| Home |

|

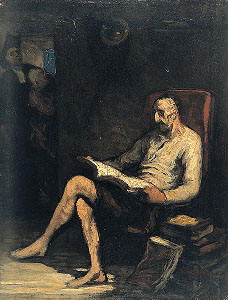

The Chairman

©2006 All content on site protected by copyright |

28-Sep-2006

Buoyancy and the Markets, from Victor Niederhoffer

One of the worst books ever written is the Little Book of Scientific Principles, Theories and Things by Surrenda Verna, which introduces the 175 major laws and principles of science, and in which none of the explanations seem valid or scientifically accurate.

Despite its shortcomings, the book has inspired me on one of the strangest pursuits ever known to man -- to find quantitative relations and regularities in the market, inspired by each of the 175 laws. In doing this I hark back to Chapter 1 of Don Quixote. In this chapter Quixote reads books of chivalry that contain such passages as the following:

The reason of the unreasonable treatment of my reason so enfeebles my reason that with reason I complain of your beauty

Or again:

The high heavens that with your divinity divinely fortify you with the stars, rendering you meritorious of the merit merited by your greatness.

Don Quixote's judgment was so discombobulated by reading these bad books, just as Laurel and I were similarly overwhelmed by reading comparable books about investments, that...

... he was seized with one of the strangest fantasies that ever entered the head of any madman. This was a belief that it behooved him as well for the advancement of his glory as the service of his country to become a knight-errant, redressing every species of grievance and exposing himself to dangers which, being surmounted, might secure to him eternal glory and renown.

The first principle that I was inspired by is Archimedes Principle

that a body fully or partially immersed in a fluid is buoyed up by a force equal

to the weight of the fluid dispersed by the body. Verma uses this principle

to derive a faulty explanation of how Archimedes found out that the suspect

crown was not pure gold. " When he placed a lump of pure gold equal in weight to

the crown in the water; a lesser amount of water overflowed". Verma never

mentions in explaining this principle that an object that floats in water displaces

an equal weight of water to its own mass, and that, if needed, the volume of the

object can be found by submerging it and measuring the volume of the water displaced,

(or like Archimedes one can just compare two objects). In this way Archimedes

found the density of the suspect crown in comparison to pure gold --

the density of the suspect crown being lower because it contained lead.

weight of the fluid dispersed by the body. Verma uses this principle

to derive a faulty explanation of how Archimedes found out that the suspect

crown was not pure gold. " When he placed a lump of pure gold equal in weight to

the crown in the water; a lesser amount of water overflowed". Verma never

mentions in explaining this principle that an object that floats in water displaces

an equal weight of water to its own mass, and that, if needed, the volume of the

object can be found by submerging it and measuring the volume of the water displaced,

(or like Archimedes one can just compare two objects). In this way Archimedes

found the density of the suspect crown in comparison to pure gold --

the density of the suspect crown being lower because it contained lead.

The buoyancy of the stocks and the market is best measured by what happens to individual stocks when they sink or float on a big day of market declines. Do the ones that float show greater strength in the future? The problem is complicated by the fact that everything floats after the big market days of sinking. In general , the stocks that go down the most and those that go up the most do much better than the average during the week following big market sinks. But then, so does the market.

I also find, with the help of Mike Pomada, that individual stocks that decline 10% more than the average on days that the market is down by over 1% go up some 2.8% in the next week. However, the market itself goes up 2% or so also, (1998 - Present).