Archives

July

16-31, 2006

Write to us at:

![]() (not clickable).

(not clickable).

Please include your full name, and omit attachments.

|

Daily Speculations |

|

|

|

Archives Write to us at:

|

31-Jul-2006

Be Careful What You Wish For, from GM Nigel Davies

With my son having had some problems with his talking, it is a cause for delight whenever he comes out with complete sentences. Of course I have not really given much thought to what he might say but there was a likely premonition at today's trip to the Model Railway Village. He announced loud and clear that "I had enough little boy," when another boy irritated him, much to the consternation of the child's parents. "He says the same to his father" I told them before convincing junior that it was a good time for 'Old McDonalds.'

It reminded me of my one-time attempt to live in Portugal, which seemed like a great idea until I started to understand what everyone was saying. Not to mention the Buddhist saying that 'our problems begin when we first want something'. This phenomena exists in romance too when someone pursues the object of their desires and believes they are 'in love' until they actually catch them.

I have noticed the same thing in my chess games, I often look forward to a particular continuation until it is actually played, and only then do I see what I have missed, the reality often being a complete let-down. And the same phenomena seems to exist in markets, prices rising or falling in anticipation of a particular event and then setting off in the opposite direction once whatever was hoped for actually happens.

It seems to me that this phenomena deserves some study, what are the dynamics of this effect? I have often thought that the best way to destroy someone is to give them exactly what they want, but perhaps this is too simplistic. Any thoughts on the matter?

31-Jul-2006

A Three-Foot Review of "My Super Ex-Girlfriend," by Dr. Marion Dreyfus

First off, save your shekels with "My Super Ex-Girlfriend." Though its lineage looks good from the git-go, with

Ivan Reitman ("Ghostbusters," "Stripes," "Groundhog

Day" and "Meatballs", among many other light-as-air popcorn packers) as director, screenwriter

Don Payne (three "Simpsons" flicks) gives us a dysfunctional "Superman"

with PMS -- without the humanity, complexity or grace of its elder testosteronic bro. Nor would the FDA have OK'd this over-the-counter bit of embarrassment. A waste of the lovely

Uma Thurman, as mousy Jenny Johnson (is that the best they could do for iconic name-calling?) who transforms into G-Girl (we never learn what the G stands for: Does it have anything to do with the G-spot? or Girliness? Gosh oh Gee? whatever) a sub-Kryptonite discredit for confused-looking

Luke Wilson as her feckless Lois-Lane love-interest wannabe.

First off, save your shekels with "My Super Ex-Girlfriend." Though its lineage looks good from the git-go, with

Ivan Reitman ("Ghostbusters," "Stripes," "Groundhog

Day" and "Meatballs", among many other light-as-air popcorn packers) as director, screenwriter

Don Payne (three "Simpsons" flicks) gives us a dysfunctional "Superman"

with PMS -- without the humanity, complexity or grace of its elder testosteronic bro. Nor would the FDA have OK'd this over-the-counter bit of embarrassment. A waste of the lovely

Uma Thurman, as mousy Jenny Johnson (is that the best they could do for iconic name-calling?) who transforms into G-Girl (we never learn what the G stands for: Does it have anything to do with the G-spot? or Girliness? Gosh oh Gee? whatever) a sub-Kryptonite discredit for confused-looking

Luke Wilson as her feckless Lois-Lane love-interest wannabe.

Though the team is evidently pitching its taffy at the teen audience, it features way too much energy on how a supposedly modest librarian-type lays on the leer with athletics in bed. Since when does a satisfying filmic "relationship" take its cue from nerdy friends advising on who or who is not "attractive"? This film puts men firmly on the bottom, figuratively and physically, letting the heavy lifting devolve solely on the femme. We get maybe two smooches (Wilson is taught how to use his tongue, as if he fell full-grown out of a turnip truck, despite his having had a trail of broken relationships under his befuddled wing), then it's strip for action, into bed at the first opportunity and -- break a wall or two.

What kind of message is this supposed to convey: Mousy girls carry a heckuva wallop under their spectacles? Or pounds per thrust is what counts in an erotic encounter? (Who gauges the success of any pair-bonding on the distance traveled by your bed during those shared non-restaurant moments?) Or could it be that the unstated agenda behind all this disrespect of joists and sheetrock is to prop up the construction/reconstruction trades in a down market?

"My Super Ex-Girlfriend" is not very super (but possibly in need of a janitor).

Dreyfus Recommendation: Out of 3 'Legs' (drei=3, fus=feet): Half a Leg

Prof. Adi Schnytzer rejoins:

Well, I saw this film last night and must suggest that you have taken it way too seriously. It is a light and funny bit of a sendup of Superman type movies and to suggest that it is selling wall-breaking s#x is a bit rich. Why take this nonsense so seriously? Is having your weeny nearly ripped off an aquired taste? None of my kids would be in the least endangered by this movie.

Well, I saw this film last night and must suggest that you have taken it way too seriously. It is a light and funny bit of a sendup of Superman type movies and to suggest that it is selling wall-breaking s#x is a bit rich. Why take this nonsense so seriously? Is having your weeny nearly ripped off an aquired taste? None of my kids would be in the least endangered by this movie.

31-Jul-2006

If You Are Happy and You Know It, sent in by Pitt Maner III

From "Dr. Happy" at the University of Illinois at Urbana-Champaign:

The relation between income and happiness is intricate. Although money is not on average a major source of the individual differences in well-being in wealthier nations, it can make a substantial difference in poor societies where basic needs are not fully met. Materialism, valuing money more than other things such as relationships, is usually a negative predictor of well-being. However, wealthy nations are considerably happier than very poor societies, although people in very poor cultures can be happy if their basic needs are met.

The happiest people all appear to have strong social relationships... [Read More]

And on subjective well-being:

Q: Are some societies happier than others?

A: For many years the results of surveys have indicated that people in some societies say they are happier and more satisfied than people in other societies. For example, Diener, Diener, and Diener (1995) report a strong correlation between the wealth of nations (which goes along also with having more human rights, equality, and freedom) and the SWB reported by their citizens.

Thus, conclusions about the happiness of societies, based on broad survey measures, suggests that countries do differ substantially in SWB. Another reason that nations seem to differ in SWB is because of the norms (beliefs about what is right) they have for feeling emotions. We find that in Latin nations (South America, Spain, etc.), there is a belief that positive emotions are mostly all good and negative emotions are mostly all bad. In the Confucian nations of the Pacific Rim (e.g., Korea, China, and Japan), there is a belief that negative emotions are as good as positive ones. Thus, there is not a high value placed on SWB and being happy. We find that these nations differ in SWB, especially when income is controlled. The Latin nations are much happier than we would expect based on their income, and the Pacific Rim countries are less happy. Thus, we see two primary forces determining how happy on average people in a nation are: the wealth (and concomitant human rights, equality, and freedom) of nations, and the norms governing the desirability of positive emotions.

Despite this, we might question the validity of the broad survey measures, and only recently have we begun to take a deeper look across nations, using a multimethod measurement approach. In this approach, we employ, in addition to the global survey measures of SWB, experience sampling (the Palmtop method of obtaining moods at random moments over time), informant reports (friends and family tell us how happy the target respondent is), and memory measures (can the individual quickly remember more good things than bad things from his or her life). We also use broad and narrow measures, in order to pick up response tendencies. At the gross level, we find that the survey measures perform OK - we can distinguish the happiest from unhappiest nations. But the additional measures also show that one can get different results with the different measures when one takes a more fine-grained analysis. And also, positive affect measures can produce different results from negative affect measures - that is, how much joy a people in a country feel on average is not the opposite of how much sadness people feel there. There are nations where lots of both positive and negative are felt, and there are nations where not much emotion of either type is experienced. [Read More]

30-Jul-2006

Steve Ellison on the Second Law of Thermodynamics

Entropy does occur on a massive scale among individual stocks. Most economic growth is generated by start-ups and small businesses, especially those that grow into large companies. Once companies get large, they tend to go into decline. The attached graph is from the book Creative Destruction by Richard Foster and Sarah Kaplan. It shows the median stock performance of companies in the S&P 500 index as a function of how many years they have been part of the index, relative to the performance of the overall index. The stock indices keep rising because there is constant substitution of new companies for the old companies that fall on hard times, go bankrupt, or are acquired. Foster and Kaplan note that only 74 of the 500 companies that were in the index in 1957 were still in the index 40 years later, and only 12 of those outperformed the index over that period.

