Archives

July 01-15, 2006

Write to us at:

![]() (not clickable).

(not clickable).

Please include your full name, and omit attachments.

|

Daily Speculations |

|

|

|

Archives Write to us at:

|

15-Jul-2006

Stealing the Blinds, by Steve Leslie

How often do we own a stock of a good company that is a solid investment according to our criteria, but we sell it or give up on it because of pressure from the market? A similar situation can happen in poker if you are not aware.

Stealing the blinds occurs in poker when you are

sitting in late position or on the button and everyone

has folded ahead of you. Since the blinds are forced

bets and are already in the pot you take advantage of

the situation and attack the players who are in the

weakest position and have already committed money to the pot.

Stealing the blinds occurs in poker when you are

sitting in late position or on the button and everyone

has folded ahead of you. Since the blinds are forced

bets and are already in the pot you take advantage of

the situation and attack the players who are in the

weakest position and have already committed money to the pot.

In order to pull this off a few things should be in place. First of all, the blinds should be large enough that it will cost the players some money to protect their blinds. Plus it should be worth your effort to go after the blinds in the first place. You typically don't use this technique early on in a tournament since the blinds are quite small. Second, the blinds should not have a lot of money in their stacks. If they have a lot of money in front of them, then it won't be improper for them to call your bet to see the flop. Third the game should be tight or have tight players in the blinds. You don't want to try to steal blinds against an aggressive player since they like to protect their blinds and they may bet back at you. Plus, tight players are only going to call your bet if they have a good hand themselves so you will have valuable information for you to work off of if they do call your bet. Fourth, you need to have discretionary funds available. You should not try this move if you are short stacked or you could get called and get forced out of the tournament. Plus the others may perceive you as being weak and call your bet. Finally, you have a weak hand and thus are playing a hand that you normally would throw away if circumstances were different.

Here is how it works, when the bet comes to you and it is your play you add up the total of the blinds. For example, if they are 50 and 100 then you would toss in 3 times the total or 450. So for the small blind to call, they will have to come up with 400 more chips and the big blind 350. If you have a lot of money in front of you you may try 4 times the pot. This will force the blinds to have a real hand to call.

A few follow up points. Only try this once in a while, and under the right circumstances. This is an advanced play that done wrong can be very costly to you. If they do fold, it is not a bad thing to show your hand and show them that you buffed them, and are willing to play more than just good starters. This will tend to disrupt their confidence as it will be harder for them to put you on a hand down the road and it will give you an image of being a chip bully. It will also set them up in the future, when you find yourself in a similar situation, and they call you but this time, you raise with a real hand and win a big monster pot.

This is yet another play that you should have ready, for those spots when things are set up correctly. Try it a few times and see how it works. You will be surprised how many times you will pick up chips that you would not normally get.

14-Jul-2006

Beauty, from Jim Lackey

First, my little girl is five years old today.

Next, all the BMX boys are going to Brazil, and this contestant in the Miss Universe pageant is the favorite with all the boys: Rafeala Zanella, Miss Brazil.

And for those who think supermodels only come young... 52 year old Christie Brinkley is back on the free market!

14-Jul-2006

Buggles of War, by Sushil Kedia

Every market in the world it seems is playing a truanting tune with this one more buggle of war. Dollar bearish consensus is being tripped, even while gold is rallying.

Oil bears are being squeezed out. Equities, bonds, money in every form is just going and spooking the majority positions.

Do not get a picture that adds up to various market relationships moving on any one logic of the expected outcomes of this event. That then is one unique subset of all possible relationships that the majority is being squeezed out by the Mistress. A time to turn a contrarian should arise soon against moves of the last couple of days in most markets then. Which ones? How to measure and count them?

14-Jul-2006

Strafed in Beirut, a Poem by

Larry Williams

Strafed in Beirut 1973 Up late at night Telexing orders to NYC Israeli jets swoop low, strafing Hamra Street, downtown Beirut We dive for cover Some things never change Still trading... Jets a long way away from me Hamra Street still suffers Cover, always looking for cover

13-Jul-2006

Little Green Army Men, from

Dr. Bill Egan

You've seen them. Little, green army men, in a bag or a box in the toy section of the store. Cheap plastic molded infantrymen with jeeps, helicopters, guns, etc. Some of you may have played with them when you were younger, or your kids have them now.

You've seen them. Little, green army men, in a bag or a box in the toy section of the store. Cheap plastic molded infantrymen with jeeps, helicopters, guns, etc. Some of you may have played with them when you were younger, or your kids have them now.

Now ask yourself the following question: What kind of short story might Stephen King write with little, green army men in it? The kind of story, of course, just like the one you or your kids imagined while playing with them.

A story where they can really fight. It's title is "Battleground" from his collection "Nightmares and Dreamscapes." TNT just adapted some of these stories into one hour cable episodes. "Battleground" is highly recommended for all green-wearing, gun-slinging specs and all others who enjoy this sort of thing. Repeated on TNT on 7/13 at 11pm EST.

13-Jul-2006

The Truth About China, from Larry Williams

Ahhhh, the dream of untold wealth for the world in China...

Ahhhh, the dream of untold wealth for the world in China...

Let me give you some hard realities: I have three books in Chinese, published by the gummint guys there.

So far royalties are zippo. Guess the books never sold, but wait: why do I get so many emails from there asking questions about the book? And how come 500+ people came out for an autograph party if there were no buyers?

The Chinese will stack the deck for themselves against all outsiders. They know the have the cards and they are dealing a sucker's game... that the corporate world has fallen for.

There are more legitimate opportunities in the good old US of A than all of China. Been there, seen it.

George Zachar adds:

I just read "James J. Hill, a Great Life in Brief" by Stewart H. Holbrook, about the great 19th Century railroad man. he too promoted, funded, and then abandoned a China venture, based essentially on the notion that if everyone in China bought one toothpick, he'd have a market for all the timber on his Western properties...

13-Jul-2006

Elective Surgery at Third World Prices, from J. P. Highland

Tijuana is not the nicest place in the world, but I had a successful laser eye surgery at a bargain price. I was living in the Los Angeles area at that time and several times I crossed the border in order to buy drugs due to the big spread that exists between the drugs sold in California and Tijuana. Dentists are also much cheaper, as are car repairs.

12-Jul-2006

Preliminary Thoughts on Evolution and S-x

Tuesday! What a day, with moves through the old lows, moves through

the old highs, a recapitulation of the month of May, finally ending exactly where the month of June ended, enough

to get all system players pointed the wrong way, and unloose all

weak holders from their positions. It's a day that recaps

the entire ontogeny of the market booms and busts over the

past year with Nasdaq, for example, below its low of a year

ago, and moving up a few percent from that low in the last

few hours. Counting on key reversal and wide days of this

nature, and moves after series of reversals, and runs now of

up 3:30 to closes as the giants shift their strategy to

early morning feasting on bulls, is in order.

weak holders from their positions. It's a day that recaps

the entire ontogeny of the market booms and busts over the

past year with Nasdaq, for example, below its low of a year

ago, and moving up a few percent from that low in the last

few hours. Counting on key reversal and wide days of this

nature, and moves after series of reversals, and runs now of

up 3:30 to closes as the giants shift their strategy to

early morning feasting on bulls, is in order.

Yes, all days in the market are different. And some days

have more ability to keep the market going and keep the flow

of energy in the system in balance than others. But unless

these days can reproduce, repeat, and continue onto the next

generation they are lost for ever. It would be so nice if,

like the aspen tree, they could just reproduce by cloning, with exactly similar moves each day. But

then the public would get wise, and the fixed and slow moving

would not be able to lose all their money to those with a

more permanent perspective.

