investors who traditionally are the stock market ecosystem suppliers of energy: the small investors who read the newspaper in the morning and get confused by the "oraculum" language used in ever-changing-view statements.

25-May-2005

Space Advantages and Implosions, by Grandmaster Nigel Davies

A space 'advantage' in chess is one of the most difficult things to handle. On the one hand your opponent may be 'cramped' and find it difficult to coordinate his pieces, on the other you have vast reaches of territory that require defence. Everything, as usual, depends on the disposition of the forces.

This got me thinking about markets, and how the price action over a particular time frame might show one side or the the other to have a 'space advantage', depending on whether the bulls or bears have encroached on the other's 'territory' on a chart. And this in turn led me to wonder if there are ways one can gauge the disposition of forces to know if such encroachments represent advantages or implosions waiting to happen.

Dr. Phil McDonnell responds:

As so often happens on this venue the Grandmaster's musings have spawned another Eureka moment on this side of the North Pole. Frequently we observe that the daily fluctuations of the market push one way and then seem to thrust in the other direction without any apparent news or clear reason.

One interpretation of these moves may be that the market is trying to create space for itself. One need only watch a low range, low volume day to realize its chilling effect on trader interest. Markets which become locked in between large limit orders quickly become dull and uninteresting. The lifeblood of the market ecosystem is order flow. Thus market makers and sell side brokers require space in order to continue to interest traders.

One way to create space is to make daily runs up to the highs in order to clean out the sell at limit orders. Then the market can turn down to make a similar run to clear out as many buy limit orders below the market. When the bears are in control the runs down will make lower lows as it is easier to clear out orders on the downside. Higher highs would indicate that the bulls are in control.

The GM's concept of space dovetails quite nicely with the Chair's oft noted observation that a large range can be an indicator of a buying opportunity. As the range expands the market has the space it needs to attract trader interest. New money enters the fray and prices are pushed higher. For an example of the converse of the expanded range theory, one need only look at the very narrow daily range of the market just prior to the recent sharp decline.

Yishen Kuik adds:

To tie in some other ideas.

Markets like to follow the path of maximum volume. As the market rushes upwards, it runs stops, forces weak bears out and entices fresh bulls to join in.

While this is happening, stops on the downside accumulate like barnacles at various obvious points. Markets then turn downwards to exploit the volume below, once again running stops, causing weak bulls to exit and enticing fresh bears to join in.

Brokers would love for this to continue ad nauseam, but with each up and down chop, breakout boys and trend-followers lose interest. The range created by the chops get smaller and smaller in amplitude, volume shrivels up. The chart looks like an attenuating sine wave.

The market knows that if it persists in this wanton act of abusing the audience, it will be killing the golden goose - so better to put on a good show at this point. Set up a nice extended run that everyone can talk about, easy for traders to hop on and boast of good returns later at happy hour.

Better to keep the audience coming in than completely decimate them with choppiness.

25-May-2006

Further Thoughts on Space, by Briefly Speaking, by Grandmaster Nigel Davies

The classical view of a space advantage was that it naturally conferred superior piece play on its possessor, whilst the player with a 'cramped' position would have his pieces tripping over each others' toes. And there is probably some truth to this concept.

Yet stated in these terms is far too general to be a useful rudder in competitive play, and there are numerous caveats which must be considered. Here's a first attempt at categorising them:

The last of these actually points to a single concept, and that is the idea of dynamic potential. Is a position being stretched beyond its elastic limit, or is it poised for a rebound.

25-May-2006

Briefly Speaking, by Victor Niederhoffer

This market move back and forth was a classic involving disruption, promotion, symmetry, bear raids, Father Fed and, of course, the most important factor of all -- the function of markets to signal imbalances, provide information about the future and transport goods over time.

It started with a 2% decline on Thursday the 11th, continued with a 2% drop on Wednesday the 17th, and another horrible 1% on the 18th. VIX moved up a nice 80% from the mid-11s to 20. But through it all, the highest move in the actual November VIX futures contract barely budged from 14.40 to a high of 15.60. Thus the markets are always so much more prescient than the spot numbers themselves in forecasting the future and taking account of correctable imbalances.