Dr. Kim Zussman adds a few points:

Dr. Phil McDonnell extends:

In physics entropy can be viewed as energy. In that sense energy runs down through numerous dissipating losses of energy. In mechanical systems the energy is lost through friction where it may be further converted to heat or sound. Heat is conducted away or radiated away as infra red radiation. If a body is hot enough (white hot or red hot) energy may be radiated as visible light. The Second Law of Thermodynamics says that the universe has a natural tendency to dissipate energy.

If the natural order of the universe is to dissipate energy how do some systems continue to exist for long periods of time? Anyone who has held a lit match knows that event does not last long. The energy is quickly lost as heat, light and even sound. Eventually the process terminates when little black spots are produced on our seared finger tips and the fuel is exhausted. Our cars continue to run because we stop at the gas station adding more energy stored in the form of gas. The Solar System continues as a stable system because the energy loss in a vacuum is minimal relative to the amount of energy available. For a system to persist energy must be added or the friction must be low relative to the energy available.

So too with markets, the principle applies. The energy of markets comes not only from the initial conditions at which they started but also from on going additions of energy. The energy of markets is, of course, not the same as in physics, but the energy of economic value. This can be thought of as new money but is not restricted to that. A broader measure of the energy of markets is the economic value which the participants bring to those markets. When new companies are created and offered to the public the market sets their value. This is the economic equivalent of new energy being added to the system. As older, larger or obsolete companies go into decline they are gradually dissipated by the entropy of which Mr. Ellison speaks.

Ultimately the new energy added by human ingenuity and enterprise more than offsets the negative effect of economic entropy in a well managed economy. The long term positive drift of the markets tells us that the net result is positive. The innate human need for achievement and desire to better one's self is overcoming all of the obstacles put in its path. The outlook is good for more of the same.

Steve Leslie comments:

Although it has been some time since I have studied physics, I believe that Dr. McDonnell has given an excellent explanation of Newton's Second Law of Thermodynamics. "Friction" will force the energy of a system to be dissipated as mentioned.

Let me supply a real life example. Let us look at a game of poker held in a casino and let us assume that this is a closed environment where everyone brings the same amount of money to a table and no new money is added to the game. The rake or the amount of money that the house takes from every hand is fixed for each hand that is played. If the house takes $4 every hand and there are 25 hands played per hour then the house has eliminated $100 from play every hour. This goes into the black box on the side of the table. If each winning player tips the dealer $1 per hand then the money that is taken off the table will be $125 every hour. Money will be eliminated from the game at a mathematical pace that eventually will force the games demise due to the small amount of money that is left to be gambled on. The only way that a poker game can survive in a casino is if more money is added either by the existing players or new players.

Thus playing poker in a casino can be like climbing the proverbial slippery slope or a salmon swimming upstream . You had better be a very good poker player to win in a casino poker game, the percentages are way against you. This is why poker professionals look for soft games, play few hands, have been know to play teams, and are generally considered poor tippers.

In a home game with no rake and no tipping, the money will be distributed to the better players over time based on factors such as luck and skill. Thus one stands a much easier row to hoe if they organize their own home game and invite the weakest players they know and preferably those who have ample bankrolls.

Sharks attack the weak, they do not attack other sharks.

Scott Brooks writes:

I agree that money will gravitate toward the better poker players, but it will do that regardless of where the game is played. When I was playing poker back in the 1980s, I viewed the rake positively, as a necessity and not as a negative draw down on the possible funds for winning.

The biggest reason I paid the rake was because I knew I was getting an honest game of poker. You see the house (the one getting the rake) would absolutely have to ensure that the game was honest, that no one was cheating (i.e. dealing off the bottom of the deck). So part of the vig that was paid was well worth it to me. If the house got caught cheating, or if cheating occurred at the house, they were through. The rake is nicely profitable, and the house would be foolish to jeopardize that profitability. Thus, they ensured an honest game.

Another reason to pay the rake or the vig is that house would use part of that rake to create the ambiance of the room. When gamblers and players would come in, the house (I am not talking about a casino here, I'm talking about a private poker house), would have their favorite food ready in advance (if they knew they were coming), their favorite brand of cigarettes (its cheaper to buy someone a pack of cigarettes than to have them leave to get them if they ran out and possibly not come back), your favorite drinks, etc. The house would also keep track of what sporting events you had bet on and/or what horses you had bet on, etc. and update you on their progress (i.e. The Celtics are ahead by 6 with 2 minutes to play).

The "house" in this case simply created an environment that was inviting.

I did not eat or drink nearly enough to make the extra vig I paid personally worth it if you only looked at the water or diet coke that I drank, or the Doritos that I ate, maybe an occasional bowl of chili. But it was well worth it to me to pay it because it created an environment that attracted gamblers. Gamblers wanted to be there. And believe me, I wanted the gamblers there! They were the "fish" at the table.

They liked the free cigarettes, food, drinks, and general concierge service. The house knew its job well, and so did I. They made money attracting gamblers to their poker house, and I made money playing poker with the gamblers.

The corollary to the market is, I believe, pretty obvious.

Markets are created, whether its Schwab, the NYSE, VTrader, MorganStanley, etc. to cater to investors and make them happy (i.e. giving good service at a reasonable price, good fills, etc.). For those on this list that are adept at making making money in the markets, we simply pay the vig as a price for honest markets, good fills, reasonable margins, and the opportunity to test our skills against the masses (including the tow truck drivers from the 90s that owned their own islands).

Even with that vig, the money has a tendency to "drift" to the more the adept. So I submit that the vig or the Rake is simply the price I have to pay to have the opportunity to prove that I am more adept in an honest game. I want an honest market. I will let the tow truck guys enjoy the free cigarettes.

Professor Pennington takes the thread back to its roots:

Here are two examples to illustrate that entropy and energy are different quantities, which must be considered separately:

Suppose that one has a thermally insulated box with its left and right halves separated by an impermeable membrane. The left half has gas in it, but the right half is a vacuum. Now the membrane is removed, and the gas occupies the entire box. In this process, the energy of the system stays the same. (No work was done on the system, and no heat entered or exited, because the walls are thermally insulated.) But the entropy of the system increased.

Alternatively, suppose that one has a cylinder of gas, again with thermally insulated walls with one end closed. At the other end is a piston, which is used to compress the gas (which I'm defining as 'the system'). As the piston compresses the gas, it does work, and the energy of the system increases. But since the walls of the cylinder are thermally insulating, the entropy of the system stays the same.

So we have two simple examples, one in which entropy increases and energy stays the same, the other in which energy increases but entropy stays the same. So entropy and energy must be considered separately; one should not be viewed as the same as the other.

It would be nice if they were the same; everything would be a lot simpler, but they are different and we are stuck with it.

30-Jul-2006

Counting Violence in the Markets, from George Zachar

The value of the decline in short speculative open interest in the three month eurodollar contract at the Chicago Mercantile Exchange last week alone exceeds the annual GDP of Israel and Lebanon combined.