Tuesday elicits thoughts on why we spend so much time and energy on courtship and mate selection and in the structures that enable reproduction to take place. It happens because we can get the best of variability in the population and engender children that can handle new situations better. The courtship the market displays attracts new entrants into the market to give romance and money, but like courtship in the peacock, it also makes them more visible and more liable to attack by predators.

The predators like to attack when there is too much

downness, although they are old now and often find it hard

to get out of their stately mansions. Canes were taken out

by old lions and others with a buy and hold mentality

Tuesday, and I saw them walking slowly back to their stately

mansions late in the morning. Many attractive younger

players arenít overly enthused by the old codgers who take

out their canes on such days, but the fact that these

old people have so much wealth at their disposal often

enables them to find a fit.

A day like Tuesday fuses so many different kinds of activity, the s-x of downness, the s-x of upness, the s-x of reversalist versus trendist, that one develops a deep appreciation of the hybrid vigor that the market displays. The fact that we have such a day, that markets like this can be created, is a testimony to the importance of s-xual selection in maintaining the tangled bank that allows us to provide the proper flexibility, and liquidity, for the multifarious parties to the fray.

And yes, we can all take comfort that death is relatively swift, while not entirely painless in such situations.

Dr. Janice Dorn replies:

Thou shalt not be aware. It is a mantra for many, and

herds are composed of many. People know that they are losing

or panicking but it means little at the time, since they are

-- in that moment of panic -- almost entirely old-brain

driven. In order to get to awareness, one must leave the old

brain and ascend to higher cortical centers. One must accept

complete responsibility. The role of these higher centers in

decision making is, in a large number of cases and in the

heat of battle, over-ridden, as fear is stronger than greed

and wanting out now reflects that the pain is no longer

tolerable. Awareness of some variety, may (or may not) come

later -- in the sense of remorse, self-deprecation or dysphoria. In this respect, it is not so much awareness in

the true sense of the word, rather it is emotion which may

or may not lead to contemplation and acceptance of personal

responsibility for one's actions.

Thou shalt not be aware. It is a mantra for many, and

herds are composed of many. People know that they are losing

or panicking but it means little at the time, since they are

-- in that moment of panic -- almost entirely old-brain

driven. In order to get to awareness, one must leave the old

brain and ascend to higher cortical centers. One must accept

complete responsibility. The role of these higher centers in

decision making is, in a large number of cases and in the

heat of battle, over-ridden, as fear is stronger than greed

and wanting out now reflects that the pain is no longer

tolerable. Awareness of some variety, may (or may not) come

later -- in the sense of remorse, self-deprecation or dysphoria. In this respect, it is not so much awareness in

the true sense of the word, rather it is emotion which may

or may not lead to contemplation and acceptance of personal

responsibility for one's actions.

Dr. Lee Shulman adds:

Awareness is extremely important to good functioning in any area of endeavor. However, two factors which interfere with awareness are avoidance and denial. When life is not going well, either financially or emotionally, there is a strong tendency toward not wanting to know and fear of taking action.

J. T. Holley responds:

These words and thoughts remind me of words from Bataille's Eroticism and the players you mentioned above:

Animal s-xuality does make for disequilibrium and this disequilibrium is a threat to life, but the animal does not know that .... Eroticism is the s-xual activity of man to the extent that it differs from the s-xual activity of animals. Human s-xual activity is not necessarily erotic but erotic it is whenever it is not rudimentary and purely animal.

These are some extracts from Eroticism that have the same theme and even more importantly Bataille's look at the "comfort that death is relatively swift, while not entirely painless in such situations" that you mentioned.

11-Jul-2006

Counting on Aspen, by

George Zachar

I was in the tiny resort town of Aspen Colorado on holiday last week, and it was a stage-set model of prosperity.

For the first time in local memory (and yes, I checked

several sources), the private jets were parked in 3 full

rows at the local airfield (exceeding the old high water

mark of two), with smaller aircraft literally parked under

the wings of the bigger planes.

The dozens of commercial flights were solidly booked.

Folks looking to join the ongoing party might be interested in a new house on the market: "Prince Bandar bin Sultan, the former Saudi Arabian ambassador to the United States, is selling his palatial home in Starwood Ranch for $135 million in what is likely the most expensive single-family residence listed in the nation."

Electorally, Aspen is a "blue" place, voting solidly Democratic in presidential elections, though it's surrounded by red in the GOP-leaning state of Colorado. So, those who resent the place for its prosperity can approve of its politics (and status as an enormous money tree for the Champagne socialists).

11-Jul-2006

What? me Count?, by James Sogi

Remember Alfred E. Newman and

Mad Magazine? He always asked, "What, me worry?" Well, our motto should be,

"What, me count?" The question

is what do we count? One answer is in my favorite series The

Cambridge Series in Statistical Probabilistic Mathematics by J. K. Lindsey,

Statistical Analysis of Stochastic Processes

in Time. Though the title is mighty intimidating, the writing is very

clear and well edited unlike many other books on math and

statistics filled with gobbledygook. Many main ideas are

presented without proofs which are for the most part

meaningless to me anyway. Surprisingly there is not much

well written literature on fitting stochastic models to

data, especially time data specs are presented with daily.

As always with this excellent series is the gold mine of

examples with R code which can be adapted to fit the

reader's needs. The main subject of study, dear to specs, is

events in time. These are:

"What, me count?" The question

is what do we count? One answer is in my favorite series The

Cambridge Series in Statistical Probabilistic Mathematics by J. K. Lindsey,

Statistical Analysis of Stochastic Processes

in Time. Though the title is mighty intimidating, the writing is very

clear and well edited unlike many other books on math and

statistics filled with gobbledygook. Many main ideas are

presented without proofs which are for the most part

meaningless to me anyway. Surprisingly there is not much

well written literature on fitting stochastic models to

data, especially time data specs are presented with daily.

As always with this excellent series is the gold mine of

examples with R code which can be adapted to fit the

reader's needs. The main subject of study, dear to specs, is

events in time. These are:

Of course, randomness is the unpleasant wrench in the works, and this needs to be modeled. The goal is to construct simple models.

Some things to count:

No. 2 models the intensity directly

instead of the probability or density. How often has it been

said in trading I was right, but was too early? What pain

did it entail and for how long? Recently, many of the points

moved have occurred in a rush and the rest of the time the

market drifts when all of a sudden it rushes up or down 12

or more points like this afternoon's rally. It would be nice

to know the time between such big moves to cut down on the

time getting stretched on the rack as Chair aptly describes

it. It would be nice know what precedes such moves. Look at

the recent month. Most of the big moves occurred in an hour

or two. The rest of the bars are all small. At certain times

there are flurries of trades with many 500 plus lot orders,

like a skirmish between T-Rex and Triceratops, often at

inflection points. The normal fixed interval bars and volume

do not model the intensity of trading, the duration between

the ticks, or the number of ticks in a point of price or the

direction of change per group of ticks. Many things to

count.

No. 2 models the intensity directly

instead of the probability or density. How often has it been

said in trading I was right, but was too early? What pain

did it entail and for how long? Recently, many of the points

moved have occurred in a rush and the rest of the time the

market drifts when all of a sudden it rushes up or down 12

or more points like this afternoon's rally. It would be nice

to know the time between such big moves to cut down on the

time getting stretched on the rack as Chair aptly describes

it. It would be nice know what precedes such moves. Look at

the recent month. Most of the big moves occurred in an hour

or two. The rest of the bars are all small. At certain times

there are flurries of trades with many 500 plus lot orders,

like a skirmish between T-Rex and Triceratops, often at

inflection points. The normal fixed interval bars and volume

do not model the intensity of trading, the duration between

the ticks, or the number of ticks in a point of price or the

direction of change per group of ticks. Many things to

count.

What, me count?

