|

|

|

|

|

Daily Speculations The Web Site of Victor Niederhoffer & Laurel Kenner Dedicated to the scientific method, free markets, deflating ballyhoo, creating value, and laughter; a forum for us to use our meager abilities to make the world of specinvestments a better place. |

Write to us at:

(address is not clickable)

(address is not clickable)

Daily Spec Forum: Trees and Markets

The highlight of Vic’s trip to London in April 2003 was a visit to Kew Gardens, where he saw “the most remarkable oak tree of all time. Like a Beethoven symphony, a day with 95% of issues up, a meal at the Four Seasons, an N.C. Wyeth painting, a Cervantes or Hugo novel, an O’Brian celebration."

Vic and daughter Kira at Kew Gardens, London (May 2003)

May 2003

On Trees, by Victor Niederhoffer

The theory of least effort, so useful in understanding life and markets, may be observed to govern the proportion of trunk and branches. With lack of competition the trees have low branches as they don’t have to compete for the sun. They keep growing taller to compete with the adjacent trees for light. The trunk is a long-term investment but a good one as trees cover 30% of the land. The fallen tree provides much room for herbaceous plants. Brahms and Beethoven both liked to start the day off with a walk in the woods, and a Speculator walking through the woods may find inspiration as they did:

Bill Craft comments:

Enjoyed your ruminations on the stately Oak in Kew Gardens and the similarity of trunk and branches to life, markets and such.

I would like to respond to your first question.

While we may muse on the beauty of a single specimen (or equity as such) the underlayment for a competitive comparison is not formed by one but how the one reacts with others as in a forest (competitive) setting.

The rough division of trees is not really rough at all and depends on soil/site relationships over time, usually a long time(for us). I would reverse the position of Tech and commodity companies in your question. Please read on.

A rough division of tree species or groups (Stands in a forest) is generally the

result of length of time from major disturbance (Market Crash).

The shade intolerant 'stands' of pioneer trees slowly give way to the shade

tolerant species.

Shade tolerance is measured by the amount of light needed to allow free growth

of a tree species (or any plant for that matter).

Shade intolerant species gown under a canopy will not achieve their maximum potential and, absent of its cohort dying, will stagnate and die. (The Fed policy has provided more 'light' for the market). Sustainability is another matter as I am not a fortune teller.

This change in species composition (Industry Groups in a short term

perspective) is called succession.

The time line is an Early to a Late Successional Forest (Market Timing anyone?).

GENERALLY the higher value (Market Value) species are Early successional or

Shade Intolerant. The pretty trees (later successional) can have heartrot, root

rot

and the like AND are generally not as valuable (read old and stodgy) but do

produce returns over

time.

Therefore to have a healthy Forest (Market) you must have a disturbance (Tech crash 2000) and a reemergence of early successional stands (market Leaders) and late succesional trees that now have more room to grow (S&P 500).

The "rough division" of conifers and hardwoods is not really rough and follows a pattern. Liken the Tech companies to the Early successional, Market Leader Conifers AND the commodity companies to the latter succesional stands of Oak and Hickory. The latter are pretty to look at, self replicating (they reproduce a shade intolerant understory) barring a major disturbance of course, but with heavy crowns (bloated infrastructure) and possible root rot (The problem with rot or decay is many still look good on the OUTSIDE).

Did I hear accounting?

Think of the Old Speculators Society. The Old men with canes recognized that

major disturbances created new Stands of the Early Successional Shade INTOLERANT

equities AND created opportunities for growth in the Latter Succesional, slower

growing Shade

Tolerant Stalwarts.

http://www.sfasu.edu/forestry/williams/Light.PDF

Bill Craft comments, Part II (9/13/2003)

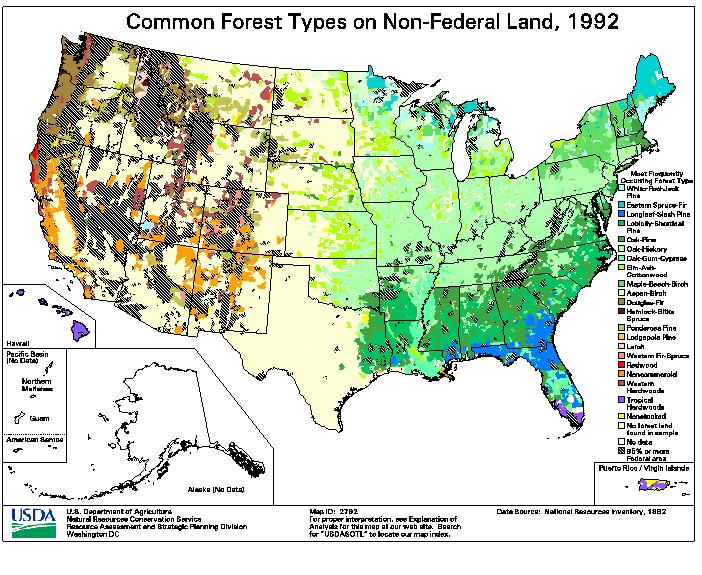

An expansion or contraction of thoughts on the previous post. There are many Forest Types (Industry Groups) in the World. These types are composed of groups or associations of Tree species (Companies) that Interact with one another (Competition or Coexistence, Success or Failure). Attached is a map of Common Non-Federal Forest (Cover) Types in the U.S., 1992.