Israeli GDP -- $122,000,000,000

Lebanese GDP -- $19,300,000,000

30-Jul-2006

The Art of Negotiation, from Jim Sogi

My daughter is anxious about buying her first car. Are there some good tips on the art of negotiation?

The Chair discussed the Art of Negotiation in Practical Speculation, and Kevin Depew mentioned a few techniques some time ago. Can other sharp specs add to the arts of negotiation, tips, tricks? Perhaps these are outdated now. Its been a long time since I have bought a new car, but we use all kinds of hardball negotiation in legal matters. I try to be really hardball when buying stocks and wait for truly dismal prices when the sellers are truly panicking and desperate to sell at a low price. Even a few ticks on every buy makes a big difference.

A few possible tips:

Martin Lindkvist adds:

Here is what I used last time I bought a new car a few years ago (a company car, so it was actually the company paying, but they did not have any arrangements with the dealer and no rebates):

Then I used this knowledge to haggle the price.

In the end, I settled for the car, priced at 330,000 SEK, for about 300,000 SEK, but knowing the price structure having been in the automotive industry, I would say that it would be unlikely I would succeed with that again. Then again, knowing the money structure in my bank account having been long in the market in May, there is no chance I could even be trying.

Peter Grieve comments:

Apparently car dealerships now have 'internet managers' or salesman who can function as such. They will give low prices via email (and they have stuck to them in my case). They know that a raft of other dealerships will be emailing prices to you also, so they are competitive. I really thought that they were low-balling me, but they stuck to the price. Invoice prices and other support can be found at www.edmunds.com. Maybe there is some collusion or deception in all this, but I do not see it, and it made car buying much more pleasant.

John Humbert adds:

Someone said to me a long time ago, buy as big a house as you can handle. It was great advice then, I am not so sure it is as clever in today's world. There has been much sound advice on buying a car already, but here is my two-bits anyway. I say to car buyers: buy a used car. If you have to buy a new car, buy a Honda and plan to drive it at least 250,000 miles. they are comfortable, reliable, low maintenance, and last forever. I have done this twice, driving to total collapse. Total mileage around 425,000! When you're done, or rather it is, look at the cost per mile. It is important to know how to haggle, but it's more important to buy the right stock.

Recently I bought a used Ford Focus. 16,000 miles on it, ugly, white, clearly a rental in prior existence. It had a very zippy engine but was otherwise very dull. It was very very cheap, with a few grand down, and I hope it will endure, although past patriotic urges have been met with disappointment. I have reached the point where I do not drive much more than 8k a year.

I measure my life by car and bookshelf. I may make it to the end of this car, but will I outlast my collection of unread statistics books?!

Steve Leslie offers:

I studied Negotiation very seriously for a year, and read numerous books and listened to audio tapes on the subject. One should be very aware that good negotiators are made not born. Anyone can learn the techniques provided they want to and will invest the time. I will recommend some authors who I feel are extremely adept at discussing the subject matter and a few techniques that I took from them.

Here are a few useful phrases and anecdotes:

At the end of the day, everything can be negotiated -- nothing is etched in stone. There is always someone who is willing to work a deal. If you never ask, they will never offer. Never assume what someone is willing to work off of and most importantly, as Herb Cohen says "Never take it personally, remember it is a game!"

30-Jul-2006

Kohn Tells Bunning About Reflexivity! From George Zachar

From a just-released June 13th letter, Fed vice chair Don Kohn gives gadfly Senator Jim Bunning a discourse on reflexivity:

I find it useful to look at a variety of forward-looking measures of inflation when considering the economic outlook. These include both survey-based measures of inflation expectations, such as those from the University of Michigan Survey Research Center and Professional Forecasters surveys of the Federal Reserve Bank of Philadelphia, and market-based measures, such as those derived from inflation-indexed Treasury Bonds and futures markets.

Each measure is useful because it provides information about inflation expectations from a different perspective and thus helps to form a more complete picture of how individuals view the outlook for inflation. These expectations in turn influence the path that inflation actually will follow, and it is the forecast of that path into the future that helps to shape the policy decision in the present.

Dr. William Rafter adds:

Okay, so our Fed people decide that inflation is a result of sentiment.

And they monitor that sentiment to determine policy. Sounds like a

former President who used to monitor public opinion to determine

national policy. You decide how sound that is. Here is what the Fed looks at:

Okay, so our Fed people decide that inflation is a result of sentiment.

And they monitor that sentiment to determine policy. Sounds like a

former President who used to monitor public opinion to determine

national policy. You decide how sound that is. Here is what the Fed looks at:

After lots of work, the best we have been able to find is a really good coincident indicator of inflation. But that is okay, as it is still ahead of what the public is looking at, and now I have learned that it is ahead of what the Fed is looking at. From reading those 2 paragraphs, I get the opinion that the Fed does not know a forward-looking measure of inflation. It looks like the senator was just being rope-a-doped.

30-Jun-2006

The Better Safe than Sorry Challenge, from

Dr. Mark Goulston

I am guessing that many of you are able to bypass or circumvent problems in 'matters of the heart' by interacting and using your minds so vigorously and exclusively. Nevertheless here is a challenge to you that comes from my clinical practice with some of my less intellectually gifted/inclined, but still salt of the earth decent people. I call it the 'Better Safe than Sorry Challenge'

If you had the choice to be with a mate, spouse, or lover who was very safe (in that they did not lie to or cheat on you), but so boring that you sometimes would rather jump out the window than listen to them for a half hour or be with one that was exciting, stimulating, emotionally and intellectually invigorating, but who was so unsafe (in that they did lie to or cheat on you) that when you caught them, it made you want to push them out the window -- which would you choose?

Dr. Bill Egan adds:

I had some thoughts about this question; Do you want a thrill or success?

How often and hard do you like to be bitten?

How much biting do you need to put up with to get what you want? How often do you confuse these two?

I had some thoughts about this question; Do you want a thrill or success?

How often and hard do you like to be bitten?

How much biting do you need to put up with to get what you want? How often do you confuse these two?

This question reminds me of the Kobayashi Maru scenario in Star Trek, where all junior officers are given command of a starship in an exercise designed so that they cannot win. Captain Kirk achieved early fame by being the first and only person to change the computer parameters so he could win. He played a different game. As Vic often points out, lots of people have to pay the vig to keep the market going. Are you playing by others' rules and losing?

On a personal note, I married a smart, honest, loving woman who is my best friend and who enriches my life every day. Safe yet exciting, and invigorating. It took me a while to find her, but I finally did, and the best decision I ever made was to marry her fifteen years ago. I suppose I am a greedy cheater with respect to Mark's question!

Abe Dunkelheit mentions:

I wonder what the answer to such a question as Dr. Goulston poses might be if applied to market systems. Would one rather be consigned to make a risk free return with a fund of funds, or go to great glory or disaster with a more risk absorbing strategy to the point where when you lose, you wish to push the purveyor out the window?

People want security but no boredom; they want excitement and thrill (= the illusion of risk) but no real risk; they want pleasure without pain. The dilemma (either safe and boring or exciting and unsafe) is unrealistic because it lacks the dynamic element:

I would guess that half of the people would choose the safe and boring mate with the implicit hope that s/he will turn exciting and the other half will chose the exciting and unsafe one with the implicit hope that s/he will turn safe. People will choose dependent on what they currently lack: either safety or excitement; and they will discount the negative (uncertainty and boredom) and hope it will change.

So if one goes for a risk free return with a fund of funds, one implicitly hopes for an economical downward spiral and deflation and a credit crunch which makes it very exciting to hold cash and if one goes for glory and disaster one implicitly wishes the purveyor to reimburse the loss (if one gets to the 'unlikely' point where one loses).