12-Jul-2006

Sentiment of the Day, from

Clive Burlin

From the Yra Harris interview in Inside the House of Money:

The worst thing you can do in a trade is try to get back to even. I call that the "prayer trade." I can spot guys on the floor who have it on because they shake back and forth, basically in prayer, mumbling, "oh, please God, just let it come back to me. Let me break even."

What is that? Break even? That's a loser. I'm not in this business to break even. There's always opportunity in the markets, so forget breaking even. If breaking even is your goal, you're not trading anymore.

12-Jul-2006

A Great Investment Book, by Allen Gillespie

I just read a new book for me, but one that was published in 1933 that I would highly recommend:

Profitable Grain Trading by Ralph M. Ainsworth. The book covers more than a few of the

Chair's & the Senator's lessons, and if the economics still hold, lays out some

timely info for wheat trading. He also reminds a trader of a few economic

truths. He does have a little technical stuff, but he was trading pre-computer.

A few of the highlights:

I just read a new book for me, but one that was published in 1933 that I would highly recommend:

Profitable Grain Trading by Ralph M. Ainsworth. The book covers more than a few of the

Chair's & the Senator's lessons, and if the economics still hold, lays out some

timely info for wheat trading. He also reminds a trader of a few economic

truths. He does have a little technical stuff, but he was trading pre-computer.

A few of the highlights:

12-Jul-2006

A Perspicacious Spec Reads the Newswire, a Continuing Feature

12:01 *SEC ISSUES GUIDELINES FOR MONEY MANAGER USE OF `SOFT DOLLARS'

12:02 *SEC PROPOSES TIGHTER RESTRICTIONS ON SOFT-DOLLAR PURCHASES

12:02 *SEC SAYS FIRMS CAN'T BUY COMPUTER HARDWARE WITH SOFT DOLLARS

12:02 *SEC SAYS SOFT DOLLARS ONLY TO BE USED FOR `RESEARCH SERVICES'

This'll knock a few pennies off the Bl00mberg IPO price..

12-Jul-2006

The Newest Colony, by

Laurence Glazier

I have been reading about a newly settled region where a few towns have recently sprung up. There is a nascent economy, comparable to Monaco in GDP, and a sparkling new university where seminars and courses are held. The weather is always good and everyone, it appears, is beautiful. It is a hugely growing sector, I am not sure if or when it will peak. It is called Second Life.

Following years of building up latent energy with the development of the VRML and Havoc products for modeling reality and physics, VR appears to have blossomed. The beauty of Second Life is that the bulk of the creation of value is now apparently done by the customer (i.e. citizen).

I noted, with approval, that there is a chess club, organized by the appropriately named Stephane Zugzwang. I anticipate a stock exchange, this has already been tried, but to no avail as yet (only one company listed).

To join, one chooses any first name, and one from a list of possible surnames.

This world is contained in a server farm of a few thousand servers. Land is rented out in real world currency at $25 per acre per month, and as necessary more servers are added.

Unfortunately, or more accurately fortunately from the point of view of preserving disposable time, this trader was unable to set foot in the new territory as Colorgraphic Xentera multiple trading screens are incompatible.

A couple of interesting Google videos regarding Second Life: A long Google talk on Second Life and the NMC Virtual Campus.

10-Jul-2006

Retrospective Numbers, by Victor Niederhoffer

It's

almost the fundamental truth of economics that markets provide better

signals than historical numbers as to the likely

balance between supply

and demand, prices and activity.

balance between supply

and demand, prices and activity.

Yet, over and over again one sees a day like Friday, where on the basis of one economic number -- a seasonally adjusted retrospective inflation number for April -- the idea that has the stock market in its grip is that interest runs rampant. At the same time, the long bond closes at 106.10, a 15-day high, within a third of a point of its April month-end close, up half a point on the day. Oil is down a buck at $74.09, and the Goldman July commodities index futures are down 1.5 % at 485.

There are two things one can do on a day like this for stock market investors and traders -- throw up the hands in disgust, or take out a pencil and envelope and calculate what happens after such days . Is there something that the stock market knows about inflation that somehow the bond market which invariably sells at a yield almost 100% 1-to-1 with the future expected inflation indexes is missing? Or is there an opportunity here to take account of a mismatch. The dilemma calls into the fray, the difference between a qualitative and quantitative analysis, the importance of ever changing cycles, the interactions between markets, and markets versus history as a benchmark among other important areas .

A hand study of the most similar of 15 most similar observations going back eight years shows the effect on S&P, bonds and crude one week later as up 1%, 0.5% and 1% respectively, with variability about two times the mean.

10-Jul-2006

Producer Surplus and Price Variations, by Victor Niederhoffer

One of the central concepts that helps in understanding the

gyrations in prices, the profits structure of business, and the

dynamics of the adjustment process

is producer surplus. This is the extra amount that producers could get

if they

knew  exactly how much the maximum that each consumer would pay for

their goods

and priced their product accordingly. The produced surplus is usually

calculated

geometrically as the sector that's left when you subtract the rectangle

from the

price and quantity at the actual single selling price from the area

under a

supply curve. A good way to see it in real life is with a homely

example like

one involving a Broadway show. Suppose the producer could get each member

of the

audience to pay the maximum price he would willingly pay to

enjoy it.

Some might gladly pay $1,000 and others might only wish to pay $5.00,

and if the

producer could just find out who they were, they would make so much

more

revenue and profit. Indeed, they say that the main reason that

Broadway shows

are so much more profitable these days is that they are reserving more

and more

of the good seats for price-insensitive buyers. And those who want to see it the

most get

to see it. Previously excess profits and

frictional

costs of such activities were controlled by scalpers.

exactly how much the maximum that each consumer would pay for

their goods

and priced their product accordingly. The produced surplus is usually

calculated

geometrically as the sector that's left when you subtract the rectangle

from the

price and quantity at the actual single selling price from the area

under a

supply curve. A good way to see it in real life is with a homely

example like

one involving a Broadway show. Suppose the producer could get each member

of the

audience to pay the maximum price he would willingly pay to

enjoy it.

Some might gladly pay $1,000 and others might only wish to pay $5.00,

and if the

producer could just find out who they were, they would make so much

more

revenue and profit. Indeed, they say that the main reason that

Broadway shows

are so much more profitable these days is that they are reserving more

and more

of the good seats for price-insensitive buyers. And those who want to see it the

most get

to see it. Previously excess profits and

frictional

costs of such activities were controlled by scalpers.

A good way to see this in tabular form is-

Price of Quantity Marginal

Ticket Sold Rev. Rev. Cost Surplus

500 1 500 500 10 490

400 2 800 300 20 780

300 3 900 100 60 840

20 100 2000 1100 2000 0

In a market where costs equal price, with no price discrimination the ultimate selling price equals the costs and profits are zero. With price discrimination, the producer produces much less, makes more profits, and the customers who get the most satisfaction from the product get to see it. Pashigian in Price Theory and Applications give three kinds of price discrimination in his analysis of producers' surplus. There is the first degree situation where the producer has complete information about the consumers demand and captures all the producer surplus. These is a second degree situation where the producer has different price schedules for different classes of customers who have different demand schedules the way academic journals do for business, library, and faculty, and student subscribers, or the way colleges do when they give less scholarships to those who apply for early admission or go to visit the college. There is the third degree price discrimination where the seller has no info on the buyers' demand schedules but knows they had different schedules.

The solution to how firms act in these situations is based on the urgency, age, income, and information of the consumers of the product. Working out tabular examples of the kind above leads to the following pricing policies.

