Letters to the Editors

Nov-Dec. 2006

Write to us at:![]() (not clickable).

(not clickable).

Please include your full name, and omit attachments

|

Daily Speculations |

|

|

Letters to the Editors Write to us at: |  |

Notice from the Editors: Competition for Contributions

Daily Speculations is dedicated to the scientific method, free markets, ballyhoo deflation, value creation and laughter. The material on this Web site is provided free by us and our readers. Because incentives work better than no incentives, each month we reward the best contribution or letter to the editor with $1,000 to encourage good thinking about the market and augment the mutual benefits of participating in the Daily Speculations forum. Prizes are awarded at the end of each month by the Chair and the Collab. Past winners29-Dec-2006

How to Spot a Speculator at the Gym, from

Gibbons Burke

John Walker, founder of AutoDesk, was faced with the problem of weight loss and maintenance, so he set out to create an exercise regime he could follow that was simple enough that there could be no possible excuse not to do it. He took the famous Canadian Air Force calisthentics program and simplified it so that it could always be performed in 15 minutes or less, and didn't require any special equipment so it could be done anywhere. He wrote about it in his book "The Hacker's Diet", in which he took an engineer's perspective on losing weight, and even employed a trend following approach (complete with an Excel spreadsheet, or a PalmOS program he wrote, both available for free) to tracking his daily weight gain/loss. The book is published free on his popular site, Fourmilab.

He starts it off with a quotation from the Earl of Derby: "Those who do not find time for exercise now will have to find time for illness."

GM Nigel Davies mentions:

Whenever an enquiry comes in about my chess teaching services, odds are that its from someone sub-2000 who wants to become national champion within 2 months, an I.M. in 3 years and then World Champion shortly thereafter. In other words they are totally unrealistic and have a complete lack of understanding as to the difficulty of the task before them.

The rare enquiries I get which are quite modest in their goals usually come from highly successful individuals who know the dedication required to achieve excellence. They know the price of achievement and how much they're willing to pay. It's these guys that usually make the best progress.

So I would agree with you that all things are possible, but one must be very wary about spreading oneself too thin. A dedicated person with talent can become a good short term trader, but he may not be able to do this whilst simultaneously studying brain surgery and working out sufficiently to become an Adonis. Or writing 10 zillion chess books for that matter, so I need to pay attention to my own shortcomings.

27-Dec-2006

How Noise Protects the Entire Marine Ecosystem,

from John Lamberg

I found an interesting article from Feb 2005 which discusses the positive effect of noise on an ecosystem:

The results based on their model study imply that oscillatory behaviour in many natural systems, rather than being disturbed by noise, is thus sustained by it. For instance, the "noise" in a marine ecosystem due to temperature changes, ocean currents, wind-driven waves, fluctuations in nutrient levels, the movement of schools of fish, and wind-driven waves affect how plankton blooms grow and recede. If the conditions are below an optimum the plankton do not grow, but they can be forced into action by noise, and once they are stimulated the whole system is activated and a marine landscape is quickly blanketed by the bloom. [Read More]

21-Dec-2006

Economies of Scale in Software Distribution, by Laurence Glazier

In the 1980's when I was working in a computer shop, software distribution was horrendous, a plethora of floppy disks for each printer, word processing program and model of PC. A British upstart named the Apricot was taking on Apple and Microsoft. Sleek and beautiful, it didn't quite work.

Over time Mr Softy's influence led to compatibility across platforms, but software would only be updated once every year or two with new versions and marketing campaigns. Sometimes with great hullabaloo - on one occasion I attended the British launch of an integrated spreadsheet and database made by Lotus named Symphony. As the Ode to Joy welled from behind the dignitaries, a curtain unfurled to reveal a real live symphony orchestra.

Around 1985 I made contact with a firm called the Westminster Cable Company and proposed setting up a scheme to make software available for direct use online, charging people by the minute. This would have dealt with the difficulties of upgrading to new versions of programs. While farsighted, it never crossed my mind that when this idea eventually came to fruition, it could be free to the end-user, supported by advertising.

The early years of this decade saw the adoption of online software distribution and updating, which among other things has enabled people like me to get on the trading train. Online software has expanded the market for niche suppliers and increased competition, which with the ease of updating has increased quality.

My 1985 concept is now well underway, far better than I envisaged in pre-mouse days, and with software resident online, updates happen invisibly - this seems to be accelerating progress again. The most complex part of business software is the database, which must be able to model the individual nature of the organisation - I am currently beta testing a product called CEBase which compares favorably with Access in usability, and it is not without competitors. These Web 2.0 products, as they are known, seem to develop as much in a few weeks as offline products do in a year. The Net becomes the hard disk, which requires significan trust - what if the web falls over? Or is this like asking what does one do if the power is cut?

It is only the hugest products now which need shrink wrapping and mailing, and the quesiton is how long will it be before this practice becomes a quaint custom of the past.

19-Dec-2006

Comments on the Junto Video, from Alan Millhone

The video is great. Additionally, your site has constantly improved since I began reading it. The insertion of photos, etc. is attention getting and makes reading the articles much more interesting. Not that I understand everything I read on investments but I feel your site has expanded my mind to now think beyond the barriers I once had.

The Gatlin Gun photo made me think of General George Armstrong Custer and his debacle at the Little Big Horn. He could have taken a Gatlin or two along, but he felt it would slow his troops down too much. Couple that fact and that the troops had old rolling block rifles and not repeaters (Our Government felt the men might waste ammo in a repeating rifle!) Custer never had a chance.

19-Dec-2006

Fogel and L'Amour, from James Ramos

I would say L'amour and the Fogel book make for an excellent reading combination. Fogel's tracking of human progress in the last three-hundred years is Apache-like in skill, and his subsequent forecast is forceful and convincing (and I think one can make a lot of money from his ideas). It makes me feel much like Barnabas Sackett, attacking the unknown with a few good maps and a body brimming with spirit. These books are fantastic. Though I can't afford to purchase all the many books that pass in mention, your website is unrivaled in the quality and relevance of its recommendations. I've never been disappointed. I just wanted to let you know that I've gained tremendously from following your website and that you and your contributors deserve a rightful round of thanks.

The happiest of holidays,

18-Dec-2006

Reminiscences of M. Diamond's Propaganda, from Jason Schroeder

Although, the antidote to "Guns, Germs and Steel" is "The Wealth and Poverty of Nations", there is no need to rehash the elements here. The book is explicated by referencing the question of a New Guinean: "Why is it that you white people have so much cargo, and we New Guineans have so little?"

Plainly, put "Why are the things I do not appreciated by others?" is a nonsense question.

What did strike me, is that the question is a false dichotomy. The dichotomy is to elide dialectic into action. A subtle way of habituating the audience to presuppose actions "just happen" (like any animistic society).