Russell Sears comments:

We speak of the market as the mistress, because on any given day we do not have a clear understanding of our relationship to her. Are we the pursuer or are we the prey? It is this everyday challenge that keeps our interest. The potential for the fatal heartbreaking, con and deception is around every corner, yet fundamentally we believe in her. We trust her -- the drift will continue, due to the great ingenuity and human spirit she contains. The coaching of incentives reveals her benevolent spirit.

Hence, find someone whose philosophy we trust, but whose actions keeps us guessing what the next move will be And finally, who is wise enough to use this tango to steer us in a positive direction.

Good luck to those still looking.

George Zachar responds:

Standard evolutionary biology observes that in many species, those with the greatest reproductive risk (typically females) pursue two strategies across time. Various species of birds and beasts have females who try to get fertilized by highly energetic males, but induce more sedate, resource-sharing males to provide the young's upkeep.

In sum, "sleep with cads, but marry dads."

Substitute scarce capital for scarce eggs, and the metaphor leads one allocate one's capital across the risk spectrum in varying amounts at different stages of one's life.

Hanny Saad comments:

Comparing market character with human character is a step too far. Can you change a lying, cheating woman regardless of how smart and well endowed you are (think you are)? If you take that risk you are assuming a future reward that she will/ might change, which is very unlikely historically. However, if you chose a risky position in the markets, instead of a fund of fund, you can always adjust the parameter of your risk reward ratio, (easier said than done), and you realise that historically the riskier the position the higher the expected return.

Maybe we should have an analogy between a short term speculation and a lover vs. a buy and hold investment and a spouse. I would chose the lying , cheating lover as a short term speculation knowing that I will get out of my speculation once the return turns negative. I would choose the risky investment over the fund of funds

Sushil Kedia contributes:

Nearly all human observations of systems bring up a local randomness and a global determinism existing simultaneously.

Imagine, when the first joint stock company would have been floated and thereafter the first piece of stock would have changed hand. That first transaction is the origin of the stock-market. With or without any assumptions of the nature of the first buyer and seller of a stock in the world being long term investors or short-term speculators (a total of 4 possible combinations), the growth of the system called stock markets has come to accommodate millions of participants at each possible time interval of a few seconds to a few minutes to hours and so on and so forth into several years and decades.

If the market system (for a change I am not calling her a mistress, though only temporarily) has as its core function providing liquidity and the allocation of commensurate capital adjusted for risk then such a system has grown naturally on the provisions of a number of deterministic propositions and allowing perfectly for variation, innovation, creativity, randomness and chaos. This is because for the system to collect its upkeep, maintenance and provide stability in general; the failure of the players of any particular time frames would still allow the market to perpetuate for the players of other time frames.

Through cell-divisions and multiplications, specific organs build up within an organism. Such a specific organ though has a deterministic application and function, the individual cells within an organ may continue to die, newer ones continue to replace them and variations of functionality at the cellular level co-exists with the deterministic attributes of a particular organ.

Now, in choosing a unit of time, trading-off between the probabilistic variations and the deterministic certainty is a case of self-assessment of how much one could achieve without breaching the risk of ruin (as estimated by the probabilistic variations possible at the level of choice on the scales).

So far, the drift has come to be a given and has been appearing in the realm of a deterministic reality of the markets. So, the Templeton, the Capital International, the Fidelity etc. funds have continued to attract bazillions of client money.

The last decade has witnessed a rising rate of client attrition from such Dedicated Bull suitors of the drift towards the Alternative Investment world where rapidly rising display of skills and technical competence has helped enrapture the onlooker that performance can be enhanced by playing the variations, the shorter term moves are possible to be deciphered.

The market -- an economic organ -- is developing specialized tissues and differentiating its functionalities further on larger and larger food supplies coming to it. Will this growth of the Alternative Investment Management industry turn out to be a further evolution of the market or a mere cancerous growth?

My guess is tilting towards a rapid specialization of the market organs into being able to offer tailored risk packages and this focus originates from the belief that nothing is really deterministic if you have the patience for the real long term. Until the Second Law of Thermodynamics came to our consciousness and until its applications taken far into understanding many phenomena the human view of the theories prevalent in the universe could go forwards and backwards. That state of mind was deterministic. However, since then time irreversible structures are part of our theories and thus human perceptions over longer drafts of time change the deterministic assumptions too clearly.

At a particular fractal of time, an idea appears deterministic and yet at another it is nothing more than random.

Finally, returning to address the market with our favorite expression relating to her as the mistress is in this context as much more appealing. We pursue her with an attraction that she has the solutions to our pursuit and the variations and color she brings to this pursuit makes it worthwhile to survive and battle the variations. Her form & her inviting seductions that make her into a perfect enchantress thrive on some deterministic assumptions. The stories of yore as to how she has made life so rewarding and fulfilling for the devoted suitors forms the perfect proof of such existing determinism. The Mistress keeps on plying the endowments of every suitor with a new variation that continues to keep the deterministic enchantment intact.

Dr. Goulston, your question comes with a very difficult choice to make since there is really no choice. What is boring and apparently stable is but one variation. What is spicy (and the question is obviously conditioned to assume that only such will be disloyal) is the other varying face. The Mistress prevails, we do not have a choice. The variations are parts that come to only enhance the utility of this deterministic design. Howsoever a perfect choice one may make, seeking either loyalty or spiciness, one may be ready to face the variations producing results different from the chosen expectations. Risk is not just a state of mind, but a state of reality.

27-July-06

Victor Niederhoffer on Earnings Reports

Of the 162 S&P 500 companies that had reported quarterly earnings through July 21, 130 reported earnings increases over the previous quarter when the previous quarter was also up, averaging 21%. Four were unchanged, four went from a down quarter to an up quarter and 24 went from an up quarter to a down quarter. The average increase in earnings was approximately 14% versus a predicted 12% as of June month-end. About two thirds have beaten their estimates and one third are at or below their estimate.

Often the stock market goes down sharply when a company announces an earnings shortfall at the end of the day. This is one of the best examples of regression fallacies, and can be analogized with the baseball statistic, that a batter with an average above his norm during the first half of the season, tends to drop his average by about half from its excess above the mean, in the second half of the season.

28-Jul-2006

Jim Sogi on America

America is a great country. I saw this on my trip to New York. Everyone, and I mean everyone from the the passengers, to the pilot, to the ticket lady, the flight attendants, the taxi drivers, the taxi dispatcher, the bellhops, the concierge, the maids, the waitresses, the Realtors, tradesmen, grocery store personnel, the security men, the Hedge Fund traders, secretarial staff, service staff, money managers, brokers, musicians, club owners, restaurateurs, lawyers, the kids, the bus drivers, the citizens on the street, all of them were engaged in their occupations, striving to do their job in a friendly and earnest manner.

Each person desires the same, to be free of pain and respected. As I sat in the lobby I met an earnest young man who had traveled a long way from New Jersey for a job at the hotel. He was eager, the employees at the hotel were kind, polite to him. No one, no one I saw on the street engaged in anti social behavior. Even the homeless peoples cardboard boxes were neatly arranged and cleanly kept. One had an electric guitar, attempting to break into the American dream. Train riders all politely worked out the crowded situation. The queues were orderly. Even the teens I met had good attitudes.

I saw no public drunkenness, no bums in public places, no pan handling, no displays of anger or even frustration, no crime... Even the traffic was light for trips to and from the city due to easy lass tolls and public transportation. The trains, planes, terminals stations, parks and bathrooms were all clean. Everyone was well dressed, clean and healthy looking. Those who think otherwise to this are deluded and their negative attitude causes their own misery and loss. My daughter reports this summer in Europe that people there held Americans in awe and respect. In Morocco crowds gathered to behold her group of Americans.