I find all these considerations very similar to the price movements in stock and fixed income and commodity markets. The price varies so that customers who want the product can come in at different levels based on their urgency, information, income, and uncertainty. Prices move around to maximize the profits of producers, who try to differentiate the points at which they can gain the most revenues from frictional costs and ephemeral trades that will be quickly broken at a loss with low cost in inventory, and possible selling at a loss when the market moves against of the producers.

Pashigian and other good price texts have 50 categories of pricing behavior that producers take based on such things probability distributions of consumer demand, price cutting, number of rivals, differences in marginal costs, facilitating practices, demand shifts, Nash equilibria, quantity demanded, reservations prices, seasonal variations, signaling, bundling markdown, low price polices, market entry, meeting competition, suggested retail prices, punishment strategies, tit for tat pricing, two part tariffs, uncertainties about tastes, price elasticities, short and long run cost differences.

An understanding of the economic analysis of these factors is invaluable to understanding the reasons that business makes and loses money, and how price variations effect same. It makes you immediately very skeptical of the accepted view that when a company reduces prices or changes prices or misses a quarterly earnings number the way Intel did because of lowering prices or retailers do to clear inventory or MMM did to enter a new market, that these are long term factors that should induce you to sell. Disclaimer: I don't own any of these stocks but use them as examples.

11-Jul-2006

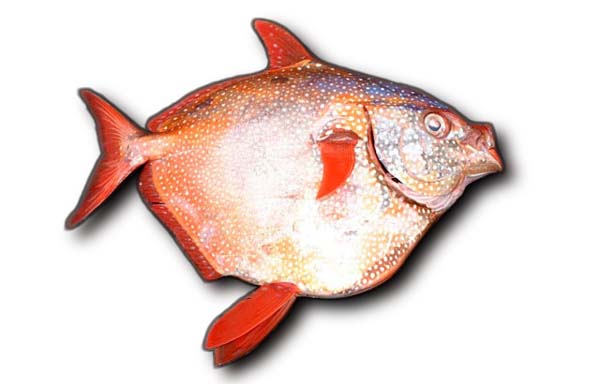

There is Something Fishy About This Market, by

James Sogi

There is something fishy about this market -- the

Honolulu fish auction market, that is.

This is where the fishing boats

come in from Alaska, Seattle and other points to Pier 38 and unload their fresh caught moon

fish, swordfish, tuna, and dorado, and wahoo.

UFA charges the seller a 10% commission

on all sales regardless of volume. This commission has remained unchanged since 1952.

Longline, deep-sea bottom fish and small-boat commercial fisheries both local and

foreign supply the auction with as little as a few thousand pounds to as much as

160,000 pounds of fish on a daily basis. The restaurateurs and fish buyers gather

round the auctioneer and move down the long rows of large ocean going fish. Each

fish is cut at the tail so the buyers may see and feel the quality of the meat, the

oiliness and color. The auctioneer starts the prices and flips back and forth

between usually two bidders, $4.30/40/50/60...sold. And the clutch of buyers moves

on to the next fish lying in the chilled room and covered with ice. Everyone

has to wear knee high boots inside. The fish immediately is loaded on to the palettes,

sealed, and moved into the waiting trucks for air shipment to Japan and New York

and La where the fish will be eaten that night in fine restaurants. It was a good

experience to see that kind of commodity market auction in person. Refreshing to

know that the live auction markets are live and well in this day of technology.

There is something fishy about this market -- the

Honolulu fish auction market, that is.

This is where the fishing boats

come in from Alaska, Seattle and other points to Pier 38 and unload their fresh caught moon

fish, swordfish, tuna, and dorado, and wahoo.

UFA charges the seller a 10% commission

on all sales regardless of volume. This commission has remained unchanged since 1952.

Longline, deep-sea bottom fish and small-boat commercial fisheries both local and

foreign supply the auction with as little as a few thousand pounds to as much as

160,000 pounds of fish on a daily basis. The restaurateurs and fish buyers gather

round the auctioneer and move down the long rows of large ocean going fish. Each

fish is cut at the tail so the buyers may see and feel the quality of the meat, the

oiliness and color. The auctioneer starts the prices and flips back and forth

between usually two bidders, $4.30/40/50/60...sold. And the clutch of buyers moves

on to the next fish lying in the chilled room and covered with ice. Everyone

has to wear knee high boots inside. The fish immediately is loaded on to the palettes,

sealed, and moved into the waiting trucks for air shipment to Japan and New York

and La where the fish will be eaten that night in fine restaurants. It was a good

experience to see that kind of commodity market auction in person. Refreshing to

know that the live auction markets are live and well in this day of technology.

11-Jul-2006

Trading and Poker and Tail-End Occurrences, by

Leonardo Cecchini

Last week I saw on a cable channel the Monte Carlo European Poker Tour Final (Texas Hold'em rules). I believe this was a rerun so I can't say for certain when the actual final was held.

That poker and trading share numerous similarities has long been discussed and written about. Notably, a recent book by Aaron Brown, The Poker Face of Wall Street, highlights the case remarkably well.

I am writing instead to try and highlight how the unforeseen events in life are more common and frequent than one might expect by drawing an analogy from this poker tournament.

It is generally believed statistically that observations that occur at the tail-end are exceptional and can therefore be almost disregarded (or seem to be disregarded by market participants). Looking at the poker tournament, the finalists' table included two Internet qualifiers. One was 19 years old whilst the other 20. That in itself was deemed an unlikely situation. You might expect one qualifier to make the finals but not two, especially when young. The final was eventually won by the 19 year old, beating some big European stars along the way, whilst the other came third. Again, this would be deemed an incredible and unlikely outcome.

At the micro level, if we analyze some of the hands that were played which helped the soon-to-be champion build is chips. Few of the key hands, where he won big, were from the last card turned (the 'river' card) whose chance of winning was never higher than 9-12%. And guess what? He won every single time.

So maybe tail-end events are more common than perceived and, as with most things, time and location are probably the two single most important components when assessing an uncertain outcome or situation.

Steve Leslie adds:

One thing you have to remember when watching televised

poker events is that these are all edited for

television. Therefore all that you get to see are the

highlighted hands, the ones that have the greatest

impact on the outcome of the tournament. So be careful

to draw any conclusions as to style of play that a

poker player may exhibit or how they may have won the

tournament.

One thing you have to remember when watching televised

poker events is that these are all edited for

television. Therefore all that you get to see are the

highlighted hands, the ones that have the greatest

impact on the outcome of the tournament. So be careful

to draw any conclusions as to style of play that a

poker player may exhibit or how they may have won the

tournament.

FSN, owned by Fox, did show one tournament that was unedited, with Phil Ivey ultimately winning it. The final showdown took several hours of coverage. Now I am addicted to poker and I found it to be truly boring, One step above cricket.

For my money, the best show on tournament poker is the World Poker Tour with Mike Sexton and Vince Van Patton as hosts. Sexton is entertaining, humorous and knowledgeable having been around the game for over 25 years. He knows the players and is also a top competitor himself. His insights are very valuable and one can learn much from his commentary.

Gabe Kaplan is the worst. Completely unfunny and devoid of personality.