Although the reader is played into a "plain-folks" situation where less corrupted people ask better questions: If the question were "Why do Zebras have stripes?" or "Why does the earth revolve around the sun?" there are standard scripts for handling these questions.

Competition is the best tonic to defend against vanity. Eliding dialectic into action demonstrates that a mind has not sufficiently differentiated the self from everybody else.

14-Dec-2006

Lamar Hunt Estate Taxes, from Steve Leslie

Interesting fact about Lamar Hunt who died Wednesday at the age of 74 years.

In 1960 he formed the American Football League and invested $25000 into the Dallas Texans who then became the Kansas City Chiefs of today. The current value of the KC Chiefs is over $800MM. In 1997 Mr. Hunt gifted 80% of his ownership of the team to his children and paid $82MM in estate taxes as a result of the valuation of the team at that time.

Had he not done this and coupled with the meteoric rise in the value of NFL franchises the estate taxes that would be due in 2007 would have been over $320MM alone.

As a result of his planning, he has been able to retain ownership of the Chiefs in the family and not be forced to sell it to pay death taxes.

Furthermore, he saved his family app. $240MM in estate taxes.

Joe Robbie former owner of the Miami Dolphins did not have such foresight even though he was a lawyer and entrepreneur. When he died in 1990 his family was not able to raise the money to pay for the estate taxes and thus had to sell the team to pay the U.S. Treasury its due. Thus the Robbie family missed out on the incredible rise in valuations of NFL franchises that other owners such as Jerry Jones who purchased a financially strapped Dallas Cowboys in 1989 have enjoyed.

12-Dec-2006

Skyscraper Hubris, from John De Palma

From a Bloomberg column today on 'The Skyscraper Curse'

... Yet history shows an uncanny correlation between tallest building projects and financial crises. Be it in Kuala Lumpur in 1997, Chicago in 1974, New York in 1930 or the biblical Tower of Babel long ago, mankind's penchant for architectural overreach is a strangely reliable omen of troubles.

A coincidence? Perhaps, yet economists such as Mark Thornton, senior fellow at the Ludwig von Mises Institute in Auburn, Alabama, argue that skyscrapers can speak volumes about a nation's wealth, technological prowess, ambition and, perhaps most importantly, hubris ...

Consistently, in Practical Speculation you wrote:

...Right up to modern days, the landscape is littered with disastrous examples of the tendency to build high before a fall. The soaring towers of Southeast Asia, completed before the 1997 crash, come to mind. The world's current tallest buildings, the Petronas Towers, were completed in Kuala Lumpur in 1997, the year the Malaysian stock market fell 50 percent. The December 28, 1999, christening of the world's largest video display, the Nasdaq's $37 million MarketSite Tower in Manhattan's Times Square, came just three months before a 70 percent, 18-month crash in the Nasdaq Composite Index. Enron had almost completed a lavish 40-story tower designed by celebrity architect Cesar Pelli when it filed for bankruptcy in 2002...

But (inconsistently?) from Ayn Rand's Fountainhead:

"And that particular sense of sacred rapture men say that they experience in contemplating nature-- I've never received it from nature, only from ... " She stopped. "Buildings," she whispered. "Skyscrapers."

... I would give the greatest sunset in the world for one sight of New York's skyline. Particularly when one can't see the details. Just the shapes. The shapes and thoughts that made them. The sky over New York and the will of man made visible ... Is it beauty and genius they want to see? Do they seek a sense of the sublime? Let them come to New York, stand on the shore of the Hudson, look and kneel ...

12-Dec-2006

Aristotle's Golden Mean, from J. T. Holley

It is amazing when I see articles such as this one that more people don't understand means, whether geometric, arithmetic or harmonic, and the impacts that they have in all aspects of life, much less trading. It seems that we are taught and drawn to extremes in everything in life, and if we don't hit the mark of the "good" extreme then we advance or fall to the "bad" extreme. Why not shoot for the mean in some things instead of concentrating on the extremes? The Black Swan, or professor now, seems to focus on those extremes? I often thought that in his case wouldn't it make more sense to place chips on the table that Sisyphus is "yet once again" going to roll the stone up the hill and watch it fall back, than to bet it doesn't? Especially after adequate examples?

I've never avoided things in my life, mainly because I'm adventurous and do things when told not to do them. This has caused me many times to experience both the good and bad extremes. I know from these experiences that I should practice and shoot for the mean in a lot of things, yet have had lofty goals, especially at younger ages. If I traded too much I give way to the bid/ask, vig, friction that the mistress provides. If I don't trade at all then I never profit but sit on my hands and talk of what if? The golden mean is the right amount to speculate it seems? What is it?

We've often talked about the right amount of leverage to use and anywhere from 2 to 4 times comes the answer, but what is the "mean" in trading during the day, week, month, year? What is too much trading? What is too little? I think I'll go have a glass of Merlot and extend my life.

12-Dec-2006

Scott Brooks on Hoodoos

Years ago, (1987 specifically) when I was new in this business, I read a book on sales, (Tom Hopkins, "How to Master the Art of Selling"). There was a part of the book that struck me as profound and I've never forgotten the message. If I may take some literary license and paraphrase what Mr. Hopkins had to say, it was basically:

Remove all things and all people from your life that do not add value!

As a result of that, I made the choice to stop hanging around a group of friends that I went way back with. I didn't tell them to jump in a lake, nor did I make a clean break. I just made myself more and more unavailable. That whole group was a hoodoo. Since then, the group has mostly broken up, but a few of us still keep in contact once in a while.

What's interesting is that the whole group together was a hoodoo, but individually or smaller groups, the people of the group were ok. As I think back on it, most of the problem centered around one member of the group. He was basically the alpha male of the group and whereas the others were definitely subservient to him.

What I found interesting was my part in the group. Although he was the alpha member, I wasn't subservient to him. It was almost like he was the brawn and I was the brains of the group. He was a fun guy to be around as he was willing to do things that no one else was willing to do.

The things he did were absolutely outrageous! And he could back up whatever he did with his fearless brawn. But sometime he would go to far and it became my job to step in and solve the problem.

That was, as a teenager and a young man, a very fun situation to be in.

But as I matured I started to feel there was something wrong about the situation and environment.

Then I read Tom Hopkins' words and it became clear to me. Although I had never heard the word "hoodoo" at the time, and never used that word until recently, I was in the presence of a hoodoo.

And what made it worse, is that I was the most guilty person in the group. I was the one person who should have seen what was happening and recognize the destructive nature of our situation.

Instead recognizing that, I was the biggest enabler of the group. The hoodoo knew he could push the envelop further and further, testing the boundarie's of acceptability (and the law in many cases) because he had me there to solve the problems that his brawn (he was big, strong, a great fighter and utterly fearless) couldn't solve, and in most cases, I would stop him before he went over the edge and caused a problem that I couldn't solve.

So in 1987, I extricated myself from that group. That was the "people" that I removed from my life.