The gold contract had to come down from 730 to a low of 636 and other inflation indicators followed south, with silver down 25% from a high of 15.20 to a low of 12.21, and oil down a mere 10% from 75 to 68. The Goldman futures index dropped just 8% from a high of 503. Once again, the markets showed that inflation was not a threat, or at least that the threat was was overblown. Those who bet on inflation lost their shirts. Most important of all, the ephemeral people who follow fixed systems, mainly trend followers, were crowing about the never-ending moves and ineluctable profits of just following momentum. What a beautiful setup for the trend following index to fall from 1250 to 1140 or so in a week. The markets again showed that ephemeral factors were at work, that fears were overblown and a correction to normalcy was in order.

As usual, emerging markets led the way. First the Arab markets plunged 50%,

setting off the debacle in Europe and then the U.S. As soon as the Western

decline got going, the Arab markets showed a quick 20% rise, signaling that they were ready to go back the

other way. The European markets led the U.S. down, dropping a quick 10%

for example from 6150 in the DAX on May 10 to 5550 on May 22. But then they led the

way back, going up 3% on Tuesday while the U.S. market cratered, trying to squeeze the

longs one last time.

As usual, emerging markets led the way. First the Arab markets plunged 50%,

setting off the debacle in Europe and then the U.S. As soon as the Western

decline got going, the Arab markets showed a quick 20% rise, signaling that they were ready to go back the

other way. The European markets led the U.S. down, dropping a quick 10%

for example from 6150 in the DAX on May 10 to 5550 on May 22. But then they led the

way back, going up 3% on Tuesday while the U.S. market cratered, trying to squeeze the

longs one last time.

The squeeze was a disruptive move of the kind that Gestalt psychologists would have endorsed. Irving Redel's theory of least observable change was rampant. When the market wants to squeeze you, it gives you some horrible news... and a horrible move. It did that on Tuesday in the last half hour, dropping some 2.5% on rumors planted on Drudge, presumably by the bears, that bird flu had been spotted again. It reminded me of the moves that prevailed in the last half hours of late 2005 when news that a suspected terrorist was thought to be surveying the Boston subways.

With all that was going on, the planted news about bird flu, Iranian missile tests, the release of the Bin Laden tape to heighten the Tuesday decline and the fear that it would be repeated on Wednesday, as well as the absence of two consecutive up days in the U.S. stocks for a month was all that it needed to set the bear trap. Of course it ended the same way it started, with a big Wednesday and Thursday up, to Lobogola the move down.

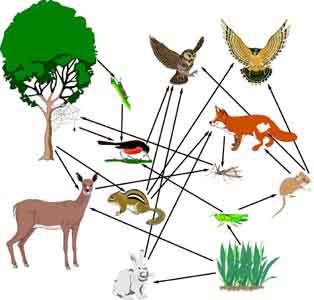

This is all merely description, and as for my predictions, ha, look at the food web and what I said about the consistently planted rumors by infallible forecasters who had called every previous move right.

And as always, romance played a role. The market dropped on the

initial signal that Chair Bernanke couldn't control his emotions with a pretty

reporter. When it was confirmed that CPI was actually up 0.1% more than

expected the combination of the Oedipus complex and the security of the father syndrome

went into play, and the market was ready to take its vast 7% plunge, which

it hadn't done for four years. But then, the signal it was over -- "Why is it

always romance?" as Rumpole would say, was when Bernanke admitted that he made a

mistake in judgment and that he would never succumb again. The wife and markets

must have been very happy, and that was all it needed in conjunction with the

other things to return to go its normal course of 10% a year up, as holds in conditions when the earnings-price ratio is so much higher than the 10-year rate.

The one

truly bearish factor was the move above 5% in 10-year note yields. But when

this was quickly reversed the next week and bonds quietly moved to a one-month

high. With the promise of no more romance from the Chair of the Fed, it

was clear sailing ahead.