10-Jul-2006

Soccer, Deception and Markets, by

James Sogi

Soccer, as with many sports such as golf, tennis, are all

related to the ability to control the ball with the

difficulty

handicapped by the limitations of maneuvering the

ball with the feet, or in golf using a long stick to hit a

little ball where the ability to control the outcome

is limited by the mechanism, and the added factor of an

opponent trying his very best to take the ball away from you

or putting it out of reach. The other interesting take on

the soccer is the constant use of deception. Two or more of

ever three moves is a use of deception, a fake, a juke,

reverse of direction. It's ingrained in the game. Traders

might learn from the world's best soccer players. Much of

the game of soccer, as with trading, is not in the goal, but

in the maneuvering into position, using fakes and deceptions

designed to get a step ahead of the opponent. Once a step

ahead a good play can be set up. Aside from the fact that

there are 10 other players awaiting to take your ball away

from you the trader might use every entry, ever order to use

a bit of a fake, a bit of deception, a juke, to get in just

a step ahead of the opponent. How much easier it is to make

a good play when your first possession leaves you a step

ahead, rather than an immediate step behind, running and

huffing and puffing. How much more satisfying to enter the

trade a few points up a step ahead of the opponent giving a

little breathing room and a little time to look around to

set up another kick or pass or play or even a goal.

handicapped by the limitations of maneuvering the

ball with the feet, or in golf using a long stick to hit a

little ball where the ability to control the outcome

is limited by the mechanism, and the added factor of an

opponent trying his very best to take the ball away from you

or putting it out of reach. The other interesting take on

the soccer is the constant use of deception. Two or more of

ever three moves is a use of deception, a fake, a juke,

reverse of direction. It's ingrained in the game. Traders

might learn from the world's best soccer players. Much of

the game of soccer, as with trading, is not in the goal, but

in the maneuvering into position, using fakes and deceptions

designed to get a step ahead of the opponent. Once a step

ahead a good play can be set up. Aside from the fact that

there are 10 other players awaiting to take your ball away

from you the trader might use every entry, ever order to use

a bit of a fake, a bit of deception, a juke, to get in just

a step ahead of the opponent. How much easier it is to make

a good play when your first possession leaves you a step

ahead, rather than an immediate step behind, running and

huffing and puffing. How much more satisfying to enter the

trade a few points up a step ahead of the opponent giving a

little breathing room and a little time to look around to

set up another kick or pass or play or even a goal.

Bruno Ombreux responds:

Here is a video compilation about Zinedine Zidane, one of the best soccer players, with great dribbles illustrating the use of fakes and deception.

GM Nigel Davies replies:

Everybody living outside the US and Canada will think of a round ball when the word 'football' is mentioned. I make a conscious effort to translate this into 'soccer' when speaking to Americans.

Not that I talk about football

-- I mean soccer --

much. Not every Brit likes the game. I figure it was because

I was overweight as a kid, was always picked last (or second

last) for the teams and then they made me go in goal. I

think they figured it would be more difficult to get the

ball past me than a skinny kid, elementary physics.

Not that I talk about football

-- I mean soccer --

much. Not every Brit likes the game. I figure it was because

I was overweight as a kid, was always picked last (or second

last) for the teams and then they made me go in goal. I

think they figured it would be more difficult to get the

ball past me than a skinny kid, elementary physics.

Later on it seemed that British soccer hooligans had destroyed every European city I visited a week before I got there for my chess tournament. And if we hadn't destroyed their city we'd be trying to renegotiate our membership of the EU. Having a little Union Jack by your board didn't make for a warm welcome. It was almost better to fly the Israeli flag (yes, I tried that too for a while).

Thinking about soccer, I'm not sure that Americans can understand the culture of the game. It is so closely connected to countries, regions, clans and even religions (there are teams traditionally supported by Protestants, Catholics and even Jews). Probably 'we' need it because we're all piled on top of one another in this overcrowded little continent. It's a means of distinguishing one's identity, you relate to a particular team.

Some odd-balls will raise an eyebrow or two by 'supporting' a team that nobody has ever heard of, or one that is totally inappropriate for their apparent identity. But woe betide those who say they prefer tennis.

10-Jul-2006

Analysis of Daily Volume, by

Dr. William Rafter

Be careful with analysis of volume data. Most people just assume that you should multiply the price move (or whatever) times the volume. That action treats volume as though it behaves in a uniformly consistent manner over the price data. However, a few illustrations prove otherwise:

Specifically, SPX volume appears to have at least a

2-humped distribution. Since the distribution is neither

normal nor anything resembling normal, then something else

is going on. A two-humped distribution would usually

indicate two separate relationships.

Specifically, SPX volume appears to have at least a

2-humped distribution. Since the distribution is neither

normal nor anything resembling normal, then something else

is going on. A two-humped distribution would usually

indicate two separate relationships.

If you do a scatter diagram of SPX volume against VIX, you can see that volume has two faces: At low levels of volatility (usually associated with bullishness), increased volume is associated with lower volatility, and hence more bullishness. However, at higher levels of volatility the relationship goes the other way: higher volume is associated with more volatility which is more bearish. I used the value of 22 for VIX as the cutoff point, but that value is not critical to making the point.

So, a reasonable suggestion is that volume needs to be "qualified" before being used to weight price activity. Implied volatility is just one of the possible ways to do so.

The frequency distribution and scatter diagram can be seen here.

Craig Cuyler responds:

When looking at volume in the futures markets it is important to take note of new buyers or sellers as opposed to long holders selling out existing contracts or shorts buying back their positions. If a markets moves up for example and the open interest increases at the same time then it shows that new buyers have entered the market and vice versa for moves down. The COT data can be broken down to give this type of volume information. In spot markets the volume prints are meaningless as Larry says because the interbank markets, swap markets and hedger markets are huge and these transaction don't cross the screens.

Larry Williams replies

Volume is not really volume or buying/selling pressures -- more now than

ever with arb programs, just look at huge volume increases at expiration to

see volume that is not real buy/sell; much of volume is swaps, hedging and

some tax maneuvering -- nothing at all to do with supply demand as volume watcher think.

Volume is not really volume or buying/selling pressures -- more now than

ever with arb programs, just look at huge volume increases at expiration to

see volume that is not real buy/sell; much of volume is swaps, hedging and

some tax maneuvering -- nothing at all to do with supply demand as volume watcher think.

So what is one to do -- and was volume ever reliable? Our studies suggest most everything the books say about volume is incorrect; a selloff on large volume is bullish; the say bearish is just one of many examples.

J. T. Holley responds

Larry, you left off a few more hedges in your example! After the farmer sells his wheat to the local grain elevator operator he to then hedges by selling futures contracts for an amount equal to his inventory. As time goes by he sells wheat from his inventory and lifts portions of his hedges so that he stays equal between the physical wheat and the contracts. The miller who buys the wheat from the grain operator has contractual commitments w/ his customer to deliver his ultimate product of flour. He has specific prices he to needs to meet for his obligations so he to hedges his inventory. His hedge though is the opposite of the above mentioned gentlemen! Meanwhile the Baker who is going to buy the flour from the Miller is making contracts for delivery of his goodies. He must also hedge against these contracts by making buying hedges! All to provide liquidity and to keep price swings low do the Farmer, Elevator Operator, Miller, and Baker invite guys like us that stuff Twinkies, Ho-Hos, Loaves of bread, and Double Layer Chocolate Cake in our mouths to the party. Larry's right it's "for" the user and producer, but by the Grace of God the Speculator is allowed to ply his trade amongst them.

Bruno Ombreux replies:

My few cents, as a long time professional hedger:

Studying Open Interest looks like a more promising subject of study, and I think Larry wrote a book on the CoT report.

I have this theory that when hedgers as a group are increasing their long hedges, this is because there is increasing physical shortness. And vice-versa. That would be because considering them as a group and over several weeks, averages out the wide variety in their behavior; ending up in a reflection on what's happening physically.

But this should be tested with statistical studies of OI and CoT evolution vs fundamentals such as stock levels.

A shorcut for gauging the physical situation is looking at front-to-back spreads, which is what many commercials do.

Gregory van Kipnis replies:

Generally, futures markets come into existence when certain conditions existed, such as it is a commodity and is fungible (one ingot or one bushel is the same as another); It can be stored and delivered cheaply and easily; many buyers and sellers, but with one side believing that without a market (tape) it is being disadvantage by pricing inefficiency (collusion).