The "thing" that I removed from my life was alcohol.

I never had a drinking problem, actually I didn't drink that much to begin with. But after some soul searching, I came to a few conclusions -- that I could see no value that alcohol added to my life, physically, mentally, and spiritually, and that I had seen a lot of people who have had their live's destroyed by alcohol.

Just a personal decision on my part. Avoid Hoodoo's!

8-Dec-2006

A Letter From Robert Z.

Aliber to His Local Paper

To the Editor

I was Milton Friedman's student, his colleague, his neighbor in Chicago and in a vicarious way his neighbor in Vermont.

The headline for Steve Nelson's column in the November 26 edition of the Valley News reads. "Free Markets Produce Cheap Goods, but Not Social Justice" is off-base.

Perhaps Steve Nelson will help us understand when a regulated or a non-free market is more likely to lead to social justice than a free market.

Milton Friedman had many provocative ideas that challenged the establishment views-the volunteer army, the negative income tax, and a monetary rule for the Federal Reserve. He believed that regulation has been adopted to protect the vested interests of a few. One of his ideas was that school children should be given vouchers that would allow them to choose the school that would best suit their needs-they would no longer be required to patronize the local monopoly supplier of educational services.

Steve Nelson is head of the Calhoun School in New York City. Annual tuition at Calhoun's high school is a nickel shy of $30,000 -not much below tuition at Dartmouth, and about twice the tuition at Hanover High. Because New York City residents pay federal, state, and city income taxes, a family needs to earn $50,000 in pre-tax dollars to have $30,000 in after-tax dollars.

The parents that pay the full tuition at Calhoun are in the top one to two percent of income earners in the city. These parents have a very lengthy menu; they can choose to send their children to Brooklyn Friends, Browning, Brealey, Chapin, Collegiate, Dalton, Ethical Cultural Fieldston, Friends Seminary, Horace Mann, and eight or ten other superb day schools and to Andover, Exeter, St. Paul's, Taft, Milton, Hotchkiss, Choate, Kent, South Kent, Kimball Union and twenty or thirty other quality boarding schools.

Probably no more than three or four percent of high school age individuals in New York City attend a school with the advantages of Calhoun or Collegiate.

If the New York City Board of Education adopted Friedman proposal for vouchers, every school child in the city would be as free to choose a school to attend as the privileged ones now at Calhoun.

Does Steve Nelson believe that the adoption of vouchers for elementary and high school students in New York would reduce social justice? Does he believe this innovation would reduce the quality of education these students would receive?

6-Dec-2006

A Letter from Donald J. Boudreaux to the Editor of the New York Times

To the Editor:

The subtitle under today's front-page headline "New York Bans Most Trans Fats in Restaurants" reads "A Model for Other Cities."

A model for what, exactly? For petty tyranny? For opportunities by the petty tyrants to practice Orwellian newspeak - such as Mayor Bloomberg's declaration that the city "is not going to take away anybody's ability to go out and have the kind of food they want"? Or perhaps for similarly inspired bans on other voluntary activities with health-risks? Why not also ban unprotected sex? Clerking in convenience stores? Walking in the rain?

Sincerely,

Donald J. Boudreaux

Chairman, Department of Economics

George Mason University

6-Dec-2006

Marketing case study: HP calculators, from Prof. Ross Miller

Carly Fiorina was been portrayed in the press (and by herself) as some kind of marketing genius. My impression is that HP is totally clueless when it comes to marketing even after all several years of Carly reshaping the company as a marketing powerhouse.

As a guy who teaches approximately 150 students the introductory MBA finance course each year at a large state university, I am especially beloved by book publishers. Although I am very much a fan of McGraw-Hill's textbook offerings, other publishers are always trying to woo me away. The cost/benefit is such that I receive a steady stream of fat finance textbooks for free that must cost at least $5 each to manufacture. I do actually look at them if only as potential fodder for a future column about the dreadfulness of finance textbooks.

Well, the other day I got a flyer in the mail from HP informing me that in consideration of my exalted position, I qualify for a 10% on the "limited edition" 25th anniversary edition of the HP 12c financial calculator. So, I can get a $79.95 calculator for $71.955 (according to my $5 clearance table Casio calculator that does more than the ancient HP could ever dream of).

So, here's the math. The calculator costs them at most $1 to manufacture (even the limited edition). Assuming that they make $20 profit on each calculator and that by adopting it for my classes 100 students per year would buy the calculator who otherwise would not, they make $2,000 a year indefinitely.

So, MBA students of all stripes, why doesn't HP just send finance professors free calculators the way book publishers send us free books?

5-Dec-2006

2 + 2 = 55 on Illegal Immigration into

Britain, from GM Nigel Davies

Maybe my sums are wrong, but:

I guess that the government figures will be out be at least by a factor of 10, and maybe it's much much higher than that. I don't know what the implications will be from an economic standpoint, but it should be very good for British chess.

5-Dec-2006

Ask the Captain, from Jay Pasch

You mentioned earlier using 100-200 days of data for quantitative work. A few weeks back, using the S&P, the attached monthly -- a non-quantitative, subjective and interpretive resistance level of 108.25-1413.75 was identified, and is now being worked as such. An important question to the Captain is, given that these resistance levels were obtained from 1999-2000 levels, in your opinion, are they too retrospective to be of use for current trading? Your likely feedback eschewing such un-tested measures is understood and agreed with; it is your opinion on going so far back in time for current trading that is of interest here.

Thanks for maintaining the rudder -- Jay

Vic replies:

I find such things worthless as well as untested. even the question has to be focused much more narrowly.

2-Dec-2006

The Latest Brooks Farms

Hunt Update -- Capitalism in Small Town America, from Scott Brooks

1-Dec-2006

The Latest Brooks Farms

Hunt Update -- Missouri Ice Storm, from Scott Brooks

28-Nov-2006

An Appeal from Susan Niederhoffer on Behalf of the National

Foundation for Teaching Enterprise

I received the following message from the Motley Fool as part of their 'Foolanthropy' campaign. NFTE is a very worthy cause, and I wondered if some of your readers and contributors are interested in supporting them?

We [NFTE] are honored to have been selected as a worthwhile charity by The Motley Fool ... This is a great opportunity for NFTE to increase our visibility as well as raise funds for our youth entrepreneurship programs.

Here's how it works:

On the homepage for Foolanthropy you click on NFTE and will be taken to the our page, which features a 'Donate to NFTE' button at the bottom of the page. Every dollar donated through this link from Nov. 21 to Jan. 7 is tallied and the organization that raises the most will receive a $10,000 bonus from The Motley Fool. We can also count checks received via snail mail in our tally, provided that 'Foolanthropy' is written in the check's memo.

So please take a moment and help NFTE by donating through our Foolanthropy page ... and creating buzz about NFTE on The Motley Fool online discussion boards. Please take a moment to share your thoughts about NFTE with The Motley Fool community and help us build our network of committed supporters and volunteers!