The new immigrants of America proudly work their low level jobs, glad for the chance to get a foothold in the Dream. It has not always been this way. The 1970s were a sad example of rough times. Times are good now -- friends, we are in a golden age. We are the greatest nation the world and that history has ever seen. Those predicting our imminent demise are sadly deluded.

Stefan Jovanovich adds:

When my grandfather got off the boat in New York in the spring of 1906, he had two $20 gold pieces, some silver and the address of an 'Uncle' in Scranton, Pennsylvania. The 'Uncle' was not an actual relative but a comrade of his father who had emigrated to America after the Serbian-Bulgarian War. 'Uncle' had written to grandfather's mother a year earlier to tell her that he could get work for her older son in the coal mines. With his mother's blessing grandfather had walked the 90 miles from his village to the Adriatic coastal town of Bar where his mother had a cousin who was a butcher. In return for a year's work as an apprentice grandfather was promised the steamship ticket to the New World.

Half a century later, when Grandfather finally gave in to my relentless pestering and finally told me the story of how he came to America, he did not think it was anything remarkable. He remembered with amusement that he had walked barefooted over the mountains so that he would not wear out his one pair of shoes and that he had learned how to make German sausage for a mining engineer from Düsseldorf who was desperate for a taste of his homeland. He had no sense of having done anything special. Like every true adventurer, he was far more interested in the doing than in the stories about what he had done. The only way I could get him to talk was to offer to help him build or fix or plant something. He did not mind talking if we had some work to do, but if we were just sitting on the porch, he would rather play his gusla and recite Njegos. Njegos, he said, told much better stories.

He liked Americans and thought the United States was a great and fascinating country, but he never thought that it was his country. When I asked him what it would take for him to become 'a real American', his reply was that the Jovanovich family would have to be here long enough to make and lose a fortune. That, he said, took more than one generation.

He was right, of course. One simply does not understand this country or really become part of it until you join the carnival of risk.

28-Jul-2006

Jim Sogi on Baltimore Clippers

Around 1770 skilled naval architects in the Baltimore area designed and built narrow nosed, fore and aft rigged schooner clippers, taking the best ideas and technology from each of, the Vikings, the Spanish and the British. These were used in the war of 1812 against the British Frigates and Man O' Wars. The Pride of Baltimore alone, acting as a privateer, captured or sank more than 500 British merchant ships effectively blockading British shipping. These vessels were fast and maneuverable; just fast enough and weatherly enough to out maneuver the British merchant ships and war ships. The clipper's low freeboard, the slung back rig and the narrow hulls, allowed the Baltimore clipper to be able to sail a few points higher on the wind than its prey or pursuers in order get upwind and escape, or to turn on the pursuer with the weathervane advantage and be able to control the terms of the engagement and either sink, disable or capture the enemy target. As a privateer they also had tremendous incentive for the owner, captain and crew to perform in top order.

Clippers were approximately 100 feet in length from stern to bow. Baltimore Clippers had heart shaped midsections with short keels and raking sterns. The undecorated hulls of these ships were black, low-sided, and shaped bowed, leaving the Clippers with minimum freeboard. Quite unlike other ships of the period, the clippers bore no figureheads, headboards or trail boards. These were stripped down vessels ready for action.

Here is a good example of how a small edge, a few points higher sailing on the wind and a few less pounds of dead weight made the difference between life and death and results in fortune or disaster for a sailor and for a nation. It is not the huge advantages that give victory. It is the small details, the efficiency of operation.

Traders need to be able to sail just a few points higher on the wind than the competition, to be able to outrun and outmaneuver the opponent and dictate the terms of their engagements. Small traders are like privateers on the market oceans, taking prizes and withstanding great risk to life and limb. Great danger exists for the small privateer operation when caught in the broadside of a huge Man O' War unless able to outmaneuver the opponent, or sail up out of range. Luckily, the huge warships take time to turn around, allowing for the skillful and the swift to escape.

28-Jul-2006

One Night in Bangkok, from Dr. Marion Dreyfus

When I lived in Bangkok, I was in some bar or other one night, and in walk Gloria Vanderbilt and Bobby Short -- on tour. Since I was a stripling and ignorant of piano players of note in the Carlyle, I was bemused when she tried to wheedle me into going gaga over Bobby and his magic fingers on the ivories. While I was mildly interested in the duo and his playing, I was struck by the obliviousness of the Thais to both of them, and their reluctant focus on me as a Westerner (and my entourage) to pay them homage. Slim pickin's if you have to depend on me for recognition in Bangkok! But Vanderbilt's son Anderson Cooper is indeed a babe. Wherever he is is the line of skirmish. He made his chops last when I watched him covering The tsunami from our safe perch up in Vancouver Island. He seemed to be extraordinarily sober and comprehensive without being smarmy and mawkish and ain't-I-great!?! the way so many on-site guys are.

27-Jul-2006

Straight Line Bias, from

GM Nigel Davies

Here's a chess position which demonstrates straight line bias in the human mind. Place a White King on e6 and pawn on a6, Black has a King on c3 and a Pawn on a7. White to play wins with 1.Kd5!, reaching Black's pawn just as quickly as with the straight-line 1.Kd6 which only draws after 1...Kd4 2.Kc6 Ke5 3.Kb7 Kd6 4.Kxa7 Kc7.

Most inexperienced players will play 1.Kd6 in this position, going for Black's pawn on a7 in what appears to be the straightest possible line. The reality is that both 1.Kd5 and 1.Kd6 get to the pawn just as quickly but the human mind doesn't naturally see it like that. Of course the good thing about chess (and counting) is that we can actually test our ideas and falsify those that aren't good.

27-Jul-2006

Another Gratuitous Shot at Technical Analysts, from Craig Cuyler

One of the biggest mistakes technical analysts can make is that they look for and

apply a set of indicators over irrelevant and constant time frames. It is either

half hourly, hourly, daily, weekly, etc., but these are misleading and

often irrelevant because they do not predict the price element at all! How often

has a chart pattern or an indicator predicted a low or a high only for the price

to trade a range for days, weeks or months without any price movement? How can

you tell with statistical relevance whether a cycle is about to begin or end and

then trade profitably on the back of this information? The problem with many of

these cycle predictions is that they might generally call the top or bottom of a

market but because they can't account for the price magnitude in the day or two

that they are off, they cannot be used with any accuracy. Let me use an example

that a few people on the list would have have heard of and in which I have some

experience (in my distant past).

One of the biggest mistakes technical analysts can make is that they look for and

apply a set of indicators over irrelevant and constant time frames. It is either

half hourly, hourly, daily, weekly, etc., but these are misleading and

often irrelevant because they do not predict the price element at all! How often

has a chart pattern or an indicator predicted a low or a high only for the price

to trade a range for days, weeks or months without any price movement? How can

you tell with statistical relevance whether a cycle is about to begin or end and

then trade profitably on the back of this information? The problem with many of

these cycle predictions is that they might generally call the top or bottom of a

market but because they can't account for the price magnitude in the day or two

that they are off, they cannot be used with any accuracy. Let me use an example

that a few people on the list would have have heard of and in which I have some

experience (in my distant past).

It is called Delta Theory and it purports to be able to predict turning

points for any commodity market by unlocking the unique patterns of each market.

At first glance these patterns look remarkable and in retrospect they work

unbelievably well, until you try them in real time that is. I still believe the

idea and the creativity in expressing this theory is quite amazing, but the devil

lies in the detail. Delta cycles give a 'window' of time in which the turning

point is meant to occur, this can be minutes, hours, days or even months. If you

for example have 3 or 4 turning points in a given month and each has a 4 day

window of occurrence and then you break down the trading days in a month

(typically 20-24) and you then throw in the margin of error of 4 days per

turning point, you end up figures that occur well within the realm of chance.