Irrespective of which country had the first futures market and why, the history of grain markets in the US has its own interesting details. Grain is harvested according to a rolling set of dates as you cross the grain belt. The Railroads had a monopoly on transportation and the grain purchasing agents would hold a single point purchase at each RR junction and get the local farmers to drive prices down. Co-Ops were developed to store grain near transportation hubs; prevent spoilage, and to allow sales to be spread over time. Chicago Board of Trade created a contract that would forward sales and purchases and included a physical delivery feature. Huge issues had to be overcome to insure performance and avoid gambling law violations. 'Margins' were small, good faith deposits, held by the broker as part of the insuring performance process. If you were a seller (farmer) you could satisfy your obligation by either delivering at the designated warehouses or buying back your contract. If you were a merchant you bought to fix your costs and could force delivery to ensure supply. Warehouse receipts evidencing quantity and quality were perfected. If there was a way to cheat someone exploited it. So the details of how the futures exchange function evolved. There have been notable crisis revolving around the taking delivery including the famous salad oil scandal (fake warehouse receipts) and the Russians bypassing normal commercial channels, to hide their tracks, taking huge futures positions, and then taking delivery during the Nixon Admin following a disastrous USSR crop failure.

10-Jul-2006

Lessons learned from Sports, by Steve Leslie.

Roy Hobbs "Did you ever play baseball Max?"

Max Mercy "No Hobbs, I really didn't. But I will tell you I make it more interesting for people to read about it . You know something Hobbs I am going to be around here alot longer than guys like you."

Loosely quoted from "The Natural" with Robert Redford and Robert Duvall.

"Who the hell is Mel Kiper." quote from the general manager of the Indianapolis Colts Bill Tobin.

"Winners always want the ball." Gene Hackman in The Replacements.

I find that probably the most fascinating lesson to learn from sports is from the views of the large number of "experts" who study the game. Especially those who call themselves journalists and either write about sports or cover it on television. More importantly how incredibly wrong these so-called analysts can be and what damage they can inflict on a person's career if they are allowed to, and they are accepted as some sort of be-all and end-all of authority and judgement.

Case in point:

Amelie Mauresmo just won The Wimbledon Championship defeating Justin Henin-Harden in 3 sets. Even though Amelie is ranked #1 in the world, Mary Carillo the NBC analyst was constantly questioning her mental character throughout the final. Her comments were things like "She has always had the game for Wimbledon but many question her mental toughness." Well I guess they don't have to question it any more.

I recently wrote about Dan Duquette General Manager of the Red Sox who 10 years ago was wondering aloud how long Roger Clemens' career would last and if it would not be better to trade Roger for value before the end of the season. Since then all he has accomplished is 3 more Cy Young awards, 2 world championship rings and 4000 strikeouts and the most wins by a right-hander in modern day history. Plus, he is still pitching.

George Foreman was considered a carnival act until he knocked out Michael Moorer for the heavyweight championship at 47 years old.

Muhammad Ali was a huge underdog to Sonny Liston before their first fight for Liston's championship belt in 1964. Do you remember how Ali embarrassed Liston. How about Foreman vs Ali in Zaire and how Foreman was considered invincible until Ali put Foreman to bed in the eight round with his rope-a-dope style.

Phil Mickelson did not have the toughness to win a major golf tournament until he won his first Masters. Now he has 2 and a PGA.

Terry Bradshaw was rumored to be stupid because he talked funny and came from Louisiana Tech. 4 super bowl rings later and the only quarterback besides Joe Montana to have 4 rings he doesn't look so stupid to me. Incidentally, the same was said of Brett Favre because he came from some town in Mississippi that doesn't even show up on a map.

Speaking of Montana he was 3rd string on Notre Dame's depth chart beginning his sophmore year for the Fighting Irish.

James "Buster" Douglas shocked the world by beating "Iron Mike" Tyson with a 9th round knockout in Japan even though he was a 45-1 underdog.

Michael Jordan was cut from his grade school basketball team.

I could mention many others such as Wilma Rudolph, Tom Dempsey, Lance Armstrong but my point remains is that what made these athletes and countless others remarkably great and enduring was that they refused to allow anyone to define their life other than themselves. The greats become the true greats because the never learned the word quit. They find a way. Winners always find a way.

I like that.

GM Nigel Davies responds:

Yes, you are pointing to the overlooked dynamic element which fouls all the predictions. As Jeff Goldblum said in 'Jurassic Park', "Life finds a way."

So Nadal has changed his game on grass, Mauresmo has gone a long way towards solving her psychological problems, and Foreman changed completely after the Rumble in the Jungle to become quite an extrovert (his grill is great, by the way). It is mankind's striving that is overlooked, and this is magnificently illustrated by my all-time favourite film 'Rollerball'. The game of Rollerball was designed to demonstrate the futility of effort, the inevitable failure of the heroic. But Jonathan E defied them all to become a hero in a futile game.

Similarly we see stocks defying those who believe in a closed controlled universe and the futility of effort. It is striving and innovation that constantly disrupt 'fixed laws' of supply and demand.

10-Jul-2006

Expectation, by Dr. Janice Dorn

Blessed is he who expects nothing, for he shall never be disappointed. -- Benjamin Franklin

Often, when we open the front door, and invite others in as our guests, we get a bit more than we bargained for. We find that, not only have we opened the front door. We have opened the back door, the windows, the garage door and the doggie and kitty door. Suddenly, the rooms are overflowing and it feels like the walls are either closing in on you or falling down. At some point, you ask yourself, why am I doing this? How much more of this can I tolerate and still keep myself intact? Why aren't I getting back all of this that I am giving? Why aren't people thanking me for everything I am doing for them? Why do I feel so empty and drained and caged in? Help! What are you doing and what do you expect? If you expect "Thank You," then be prepared for disappointment. If you expect "Applause," then be doubly prepared for let down.

The best you can do it to expect the unexpected. Expect nothing. That way, if you do get thanks or a hug or even two hands clapping, it is a bonus because you didn't expect anything to begin with. Our hearts and minds are only open truly when we do what we do without expectations of response from others. We do these things for ourselves. Altruism, in most aspects, is not about doing for others. It is about doing for ourselves, via what we do or give to others. We are able to open fully our hearts ( doors) to others when we truly have absolutely no hope whatsoever of getting anything back. The random act of fried chicken kindness I did was for me, not for the poor homeless woman. If it brightened her day in any way, I do not know. All I know is that it made me feel good and it brought up in me certain aspects of my own life on which I needed to work.

If you do what you do for others because you want them to like you, respect you, treat you well, give back to you or for any reason that had anything to do with you, you are on a path of self-deception and disappointment. Expect nothing from others and expect everything from yourself. That is what it means to strive for excellence and inner peace without worrying about the negative voices which tell you that you can't, you won't or you're not good enough. Remain open without expectation. Truly feel that and be with that. Be grateful to those whom you invite in, as they are your teachers. If they thank or praise you, it is an unexpected gift. Accept it and take note of it. Remember those people. If they don't thank you, applaud you, praise you or continue to want more and more doors open, even as your walls are falling in, take note of that. Remember those people and learn from them.

10-Jul-2006

Life Lessons from Games, by Steve Leslie

Now that there have been two excellent discussions on torture in the markets and another with a nautical theme, I thought that it would be helpful if we could start a discussion on the lessons learned from games to the markets.

There must be some valuable lessons to be gleaned from such games as checkers, backgammon, bridge, monopoly, dominoes, and games of chance.

The site is authored by such wonderfully brilliant people that this could be a tremendous exercise to initiate this weekend. I will weigh in with something that I wrote a month or so ago on roulette and gambler's fallacy.