Thanks in advance for your support and best wishes for a happy and healthy holiday season.

Sincerely,

Steve Mariotti

President & Founder, NFTE

04-Dec-2006

A Synthesis of Chess and Music,

sent in by GM Nigel Davies

Chess and music people love to bring them together. Wasn't Philidor, the great chess master, also a renowned composer of classical music? Mark Taimanov is an accomplished concert pianist, former world champion Vassily Smyslov an operatic singer. And isn't chess itself a form of art, in many ways related to music?

The answer is yes, chess has much in common with music. But not, perhaps, in a way that we normally think. Chess is related to music composition because the latter can be programmed in much the same way as chess is programmed. Surprised? [Read More]

01-Dec-2006

Nature Versus Nurture,

from GM Nigel Davies

I'm sure you will recall the temperance study from Statistics on the Table which showed no correlation between levels of parental alcoholism and the health and intelligence of their offspring, despite the 'obvious' link in the minds of many. In a similar vein perhaps we just want to believe that the positive actions of parents have an effect. But where is the evidence?

Perhaps nurture is just another idea of the left that has, like global warming, the sole idea of redistributing wealth in the direction of the genetically inferior for mass 'education'!?

30-Nov-2006

Bias in Reporting Bias, from Greg Rehmke

Yesterday's NPR report on Conflicts of Interest in Medical Research cites a new "first-of-its-kind" study claiming that academics in institutional review boards sometimes "have financial ties to companies that pay for testing."

We want to know when an analyst flogging a company owns shares, and similarly we want to know when an academic is tied up financially with the subject he is studying.

Unfortunately, it is hard for government-funded NPR to comprehend wider implications of reporters and researchers being influenced by their income sources. Nearly all scientists, medical researchers, and academics work for someone (scientists and scholars contributing to Daily Speculations seem a notable exception). If researchers get paychecks or grants from the FDA or National Institute for Health, United Nations Health Agency, or World Bank, they are similarly tied up financially with certain perspectives on the world. They are less likely to consider that the FDA itself, for example, might be disrupting medical research and practice through its various regulations.

While the media search for financial links with business and medical research, scholars are finding plenty of problems with government-funded research. As an example, consider scholars publishing economic development studies investigated in a study by George Mason University economist Daniel Klein and Therese DiCola in Econ Journal Watch. Their August 2004 article investigates Institutional Ties of Journal of Development Economics (JDE) Authors and Editors.

It turns out that of 124 authors of JDE articles, 75% were employed or received grants from the "Big 8" government development agencies. They found too that of the 26 editorial officers within the Journal, "all have ties to the Big 8, all but one with ties of employment, consultancy, or grant." The "Big 8" taxpayer-funded agencies include: World Bank, International Monetary Fund, The Inter-American Development Bank, The Asian Development Bank, U.S. AID, the United Nation.

I don't listen to NPR every evening, so I may have missed their expose story on bias from government funding of most academics and all of the editors involved with the Journal for Development Economics.

While we can perhaps rely on NPR to report on inappropriate business funding of research, independent journals like Econ Journal Watch point out the equal or worse bias caused by government funding of academic research.

30-Nov-2006

Market Poetry, from Eliot

What an interesting site you and Laurel maintain! Thank you for sharing your thoughts on so many topics.

It seems that we share an interest in applying literary creativity to investing. I maintain a site called Market Poetry. It is a community poetry project publishing poems of all types related to investing, as loosely defined.

Our latest piece is here and we also have a limerick here. Like daily speculations, we have some haikus too. Here's one from a reader named Lisa Roberts:

Hatred of losses

More than a love of fat gains

Keeps me in the game

We even have what you might call "a song of speculation." It comes from an anonymous donor, is entitled Mr. Oracle, and is meant to be sung to Simon & Garfunkels' Mrs. Robinson.

Given our common interest in this unique genre, I wanted to invite you to come visit marketpoetry.com. If it ever strikes your fancy to submit a haiku or poem of your own to the site, it would be an honor for us to publish it.

Good luck with Daily Speculations!

29-Nov-2006

A Nice Product for Christmas, from Gordon Haave

There have been over the years conversations about learning, getting books for kids, etc. I have found a one year home study course in Austrian Economics, which could be a very good resource for the right person.

29-Nov-2006

Corruption Through the Ages, from George Zachar

The inscriptions on two bronze urns unearthed recently in northwest China's Shaanxi province tell the story of how, in 873 BCE, a noble man managed to bribe the judiciary in order to dodge charges of appropriating farmland and slaves ... [Read more]

28-Nov-2006

A Psych Book for Quants, from Henry Carstens

Brett Steenbarger has written a new and wonderful book called Enhancing Trader Performance. This book has kept me thinking about trading, performance and niches since I got it.

The book starts with four composite traders built up by personality type. It's just so fascinating to see oneself illuminated that way. Next the book takes each composite trader through a series of hurdles before they discover their trading niche. Again, quite illuminating and it sets the stage for the second part of the book which provides sound, proven tools and techniques for performance enhancement.

The book is beautifully written, easy to read and worth orders of magnitude more than the price of admission.

A psych book for Quants - imagine that!

28-Nov-2006

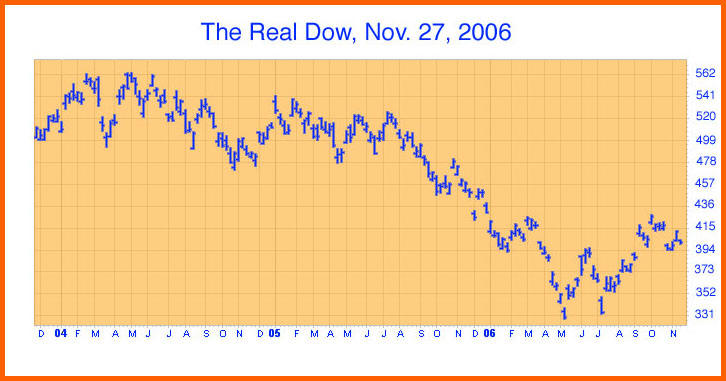

The Real Dow, from Mitchell Jones

Laurel mentioned the other day that:

The Dow grew from 66 to 11,497 in the 20th century

While that may be technically true, I would submit that it is not a statement about reality, for a very simple reason: "the Dow," meaning the Dow Jones Industrial average, is a series of numbers derived from a definition that constantly changes. It is as if the height of a child were measured and recorded on each of his birthdays, with a yardstick that was shrinking at a varying rate. The result would be a series of numbers, but the variation in those numbers would bear no useful relationship to reality and from it no useful conclusions could be drawn.