And as always, romance played a role. The market dropped on the

initial signal that Chair Bernanke couldn't control his emotions with a pretty

reporter. When it was confirmed that CPI was actually up 0.1% more than

expected the combination of the Oedipus complex and the security of the father syndrome

went into play, and the market was ready to take its vast 7% plunge, which

it hadn't done for four years. But then, the signal it was over -- "Why is it

always romance?" as Rumpole would say, was when Bernanke admitted that he made a

mistake in judgment and that he would never succumb again. The wife and markets

must have been very happy, and that was all it needed in conjunction with the

other things to return to go its normal course of 10% a year up, as holds in conditions when the earnings-price ratio is so much higher than the 10-year rate.

The one

truly bearish factor was the move above 5% in 10-year note yields. But when

this was quickly reversed the next week and bonds quietly moved to a one-month

high. With the promise of no more romance from the Chair of the Fed, it

was clear sailing ahead.

25-May-2006

Do Independent Directors Count? from Yishen Kuik

I was listening to Maurice Greenberg talk about his life, AIG, C.V. Starr, etc at the 92nd St YMCA. Mostly, the theme was how American competitiveness was being eroded by regulation, and how China should be embraced, not confronted. In the middle of his speech, he said that the stock price of companies with no independent directors on their board outperformed those with independent directors on their board. I don't have the means to test this, but thought I'd share.

Russell Sears notes:

It would be interesting to see how much of this out-performance occurs due to a switch from no independent directors to those with independent directors. Is this a signal or admission of guilt, and vice a versa?

25-May-2006

Common Errors Made by Forecasters, by Victor Niederhoffer

During bear markets,

the one thing you can count on is that all the people who have refrained

from buying stocks over the last 10 years will come out of the woodwork, thumb

their noses at you, and tell you they called it all along. The phrase "as

predicted" "stock market" on Google has more than 100,000 entries.

During bear markets,

the one thing you can count on is that all the people who have refrained

from buying stocks over the last 10 years will come out of the woodwork, thumb

their noses at you, and tell you they called it all along. The phrase "as

predicted" "stock market" on Google has more than 100,000 entries.

As I point out in EdSpec, Harry Browne in his book Why the Best-Laid Investment Plans Usually Go Wrong has a hilarious chapter on this. He actually saves the forecasts of those who claim they caught it, and finds that their self reported results are usually far off the mark. Indeed there is a whole field in psychology concerning the tendency to overestimate success on routine tasks, and most astute decisions makers take account of this in their revised estimates based on such self reports. I have read numerous articles on this thread which comes under the "accuracy of predictions" "self reported" rubric.

I would point out some common errors that I find. One of the worst is those who say something like "1282 is a key level." Of course almost any level will be touched, and such forecasts, which donít tell whether they are bullish or bearish, are particularly likely to be self reported as incredibly accurate afterward. Another common error is the retrospective forecast. "Monday was the day I went long on bonds" the forecaster reports two days or a week after the event occurred. A third error common among forecasters is, "There will be an increase in volatility," or, "There will be rangebound days." Yes. There will always be rangebound days between high and low, because those are the extremes of the day. As for volatility, everyone knows that it has ephemeral moves to lows and highs. However, the actual contracts that pay off based on where the volatility actually will be in three months et al. take that into account. For example, the VIX futures for August haven't moved by more than a half vol during this whole market decline where the current VIX has moved from 10% to 20% or so.

It is good to evaluate the actual track record of forecasters who claim that they caught every move. Invariably they'll come up with some excuse; they only report it offshore to their clients because they donít want the amateurs to know what they're doing. If you ask them how they did last year, they'll come up with yet another obfuscation.