I have been reading my copy of "Beyond Greed and Fear" by Hersh Shefrin. Dr Shefrin is one of the pioneers in Behavioral Finance and his book is must reading for anyone interested in markets and games. He has a profound ability to take a complex subject matter and make it easy for a layman to understand. Perfect for someone like me.

I just finished his chapter and discussion on gambler's fallacy.

Gambler's fallacy is a phenomenon that casinos use to their great advantage. It helps them create a false sense of expectation among the players in some of the most popular games of chance. The most obvious example of which is Roulette.

The gambler's fallacy is a logical fallacy which encompasses any of the following misconceptions:

A random event is more likely to occur because it has not happened for a period of time; A random event is less likely to occur because it has not happened for a period of time; A random event is more likely to occur because it recently happened; and A random event is less likely to occur because it recently happened.

.gif) In the game of roulette there are either 37 or 38 numbers

depending on the type of wheel used. From 1 to 36 they

alternate in color from red to black. The 37th number is a

neutral color 0 and if there is a 00 it also is a neutral

color.

In the game of roulette there are either 37 or 38 numbers

depending on the type of wheel used. From 1 to 36 they

alternate in color from red to black. The 37th number is a

neutral color 0 and if there is a 00 it also is a neutral

color.

Players can then wager on numbers, colors or combinations of numbers. Their payoff is determined by the odds, with a little left over for the house.

With respect to roulette this is how the casino uses gamblers fallacy to their advantage. Casino's install a tote board similar to that which you see at NASCAR events, alongside the roulette wheel that tracks every number that comes up on the wheel. Red numbers are on the left and black numbers on the right. Players who view the tote board may then try to use this information to detect a pattern or a run and to make their next wager. Naturally the information is entirely useless because with respect to a random event such as roulette past performance is no indication of future performance. The ball has no memory. If there are 37 numbers on a roulette wheel and your lucky number or birthday just hit, on the next spin you still have a 1 in 37 chance that the same number will hit again. Therefore, in a fair game, with a balanced wheel, the gambler can not receive any advantage from the tote board. The board will show runs of colors and numbers but it is completely useless information as to what is going to happen on the next spin of the wheel.

Why does the casino use such an obvious ploy? They found in research that their take at the wheel went up dramatically after they installed a tote board. The ill-informed assumed that they could use the information on the board to detect patterns to help them determine how they should place their next wager. It is like a rubber crutch. The gambler takes worthless information and uses it in a ill-conceived heuristic to devise a strategy. A fatal concoction to say the least.

Other examples are seen in baccarat, where the player is given a sheet of paper and a pencil to let them track the winnings of the player vs. the banker. They try to use the information to help them place their next bet. Once again, not worth the paper it is inscribed on.

Just remember, if a casino is giving something free away especially information, it is to their advantage and not that to the player and it is an inducement to have the player gamble more . Not unlike the information that one can receive on Wall Street on a daily basis. Someone once said if you can read it in a research report or in the newspaper its usefulness has been severely diminished.

10-Jul-2006

The State of Origin Indicator, Specious Correlations & PE

Ratios (ASX 500), by Andrew McCauley

I note that the performance of the All Ordinaries Index

is inordinately positive after NSW (New South Wales) win the

State of Origin

series. I also note that stork sightings & birth rate

increases are somewhat correlated.

I note that the performance of the All Ordinaries Index

is inordinately positive after NSW (New South Wales) win the

State of Origin

series. I also note that stork sightings & birth rate

increases are somewhat correlated.

The numbers above disclose the existence of statistical correlation between two sets of data. However, the data does not imply any causal link between two pastimes as unrelated as the Greatest Game of All & the stock market.

This non causal link reminds me of the "Market Gurus" in the media who regularly talk about general market PE levels. They talk about the PE Ratio as if it had some conclusive predictive quality, when it is trading above or below an historical average, with the ring of truth or plausibility but actually fallacious.

I note that on all occasions that NSW won the State of Origin Series the general market PE Ratio was above the long term historical average. Could it be that the State of Origin Series Winner has more predictive quality than Broad Market PE Ratio? I suspect not. However, both are spurious in forecasting ability.

Who knows, if the Blues win & the market continues up in the order of 1% per month for the rest of 2006, maybe some investors will take this indicator seriously. I hope not. Go the Blues.

09-Jul-2006

Horatio Alger in a Different Light by

David Baccile

I came across a very funny passage in "Our Crowd" by Stephen Birmingham that I will share with the website. Our Crowd is filled with the stories of how several Jewish immigrant peddlers became the great Jewish families of NY.

"To educate his five boys, Joseph (Seligman) hit upon a dazzlingly American idea. He hired the creator of the great American boy hero, Horatio Alger, to live in his house and tutor his sons.

The experiment was not entirely a success. Alger may have been able to invent boy heroes, but he was far from one himself. He was a timid, sweet-tempered man who, in his non-teaching hours, practiced his ballet steps. He was easily cowed, and his customary cry of alarm was "Oh, Lordy-me!" Ten lively Seligman boys were clearly too much for him, and was forever having to rush...for assistance. Once when he cried out for help, the boys jumped on him, tied him up, and locked him in a trunk in the attic. They refused to let him out until he promised not to tell their mothers.

After lessons, such as they were, he liked to play billiards with the boys. He was extremely nearsighted, and when it was his turn at the cue, the boys substituted red apples for red balls. Alger never caught on, and, as each new apple was demolished with his cue, would cry, "Oh, Lordy-me, I've broken another ball! I don't know my own strength!"

But Alger had his compensations. J. W. Seligman Co. opened an account in his name, took the literary royalties and invested them for him, and made him a wealthy man. He remained a friend of the Seligman's and long after the boys were grown, was a regular guest at Sunday dinner, where the practical jokes continued.

There was one favorite. Joseph's married daughter, Helene, and her husband lived with her parents. After dinner one of her brothers would steer Alger into the library and into a sofa next to Helene. There he would artfully drape one of Mr. Alger's tiny arms around Helene's rather ample waist while another brother ran from the room shouting "My Alger is trying to seduce Helene!" Helene's husband would then rush into the room brandishing a bread knife, crying, "Seducer!" The first three times this happened, Alger fell to the floor in a dead faint. Perhaps he did teach the boys to be Americans after all. "

09-Jul-2006

Skip College, by

Ken Smith

College - an academic institutional setting - can be skipped if all you want is an education.

--Munch

To those readers who despair of tuition costs and desire only an education, can do without credentials, I recommend a course of reading the will provide you with an education surpassing any general education you might obtain from a university and the expense is relatively nothing compared to university costs and time wasted in your short life.

David Wren-Hardin adds:

I agree, with a couple of caveats. The first is that even for a well-motivated, well-informed student, there is a huge risk when self-teaching that one will miss vital aspects of a field simply because the student isn't aware they are there. This would be especially true for someone with absolutely no background, i.e., a 19 year old fresh out of high school.

Secondly, there is a lot to be said for being guided through the material by an expert in the field. A good college will provide the student with small class-sizes and discussion groups in order to more quickly answer questions and fill out nuances. This expert can be at your work too. A mentor can be a huge benefit, and should be sought out by the self-learner. This list, obviously, can serve that function.

Finally, it takes a lot of discipline to work through material in a through fashion. College is a good transition where you are responsible for studying on your own to a large extent, but with deadlines that force you to keep up the pace.

But you're right, there is a tendency to chase credentials. "I need a B.S. in business. Now I need an MBA. Ooo....CFA!" This person then enters the marketplace with little practical experience, but a whole-lot of letters after their name that force them out of the pay scale of entry level positions. Get your degree, then get a job, ideally one with a good mentoring system that will eventually pay for your MBA/CFA if you need to get one.