To be specific, when the Dow value of 66 was registered at the beginning of the 20th century, the U.S. was on the gold standard and $20.67 would purchase one ounce of gold. Thus one dollar would purchase 1/20.67 = .048 oz of gold, whereas at the beginning of the 21st century gold was at $280/oz and one dollar would purchase only 1/280 = .0036 oz of gold. Hence if we want to compare those prices to present prices using a physically unvarying yardstick, we can multiply each nominal Dow quote in the series by 20.67/G, where G is the dollar price of gold at that time. Hence prices from the 1900 to 1934 (when FDR devalued the dollar to $35/oz) would be multiplied by 20.67/20.67, or 1. Prices from 1934 to 1971 (when Nixon stopped selling gold at $35/oz and let the price float) would be multiplied by 20.67/35, or .59, and prices subsequent to 1971 would be multiplied by 20.67/G, where G would be set equal to the gold price on each particular day for which an adjusted Dow quote was to be calculated. Result: when gold hit $280/oz at the end of 1999, the multiplier would have been 20.67/280 = .074. At that time, the nominal Dow industrials were at about 11,497, so using the dollar as defined under the gold standard, the real Dow value would have been (. 074)(11497) = 849. Thus when measured against this particular unvarying physical standard, the proportional change in the stock market during the 20th century comes out to be 849/66 = 12.9, which is vastly less than the multiple implied by the change in the nominal Dow from 66 to 11,497 (i.e., 174).

Since the beginning of the 21st century, the disparity has gotten even worse: the price of gold has soared, to $638 most recently, when the Dow closed at 12250. Thus basis the gold standard, the adjusted Dow value becomes 12250(20.67/638) = 397. Result: the Dow multiple from the beginning of the 20th century to the present is a mere 397/66 = 6.

I would also note that the real value of the Dow, from the beginning of the 21st century to the present, has fallen from 849 to 397, or 53%.

I have attached a chart showing the recent pattern of the Dow, based on the above-described adjustments. (I started with the chart at stockcharts.com. I then multiplied the numbers on the vertical scale by 20.67 and prettified the thing using Photoshop Elements 3.) As you can see, that chart bears little resemblance to the chart of the nominal Dow, on which the "counters" at your site lavish so much analytical attention.

Bottom line: unless you (and Laurel) would be comfortable measuring the height of your son using a yardstick that shrinks at a varying rate from year to year, how can you be comfortable thinking about an equally meaningless measure of long-term variations in stock prices?

Note: for brevity, numbers given above were rounded, whereas calculations were done using un-rounded numbers, so there will be some apparent discrepancies across equal signs.

Al Mowbry comments:

Mr. Jones provides an excellent analysis of the "real Dow", as computed by bringing the price of gold into the mix as a better yardstick than the "point", or dollar. Another interesting factor to consider is real GDP (in chained 2000 dollars):

gold 1900 = $20.67

gold 2006 = $630

increase = x 30.5

real GDP 1900 = $376B

real GDP 2006 = $11,388B

increase = x 30.3

Which is an interesting final relationship showing that gold and real GDP just about kept pace over the time period, once gold was free to be priced by the marketplace.

Meanwhile:

Dow 1900 = 66

Dow 2006 = 12,179

increase = x 184.5

(Note that the Dow ranged from the low 50s to about 70 in 1900, but I use 66 for consistency. Current Dow position as of this writing.)

On this basis the Dow increased about 6.1 times more than gold. Seeing it "in terms of gold", the Dow increased only about 1.8% per year on a compounded basis.

However, a key element has been left out: dividends. Gold doesn't pay dividends, and may even incur storage costs, but for this analysis we should factor in a dividend rate for the Dow and see how the Dow compares with dividends reinvested. Looking at historical dividend rates, one could conservatively assume an average yield of 2.5% per year for the Dow.

The Dow's nominal rise from 66 to 12,179, from 1900-2006, was a compounded increase of a little more than 5% per year. If we compute the Dow value including a 2.5% reinvested dividend, we get:

Dow 1900 = 66

Dow 2006 with dividends = 148,000

Increase = x 2242

On this basis the Dow increased about 73.5 times more than gold. In terms of gold then (and in terms of real GDP), the Dow, with dividends reinvested, increased about 4.1% per year on a compounded basis.

27-Nov-2006

John De Palma on Why Mutual Fund Managers are Like Ants

Dr. Niederhoffer,

A couple of articles I read recently correspond with your writing last month on the Average American ...

Earlier this month John Kay's column in the "Financial Times" (Why the successful prefer being average to extreme) covered the dynamics of momentum and mean reversion. Kay wrote:

One of the most important, yet least understood, ideas in economics is the importance of convexity - our preference for averages over extremes ... Mean reversion explains why star fund managers tumble, fatalities fall when speed cameras are installed on dangerous roads and why subordinates tend to improve performance when criticized but not when praised. No cause and effect is necessary: these processes simply return to their normal state. Fashions in clothes, fads in management and speculative asset prices often seem to tip and then to revert.

In the article he compared mutual fund managers to ants, strangely similar to the article in The Economist ("Swarming the shelves") a few days earlier that compared ants to grocery store shoppers. (Kay: "Ant colonies tip - ants sometimes follow each other around in a circle of death - and so do herds of fund managers.")

He also offered the requisite Galton allusion and tied it to markets:

"If you take an average of two attractive faces, most people find the resulting blend more attractive still. This phenomenon is general and the existence and stability of market equilibrium depends on it."

And last weekend Alan Schwarz had an article in the NY Times about the "average" major league baseball player ("When Being Medium Is No Mean Feat")

In a quest to find the most average player, Schwarz considered "10 different statistical categories" using weightings consistent with "general offensive value."

Schwarz said he was looking at the "belly of a Bell curve." Interestingly he's really looking at the average of a group already several standard deviations above the talent of the general public. (And technically he might not even be looking at a Bell curve since there's evidence that the distribution of some baseball statistics follows a power law.

27-Nov-2006

Vincent Andres on Vegetables

I would like to make an optimistic hypothesis.

There are roughly 2 generations completely brainwashed by television/magazines/and the like. Turned in fact into vegetables. But this is/was quite new in human history. If you read for instance letters from very simple people e.g. soldiers, from 100 years ago, it is very obvious that those people were by far not so stupid as today.

1960-2000's behavior may well be only a 40 year parenthesis. TV is a media where the spectator is 100% passive, relieved of the task of thinking by himself/interacting. But in my humble opinion the genetics/fate of human beings is not to become passive. TV is/was only a way to encourage this bad propensity. And it has succeeded quite well until now.

Now, I want to see internet as a completely different media, where the difference between information producer and information receiver is dramatically reduced. This allows people to become producers. And this is in fact what they do. With TV, neighbors stopped working/speaking together in the evenings. Everybody was at home to hear the same lecture. With internet, discussions/interactions are back, and with it comes some awareness.

I believe that the internet will help to encourage peoples' real propensities which are to be aware, active and interacting. Perhaps earth will not become a vegetable garden planet.