It is called Delta Theory and it purports to be able to predict turning

points for any commodity market by unlocking the unique patterns of each market.

At first glance these patterns look remarkable and in retrospect they work

unbelievably well, until you try them in real time that is. I still believe the

idea and the creativity in expressing this theory is quite amazing, but the devil

lies in the detail. Delta cycles give a 'window' of time in which the turning

point is meant to occur, this can be minutes, hours, days or even months. If you

for example have 3 or 4 turning points in a given month and each has a 4 day

window of occurrence and then you break down the trading days in a month

(typically 20-24) and you then throw in the margin of error of 4 days per

turning point, you end up figures that occur well within the realm of chance.

Finally when using charts, especially for cycles, there are many hidden elements that have been documented extensively on this list and some of these are continuity, bid/ask spread (vig), non-stationary time frames and so-on. Charts hide these factors, so when trading a system or a set of indicators your actual results differ measurably from your theoretical ones.

Venky Chari responds:

There are a few points I would like to take up with Mr Cuyler.

27-Jul-2006

Dimson et al. on the Equity Premium, from Mahalanobis, sent in by

George Zachar

[Full Article by HedgeFundGuy at Mahalanobis] ... Elroy Dimson is a solid empirical economist. His "Dimson betas" are a straightforward way to adjust betas for illiquid securities, useful and unpretentious. His book, Triumph of the Optimists is a good read about historical stock returns and their context. His latest paper (with Marsh and Staunton) The Worldwide Equity Premium: A Smaller Puzzle, is in that vein: simple and useful.

The puzzle is this. Mehra and Prescott found that the equity premium was 6.2% back in 1985 using US data, which is much higher than standard utility models can generate (at most 1%). Ivo Welch's consensus of finance professionals puts it at 5.5% right after the 2001 crash, and Ibbotson puts the arithmetic average at 8.9%. Dimson estimates in this paper the actual equity premium is more like 3%, using more data (from 1900 to 2005 and more countries, though only those with developed equity markets, and using geometric as opposed to arithmetic averages). This empirical update is much plausible than any of the myriad theoretical attempts to explain this anomaly, which Dimson admits is still a puzzle...

Prof. Elroy Dimson responds:

Victor Niederhoffer pointed out your article to me, and there is an error that you may wish to fix: Tax is paid largely on equity income and not on capital gains, for which the tax rate historically was zero for most countries/years (and capital gains tax is today largely avoidable/postponable). Dividend income and risk-free interest rates have historically been about the same. So the after-tax premium has historically been about the same as the pre-tax premium. You cannot materially reduce the historical equity premium through the tax argument.

Another point relates to the German hyperinflation. During that interval, the historical equity premium was huge. Adding back 1922-23 also does not reduce the historical premium.

As for fees and costs, while I agree that active mutual funds substantially erode the equity premium, have you looked lately at the fees for passive management? BGI now have a product that charges -0.1% per year. (Not a misprint, I did write minus 0.1%). It's their asset trust. It's marketed here by Mike O'Brien, MD in BGI's London office. But over the course of history, there were indeed transaction costs to be incurred by equity investors.

27-Jul-2006

Wave Theory, by Jim Sogi

One thousand miles away a violent storm brews over a dark sea. The global forces of the spin of the earth sets large forces into motion. The winds blow at hurricane force whipping up a confused sea. As the days roll by, the waves in a combination of structural and physical laws and the operation of random factors form into organized wave trains that travel in energy across the globe. They wash up on distant shores as sets of waves coming in series of twos, threes, fours or more, basically at random, as it cannot be predicted what the wave pattern will be. However, once the waves arrive, it becomes apparent by counting several things that: 1) Wave height is generally consistent and predictable by height and variance, 2) The wave periodicity or time between peaks is countable and consistent, 3) The number of the waves in a set and the largest one in sequence is also predictable. These are what top surfers use to position themselves for the best rides and the fewest wipeouts.

In the market, global macro events set large forces into motion, but human reactions and structural elements in the market making algorithms and execution platforms form the price patterns into waves. Two weeks ago at the bottom there was a three wave pattern over as many days before the reversal. Had one known that it was to be a three wave set with the third wave the largest, how many wipeouts and trips under water, and over the falls might have been avoided? The hypothesis of this model is that the wave patterns repeat as to periodicity, height and variance. The waves will mirror prior cycles. Lobogola is one example. Bridges are another structure. Refute this and show it as mumbo jumbo, as chartism. Charts are good for seeing historical patterns and as a start for counting and testing, but fall short from rigorous testing by themselves. With higher levels of margin and dollars, more precise analysis is necessary than is possible with rough averages.

Eyeballing of chart is akin to building a bridge or tall skyscraper with the eyeballing of measurements and angle, it is not precise enough. You are not going to get off the ground floor. Precise testing results can be displayed graphically, and initial data perusal and manipulation and model testing can and should be done graphically initially as a first step.

Scott Brooks comments:

Building a sky scraper and just eyeballing measurements would be crazy, however, with precise numbers one can calculate the exact dimensions and layout of that skyscraper. The skyscraper can also be charted from those numbers in the form of a blueprint, or the architect can construct the picture first and then figure out the numbers that will create the basis for his drawing.

The numbers (data) create the charts. These charts are a visual representation of that data that makes things more or less clear to the person looking at them. Some people like to see the blue prints to see what the building the will look like (counting) and some like to see the actual picture of what the building will look like. The counter would be foolish to just look at the blueprint and the technical analyst would be foolish to just look at the final picture. I believe to be successful, you need both. That is why I have decided to learn to be counter.

People like Jim Sogi, who drew a wonderful word picture for me in this great post, are making it easier for me to learn.

27-Jul-2006

Red Bull, from James Lackey

The anti-drug deal is so

out of control we can't even drink Red Bull and we joke that next to be banned is Mountain Dew.

I do feel for some of the new pros who really do not realize they are drinking a banned substance. The list is silly. The BMX World Championship is in Brazil now. The Olympics is in 2008 in China. Joke is that everyone is going to test hot just from the water/food in China.

The anti-drug deal is so

out of control we can't even drink Red Bull and we joke that next to be banned is Mountain Dew.

I do feel for some of the new pros who really do not realize they are drinking a banned substance. The list is silly. The BMX World Championship is in Brazil now. The Olympics is in 2008 in China. Joke is that everyone is going to test hot just from the water/food in China.