The key to understanding locally specific or general widespread growth (returns) is dependent upon knowledge of how the Stands of trees react to internal and external forces as well as lack of competition (wolf trees with big crowns).

In a pure sense, one must be able to ' see' the Forest and not the trees.

As you so aptly put it, the consonance and dissonance of a ballet. Understanding reactions and then measuring responses.

Narrowly, one must focus on individual stands and determine what response is wanted or needed from those groups then measure that reaction (growth or mortality) to a treatment.

Approached in this manner, the component stands are understood and the Forest seen as an orderly collection of groups doing their thing in their associated cover type. (Ind. Groups)

This is what I see you doing in Daily Speculations.

On the stand level, trees are inventoried by tallying stem attributes, age and site index (productivity ROE, Profitability).

This compilation of data, put into spreadsheets and data bases, create distributions of stems by diameter classes, imply the level of stocking and projected growth. A Balance sheet.

What I call the FLAT (one dimensional) forest, predictive and descriptive.

http://www.cnr.vt.edu/g&ycoop/fws-1-84.pdf

Inferences from this data form the basis for understanding and knowledge, the derivative being a timeline of management decisions based on health and growth, suggesting thinning, final harvest, and regeneration (Making investments and Taking profits).

For all the stand data generated, rules of thumb, local knowledge and aged judgment apply.

A Subjective and Objective menu for decision making and understanding.

Timber Management: A Quantitative Approach, Clutter et al., is a good read (meal).

Victor Niederhoffer on Tree Energy

Started reading about the energy budget of trees and how the trunk and leaves interact with the theory of least effort to determine the proper balance depending on how much competition there is. It is a very general subject that provides insights in many fields. With lack of competition the trees have low branches as they don’t have to compete for the sun. They keep growing taller to compete with the adjacent trees for light. An additional factor is the weight of energy-producing leaves the tree can bear on its branches. The trunk is a long-term investment but a good one as trees cover 30% of the land. The fallen tree provides much room for herbaceous plants.

Trees are usually divided into hardwoods (angiosperms) and conifers, with the former being much more varied with many more cell types. Would this correspond to technology companies and commodity companies?

The horizontal length of branches relative to height is a key to a tree’s identity, along with how high up the trunk the branches begin growing. Would this correspond to the number of SICs a company has, relative to its core business?

Trees are usually classified relative to color, grain, texture, direction of alignment, texture and decorative elements.

Brahms and Beethoven both liked to start the day off with a walk in the woods. This inspired their music. What can speculators learn from trees? Are there certain remarkable companies that are like certain remarkable trees?

How do you know when a tree or company has grown too tall for its own good? Are there any companies that are like the strangler fig, growing above the low branches of the tree and then sending roots down so that the host loses access to light and dies?

Tom Ryan: The Dendrochronology Posts

Dendrochrology #1 (05/16/2003):

Met a very

interesting gent who works in the tree ring lab at the university. It would seem

that this is very much a statistical science with

possibly some overlap to our world. We measure prices and use them to

indirectly make observations about bias and probabilities. The tree folks

measure rings and use them as an indirect measure of climate and precip

probabilities. Also both have a-periodic disturbances (wildfires, bear

markets) within their records. Both have some autoregressive character. Both measure individual elements (stocks-trees) and composite to wholes

(indices). Both have some fundamental organizing principles including

supply-demand. these can be very long term records. Look at the one he

forwarded to me from some trees near to where our cabin is. The record

stretches back to the 1590s. Also gave me this interesting url (http://web.utk.edu/~grissino/)

which has a link to the int'l tree ring database. Has anyone been down this

road before. I am headed down it for awhile.

Dendrochronology #2

(5/19/03):

At first glance the natural philosopher would tend to think that

evaluating tree growth to back calculate or study cycles or to study

natural law would be adding another messy layer of independent

variables that would make

analysis more difficult and make it harder to draw meaningful analogies.

Better to just work with direct natural events such as rainfall records or

earthquake records or flood records or temperature records.

Yes--but the aforementioned events are all environmental, non-animus, while the tree is a living, growing thing capable of adapting and evolving which makes it actually more applicable than one would think at first glance. The tree rings show us the result of not only these climate and environmental inputs but how the tree responds and reacts to them - as well as the effects wrought on the tree by its neighbors, survival of fittest, etc. Overall a good place for the statistically inquisitive I think.

Dendrochronology #3 (5/20/3)

some preliminary thoughts. The obvious ones

Dendrochronology #4 (5/27/3)

continuing on, i find some interesting

statistics for a grove of old douglas

fir near baldy peak arizona.

More Tree Posts from Specs

Bonnie Lo:

When the tree is rotten at the core or mold

is growing you may want to clear it so that the healthy trees around it may

grow more and reduce the danger of the disease spreading. You may also want to

look for symbiotic (mistletoe) or parasitic growths on the tree as it gets

older.