27-Nov-2006

Speaking of Thanks, by Kim Zussman

Star Quarterback Carson Palmer is grateful for Achilles tendon from Julie De Rossi, killed by drunk driver ... Julie's family is rooting for Palmer and Julie to one day make it to the Superbowl [Read More]

I found this via a search regarding MTF donor tendon infection case, peripherally related to jawbone grafting with cadaver bone as well as appreciation for those in the herd who lose more than they have a right to.

Ironically just today a Chinese woman was explaining how fish are eaten with their eyes so they can see their way to the next world. Another form of consideration for flesh to the flesh.

27-Nov-2006

A Book List Question from David Lamb

A while ago I think through one of the threads on the spec-list I remember a link someone offered that described a pretty all-encompassing list of books. I have done a word search through my gmail but to no avail.

This list included all of the best writers and most of their works, from the earliest of recorded times/history to the latest. As I continue to work on my own library I thought perhaps I could first start with suggestions from the spec-listers, then ask you about that link?

I have already ordered and read many of the dailyspeculations reading list.

Dylan Distasio offers:

Happy Thanksgiving to all!

I don't know if this was the exact list you were looking for, but it sounds like it. In any case, its a great one (pun intended). I've used it as a source of reading material myself. I would also strongly recommend any of Harold Bloom's work from a critical perspective, especially 'The Western Canon.' You can also find similar lists by googling 'Great Books.'

I would also strongly recommend Library Thing as an awesome resource to catalog your library, and search for suggestions for new reading based on the millions of volumes other members have cataloged. If you're a reader or bibliophile, you'll love the site.

27-Nov-2006

Bruno Ombreaux on the Market Genome

I find that market heatmaps look a lot like DNA microarrays.

There is a rich statistical analysis literature for microarrays, as well as a huge project in R called Biomonitor.

I always wondered if one could apply some techniques developed for microarrays to market maps, deciphering the market genome?

27-Nov-2006

Alan Millhone on Tasmania

I have Just now enjoyed reading the article on Tasmania. It is amazing how few Aussie's have ever been there. In 1996 my Wife and me spent a week in Tasmania. We flew into Hobart and had a car for a week. We enjoyed the climate, the people and the wildlife there. Hobart has a wonderful botanical garden that is well worth seeing. You walk thru the wildlife parks and we had roos and wallaby's eating out of our palms (hundreds of them). Later in the week we ventured north and ended up in Launceston. We turned in our car and took passage on the Abel Tasman Ferry to Melbourne, an overnight trip I will never forget ! Also while in Tasmania we got to see and hold some baby Tasmanian Devils . Ugly little creatures that root like pigs and make a pig type sound. We held babies of about three weeks old. The keeper there said in another few weeks they would literally bite off your fingers if held. I feel Tasmania is a well kept secret and worth a visit sometime.

Sincerely:

Alan Millhone

Belpre,Ohio

26-Nov-2006

A Note from the Editor

I recently had a barbeque in Austin, Texas, at the Westlake Salt Lick and County Line during the course of my first vacation in 15 months, (the last one having been interrupted in Venice by a ephemeral fall in the market due to Katrina). I must report that all tasters found that the food at the former mentioned location was far superior to that at the latter, even though the food at the former was transported from a smoke house which was an hour away. It is Good to be back with you all again, and I have read many good books, especially Towing Icebergs, Falling Dominoes and other Adventures in Applied Mathematics by Robert Banks, on which I will share some thoughts with you shortly. Vic

26-Nov-2006

The Latest Brooks Farms

Hunt Update -- Half Time..., from Scott Brooks

16-Nov-2006

The Latest Brooks Farms

Hunt Update -- Pack of Wild Dogs..., from Scott Brooks

16-Nov-2006

Warm Weather Wrecks Bear's Slumber, from G.M. Nigel Davies

"MOSCOW, Nov 15 - Insomniac bears are roaming the forests of southwestern Siberia scaring local people as the weather stays too warm for the animals to fall into their usual winter slumber." The full story is found here.

15-Nov-2006

A Comment on "Faith of Our Fathers", from Gary Rogan

Religion does bring happiness to many people, that's undeniable. Studies in behavioral psychology have indicated that human beings are genetically predisposed towards religious beliefs. Evil ideologies have in the past tried to control religious thought because it interfered with their attempts at mind control, therefore one always has to be suspicious at such attempts. Religious freedom is a litmus test of free societies.

Nevertheless, by definition religious beliefs are not rational. People are trained from childhood not to exercise the same level of skepticism towards "facts" associated with religions as they would towards most other subjects. Therefore, when a significant number of people acquire similar religious beliefs, religion often stops being just a force for personal fulfillment and becomes an organization force to achieve some real-world ends. Since religious beliefs cannot be argued with on a rational basis, if they happen to contain elements of intolerance or imposition of one's will on others, they can and have led to great injustices imposed on those who don't profess them. Even today, it's a real possibility for whole cities and contries to be blown up in the name of religion.

The shifting lines between rationality and "magical" thinking patterns is something that has been with us since the dawn of our species. There are obviously no easy answers. People should be left alone in their happiness, but any attempts to impose their "happiness" on others need to be stopped.

15-Nov-2006

Scary but True, from Craig Mee

It's scary, but true: More people voted in the final of this year's American Idol than voted in the US 2004 presidential election.

Stefan Jovanovich replies:

The fact that more people voted for American Idol than for the Presidential candidates is an indication of the native common sense of the American people. Voting for American Idol offered a choice of candidates whose differences were apparent. For the American earning $14/hr. and driving a car worth $4K, the choice between 2 millionaire preppies - neither of whom had ever held a job even close to what the "average" American does for a living - was largely an exercise in magical thinking.

Roger and Carole's constitutional historicisms do not fit the facts. The purpose of the Electoral College was to give the states with smaller than average population greater political weight. Each state gets an electoral vote simply for existing. For the states like Montana and the Dakotas, to name a few examples, that means a doubling of their national power in Presidential elections. The Senate was created for the same reason. Both Constitutional provisions continue to give far greater political importance to the small states in the Union than they would deserve based solely on popular franchise. That was and remains their constitutional purpose.

The demand for the popular election of Senators came from autocratic rather than democratic. It was part of the Progressive movement to take Senatorial elections out of the grubby hands of elected legislatures and make them accessible only to "reformers" - i.e. rich kids who could afford the costs of statewide campaigning. It was also part of the move towards giving the Federal government greater power than the States on the theory that removing decisions to Washington would result in "cleaner" government. For that "reform" to take effect, however, there had to be an understanding that the one area where Federal power would NOT be extended was in the area of enforcing the Constitutional rights of voters. When the House passed proposed amendments for the direct election of Senators in 1910 and 1911, they included a "race rider" meant to bar Federal intervention in cases of racial discrimination among voters. When in 1913 the Senate instead adopted Senator Bristow's language for the amendment, it was with the assurance of the newly-elected Democratic President Wilson that the Justice Department would no longer enforce the 14th and 15th Amendments. The race rider would not be in the words of the Constitution, but it would be inferred. "Clean" government would be for white folks only.