27-Jul-2006

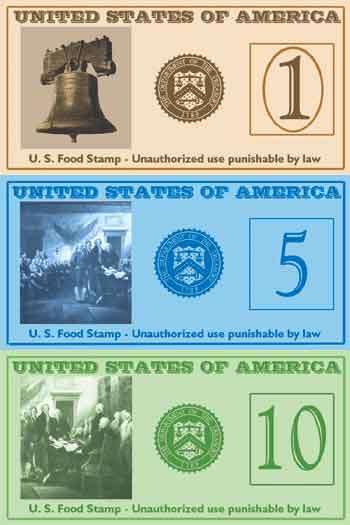

Food Stamps, from

Bo Keely

I've been fascinated by food stamps and surrounded by patrons on the USA

roads and rails for decades, but it wasn't until yesterday that it occurred

to me that I may be eligible. I haven't worked as a substitute teacher for two

years, since a 2003 invasion of teachers to Blythe, CA, and, besides, I was

curious about how the stamp program worked. I walked into the county social

services building next to Kmart and in a matter of an hour of forms and

plastic chairs was assigned a food stamp case worker. We stared at each

other through a glass pane, she a middle-aged lady with care furrows and I a

bleaching desert rat, and both smiled. 'You're a sub-teacher without income

according to your application,' she opened amiably. 'My G-d, are you

collecting cans to support yourself?' I explained that I lived meagerly and

wanted temporary support only until the new school year began. I provided

my driver's license, Social Security card, bank statements showing accounts

totaling $200, and no IRS forms since my income for the past five years was

too small to file. 'The last two years is a shame,' she grieved. 'Why

haven't you collected unemployment?' I described a recent visit next door

to the unemployment office, first time in my life, where they declared

me ineligible since I hadn't made any money in the past year. I would have

to return after I had worked a bit. She shook her head in sympathy beyond

the glass and then brightened. 'You will walk out of here with the maximum

allowance of $152 in stamps.' These would continue monthly and, in fact, I

could continue receiving on a sliding scale as long as my income ran no

higher than $1000 per month. She pushed through a perjury form to sign, and

I was fingerprinted and a mug shot snapped. She then opened a drawer to

draw my stamp card and at the same time I reached for my pocket and pulled

out my property deed. 'I don't want this to bite me in the butt in the

future,' I confessed. 'I checked the single box on the application that

asked if I have a bank account or property. You asked me about the account

but not the property. I bought 10 acres of sand and cactus 100 miles from

here six years ago.' 'That's fine. What's the address?' I told her it was

so remote there was none. 'What is the property value?' Her countenance

saddened when I replied $3000. 'That puts your total assets over the

maximum $2000 for Food Stamps, unless I can find a loophole. For five

minutes she scoured the computer and for another five asked others around

the office. Soon the other gals were peeking around the glass to witness the

poor substitute teacher with property who could collect neither unemployment nor food

stamps. In the end she returned exasperated. 'I'm sorry, I can't do

anything for you. It could bite me in the butt in the future.' In turn I

felt bad for her because she must maintain a case load to keep a job.

'Here's your letter of action explaining you were denied food stamps due to

an excess of resources. Good luck, and tell our story to the students this

fall.' I smiled again, rose and wheeled. I have some emergency cash buried

in a jar in the desert that I figure is my own business.

I've been fascinated by food stamps and surrounded by patrons on the USA

roads and rails for decades, but it wasn't until yesterday that it occurred

to me that I may be eligible. I haven't worked as a substitute teacher for two

years, since a 2003 invasion of teachers to Blythe, CA, and, besides, I was

curious about how the stamp program worked. I walked into the county social

services building next to Kmart and in a matter of an hour of forms and

plastic chairs was assigned a food stamp case worker. We stared at each

other through a glass pane, she a middle-aged lady with care furrows and I a

bleaching desert rat, and both smiled. 'You're a sub-teacher without income

according to your application,' she opened amiably. 'My G-d, are you

collecting cans to support yourself?' I explained that I lived meagerly and

wanted temporary support only until the new school year began. I provided

my driver's license, Social Security card, bank statements showing accounts

totaling $200, and no IRS forms since my income for the past five years was

too small to file. 'The last two years is a shame,' she grieved. 'Why

haven't you collected unemployment?' I described a recent visit next door

to the unemployment office, first time in my life, where they declared

me ineligible since I hadn't made any money in the past year. I would have

to return after I had worked a bit. She shook her head in sympathy beyond

the glass and then brightened. 'You will walk out of here with the maximum

allowance of $152 in stamps.' These would continue monthly and, in fact, I

could continue receiving on a sliding scale as long as my income ran no

higher than $1000 per month. She pushed through a perjury form to sign, and

I was fingerprinted and a mug shot snapped. She then opened a drawer to

draw my stamp card and at the same time I reached for my pocket and pulled

out my property deed. 'I don't want this to bite me in the butt in the

future,' I confessed. 'I checked the single box on the application that

asked if I have a bank account or property. You asked me about the account

but not the property. I bought 10 acres of sand and cactus 100 miles from

here six years ago.' 'That's fine. What's the address?' I told her it was

so remote there was none. 'What is the property value?' Her countenance

saddened when I replied $3000. 'That puts your total assets over the

maximum $2000 for Food Stamps, unless I can find a loophole. For five

minutes she scoured the computer and for another five asked others around

the office. Soon the other gals were peeking around the glass to witness the

poor substitute teacher with property who could collect neither unemployment nor food

stamps. In the end she returned exasperated. 'I'm sorry, I can't do

anything for you. It could bite me in the butt in the future.' In turn I

felt bad for her because she must maintain a case load to keep a job.

'Here's your letter of action explaining you were denied food stamps due to

an excess of resources. Good luck, and tell our story to the students this

fall.' I smiled again, rose and wheeled. I have some emergency cash buried

in a jar in the desert that I figure is my own business.

27-Jul-2006

The R Word, from George Zachar

It's pretty clear the lefty/academic/thinktankish crowd is starting to push the economy is going into a recession line as their headline for the fall election cycle.

Watch for Roachian op-eds.

The political types are pushing the stagnant wages line, ignoring the mushrooming benefits component of total compensation.

26-Jul-2006

A Dozen Thoughts on Excuses, by

Russ Sears

Maybe the best lesson I have learned from my

competitive running is how damaging an excuse can be to your motivation. When you are going head to head against a competitor and pushing yourself to the physical limit, your mind searches for excuses if you do not guard it.

Maybe the best lesson I have learned from my

competitive running is how damaging an excuse can be to your motivation. When you are going head to head against a competitor and pushing yourself to the physical limit, your mind searches for excuses if you do not guard it.

From the excusers perspective one would think that a bad excuse is one that the receiver does not believe is legit, but my running has taught me that the worst excuse is one that the excuser believes them self. The excuse, when believed, kills motivation. Or as Ben Franklin put it "He that is good for making excuses is seldom good for anything else."

It seems to me that a trader could benefit from three angles through the study of excuses. If George Washington Carver is right, "99% of failures come from people who have the habit of making excuses," then eliminating our own personal excuses will keep us marching towards success. Also recognizing others' habits of making excuses will prevent us from attaching our sail to ships forever stuck in the harbor. Finally, studying the excuses coming from competitors could tell us when to attack.

There are two reasons for bad excuses; one is to salvage our self esteem, the other is to salvage a relationship. Excuses are made to put on the appearance that we are motivated, caring people, when often they are a signal of too heavy of a battle and wanting to retreat, or being a two-faced jerk!

Now whilst studying excuses we should of course distinguish between a healthy analysis of the problem (reasoning/explanation), with the hope of conquering it, and simply looking for the easy way out (excuse). A comparison should be made between good realistic analysis of the situation and bad or dishonest excuses.

In studying excuses on the net, it seems that teachers and coaches are experts at learning to recognize and deal with them. My conclusion is that a good analysis has the following characteristics.

Here are a dozen ideas, some self evident, others anecdotal, some needing more counting and refinement, and others I believe are fertile for hypotheses.

Abe Dunkelheit comments:

Point number seven seemed out of place, a gratuitous shot at technical analysis. Despite this I thought it was an excellent and very thoughtful post.

I still do not understand what the conflict between technical analysis and counting is all about. It seems it depends on one's perspective. To me technical analysis, as I understand it as the measurement of the liquidity process to gain a present tense understanding of what is going on in the market, is the intuitive and qualitative (yet objective!) mirror side of the analytical and quantitative side of counting. I don't have to do any math or statistics in order to come up with most of the spots and times in the markets at which counters would prefer to do business. The conflict is not between technical analysis and counting but between trying to gain an understanding of what is going on in the present tense and predicting the future. Predicting the future never works regardless of the methodology; while -- as a general rule -- everything should be embraced which helps to gain a present tense understanding of what the market tries to communicate.