You get the gist: good decision makers are always very humble. They know how

hard it is to forecast and they donít trash talk when they're right or

bemoan unduly when they're wrong. The Palindrome was an exception here, and he

never admitted to having a winning trade and always emphasized his losses, and

aside from what he taught me about always playing tennis with two new cans, that

is the most valuable lesson I ever learned from him, albeit I like most good

athletes had adopted a similar technique, never admitting to a potential victor in advance in my athletic career and always emphasizing how much better chances the adversary had.

You get the gist: good decision makers are always very humble. They know how

hard it is to forecast and they donít trash talk when they're right or

bemoan unduly when they're wrong. The Palindrome was an exception here, and he

never admitted to having a winning trade and always emphasized his losses, and

aside from what he taught me about always playing tennis with two new cans, that

is the most valuable lesson I ever learned from him, albeit I like most good

athletes had adopted a similar technique, never admitting to a potential victor in advance in my athletic career and always emphasizing how much better chances the adversary had.

25-May-2006

The Art of Defence in Chess, by GM Nigel Davies

Most of what I know about defence in chess is from Keres' chapter in 'The Art of the Middlegame' and 'Lasker's Manual of chess'. Here's the gist of their more important concepts:

Keres:

When defending difficult positions, don't stake everything on an immediate all or nothing counterattack. Instead your job is to make it as hard as possible for the opponent to win, increasing the odds of his tiring or making a slip.

Lasker:

Make sure there is no weakest point in your position, trying instead to make all points equally strong. Try to avoid passive (immobile) positions as if have the potential to counterattack it can draw your opponent's pieces away from his own offensive.

Underlying Lasker's thoughts on defence is the 'theory

of Steinitz', which suggests proportionality in our

commitment to attack or defence depending upon whether

or not we have an advantage or disadvantage. So when

you have an advantage you must attack, but the attack

should be in proportion to the advantage. And when you

are on the back foot you must defend, but once again

with the commitment to defence reflecting your

disadvantage and the remainder of the pieces employed

in counterattack.

Underlying Lasker's thoughts on defence is the 'theory

of Steinitz', which suggests proportionality in our

commitment to attack or defence depending upon whether

or not we have an advantage or disadvantage. So when

you have an advantage you must attack, but the attack

should be in proportion to the advantage. And when you

are on the back foot you must defend, but once again

with the commitment to defence reflecting your

disadvantage and the remainder of the pieces employed

in counterattack.

I see this aspect of chess in terms of energy flows, with the disposition of pieces having to adjust with the cut and thrust of battle. It's rather more sophisticated than the single gear approach.

24-May-2006

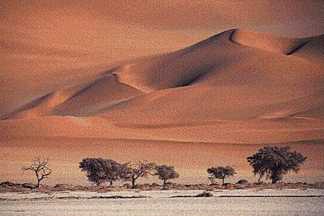

Desert Hazards, from Steve Ellison

The desert presents difficult survival challenges. Hot, dry weather

dehydrates the human body rapidly. Clear visibility and sparse

vegetation make distant objects appear much closer than they really

are, occasionally luring a wanderer to try to hike to a mountain that

is actually 30 miles away, with possibly catastrophic results.

Richard Lingenfelter wrote in "Death Valley and the Amargosa: A Land

of Illusion":

The desert presents difficult survival challenges. Hot, dry weather

dehydrates the human body rapidly. Clear visibility and sparse

vegetation make distant objects appear much closer than they really

are, occasionally luring a wanderer to try to hike to a mountain that

is actually 30 miles away, with possibly catastrophic results.

Richard Lingenfelter wrote in "Death Valley and the Amargosa: A Land

of Illusion":

The first sensations of thirst begin with the loss of a little over a quart of water. By the time you have lost a gallon you begin to feel tired and apathetic. Most of the water lost comes from your blood, and as it thickens, your circulation becomes poor, your heart strains, your muscles fatigue, and your head aches. With further loss of water you become dizzy and begin to stumble; your breathing is labored and your speech is indistinct. By the time you have lost two gallons of water [which you can lose just by sitting in the shade on an average summer day in the valley] your tongue is swollen, you can hardly keep your balance, your muscles spasm, and you are becoming delirious.