15-Nov-2006

Religion, Medicine and Methodology, by Alston Mabry

An interesting conversation on NPR with Dr. Richard Sloan, professor of behavioral medicine at Columbia, about the relation between religion and medicine. The conversation is stimulating purely from a counting POV because Sloan discusses interesting methodological flaws in research studies.

An interesting paper by Sloan, et al., from the NEJM, which expands upon some of the NPR conversation: Should Physicians Prescribe Religious Activities?

And his book: Blind Faith: The Unholy Alliance of Religion and Medicine by Richard P. Sloan.

13-Nov-2006

A finnegan = "merkel"?, by D. Wrestle

Is a finnegan also known as a "merkel"?... as in gold overnight?

12-Nov-2006

The Latest Brooks Farms

Hunt Update -- Missed Opportunities, from Scott Brooks

11-Nov-2006

The Latest Brooks Farms

Hunt Update -- The Night Before, from Scott Brooks

10-Nov-2006

Why the GOP Lost, from Gibbons Burke

Former House majority leader Dick Armey provides a pretty good post-mortem which essays to explain how the Republicans lost their way:

When we took control, that positive Reagan vision of limited government and individual responsibility provided a great deal of discipline and allowed us to govern accordingly. Our primary question in those early years was: How do we reform government and return money and power back to the American people?

Eventually, the policy innovators and the "Spirit of '94" were largely replaced by political bureaucrats driven by a narrow vision. Their question became: How do we hold onto political power? The aberrant behavior and scandals that ended up defining the Republican majority in 2006 were a direct consequence of this shift in choice criteria from policy to political power.

I think he saw the train wreck coming back when he left the House.

10-Nov-2006

The Latest Brooks Farms

Hunt Update -- The BBQ, from Scott Brooks

10-Nov-2006

A Letter to a Trend Follower, from J.T. Holley

"Once I was blind but now I can see". I used to be a consultant and actually have placed much more of my clients assets into trend following funds than I should have. After a period of underperformance, one thing that I noticed usually in their marketing material or by word of mouth is that they are adding some of "their own money" to the funds. Nice!

Does anyone else see this as ironic? I mean the trend followers say that "volatility is to blame" and that they feels that volatility will come back like it always does and that this means that trends will prevail in the future. No no,it's called "mean reversion"!!!!! Trends don't exist, they aren't defined, and anyway you put a pencil to an envelope and test it like done by the fabulous duo in Prac. Spec. (around the 2nd chapter) you'll realize that the markets have a strong tendency to mean revert and it might be the way that you approach the markets in the first place? Of course not, this would cause a huge marketing catastrophe and the "run on the bank" would begin! But who am I but someone who believes in such superfluous things like statistics, law of ever changin', empiricism, and peanut butter on his pancakes. I mean after all I'm not successful because I don't have billions of assets under management and make a lot of money.

09-Nov-2006

An Oil/Energy Consequence Question, from Fred Belsak

One can hardly fail to trip over mantraic forecasts that a Democratic majority is bad for the valuations and fortunes of hydrocarbon-producing/using companies. Contrarianly speaking, what if such forecasts are memes fanned by deft Teal-tinted uber-investor/advisors seeking to increase their overplusses by playing against public herd movements?

09-Nov-2006

I'd Prefer Real Pigs to Hold Seats in Congress, from Don Boudreaux

Editor, The New York Post

To the Editor:

Re "W Hears the Voters" (Nov. 9):

Within hours of the GOP's 1994 takeover of the House and Senate, then-Senator Phil Gramm (R-TX) proclaimed the lesson of that election to have been "about freedom."

Turns out that, especially since 2000, it was more about power and pork.

Those of us who fear concentrated power should look not to a political party to protect our liberties but, rather, to divided government and glorious gridlock.

Sincerely,

Donald J. Boudreaux

Chairman, Department of Economics

George Mason University

09-Nov-2006

Global Cooling and CO2, from George Zachar

This piece by George Reisman at the Ludwig von Mises Institute states:

In the last 500 million years, there have been two ice ages at the same time that vastly higher carbon dioxide levels prevailed in the earth's atmosphere-up to 16 times the present level.

09-Nov-2006

Re: Letter to a Newborn Son, from Arvind Radhakrishna

I read your "Letter to a Newborn Son" and wanted to tell you that I wish I had read something like that when I was very young. Although at age 26 it is not too late for me to incorporate the suggestions in the letter, I can only wonder how my life would have been different had I come across such wonderful and inspiring advice during my more impressionable years. I'm very glad you chose to make it available on your website.

08-Nov-2006

Letter to Temporary Democratic Co-ed, by Dr. Kim Zussman

Hurrah! The party of redistribution is upon us anew!

In honor thereof, here's an idea for campus democrats (a fair % no doubt headed to law school):

In large class (think psych 101), at each test students scoring over +1SD will get 5 points deducted from their score, and these are distributed to the bottom -1SD. The brains at +2SD likewise are taxed 10 points, and 3SD or more -15 points.

This really is equitable, since it is not fair that top students are completely enabled by rich parents and they should not try to fool us into thinking that their good results relate in any way to hard work. Hard work is only done by people in hard hats wearing steel-toed boots, who dig foundations of great government institutions meant to better the world.

Furthermore, it would be interesting to see how students in such a class, were they allowed to vote on grade taxes, would break down in according to their past achievements or current goals.

07-Nov-2006

Today, Many Will Lose, but You Can Win, from Jason Thompson

The time draws near for another celebration of American Democracy. To vote on this great day is to rejoice in the participation of this, the greatest of all Republics. This joyous occasion brings with it uncertainty for both constituents and candidates across the land, best witnessed at Tradesports.

It would seem danger lurks for those politicos that sport an elephantine logo. The Republicans may well be out on their ear come Wednesday, at least a likely outcome in the House (latest likelihood of loss = 80%) as well as across the majority of gubernatorial races. If they do go, with it will depart the tattered promise of the Contract with America, and what remains of the conservative (a.k.a classical liberal) imaginations influence over government will be extinguished. The lights are about to go out all over Washington, indeed they will likely dim across America. It saddens me to realize that I know not when, or if, I might see them lit again.

But why be moved by the crocodile tears of the Republican leadership? Why be coaxed to action by dinner-time phone calls and pandering for monies in defeat of the Great White Hillary? The left is not the only constituency vexed to nightmare by twelve years of Republican mis-management. The right, too, has seen its hopes dashed at every turn. Conservatives were once inspired by the Republican Partys libertarian vision of limited government, fiscal restraint, and economic freedom. Rather than foisting plans for social engineering on an unwilling population, the state was to respect the enterprise and moral character of the American people. All of these expectations have been systematically betrayed. Now, rather than wring their hands over Republican misfortunes, conservatives should abandon the Party and seek the company of the libertarians (note lower-case l).