07-Jul-2006

A Highly Recommended

History of Finance Book, by Victor Niederhoffer

One of the best and most enjoyable ways to appreciate and navigate the world of markets today is to study its foundations and evolution. The highly recommended book The Origins of Value, by William Goetzmann and Geert Rouwenhorst contains a series of 20 essays that trace the history of finance from its origins in Sumerian and Roman times to today. Chapters on the origins of interest, the first corporations, the business and money used on the Chinese Silk Road and the Italian City States, the origin of bonds and stocks, mutual funds, conduct and returns in the Dutch East India Company, the innovations of John Law, the origins of the New York Stocks Exchange, Eurobonds, German Debt, annuities, and Fibonnoci's contributions, and King Leopold's finances and madness appear. The book considers these particular aspects of finance in the context of three principles, the transfer of value through time, the development of mediums for the transfer of uncertainty, and the ability to buy and sell to negotiate value.

There are numerous insights that I gained from this book about how things that we now take for granted were started and developed in a different time and place, but with uses very similar to today.

Every chapter is filled with fascninating facts about the structure and materials that we use today. Pictures, tables and maps illustrate how things actually looked and worked during that time. There are only 5 charts, but those are completely fascinating in that they show the prices, debt, equity, and dividends (incredibly high) of the Dutch East India Company, and moves in prices of equities and debt of big bank and insurance companies on the NYSE from 1790-1820.

The one criticism of the book is that it contains mainly facts and history, illustrations and examples and explanations. There is little of a grand framework of analysis to fit all the pieces together and provide a framework for how all the parts fit together. The authors' recommend The Rise of Financial Capitalism:International Capital Markets in the Age of Reason by Larry Neal for that. Along with Larry Harris's book, Trading and Exchanges, this book provides the ideal foundation for the study of markets and finance from the ground up.

06-Jul-2006

Torture in the

Markets, by Victor Niederhoffer

No one shall be subjected to torture or to cruel, inhuman, or degrading treatment or punishment-- Universal Declaration of Human Rights, UN, Dec 10, 1948.

The violent and cruel moves of the market from mid May to

July, with the excruciating pain of the first 20% decline in the first

week and a half, the fake relief rally during the next w eek to June 2, the even more

horrible decline of the next two weeks, with the gradual rise to July

4, leaving most markets within a single digits of their old high, still

up substantially on the year, has all the earmarks of the torture

techniques perfected in the times of the Roman Caesars, used throughout

the world for 350 years during the inquisition, and now coming back

into prominence in conjunction with the treatment of Iraqi prisoners in

Guantanamo Bay.

eek to June 2, the even more

horrible decline of the next two weeks, with the gradual rise to July

4, leaving most markets within a single digits of their old high, still

up substantially on the year, has all the earmarks of the torture

techniques perfected in the times of the Roman Caesars, used throughout

the world for 350 years during the inquisition, and now coming back

into prominence in conjunction with the treatment of Iraqi prisoners in

Guantanamo Bay.

Like Senator McCain, who was exposed to physical and mental torture by the Vietcong and now is one of the leading advocates of its abolition under any circumstances, even if the ticking time bomb is at issue, I have had direct experience with many of the techniques of financial and psychological torture that these moves have inflicted. I thought it might be well to reflect on the instruments and techniques of torture so that I and others would not be subjected to such pain in the future, and possibly to induce the inflictors of torture to give up such activities in the future.

Let’s start with the most famous historical cases of torture, those inflicted by Spanish Inquisition which from its inception in 1480 to its end in 1808 registered the following statistics:

Burned alive 31,912

Burned in effigy 17,659

Subjected to severe

pain and penance 291,450

(Source: Knox, op. cit)

The

main initial instruments of torture used by the Spanish appear to have

been the rack, the wheel, the thumb

screw, and the water

torture. These created so much pain and damage that a confession and

recanting was almost always obtained. A common feature of these

tortures was the compression and stretching that these machines

inflicted on the human body, which was not made to withstand forces of

this nature. The financial body of most people is not made to withstand

the forces set by a 10% decline, especially when leverage is used or

the money has been recently invested at the top. The firsts 10 to 25%

declines in the markets did elicit capitulation and recanting from

investment in stocks from all who had the least vulnerability to such.

screw, and the water

torture. These created so much pain and damage that a confession and

recanting was almost always obtained. A common feature of these

tortures was the compression and stretching that these machines

inflicted on the human body, which was not made to withstand forces of

this nature. The financial body of most people is not made to withstand

the forces set by a 10% decline, especially when leverage is used or

the money has been recently invested at the top. The firsts 10 to 25%

declines in the markets did elicit capitulation and recanting from

investment in stocks from all who had the least vulnerability to such.

One of the terrible things about torture is that it hurts so much that when it's over great relief is felt. That's when the guard is lessened. The Spanish perfected a technique to prey upon the weakness that occurs. It was the "no hard feelings either way, now we're all friends again. Just embrace us and this peaceful statue of the Virgin Mary" gambit. A nice description of it is contained in one of my favorites, a 942 page, 125 year old book, ok, The Underground: Or, Life Below the Surface, 1880, profusely illustrated, by Thomas W. Knox. After the heretic had recanted, he was told that now that all was forgiven, he should kiss the statue to prove his sincerity.

As he went to obey the injunctions, he placed his foot in front of the image and his weight fell upon a board which touched a spring. The arms of the statue were instantly closed about him; knives were thrown from these arms; and he was pressed against the breast of the figure. Pierced in many places, the recanting heretic yielded his life

A related mode of death just when it was felt that the torture was over was to encourage the victim to descend a dark stairway where sustenance and relief might be found. The stairway would suddenly give way and the victim "was precipitated upon rows of spears fixed upright.”

To put it in perspective consider a few markets, typified by India down from 12,500 on May 12, to 10,000 on May 20, up briefly to 10,500 on June 2, then down to 9,000 on June, 14, now up to 10,700 with comparable moves in the US down from 1330 on May 12, to 1260 on May 20, back up to 1285 on June 2, then down to 1220 on June 11, then back up to 1280 as of July 2, or Japan, down from 17,500 on April 15, to 15,600 on May 23, then up to 15,915 on June 29 then down to 14,218 on June 13, now back up to 15,600, or Egypt at 60,000 on April 12, then down to 45,000 on May 14, false rally to 49,750 on June 2, then back down to 43,000 on June 10, now back to 44,640 as I write.

There is a reason that torture has been used throughout history to extract confessions. The main illegitimate one is that an atmosphere of terror and punishment is necessary to maintain leaders in power when their positions are not due to voluntary behavior on the part of their constituents, whether they be political or supplicant. The main legitimate reason is that often the harm that would come from not being able to extract a confession is infinitely greater than the harm that comes to society from acting in a humane way. Consider for example the not so hypothetical case of the prisoner just taken who knows the whereabouts of a ticking time bomb that will be deployed in one hour that will destroy a few million inhabitants of a city. Are the gains to be made from respecting the prisoners' rites and other innocents who don’t know of ticking time bombs that much greater than the loss of life from one who knows of a ticking car bomb destined to go off in the middle of a city? The Israelis have a name for such a situation "The Ticking Time Bomb” problem. You see terrorists are often captured with information of just such a nature.

The torture that was inflicted on market participants must be

considered within the backdrop of what happened

in Arab markets. Markets

like Dubai and Saudi Arabia had already dropped some 50% before the

first rumblings of havoc were unleashed in the US. Such markets as the

10 year bond market had moved from 4.8 % yield to 5.2 % yield in the

previous several weeks, the price of gold had registered some $720 an

ounce up from $600 an ounce a month earlier and Silver was over $15.00

an ounce. There was every reason for the grand inquisitors in this case

to consider that there was a ticking time bomb problem here and that

some staged jawboning of inflation while it might administer torture to

many market participants was in the long term interests of a more

orderly economy.