I look at the rings of a tree trunk: rings are wider in years of plenty, contraction of the ring growth when things are dry, the cycles of weather. More growth when capital is raining down in droves, but unless the tree is strong a dry spell will destroy or create a forest fire, the more probable if the woods are too thick. Hmm…forest fire...burning the overgrowth...

I love the maple tree - syrup and leaves - and also fruit trees - apple and pear trees grow at my parents home, no one thought the pear tree would survive but dad was stubborn and it lives and bears fruit still. I miss it during this time of year as the pale blossoms are in full bloom and the fragrance speaks of promise and plenty.

But perhaps the evergreens are more practical for their retention of green color even through harsh winters and general hardiness as they grow in pots or on mountains as would a company with the ability to spread into new markets.

Russell D. Sears:

For almost a century, government

tried to preserve the giant sequoia forest—only to accidentally stop its

nursery cycle. Once the trees were included in a national park, fires were

regulated. The naturalists of the time didn’t realize that the fires brought

creative destruction. First, the trees had a natural defense against fires;

however, as brush built up over the years, fires began burning too hot, ruining

the trees’ natural defenses. Second, it

is now known that the heat of the fire is needed to burst the seed from the cone

like popcorn, before it can start growing.

Many obvious lesson here.

While others have talked of trees’ growth and maturity, I believe many parallels exist with trees and beginning businesses and investors.

In planting my two acres with native Indiana trees, I learned:

I believe there may be some lessons in there about the present "tech boom to bust," overcapacity, eventual outcome. Also in which country you should plant your hardwoods.

Laurel Kenner:

The question of why plants lose their

vigor has by no means been resolved in botany. With technology improved to the

point that scientists can now analyze whole strands of DNA, rather than chunks,

longevity is one of the hottest topics of research.

In the mountain country of the West, the puzzle can be plainly seen. The bristlecone pine grows very slowly; the oldest are some 6,000 years old. Bristlecones are the ultimate survivors. They can be found in the mountains where it is extremely cold in winter and dry in summer; they can be seen leaning off precipices in Utah, seemingly growing out of the rock. In the same environment, a yucca blooms once and dies.

To the ordinary eye, landscapes are peaceful, serene. A botanist sees an entirely different picture. Behind that beauty, under the ground and at the treetops, a fierce battleground is going on where competition rules—a scene very like the financial market.

Every minute of the day, plants invade others’ territory. They bid for resources. They force others to adapt to them.

In the evolutionary struggle, the flowering plants are the winners. Like successful companies, flowering plants market themselves well, by spreading their seeds far and wide. They evolve to please the customer, by developing flowers of the exact form, color and scent attractive to specific kinds of birds and insects. They entice, they lure, they fool – anything to get their partner to scatter the seed.

Successful plants are sensitive. Their roots and leaves have hairs to adjust to the thermal situation. If there is too much light, they will adjust by evolving red coloring on their leaves, white hair on the flowers, smaller flowers and leaves.

The plants learn to please man, too. They oblige us by becoming the kind of plants that we like. Some botanists laugh at the idea that man controls nature, pointing out that in many ways plants have made us their servants. We plant them and care for them and spread them around the world—thus ensuring their survival.

For me, the strangest puzzle of all is why some plants can cure man’s diseases.

Steve Treglia:

English Oak (Quercus robur) gives pause to most who look

upon. This tree is quite adaptable and

has been successful from North Dakota to Utah. Much easier to transplant than

the White Oak or Bur Oak.

For me, the Kentucky Coffetree ( Gymnocladus dioica ) is a tree worth planting for all seasons. This unknown jewel is tolerate of all climates and stresses know to humanity. A superb tree for large areas as it grows 60 to 75 ft. high, 40 to 50 ft. wide. During the depression days, lucky landowners would take the tree's fruit and grind their own "coffee.” Several years ago I planted four of these and they are with me today. Unlike those temperamental spruce and hemlock we lost over the past couple summers.

For those looking for an up and comer, investigate the Chinese or Lacebark Elm (Ulmus parvifolia ) A shade tree with few equals. This tree is often confused with Ulmus parvifolia which is susceptible to disease. One downside to this tree is the seedlings are variable. You could have either a bonsai specimen or 70 ft. winner.

Hardy trees and shrubs might offer a wonderful area for speculators wishing to improve their wares. One looking for inspiration should travel to Longwood Gardens in Kennet Square, Pennsylvania. There you will see weed species that have transformed themselves into grand 70 to 80 ft. shade specimens.

Nature speaks to all interested in climbing back up the stairs.

David Higgs:

From a short distant the silhouette of

the tree pretty much provides the clue as to type. When the distance is far that's when second-guessing occurs and

that can be disastrous. So get up close, look for dead wood among the foliage,

look for roots that surface the grade, exposing them to possible disease.

Although wood is man's oldest natural resource, we still have not harnessed the

sun's energy, the miracle of organic growth, not to mention patterns of growth.

Just pray your trees don't get petrified.

Derek George Lees:

In regard to the question, “How do

you know when a tree or company has grown too tall for its own good?" Usually a tree collapses. With corporations I suspect

there may be a period of turgidity or atrophy involved.