Sushil Kedia comments:

The eighth point, on accounting shenanigans, contains an encrypted key pointer to the similar shortcomings of fundamental analysis too. Technical analysis could be seen as the study of price while fundamental analysis is the study of value. Each school of hypothesizing has its merits and demerits

Counting is the verification of hypotheses derived either from the fundamental or the technical or the behavioral orientation or any other. So it is not technical analysis vs. counting, but more like surmising (whether through an obsession for value or a religious following of price) vs. verifying.

But is it fundamental analysis or technical analysis that makes one more inclined to assume? Ass-u-me either which way; surmises are turned into theorems only through counting.

David Wren-Hardin replies:

As yet another perspective, I consider counting to be the rigorous application of analytic methods to whatever the problem is at hand. You are correct, Abe, in your definition of technical analysis. However, my sneaking suspicion is that if you asked traders who claim to do technical analysis what it is, fewer than 50% of them would give your definition.

Technical analysis seems to often lean heavily on charting, and I agree with Russ, it sets one up for excuses and fuzzy thinking. All too often I hear pronouncements like "The market has resistance at such-and-such, and should bounce there, unless it goes through, in which case it will go lower." They get to win either way. Or conversely, someone who uses charts has a built-in excuse if a trade goes bad. "I would have won if XYZ hadn't broken the 30day moving average."

The human brain is very good at pattern recognition, especially visual patterns. By relying too much on charts that overlay all sorts of data, the trader can very easily see spurious patterns that aren't there, or that are meaningless. Unless the trader tests the predictability of the patterns he is seeing with real, actual analysis, he is just setting himself up for failure and excuses.

This is not to say that visual representations are bad, quite the opposite. Once you have a verifiable signal or pattern, being able to display it visually can be a huge help. For example, I was speaking with Jim Sogi this weekend about his trading, and he mentioned how his system measures trades on the bids and offers, and displays the information visually. This is a similar measure of order-flow as a candlestick chart, but it uses actual numbers that can be used to make predictions that can be tested. It's technical analysis, but far better than "The five minute candle touched the 20 day moving average, but the next five candles did not have lows below the low of that candle..."

Counting is not a discipline separate from other methods of analysis. Counting is the discipline one brings to his analysis.

Scott Brooks adds:

I have been in the dark, mainly self imposed, on counting for my entire career. I have only recently had my eyes opened as to counting by the immersion that the spec list provides. For that I am grateful.

I have made my living looking at charts for some time now, however I can wholeheartedly agree with what has been said, especially as to the subjectivity of charts. But many things in life are subjective and require one to make inferences in what one is seeing, whether it is charts, numbers, or toes on the chairman's feet.

I will submit this to the list. There are two sides to what we do, science and art.

We could all be presented with the same charts, or set of numbers. The creation of those charts or numbers is the science of what we do (objective data). What we choose to do with those charts or numbers is the art of our trade (subjective decisions). I would submit that if each of us were presented with the exact same disguised historical data and then asked to design an investment strategy for the next day, week, month, year, etc. we would each come up with a different strategy. Objective data, submitted to subjective minds (brilliant minds, but subjective, nonetheless).

How does an artist look at a block of granite and see the Statue of David inside, while the majority of the population see only a block of granite. How does that same artist chip David out of the block, when the rest of us would merely create a pile of rubble? The artist sees the development of patterns within the block and reacts to what he sees and learns as the process unfolds before him. I am not sure that this is the best possible example to use, but I believe that each person's mind works differently, and we see, experience, and process the data of the world differently.

I am no longer a non-counter, I am embracing it. I will become a counter. In the meantime, I will rely on the quant I have recently hired. I do not know if counting will change the way my mind works. Maybe it will not. Maybe counting will add to my ability to add value to my clients lives.

Russ Sears responds:

I would point out that in trash talking Technical Analysis I included the words "at its worst". I am going to clarify now why I believe Technical Analysis at its worst causes excuses.

Firtly, T.A. by itself is mentally lazy. Popping a chart-up and seeing a formation is easy. The T.A. argument is that it is art and that art is easy for the artist. I believe this does not hold; if it was an art form it would not take many talented artists until these obvious profit opportunities quickly disappeared, also, these talented artists would never disclose the secrets to their wealth. On top of this, any rules of thumb would soon disappear due to ever changing cycles. A fundamental rule of economics is 'if you do not work you do not eat'. This rule may be violated individually for the few lucky ones in a zero sum game, however it clearly is true for the total, because no wealth is created 'freely'. So this economic rule applies to the economy of the trader too.

Secondly, mental laziness is kin to the excuse, because it allows our bias to effect our decisions. T.A., at its worst, is unbridled data mining, giving in to our personal bias.

Thirdly, a few years ago I wrote a post about T.A.s touting their wares after a big public debacle. T.A.s exclaimed at such times, 'I would have gotten you out of Enron at X'. I exclaimed that what the T.A. is saying is 'I could have saved your job!', not, 'I would have improved your performance by y% over the long term.' In that post I pointed out that often the manager is judged in hindsight, and the manager's goal is not to lose his job. To bring out a chart in hindsight, with an obvious formation and then have a T.A. as an expert witness for the jury, was a slam dunk for the prosecution. The point is that the T.A. touting his wares, is really trying to preserve a relationship, by offering up an excuse.

Perhaps after studying excuses, I only told half the story, because besides preserving a relationship, bad T.A.s claim that they can preserve your self esteem by giving you an excuse to gamble. My admittedly limited exposure to T.A., is due to a study of options from an early adapter website touting options. The website is still a leader in option advising, but I suspect that this site uses T.A. and F.A. specifically because its followers do not do rigorous counting.

Like Nat's genetic lotto customer, trying to win big again in the government's lottery to boost his self esteem, big winnings are likewise an excuse to gamble in the options; a lottery ticket in the markets. This T.A./F.A. site, I believe, touts options as lottery ticket by using simple averages of its 'historical results' studies, large percentage losses and large gains of the leveraged option world. In this way, the site, like the gambler looking to shore up his esteem, gives the big win more weight than it is worth.

This is easily shown with the 50% loss followed by 100% gain. Losing half and then doubling that half again leaves the option player even.

But in the end, this T.A./F.A. site is offering an excuse, not claiming that using this system will make you more money or less monetary risk, i.e. they are not claiming they offer the 'right' decision.

Finally, I did include 'at its worst' for the reasons listed in thought nine, I am not trying to beat up all T.A.s. It is hard for me to judge Roger Bannister's training techniques, compared to his contemporaries, because my modern day knowledge of professional running would bias me to compare him to the present day knowledge of training. Clearly, Bannister's techniques are not equal to modern training methods, but they also had some weaknesses even compared to others of his times. Bannister was also a med student at the time and freely admits that this affected his workout schedule. But what is clear is that Bannister's execution of his techniques was full of heroic effort. Almost all, (including me at my best), even with all the modern advantages, would still find these workouts difficult/impossible to implement.

Using sub-optimal techniques, small time amateurish players like me in the market cannot expect to compete equally with the best, however, this does not mean we cannot give an honorable effort, if not a heroic effort, to compete.

I have been known to pop up a chart to generate ideas. A good picture maybe worth a 1000 words, but a good chart can show a 1000 relationships within the numbers. This is both the T.A.'s strength and weakness. A good T.A. is well aware of the data mining and bias, and therefore a good T.A. tries to investigate the ideas behind the charts. A good T.A. tries to count.

26-Jul-2006

Reminiscences of a Convenience Store Clerk, from Nat Stewart

Talk of the 15% rake at the track brought back memories of a time when I sold perhaps one of the worst gambling games that exists; Scratch tickets.

While finishing up in college, I worked the evening to 11pm - 12pm shift at a locally owned convenience store. I soon realized that I was the dealer to a group of some of the most desperate gamblers you will ever find. In this little casino, a core group of regulars purchased a large percent of the tickets, often returning 2, 3 or 4 times a day.