It was a libertarian idea that stirred the conservatives, and conservatives should follow that idea, not its false prophet. To give into the inclination to vote Republican as a negative vote against collectivists and socialists is to enter into political slavery. Recall that once in the chains of such servitude, the value of your vote is swiftly relegated, with it your voice muted.

One wonders, however, if such inclinations do not lead to grave "unintended" consequences. The rough beast who slouches toward the Speakership, her blank and pitiless gaze caked with layers of eyeshadow, would doubtless be pleased by such writings as these. I cringe at thoughts of her wicked agenda, of her "promises" if she ascends the throne of the People's House. Indeed, I am reminded of the sentiment, expressed by an outstanding parliamentarian that "Ideological purity is an extravagance; defeat is the price we pay for it."

Yet I feel I am left little choice. I cannot become a slave. Surely not willingly, not by my own hand, be it wielding a pen or a plow. But by voting the party-line, by going-along to get-along I grant my political freedom without recourse and I get, well, what we all have gotten out of Congress and the Administration at some level: disappointment.

But I must vote, and vote I shall for those that have the character and idealism worthy of America's founding and her promise of the future. I will not vote for a party today. I will not vote for fraudsters, pilferers, knaves or hypocrites. Rather I intend to emblazon in my memory the deceit and disappointment engendered by many members of the GOP over the past decade, holding to the trait of the Elephant, which, it is said, never forgets. Today in the voting booth I will not forget, today I will vote for those persons who best adhere to the principles of freedom and liberty that make this country that "shinning city on a hill" for the rest of the world. I will do this, even though it will likely mean writing in name after name on the ballot. I encourage you today to likewise cast off the chains of political slavery, to speak loudly today with your voice - your vote - and use it today to effect change.

06-Nov-2006

Long-Term Positive Kaboom, from Alston Mabry

On PBS this week there is a great two-part Secrets of the Dead, based on the book Catastrophe, by David Keys. It explores the evidence for, and impact of, a mid-sixth-century climactic disaster that perhaps changed the course of human history in many places around the world. Got some fun science and some interesting conjectures.

I also think that David Faber (and his production team) has done another very good job with Big Brother, Big Business, his report on personal data in the net age, airing now on CNBC.

Just for an entertaining and informative dose of doom and paranoia.

06-Nov-2006

Reflexivity, Volatility, and Early System Adoption, from Warren Quick

Reflexivity may provide some insights into the ever changing influence of one market on another. The complexity of global markets makes it difficult to determine the underlying principle of the relationship. One can, however, determine that a relationship indeed exists through counting. The problem for a speculator is that these relationships are not static - they change. When proven 'most profitable' (from back testing) it is very likely that many others will have reached the same easily formed determination. The more people aware of the relationship, the higher the risk of system breakdown.

Reflexivity would suggests that as more and more speculators adopt and profit from the relationship, profitability will be strengthened up to a capitulation point where the strength of belief has become completely irrational. The irrationality represents the inevitability of breakdown but timing is more difficult. We have a boom bust model and must determine where we are positioned.

As I see it, tops and bottoms in the markets are preceded by large gains and losses. The turning points are associated with increases in volatility. If we are to use these assumptions to analyse system performance we may find clues as to when to adopt and discard a system. How profitable a system has been for a speculator has a lot to do with how early in the cycle the system was adopted. If market relationships follow this boom/bust model, as I believe they do, volatility in system performance rather than the market itself may hold a key to early adoption and healthy trading profits.

04-Nov-2006

Manufacturing Election Invalidation By Stefan Janovich

Once the Quasi-War with France ended, the Federalists found themselves facing a President and Congress who were determined to challenge British impressments of American seaman even if it meant war. The Federalists thought President Madison and the Republican Congress were literally insane. After war was formally declared, the successes of Joshua Humphries' new frigates and the American volunteer Navy created a temporary wave of patriotic enthusiasm and optimism, but it did not last. The difficulties of the newly-formed professional American Army in the fighting against the British forces in Canada were taken as proof that the country was on the road to ruin. When the local militias literally ran away from the defense of Washington and the White House was burned, anti-war fever swept the Federalist stronghold of New England. The Nantucket assembly formally declared the island to be neutral territory, and the Hartford Convention was called for the states to consider formal secession from the Union. The successful defense of Baltimore (observed by a local poet and lawyer) and Commodore Perry's naval triumphs were not taken as signs of eventual victory but as "manufactured successes". To the opponents of the war it was certain that United States of America was going to lose and that the only sane and proper thing for good people to do was to abandon the Union.

When the British decided that Napoleon back from Elbe was a more important enemy than their former colonists, the Republicans were let of the hook. To the Federalists lasting frustration the final act of the war - which came after the Peace of Utrecht had been formally signed - was Andrew Jackson's decimation of the British forces under General Pakenham. That unexpected victory would eventually lead to John Quincy Adams' equally humiliating electoral defeat at the hands of the Hero of New Orleans and to the destruction of the Federalist Party itself.

03-Nov-2006

Hedge Fund Returns, from Philip McDonnell

Prof. Ibbotson has a paper out which claims a 3% alpha after adjusting for hedge fund reporting bias and fees.

Kim Zussman adds:

There is a new book by Goetzmann and Ibbotson along the same lines. Appears to be compilation of prior papers related to equity risk premium (have not read).

Professor Gordon Haave responds:

I have three preliminary comments:

02-Nov-2006

Reminiscence From the Not Too Distant Past, from C.Z.

I don't want to sound too alarming but do you remember the late 90's when NY taxi drivers where trading internet stocks from their cabs? Well, today my Russian hairdresser on Lexington Ave gave me a lecture on the great benefits of investing in equity options. I don't know if this should be used as a leading indicator but as an avid reader of Daily Speculations I certainly thought this was worth sharing.

02-Nov-2006

November Election Counting, from Steve Ellison

With Tradesports assessing the Republicans chances of retaining the House at less than 40% for the past three weeks, presumably a Democratic House majority is already discounted in stock prices, and the market apparently is not afraid.

I checked the closing S&P index prices the Wednesdays before mid-term elections during a president's sixth year and compared them to closing prices on the days after the elections. This situation has only occurred three times since 1974, but in all three instances the market went up. In at least two instances, the election results would have been judged negative by those who presume that Wall Street's interests are aligned with the Republican party. The post-Watergate 1974 elections were the high tide of liberalism. In 1986, Democrats gained a majority in the Senate.

Wed Day

before after

election election Change

10/31/1974 73.90 75.21 1.8%

10/29/1986 240.94 246.58 2.3%

10/28/1998 1068.90 1118.67 4.7%